Pembiayaan ekspres satu minggu | 15 proyek menerima investasi, dengan total jumlah pembiayaan yang diungkapkan sekitar U

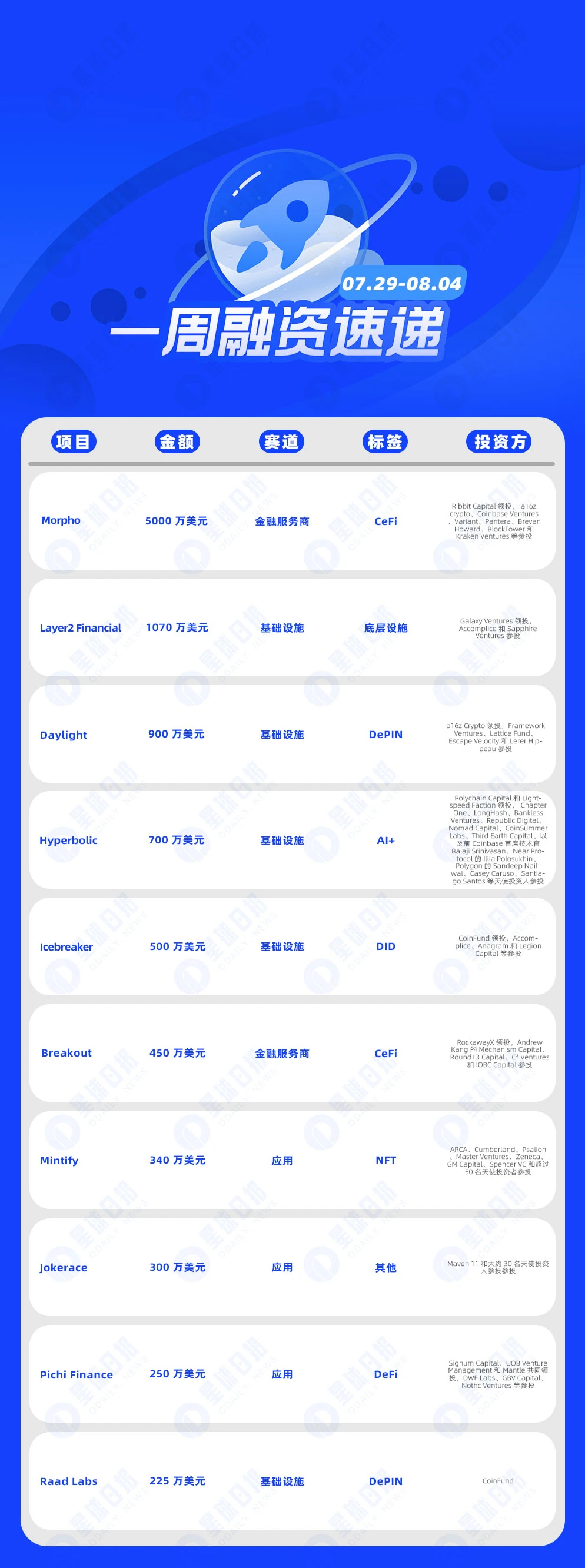

According to incomplete statistics from Odaily Planet Daily, there were 15 blockchain financing events announced at home and abroad from July 29 to August 4, which was a decrease from last weeks data (23). The total amount of financing disclosed was approximately US$102 million, which was a decrease from last weeks data (US$129.5 million).

Last week, the project that received the most investment was crypto lending company Morpho ($50 million); followed by cross-border payment infrastructure Layer 2 Financial ($10.7 million).

Berikut ini adalah acara pendanaan spesifik (Catatan: 1. Urutkan berdasarkan jumlah uang yang diumumkan; 2. Tidak termasuk acara penggalangan dana dan MA; 3. * menunjukkan perusahaan tradisional yang bisnisnya melibatkan blockchain):

On August 1, crypto lending company Morpho announced the completion of a $50 million strategic round of financing, led by Ribbit Capital, with participation from a16z crypto, Coinbase Ventures, Variant, Pantera, Brevan Howard, BlockTower and Kraken Ventures. The specific valuation information has not been disclosed yet.

Layer 2 Financial Completes $10.7 Million Series A Funding, Led by Galaxy Ventures

On July 31, cross-border payment infrastructure Layer 2 Financial announced the completion of a $10.7 million Series A financing round led by Galaxy Ventures, with participation from Accomplice and Sapphire Ventures. The company plans to use the funds to expand in new jurisdictions, expand its team, and advance its product development.

DePIN project Daylight completes $9 million Series A financing, led by a16z Crypto

On August 1, DePIN project Daylight completed a $9 million Series A financing round, led by a16z Crypto, with participation from Framework Ventures, Lattice Fund, Escape Velocity and Lerer Hippeau. However, its co-founder and CEO Jason Badeaux refused to disclose the structure, valuation and other information of this round of financing. As of now, the companys total financing amount has reached $13 million.

