Judul asli: The Rainmakers of the Crypto Market

Original author: TokenTerminal

Original translation: Mars Finance, MK

memperkenalkan

This newsletter focuses on the protocols (both blockchains and decentralized applications) that generate the most significant fees. We focus on these protocols for the following reasons:

Which protocols do users prefer to pay for services? What kind of services do these protocols provide and what is their business model? How much do users actually pay in total? Which specific market sectors are more popular than others? Are there any protocols that dominate certain market sectors? By analyzing a detailed chart, we will delve into the industry trends of the cryptocurrency market.

Let’s explore it in detail!

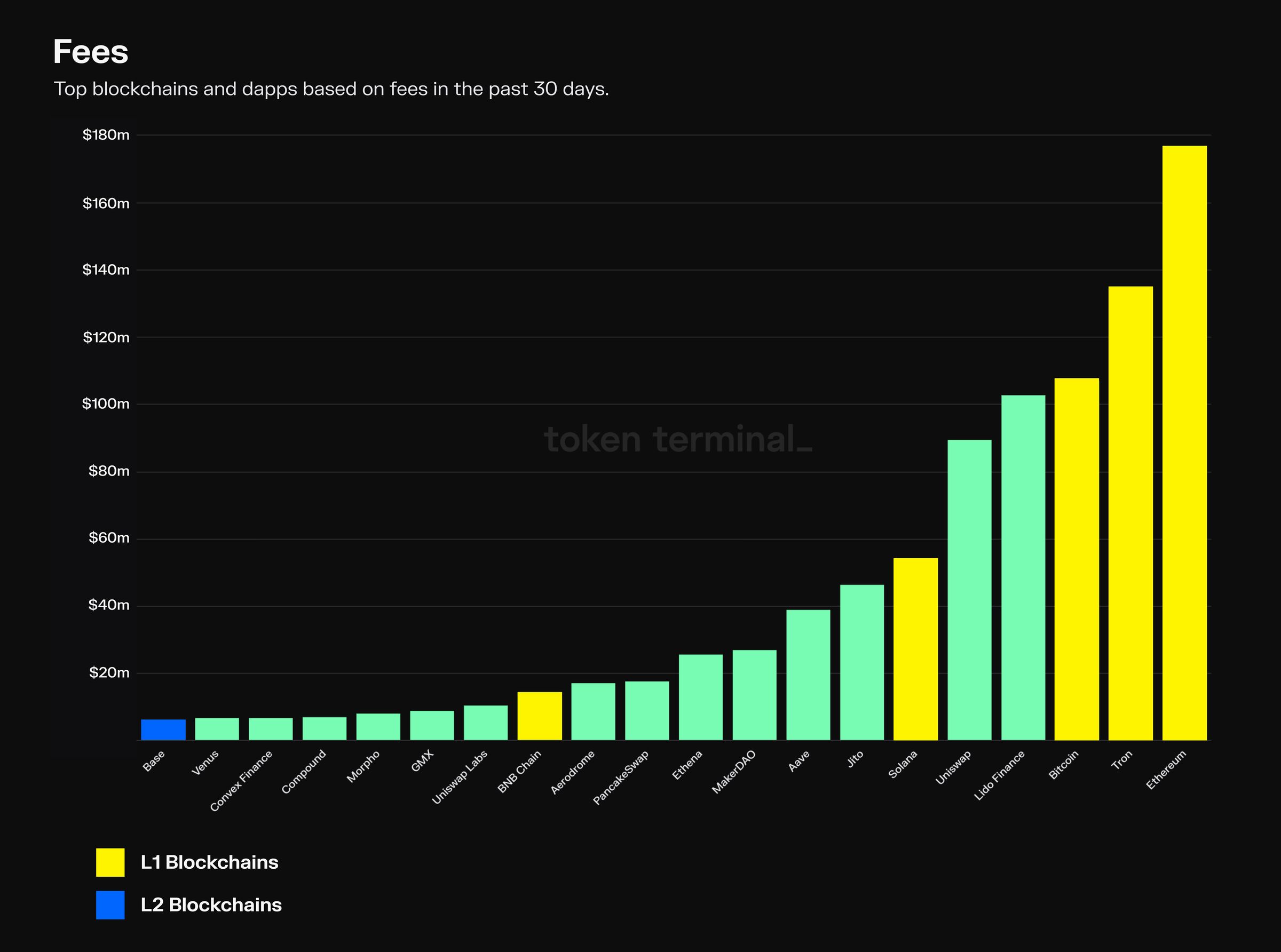

1. Focus on the top charging protocols of blockchain

The protocols in focus include: Ethereum, Tron, Bitcoin, Solana, BNB Chain, and Base.

The main cost comes from the general blockchain

Among the top 20 protocols, 5 are layer 1 (L1) blockchains and only 1 is a layer 2 (L2) blockchain.

Ethereum has the highest fee generation of about $180 million in the past 30 days. Despite the relatively low average transaction fee of about $0.03 (compared to $4.5 for Ethereum L1), Base has also managed to enter the top 20 due to the increase in user activity at the L2 level.

Apart from L1 and L2 blockchains, all other protocols in the top 20 belong to the decentralized finance (DeFi) category.

