Bitget Research Institute: Bitcoin berfluktuasi dalam kisaran sempit $60.000, meme Solana rebound dan ada tawar-menawar

Dalam 24 jam terakhir, banyak mata uang dan topik populer baru telah muncul di pasar, yang mungkin menjadi peluang berikutnya untuk menghasilkan uang , termasuk:

-

Sectors with strong wealth-creating effects are: Solana Meme, DeFi;

-

The most popular tokens and topics among users are: Satlayer, Magic Eden, Popcat;

-

Potential airdrop opportunities include: Symbiotic, Usual;

Data statistics time: August 23, 2024 4: 00 (UTC + 0)

1. Lingkungan pasar

BTC price has been moving in a tight range over the past 24 hours. Short positions have accumulated heavily above $62,000, making this level a key target for resistance and support shifts.

Meanwhile, the U.S. Ethereum ETF has seen outflows for five consecutive days, the longest period of consecutive outflows since its launch on July 23. According to Farside Investors, ETHE has seen outflows every day except for August 12, when the Grayscale fund reported no net flows. As of August 22, outflows have exceeded $2.52 billion.

2. Sektor Pencipta Kekayaan

1) Sector changes: Solana Meme (FWOG, POPCAT)

alasan utama:

The wealth effect of the Sunpump launch platform token began to decline, and hot money flowed back into the Solana ecosystem. The meme tokens that had hit bottom due to the outflow of hype funds in the early stage began to rebound due to the return of funds.

Rising situation: FWOG and POPCAT rose 37.78% and 28.51% respectively within 24 hours;

Faktor-faktor yang mempengaruhi prospek pasar:

-

Tren token SOL: Dalam ekosistem Solana, tren token SOL akan memengaruhi harga seluruh token ekosistem, karena banyak token di DEX yang dihargai dalam SOL. Terus perhatikan tren harga SOL. Jika SOL mempertahankan tren naik, Anda dapat terus memegang aset ekosistem SOL.

-

Peningkatan atau penurunan open interest: Open interest SOL meningkat kemarin, yang mengindikasikan masuknya hot money. Gunakan data kontrak di situs web tv.coinglass untuk memahami pergerakan dana utama. Pertama, lihat peningkatan net long position pada kontrak; lalu lihat apakah data kontrak menunjukkan peningkatan net long position, peningkatan OI, dan peningkatan volume perdagangan. Jika demikian, berarti kekuatan utama terus membeli dan dapat terus bertahan.

2) Sector changes: DeFi (CAKE, CHESS)

alasan utama:

-

BNB Chain launched the ecological meme distribution platform Four.Meme, and launched a points activity. Users can get points by completing relevant tasks on the designated page of the platform. Points can be exchanged for BNB Chain ecological meme coins FOUR and WHY. The trading volume of BNB Chain ecological meme token CAT exceeded 117 million US dollars on the opening day. The increase in activity and wealth effect on the BNB Chain chain has stimulated the data of ecological DeFi projects. The influx of hot money has also promoted the rise in token prices.

Increase: CAKE increased by 11.32% in 24 hours, CHESS increased by 28.55% in 24 hours;

Faktor-faktor yang mempengaruhi prospek pasar:

-

Protocol indicators: Protocol indicators are the key to judging the activity of the protocol, including daily activity, transaction volume, profitability, etc. For example, AAVE can reach a historical high in terms of protocol indicators in the current market environment, and the market will naturally give a corresponding market value valuation for repair. On the contrary, if the protocol indicators cannot grow, then the market has no reason to be optimistic about the development of the protocol.

-

Profit distribution: More and more DeFi protocols link their own tokens to protocol revenue. This business model repeatedly activates the enthusiasm for token trading. Investors have good reasons to hold the token. Therefore, the promotion of the protocols profit distribution will greatly affect the token price.

3. Pencarian Populer Pengguna

1) Dapp Populer

Satlayer:

SatLayer, a Bitcoin re-staking platform based on Babylon, announced the completion of an $8 million Pre-Seed round of financing, led by Hack VC and Castle Island Ventures, with participation from Franklin Templeton, OKX Ventures, Mirana Ventures, Amber Group, Big Brain Holdings, CMS Holdings and others.

