Wawancara dengan Raymond Qu, Co-founder PolyFlow: Membangun Infrastruktur PayFi

Penulis asli: Will Awang

Sumber asli: Web3 Lawyer

The Bitcoin white paper in 2008 described a peer-to-peer electronic cash payment network that does not require a trusted third party. Payment is one of the earliest promises made by digital currency and blockchain technology, and it was also the blockchain solution given by Satoshi Nakamoto to the failed financial system at the time.

Although the industry has invested billions of dollars in the development of underlying blockchain infrastructure over the past decade, and we can now see the explosive rise of high-performance blockchains such as Solana and stablecoins, most of the current market infrastructure is still built around transactions and cannot truly support the real-time and scalability of payments, which also hinders the large-scale popularization of Web3 payments.

So what kind of infrastructure do we need to support real-world payment scenarios? What is the value and significance of PayFi?

In this article, we had the honor of having an in-depth conversation with Raymond Qu, co-founder of PayFi infrastructure – PolyFlow. Rather than a conversation, it is more like understanding and learning from this senior with more than 20 years of international financial consulting and management experience, his all-round thinking and practice of digital finance from a global perspective, and his deep understanding of digital currency and blockchain technology.

Raymond has a unique vision for innovative financial services in the international market. Under his leadership, Geoswift has become a comprehensive global financial services company covering international payments, cross-border remittances, foreign exchange and prepaid card businesses. At the same time, he is also a well-known investor in the global digital finance field, with investment targets covering many leading companies in the fields of financial technology, digital banking, blockchain, Web3 and artificial intelligence. Raymond is also a senior advisor to the Development Bank of Canada and a member of the expert group of the Financial Research Institute of the Development Research Center of the State Council of China.

1. The original intention of creating PolyFlow

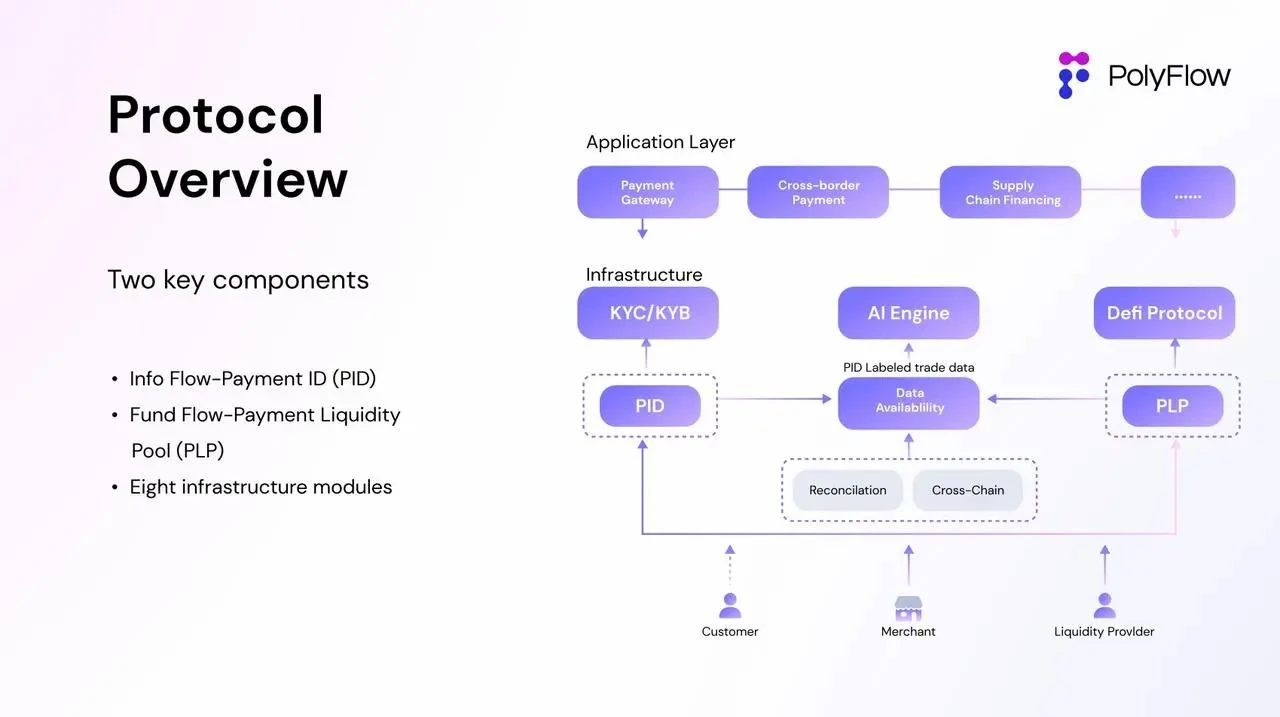

PolyFlow is the infrastructure layer of the blockchain network, which aims to integrate traditional payments, Web3 payments and decentralized finance (DeFi) to handle real payment scenarios in the real world in a decentralized manner. PolyFlow will serve as the infrastructure of PayFi to promote the establishment of a new financial paradigm and industry standards.

