perkenalan

Pendle aims to provide a yield to maturity trading market for income-generating tokens. Pendle introduces the concept of principal and interest separation in the traditional financial market into the DeFi field, dividing income-generating tokens into principal tokens and income tokens, and providing trading liquidity for both tokens.

Through Pendle, users can maximize asset utilization and realize multiple benefits, bringing new possibilities to the DeFi market.

Informasi dasar proyek

tim proyek

-

tim inti

TN Lee: Founder, former member of Kyber Networks founding team and business manager. In 2019, he founded Dana Labs, which mainly specializes in FPGA customized semiconductors.

Vu Nguyen: Co-founder, formerly CTO of Digix DAO, specializes in the RWA project for the tokenization of physical assets. He co-founded Pendle with TN Lee.

Long Vuong Hoang: Head of Engineering, holds a Bachelor of Computer Science degree from the National University of Singapore. He joined Jump Trading as a software engineering intern in May 2021, joined Pendle as a smart contract engineer in January 2021, and was promoted to Head of Engineering in December 2022.

Ken Chia: Head of Institutional Relations. He holds a bachelors degree from Monash University. He was an investment banking intern at CIMB, the second largest bank in Malaysia, and later worked as an asset planning expert in a private investment bank at JPMorgan. In 2018, he joined Web3 and worked as COO at an exchange. In April 2023, he joined Pendle as Head of Institutional Relations, responsible for the institutional market – proprietary trading firms, cryptocurrency funds, DAO/protocol treasuries, and family offices.

Pembiayaan

-

Putaran benih

In April 2021, Mechanism Capital led the investment, followed by HashKey Capital, Crypto.comCapital. CMS Holdings, imToken Ventures, SpartanGroup, Alliance DAO, Lemniscap, LedgerPrimeParataxis Capital, Signum Capital, Harvest FinanceYoubi Capital Sora ventures, D 1 ventures, OriginCapital, Bitscale Capital, Fisher 8 Capital, and Hongbo.Taiyang Zhang, with a total investment of US$3.7 million.

-

Private placement round

In April 2023, Bixin Ventures announced an investment in Pendle, but the amount was not disclosed.

In August 2023, Binance Labs announced an investment in Pendle, but the amount was not disclosed.

Judging from Pendles financing situation, the top investment companies in the market are very optimistic about its prospects.

-

Kekuatan Pengembangan

Pendle was established in 2020 by founder Yong Ming Lau. The key events in the development of the project are shown in the following table:

Judging from the key events in Pendles development, Pendle has been progressing steadily and the project operation is stable.

Operation Mode

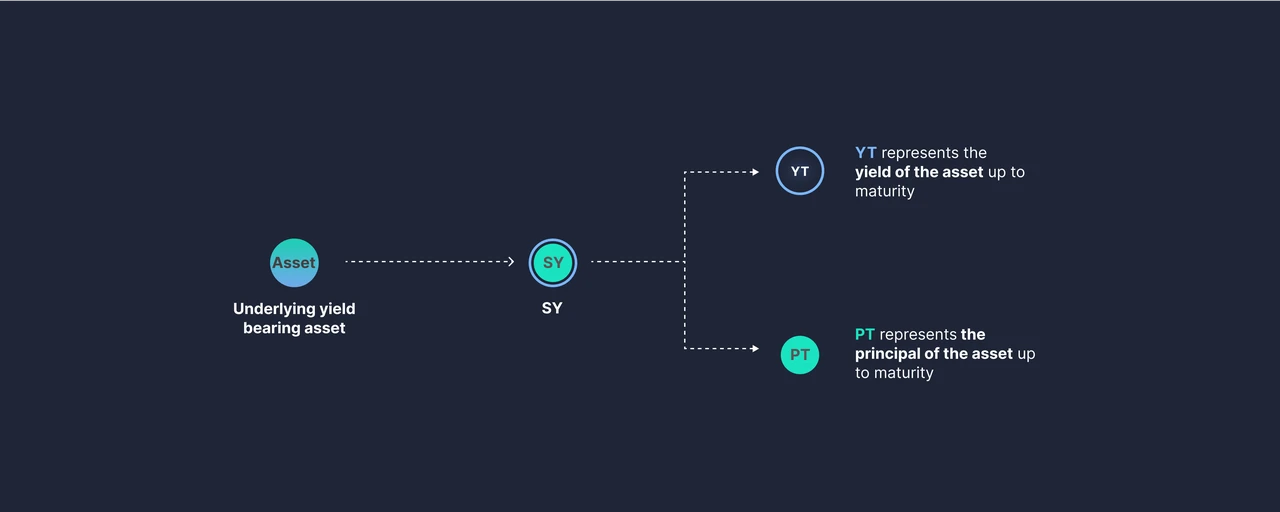

Pendle packages the tokens that generate income into SY (Standardized Income Token), and then SY is divided into two parts: principal and income, namely PT (Principal Token) and YT (Income Token), which can be traded through the customized V2 AMM. Users can purchase assets at a discount, make long and short returns, and achieve low-risk fixed income.

