Melihat stablecoin dari perspektif jaringan kartu kredit: Apa peluang potensialnya?

Penulis asli: Alana

Terjemahan asli: TechFlow

Stablecoins represent the most transformative evolution in payments since the credit card, changing the way money moves. With low cross-border fees, near-instant settlement, and global access to a widely in-demand currency, stablecoins have the power to improve the financial system. They can also be a very profitable business for those who custody the dollar deposits that back digital assets.

Currently, the total amount of stablecoins in the world exceeds $150 billion . There are five stablecoins with a circulation of more than $1 billion: USDT (Tether), USDC (Circle), DAI (Maker), First Digital USD (Binance), and PYUSD (PayPal). I believe we are moving towards a world with more stablecoins – a world where every financial institution will offer its own stablecoin.

Ive been thinking about the opportunities that will arise as this growth occurs, and I think watching the maturation of other payment systems, particularly the card networks, might provide some insights.

How similar are credit card networks and stablecoin networks?

To consumers and merchants, all stablecoins should feel like dollars. But in reality, each stablecoin issuer handles dollars differently, due to different issuance and redemption processes, reserves backing each stablecoin supply, different regulatory regimes, frequency of financial audits, etc. Solving these complexities will be a huge business opportunity.

We’ve seen this before with credit cards. Consumers spend using assets that are almost fungible but not really fungible, which are dollars (they’re loans against dollars, but those loans are not equal because people have different credit scores). There are networks — like Visa and Mastercard — that coordinate payments across the system. And the stakeholders in both systems will (ultimately) look similar: the consumer, the consumer’s bank, the merchant’s bank, and the merchant.

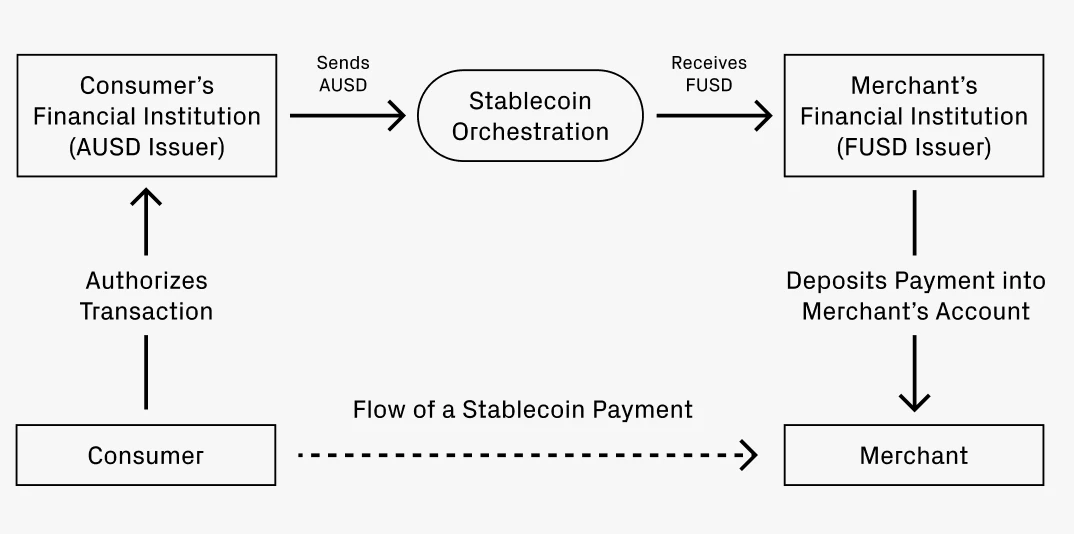

An example may help illustrate the similarity in network structure.

Lets say you go out to eat and pay the bill with a credit card. So how does your payment get into the restaurants account?

-

Your bank (the one that issued your credit card) authorizes the transaction and sends the funds to the restaurants bank (called an acquirer).

-

An interchange network—like Visa or Mastercard—facilitates the exchange of funds for a small fee.

-

The acquiring bank then deposits the funds into the restaurants account, minus a fee.

Now lets say you want to pay with a stablecoin. Your bank, Bank A, issues the AUSD stablecoin. The restaurants bank, Bank F, uses FUSD. These are two different stablecoins, although they both represent USD. The restaurants bank only accepts FUSD. So how do payments in AUSD get converted to FUSD?

Ultimately, the process will be very similar to that of the credit card networks:

-

The consumer’s bank (which issues AUSD) authorizes the transaction.

