Pengujian Strategi 02锝淥KX dan Institut Penelitian AICoin: Strategi Grid

OKX telah bekerja sama dengan platform data berkualitas tinggi AICoin untuk meluncurkan serangkaian penelitian strategi klasik, yang bertujuan untuk membantu pengguna lebih memahami dan mempelajari berbagai strategi dan menghindari penggunaan buta melalui analisis dimensi inti seperti pengukuran data dan karakteristik strategi.

Grid trading is a systematic trading strategy whose core principle is to divide multiple grids within a preset price range and implement counter-trend operations – buy when prices fall and sell when prices rise. This strategy reduces emotional interference by maintaining a balance between long and short positions, automating the execution of transactions, and accumulating profits through frequent small transactions. It emphasizes flexible adjustment of parameters to adapt to market changes, pays attention to risk control and fund management, and is particularly suitable for long-term operations in volatile markets. Although it performs well in sideways markets, it may miss big moves in trending markets. Successful implementation of grid trading requires flexible application of these principles based on specific assets and market environments, while carefully controlling risks and avoiding excessive leverage.

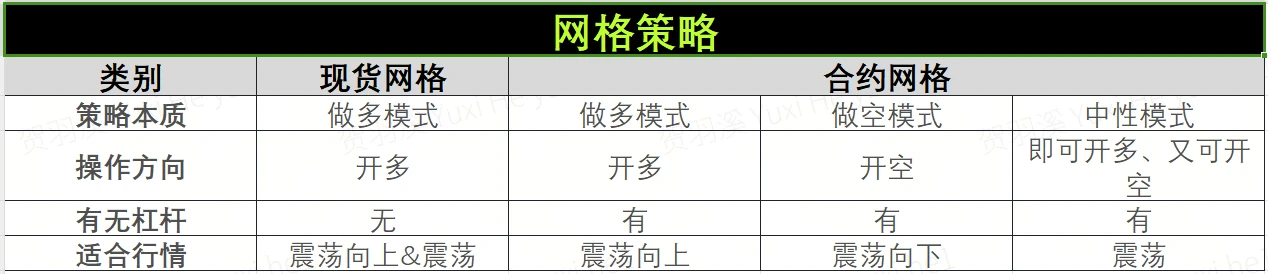

Generally speaking, grid strategies are divided into two types: spot grid and contract grid. Among them, contract grid is divided into three types: long mode, short mode, and neutral mode, each of which has its own suitable market conditions. (Note: Contract grid neutral mode is hereinafter referred to as neutral contract grid)

Issue 02 introduces the grid strategy, using 3 big data models to test the [neutral contract grid spot grid]:

Model 1: Neutral contract grid and spot grid under 1-hour sideways fluctuation cycle

Model 2: Neutral contract grid and spot grid under the 4-hour operation cycle of oscillation downward

Model 3: Neutral contract grid and spot grid under the 1-day oscillating upward cycle

In this data test, the neutral contract grid operation standard is: taking the market price of the trading pair when the strategy is turned on as the center, determine the lower and upper limits of the grid, and divide the pending orders into above the market price and below the market price. When the price is above the market price, sell to open a short position every time the price breaks through a grid, and buy to close the short position every time the price falls below each grid, so as to obtain the profit from the price decline.

Contract grid neutral mode spot grid strategy can be summarized in one sentence: Focusing on range trading, it provides a rational trading method under the premise of careful risk management and parameter optimization.

