Bitget Research Institute: Volume perdagangan hari pertama ETF spot Ethereum melampaui US$1,10 triliun, dan mini-game di

Dalam 24 jam terakhir, banyak mata uang dan topik populer baru telah muncul di pasar, yang mungkin menjadi peluang berikutnya untuk menghasilkan uang, termasuk:

-

The sectors with relatively strong wealth-creating effects are: AI sector and TON ecosystem;

-

Hot searched tokens and topics by users: Jito, Ethereum, AVAIL

-

Potential airdrop opportunities include: Mezo, Kakarot

Data statistics time: July 24, 2024 4: 00 (UTC + 0)

1. Lingkungan pasar

In the morning, the price of Bitcoin (BTC) remained at around $66,000, while altcoins generally fell. The price of BTC was slightly below $66,500, which remained basically unchanged in 24 hours. The price of ETH hovered around $3400-3500. Yesterday, many first-level projects announced the completion of financing. At the same time, the small game Catizen in the TON ecosystem continued to be hot. The cross-chain protocol project Owlto Finance had more than 110,000 cross-chain transactions in the past 24 hours, with a market share of 25%. The overall wealth effect was concentrated in the AI sector and the TON ecosystem.

In terms of data, data from the US spot Bitcoin ETF yesterday (July 23) showed that BITB had a net outflow of US$70.3 million; ARKB had a net outflow of US$52.3 million; and EZBC had no inflow or outflow of funds. After the Ethereum spot ETF was approved, the current first-day trading volume exceeded US$1.019 billion, and Grayscale ETHE accounted for about half of the total trading volume, with a total net inflow of US$106 million yesterday. Bitwise announced that it would donate 10% of the profits of the spot Ethereum ETF to Ethereum open source developers. According to Grayscales official report, Grayscale Ethereum Trust ETHE currently holds more than 2.629 million ETH, with an asset management scale of more than US$9 billion. Investors can subsequently pay attention to the inflow and outflow of funds from Grayscale Ethereum Trust to determine whether it puts pressure on ETH prices.

2. Sektor yang menghasilkan kekayaan

1) Sector changes: AI sector (FIL, TAO, NEAR)

alasan utama:

-

Yesterday, the decentralized AI platform SingularityNET announced an investment of $53 million in modular supercomputers, focusing on decentralized artificial general intelligence (AGI). The first phase will invest $26.5 million and use Ecoblox modular data centers and high-performance hardware from companies such as Nvidia and AMD.

-

Grayscale announced on X that its recently launched decentralized AI fund, Grayscale Decentralized AI Fund, is now open to qualified investors, who can gain diversified investment in the intersection of AI and cryptocurrency by holding the fund. As of July 22, Grayscale Decentralized AI Fund has an asset management scale of $562,664.08.

Upward situation: Currently, you can buy Bittensor (TAO), Filecoin (FIL), Livepeer (LPT), Near (NEAR) and Render (RNDR) on dips;

Faktor-faktor yang mempengaruhi prospek pasar:

-

Good news released: Near and Filecoin and other recent projects have some good news, and the market response is good. Previously, the WorldCoin Foundation announced that it will launch the World Chain public chain based on , and there may be new progress in the next two months. Worldcoin developers are also trying to cooperate with PayPal and OpenAI;

-

Impact on the funding side: With the launch of the decentralized AI fund by Grayscale, it will bring a new investment tool for the AI track of the crypto industry to the mainstream market funds. This will provide convenient conditions for traditional finance to enter this field and invest. The incremental funds will continue to drive the rise of crypto assets in the AI track.

2) Sektor yang perlu menjadi fokus di masa depan: ekosistem TON

alasan utama:

-

In the crypto market where the narrative of the primary track is dull, TON is one of the few public chains that has kept people playing for months. Yesterday, Binance Labs announced its investment in Pluto Studio, the publishing platform of the Telegram-based Web3 game Catizen. The specific amount has not been disclosed yet, which has attracted more attention to TON ecological mini-games. Telegram CEO Pavel Durov said in his Telegram channel, The mini-game Catizen has more than 26 million players and has earned $16 million through in-app purchases, and donated 1% of it to rescue stray cats.

Faktor-faktor yang mempengaruhi prospek pasar:

-

Whether subsequent high-traffic projects in the TON ecosystem, such as Catizen, Hamster Kambot, etc., can continue to create wealth effects; whether the TON ecosystem itself can quickly make up for the shortcomings of DeFi within the ecosystem… will determine the stability of TON tokens and the momentum for their continued rise to a certain extent.

3. Pencarian Populer Pengguna

1) Dapp Populer

Jito: Jito is the largest liquidity pledge protocol in the Solana ecosystem. Yesterday, TVL exceeded $2 billion for the first time. Jito is also the only protocol on Solana with a total locked volume exceeding $2 billion. At the same time, OKX Web3 wallet announced the integration of Jito services to further enhance users Solana network trading experience. Solanas price increase is greater than that of Bitcoin and Ethereum. In the future, liquidity pledge protocols may perform better during the bull market.

