Laporan Riset Sentimen Pasar Kripto (23-08-2024): Koreksi kejutan bulan Agustus, tunggu dan lihat tren baru

The market fluctuated and corrected in August, and we are waiting to see the new trend of the market

Data source: coinmarketcap

After the release of non-agricultural data in early August, the mainstream currency market experienced a sharp drop in price. Subsequently, the market has repeatedly experienced a trend of rising and falling, and the implied volatility has gradually declined from the highest level on August 5, and the overall market has shown a wide range of fluctuations. The current market urgently needs the guidance of a new round of economic data to promote the development of the next stage of the market.

The market generally expects the Fed to announce a rate cut at its meeting on September 19. However, the new non-farm payrolls data to be released on September 6 will be key. If the data is strong, it will significantly reduce the probability of the Fed cutting interest rates in mid-September. In addition, the PPI and CPI data to be released on September 11 and September 12 will also be closely watched. If these inflation indicators do not show a significant decline, it will also reduce the possibility of the Fed cutting interest rates. Therefore, investors need to pay close attention to the upcoming economic data to judge future market trends.

There are about 19 days until the next Federal Reserve interest rate meeting (September 19, 2024)

https://hk.investing.com/economic-calendar/interest-rate-decision-168

Analisis lingkungan teknis dan sentimen pasar

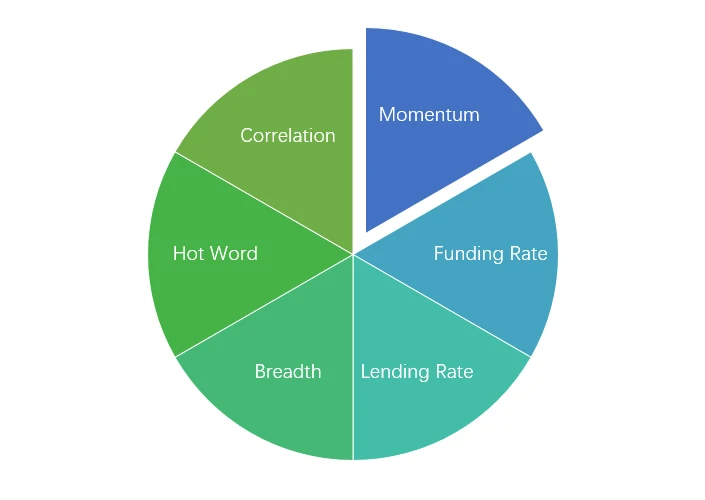

Komponen Analisis Sentimen

Indikator teknis

Price Trends

BTC price fell -1.68% and ETH price fell -3.63% over the past week.

Gambar di atas adalah grafik harga BTC dalam seminggu terakhir.

Gambar di atas adalah grafik harga ETH dalam seminggu terakhir.

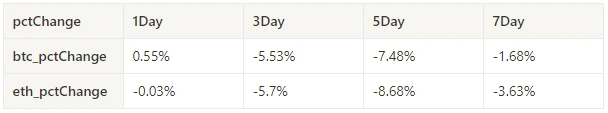

Tabel tersebut menunjukkan tingkat perubahan harga selama seminggu terakhir.

pctChange1Day3Day5Day7Daybtc_pctChange0.55% -5.53% -7.48% -1.68% eth_pctChange-0.03% -5.7% -8.68% -3.63%

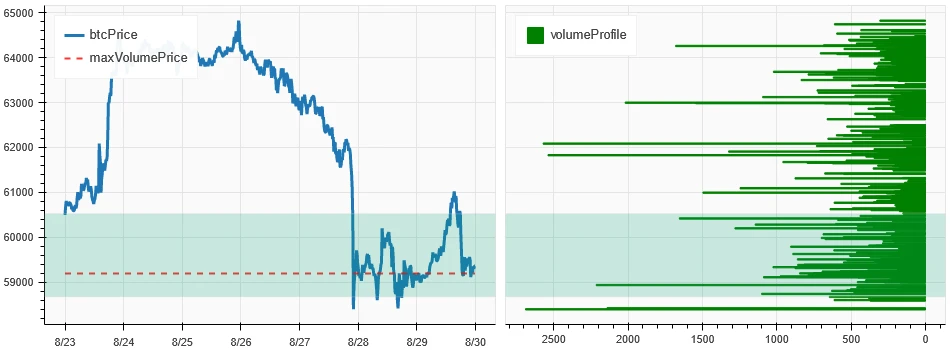

Grafik Distribusi Volume Harga (Support dan Resistance)

In the past week, both BTC and ETH hit a high point and then fell back to a high-volume trading area.