In Pendle, the owner of SY decided to separate the income from the principal, thus creating PT and YT. Since YT represents the right to future income, the price of PT will be lower than the price of the original bond (ST). The value of PT actually represents the recovery value of the principal when the bond matures. As the maturity date approaches, the market value of PT will gradually rise, because market participants expect that at maturity, PT holders will be able to redeem PT at a price equal to the value of the underlying asset (i.e., the principal of the bond). If the face value of the bond is $100, then in theory the price of PT should gradually rise back to $100. At maturity, the holder of PT can use PT for the equivalent of $100 in bond principal. Therefore, even if PT initially trades at a discount (e.g., $95), its value will gradually increase over time and as the maturity date approaches, eventually returning to the full value of the underlying asset, which is $100. Among the counterparties, people are trading or hedging future yields. Selling YT means smoothing the future yield curve in advance and cashing it out, or being bearish on future yields; while buying YT means being bullish on future yields. Buying PT means buying at a certain discount and believing that the yields during this period will be lower.

SY token split diagram

Tokenization of revenue

YT represents real-time access to all earnings generated by the underlying yield token, and can be manually claimed at any time from the Pendle dashboard. If a user owns 1 YT-stETH and stETH has an average annual yield of 3.4%, then the user will have accumulated 0.034 stETH after expiration. YT can be traded at any time, even before expiration.

Pendle AMM

In the Pendle project, the mutual exchange between SY, PT and YT requires the use of Pendles V2 AMM, which is also the core of Pendle finance. Pendles V2 AMM is designed for trading returns, and the AMM curve changes to take into account the yield generated over time and narrow the price range of PT as it approaches expiration. By concentrating liquidity into a narrow, meaningful range, the capital efficiency of trading yields will increase as PT approaches expiration. In addition, through AMM, we are able to use only a single liquidity pool to facilitate the swap between PT and YT. Through the PT/SY pool, PT can be traded directly with SY, and YT can also be traded through flash exchange. The Pendle V2 AMM design ensures that the problem of IL (minimum impermanent loss) is negligible. Pendles AMM mitigates time-related IL (minimum impermanent loss) by moving the AMM curve to push the PT price towards its potential value over time, thereby releasing the natural price appreciation of PT.

Pendles AMM curve can be customized to cater to tokens with different yield fluctuations. Yields are usually cyclical, usually fluctuating between highs and lows.