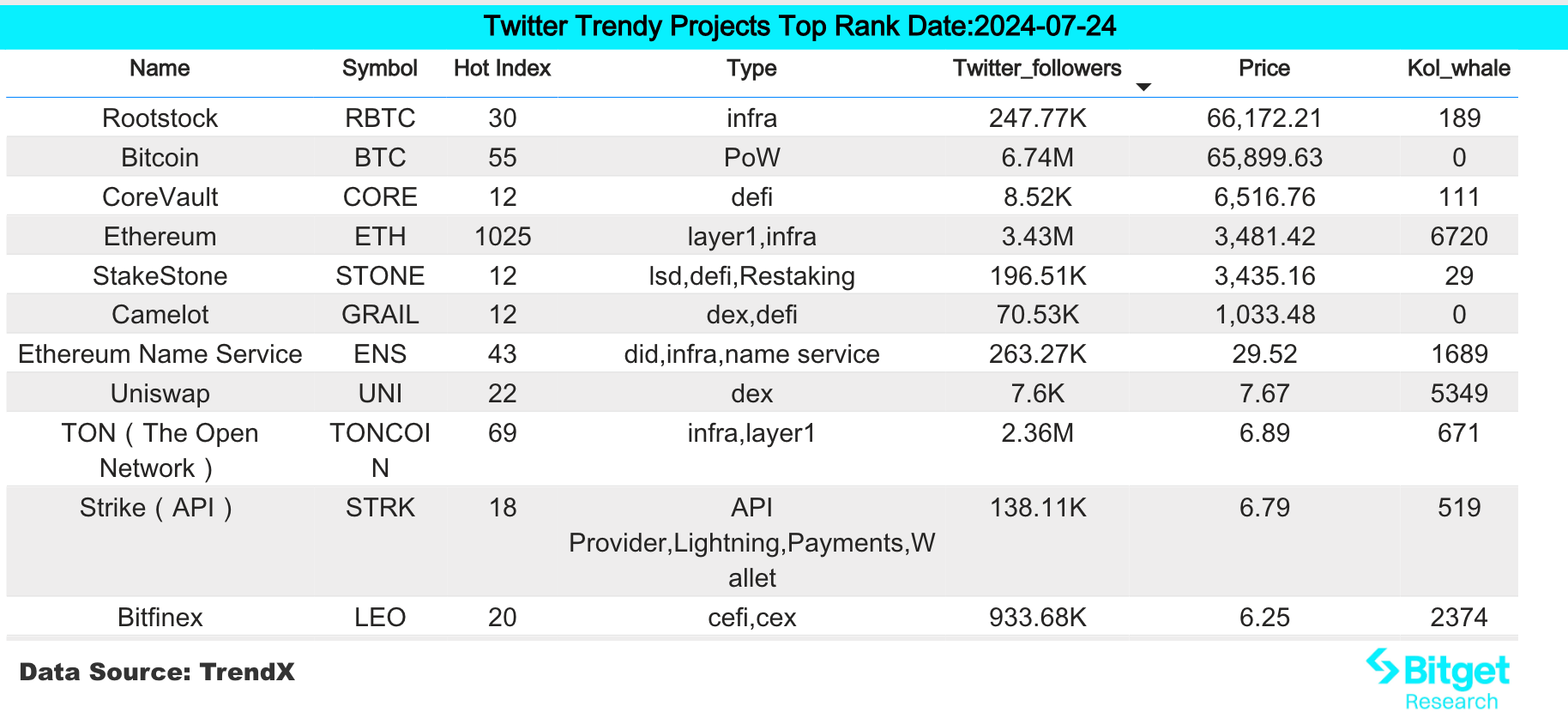

2) Twitter

Ethereum: Yesterday, 9 Ethereum ETFs were launched. According to data from The Block, the cumulative trading volume on the first day of listing on US exchanges exceeded US$1.019 billion. Grayscale Ethereum Trust (ETHE) led with a trading volume of US$456 million, accounting for nearly half of the total trading volume. However, the price of Ethereum has not fluctuated much. Currently, Grayscale is under great selling pressure, and users are advised to trade with caution.

