Bitget Research Institute: Data CPI menyebabkan pasar saham AS mundur, mendorong penurunan keseluruhan dalam mata uang kripto

Dalam 24 jam terakhir, banyak mata uang dan topik hangat baru telah muncul di pasar, dan kemungkinan besar ini akan menjadi peluang berikutnya untuk menghasilkan uang.

The annual rate of the unadjusted core CPI in June was 3.3%, lower than the market expectation of 3.4%, and fell to the lowest level since April 2021. As a related risk asset, Bitcoin fell due to the negative impact of U.S. stocks.

-

The sectors with relatively strong wealth-creating effects are: Solana Meme, ETH ecology;

-

Hot searched tokens and topics by users are: Nillion Network, Bitcoin;

-

Potential airdrop opportunities include: Espresso, Mezo;

Data statistics time: July 12, 2024 4: 00 (UTC + 0)

1. Lingkungan pasar

The annual rate of the unadjusted core CPI in June was 3.3%, lower than the market expectation of 3.4%, and fell to the lowest level since April 2021. US technology stocks fell sharply yesterday, Nvidia closed down 5.57%, Tesla fell 8.44%, Meta fell more than 4%, Apple, Microsoft, Google and Amazon fell more than 2% respectively. Mainly due to the implementation of the expectation of interest rate cuts, the interest rates in the bond market will fall in the future, and prices will rise. Institutions began to withdraw from the overbought stock market and buy bonds instead. As a related risk asset, Bitcoin fell due to the negative impact of US stocks.

In the trading market, according to Arkham monitoring, in the past 24 hours, the German government wallet transferred out 10,627 bitcoins, and then recovered 4169 bitcoins from CEX. It currently still holds 9094 bitcoins (about US$522.29 million). At present, the impact of the remaining selling pressure on the market has weakened.

2. Sektor yang menghasilkan kekayaan

1) Sector changes: Solana Meme (MOTHER, BODEN)

alasan utama:

-

DWFLabs announced its latest strategic partnership with Iggy Azalea, dedicated to supporting innovative projects in the Web3 space.

-

US President Biden said at a press conference that he would not withdraw from the election.

Rising situation: MOTHER and BODEN rose by 10.8% and 21.32% respectively within 24 hours;

Faktor-faktor yang mempengaruhi prospek pasar:

-

Tren token SOL: Dalam ekosistem Solana, tren token SOL akan memengaruhi harga seluruh token ekosistem, karena banyak token di DEX yang dihargai dalam SOL. Terus perhatikan tren harga SOL. Jika SOL mempertahankan tren naik, Anda dapat terus memegang aset ekosistem SOL.

-

Peningkatan atau penurunan open interest: Open interest SOL meningkat kemarin, yang mengindikasikan masuknya hot money. Gunakan data kontrak di situs web tv.coinglass untuk memahami pergerakan dana utama. Pertama, lihat peningkatan net long position pada kontrak; lalu lihat apakah data kontrak menunjukkan peningkatan net long position, peningkatan OI, dan peningkatan volume perdagangan. Jika demikian, berarti kekuatan utama terus membeli dan dapat terus bertahan.

