Membunuh Sistem Poin, Akankah Mekanisme Bukti Likuiditas Berachain Menjadi Masa Depan?

Asli|Odaily Planet Daily

Penulis: Wenser

On June 24, Infrared Finance, the Berachain ecosystem liquidity pledge protocol , diumumkan the completion of a new round of financing, with Binance Labs participating in the investment. The specific amount has not been disclosed. According to Raito Bear, the anonymous co-founder and CEO of Infrared, this round of financing is a strategic round of financing in which Binance Labs participated as the only investor.

Pada bulan Mei , Jack Melnick, former head of Polygon Labs DeFi, joined Berachain to be responsible for the construction of the DeFi ecosystem. In April, Berachain mengumumkan itu the scale of its Series B financing had increased to US$100 million, led by Brevan Howard Digitals Abu Dhabi branch and Framework Ventures, with participation from Polychain Capital, Hack VC, Tribe Capital and other institutions. Its valuation has exceeded US$1 billion.

After many L1 and L2 network dramas have come to an end, based on the recently proposed Proof Of Liquidity (POL) mechanism, Berachain may become a key player in reviving the glory of L1 public chains. Odaily Planet Daily will briefly analyze this in this article for readers reference.

Market status: The world has suffered from the points system for a long time

Di dalam artikel The world has suffered from the points system for a long time, and this article reviews the rise and fall of the points model written by Nan Zhi, a senior writer of Odaily Planet Daily, we can see that the emergence of the points system is due to its special market environment and other conditions.

First of all, in terms of timing, Blur was born during a bear market, and the points system is an effective way to extend the life cycle of a project. At least in terms of time, it can postpone the expectation of coin issuance and delay the urgency of coin issuance.

Secondly, from the perspective of project differences, projects that usually involve trading, order placement, liquidity locking and other links tend to adopt the points system. On the one hand, it clarifies the users behavior trajectory and investment cost, and on the other hand, it gives users a relatively intuitive and clear numerical incentive. I believe that many people have felt the visual stimulation brought by the continuous increase of the points value. Although it is not a change in the balance, it is indeed more advantageous than the previous static interface.

Thirdly, from the perspective of user fission, the points system can achieve a wider range of social fission through invitation links. Moreover, the generation of rankings can also bring more significant conversion effects to the marketing and operation of the project. In many cases, large whales will invest a lot of money for the title of the number one brother on the list, which is similar to the psychological effect and marketing advantage of Web2 live broadcast platforms.

Finally, from the perspective of OTC trading, the points system also provides price guidance for token listing. Whether it is an OTC trading platform such as Aevo and Whales Market, or an OTC trading group that adopts a double-staking model, they can use the points system to gather a certain amount of liquidity. Moreover, people in the industry also know that due to the influence of time difference and anonymity factors, OTC trading sometimes has a certain premium effect, which can easily boost the price of project points.

In addition, recently, Robinson Burkey, co-founder of the Wormhole Foundation , expressed his views on the points system in response to some of the progress made since the W token airdrop was launched nearly three months ago. I think the best airdrops are those that users dont expect. However, I think we can no longer go back to that simple era and have to enter the points activities and witch wars. The points activities are like a tacit understanding between the protocol and the new users that airdrop farming is acceptable. The question becomes whether the protocol can be well used by farmers for farming. I personally support the points program because they can reduce the workload of the protocol team (i.e. reduce the time associated with anti-witch work).

Of course, after the overwhelming number of project points activities, the current points system has made people feel aesthetic fatigue and even rebellious psychology. The reasons are:

- The point system limits liquidity lock-up. Blast’s fund lock-up limit is a stark example of abhorrence.

- The points system is not friendly to retail investors in the market. The big whales get rich returns through large amounts of funds, but retail investors get little.

- The long-term harm of the point system to the ecological network. In many cases, the point system has created a false prosperity for the project, just as the daily transaction volume plummeted by more than 95% compared to the peak after the LayerZero airdrop. After the point system activity ended, the project was left with only a mess.

Therefore, the market is calling for innovation in the points system, and Berachains Proof Of Liquidity (POL) came into being.

Proof of Liquidity: Providing rewards for liquidity and feeding back to the ecosystem

Previously, Smokey, co-founder of Berachain , wrote : “ Berachain is the first chain to vertically integrate liquidity into the base layer. Block rewards from validators flow to applications on the chain and ultimately to their users, bringing liquidity to DApps on the Bera ecosystem. Berachain is a collection of application layers.”

