BTC Volatility: Week in Review September 9 – September 16, 2024

Key Metrics (September 9, 4pm -> September 16, 4pm Hong Kong time):

-

BTC/USD +6.9% ($55,080 -> $58,900), ETH/USD -0.7% ($2,320 -> $2,305)

-

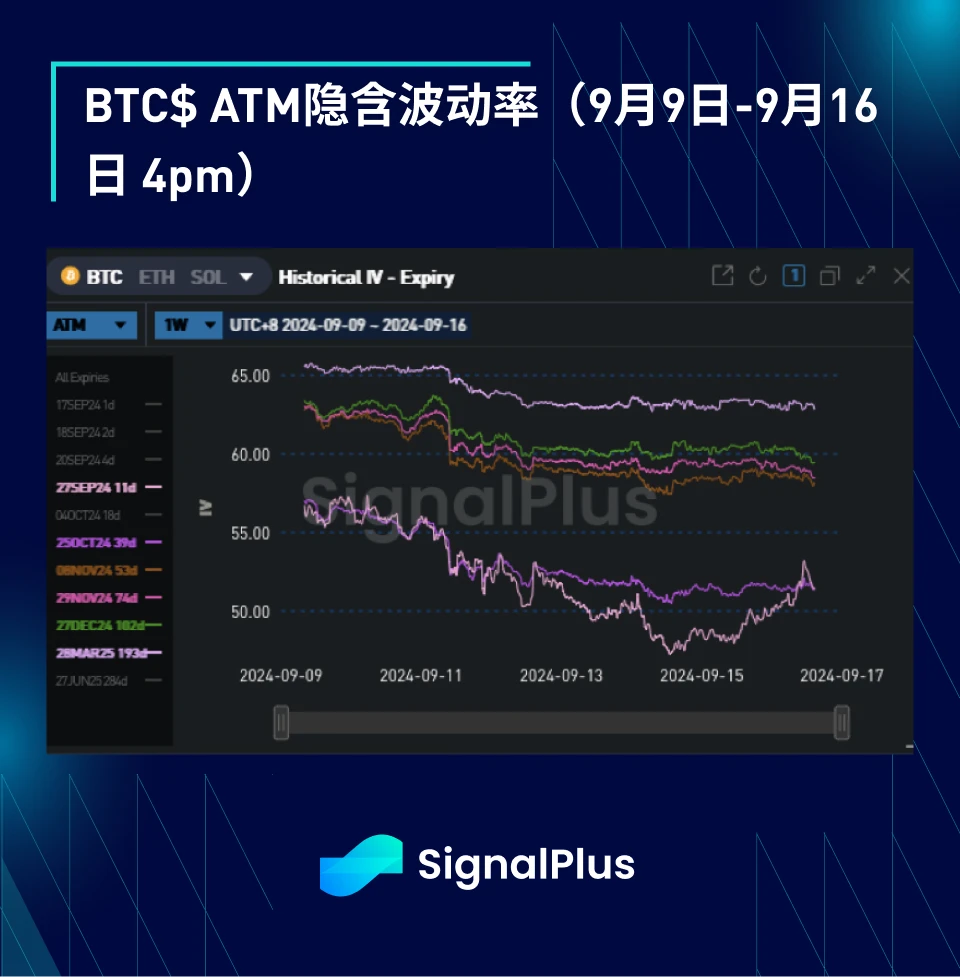

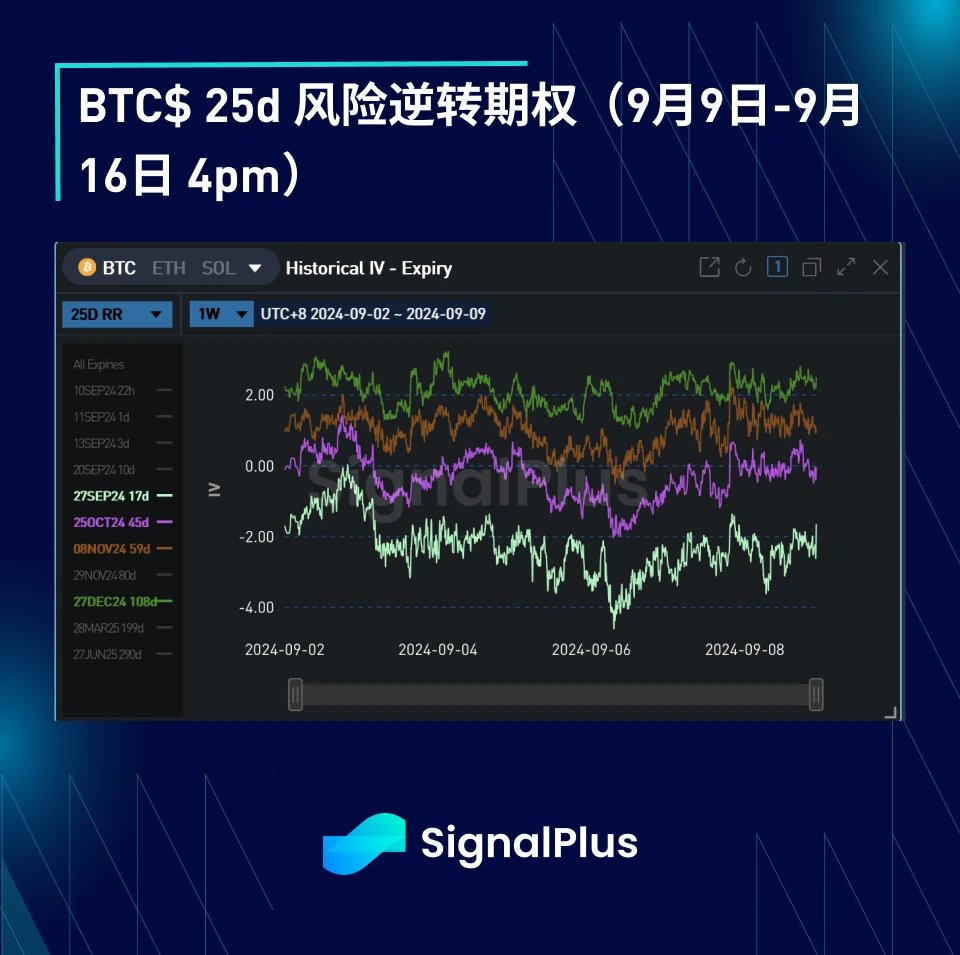

