Edisi Khusus Riset Makro SignalPlus: Sedang Membuka Lowongan

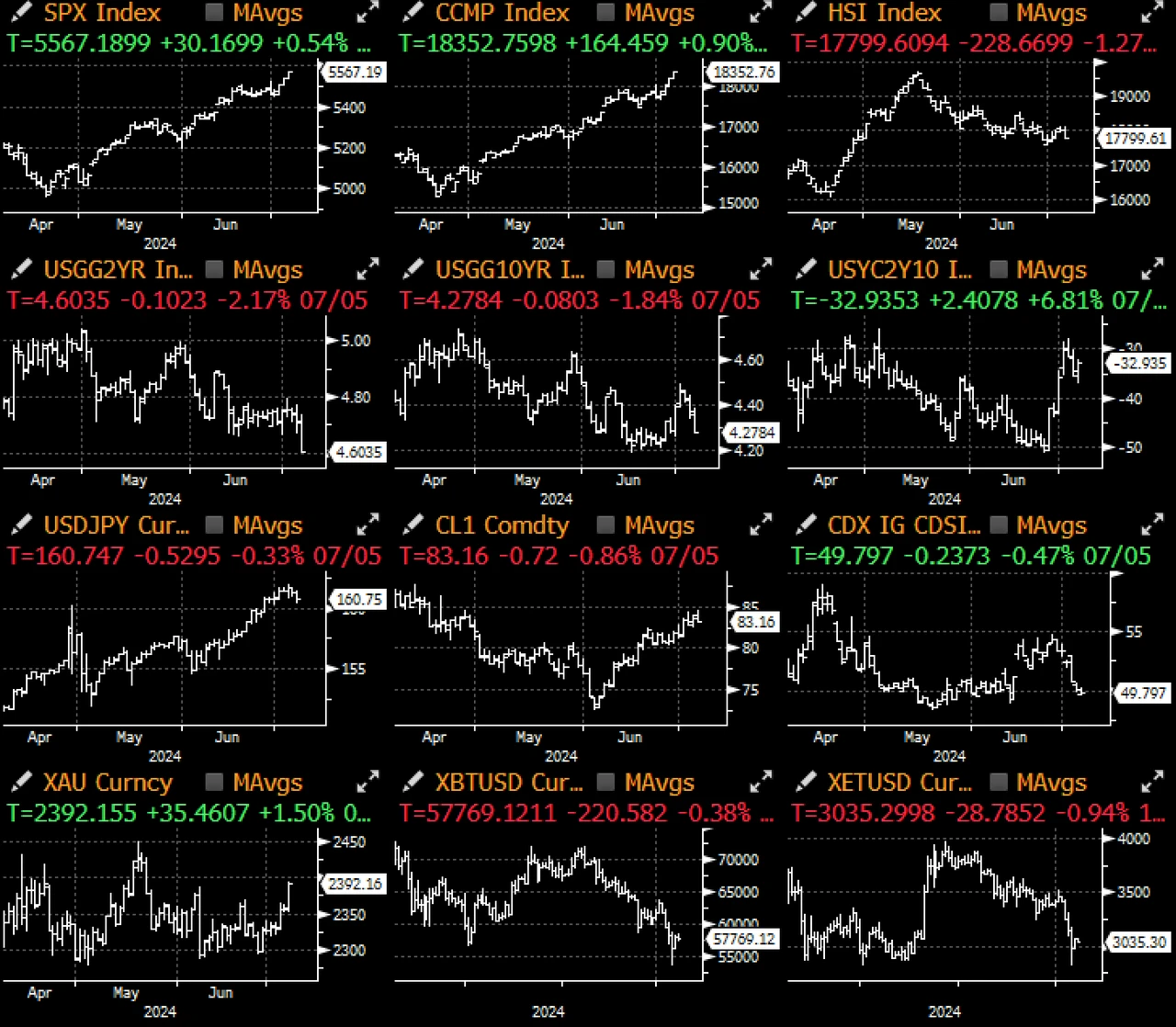

The non-farm payrolls data was slightly weaker than expected, continuing the recent trend of weakening momentum in the US economy. The unemployment rate rose from a cycle low of 3.43% to 4.05%. Of the approximately 200,000 new jobs added in the past month, approximately 150,000 were from the government and healthcare sectors, and the employment data for the past two months was also revised down by 111,000. Wage growth slowed to 3.9% and 3.5% year-on-year and month-on-month, respectively, providing more positive signals to the Federal Reserve that inflation is slowly falling back to its long-term target. In addition, given the recent performance of cryptocurrencies, will we see a small surge in job seekers and lead to lower wage pressures in the coming months?

