Naik turunnya perdagangan paus NFT: dari menghasilkan lebih dari $15 juta keuntungan hingga kehilangan segalanya

Penulis asli: Gambar , Web3 researcher

Terjemahan asli: Felix, PANews

The guy in the picture below is called Fraklin. He made over $15 million trading NFTs, but then lost everything (even his sanity?). Here’s his little-known rise and fall.

Franklin first learned about NFTs from NBA TopShot. But flipping “basketball video clips” didn’t go well for him.

He wasnt making any money, but that didnt stop him.

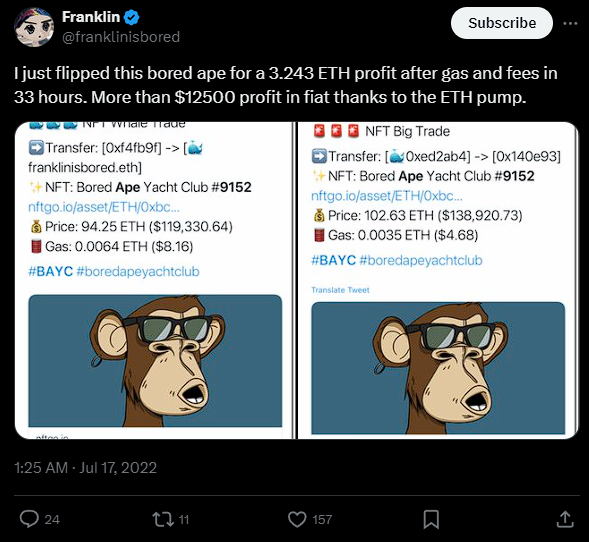

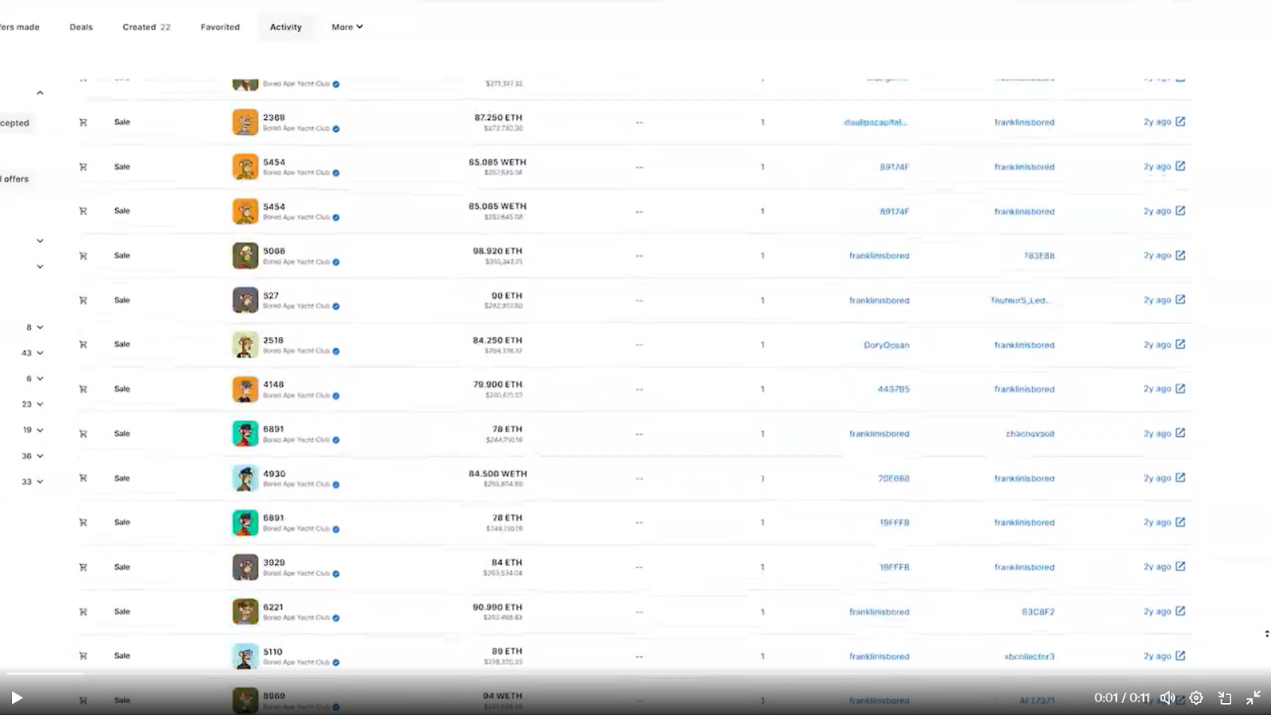

When BAYC came out, Franklin minted some. Seeing his NFT triple in value, he became obsessed. Over the next two years, he became obsessed and traded a lot.