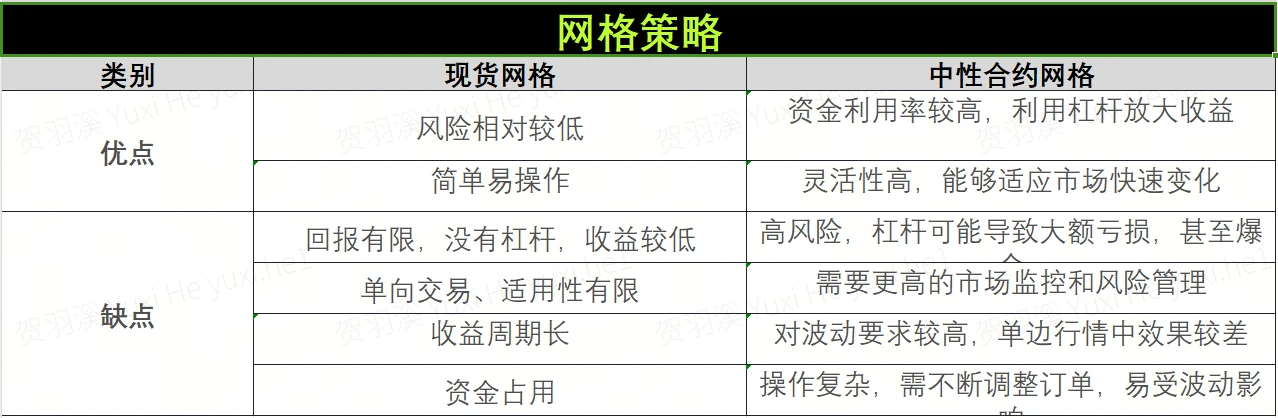

Pros and cons comparison

In general, the sideways market reduces the risk of trending, and the two strategies can focus more on range trading. However, we need to be alert to the possibility of the market breaking through the current range of fluctuations, and we may need to adjust the grid parameters. Users can consider optimizing the grid spacing based on the observed price fluctuation range. Try to dynamically adjust the grid to adapt to possible fluctuation range changes.

In addition, there are obvious differences in the operation methods and risk management between the two. The neutral contract grid is suitable for two-way trading and high-leverage contract markets, emphasizing the capture of opportunities in volatility and bearing higher risks; while the spot grid is suitable for one-way trading and more stable spot markets, suitable for more conservative trading strategies. The core concepts of the two are similar, but in actual application, they need to be selected according to the risk tolerance of traders and market conditions.

Among them, the neutral contract grid trading strategy combines the advantages of grid trading and market neutral strategies, providing multiple advantages. It reduces systemic risk through long-short hedging, takes advantage of high-frequency small transactions and market fluctuations to make profits, and reduces directional risk. This strategy is highly flexible and adaptable, can be automated and applied to a variety of assets, and provides liquidity to the market, but it is more complicated to implement.