Gambar di atas menunjukkan sebaran area perdagangan BTC yang padat dalam seminggu terakhir.

Gambar di atas menunjukkan sebaran area perdagangan ETH yang padat dalam seminggu terakhir.

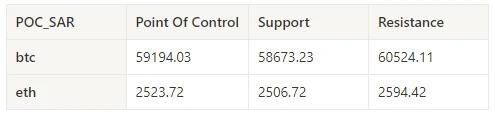

Tabel tersebut menunjukkan rentang perdagangan intensif mingguan BTC dan ETH dalam seminggu terakhir.

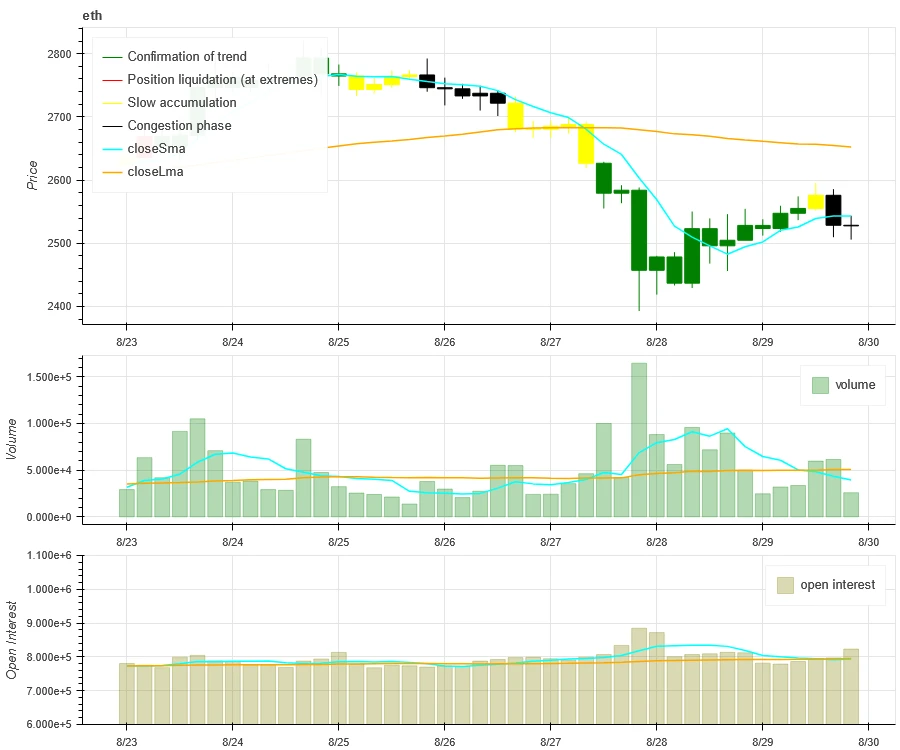

Volume dan Minat Terbuka

In the past week, the trading volume of BTC and ETH was the largest when they plummeted to 8.27; the open interest of BTC and ETH did not change significantly.

Gambar bagian atas menunjukkan tren harga BTC, bagian tengah menunjukkan volume perdagangan, bagian bawah menunjukkan open interest, warna biru muda adalah rata-rata 1 hari, dan oranye adalah rata-rata 7 hari. Warna garis K mewakili keadaan saat ini, hijau berarti kenaikan harga didukung oleh volume perdagangan, merah berarti penutupan posisi, kuning berarti akumulasi posisi secara perlahan, dan hitam berarti keadaan ramai.

Gambar di atas menunjukkan tren harga ETH, di tengah adalah volume perdagangan, di bawah adalah open interest, biru muda adalah rata-rata 1 hari, dan oranye adalah rata-rata 7 hari. Warna garis K mewakili keadaan saat ini, hijau berarti kenaikan harga didukung oleh volume perdagangan, merah berarti penutupan posisi, kuning berarti akumulasi posisi secara perlahan, dan hitam berarti ramai.