With only a few meetings left before the November election, and given the Fed鈥檚 strong desire not to surprise the market, we expect this month鈥檚 FOMC meeting to take a more forceful stance, positioning the market for a 25bp rate cut in September.

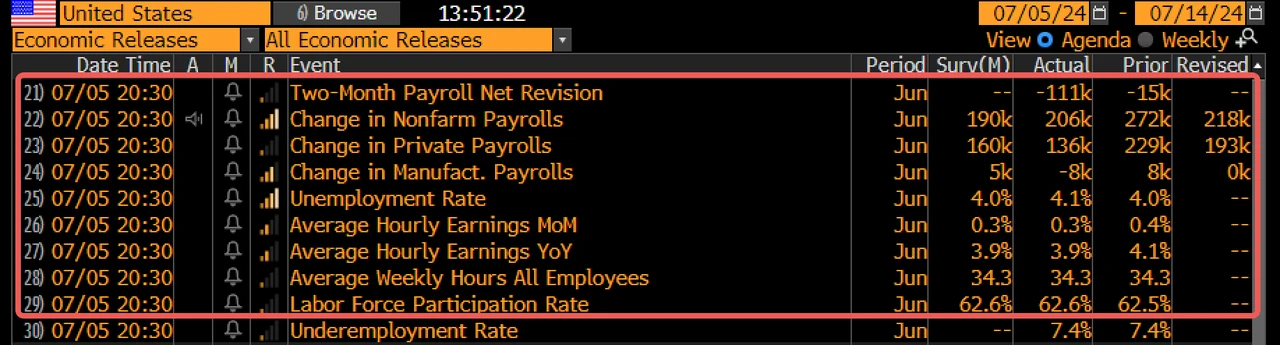

TradFi assets welcomed the continued slowdown in economic data. U.S. Treasury yields fell 5-10 basis points in the steep bull trend. At the same time, driven by technology and growth stocks that are highly sensitive to low interest rates, U.S. stocks once again set a new record high. How many times has this set a new record high this year?

