Riset terbaru Uniswap Labs: Faktor apa yang menentukan tren harga Bitcoin?

This article comes from What Drives Crypto Asset Prices?

Penulis asli: Aus tin Adams, Markus Ibert , Gord on Liao

Disusun oleh: Suami Harian Odaily Planet

In the paper What Drives Crypto Asset Prices? co-authored by researchers from Uniswap Labs, Copenhagen Business School and Circle, the VAR (structural vector autoregression) model was used to analyze the price trends of Bitcoin over the years and the impact of three institutional shocks, revealing the market performance of Bitcoin and showing its dual characteristics as a value storage tool and a speculative asset. This article contains a lot of technical content, and Odaily Planet Daily has specially compiled a simplified version for readers reference.

Kesimpulan utama:

Traditional monetary policy and risk premium shocks have a significant impact on crypto asset prices.

More than two-thirds of Bitcoin’s dramatic 2022 drop has been attributed to contractionary monetary policy.

Since 2023, the primary driver of cryptocurrency returns has been the compression of cryptocurrency risk premiums, rather than volatility in traditional markets.

Stablecoins are regarded as safe assets in the crypto ecosystem. By observing the fluctuations in the market value of stablecoins, the cryptocurrency demand shock can be further subdivided into crypto adoption shock and crypto risk premium shock.

Compressed cryptocurrency risk premia explain Bitcoin’s positive returns in 2023 and beyond, especially around the launch of the Blackrock Bitcoin ETF.

A positive traditional risk premium shock causes the price of Bitcoin to fall, and the prices of traditional assets such as U.S. Treasuries and stocks will also fall.

An aggressive contractionary monetary policy shock would cause the price of Bitcoin to fall, bond yields to rise, and stock prices to fall.

Understanding the drivers of cryptocurrency prices and their relationship to traditional financial markets is an important and challenging task for economists, policymakers, and investors. As cryptocurrencies gain more mainstream popularity, their potential impact on the broader financial system is also increasing. However, the factors that influence cryptocurrency price movements and the interconnectedness of cryptocurrencies with traditional asset classes are not yet fully understood.

This paper aims to reveal the drivers of crypto assets through the lens of the Vector Auto-Regressive (VAR) model. We illustrate the usefulness of our approach in decomposing Bitcoin returns into three structural shocks: a traditional monetary policy shock, a traditional risk premium shock, and a cryptocurrency-specific demand shock.

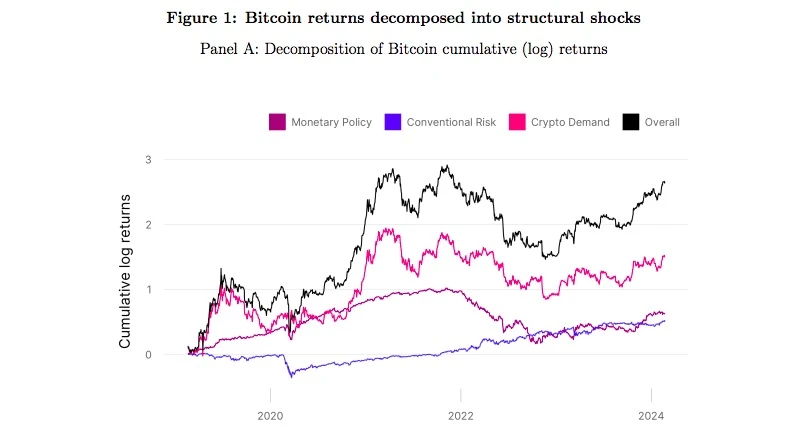

The figure shows the cumulative decomposition from 2019 to 2024 (Panel A) and on a year-by-year basis (Panel B). The model shows that traditional shocks significantly affect the returns of new asset classes. For example, a monetary policy shock causes Bitcoin to rise by 50% in 2020, but causes Bitcoin to fall by 50% in 2022. In other words, the model shows that Bitcoins returns would be more than 50% higher if the Federal Reserve had not unexpectedly tightened its monetary policy stance during 2022.

