Setelah peluncuran Ethereum ETF, akankah jalur RWA mendatangkan ledakan?

Penulis asli: Kripto, Disuling

Terjemahan asli: TechFlow

Q3 2024 – RWAs Watchlist

First it was digital gold, now it’s tokenized and real-world assets (RWAs).

BlackRock’s master plan is unfolding before our eyes.

With the $ETH ETF likely to launch in July, are RWAs the next sector to break out?

The New Narrative in Cryptocurrency:

While everyone is talking about the $ETH ETF, a bigger trend is quietly emerging: the tokenization of financial assets.

BlackRock CEO Larry Fink believes tokenization will be the “next generation of markets.”

Why Tokenization?

Tokenization leverages blockchain to overcome the limitations of traditional assets. It opens up liquidity and investment opportunities for all capital levels.

Here is an overview of the key benefits:

Growth Potential:

How big are the chances?

Experts predict that the tokenization market could reach $10 trillion by 2030.

For comparison, the current market cap of $BTC is about one-tenth of this value.

(Thanks to @21co__ )

Are we in the early stages?

Yes, we may be in the early stages.

This isn’t just about cryptocurrencies; it’s also about stocks, bonds, and real estate.

RWAs are still relatively untapped, with many catalysts expected to emerge in 2024/2025.

(Thanks to @QwQiao )

Opportunities for RWAs:

Real World Assets (RWAs) are the hottest area in the tokenization movement.

From January 1st to May 31st, many RWA leaders had better Sharpe ratios than $BTC.

A higher Sharpe ratio indicates superior “risk-adjusted” returns.

(Courtesy of @Cointelegraph )

RWA Industry Overview:

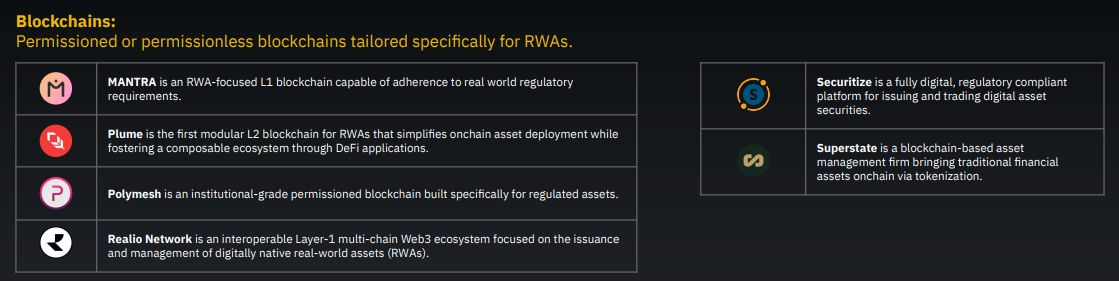

@BinanceResearch identified two key areas for RWA innovation:

a. RWA Rails – Project that provides regulatory and operational rails for RWAs.

b. Tokenized Asset Providers – Focused on creating and meeting the needs of RWAs.

(Thanks to @binanceresearch )

RWA Blockchain:

Blockchain is the backbone of the RWA industry.

For example, Mantra and Polymesh are designed specifically for this purpose.

(Thanks to @binanceresearch )