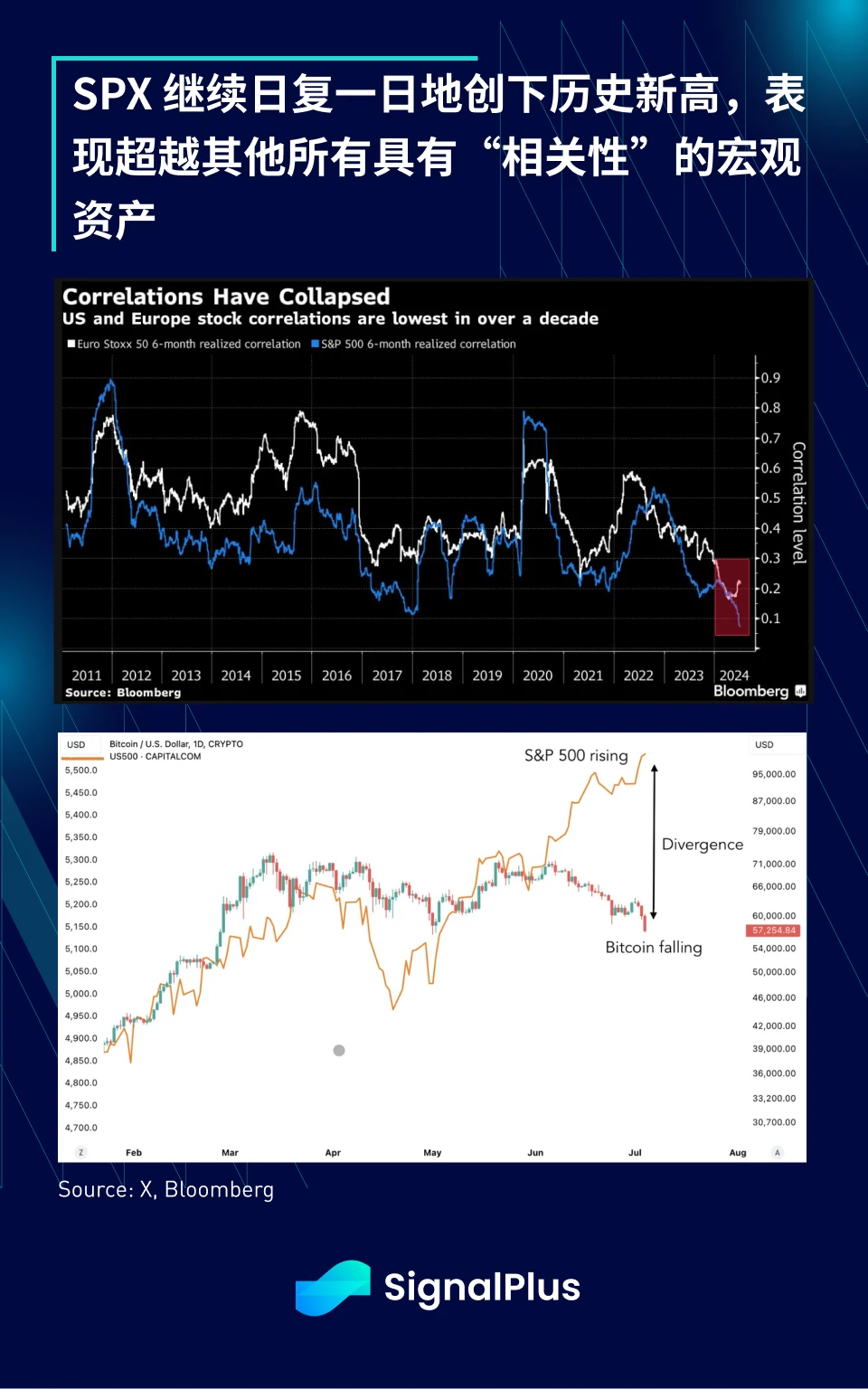

Since June, the U.S. stock market has been rising continuously, which is a huge difference from the performance of European stocks and even cryptocurrencies. There is a lack of convincing catalysts in the short term. Even France鈥檚 far-right deadlock or Trump鈥檚 victory seems unable to shake this market. Especially when the Federal Reserve still has ample room for easing policy, it is best not to fight against market trends.

As the second quarter comes to an end, the focus will turn to corporate earnings reports, and Citi analyst models show that there is a possibility of more positive earnings surprises based on management guidance and strong corporate pricing power. Well, goodbye to another catalyst for short selling.