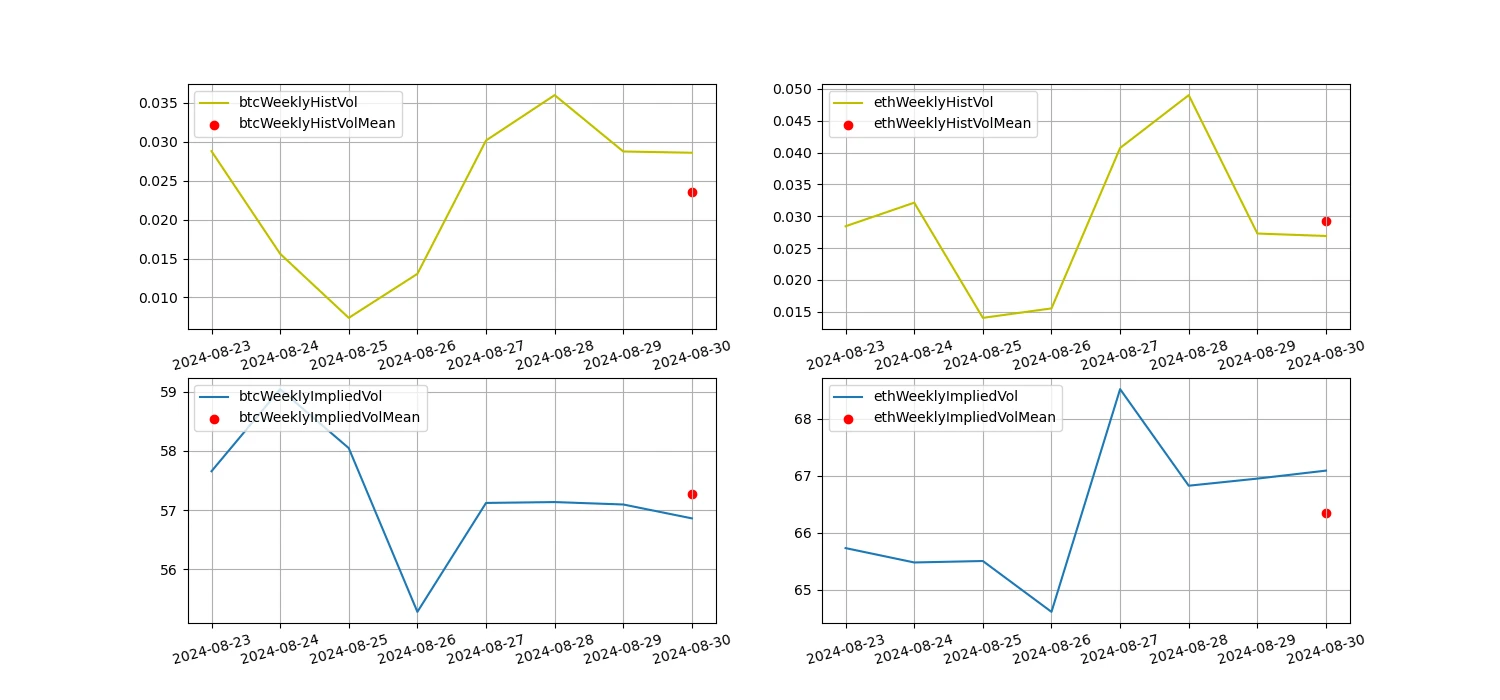

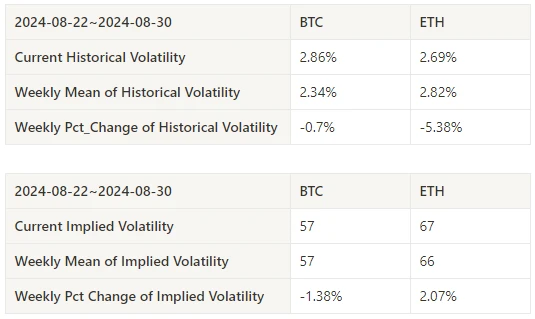

Volatilitas Historis vs. Volatilitas Tersirat

Historical volatility for BTC and ETH was highest this past week at 8.27; implied volatility for BTC fell while ETH rose.

Garis kuning adalah volatilitas historis, garis biru adalah volatilitas tersirat, dan titik merah adalah rata-rata 7 hari.

Didorong oleh peristiwa

No major data was released in the past week, and we are waiting for the release of non-farm data on 09.06.