BTC/USD December (end of year) ATM volatility -2.9 v (62.4->59.5), December 25 day risk reversal volatility -0.1 v (2.5->2.4)

-

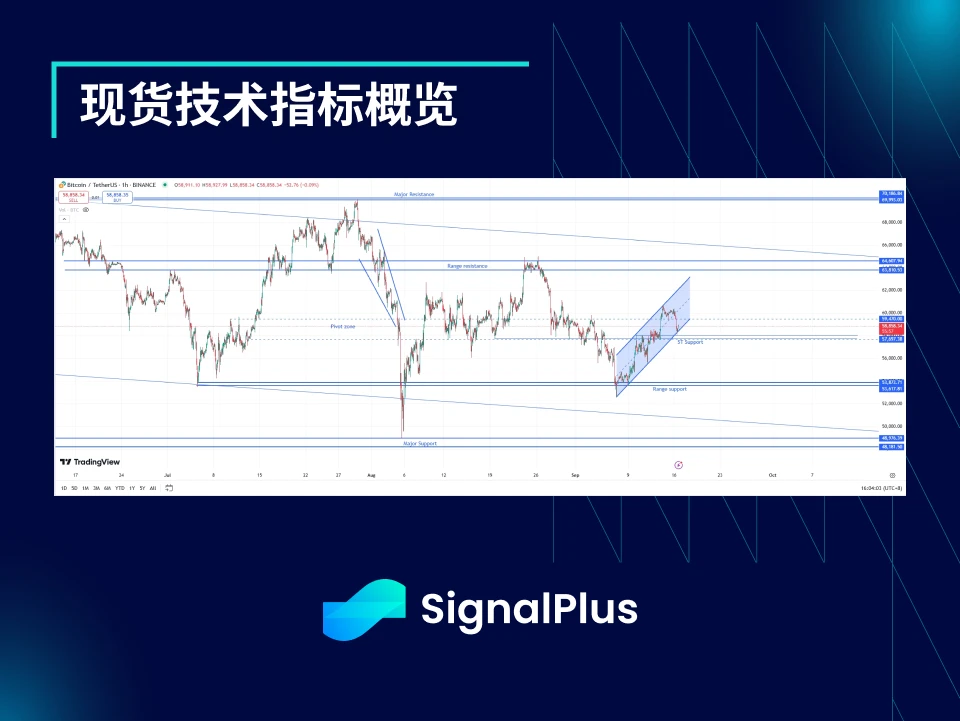

BTC/USD rebounded strongly from the range support and moved back to the $58-60k key price zone and is currently trying to find balance amidst high price volatility.