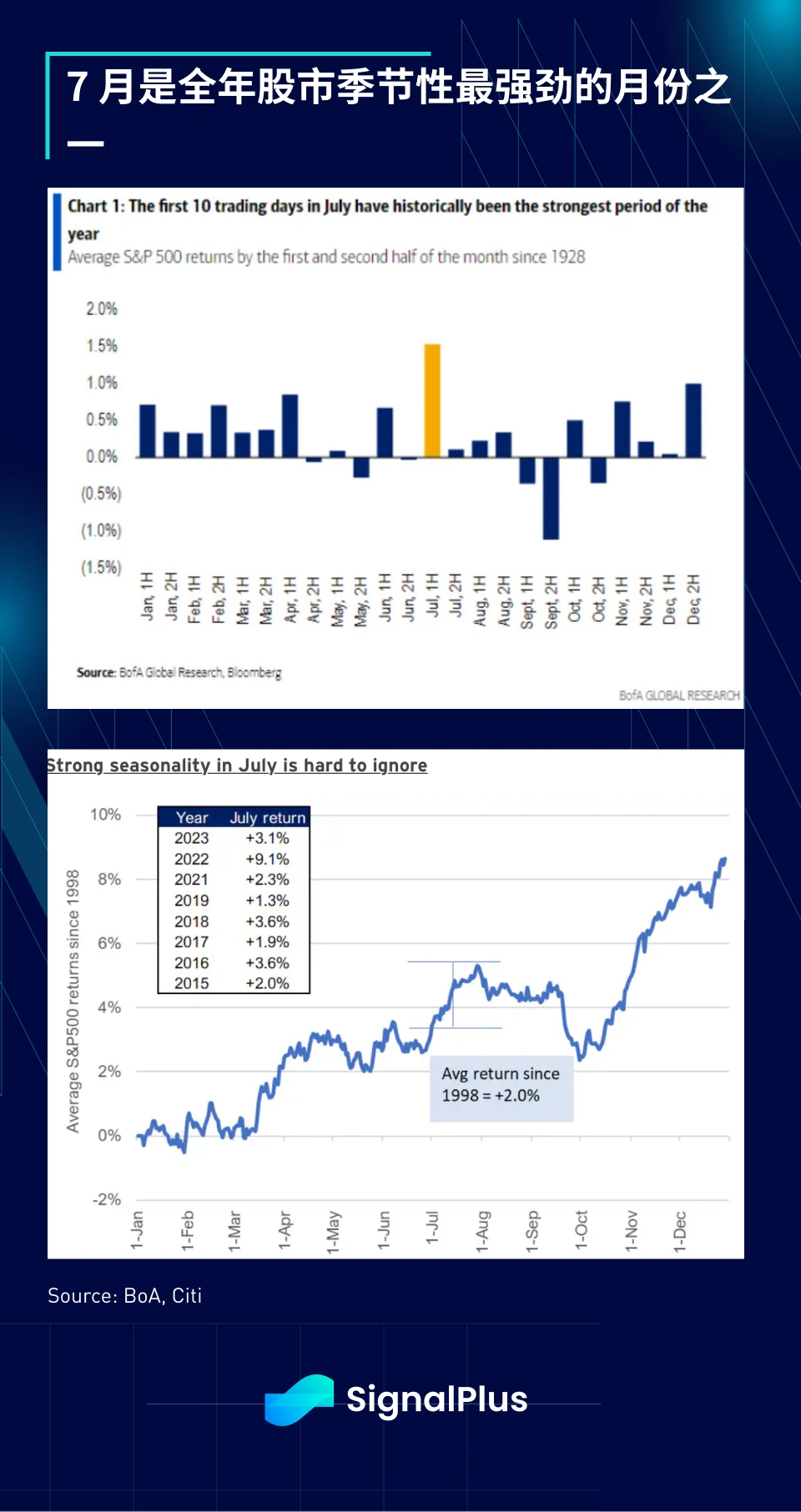

We mentioned the strong seasonality of July before, and it鈥檚 going pretty well so far. The first two weeks of July are historically the strongest for the U.S. stock market, and July as a whole was an exceptional month in its own right. Can you share some of the heat with cryptocurrencies?