Before talking about PolyFlow in detail, Raymond first explained the nature of financial transactions to help us better understand the true value of PolyFlow.

1.1 The core of financial transactions

In traditional financial markets, any financial transaction and value transfer is inseparable from the information flow and capital flow of the transaction, which together constitute the basis of financial transactions.

-

Information flow refers to the information in the transaction process, including a set of transaction initiation, payment and settlement instructions. It ensures the accuracy and timeliness of transactions and focuses on the transmission of transaction instructions and data.

-

Fund Flow refers to the entire process of fund transfer between parties in a transaction, focusing on the actual flow of funds.

-

Information flow and capital flow are inseparable in financial transactions. The effective combination of the two ensures that financial transactions can be completed safely and efficiently.

1.2 Information and capital flows in a cross-border context

Due to differences in language, currency, and regulation, the paths for information flow and capital flow of financial transactions in a cross-border context are also different. For example, the well-known SWIFT only focuses on the transmission of information flow, but does not actually involve capital flow. SWIFT has built a highly standardized and automated international financial communication network through standardized message formats, enabling banks around the world to exchange financial transaction information quickly and accurately. The information flow of transactions can be fully transmitted through SWIFT, but the capital flow is limited by factors such as foreign exchange controls, regulatory compliance, and anti-money laundering in various jurisdictions, and cannot be synchronized in real time like the information flow. The capital flow still needs to circulate through banking and financial intermediaries in various countries, and will involve complex domestic clearing systems in various countries, cross-border payment and clearing systems for settlement currencies, and international payment and collection clearing systems. What further hinders the flow of global value is that for the processing of capital flows, even if you have a SWIFT CODE, it does not mean that you are qualified to participate in this network.

1.3 Promoting value circulation through PolyFlow

This brings us to the original intention of founding PolyFlow: to build a decentralized infrastructure that allows more people to participate in the construction of a global payment network, help reduce regulatory compliance pressures, eliminate the risks of fund custody, and minimize third-party involvement.

The core concept of PolyFlow is to effectively separate the transaction information flow and capital flow previously controlled by centralized institutions through modular design, and use a decentralized approach to enable each transaction process to better comply with regulatory compliance standards and eliminate fund custody risks. At the same time, it uses the characteristics of blockchain to connect the DeFi ecosystem and promote the large-scale implementation of PayFi applications.

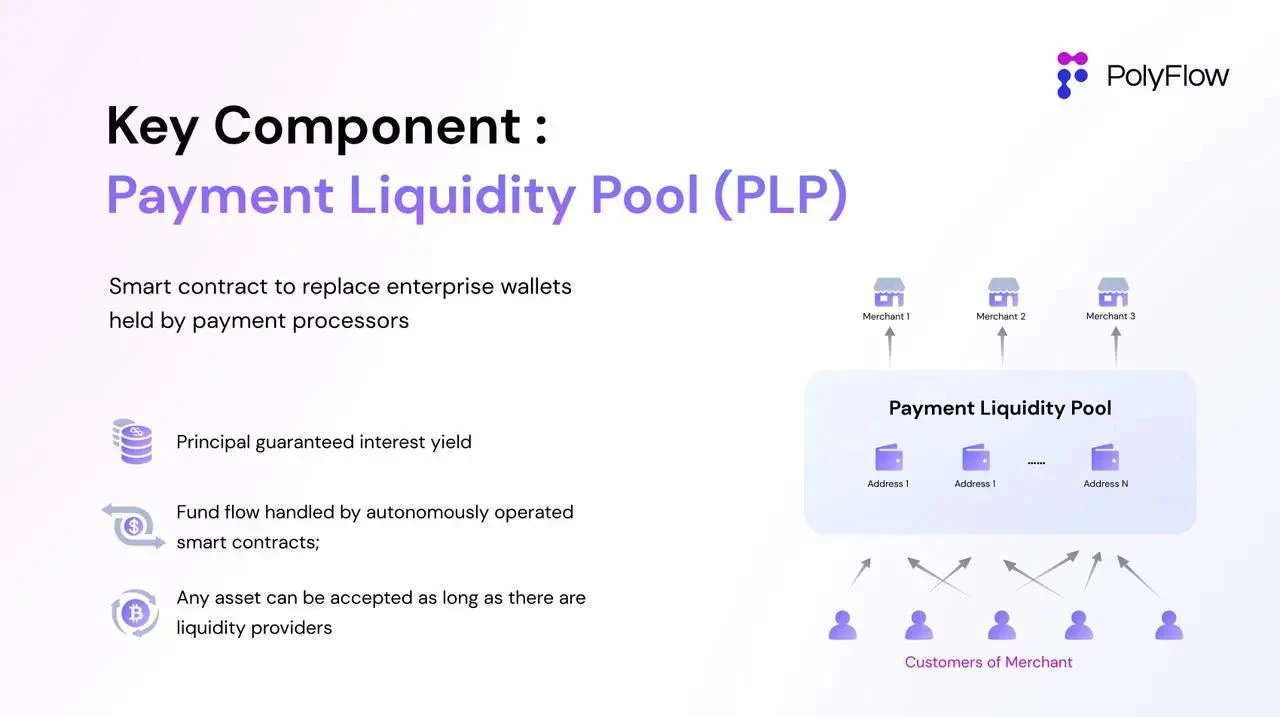

PolyFlow has launched two key components: Payment ID (PID) and Payment Liquidity Pool (PLP):

