Penjelasan terperinci tentang Aset Intent dappOS: Bagaimana mencapai likuiditas instan dengan bunga aset yang stabil?

Asli | Odaily Planet Daily ( @OdailyChina )

Penulis | Fu Howe ( @vincent 31515173 )

As the integration of mainstream finance and the crypto industry accelerates, the advantages of Web3 are increasingly being accepted by global companies and countries.

However, Web3 is also affected by its own limitations in terms of global popularity, especially the complex on-chain processes. The complex transaction steps protect the right to use personal property, but also limit its large-scale popularization. While Web3 gives users freedom, it also makes itself a gathering place for risky activities, resulting in a high threat to the security of on-chain assets.

This is also the reason why in this bull market, new external funds are still staying at the doorstep of Web2 and Web3 (that is, spot ETFs), but have not actually come to the chain.

From the perspective of Web3, the public chain ecosystem is relatively fragmented, and low asset liquidity and utilization lead to a lack of demand for on-chain assets, and few new asset issuance models are born.

However, the concept of intent-centric came into being, setting off a wave of simplifying the steps for users to participate in on-chain activities, thereby attracting new users to continue to flock to Web3.

It has been a year since the birth of the intent-centric sector. Most projects are under development in full swing, and few new growth points have emerged. However, dappOS, a representative project of this sector, recently launched a new asset model – Intent Assets.

Intent Assets is translated as intention assets from the perspective of its literal meaning. According to the official introduction, Intent Assets can not only generate interest directly, but also be traded seamlessly in the ecosystem, and can also be traded as original tokens at any time on the exchange.

Presumably, everyone is interested in the core principles, profitability, and security of Intent Assets. To this end, Odaily Planet Daily has conducted research based on the official disclosure of Intent Assets to understand its core construction logic and dispel users unknown confusion caused by the Intent black box.

Odaily Planet Daily Note: When writing this article, I would like to thank the relevant staff of dappOS for their help in helping the author understand the core construction logic behind it.

The birth of the upgraded version of Web3 Yuebao Intent Assets

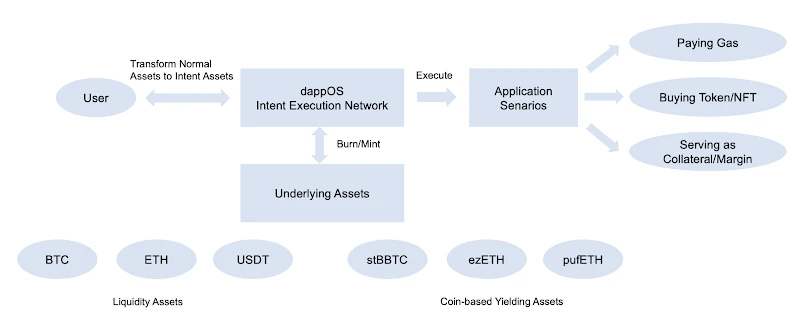

Before talking about Intent Assets, let me first introduce dappOS, which is an intent execution network designed to simplify and optimize Web3 application operations. Through the dappOS intent execution network, users can define specific operation intentions, and the system will automatically select the optimal execution path and service provider to implement these intentions. This automation and optimization reduces the users operational burden and improves efficiency.

One of the core products of dappOS based on the intent execution network is intent OS (intent operating system), which is mainly designed to reduce the complexity of users using Web3 applications, thereby achieving large-scale adoption of Web3. Intent dApps running on intent OS will use dApp interactions as the target of intent tasks, and the execution will be handed over to the dappOS intent execution network to complete. Therefore, users no longer need to switch between different chains repeatedly, nor do they need to personally perform cumbersome multi-chain wallet and fund management. They can achieve seamless dApp interaction through intent OS, just like using windows/mac OS to directly interact with computer programs.

From this we can see that before dappOS launched Intent Assets, its own foundation already had the ability to operate the new asset model.

How Intent Assets Work

Intent Assets is one of the core application scenarios of the dappOS intent execution network, which aims to simplify and automate users asset management operations in the Web3 world through an intent-driven approach. Simply put, Intent Assets is an asset management tool based on user intent (Intent), which can understand user needs, select the optimal execution path, and automatically complete complex operations.

The underlying assets of Intent Assets are withdrawal vouchers of multiple on-chain Vaults. Users can move Intent Assets to different chains by themselves, and then redeem the underlying assets in the Vault according to the oracle price. These underlying assets must be project assets in the cooperation whitelist, and there is a time lock for adding new assets. This means that Intent Asset is not a centralized custody product, and users can redeem it by themselves even without the dappOS intent execution network.

In actual operation, since users’ self-redemption is often costly and inefficient, users often interact with Intent Assets and Vault through the dappOS network. Users only need to specify the execution target, and the nodes will bid according to the user’s needs and show the user the node with the lowest cost. The user only needs to confirm and complete the operation. This mechanism ensures that the user’s operation is simple and efficient.

The interaction process mentioned here is essentially that users set profit targets or transaction targets through the intention execution network of dappOS and node service providers (or asset service providers) under the premise of ensuring security, and simplify the complex operation process (staking, transfer, lending, etc.) from the message transmission layer through nodes. This whole process is invisible, which is also the core working mechanism of intention.

User concerns: profitability, security, and liquidity

Currently, Intent Assets allows users to earn returns based on USDT, ETH or BTC by holding intentUSD, intentETH or intentBTC while maintaining liquidity. Underlying assets such as wstETH and stBBTC are designed to remain stable and gradually increase in value during market downturns, thereby reducing risks and ensuring the stability of users returns.