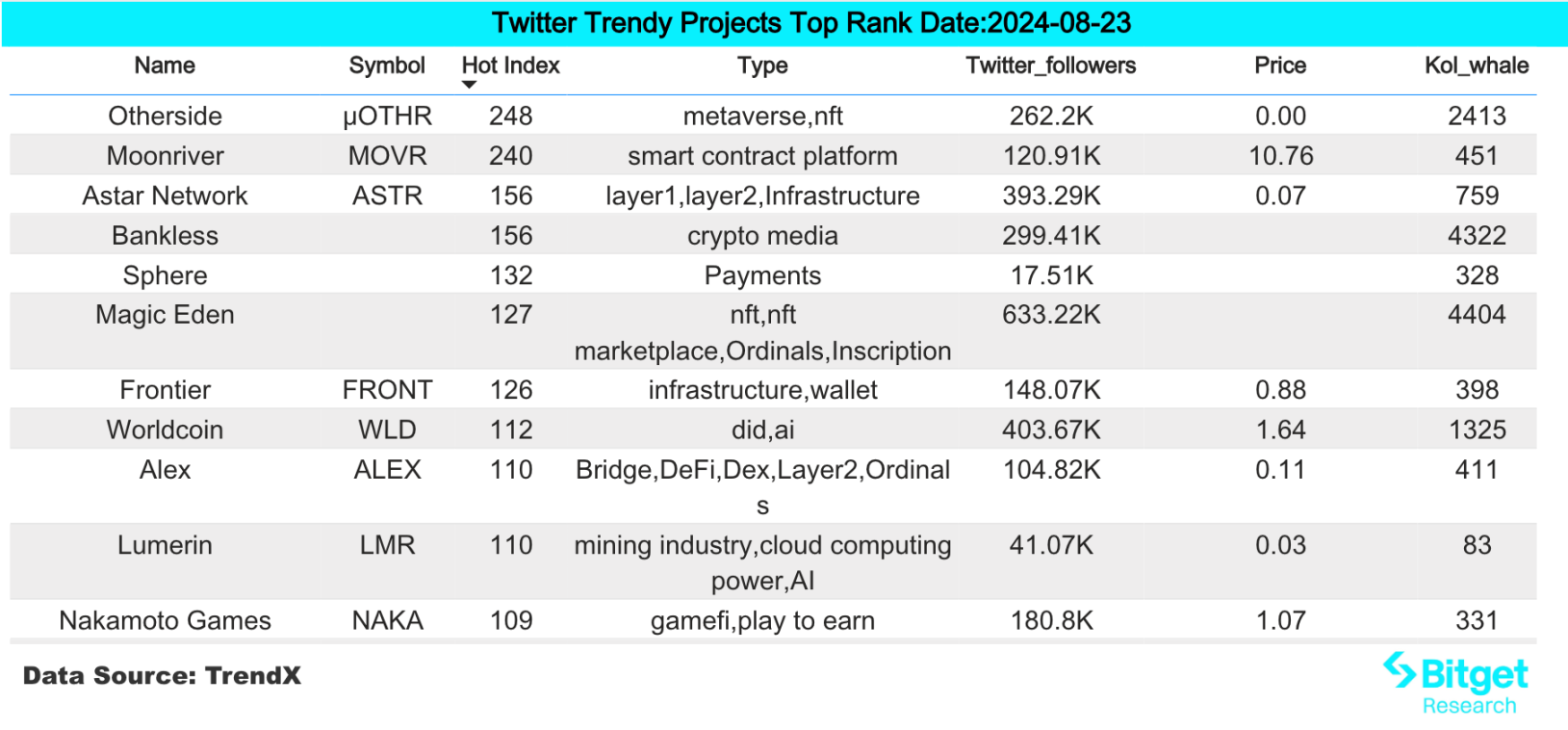

2) Twitter

Magic Eden:

The ME Foundation has officially announced the launch of the $ME token, which will serve as a Web3 consumer decentralized application token for the digital asset cross-chain trading protocol. The ME Foundations mission is to support the continued development of Magic Eden DAO and the underlying protocol through community governance. As Magic Eden moves to mobile through the Magic Eden Wallet and expands beyond NFTs, $ME will become a lever to incentivize users to trade multiple assets at any time, on multiple blockchain networks. As the NFT and digital ownership ecosystem develops, other third-party dApps will continue to operate on the protocol and are expected to adopt the $ME token for multiple scenarios.

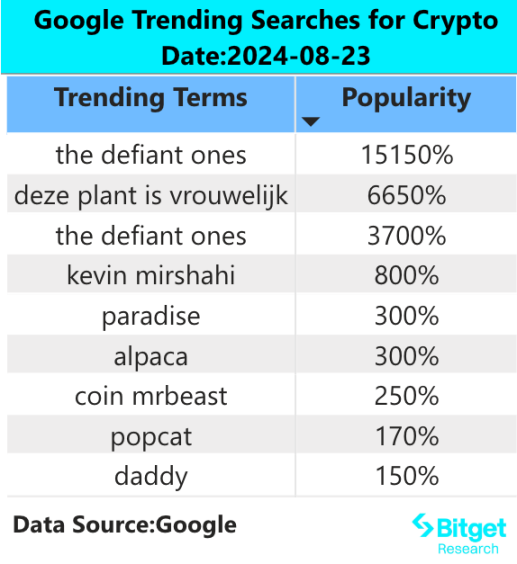

3) Wilayah Pencarian Google

Dari perspektif global:

Popcat: This token has seen a good increase in recent days among Solanas MEME coins. Binance Futures will launch the POPCATUSDT perpetual contract at 21:00 on August 22, with a maximum leverage of 75 times.