-

PID is associated with information flow as a powerful tool that can achieve user identity recognition and compliance access, privacy protection and data sovereignty, AI data processing, X to earn and other functions;

-

PLP is associated with the flow of funds, and the funds used to pay for transactions are managed by smart contracts. It can not only provide a safe and compliant framework for the circulation, custody and issuance of digital assets, but also introduce the composability and scalability of the DeFi ecosystem.

As a result, PolyFlow has built a business architecture for PayFi applications that is lightly regulated, compliant, risk-free, and compatible with the DeFi ecosystem, as well as a secure and compliant framework for the circulation, custody, and issuance of digital assets.

It is important to understand that Bitcoin and its blockchain network built by Satoshi Nakamoto represent a new solution to financial and monetary issues born in the digital age. It is not only aimed at solving the eternal problem of human society: how to make value flow across time and space, but also aims to solve the problem of trust in third parties in transactions. These are what PolyFlow aims to achieve.

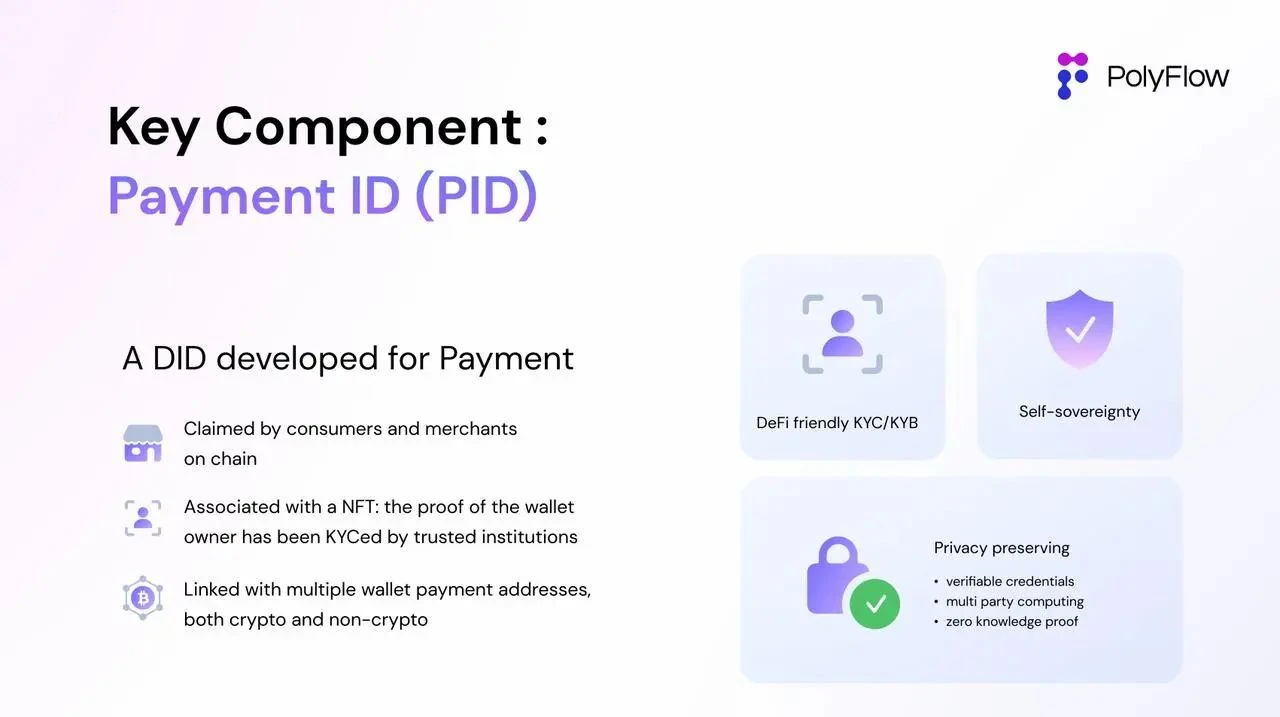

PID: Linking the physical world and digital currency wallets

The Payment ID (PID) launched by PolyFlow is a decentralized ID. It is a product split from the transaction information flow. It can be bound to the encrypted KYC/KYB proof information of the users privacy protection, and associate the users verifiable credentials (Verifiable Credentials) on multiple platforms. It can achieve:

-

Compliance access: PID can contain verification information between multiple and different platforms, helping partners to simplify the verification process.