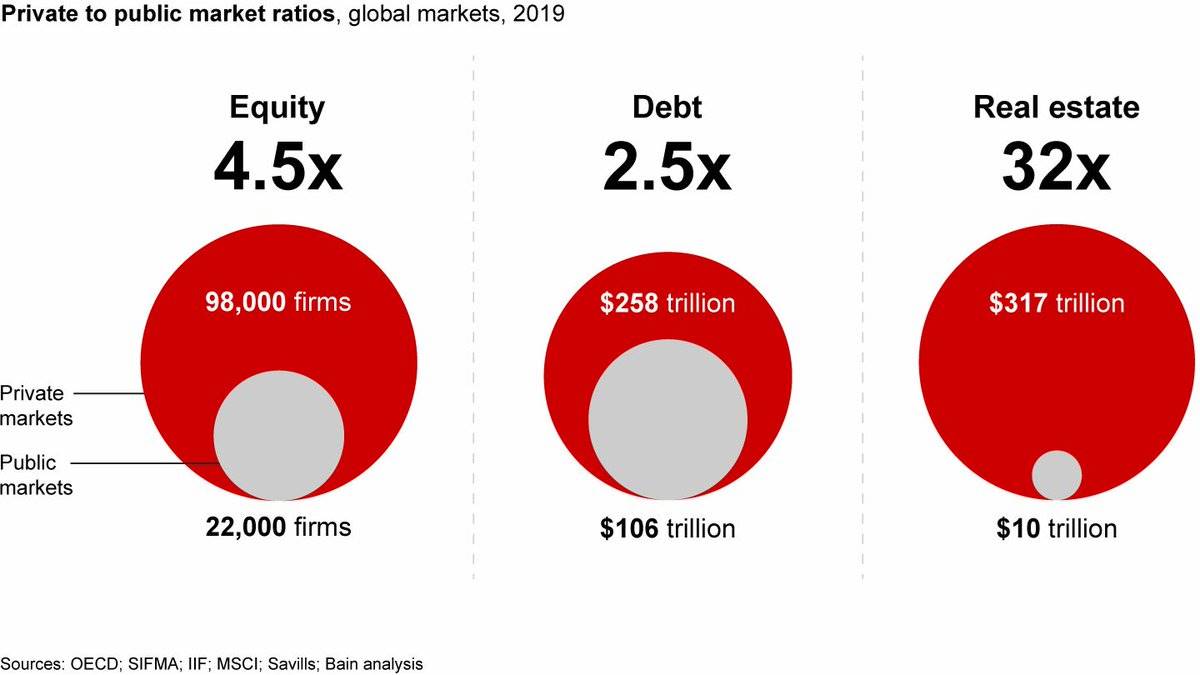

Public Market vs Private Market:

Most platforms prioritize public markets, but the real opportunity lies in private markets.

They have 2.5 times more equity and 32 times more RWAs than the public markets.

(Courtesy @BainandCompany )

Dark Horse RWA Chain:

$DUSK uniquely solves the problems of private markets, fusing privacy and compliance to ensure on-chain secure transactions of private RWAs.

We covered $DUSK in our June Crypto, Distilled Pro. Check it out now.

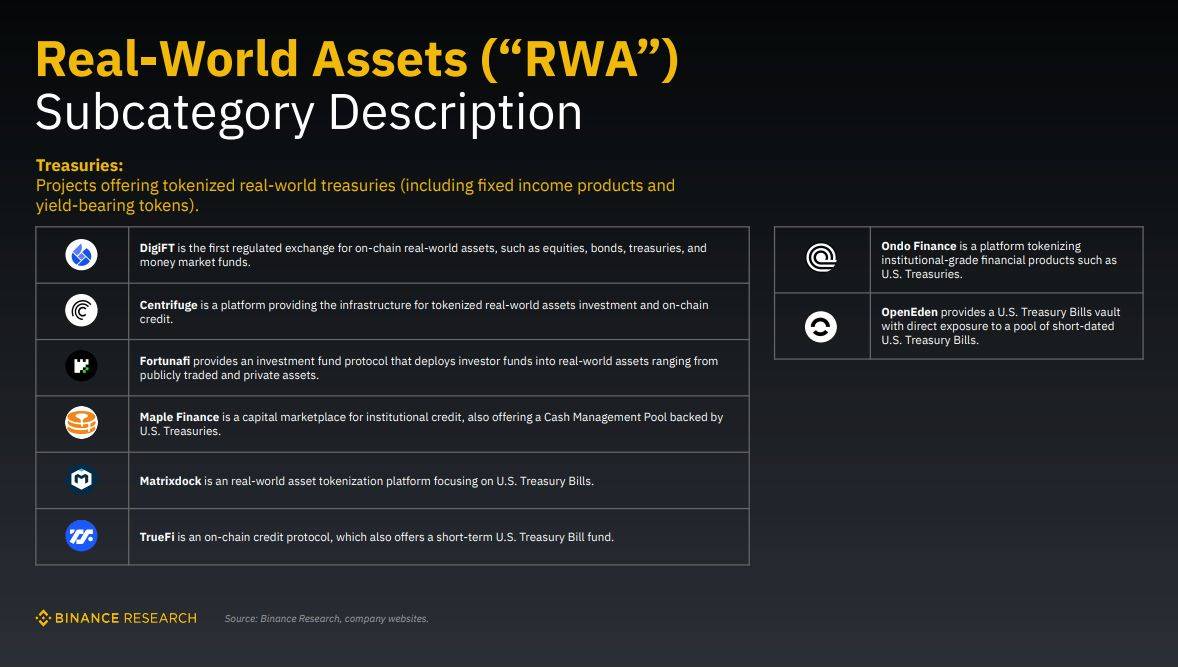

National Debt:

Tokenized government bonds, including fixed income products and yield tokens, have seen a surge in demand.