Emotional indicators

Sentimen Momentum

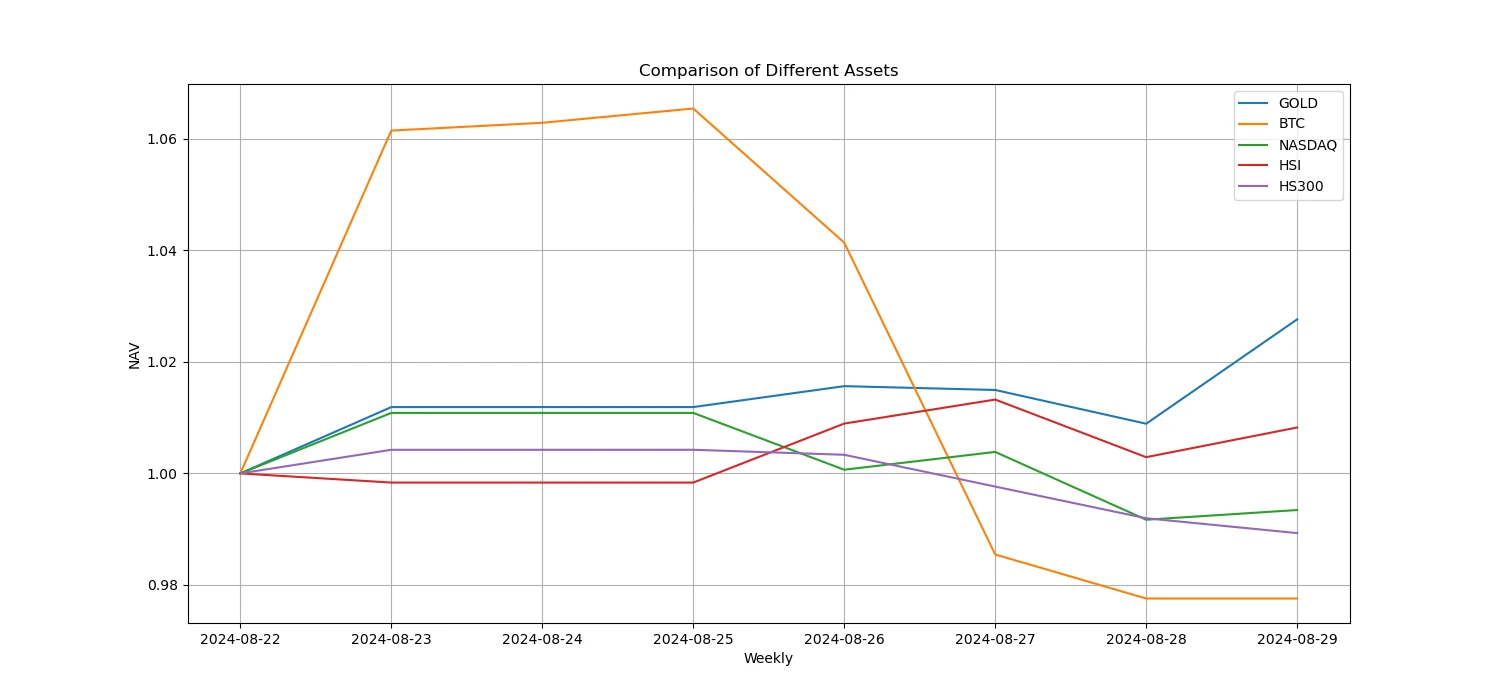

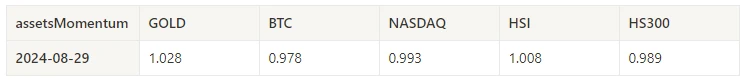

In the past week, among Bitcoin/Gold/Nasdaq/Hang Seng Index/SSE 300, gold was the strongest, while Bitcoin performed the worst.

Gambar di atas menunjukkan tren berbagai aset dalam seminggu terakhir.