-

Privacy protection: PID uses a variety of technical means such as zero-knowledge proof to help fulfill obligations such as anti-money laundering/counter-terrorist financing (AML/CTF) without leaking user privacy. This is a prerequisite for users to participate in the traditional financial/DeFi ecosystem.

-

Data sovereignty: On the one hand, PID can provide information on fund transactions to regulators to meet compliance requirements, and on the other hand, it can also return on-chain behavioral data to users.

-

AI-driven: In addition to KYC/KYB data information, PID can also associate transaction data uploaded off-chain or collected on-chain. AI can help analyze rich daily transaction data and extract additional value for PID owners. This also plays a vital role in establishing an on-chain credit system.

The innovative introduction of PID provides transformative advantages for PolyFlow, the infrastructure of PayFi. It not only builds a bridge between traditional finance and the DeFi ecosystem, but also provides users with a flexible and reliable way to manage digital identities, participate in cross-platform transactions, and build on-chain credit.

So how do we understand that the goal of PID is to link the physical world and digital currency wallets?

Raymond said: “PID is not necessarily equivalent to an ID used for payment, but should be more like a wallet in the physical world.

Think about what we have in our pockets besides cash. This could be family photos (NFT), bank cards, driver’s licenses, and ID cards (user ZK supports information extraction and data privacy protection), etc.

Therefore, from this perspective, Wallet cannot necessarily be equal to Money Wallet. There is still much more that PID can do that is worth looking forward to. The Scan to Earn project currently built around PID is one of them. ”

3. PLP – Building consensus on capital flows

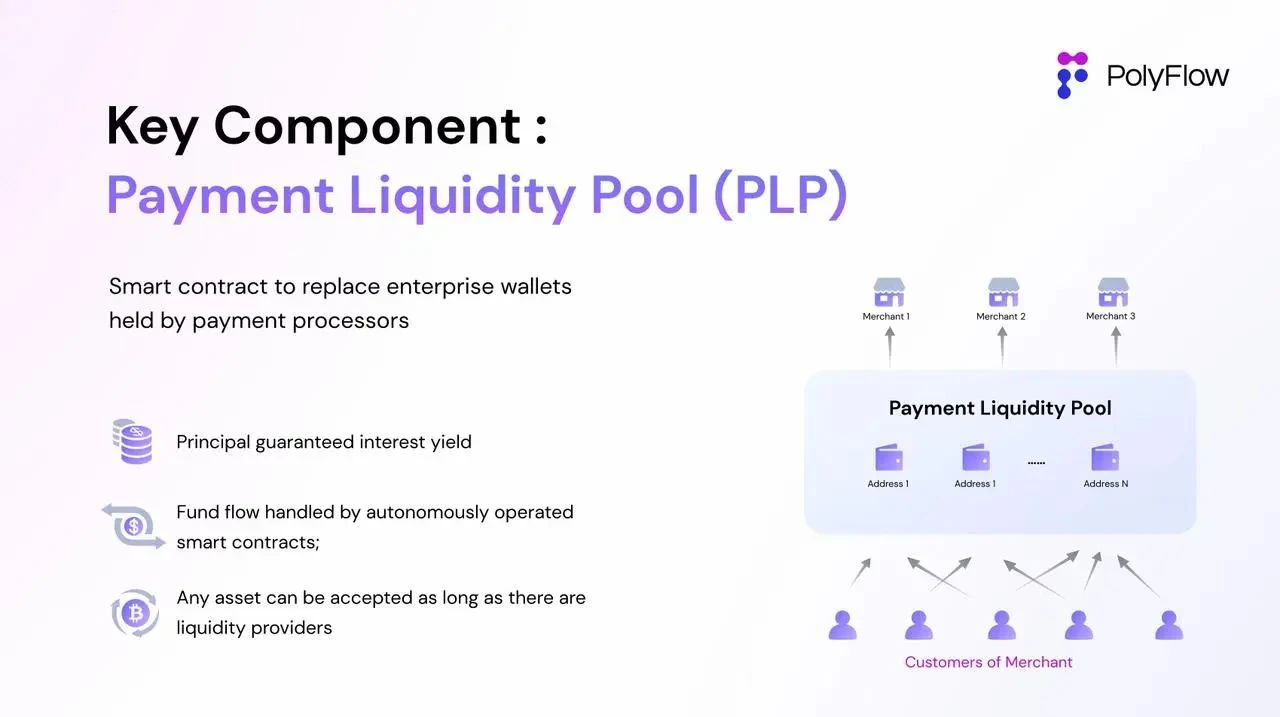

The Payment Liquidity Pool (PLP) launched by PolyFlow is a product of the splitting of capital flows. The smart contract address is used to receive transaction funds and realize on-chain custody of funds, rather than relying on the traditional method of expensive corporate wallets of centralized institutions.

PLP, a more decentralized model, can achieve:

-

Decentralized fund custody: Bring a convenient, secure, and compliant custody method to the PayFi application, while ensuring the security of funds while minimizing the need for transaction intermediaries.

-

Liquidity pool: Transaction funds are pooled through smart contract addresses to provide liquidity for financing needs in payment transactions.