Under the premise of ensuring the yield, the security of assets is particularly important. As mentioned above, the underlying layer of the intention asset is composed of a series of underlying assets, and is essentially a withdrawal voucher. Users can call the contract to mint/burn by themselves. On the one hand, this allows users to redeem the intention for the underlying assets in extreme cases, and on the other hand, when a single underlying income asset has problems, the impact on users is relatively small. In the process of redemption and use through the dappOS network, the dappOS network adopts OMS, a core trust security mechanism, to ensure that the users task results are verified, and if the task fails, the user will be compensated. Underlying assets such as wstETH and stBBTC are designed to remain stable during market downturns and steadily increase in value, thereby reducing risks.

When the two core demands of security and profitability are met, whether the liquidity of Intent Assets is sufficient is also a factor that users need to consider.

According to the official introduction, Intent Assets can be converted back to underlying assets (such as USDT) at any time, and there is no lock-up period or manual conversion cost when used in various decentralized applications. Users can withdraw USDT in real time on the exchange or use USDC to replenish Arbitrums GMX margin immediately. In addition to gas fees, there is no additional loss from using these assets.

Why can dappOS achieve this level of liquidity and asset availability? Because the node service providers within dappOS are a free market, and they bid for the opportunity to execute user tasks. In such a competitive environment, only nodes with professional service capabilities with higher execution efficiency and lower execution costs can win. And these professional nodes often have execution plans that ordinary users do not have, such as: multiple users inflows and outflows offset each other; first obtain low-cost loans, advance the funds required for user redemption, and after collecting a certain amount of interest-bearing assets, find the project party to redeem as a large user, thereby avoiding slippage losses caused by low liquidity on the chain DEX. The dappOS Intent Execution Network is equivalent to empowering users with this institutional-level professional execution capability, so that users have a good experience in using intent assets.

Market acceptance and use cases of Intent Assets

The above article introduces the operating logic and key points of Intent Assets, but whether Intent Assets is competitive and whether it can attract new users from the more mature operating process of Web3 has become the focus of dappOS.

To this end, Odaily Planet Daily has integrated the information of current related sections and compared Intent Assets with them.

Analysis of the advantages and disadvantages of Intent Assets and other stablecoins and interest-bearing projects

This article does not take other interest-bearing projects as examples. Mainly because some of their structures are different, Intent Assets is compared with these projects as a whole. The following is an analysis of their advantages and disadvantages:

The advantage of Intent Assets is that it solves the problem of the incompatibility of income and liquidity in traditional interest-bearing products. Users no longer need to choose between earning income and maintaining liquidity. Underlying assets such as wstETH, sUSDe, sDAI and stBBTC, which steadily increase in value relative to the underlying assets, provide stability and growth. In addition, service providers in the dappOS network are responsible for handling settlement tasks to ensure that users operations are simple and efficient.

However, compared with other interest-bearing products on the market, the complexity of the overall structure of Intent Assets may pose a certain barrier to new users. Although dappOS is designed to simplify operations, for users who are not familiar with blockchain technology, understanding and using Intent Assets may still require a certain learning cost.

Through the above comparison, although Intent Assets has certain advantages in design, whether it can dispel users unknown fear of new things becomes a prerequisite. However, from the introduction in this article, Odaily Planet Daily has explained the working principle behind it in depth enough. In essence, intent-based projects are very similar to Web2 on the surface, but the centralized mechanism of Web2 is partially endorsed by the state, and behind Intent Assets is a transparent series of Web3 income assets and a decentralized dappOS intent execution network. Isnt this the decentralization advocated by Web3?

User groups and use cases

Intent Assets is suitable for users who want to earn stable returns through digital assets, especially those who want to earn returns without sacrificing liquidity. These users may include advanced users seeking the simplicity of multi-chain operations, investors who want to earn additional returns through decentralized financial products, and corporate users who need efficient cross-chain asset management.

For example, if a user wants to deposit 1 intentETH as ETH into a Binance account, the node will be responsible for implementing the result of receiving ETH in the address, but can choose the implementation method and quotation (such as direct advance payment, redemption of LRT on a specific chain, or batch processing, etc.). This flexibility makes Intent Assets have a wide range of application potentials in a variety of scenarios.

Conclusion: Intent Assets is the first use case of the intent section

This article starts with the core principles of Intent Assets, explains the selection process of its underlying assets, and deeply interprets the process principles of the black box behind it. Finally, by comparing it with similar sections, Intent Assets is presented to readers.

Judging from the information collected by the author and the answers from the official staff of dappOS, Intent Assets, under the premise of decentralization and non-custody, has further enhanced the security of Intent Assets through whitelist asset selection restrictions and the assistance of the OMS system. At the same time, thanks to its own intent network and the support of many partners, liquidity is also strongly supported in terms of multi-chain interconnection.

It can be said that Intent Assets is an important innovation of dappOS for simplifying Web3 asset management. Through the intent-driven approach, the system can automatically handle complex blockchain operations, improve user experience, reduce operational risks, and improve overall efficiency. The emergence of Intent Assets not only provides Web3 users with a new asset management tool, but also provides a new platform for the large-scale adoption of Web3.

This article is sourced from the internet: Detailed explanation of dappOS Intent Assets: How to achieve instant liquidity with stable asset interest?

I talked with some colleagues these days, and this round of VC in the cryptocurrency circle is basically dead. Fortunately, we did not invest much in the primary market, but turned to the secondary market. “I talked to a market maker, and he felt very sorry for us VCs. In the first year after the project went online, VCs couldn’t get the coins. Only market makers, projects, and exchanges had the coins. But when the price dropped, it was the VCs who took the blame and were even ridiculed as VC coins.” At a cryptocurrency event in Hong Kong, LD Capital founder Yi Lihua spoke up for cryptocurrency VCs. In his opinion, VCs are the biggest scapegoats in this round of cryptocurrency cycle. Not only have they lost money, but…