Menguraikan Airdrop: Bagaimana FDV dan Ekonomi Token Mempengaruhi Harga Token?

Artikel asli oleh: Victor Ramirez, Matías Andrade, Tanay Ved

Terjemahan asli: Lynn, MarsBit

Poin Penting

-

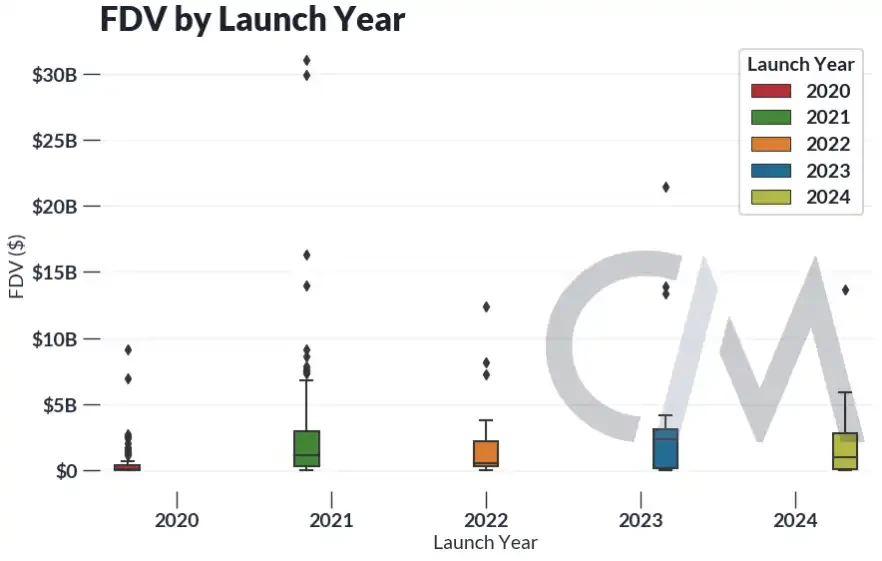

Peluncuran FDV bervariasi dalam beberapa tahun terakhir: median $140 juta pada tahun 2020 (protokol DeFi), lonjakan menjadi $1,4 miliar pada tahun 2021 (NFT, permainan), penurunan pada tahun 2022 ($800 juta untuk L2), dan rebound pada tahun 2023 dan 2024 ($2,4 miliar dan $1 miliar), yang menampilkan proyek alt L1 dan Solana.

-

FDV mengabaikan guncangan pasar jangka pendek; oleh karena itu, sirkulasi (pasokan publik) penting. Token dengan FDV tinggi dan sirkulasi rendah seperti World Coin ($800 juta vs. $34 miliar FDV) dapat mendistorsi penilaian sebenarnya.

-

tetesan udaramendistribusikan token untuk mempromosikan adopsi protokol dan biasanya dengan cepat dicairkan oleh penerima. Meskipun awalnya menguntungkan, sebagian besar token yang di-airdrop kehilangan nilai dalam jangka panjang, dengan pengecualian seperti BONK (yang menghasilkan pengembalian ~8x).

memperkenalkan

Salah satu topik yang paling sering diperdebatkan dalam dunia mata uang kripto adalah masalah ekonomi token, atau sistem yang digunakan untuk mendistribusikan pasokan token. Ekonomi token merupakan tindakan penyeimbangan antara memenuhi berbagai pemangku kepentingan sekaligus memastikan nilai proyek saat ini dan di masa mendatang.

Proyek kripto menggunakan berbagai skema ekonomi token untuk memberi insentif pada perilaku tertentu dalam ekosistemnya masing-masing. Sebagian dari pasokan token dibuka untuk umum sehingga pengguna dapat memiliki saham dalam proyek tersebut dan token dapat menjalani penemuan harga. Untuk memberi insentif pada pengembangan proyek, sebagian dari pasokan token dapat dikunci untuk investor awal dan anggota tim, biasanya dengan harga yang menguntungkan dan sebelum dapat diperdagangkan di pasar terbuka. Beberapa proyek bahkan menggunakan airdrop, memberi penghargaan kepada pengguna dengan token berdasarkan perilaku utama seperti menyediakan likuiditas ke bursa terdesentralisasi, memberikan suara pada proposal tata kelola, atau menjembatani ke Layer 2.