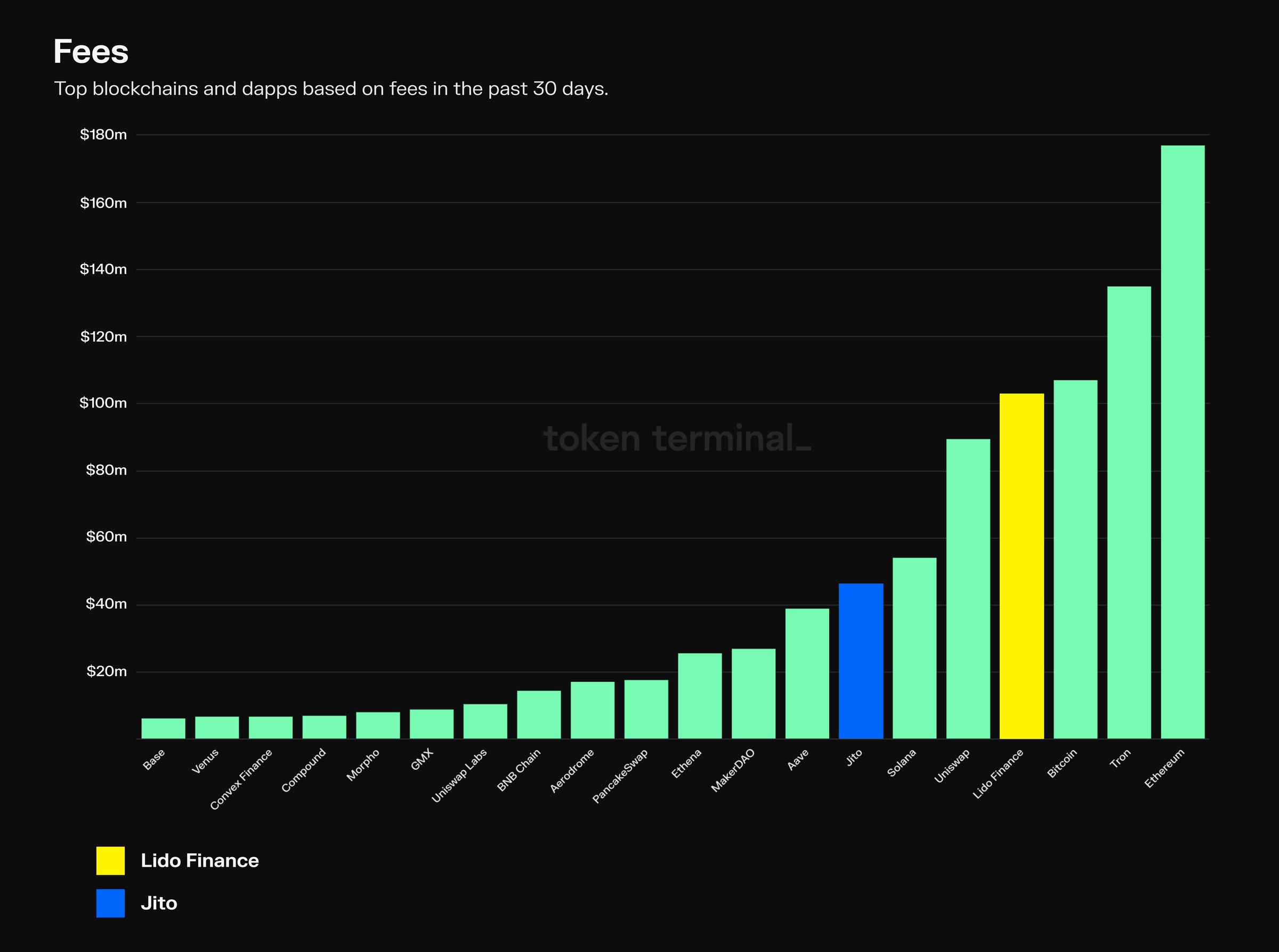

2. Top fee-based protocols, focusing on Lido Finance and Jito

Key protocols: Lido Finance and Jito.

Lido ranks first in fee generation among all crypto applications

Jito operates two distinct businesses: Liquidity Staking (JitoSOL), which is profitable through AUM-based management fees, and the Maximized Extractable Value (MEV) market, which is profitable through MEV tips collected from validators (this chart only includes MEV tips).

In contrast, Lido focuses on liquidity staking, earning commissions from staking rewards charged to depositors. Lido generates about twice as much fees as Jito, but Jito is growing faster.

Lido manages $3.35 billion in collateralized assets, while Jito has $160 million. Lido’s fully diluted market capitalization is $190 million, while Jito’s is $250 million.

3. Top fee-based protocols, focusing on decentralized exchanges (DEX)

Key protocols: Uniswap, PancakeSwap, Aerodrome, Uniswap Labs, and GMX.

Uniswap DAO dominates the DEX category with monthly fees approaching $100 million

In the DEX space, Uniswap DAO has the highest fee generation. Notably, Uniswap Labs is included as a separate entity that makes money by charging users who access the Uniswap protocol using the official Uniswap Labs front-end application.

Compared to other top 20 DEXs, Uniswap DAO generates roughly twice as much in fees.

As a Base-based DEX, Aerodrome’s fee output is twice that of its underlying L2 blockchain.

4. Top fee-based protocols, focusing on MakerDAO and Ethena

Key protocols: MakerDAO and Ethena.

Ethena has the potential to surpass MakerDAO in terms of fees

MakerDAO and Ethena dominate the field of decentralized stablecoin issuers. The largest stablecoin issuers in the market, such as Tether (USDT) and Circle (USDC), are not included because their fees and revenues are mainly generated off-chain.

Ethena is expected to be launched in November 2024, while MakerDAO was launched as early as November 2017.

5. Top fee-based protocols, focusing on lending protocols

The protocols in focus include: Aave, Morpho, Compound, and Venus.

Aave is the fourth largest fee generator in the cryptocurrency space.

In the lending category, Aave leads the pack, with a $30 million fee gap between it and second-place Morpho.

Although both Compound and Aave were launched in 2020, Aave has successfully surpassed Compound in terms of active lending and fee generation.

Although Aave leads the entire lending space, Venus has a clear lead in the BNB chain’s lending market, with about 90% of its fees currently coming from its operations on the BNB chain.