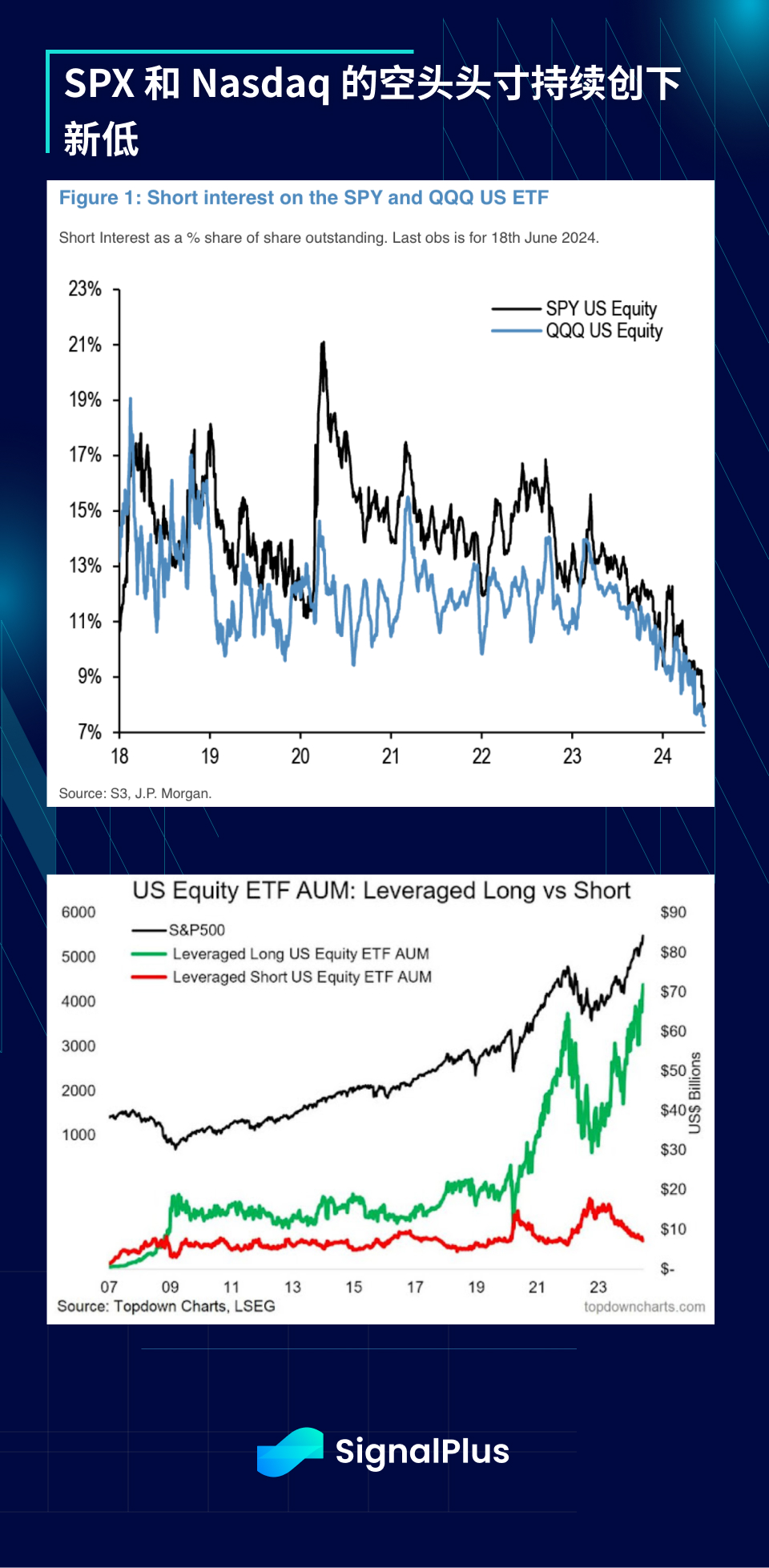

As expected, short interest in the SPX and Nasdaq continues to hit new lows, at just 7% of float. Any chance of it falling below 5% before summer is over?

Even more extreme, the SPXs concentration of winners is now above the highs of the 1930s. Dont forget that markets can correct in price and time, and even if the final sell-off feels like an instant disaster, the process of tops often takes months or even quarters, and we havent seen any significant signs of a shift in sentiment…yet.

Talking about a sentiment shift, the fortunes of many crypto tokens have changed, with major coins and top altcoins seeing a -20% correction in the past month and a 10% drop in the past week alone.