Suku Bunga Pinjaman_Sentimen Pinjaman

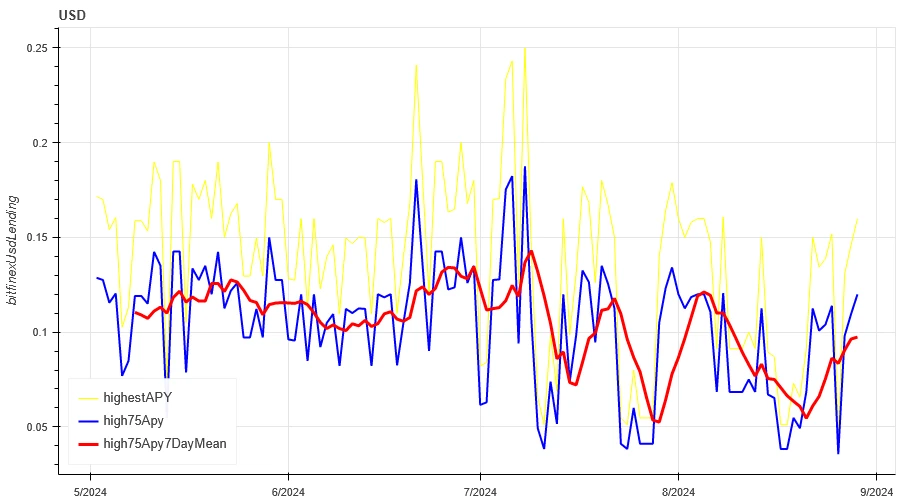

The average annualized return on USD lending over the past week was 9.9%, and short-term interest rates rose to 12%.

Garis kuning adalah harga tertinggi suku bunga USD, garis biru adalah 75% dari harga tertinggi, dan garis merah adalah rata-rata 7 hari dari 75% dari harga tertinggi.

Tabel ini menunjukkan rata-rata pengembalian suku bunga USD pada hari-hari penyimpanan yang berbeda di masa lalu

Tingkat Pendanaan_Sentimen Leverage Kontrak

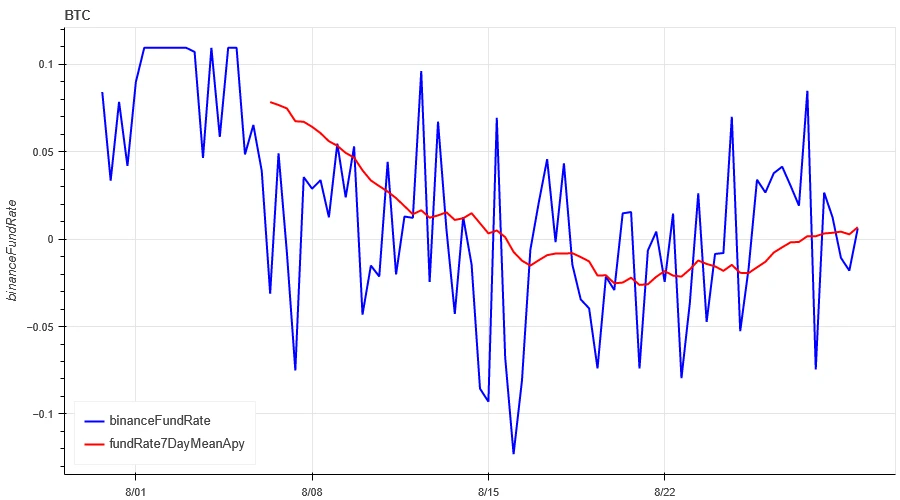

The average annualized return on BTC fees in the past week was 0.3%, and contract leverage sentiment remained low.

Garis biru adalah tingkat pendanaan BTC di Binance, dan garis merah adalah rata-rata 7 hari

Tabel tersebut menunjukkan rata-rata pengembalian biaya BTC untuk hari penyimpanan yang berbeda di masa lalu.

Korelasi Pasar_Sentimen Konsensus

The correlation among the 129 coins selected in the past week was around 0.8, and the consistency between different varieties was high.