The market recently surpassed $1.5 billion, compared to just $114 million in January 2023.

(Thanks to @binanceresearch )

BlackRock’s Dominance:

Traditional financial giants dominate the on-chain Treasury market, and BlackRock currently leads the market with its $BUIDL fund, which has a total locked value (TVL) of nearly $2 billion.

(Thanks to @rwa_xyz )

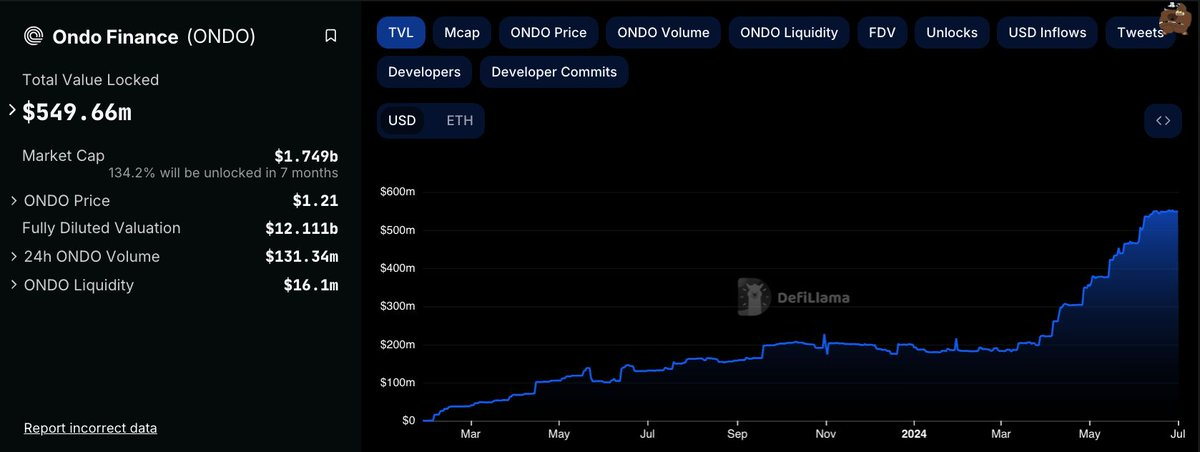

Ondo Finance:

In the cryptocurrency space, $ONDO has been a standout performer, with total value locked (TVL) more than tripling year to date.

Ondo Finance also holds a stake in BlackRock’s tokenized fund $BUIDL .

It is unclear how much of $ONDO ’s valuation is driven by governance and how much is driven by speculation.

(Thanks to @DefiLlama )

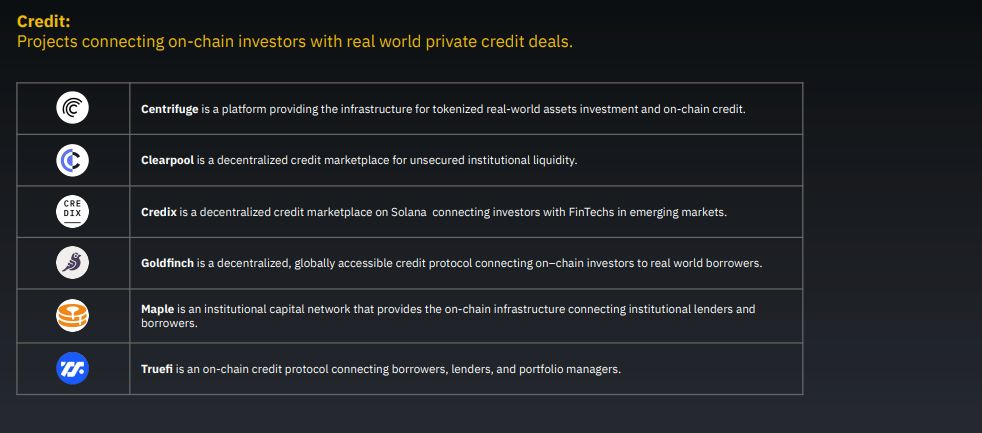

Credit:

Another key direction in the RWA (real world asset) space is decentralized credit projects.