The picture below is just a flip of BAYC, but things don’t stop there.

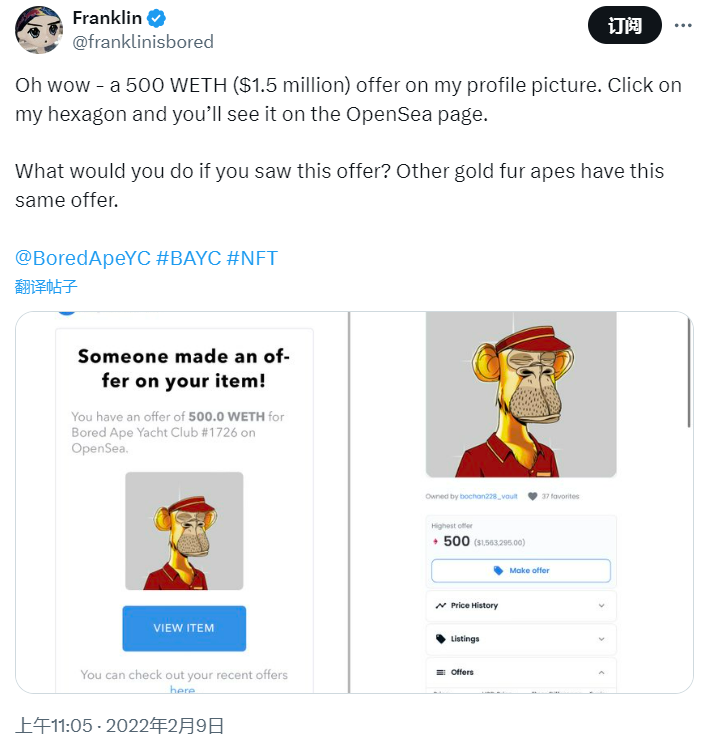

In February 2022, Franklin received a $1.5 million offer for his iconic Golden Ape.

He initially paid only $12,000 (cost) and could easily make a 125-fold return if the deal was closed.

But he rejected the deal (slip of the hand?).

Then things got even crazier.

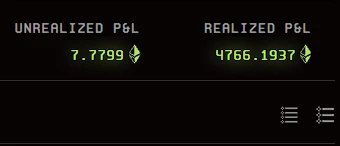

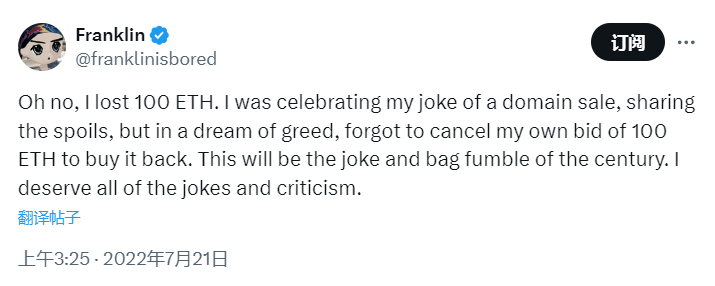

At one point, Franklin lost 100 ETH ($150,000), which seemed like nothing to him (below).

He often slips up on NFTs and loses 10-20 ETH at a time.

How could he possibly afford such a loss?