-

The short-term outlook remains bullish, but a break below the $57.5k support level could signal a larger correction

-

A pullback below $54k would break the long-standing rising flag pattern, suggesting a possible drop below $50k

-

If the price breaks above $61-62k, the next major resistance will be around $65k, the market may encounter selling pressure here, the probability before the election is still 50/50

Pasar Events:

-

Concerns about “Rektember” earlier this month appear to be overblown, as BTC/USD has rebounded this week after hitting strong support at $52k, briefly breaking through $60k. In contrast, ETH/USD lacks upward momentum and is hovering at $2,300.

-

After the September 10 presidential debate, US polls have tilted slightly in Harris favor as she is seen as outperforming her opponent. However, as the race remains close to 50/50, there will be limited impact on cryptocurrency prices unless there is more clarity on the race (which may not happen until the actual election).

-

The market is still swinging between 25bp and 50bp rate cut expectations for this weeks FOMC meeting; initially after the release of Wednesdays CPI data, the market fully priced in a 25bp rate cut, but then some leaks from some non-Fed voting members suggested a 50bp rate cut could also happen, and market expectations returned to 50/50

-

US stocks have once again found support from local lows as market positioning is clearly still relatively defensive, affected by concerns about a September sell-off; corporate earnings are mostly still solid; and US economic data has yet to show signs of a breakdown. If the Fed does cut rates by 50 basis points at this time, expect stocks and crypto markets to move further higher

ATM Implied Volatility:

-

Although the market has a high expected premium for events such as the presidential debate and US CPI, realized volatility has remained relatively flat this week. Although the 1-week implied volatility once reached 60, the high-frequency volatility remained in the mid-40s.

-

There was a surge in demand for options early in the week, but by the end of the week, there was an unwinding of volatility and directional bets, further depressing implied volatility, especially at the front end of the curve.

-

With the election still 50/50, election volatility pricing has declined slightly, in line with the reduction in premium in the overall volatility curve, and we would expect volatility to rise somewhat as we approach the election.

-

Election volatility pricing has declined slightly, in line with the reduction in premium on the overall volatility curve. As the probability of the current election outcome remains 50/50, we expect volatility to rise again as we approach the event.

Skewness/Convexity:

-

Volatility skew and convexity trends were relatively flat this week, with the market focusing on localized options demand for this month’s events.

-

Since there is no clear correlation between implied volatility and spot price movements (i.e. implied volatility does not react much to spot price increases or decreases), it is difficult for us to see any significant price adjustments before the election. Due to the uncertainty of the election results (50/50) and the significant impact of the election results on spot prices, we expect the market to adjust more to local strike price movements before the election.

I wish you all good luck next week, and I hope everyone who attends Token 49 has fun!

You can use the SignalPlus trading vane function at t.signalplus.com to get more real-time crypto information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlusCN, or join our WeChat group (add assistant WeChat: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends.

Situs Resmi SignalPlus: https://www.signalplus.com

This article is sourced from the internet: BTC Volatility: Week in Review September 9 – September 16, 2024

Related: Penetrating Monad’s social magic, how to maximize the power of culture and community?

As a Web3 investor and marketer, I have seen countless projects, but only a handful of them can truly take culture and community to the extreme. Monad is one of those rare success stories. Their community strategy is worth learning from for every entrepreneur. Today I will briefly talk about the Achilles heel of Monads community management in my eyes: cultural tension, spiritual motivation, biblical guidelines for community culture, gamification mechanisms, localized offline activities, purification rituals, and user-centered managers. 1. Monad’s cultural tension Monad did not stop at the traditional technical narrative, but introduced Meme culture and integrated it into the genes of the brand and community. Purple is Monad’s brand color. But now, purple Pepe is not just a simple brand symbol, but has gradually evolved into a symbol…