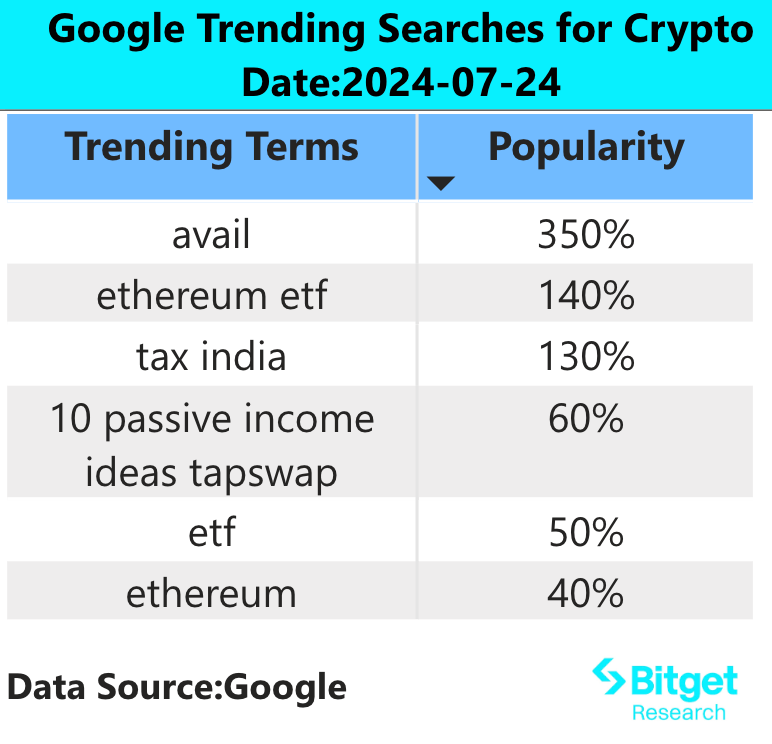

3) Wilayah Pencarian Google

Dari perspektif global:

AVAIL:

The modular blockchain project Avail announced the launch of the Avail DA mainnet and the launch of the AVAIL token. Avail DA is a modular blockchain solution designed to optimize data availability (DA) and achieve highly scalable and customizable rollups. The airdrop has been distributed and the tokens have been directly airdropped into the wallet. The price of Avail is currently 0.1721, which is down from the opening price.

Dari penelusuran terpopuler di setiap wilayah:

(1) The attention in Europe and the United States is more focused on specific tokens, but in fact, the attention to tokens is not limited to certain concepts, but is aimed at tokens with good price performance in the recent period. For example, boden, which is popular in the United States, has seen a sharp rebound today. The same is true for pepe, which is popular in Switzerland, and ftt, which has appeared in the hot searches in Spain.

(2) The hot search tokens in Asia and Latin America yesterday were relatively scattered, but the hot searches in the region were more inclined to focus on meme tokens. For example, pepe appeared in Thailands hot searches, dogecoin appeared in Indonesias hot searches, floki appeared in Argentinas hot searches, and bonk appeared in Brazils hot searches.

Potensi tetesan udara Peluang

Mezo

Mezo is a BTC Layer 2 project that focuses on the BTC ecosystem, helping BTC holders to transfer and manage money on the chain, and driving the development of the BTC DeFi system. Mezo recently announced the completion of a $21 million financing round, with participating institutions including Pantera Capital, Hack VC, Multicoin Capital and other leading institutions in the industry.

The official has already disclosed its BTC asset pledge plan and introduced a referral mechanism. There are strong expectations for the projects airdrops and it is currently in the initial stages of early operations.

Specific participation methods: 1) Visit the project official website and find the invite code in Discord; 2) Enter the invite code and link the unisat wallet; 3) Deposit BTC.

Kakarot

Kakarot is a zkEVM based on Starknet and Cairo, which will make StarknetOS chains EVM-compatible in the short term and serve as a modular backbone for the EVM validium RaaS stack in the medium term. In the long term, Kakarot aims to be a high-performance zkEVM type 1 client that proves Ethereum blocks and transactions.

Kakarot also plans to release a testnet community points system and plans to deploy Kakarot on Starknet Sepolia later this summer, making it a dual-VM ZK-Rollup (EVM and CairoVM).

Specific ways to participate: 1) Builders can deploy smart contracts, especially develop user-centric dApps. 2) Ordinary users can explore the Kakarot test network in applications such as iZUMi Finance, HisokaFinance, Goku Hub, and Swaplace.

Tautan asli: https://www.bitget.com/zh-CN/research/articles/12560603813207

銆怐isclaimer銆慣pasarnya berisiko, jadi berhati-hatilah saat berinvestasi. Artikel ini bukan merupakan nasihat investasi, dan pengguna harus mempertimbangkan apakah opini, pandangan, atau kesimpulan dalam artikel ini sesuai dengan keadaan spesifik mereka. Berinvestasi berdasarkan informasi ini adalah risiko Anda sendiri.

This article is sourced from the internet: Bitget Research Institute: Ethereum spot ETFs first-day trading volume exceeded US$1.019 billion, and mini-games in the TON ecosystem continue to be popular

Original article by: Vitalik Buterin Original translation: TechFlow Over the past few years, the importance of cryptocurrency in political policy has been increasing, and various jurisdictions are considering different bills to regulate participants in blockchain activities. For example, the European Unions Markets in Crypto-Assets Regulation (MiCA) , the UKs regulatory efforts on stablecoins , and the US Securities and Exchange Commissions (SEC) complex legislative and enforcement attempts. In my opinion, most of these bills are reasonable, although there are concerns that governments will take extreme measures, such as considering almost all tokens as securities or banning self-hosted wallets . Due to these concerns, more and more cryptocurrency practitioners have begun to actively participate in politics and decide who to support almost entirely based on the attitude of political parties and…