-

DeFi compatibility: Centralized applications are not compatible with the decentralized DeFi ecosystem. PLP built on the blockchain can seamlessly connect to the DeFi ecosystem and bring DeFi business logic to PayFi applications.

-

Risk-free RWA income category: The income generated by the protocol can be directly reflected in PLP. This income based on real-world payment transaction scenarios provides a risk-free and stable source for DeFi.

This PLP architecture can be flexibly integrated with the DeFi ecosystem, ensuring that PayFi applications can adapt to the ever-changing digital asset landscape.

So how should we understand that the goal of PLP is to build consensus on capital flows?

In this regard, Raymond gave us a step-by-step explanation of the three settlement modes of Web3 payment:

3.1 Peer-to-Peer Mode

Imagine a cross-border remittance scenario – remittance from address A to address B. Web3 payment based on blockchain characteristics can realize the simultaneous confirmation of transaction information flow and capital flow. The information is reflected in the open and transparent blockchain ledger. Everyone records the account together and confirms it across the entire network. The transaction information cannot be tampered with.

In this relatively low-frequency scenario, the synchronization of information flow and capital flow can fully demonstrate the advantages of Web3 payment, such as near-instant settlement, low transaction costs, open and transparent ledgers, and global reach.

However, the current on-chain point-to-point information flow and capital flow synchronization method cannot meet and achieve the high-frequency demand of thousands of transactions per second/per hour/day similar to traditional financial payments, which can easily cause congestion in the blockchain network.

In 2023, VISA will process about 720 million transactions per day, which means that the average daily user-generated transactions per second (TPS) in 2023 will be about 8,300, which is 8 times the TPS of Solana, the current highest-performance blockchain. Therefore, Web3 payments will appear inefficient relative to traditional payments in this case.

“The efficiency of blockchain and distributed ledger technology is not enough to support the accounting of transactions. In traditional finance, only the accounting between the two counterparties is required, but the current peer-to-peer model requires the entire network to jointly account for each transaction. It is hard to imagine the situation where the entire network jointly accounts for tens of thousands of transactions per second.” Raymond explained, “If you want to include the current crypto market with a total volume of 2 trillion, it has already caused network congestion many times before, not to mention the traditional financial market with a volume of 400 trillion to 600 trillion.”

So how do we build a payment settlement model suitable for Web3?

Raymond said: Our original answer was: we must believe in the power of technology. With the continuous improvement of computing power, the efficiency of payment and settlement will be solved sooner or later. However, we cannot use future technology to solve todays problems. We still need to solve them from the essence of blockchain – building a consensus on capital flow.

3.2 Hedging Mode

In traditional finance, although the information flow and capital flow of transactions are ultimately consistent, they are not synchronized. The information flow data based on the digital network can be fully interactive in real time, and as for the capital flow, the underlying funds are still held in a fixed address and are settled relatively independently according to the agreed settlement cycle. The interactive demand for capital flow is actually not that high.

Raymond gave us an example of cross-border fund transfer and settlement.