Dari penelusuran terpopuler di setiap wilayah:

(1) Asia: Asia has shown its focus on weighted assets, including BTC, ETH, DOGE, etc. Different Asian countries have different focuses. For example, Pakistan focuses on TON game BLUM, Indonesia focuses on ETHFI, and Singapore focuses on AI project FET.

(2) European and English regions: Keyword searches for Taiko appeared. The project has risen by 6.3% in the past seven days and has a certain degree of popularity on Twitter.

(3) Latin America: Latin America has a relatively concentrated focus on dog-related tokens, with floki, bonk, and shiba inu appearing in the hot searches. Recently, attention to gaming projects has also increased, such as SAND, MANA, etc.

Potensi tetesan udara Peluang

Symbiotic

Symbiotic is a general purpose restaking project that enables decentralized networks to bootstrap powerful, fully sovereign ecosystems. It provides a method for decentralized applications, called Active Validation Services or AVS, to collectively ensure the security of each other.

Symbiotic recently completed its seed round of financing, with Paradigm and Cyber Fund participating in the investment, with a financing amount of US$5.8 million.

How to participate: Go to the project鈥檚 official website, link your wallet, and deposit ETH and ETH LSD assets.

Usual

Usual is an RWA stablecoin protocol that launched USD 0, a permissionless and fully compliant stablecoin backed 1:1 by RWA. USUAL is a governance token that allows the community to guide the future development of the network. Usual solves the current stablecoin market problems by redistributing profits to the community and rewarding token holders with actual income generated by RWA.

Usual has completed a $7 million financing round, with investments from IOSG Ventures, Kraken Ventures, GSR, etc. On July 11, Usual announced that its mainnet has been officially launched, and the points activity has been launched simultaneously. Early participating users can get more points, Usual Pills, by providing liquidity or by minting and holding USD 0++, and use these points to obtain USUAL tokens during the airdrop period.

Specific participation method: Use USDC, ETH, etc. on the Ethereum chain to mint USD 0 tokens on the Usual website, select the Provide USD 0 as liquidity on Curve option, and use the minted USD 0 tokens to provide liquidity.

Informasi lebih lanjut tentang Institut Penelitian Bitget: https://www.bitget.fit/zh-CN/research

Bitget Research Institute berfokus pada fokus pada data on-chain dan menambang aset berharga. Ini menambang investasi nilai mutakhir melalui pemantauan real-time atas data on-chain dan pencarian populer regional, dan memberikan wawasan tingkat institusional bagi para penggemar kripto. Sejauh ini, ini telah memberi pengguna global Bitgets aset berharga tahap awal di berbagai sektor populer seperti [Ekosistem Arbitrum], [Ekosistem AI], dan [Ekosistem SHIB]. Melalui penelitian berbasis data yang mendalam, hal ini menciptakan efek kekayaan yang lebih baik bagi pengguna global Bitgets.

銆怐isclaimer銆慣pasarnya berisiko, jadi berhati-hatilah saat berinvestasi. Artikel ini bukan merupakan nasihat investasi, dan pengguna harus mempertimbangkan apakah opini, pandangan, atau kesimpulan dalam artikel ini sesuai dengan keadaan spesifik mereka. Berinvestasi berdasarkan informasi ini adalah risiko Anda sendiri.

This article is sourced from the internet: Bitget Research Institute: Bitcoin fluctuates in a narrow range of $60,000, Solana meme rebounds and there are bargain hunting opportunities

The Aethir Foundation announced the launch of the Edge Early Adopter Incentive Program, which aims to accelerate the growth of edge computing on the Aethir network. The program will provide an additional 60% token incentive for edge devices in addition to the base reward from September 1 to October 31. The original ATH allocated to edge devices was 23% of the total tokens. This additional incentive is not included in the 23% tokens. It aims to increase the profitability of early participants and attract diverse contributors through this program to accelerate the development of edge AI applications. The rapid development of artificial intelligence is driving the need for computing power at the edge of the network to enable real-time insights and responses. Aethir is a decentralized cloud computing platform that…