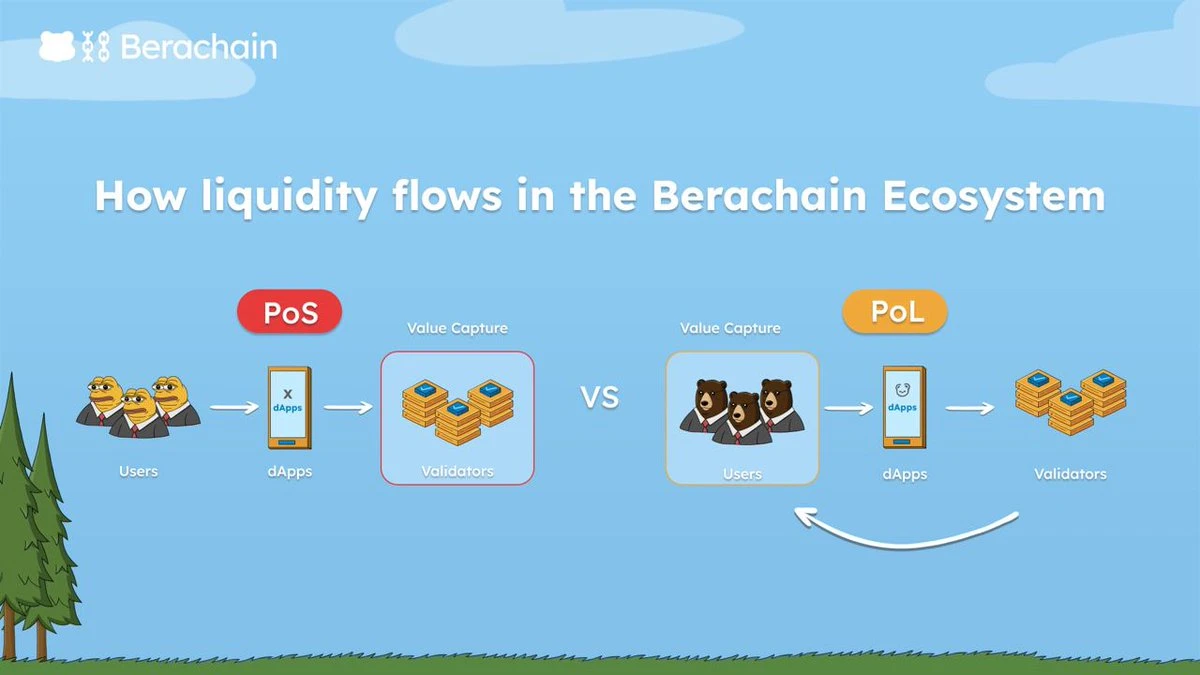

POL mechanism diagram

So, what is the POL mechanism, and what are its characteristics and advantages? The following is a detailed introduction.

What is the POL mechanism?

Berdasarkan the latest explanation officially released by Berachain, in simple terms, the POL mechanism is an accelerator for the Berachain application layer – through the joint efforts of users, protocols, and validators, the liquidity and security of the ecosystem are expanded.

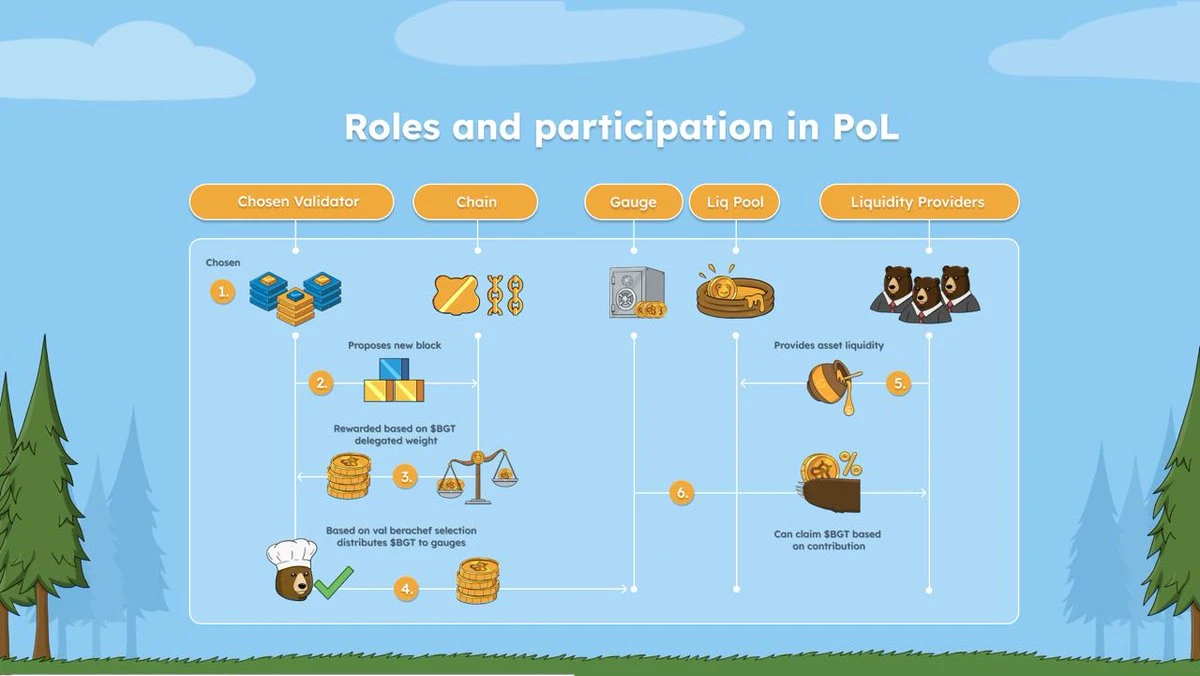

In this process, the three parties play different roles, including:

(1) Users: provide liquidity and stake LP, accumulate BGT rewards and LP fees (the BGT rewards of the liquidity pool are calculated based on the global weighted average of the validator liquidity pool).

A users BGT (Berachain Ecosystem Governance Token) income is based on 2 factors: 1. The total assets included in the stake; 2. The number of BGT sent to the dashboard.

(2) Validators: They take turns to build blocks and receive block rewards based on the amount of BGT delegated to them.

Validators, through their berachef, direct a portion of the BGT earned through block construction into the liquidity pool of the project of their choice.

The berachef interface is available at: https://bartio.station.berachain.com/validators/0x40495A781095932e2FC8dccA69F5e358711Fdd41

(3) Application Project: Create a proposal to create a new liquidity pool to make the reward vault eligible for the validator’s BGT input.

Because a liquidity pool is just a smart contract that accepts a single asset as collateral, it can exist in the form of a DEX pool in the Berachain ecosystem or any other asset pool.

Illustration of roles and participants in the POL mechanism

How are the advantages of the POL mechanism manifested?

If the above version sounds a bit complicated, the plain version is that Berachains POL mechanism achieves the matching between BGT liquidity and different application token returns by introducing the intermediate role of validator:

- Users stake their assets to a dashboard built by validators;

- Validators mobilize BGT assets to support different applications and receive corresponding application rewards;

- Application projects need to initiate proposals to attract the support of validators and reward them for distribution between validators and users.

At the same time, in this process, users and validators can flexibly enter and exit assets. At the same time, users, validators, and application projects form a community of interests, which can achieve a positive flywheel through the accelerated circulation of liquidity, thereby promoting the development of the entire Berachain ecosystem. Specifically:

- Users: Get rewards by providing liquidity for application projects and entrusting BGT to a unified validator to maximize the benefits of staked assets;

- Validators: Get rewards through more BGT delegation and service protocol liquidity bounties, collaborate effectively with application projects, and create greater profits;

- Application projects: By cooperating with validators to guide liquidity and directly incentivize users through the issuance of BGT tokens, the circulation efficiency of liquidity funds can be improved compared with conventional liquidity mining.

In this process, BGT has become the main circulating asset in the ecosystem, and application projects can issue their own assets and use them to exchange and circulate BGT assets, ultimately achieving a win-win situation for all parties. In addition, the POL mechanism also makes the generation and distribution of incentives decentralized to a certain extent. Users, validators, and application projects can all determine the flow of BGT. A more efficient liquidity circulation and win-win solution for all parties is undoubtedly the best choice.

Summary: A community of interests can promote an ecological community, not the other way around

Different from the point system, the POL mechanism allows different roles within the Berachain ecosystem to find their own ecological niche and then form a relatively complete community of interests, rather than forcibly combining the three and forcing different roles to participate because of point rewards.

Compared with the arrogant practice of Blast ecosystem that treats points and gold points as carrots dangling in front of users and dilutes the initial liquidity investment and rewards through various mechanisms, Berachains POL mechanism is undoubtedly more transparent and fair, and is expected to attract more users, validators and application projects to join.

As an L1 public chain with a strong meme attribute, Berachain, known as the playground for infinite economic games, may grow into another distinctive blockchain network.

This article is sourced from the internet: Killing the Points System, Will Berachain’s Proof Of Liquidity Mechanism Be the Future?

Related: SignalPlus Macro Analysis (20240606): BTC ETF inflows exceeded $1.2 billion in two days

Risk appetite continued on the back of weak ADP employment data (152K vs 175K) and the employment component of the US Services PMI. Survey respondents cited “adjusting our hiring and capital investment strategies and managing borrowing”, “feeling the slowdown”, “hiring is slowing and prices are rising slightly”, and “high interest rates are reducing capital investment and slowing major facility upgrades”, leading the market to ignore the strongest overall performance of the non-manufacturing ISM index in 9 months (53.8 vs 51). The Bank of Canadas 25 basis point rate cut is seen as the start of the upcoming easing cycle, and federal funds futures pricing shows that there will be two full rate cuts before the end of the year, and the probability of a rate cut in September has also…