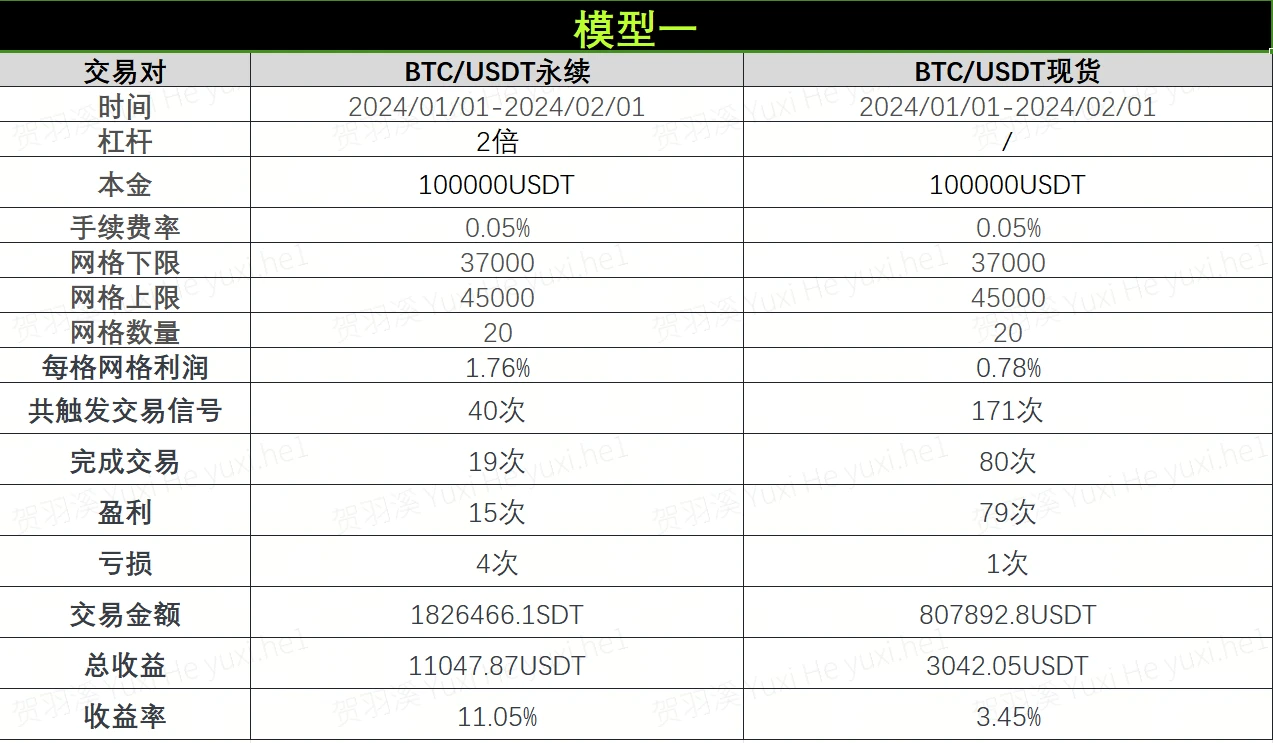

Model 1

The model is: neutral contract grid and spot grid under the 1-hour operation cycle of sideways fluctuation