In the above picture, the blue line is the price of Bitcoin, and the green line is [1000 floki, 1000 lunc, 1000 pepe, 1000 shib, 100 0x ec, 1inch, aave, ada, agix, algo, ankr, ant, ape, apt, arb, ar, astr, atom, audio, avax, axs, bal, band, bat, bch, bigtime, blur, bnb, btc, celo, cfx, chz, ckb, comp, crv, cvx, cyber, dash, doge, dot, dydx, egld, enj, ens, eos,etc, eth, fet, fil, flow, ftm, fxs, gala, gmt, gmx, grt, hbar, hot, icp, icx , imx, inj, iost, iotx, jasmy, kava, klay, ksm, ldo, link, loom, lpt, lqty, lrc, ltc, luna 2, magic, mana, matic, meme, mina, mkr, near, neo, ocean, one, ont, op, pendle, qnt, qtum, rndr, rose, rune, rvn, sand, sei, sfp, skl, snx , sol, ssv, stg, storj, stx, sui, sushi, sxp, theta, tia, trx, t, uma, uni, vet, waves, wld, woo, xem, xlm, xmr, xrp, xtz, yfi, zec, zen, zil, zrx] overall correlation

Luas Pasar_Sentimen Keseluruhan

Among the 129 coins selected in the past week, 41% of the coins were priced above the 30-day moving average, 48% of the coins were priced above the 30-day moving average relative to BTC, 18% of the coins were more than 20% away from the lowest price in the past 30 days, and 10% of the coins were less than 10% away from the highest price in the past 30 days. The market breadth indicator in the past week showed that most coins in the overall market returned to a downward trend.

The picture above is [bnb, btc, sol, eth, 1000 floki, 1000 lunc, 1000 pepe, 1000 sats, 1000 shib, 100 0x ec, 1inch, aave, ada, agix, ai, algo, alt, ankr, ape, apt, arb, ar, astr, atom, avax, axs, bal, band, bat, bch, bigtime, blur, cake, celo, cfx, chz, ckb, comp, crv, cvx, cyber, dash, doge, dot, dydx, egld, enj, ens, eos,etc, fet, fil, flow, ftm, fxs, gala, gmt, gmx, grt, hbar, hot , icp, icx, idu, imx, inj, iost, iotx, jasmy, jto, jup, kava, klay, ksm, ldo, link, loom, lpt, lqty, lrc, ltc, luna 2, magic, mana, manta, mask, matic, meme, mina, mkr, near, neo, nfp, ocean, one, ont, op, ordi, pendle, pyth, qnt, qtum, rndr, robin, rose, rune, rvn, sand, sei, sfp, skl, snx, ssv, stg, storj, stx, sui, sushi, sxp, theta, tia, trx, t, uma, uni, vet, waves, wif, wld, woo,xai, xem, xlm, xmr, xrp, xtz, yfi, zec, zen, zil, zrx ] 30-day proportion of each width indicator

Meringkaskan

In the past week, the prices of Bitcoin (BTC) and Ethereum (ETH) fell by -1.68% and -3.63% after a short-term surge. After a short-term surge, the prices of both fell back to a low-level dense trading area. On August 27, the prices of both fell sharply, and the trading volume on that day reached a peak, while the open interest did not change significantly. In terms of volatility, the historical volatility reached its highest point on the decline on August 27, however, the implied volatility performance was differentiated: BTC implied volatility fell, while ETH rose. In the performance comparison of different assets, gold was the strongest among Bitcoin, Nasdaq, Hang Seng Index and CSI 300, while Bitcoin performed the weakest. The average annualized yield of USD lending is 9.9%. The average annualized return of BTC funding rate is 0.3%, indicating that the leverage sentiment of the contract is still low. The correlation between the selected 129 currencies remains around 0.8, showing a high consistency between different varieties. Market breadth indicators show that most cryptocurrencies in the overall market have returned to a downward trend.

Twitter: @ https://x.com/CTA_ChannelCmt

Situs web: salurancmt.com

This article is sourced from the internet: Crypto Market Sentiment Research Report (2024.08.23-08.30): August shock correction, wait-and-see new trends

Related: Interpreting the new proposal ACP-77, how to unlock Avalanche L1?

Original author: Eden Au , The Block Original translation: Felix, PANews Key points: ACP-77 is a community proposal that will change the validator dynamics for Avalanche L1 (formerly known as subnets). Avalanche L1 validators will no longer need to validate the main network and stake at least 2,000 AVAX. Instead, they will follow the requirements set by the sovereign Avalanche L1. Avalanche L1 validators will pay an ongoing dynamic fee to register information on the P-Chain. The proposal benefits both institutional and retail Avalanche L1 as regulatory compliance and low barriers to entry for validators can be achieved. Avalanche has long been a proponent of horizontal scaling using “subnets,” which are now being rebranded as Avalanche Layer 1 (L1). Avalanche L1s are sovereign, often application-specific blockchains that can be individually…