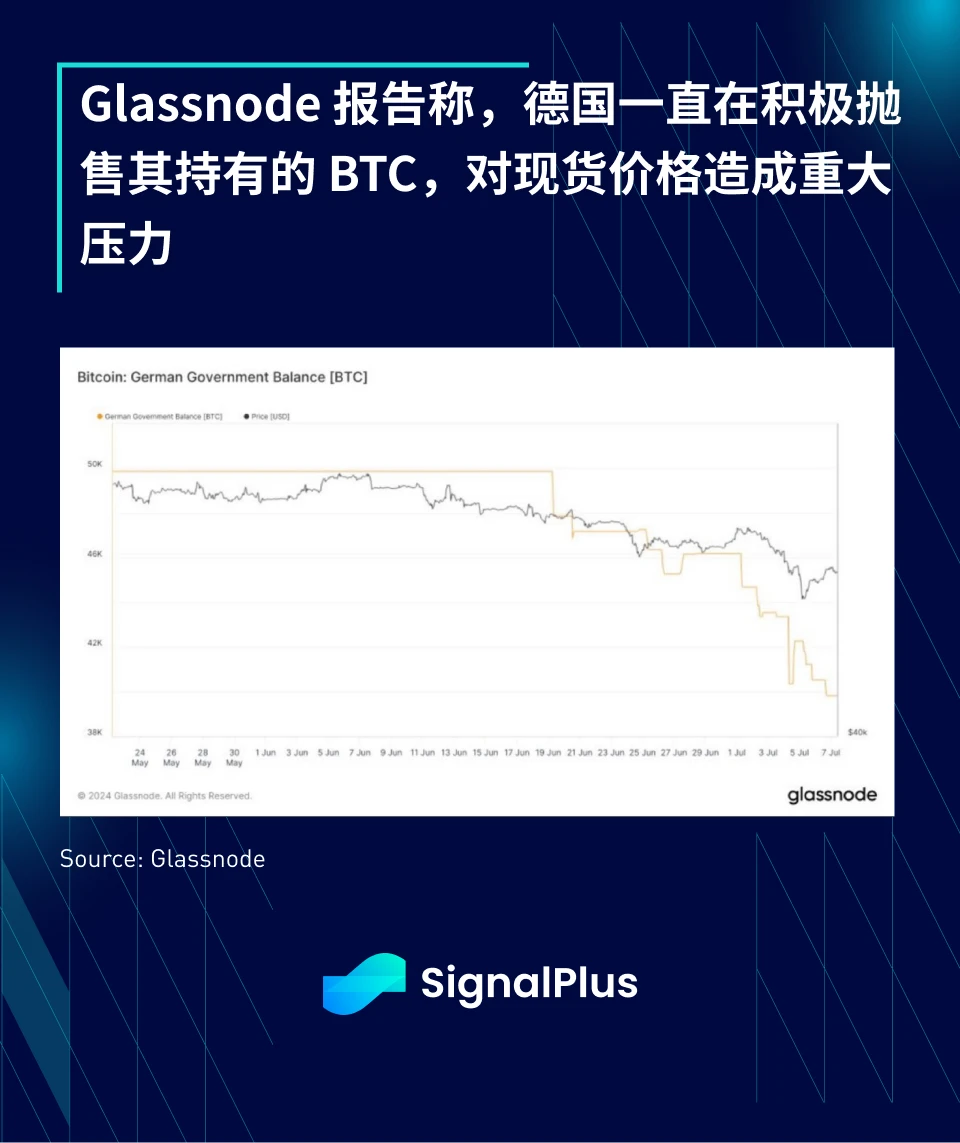

The German government鈥檚 public intention to sell and the supply unlocking of Mt. Gox pushed BTC from $65,000 to $54,000 in a week, and the lack of positive catalysts combined with long-term long positions were unable to offset the huge selling pressure, resulting in painful and dramatic position stops across the market.

A large number of BTC futures long liquidations occurred on various exchanges, and even spot ETFs experienced large capital outflows due to profit and loss protection.