Image 1: Neutral contract grid for 1 hour sideways fluctuation; Source: AICoin

Image 2: Spot grid of sideways fluctuations for 1 hour ; Source: AICoin

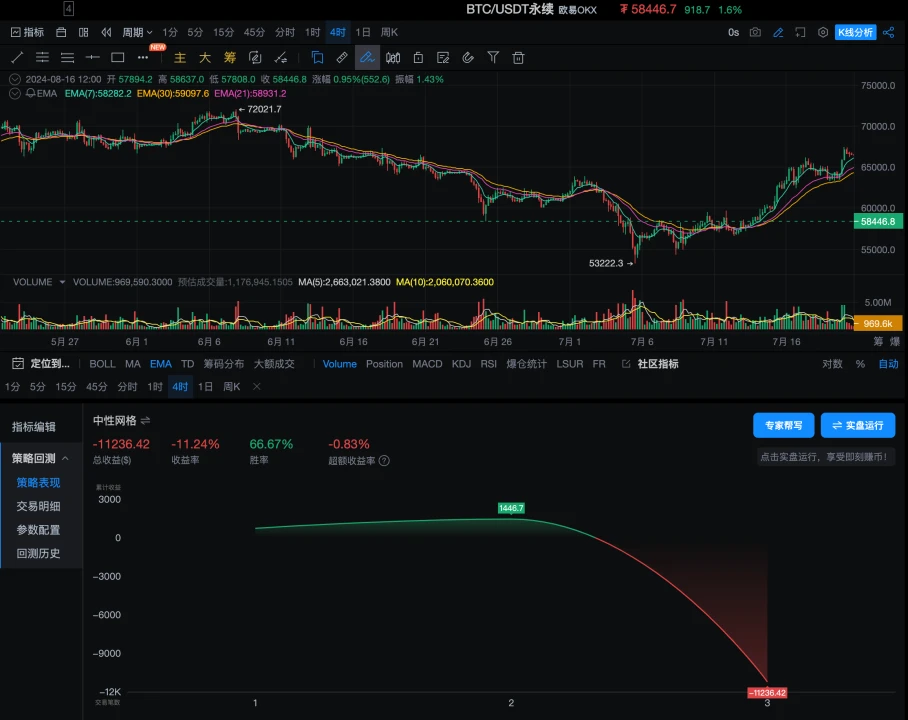

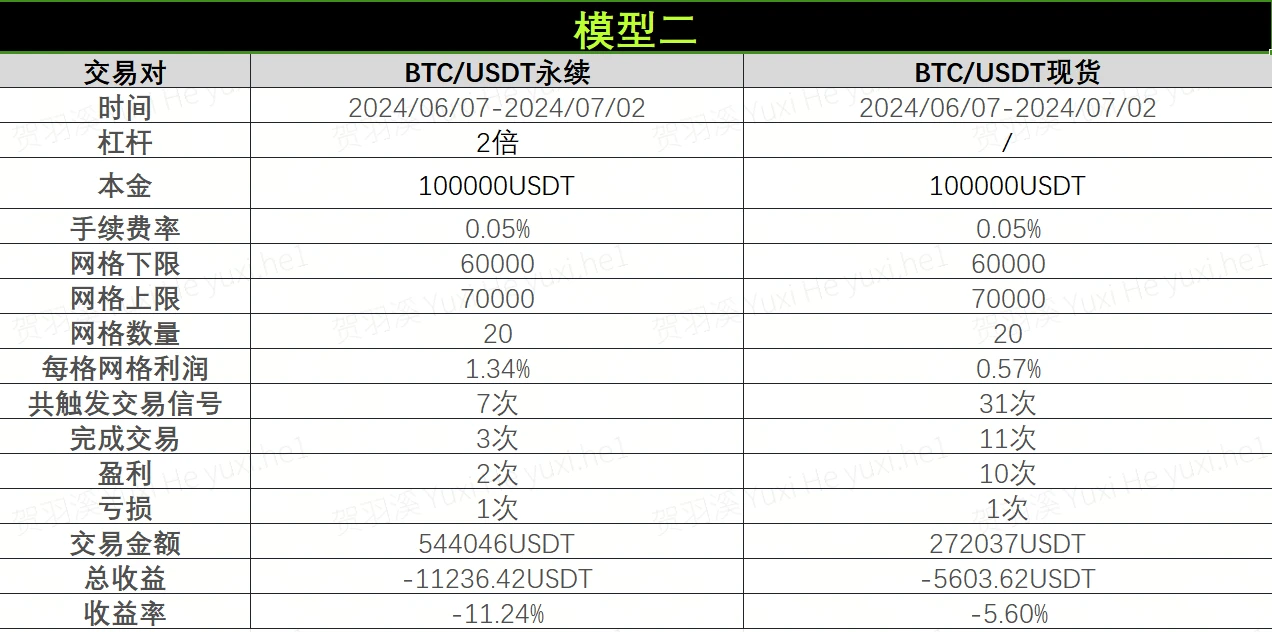

Model 2

The model is: neutral contract grid and spot grid in a 4-hour downward oscillation cycle

Image 3: 4-hour neutral contract grid for a downward swing ; Source: AICoin

Image 4: Spot grid of 4-hour downward shock ; Source: AICoin

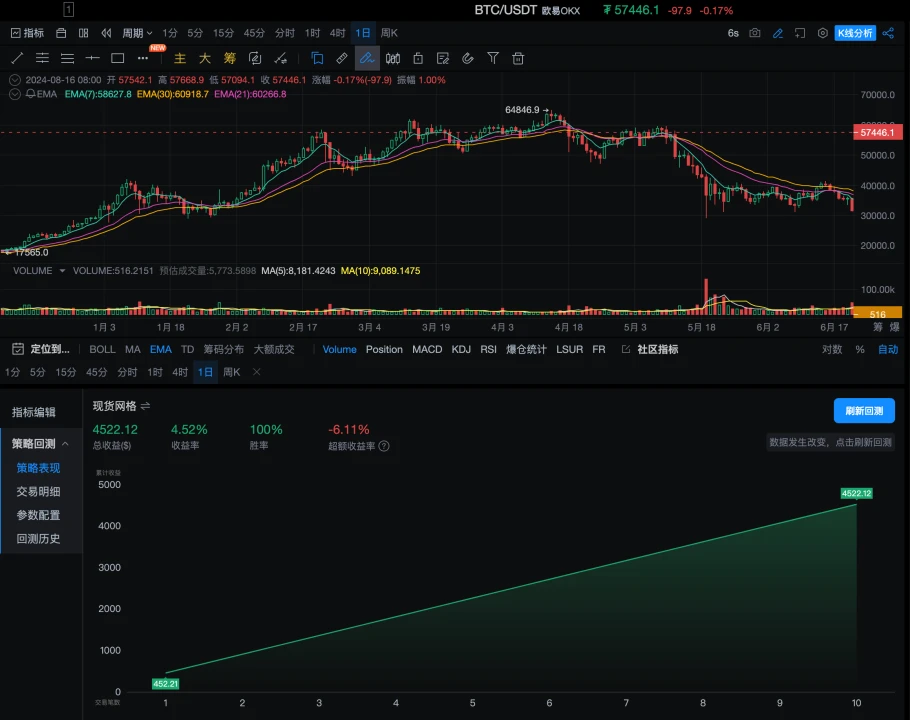

Model 3

The model is: neutral contract grid and spot grid in a 1-day oscillating upward cycle