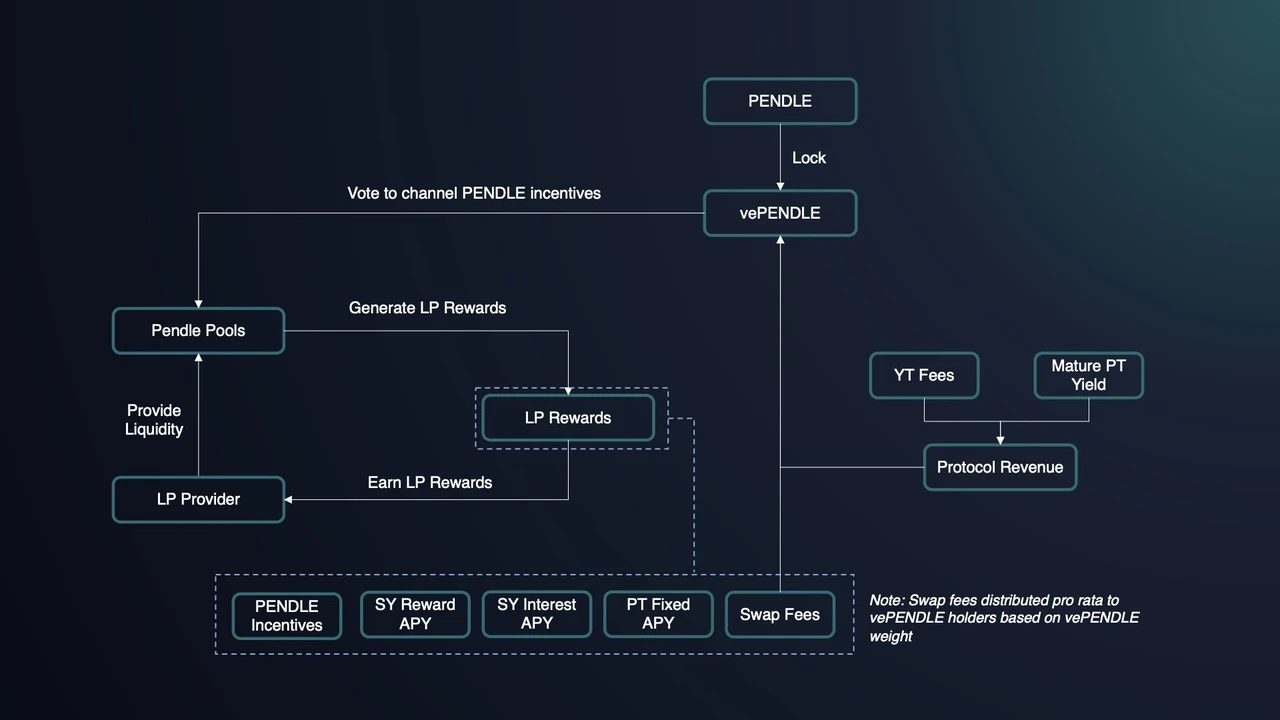

VePendle

VePENDLE is Pendles governance token. Staking PENDLE will earn you VePENDLE. VePENDLE holders can participate in Pendles management and voting, and share the income of the Pendle protocol. VePENDLE holders receive the following income:

-

The interest collected from YT (approximately 3%) and the matured PT rewards (excess income generated by not redeeming PT in time after maturity) constitute VePENDLEs base APY;

-

VePENDLE voters are also entitled to 80% of the swap fees from the voting pool;

-

By depositing VePENDLE into the LP pool to provide liquidity, you will receive PENDLE rewards in the LP pool, so the income will be further increased, up to 250%.

VePENDLE obtained after staking PENDLE will be unlocked linearly over a period of time (up to two years).

How to get PENDLE: Deposit LST or native asset tokens into the LP pool of the selected PT to get rewards, or deposit VePENDLE into the LP pool to provide liquidity and get rewards.

VePENDLE working principle diagram

Project Benefits:

The concept of separation of principal and interest

Relying on Pendles mechanism of separating principal and interest income, users can more flexibly formulate various income management strategies according to their own circumstances.

-

If users feel that the annualized rate of return will decrease, for example, after the Ethereum Shanghai upgrade, the ETH pledge ratio will increase, which will lead to a decrease in the pledge rate of return, then they can choose to sell YT assets, which is equivalent to cashing in income in advance. When the year expires, users can buy back YT assets, pair them with PT assets, and exchange them for SY assets;

-

If users think that the annualized return will increase, they can buy YT assets because YT assets will appreciate in value in the future. Since YT assets represent the rate of return, the value is cheaper than the principal. For example, in 100 aUSDC, the YT asset is worth 5 US dollars. This means that users can magnify their returns by 20 times;

-

If users feel that the rate of return will remain unchanged, they can provide a liquidity pool to provide liquidity for users who buy and sell PT and YT assets. Users can get additional transaction fees while obtaining the original income.

Higher capital efficiency

Pendle uses an automated market maker (AMM) mechanism, and Pendles AMM mechanism is a protocol designed specifically for yield markets. This means that there will be lower slippage during trading, and the AMM curve will change over time to reflect the yield generated over time. As PT (Pendle Token) approaches expiration, the AMM curve will narrow its price range. As PT approaches expiration, the possible price range will narrow, thereby concentrating liquidity within a meaningful range. This design can improve capital efficiency and increase trading yields.

Easier operation and selection

Although Pendles economic model is very complex, including SY, PT and YT, and AMM is set up specifically for trading PT and YT. However, users can use Pendle products easily and concisely. After choosing to cast SY, simply choose the number of PT and YT, and there are 42 LP pools. The page for staking PENDLE is also very concise and easy for users to operate. In other projects, the principal and interest are usually attributed to one token, such as stETH, etc., so users will face the dilemma of not wanting to give up holding ETH while expecting a possible decline in future staking income. With Pendle, this problem is easily solved, separating the principal and income, and formulating your own strategy based on your own judgment of future expectations.

Model Proyek

Model Bisnis

Pendles economic model consists of two roles: liquidity providers and participating traders.

Liquidity providers: Liquidity providers are an important component of Pendle. The AMM mechanism is the core of Pendles operation. Only by maintaining sufficient liquidity can Pendle operate normally. In Pendle, SY exists as an intermediary asset for the SWAP pool, so liquidity providers need to provide YT-SY/PT-SY token trading pairs. Liquidity providers can obtain swap fees generated by the mining pool, PENDLE token rewards, and protocol incentives issued by the underlying assets as rewards to encourage more liquidity providers to provide liquidity.

Participating traders: Pendle users are participating traders who make profits by trading PT and YT to purchase assets at a discount, earn long and short returns, and earn low-risk fixed income.

Pendles main income is:

-

YT Fee: Pendle takes a 3% fee from all earnings generated by YT (Yield Token). In addition, Pendle also charges a fee from all earnings of SY that have not been redeemed for PT.