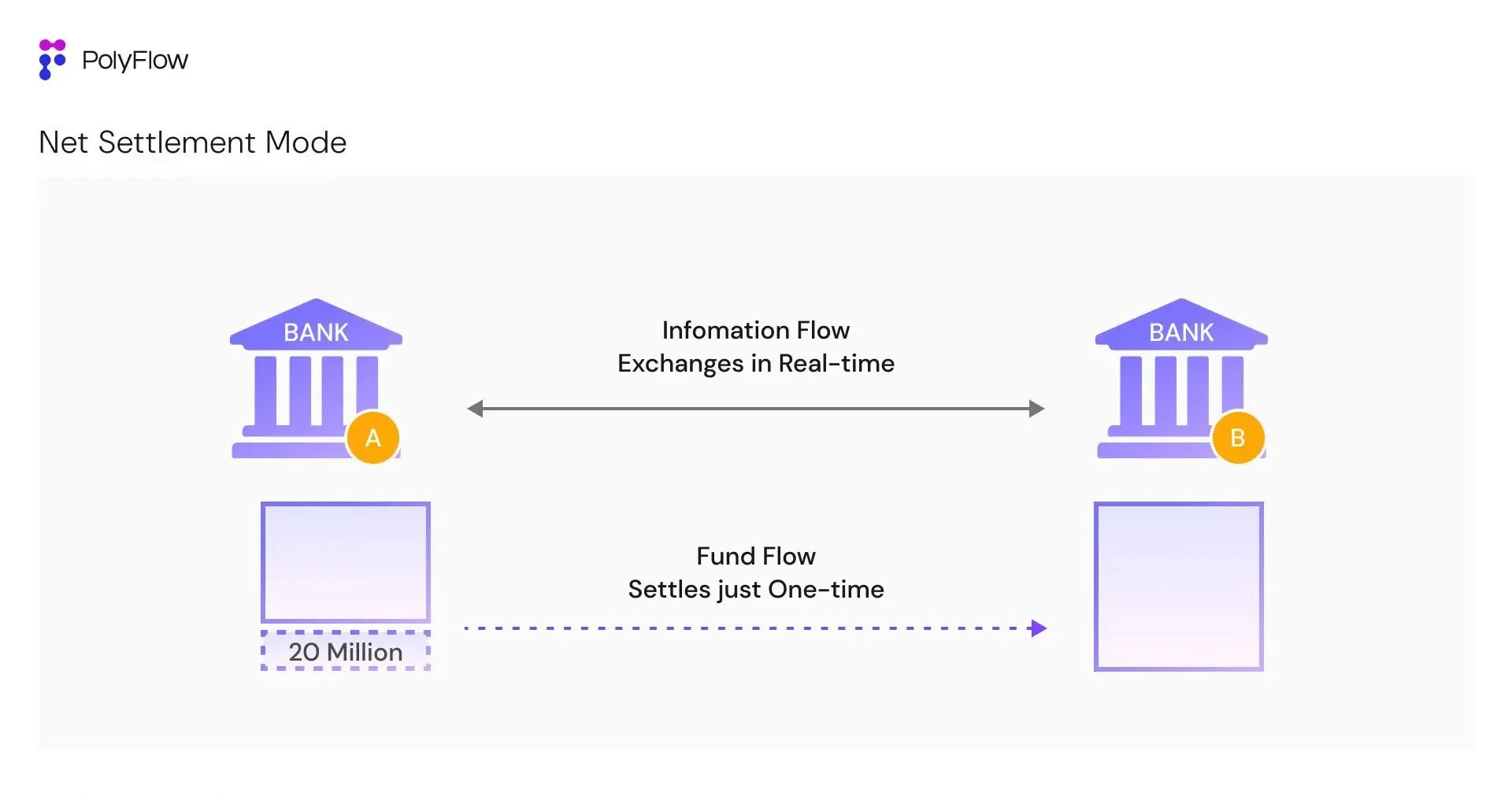

In the traditional world, Bank A in China and Bank B in the United States settle funds, and the two banks process tens of thousands of fund transactions every day. As mentioned earlier, if the two banks conduct synchronous settlement of information flow and fund flow for each transaction, no current financial infrastructure can meet such a huge settlement demand, nor is it necessary.

Therefore, a settlement method called Net Settlement is used to process multiple transactions between counterparties. In this way, the information flow between the two banks is fully interactive in real time to achieve the hedging of their respective books. At the end of the day (assuming daily settlement), after the information flow of tens of thousands of financial transactions is compared, the net amount is finally determined for separate settlement of the capital flow.

For example, if the net balance is that Bank A owes Bank B 20 million, then Bank A only needs to pay Bank B 20 million in one lump sum to settle the funds flow of tens of thousands of transactions on that day; or if the net balance is exactly 0, then the funds flow between the two banks will not change.

Raymond explained: “In this case, the actual underlying capital flow changes of tens of thousands of transactions are very small, and what everyone is doing is the interaction of information flow. This is why, when the underlying assets of traditional finance are so large, the requirements for banks’ ability to handle underlying assets, system capabilities, and payment and settlement capabilities are not so high.”

Net Settlement, a hedging settlement method, can greatly reduce transaction costs, improve settlement efficiency, reduce credit risks between counterparties, and improve capital utilization efficiency.

But at the same time, this traditional model inevitably requires a centralized credit system, and this strong trust relationship needs to be achieved through multiple methods such as historical reputation, strict auditing, compliance supervision, collateral support, and contractual guarantees, and will be accompanied by risks such as fund custody and information opacity.

In order to implement netting settlement, a more efficient hedging and settlement method for capital flows, on the blockchain and eliminate the centralized risks brought by third parties, PolyFlow launched PLP to deposit funds on the same blockchain ledger.

The purpose of this is to allow people who have no trust basis to cooperate without any third-party trust endorsement, avoid the uncertainty of fund custody, and verify the authenticity of each transaction without the need for mutual trust.

Only by fully verifying can we completely eliminate the reliance on trust. Dont trust, verify.

This is the consensus on the flow of funds on the blockchains unified ledger.

Transactions recorded by banks and other institutions are essentially bookkeeping on blockchain ledgers. As in the above case, as long as the ledgers of Bank A and Bank B are built on the unified blockchain ledger, we can achieve consensus on the flow of transaction funds between the two banks, eliminate the strong trust relationship that takes a lot of time and money to build, and realize a true Trustless Network.