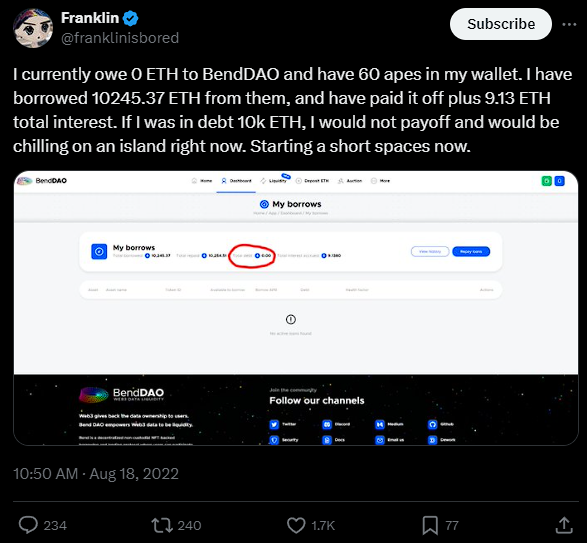

Franklin got hooked and started using leverage.

He borrowed more than 10,000 ETH from BendDAO.

At first, he repaid the loan on time (the airdrop yielded good returns)

But then the bear market hit…

If only NFT prices crashed.

Franklin also suffered setbacks in other areas:

-

$1.4 million lost in crypto casinos

-

Private investment losses of $4.2 million

These blows caused him to sell all his apes and quit the field…

But Franklin soon returned.

Franklin used his remaining money to start speculating in NFTs again.

Not seeing much in return, he decided it was time for a change…

In February, Franklin sold his Golden Ape for $675,000.

He would occasionally trade whatever was popular at the time.

But soon, things started to go haywire…

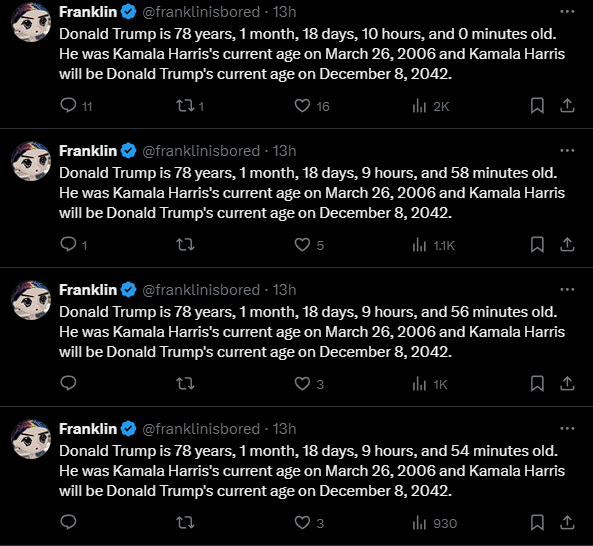

Instead of posting NFT transactions, he started posting a video every 5 minutes.

Then it evolved into sending controversial/link-bait tweets.

All this in exchange for some ETH from Fantasy Top.

Franklin was a smart guy (an aerospace engineer by profession).

However, his story perfectly illustrates why leverage should never be used.

If the next round of NFT bull market comes, can he make a comeback?

This article is sourced from the internet: The rise and fall of NFT whale trading: from making more than $15 million in profits to losing everything

Penulis asli: Nancy, PANews Ulang tahun Ethereum yang ke-10 telah menandai sebuah tonggak sejarah, dengan 9 ETF spot akhirnya "lulus bea cukai" dan disetujui, dan 8 penerbit telah memenangkan kemenangan dalam mengarusutamakan Ethereum setelah bertahun-tahun mengalami penolakan regulasi. Pada hari pertama pencatatan pada tanggal 23 Juli, volume perdagangan ETF spot Ethereum melampaui $1 miliar, yang merupakan 23% dari $4,6 miliar volume perdagangan ETF spot Bitcoin pada hari pertama di bulan Januari tahun ini. Meskipun kenaikan permintaan pasar akan mendorong kenaikan harga ETF kripto, persaingan antara produk-produk homogen pasti akan sengit, yang telah tercermin dalam struktur pasar ETF spot Bitcoin. Di antara penerbit-penerbit ini, lembaga kripto asli Bitwise tidak memiliki daya tarik seperti raksasa tradisional seperti…