Web3 AI company Hyperbolic completes $7 million seed round of financing, led by Polychain Capital

On July 30, Web3 AI company Hyperbolic announced the completion of a $7 million seed round of financing, led by Polychain Capital and Lightspeed Faction, with participation from Chapter One, LongHash, Bankless Ventures, Republic Digital, Nomad Capital, CoinSummer Labs, Third Earth Capital, as well as former Coinbase CTO Balaji Srinivasan, Near Protocol’s Illia Polosukhin, Polygon’s Sandeep Nailwal, Casey Caruso, Santiago Santos and other angel investors.

On July 31, Icebreaker, the on-chain “LinkedIn” company, announced the completion of a $5 million seed round of financing, led by CoinFund, with participation from Accomplice, Anagram and Legion Capital. The post-investment valuation reached $21 million.

On July 31, cryptocurrency proprietary trading company Breakout completed a $4.5 million seed round of financing, led by RockawayX, with participation from Andrew Kang’s Mechanism Capital, Round 13 Capital, C² Ventures and IOBC Capital. The company’s co-founder and CEO Alex Miningham declined to comment on the valuation.

On July 30, NFT startup Mintify completed a new round of financing of US$3.4 million. ARCA, Cumberland, Psalion, Master Ventures, Zeneca, GM Capital, Spencer VC and more than 50 angel investors participated in the investment. Mintify’s total financing amount is US$5 million. It is currently building infrastructure for NFT order books for gaming, art and real-world asset markets.

On July 31, the on-chain competition event project Jokerace completed a $3 million financing, with Maven 11 and approximately 30 angel investors participating. Jokerace is a no-code project that allows blockchain projects to initiate competitions, debates, and hackathons. The project was launched last year and is currently online on more than 90 blockchains.

PointsFi Marketplace Pichi Finance Completes $2.5 Million Funding, Led by Signum Capital and Others

On August 1, according to official news, PointsFi market Pichi Finance announced the completion of US$2.5 million in financing, led by Signum Capital, UOB Venture Management and Mantle, with participation from DWF Labs, GBV Capital, Nothc Ventures and others.

It is reported that Pichi Finance provides price discovery services for tokens before and after TGE.

DePIN project Raad Labs completes $2.25 million seed round of financing, led by CoinFund

On August 2, CoinFund announced on the X platform that it had led a $2.25 million seed round for Raad Labs.

Raad Labs is building a decentralized, incentive-based network to improve weather data management and collection on local, regional, and large-scale models.

MetaDAO Completes $2.2 Million Funding, Paradigm Leads Investment

On August 1, Solanas ecological governance experimental project MetaDAO announced that it had completed a $2.2 million financing, led by Paradigm. It is reported that the project is similar to the prediction market Polymarket. MetaDAOs anonymous founder Proph 3 According to t, Paradigm will hold 3,035 META tokens, becoming the largest single holder of META, accounting for 14.6% of the total supply.

On July 30, DeFi liquidity and trading engine service provider Liquorice announced on the X platform that it had completed a $1.2 million Pre-Seed round of financing, led by Greenfield Capital, with participation from Polymorphic Capital, L2 Iterative Ventures (L2 IV), 1inch, HASH CIB, Efficient Frontier, Follow the Seed, and Horadrim.Capital. The specific valuation information has not been disclosed yet.

Web3 integrated platform Agent Exchange completes $1 million in financing

On July 29, according to official news, the Web3 integrated platform Agent Exchange announced the completion of a $1 million financing on the X platform. Larry Cermak, CEO of The Block, Domo, founder of BRC 20, Web3 developers Cygaar, Mr. Block, Caladan and others participated in the investment. It is reported that Agent can support the flexible creation and management of sub-accounts through the ERC-6551 standard, helping users earn and trade points in the pre-market.

On July 31, Mycel, a decentralized cross-chain asset management platform, announced the completion of its seed round of financing on the X platform. CV Labs, FLICKSHOT, gumi Cryptos Capital, Arriba Studio, double jump.tokyo Inc., Incubate Fund, ??═⋯⋯⋯, and Gavin Birch participated in the investment. The specific amount has not been disclosed. Mycel provides cross-chain settlement infrastructure, using transferable accounts (TA) to connect and synchronize state machines, aiming to accelerate the optimization of token market prices.

DeFi protocol Chateau completes Pre-Seed round of financing, led by Hack VC

On August 2, Hack VC announced on the X platform that it had led Chateau’s Pre-Seed round of financing.

This article is sourced from the internet: One-week financing express | 15 projects received investment, with a total disclosed financing amount of approximately US$102 million (7.29-8.4)

Original|Odaily Planet Daily Author: jk This week, the U.S. House of Representatives held a vote to overturn Bidens support for the U.S. SECs cryptocurrency accounting policy SAB 121, but the vote fell far short of the two-thirds vote required to overturn the presidents decision. Background: What happened? What is SAB 121? Staff Accounting Bulletin 121 (SAB 121) is a guidance issued by the U.S. Securities and Exchange Commission (SEC) that requires companies holding cryptocurrencies to record these assets on their balance sheets and disclose the associated risks. The bulletin applies to all SEC-regulated entities, especially banks and financial institutions, and may result in them facing higher capital requirements, thereby affecting their ability to provide cryptocurrency custody services. The SEC said SAB 121 is nonbinding staff guidance intended to strengthen disclosures…