The model even suggests that monetary policy is more influential than crypto-specific demand shocks in driving cryptocurrency returns in 2022. Traditional risk premium shocks (“risk-off” shocks) have generally contributed positively to crypto-asset returns during our sample period, showing a decline in traditional risk premiums, with the exception of a brief period during the COVID-19 sell-off in March 2020. Finally, while traditional shocks can have large low-frequency effects on cryptocurrency prices, most day-to-day fluctuations in Bitcoin prices cannot be explained by traditional shocks.

We employ intuitive and theory-guided sign restrictions. Specifically, we argue that a positive conventional risk premium shock (i.e., a safe-haven shock) leads to a fall in the Bitcoin price, a fall in US Treasury yields, and a fall in equity prices. Conversely, we argue that a positive (contractionary) monetary policy shock leads to a fall in the Bitcoin price, a rise in US Treasury yields, and a fall in equity prices, via the classic discount rate channel. Finally, we emphasize that a demand shock for a particular cryptocurrency raises the Bitcoin price, but the impact on traditional assets remains undetermined (while managing the impact of cryptocurrency shocks on traditional assets through quantity restrictions).

Intuitively, the VAR model attributes daily cryptocurrency returns to different shocks based on the co-movement of the assets. For example, if interest rates fall sharply, and both stock prices and Bitcoin rise on the same day, the model will be affected by an expansionary (negative) monetary policy shock. On the other hand, if the stock market rebounds, interest rates fall, and Bitcoin rises, the model attributes Bitcoins positive returns to a reduction in traditional risk premiums. By aggregating Bitcoin returns with specific patterns in the U.S. Treasury and stock markets (adjusted for the magnitude of their returns), the model estimates the cumulative impact of each risk factor on Bitcoin prices over time. We further analyze cryptocurrency-specific shocks and related asset returns by studying the contribution of cryptocurrency growth and cryptocurrency risk premiums. To achieve this, we extend the model by combining the fluctuations in the stablecoin market capitalization with the three assets mentioned earlier.

Stablecoins are considered a safe haven asset within the broader digital asset ecosystem, and changes in their total market capitalization relative to volatile crypto asset returns help distinguish shocks driven primarily by risk premia or adoption.

The core assumption in this extended model is that a positive cryptocurrency adoption shock increases both the stablecoin market capitalization and the Bitcoin price, while a positive cryptocurrency risk premium shock (crypto-safe haven) decreases the Bitcoin price but increases the stablecoin market capitalization.

The model shows that we find that cryptocurrency risk premia have compressed significantly starting in 2023 and explain a major part of Bitcoins positive returns, especially around the launch of Bitcoin spot ETFs. The four shocks studied in our extended model encapsulate the internal dynamics of crypto markets and their interactions with broader financial variables.

Cryptocurrency adoption shocks refer to changes in the intrinsic value and adoption rate of cryptocurrencies, reflecting innovation, regulatory changes, or shifts in adoption sentiment. On the other hand, crypto risk premium shocks represent changes in the risk compensation required by investors for holding crypto assets, which may be affected by factors such as market liquidity and volatility. Similarly, traditional risk premium shocks are included to explain changes in the risk compensation required for holding traditional financial assets, which may indirectly affect cryptocurrency prices through changes in investor risk preferences and portfolio rebalancing.

Finally, monetary policy shocks are thought to capture the impact of broader economic growth dynamics on crypto markets, acknowledging the interconnectedness of cryptocurrencies with broader financial markets. While traditional monetary policy and risk premium shocks have a low frequency impact on Bitcoin returns, most of the variation in daily Bitcoin returns is attributed to crypto risk premium shocks. And echoing research on stocks, risk premiums play a sizable role in explaining returns.

This article is sourced from the internet: Uniswap Labs’ latest research: What factors determine Bitcoin price trends?