Pantera Capital: Orderly Network menggabungkan infrastruktur perdagangan likuiditas untuk memecahkan masalah pasar

latar belakang

Throughout the history of our industry, centralized exchanges (CEXs) like Coinbase, Binance, and Kraken have been the go-to choice for cryptocurrency traders. Users gravitate toward these products primarily for their strong liquidity and appealing user experience (UX), which are key pain points that traditional decentralized exchange (DEX) applications are well-known for.

But what if there was a trading venue that combined the speed and liquidity of CEXs with the transparency, asset autonomy, and settlement of decentralized finance (DeFi)?

This is the core idea behind Orderly Network.

Orderly Network solves the historical shortcomings of early DeFi applications and market trading difficulties by building a liquidity-aggregating trading infrastructure. Orderly creates an efficient and powerful trading ecosystem with better price discovery, lower slippage, deeper liquidity, and execution speeds comparable to CEXs – while maintaining the advantages of DeFi.

memperkenalkan

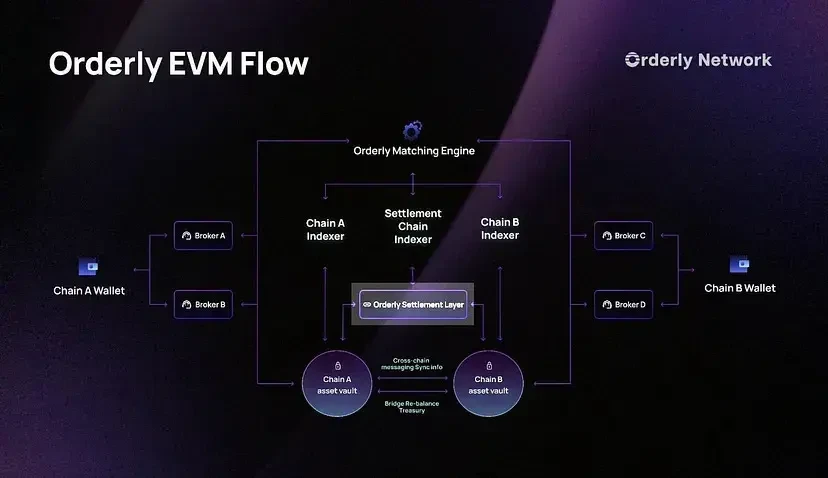

Orderly is a layer 2 (L2) solution that provides:

-

Order book based trading: Similar to CEXs, Orderly uses an order book to match buyers and sellers, ensuring smooth and efficient transactions.

-

Full-chain liquidity: Orderly aggregates liquidity from various blockchains, providing a wider pool of assets and tighter spreads.

-

High-speed execution: Orderly prioritizes fast trade execution, minimizing trade delays and failures.

Orderly uses a unified order book; users trade on different chains but in the same order book, eliminating the need for a bridge connection.

Orderly plays an important role in improving the overall efficiency and robustness of the DeFi trading environment and has quickly become one of the largest sources of liquidity for permissionless Web3 transactions.

Main achievements and impacts

Orderly Network has already made significant waves in the DeFi space, including:

-

Over $50 billion in total trading volume

-

Integration with six major blockchains (Arbitrum, Optimism, Polygon, Base, etc.)

-

Over $56 million in total value locked (TVL)

-

User base of over 215,000 unique wallets

The future of DeFi trading

With its innovative infrastructure and strong partnerships, Orderly Network is poised to become a major player in the future of DeFi trading.

What makes them stand out from existing competitors is:

-

Cross-chain capabilities: Orderly facilitates seamless transactions between different blockchains, maximizing user choice.

-

Orderly on-chain settlement: All transactions are settled on a secure and dedicated blockchain, ensuring transparency and finality.

-

Support for DeFi projects: Orderly provides institutional-grade liquidity to DeFi projects for spot and perpetual trading.

Their partner ecosystem includes WOOFi, LayerZero, Optimism, Arbitrum, Base, Elixir, Polygon, and more.

This article is sourced from the internet: Pantera Capital: Orderly Network aggregates liquidity trading infrastructure to solve market problems

Original author: TechFlow For the leeks, paying attention to the calls of various KOL bloggers is an important source of obtaining the code to wealth. So, is KOL’s shouting a sure win, or just a series of accidental coincidences? Different bloggers have completely different answers to this question. A 100-fold correct call or a wrong recommendation that returns to zero may become a very subjective survivor bias. From the perspective of the entire industry, what is the final performance of KOLs in bringing in orders? In February, several researchers from Harvard Business School, Indiana University Business School, and Texas AM University jointly published a paper titled Cryptocurrency Influencers. The article studies the crypto-asset-related returns mentioned in approximately 36,000 tweets posted by 180 of the most prominent cryptocurrency social media influencers…