Key Metrics (August 19 4pm -> August 26 4pm Hong Kong time):

-

BTC/USD +8.5% ($58,600 -> $63,600), ETH/USD +4.4% ($2,620 -> $2,735)

-

BTC/USD December (end of year) ATM volatility unchanged (62.2 -> 62.2), December 25 day risk reversal volatility -2.0 v (4.1 -> 2.1)

-

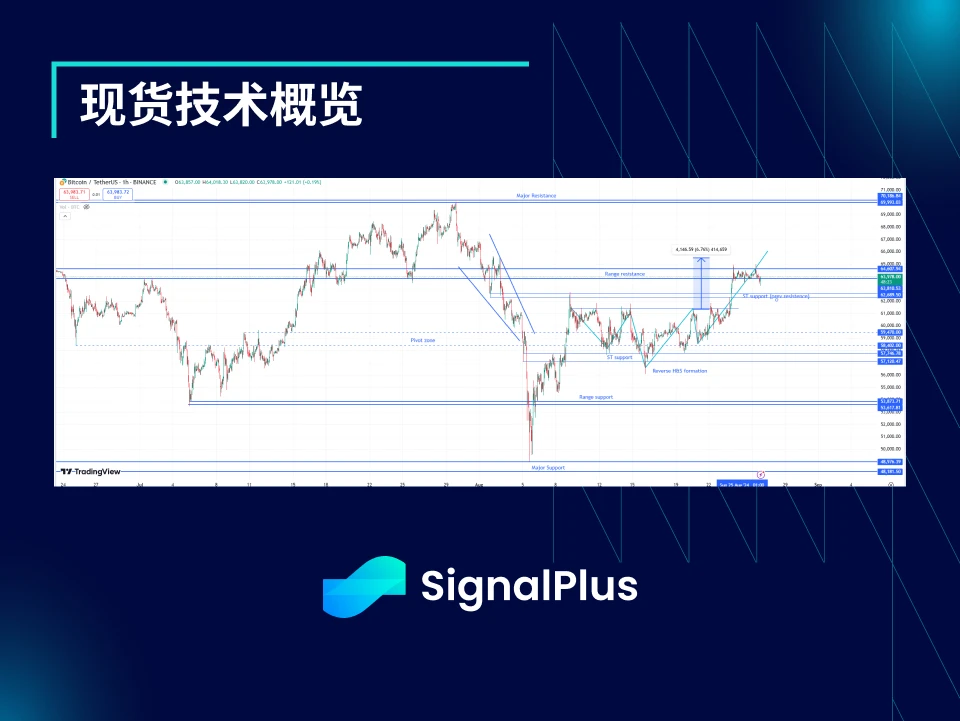

The spot price has finally managed to break through 54-63k and is testing the price range resistance of 64-65k. If it can break through this range, the BTC price may challenge the highs again (initial target is 70k, then above 74k). The initial support level is below 62.5k.

-

Combined with Fridays price breakout, the past few weeks volatile action has formed a (slightly confusing) inverse head and shoulders pattern, suggesting a more intentional move toward range lows could be in the cards if prices pull back again and fail to successfully break through overhead resistance.

Market Events:

-

The market was generally in a quiet consolidation phase at the beginning of this week, but as Powells speech at the Jackson Hole conference approached on Friday night, market expectations gradually heated up. Powell did not respond strongly to the markets expectations of a quick adjustment to faster and earlier rate cuts, but admitted that now is the time to start the Feds rate cut cycle.

-

The cryptocurrency market was relatively slow to react initially (compared to the rapid rise in US stocks/weakening of the USD versus the G10 currencies), but eventually BTCUSD broke through the recent 58-62k price range and stabilized at 64k, driving ETHUSD to the high of the recent range in tandem.

-

Geopolitical noise is now fading into the background, with no signs of an imminent escalation of tensions in the Middle East, while peace talks are struggling to make any substantial progress.