Image 5: Oscillating upward 1 -day neutral contract grid; Source: AICoin

Image 6: Oscillating upward 1-day spot grid; Source: AICoin

Analysis and summary

Grid strategies perform differently under different market conditions. Traders need to choose appropriate strategies based on market trends while weighing risks and returns. In Models 1 and 3, the yield of the neutral contract grid is significantly higher than that of the spot grid, especially in the oscillating upward environment of Model 3, where the yield of the neutral contract grid is as high as 11.28%. In the oscillating downward environment of Model 2, both the neutral contract grid and the spot grid suffered losses, indicating that the neutral contract grid and the spot grid performed poorly in a falling market.

By observing the performance of the spot grid of Models 1, 2 and 3, we can know that in different market environments, the winning rate of the spot grid fluctuates greatly and the performance of the spot grid is relatively unstable. Although the neutral contract grid has higher returns, it is also accompanied by higher risks because of the use of leverage. For example, in the volatile downward market of Model 2, leverage magnifies losses, while spot trading is relatively stable, but may result in losses in unfavorable market conditions.

Specifically:

1. Strategic performance

Contract grid strategies generally show higher profit potential in different market environments, but may also face greater risks.

The spot grid strategy performs well in sideways and upward-moving markets, but suffers losses in downward-moving markets.

2. Risks and benefits

The neutral contract grid strategy achieves higher absolute returns through the use of leverage, but also carries higher risk. Although the spot grid strategy has a lower absolute return, its risk-adjusted return may be more attractive in some cases considering that leverage is not used.

3. Market adaptability

The neutral contract grid strategy performs relatively stably in different market environments. The spot grid strategy performs better in rising or sideways markets, but is prone to losses in falling markets.

4. Trading activity

Neutral contract grid strategies typically have higher trading frequencies and transaction amounts, which may help capture more market opportunities but may also result in higher transaction costs.

5. Applicable investors

Neutral contract grid strategies may be more suitable for investors with higher risk tolerance and in-depth understanding of the market. Spot grid strategies may be more suitable for investors with lower risk tolerance and seeking stable returns.

6. Risk management

When using a neutral contract grid strategy, more careful risk management is required, including setting stop losses and monitoring leverage levels.

In summary, both strategies have their own advantages. The neutral contract grid strategy provides higher potential returns and better market adaptability, but also higher risks. Although the spot grid strategy has relatively lower returns, it also has lower risks and can still provide stable returns in certain market environments. Investors should choose a suitable strategy based on their own risk tolerance, investment goals and market judgment.

OKXAICoin Grid Strategy

Currently, OKX strategy trading provides convenient and diverse strategy varieties. Its grid strategies mainly include: spot grid, contract grid, and infinite grid. Whether it is the OKX spot grid strategy or the OKX contract grid strategy, its essence is an automated strategy that executes low-buy and high-sell in a specific price range. Users only need to set the highest and lowest prices in the range and determine the number of grids to be subdivided to start running the strategy; if necessary, you can also set the trigger conditions in advance, and when the market conditions reach the trigger conditions, the strategy will automatically start running. The strategy will calculate the low-buy and high-sell prices of each small grid, automatically place orders, and continuously buy low and sell high to earn profits from fluctuations as the market fluctuates.

However, there are three key differences between OKX contract grid strategy trading and spot grid strategy trading:

1) Contract grid strategies are traded in the contract market, and spot grid strategies are traded in the spot market.

2) Contract grid strategy can use leverage, but spot grid strategy cannot use leverage

3) The contract grid strategy supports three trading strategies: long, short and neutral, while the spot grid strategy only supports one-way trading.