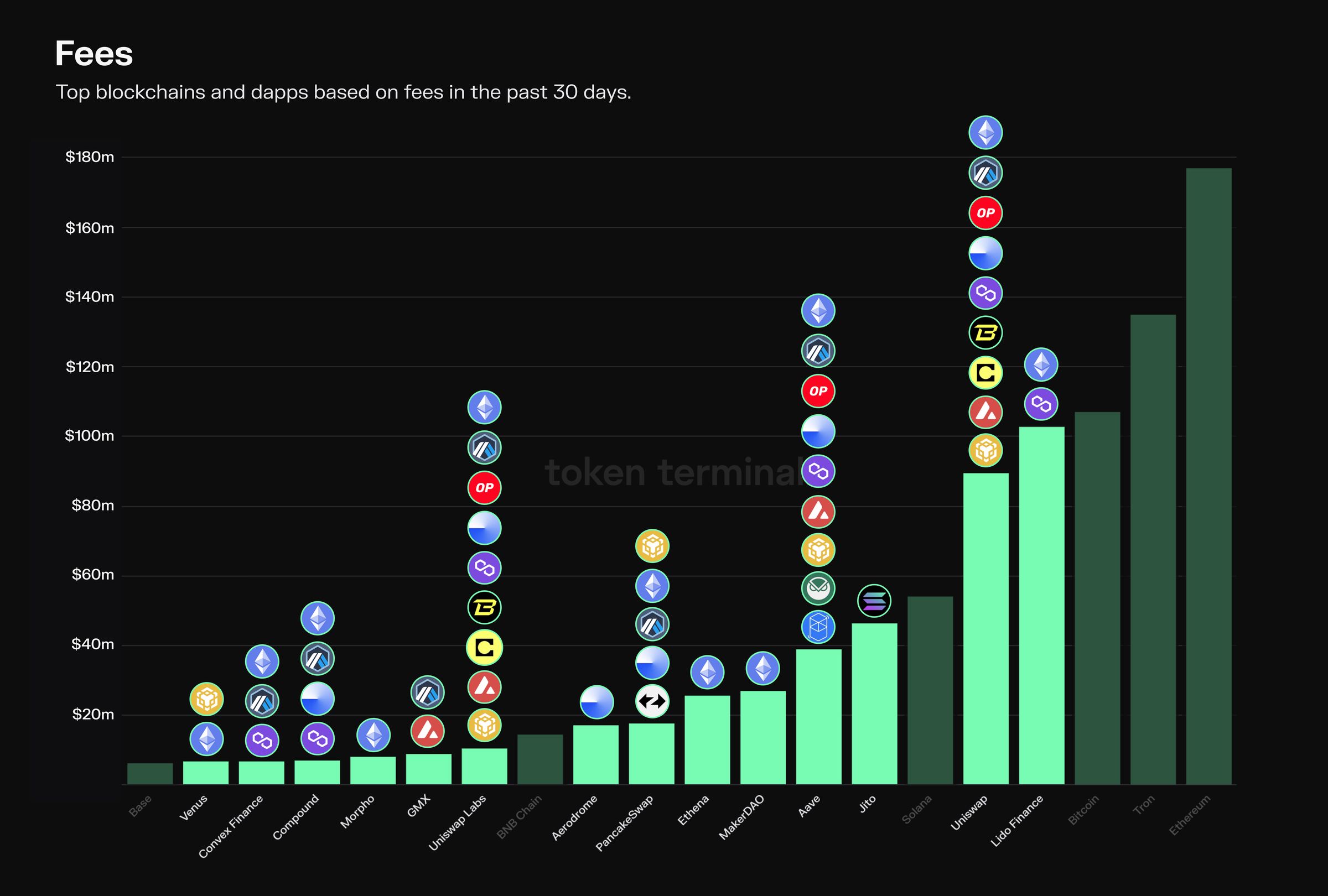

6. Top-notch fee agreements; chain segmentation

This section focuses on blockchain deployment of applications.