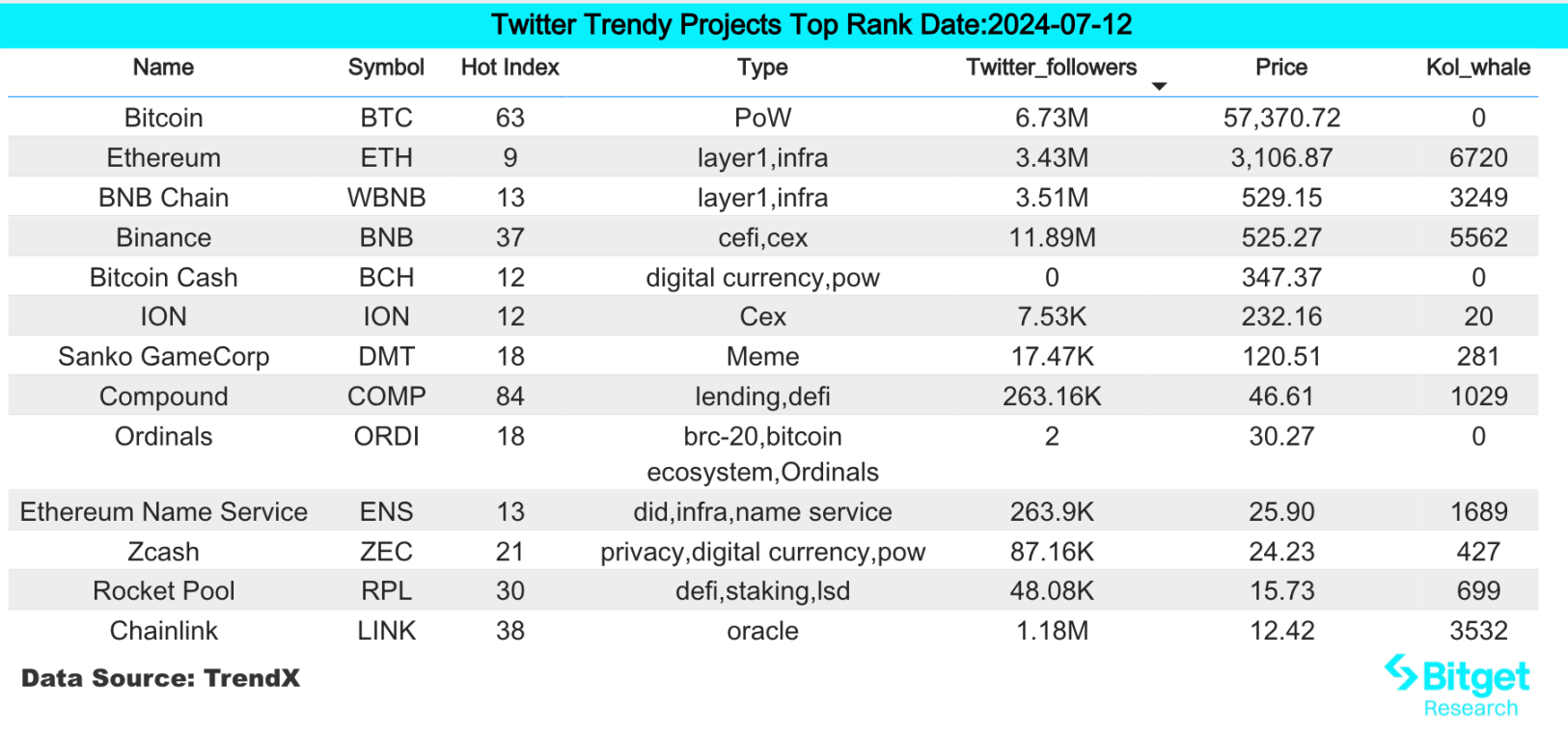

2) Sectors that need to be focused on in the future: ETH ecosystem (ENS, ETHFI)

alasan utama:

-

Etherfis second season airdrop has been launched. Please check the website. The third season will last from July 1 to September 14, and 25 million ETHFI will be distributed.

-

Bloomberg ETF analyst Eric Balchunas predicts that the US SEC may approve the spot Ethereum ETF on July 18.

Faktor-faktor yang mempengaruhi prospek pasar:

-

The news about ETH spot ETF will directly affect the price of ETH and the trend of well-known projects in the ETH ecosystem. In addition, after the SEC announced that it believes that Lido and Rocket Pool staking projects are securities, whether it will further include SSV and other projects in the scope of securities considerations will also have a significant impact on the projects in this track.

3. Pencarian Populer Pengguna

1) Dapp Populer

-

Nillion Network

Nillion, a decentralized public network based on Nil Message Compute (NMC), announced that it has launched the second phase of Catalyst Convergence. This phase includes: supporting developers to build and deploy Blind applications on the network; using NIL tokens from its Faucet to promote projects; interacting directly with the test network and accessing SDK functions; using Petnet for secure storage and computing; using Blind computing to manage and process sensitive data; and deploying the Nada AI software package.

2) Twitter

Bitcoin:

Affected by yesterdays CPI data, BTC has a certain decline in the past 24 hours. Todays Fear and Greed Index is 25, and the level has changed from fear to extreme panic.

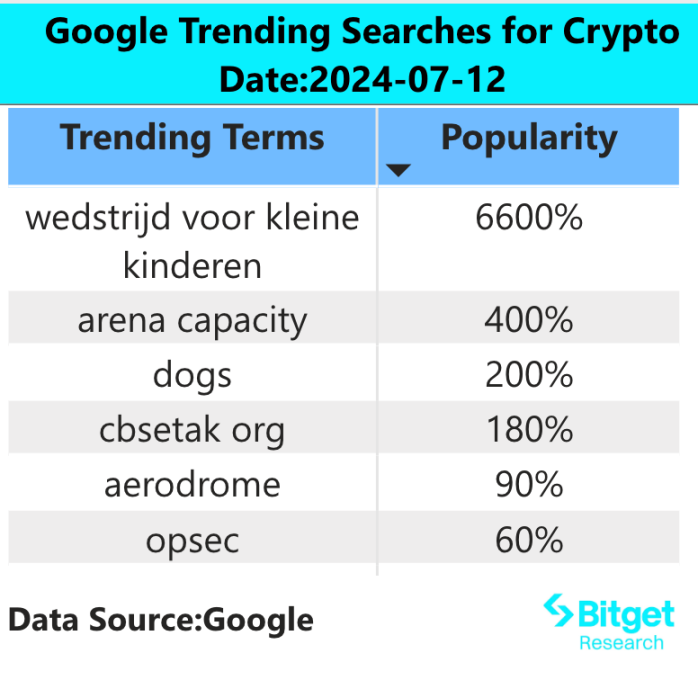

3) Wilayah Pencarian Google

Dari perspektif global:

Aerodrome:

Since the Base-based DEX Aerodrome announced that Coinbase Ventures acquired AERO tokens in the secondary market, it was found that the Coinbase Ventures address has purchased at least 4.7 million AERO (about $2.7 million). In addition, TradingVaults used by Coinbase Ventures also holds 1.5 million AERO (about $936,000). The last batch of purchases was completed 8 days ago, and all acquired tokens are locked in the Aerodrome ecosystem.

Dari penelusuran terpopuler di setiap wilayah:

(1) There are no obvious characteristics in the Google Trends hot searches of Asian countries. BTC has become the focus of market attention. In addition, the Ton ecological game project hamster kombat is on the list, and the market is paying attention to the airdrop opportunities of this project.

(2) There are no obvious characteristics in the hot searches in European and American countries. Coinbase, Crypto AI and other hot topics are on the list. There is no consensus on the tracks and projects that are being paid attention to. Bitget has become the CEX that British users are paying attention to.

Potensi tetesan udara Peluang

espreso

Espresso is a shared sorter market project that uses ZK-Rollups. The project mainly solves the consensus and interoperability between various Layer 2s. The core of Espressos strategy is to focus on privacy and decentralization, and the core members of the project are members of the Applied Cryptography Research Group at Stanford University.

The project recently announced the completion of a USD 28 million Series B financing, led by A16Z, with participation from Polychain, Coinbase Ventrues Sequioia, Sequioia, etc., making for a luxurious financing lineup.

Specific participation method: The project is currently in its early stages. Users can participate in the early project by participating in the verification node, and may obtain early airdrop qualities. For specific implementation, please refer to the official document: https://docs.espressosys.com/sequencer/guides/running-a-sequencer-node

Mezo

Mezo is a BTC Layer 2 project that focuses on the BTC ecosystem, helping BTC holders to transfer and manage money on the chain, and driving the development of the BTC DeFi system. Mezo recently announced the completion of a $21 million financing round, with participating institutions including Pantera Capital, Hack VC, Multicoin Capital and other leading institutions in the industry.

The official has already disclosed its BTC asset pledge plan and introduced a referral mechanism. There are strong expectations for the projects airdrops and it is currently in the initial stages of early operations.

Specific participation methods: 1) Visit the project official website and find the invite code in Discord; 2) Enter the invite code and link the unisat wallet; 3) Deposit BTC.

Informasi lebih lanjut tentang Institut Penelitian Bitget: https://www.bitget.fit/zh-CN/research

Bitget Research Institute berfokus pada fokus pada data on-chain dan menambang aset berharga. Ini menambang investasi nilai mutakhir melalui pemantauan real-time atas data on-chain dan pencarian populer regional, dan memberikan wawasan tingkat institusional bagi para penggemar kripto. Sejauh ini, ini telah memberi pengguna global Bitgets aset berharga tahap awal di berbagai sektor populer seperti [Ekosistem Arbitrum], [Ekosistem AI], dan [Ekosistem SHIB]. Melalui penelitian berbasis data yang mendalam, hal ini menciptakan efek kekayaan yang lebih baik bagi pengguna global Bitgets.

銆怐isclaimer銆慣pasarnya berisiko, jadi berhati-hatilah saat berinvestasi. Artikel ini bukan merupakan nasihat investasi, dan pengguna harus mempertimbangkan apakah opini, pandangan, atau kesimpulan dalam artikel ini sesuai dengan keadaan spesifik mereka. Berinvestasi berdasarkan informasi ini adalah risiko Anda sendiri.

This article is sourced from the internet: Bitget Research Institute: CPI data caused the US stock market to pull back, driving the overall decline in the crypto market

In the cryptocurrency market, data has always been an important tool for people to make trading decisions. How can we clear the fog of data and discover effective data to optimize trading decisions? This is a topic that the market continues to pay attention to. This time, OKX specially planned the Insight Data column, and jointly with mainstream data platforms such as CoinGlass and AICoin, starting from common user needs, hoping to dig out a more systematic data methodology for market reference and learning. The following is the second issue, in which the OKX Strategy Team and CoinGlass Research Institute jointly discussed the data dimensions that need to be referenced in different trading scenarios. It involves topics such as capturing trading opportunities and how to cultivate scientific trading thinking. We…