Currently, OKX grid strategy supports two creation modes:

1) Manual creation: Set parameters and trigger conditions based on your own judgment of the range of the oscillating market. Currently, the OKX spot grid strategy and contract grid strategy can set two trigger types: price trigger and RSI technical indicator trigger.

2) Intelligent creation: directly use the grid strategy parameters intelligently recommended by the system.

How to access more strategy trading on OKX? Users can go to the Strategy Trading mode in the Trading section through the OKX APP or official website, and then click on the Strategy Square or Create Strategy to start the experience. In addition to creating strategies by yourself, the Strategy Square currently also provides Quality Strategies and Quality Strategies with Strategy Leaders. Users can copy strategies or follow strategies.

Strategi perdagangan OKX memiliki beberapa keunggulan inti seperti pengoperasian yang mudah, biaya rendah, dan keamanan. Dalam hal pengoperasian, OKX menyediakan parameter cerdas untuk membantu pengguna mengatur parameter perdagangan secara lebih ilmiah; dan menyediakan tutorial grafis dan video untuk membantu pengguna memulai dan menguasainya dengan cepat. Dalam hal biaya, OKX telah meningkatkan sistem tarif biaya secara menyeluruh untuk mengurangi biaya transaksi pengguna secara signifikan. Dalam hal keamanan, OKX memiliki tim keamanan yang terdiri dari para ahli global terkemuka yang dapat memberi Anda perlindungan keamanan setingkat bank.

In addition, AICoin also provides users with a variety of strategic transactions, allowing users to understand the current market more quickly and intuitively. Users can find the Strategy Square option in the Strategy option on the left sidebar of the AICoin product. Click here and you can find the grid trading strategy in the Selected Strategies below the interface.

At the same time, AICoin grid strategy supports manual creation and AI grid. Find the AI Grid below in the Market option on the left sidebar. In this interface, users can see the grid strategy recommended by AI for this trading pair and the manual creation option. In addition to the grid trading strategy, this series will also introduce several other trading strategies, including the all-currency DCA strategy. These trading strategies can be found in the Strategy Plaza on the left sidebar.

Penafian

Artikel ini hanya untuk referensi dan hanya mewakili pandangan penulis, bukan posisi OKX. Artikel ini tidak dimaksudkan untuk memberikan (i) saran perdagangan atau rekomendasi perdagangan; (ii) penawaran atau ajakan untuk membeli, menjual, atau menyimpan aset digital; (iii) saran keuangan, akuntansi, hukum, atau pajak. Kami tidak menjamin keakuratan, kelengkapan, atau kegunaan informasi tersebut. Menyimpan aset digital (termasuk stablecoin dan NFT) melibatkan risiko tinggi dan dapat berfluktuasi secara signifikan. Anda harus mempertimbangkan dengan saksama apakah perdagangan atau penyimpanan aset digital cocok untuk Anda berdasarkan situasi keuangan Anda. Silakan konsultasikan dengan profesional hukum/pajak/perdagangan Anda untuk situasi spesifik Anda. Harap bertanggung jawab untuk memahami dan mematuhi hukum dan peraturan setempat yang berlaku.

This article is sourced from the internet: Strategy Testing 02锝淥KX and AICoin Research Institute: Grid Strategy

Related: One-week token unlocking: W welcomes the first Cliff unlocking since its launch

Next week, 14 projects will have their tokens unlocked. W and ZETA will have a large proportion unlocked, CLOUD will have a relatively high proportion unlocked, and other tokens will be unlocked in the normal range. Wormhole Project Twitter: https://twitter.com/wormhole Project website: https://wormhole.com/ Number of tokens unlocked this time: 610 million Amount unlocked this time: Approximately US$186 million Wormhole is a decentralized universal cross-chain messaging protocol that allows assets and information to be transferred between different blockchain networks. Initially incubated and supported by Jump Crypto, it aims to enable developers to build native cross-chain applications covering multiple chains. W has ushered in its first Cliff unlocking since its launch. The current circulation accounts for 20% of the total. In this round, 600 million pieces are unlocked for the community, with…