Most of the top fee-based applications choose to deploy on multiple blockchains.

In the crypto space, most of the top 20 fee-paying applications are deployed on Ethereum (both L1 and L2).

It is worth mentioning that asset issuers (such as stablecoin issuers and liquidity staking providers) mostly adopt single-chain management, and their core products (stablecoins or LST) play the role of bridge assets on multiple other chains.

Of the top 20, Aerodrome is the only application that originates from an L2 blockchain (Base).

Pertanyaan yang Sering Diajukan

What are the fees?

Fees refer to the total amount paid by the end user of the Agreement Services.

Different market sectors employ different fee structures, as protocols in each sector have their own unique business models:

-

Blockchain L1 and L2 = Selling block space to collect transaction fees

-

Liquidity staking = Earn rewards by investing in users’ staked assets

-

Exchanges (DEX, derivatives) = exchange assets for transaction fees

-

Loan = loan service by providing interest

-

Stablecoin issuers = a way to earn returns by providing interest-bearing USD or investing user deposits

-

Asset management = earning returns by investing users’ deposits

What is the difference between expenses and revenue?

-

Revenue is calculated based on the agreed fee collection rate (%).

-

This collection rate can vary between 0 and 100%.

-

Currently, Uniswap DAO and Bitcoin have an adoption rate of 0%, while Ethereum is typically around 80%.

What is the difference between income and revenue?

-

The return is calculated by deducting token incentives and operating expenses from the revenue.

-

Token incentives refer to the protocol’s spending on user acquisition, calculated as the USD value of the protocol’s native token.

-

Operating expenses include the investment in manpower and infrastructure during the development, maintenance and optimization of the protocol.

-

Please note that most protocols do not disclose their operating expenses on-chain, which is why many protocols have not yet introduced this metric.

When should expenses, income, or gains be considered?

As a rule of thumb, investors should focus on fees in the early stages of a protocol before it starts monetizing, and revenue and/or earnings once it has started monetizing:

-

Early stage: Focus on fees, showing that the protocol has paying customers.

-

Late stage: Focus on revenue, showing that the protocol is able to monetize its paying customers.

-

Mature stage: Focus on returns, reflecting the protocol’s ability to create value for its token holders.

At the same time, the following ratios should also be paid attention to:

-

Revenue/Fee = Ideally, the display protocol has greater influence on the supply side (LP) and is able to charge higher fees.

-

Revenue/income = Ideally, this indicates that the protocol has low user acquisition costs and operating overhead, allowing it to retain a higher percentage of revenue as revenue.

This article is sourced from the internet: Crypto Market Rainmakers: Top Fee-Based Protocols

Terkait: Sekilas tentang 10 token menjanjikan yang dimiliki oleh a16z, BlackRock, dan Coinbase

Penulis asli: Atlas, Crypto KOL Terjemahan asli: Felix, PANews Investor ventura menginvestasikan jutaan dolar ke berbagai altcoin setiap hari, sehingga menaikkan harga altcoin tersebut. Melacak dompet lembaga modal ventura terkemuka dan memantau kepemilikan mereka dapat menghasilkan keuntungan berlebih. Crypto KOL Atlas memindai lebih dari 100 dompet dana dan paus yang menguntungkan, menganalisis dompet mereka dan meninjau semua proyek, dan memilih dana dengan kinerja terbaik di Web3, termasuk a16z, BlackRock, dan Coinbase. Berikut adalah 10 token paling menjanjikan yang dimilikinya. Catatan PANews: Artikel ini dimaksudkan untuk memberikan informasi pasar dan bukan merupakan nasihat investasi, DYOR. Compound Labs (COMP) Protokol DeFi untuk pinjaman yang memungkinkan pengguna memperoleh bunga atas mata uang kripto yang disimpan di salah satu kumpulannya. Nilai pasar: $386…