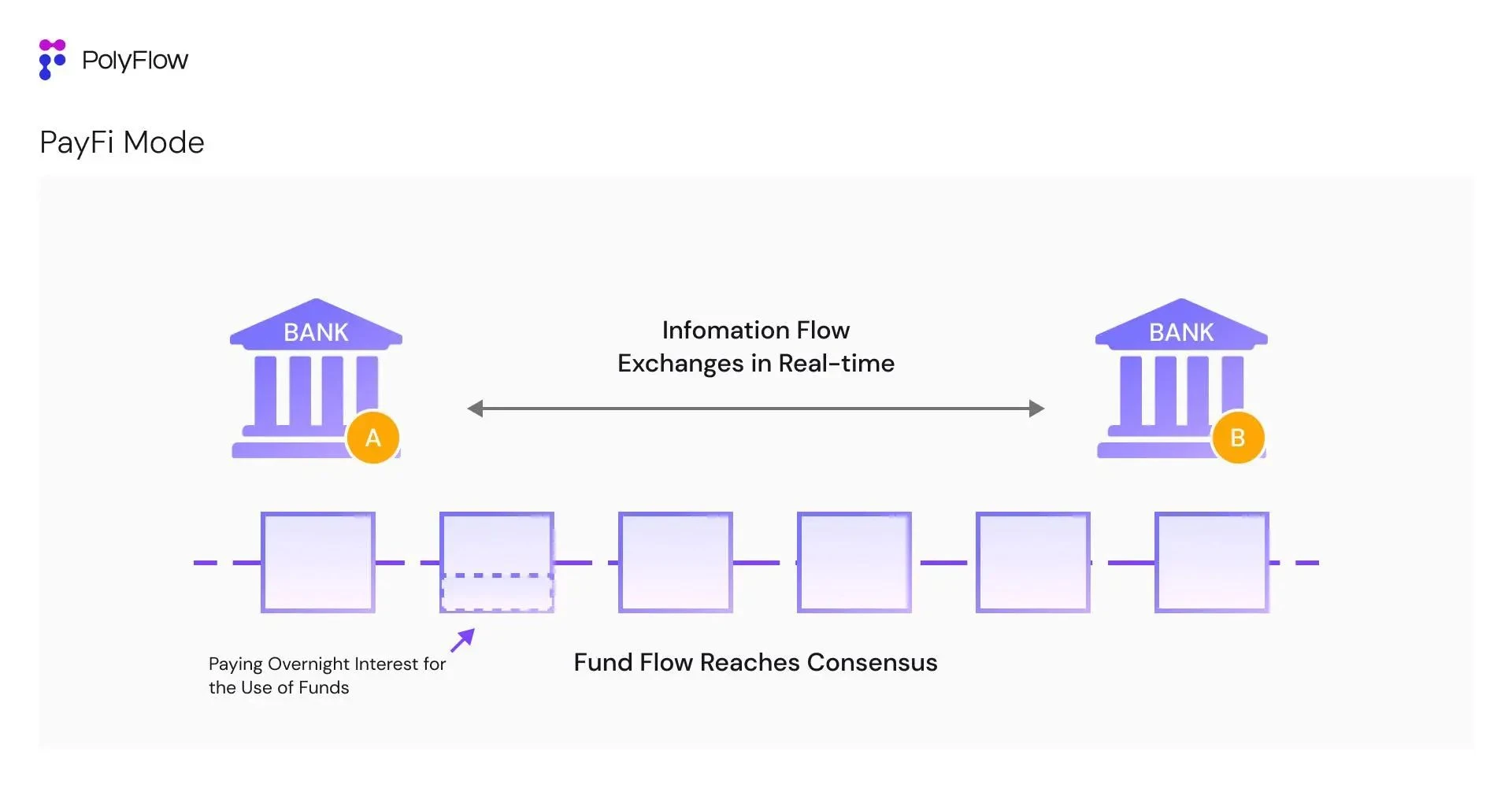

3.3 PayFi Model

Only after we reach a consensus on the flow of funds on the blockchain’s unified ledger can we truly enter the so-called PayFi world.

Let’s go back to the bank case. When both Bank A and Bank B can keep accounts on the blockchain unified ledger, the basic trust problem between the two parties is solved and a consensus on the flow of funds is reached. On this basis, the two parties can change from the daily hedging settlement mode to directly paying the overnight interest on the use of funds to each other. This can further release the liquidity of bank funds.

This is just like applying for a home mortgage loan at a traditional bank. The bank releases the loan based on the property you mortgage, but in fact the banks underlying assets (capital loan) remain unchanged. You only need to pay the interest directly to the bank, because all capital flows of the mortgage transaction are deposited in the banks ledger.

Lets build a Buy Now Pay Never scenario based on PolyFlow:

User Kevin purchased $5 worth of coffee from a merchant through a decentralized payment gateway based on PolyFlow. The funds of the gateway and the merchant are all held in PLP. Assuming Kevin is also a liquidity provider for PLP and provides $50 of funds to PLP (which will generate $5.5 of income per day), then based on the consensus of all participants on the capital flow of the PLP ledger, it is possible to realize the scenario where Kevin buys coffee today (without paying), and then uses the income generated by PLP tomorrow to pay for the $5 coffee fee. The extra $0.5 is the overnight interest on Kevins borrowed funds today.

In this scenario, the value of PayFi can be fully reflected:

1) Reduce costs and increase efficiency: Information flows are fully interactive, and the capital flow is actually static, all of which is deposited in the PLP account book.