-

Transaction Fee: Pendle charges 0.1% of the transaction amount.

Model Token

Alokasi Token

The current total circulation of PENDLE is: 155,807,014.67. The teams tokens have all been unlocked (13.75 million), and the supply will decrease by 1.1% per week until April 2026, when 2% will be issued annually as an incentive.

Token Empowerment

Pendles token design refers to Curves Ve model, giving tokens more capabilities to increase their value.

-

Governance function: Users can obtain vePENDLE by staking PENDLE, and can initiate on-chain proposals and participate in voting, directly influencing project decisions.

-

Incentive value: Users can get more economic benefits after staking PENDLE. Pendle charges a 3% fee from all YT earnings. 100% of this fee is distributed to vePENDLE holders, and vePENDLE voters are also entitled to 80% of the interest rate swap fees from the voting pool.

Kinerja Harga Token

According to Coingecko statistics, the price of PENDLE has risen more than 16 times since July 2023 (lowest point US$0.465, highest point US$7.538), and the main trading venues are first-tier exchanges such as Binance and Bybit.

TVL

Current TVL is $3.693 billion

Pendle Protocol TVL Statistics

Although Pendles TVL has dropped significantly since June 27, 2024, its total TVL still remains at around US$3 billion, ranking among the top in the Defi field.

Token Staking Rate

Pendle token staking statistics

The number of locked Pendles is 55,873,398, and the pledge rate is 36.02%. The growth rate of the pledged quantity remains stable, but the current pledge growth rate is not enough to put Pendle into a deflationary state.

Major factors affecting token prices

On June 27, 2024, Blast conducted a token airdrop, in which the distribution method of the token caused dissatisfaction among whale users, mainly because Blast announced that the top 0.1% of users (about 1,000 wallets) would linearly vest part of the airdrop within 6 months. Mainstream exchanges such as Binance and OKEX did not list Blast tokens, causing the markets expectations for its price to decline.

The Blast incident itself has little to do with Pendle, but the Blast incident directly affected the confidence of market players in the points project. Now users have greatly reduced their expectations for the points project. As the points expectations decline, users do not have much motivation to participate in staking mining. Most Pendle users are mainly to achieve the effect of killing two birds with one stone, and pure traders can use YT to increase their leverage, and SY providers can achieve hedging purposes. However, with the decline in yield expectations and market coin prices, YTs APY has also dropped significantly. Users no longer participate in staking mining, and thus withdraw collateral such as ETH from Pendle, causing Pendles TVL to drop by nearly 50% in 4 days, which also hit the price of PENDLE.

Risiko Proyek

As a DEX project, the biggest risk for Pendle is the risk of its own contract.

Smart contract vulnerabilities: Smart contracts written in Solidity may have coding vulnerabilities;

Parameter configuration risk: Pendle contracts have many adjustable parameters, such as handling fee rate, reward ratio, etc. Improper parameter settings may lead to a decline in user experience or fund security incidents;

Contract upgrade risk: As demand changes, contracts will be upgraded and iterated. If there is a lack of sound upgrade testing and version management processes, there may be a risk that the new version of the contract will undermine system stability.

Meringkaskan

Pendle brings the separation of principal and interest in the traditional financial market into Crypto. Pendle allows crypto asset holders to lock in future yields and receive earnings in advance, bringing more liquidity and flexibility to the interest rate market. While users participate in flexible interest rate market transactions, they can also earn points for some projects, achieving the effect of killing two birds with one stone and maximizing their own interests. This innovative mechanism provides a new source of income for cryptocurrency holders and injects more vitality and opportunities into the market.

However, Pendle is currently greatly affected by the Blast airdrop incident. Coupled with the fact that the overall market trend is not ideal at this stage, users have given up the option of staking mining, resulting in a significant drop in Pendles TVL and coin price.

In short, as a DEX in the interest rate market, Pendle has opened a new door for traders and arbitrage users. Although Pendle is not performing well due to the market environment, if the market shows an upward trend in the future and the prices of various tokens recover, causing YTs APY to rise, Pendle will still usher in another explosive period.

This article is sourced from the internet: PENDLE: A seriously underestimated new leader in DeFi

Related: Blast is about to be launched. How to quickly increase the points multiplier?

Original author: TechFlow The long-awaited Blast will be launched on June 26th at TGE, and the wealth effect indicator Upbit exchange has also announced that it will launch $Blast trading. It’s inevitable to feel anxious when looking at other people’s huge points, but don’t be anxious. Try your best in the last few days. What if you can overtake them? In addition to earning points by depositing, Blasts airdrop mechanism also introduces a point multiplier mechanism , which can increase the number of points a user earns per hour. A simple example explains: If you deposit 1 ETH on the Blast mainnet and have a 20x points multiplier, then the Blast points you earn every hour will be equivalent to the points earned by a user who deposited 20 ETH…