These projects connect on-chain investors with real-world private credit, with leaders including $MPL Dan $CFG .

(Thanks to @binanceresearch )

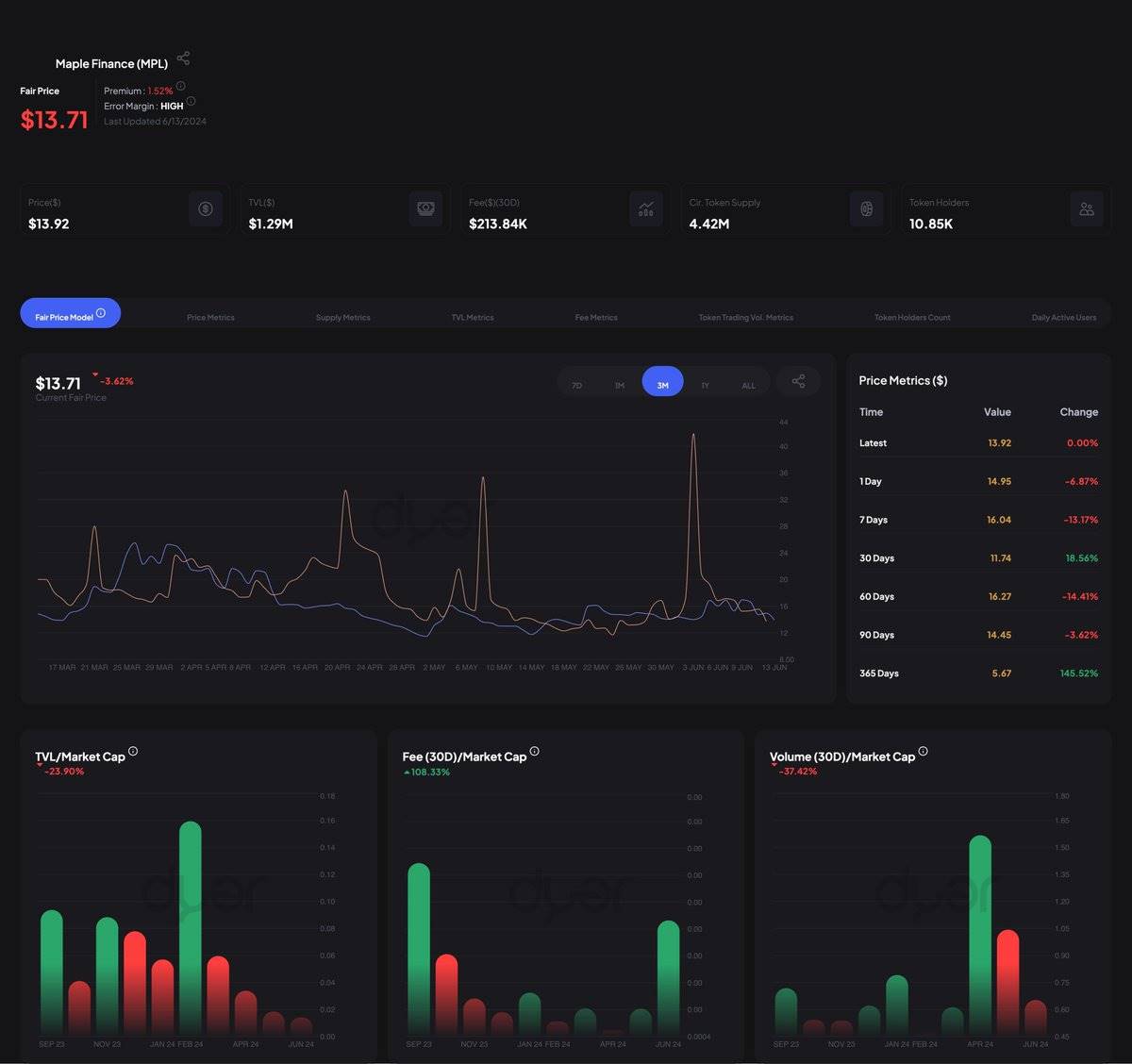

Maple Finance – Fundamentals Improvement:

As of June 13th, $MPL has been a standout performer:

-

TVL/MC ratio increased by 108% in 30 days

-

Costs increased 208% in 90 days

-

196% increase in trading volume in 7 days

-

The number of token holders increased by 5.61% in 30 days

(Thanks to @dyorcryptoapp )

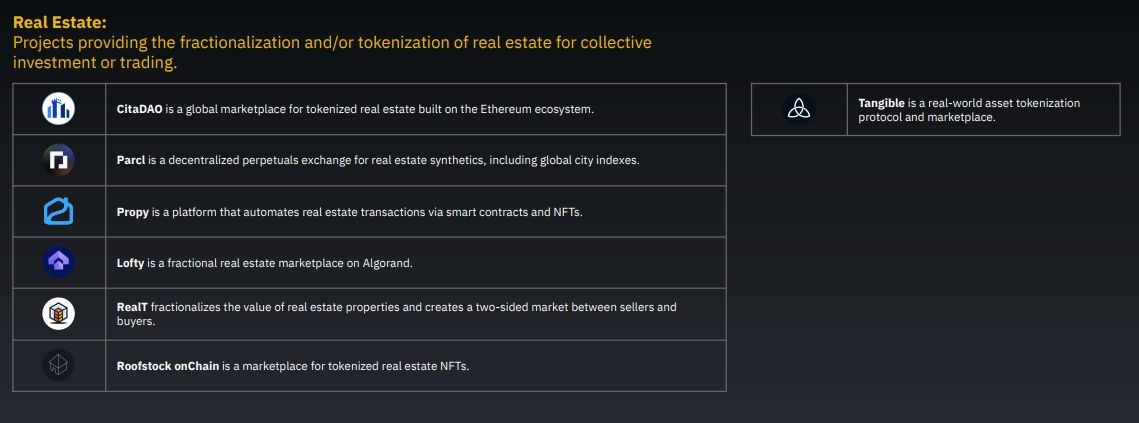

real estate:

As the world’s largest asset class, real estate is being fragmented and tokenized.

However, this field is still fairly early days.

(Thanks to @binanceresearch )

Key risks:

Despite the positive outlook for RWA, the sector still needs to address several key risks:

-

Many regulatory hurdles and bottlenecks.

-

Accrual of value to governance tokens appears weak.

-

Government blockchain as a competitor.

-

Lack of standardization and low liquidity.

-

Security vulnerabilities.

Meringkaskan:

-

Tokenization is a $10 trillion opportunity.

-

RWA may explode after the launch of Ethereum ETF.

-

Traditional financial giants are putting their assets on the blockchain.

-

Key areas: government bonds, credit, and real estate.

-

Private RWAs remain largely unexplored.

-

Regulation and poor value accumulation are big risks.

This article is sourced from the internet: After the launch of Ethereum ETF, will the RWA track usher in an explosion?

Terkait: Riset 10x: Kapan Bitcoin akan mencapai titik tertinggi baru? Lihat indikator utama ini

Sumber asli: 10x Research Disusun oleh: Odaily Planet Daily Wenser Catatan redaksi: Setelah terobosan ETF spot Ethereum, pasar kembali memasuki siklus sentimen pasar bullish. Sementara jumlah dana untuk ETF spot Bitcoin terus bertambah, kapan harga Bitcoin dapat menembus level tertinggi sebelumnya pada bulan Maret kembali menjadi fokus banyak orang. Odaily Planet Daily akan merangkum dan menyusun indikator-indikator utama harga Bitcoin yang menembus level tertinggi baru yang dibagikan oleh 10x Research dalam artikel ini untuk referensi pembaca. (Catatan: Artikel ini hanya berbagi pandangan 10x Research dan bukan merupakan saran investasi.) Indikator-indikator utama pertumbuhan harga Bitcoin Bagi kebanyakan orang, naik turunnya harga Bitcoin tampak seperti fluktuasi acak dan tidak dapat diprediksi, tetapi kita…