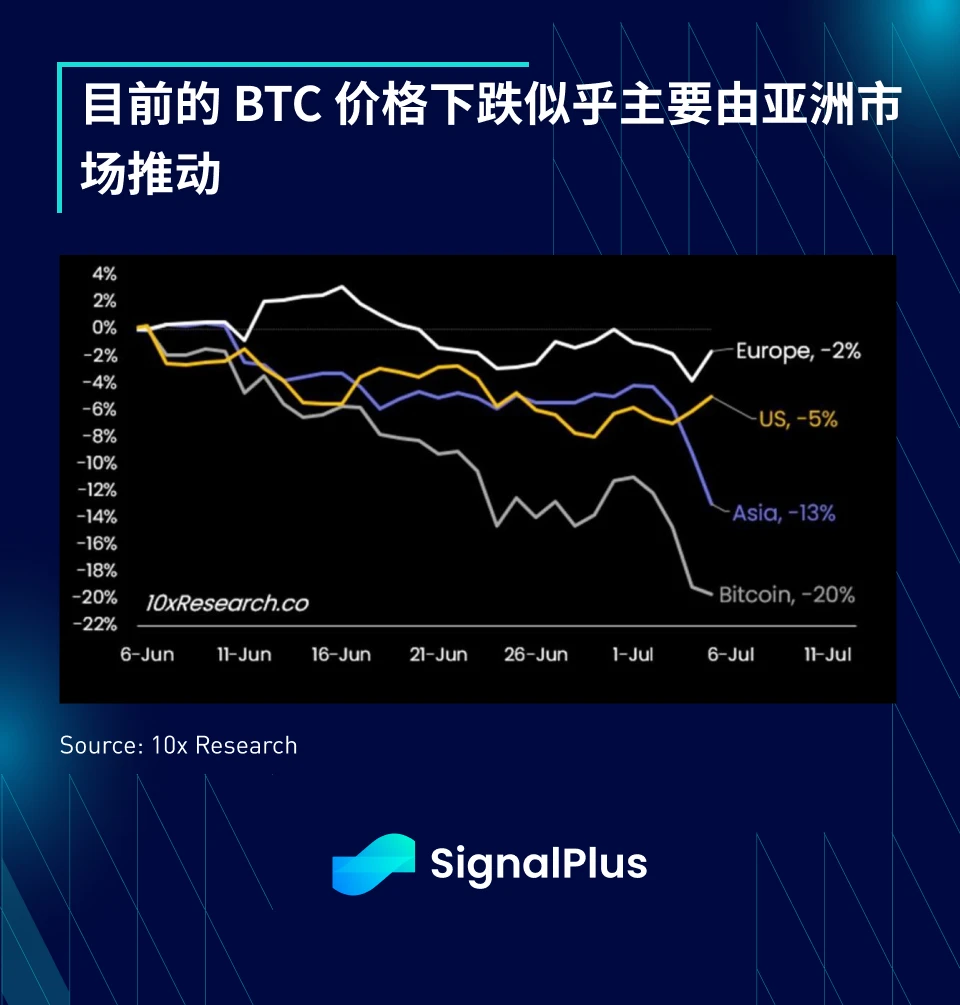

Additionally, it was reported that most of the price losses occurred in the Asian time zone, and while European and US investors may have done some bargain hunting, Asian investors bore the brunt of the capital losses.

Meanwhile, implied volatility for BTC and ETH barely budged, with traders seemingly focused on closing positions rather than buying downside protection or going short outright. This move seems to have been entirely spot-led, with traders caught off guard and focused on minimizing risk rather than initiating new positions.

After a very disappointing altcoin season and post-halving price action, the losses in the entire cryptocurrency space are quite severe, and there is little motivation to chase price rebounds in the native ecosystem alone. Even if the inflow of funds after the approval of the ETH ETF may provide a short-term bottom for the market, the distribution of positions takes time, and cryptocurrency prices may be stagnant for most of the summer. If the July 31 FOMC meeting is significantly dovish, it may provide some overall support, but the stock market sell-off (if it really happens) is still an external but real bearish risk to the overall sentiment.

We continue to believe that this crypto cycle (and the ones that follow) will be very different than what native users are used to, with the entry of TradFi, the players have changed, the wallets are different, and the rules of the game have changed.

Stay safe my friends, it鈥檚 probably going to be a long summer.

Anda dapat mencari SignalPlus di Plugin Store ChatGPT 4.0 untuk mendapatkan informasi enkripsi secara real-time. Jika Anda ingin segera menerima pembaruan kami, silakan ikuti akun Twitter kami @SignalPlus_Web3, atau bergabung dengan grup WeChat kami (tambahkan asisten WeChat: SignalPlus 123), grup Telegram, dan komunitas Discord untuk berkomunikasi dan berinteraksi dengan lebih banyak teman. Situs Web Resmi SignalPlus: https://www.signalplus.com

This article is sourced from the internet: SignalPlus Macro Research Special Edition: Now Hiring

Related: Comprehensive interpretation: Why is this bull market so different?

Original title: Game intensifies, industry development enters a new pattern Original author: DaPangDun, crypto researcher Original source: Mirror Please note: This article was written by an individual based on market data, personal cognition and logical reasoning. It may not be correct and is for reference only. 1. This bull market is different Many people should feel that this round of bull market is significantly different from the previous round, mainly manifested in: The wealth effect is insufficient. There is no general rise in the market like the last round. The choice of the target is very important. If you are not careful, you will lose money. Most currencies cannot outperform BTC. The trend of value coins is often not as good as Memecoin. Many value coins listed on the stock…