-

A coordination service performs the swap of AUSD to FUSD and may charge a small fee. This swap can be performed in a few different ways:

-

Path 1: Use decentralized exchanges to swap stablecoins against stablecoins. For example, Uniswap offers multiple liquidity pools with fees as low as 0.01%. (3)

-

Path 2: Convert AUSD into USD deposits, and then deposit the USD deposits into an acquiring bank to issue FUSD.

-

Path 3: Coordination services can offset flows of funds across the network; this may only be possible at scale.

-

FUSD is deposited into the merchant’s account, and a fee may be deducted.

Where the analogy starts to diverge

The above outlines what I believe to be clear parallels between credit card networks and stablecoin networks. It also provides a useful framework for thinking about where stablecoins begin to effectively upgrade and surpass certain elements of the credit card network.

The first difference is in cross-border transactions. If the scenario above is a US consumer spending money at a restaurant in Italy – the consumer wants to pay in USD, and the merchant wants to take EUR – existing credit cards will charge a fee of over 3%. On a decentralized exchange (DEX), the fee for converting between stablecoins can be as low as 0.05% (a 60x difference). Apply this fee reduction to cross-border payments broadly, and it becomes clear how much productivity stablecoins can add to global GDP.

The second difference is in the payment process from business to individual. The time between when a payment is authorized and when the funds actually leave the payer’s account is very fast: once the funds are authorized, they can leave the account. Instant settlement is both valuable and sought after. In addition, many businesses have a global workforce. The frequency and amount of cross-border payments can be much higher than that of the average consumer. The trend toward a global workforce should provide a strong tailwind for this opportunity.

Thinking about the future: Where might the opportunities lie?

If the comparison between network structures holds true in direction, it can help reveal possible entrepreneurial opportunities. In the credit card ecosystem, major players emerged through coordination, issuance innovation, and enablement of form factors. The same applies to stablecoins.

The previous examples primarily depicted the role of coordination. This is because moving money is big business. Visa, Mastercard, American Express, and Discover all have market caps of at least tens of billions of dollars, with a combined value of over $1 trillion. The existence of multiple credit card networks suggests that competition is healthy and the market is large enough to support major players. It is reasonable to assume that similar competition will exist for the coordination of stablecoins in mature markets. We only have 1-2 years to build enough infrastructure so that stablecoins can succeed at scale. There is still plenty of time for new startups to pursue this opportunity.

Stablecoin issuance is another area of innovation. Similar to the growth of corporate credit cards, we may see a similar trend of businesses wanting to own their own white-label stablecoins (Note: White-label stablecoins refer to stablecoins issued by businesses or organizations, and the brand and logo of these stablecoins are customized by the issuer, not by the technology provider of the stablecoin.). Owning a spending unit can provide better control over the entire accounting process, from expense management to handling foreign taxes. This may become a direct business line for stablecoin coordination networks, or it may be an opportunity for emerging startups (similar to Lithic , for example). This derivative of corporate demand may lead to the emergence of more new businesses.

There are many ways that issuance can become increasingly specialized. Consider the emergence of tiers. With many credit cards, customers can pay an upfront fee to get a better rewards structure, such as with the Chase Sapphire Reserve atau AmEx Gold . Some companies (usually airlines and retailers) even offer proprietary credit cards. I wouldn’t be surprised to see similar experiments with stablecoin rewards tiers. (4) This could also provide an opportunity for startups.

In many ways, all of these trends feed into each other’s growth. As issuance diversifies, the need for coordination services increases. As coordination networks mature, this will lower the barrier for new issuers to compete. All of this represents a huge opportunity, and I expect to see more startups in this space. In the long run, these markets will be trillion-dollar markets that should be able to support many large enterprises.

This article is sourced from the internet: Looking at stablecoins from the perspective of credit card networks: What are the potential opportunities?

Original | Odaily Planet Daily ( @OdailyChina ) Author: Golem ( @web3_golem ) Since the launch of Fractal Bitcoin mainnet, hot projects have surged one after another. FLUX, known as the first token protocol, has not been fully digested (recommended reading Over-the-counter price surges 60 times, what is the origin of FLUX, known as Fractals first token protocol? ), and yesterday a new token protocol called CAT Protocol stole the limelight again. CAT Protocols first token, CAT, has a total of 21 million, 5 coins per CAT, for a total of 4.2 million. The current minting progress is about 35%, and it will take about 2 days to complete the minting at the current progress . As the popularity increases, the Fractal Bitcoin network fee has soared from 100 to…