Volatilitas Tersirat ATM:

-

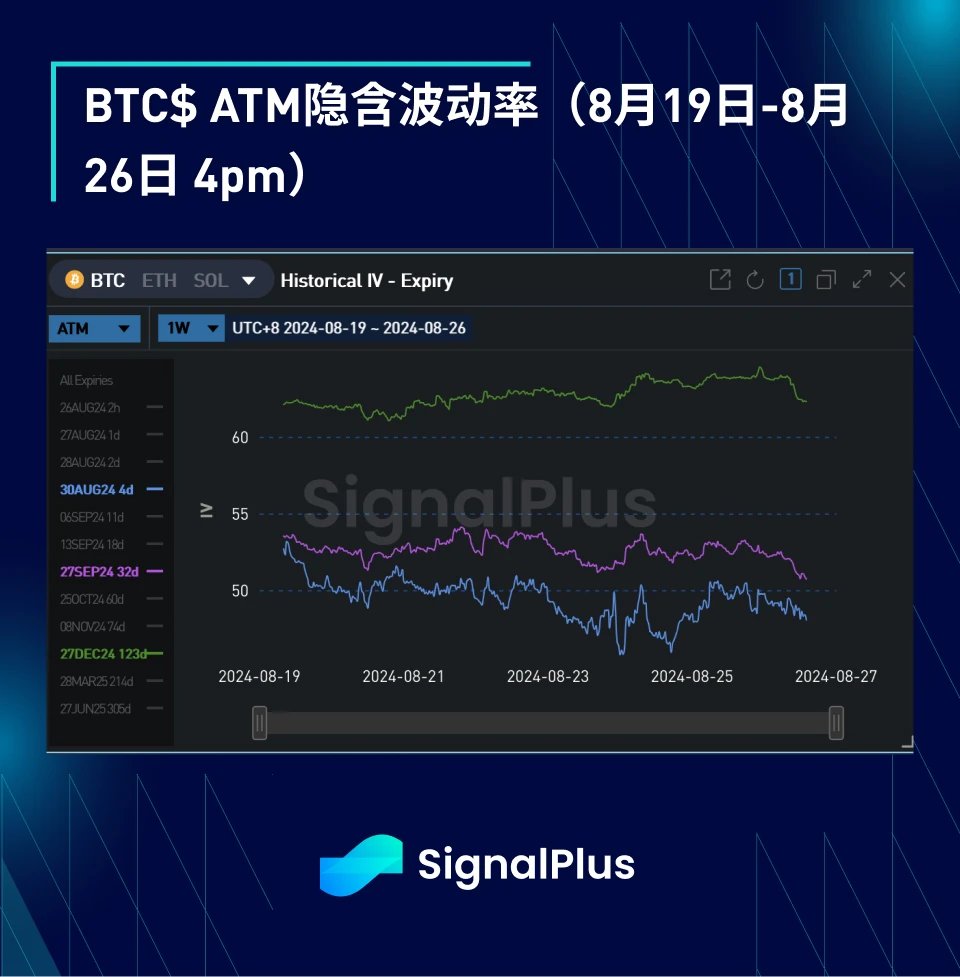

Implied volatility has been mostly sideways this week, with spot prices range-bound ahead of the Jackson Hole meeting, which has pushed implied volatility up to the overnight breakeven of 2.5% (with an implied volatility of 60). This level is roughly reasonable based on high-frequency data, but low based on fixed-time data.

-

After the Jackson Hole meeting, the spot price broke out of the 58-62k range and the implied volatility initially rose. But by Monday, the implied volatility quickly fell back, and the spot/realized volatility stagnated around 64k.

-

There was continued demand for US election-related options, mostly through rolling September/October call options to November/December. However, a large supply of long-dated call options after the weekend also caused forward prices to fall, reducing the impact of the US election.

Kemiringan/Konveksitas:

-

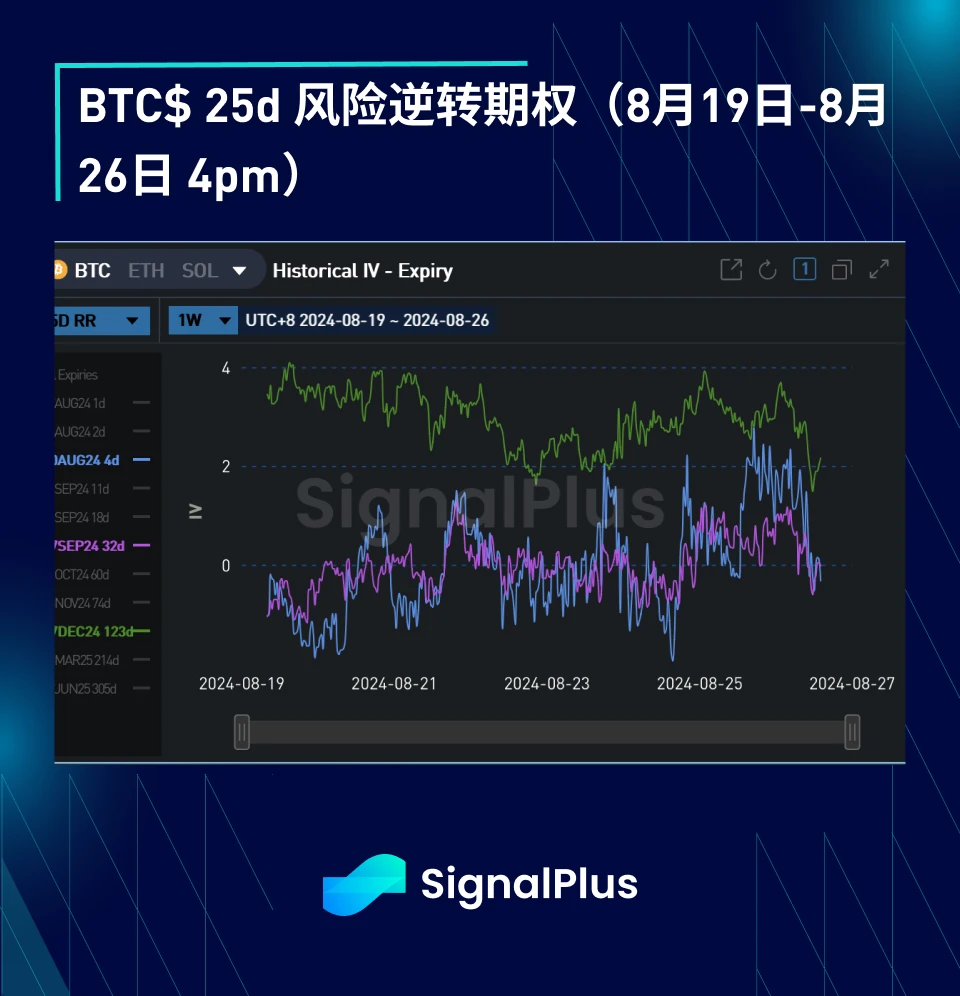

The skew pricing has moved significantly lower (less demand for options on the upside), which is interestingly the opposite of the spot price movement. This could indicate that the market is still concerned about an accelerated decline in prices, as the previous two declines in this range were very volatile.

-

In addition, some traders are taking advantage of the rise in spot prices to sell covered calls, especially at longer maturities, which puts downward pressure on the tilt of the term structure.

-

Convexity has weakened this week, with both realized volatility and realized spot risk reversals showing low correlations, which has exerted some downward pressure on convexity.

Good luck with your trading this week!

Anda dapat menggunakan fungsi baling-baling perdagangan SignalPlus di t.signalplus.com untuk mendapatkan informasi kripto secara real-time. Jika Anda ingin segera menerima pembaruan kami, silakan ikuti akun Twitter kami @SignalPlusCN, atau bergabunglah dengan grup WeChat kami (tambahkan asisten WeChat: SignalPlus 123), grup Telegram, dan komunitas Discord untuk berkomunikasi dan berinteraksi dengan lebih banyak teman. Situs Web Resmi SignalPlus: https://www.signalplus.com

Welcome to join the Odaily official community

Telegram subscription group: https://t.me/Odaily_News

Telegram chat group: https://t.me/Odaily_CryptoPunk

Official Twitter account: https://twitter.com/OdailyChina

This article is sourced from the internet: BTC Volatility: Week in Review August 19–26, 2024

Penulis asli: Crypto, Distilled Terjemahan asli: TechFlow Coinbase baru saja merilis laporan tentang bagaimana dana lindung nilai kripto menghasilkan keuntungan berlebih. Berikut adalah wawasan yang paling berharga. Ikhtisar Laporan Laporan ini mengungkap strategi utama yang digunakan oleh dana lindung nilai kripto yang aktif. Laporan ini memberikan wawasan berharga bagi setiap investor yang ingin: Mengelola risiko dengan lebih baik Menangkap keuntungan berlebih Memperdalam pemahaman Anda tentang enkripsi Memberikan wawasan yang berharga. Strategi pasif atau aktif? Terlepas dari tingkat pengalaman Anda, selalu bandingkan kinerja Anda dengan $BTC. Jika Anda tidak dapat mengungguli $BTC selama setahun atau lebih, pertimbangkan strategi pasif. Bagi sebagian besar investor, DCAing $BTC secara teratur biasanya merupakan opsi terbaik selama pasar sedang lesu. Bitcoin – Tolok Ukur $BTC adalah tolok ukur yang lebih disukai untuk beta pasar kripto. Sejak 2013, $BTC telah memiliki keuntungan tahunan…