2) Improve capital efficiency: The benefit of the stagnant capital flow is that it can give full play to the capital utilization efficiency of the $50 liquidity provided by Kevin.

3) Innovative financial paradigm: Buy Now Pay Never, an on-chain scenario, can realize innovative financial paradigms and product experiences that traditional finance cannot achieve, and promote the Mass Adoption of PayFi.

Under this PayFi model, the utilization efficiency of asset flows will be very high. Because the ledgers of all parties are unified on the blockchain, full trust can be achieved, the information of both parties to the transaction can be verified at any time, and the funding gap can be confirmed.

Raymond has been studying blockchain technology since 2011: “The unified ledger of blockchain accounts cannot be tampered with, and is open and transparent. These are already familiar terms that everyone has been talking about for more than a decade, but no one can understand the significance of its implementation.

The consensus on the flow of funds on the blockchains unified ledger is the true meaning of blockchain. This will improve the efficiency of the entire Crypto and Web3 industries.

This is also the foundation for PolyFlow to build a decentralized PayFi infrastructure.

4. The value and significance of PayFi

The fusion of Web3 payments and DeFi gave birth to PayFi, which longs for a new financial infrastructure to support its implementation and solve complex compliance issues. Since Lily Liu, chairman of the Solana Foundation, proposed the concept of PayFi at the Hong Kong Web3 Carnival, PolyFlow has been regarded as one of the first protocols aimed at building PayFis financial infrastructure.

From a literal point of view, PayFi is actually not fundamentally different from GameFi and SocialFi, but the real meaning of PayFi is to promote the application of digital currency in real scenarios in the real world.

Di sisi positifnya, PayFi dapat beradaptasi dengan migrasi grup Web2 ke Web3. Misalnya, perusahaan pembayaran keuangan tradisional dapat menggunakan teknologi blockchain untuk mendapatkan pangsa pasar yang lebih besar dan menghindari ketinggalan tren terkini.

Di sisi lain, komunitas Web3 dapat menggunakan Pembayaran sebagai operator dan memanfaatkan teknologi blockchain untuk memecahkan permasalahan sistem keuangan tradisional dan mewujudkan paradigma keuangan baru serta pengalaman produk yang tidak dapat dicapai oleh keuangan tradisional.

When talking about PayFi, Raymond has a deeper understanding: PayFi does not solve the problems that Web3 payments need to solve on the surface, such as the challenges of cross-border fund transfers and low financial inclusion. Instead, it needs to solve the most fundamental problem at the moment: effectively separating the information flow and capital flow of transactions, so that everyone can form a consensus on the capital flow on the unified blockchain ledger. Only in this way can the efficiency of the entire Web3 industry be improved and true Mass Adoption be promoted.

At present, Web3 payment is still in a very early stage of basic services and primitive state. It is more about using digital currency as a transaction medium for payment to achieve point-to-point settlement, such as OTC, Crypto Payment Card and other scenarios, or using digital currency to facilitate cross-border scenarios and achieve hedging settlement, but the scenarios are relatively limited.

Therefore, with the launch of PolyFlow, not only can more PayFi participants enter the blockchain network more conveniently, realizing the construction of real PayFi scenarios of Buy Now Pay Never in our daily consumption scenarios, but more importantly, it can enable everyone to form a consensus on capital flow and realize the efficiency improvement of the entire blockchain Web3 ecosystem.

5. Beyond Payment

The concept of a blockchain distributed ledger may not sound revolutionary or appealing, but then again, neither did double-entry accounting and the joint-stock company. However, like these great innovations, this seemingly mundane technology or process has the potential to change the way human society works.

The endowment of blockchain is financial infrastructure. PolyFlow is integrating the transformative power brought to us by digital currency and blockchain technology to create a new decentralized PayFi encrypted payment network, promote people to shift to the paradigm of innovative finance, and unleash the true value of Web3.

Finally, make the grand vision in the Bitcoin white paper a reality.

This article is sourced from the internet: Interview with Raymond Qu, Co-founder of PolyFlow: Building PayFi Infrastructure

Related: Dialogue with Tether CEO: Trying to enter the AI field, auditing is still a high priority

Original title: Flush With Cash, Tether Has Got Microsoft, Google, and Amazon in Its Crosshairs Original article by: JOEL KHALILI, WIRED Original translation: TechFlow Led by new CEO Paolo Ardoino, the crypto firm is investing heavily in an attempt to enter an artificial intelligence market dominated by the world’s largest technology companies. Paolo Ardoino, CEO of Tether Holdings, at the Paris Blockchain Week Summit in April 2024. PHOTO CREDIT: NATHAN LAINE/BLOOMBERG; GETTY IMAGES Paolo Ardoino, the new CEO, is facing a difficult but enviable problem: how to best allocate billions of dollars. Recently, Tether has been flush with funds and is moving into unfamiliar new areas, such as artificial intelligence. Ardoinos ambitious plan is to take on Microsoft, Google and Amazon. Tether, registered in the British Virgin Islands, is one…