Dalam State of the Network minggu ini, kita akan mendalami secara mendalam berbagai faktor ekonomi token suatu proyek dan dampaknya terhadap penilaian token dan aktivitas on-chain.

Memahami Nilai yang Diencerkan Sepenuhnya (FDV)

Untuk memahami nuansa penilaian token, kami akan menjelaskan beberapa metrik penilaian yang umum digunakan. Kapitalisasi pasar yang beredar dari suatu aset hanya menggunakan pasokan token yang beredar dan tidak termasuk pasokan yang dikaitkan dengan investor awal, kontributor, dan dikunci untuk penerbitan di masa mendatang. Kapitalisasi pasar yang beredar mengukur bagaimana pasar memandang penilaian token saat ini. Pasokan free float adalah token yang dapat diperdagangkan di pasar terbuka. Penilaian yang sepenuhnya diencerkan (FDV) adalah nilai pasar suatu aset setelah semua token beredar, oleh karena itu disebut istilah yang sepenuhnya diencerkan. FDV adalah proksi untuk bagaimana pasar memandang penilaian token di masa mendatang.

Rilis FDV dapat memberi petunjuk tentang bagaimana pasar menilai nilai masa depan proyek saat ini setelah dirilis. Berikut ini adalah bagan FDV yang mencakup beberapa token kripto, dibagi berdasarkan tahun peluncuran proyek.

Sumber: Umpan data pasar Coin Metrics, Network Data Pro

Dibandingkan dengan proyek-proyek selanjutnya, median FDV token-token utama yang diterbitkan pada tahun 2020 relatif rendah ($140 juta), tetapi mencakup protokol-protokol unggulan yang lahir dari musim panas DeFi seperti Uniswap, Aave, dan L1 terkemuka seperti Solana dan Avalanche. Pada tahun 2021, median FDV yang diterbitkan melonjak menjadi $1,4 miliar, terutama mencakup proyek-proyek NFT dan game seperti Gods Unchained, Yield Guild Games, dan Flow. Pada tahun 2022, FDV yang diterbitkan menurun, dipimpin oleh peluncuran Apecoin dan token-token L2 awal seperti Optimism. Pada tahun 2023 dan 2024, FDV yang diterbitkan bangkit kembali menjadi $2,4 miliar dan $1 miliar, masing-masing, termasuk gelombang baru alt L1 seperti Aptos dan Sui, dan kebangkitan proyek-proyek Solana seperti Jupiter dan Jito.

Tidak semua FDV dibuat sama

Meskipun FDV dapat digunakan untuk mengukur nilai jangka panjang, FDV tidak memperhitungkan dinamika pasar jangka pendek yang dapat timbul akibat guncangan likuiditas dan pasokan. Oleh karena itu, penting untuk mempertimbangkan pasokan FDV yang beredar, atau pasokan yang tersedia untuk umum.

Token dengan sirkulasi tinggi relatif terhadap total pasokan, seperti Bitcoin, cukup likuid, dan pelaku pasar tidak mengharapkan guncangan pasokan di masa mendatang dari penerbitan token — karena lebih dari 90% Bitcoin telah ditambang. Token dengan sirkulasi rendah relatif terhadap total pasokan berarti sebagian besar FDV mereka tidak likuid. Oleh karena itu, token dengan FDV tinggi dan sirkulasi rendah dapat menunjukkan total valuasi yang digelembungkan dan salah. Contoh ekstrem dari token FDV tinggi dan sirkulasi rendah adalah World Coin, yang memiliki kapitalisasi pasar ~$800M tetapi FDV ~$34B — perbedaan 50x.

Secara umum, kami melihat standar industri membuka sekitar 5-15% dari pasokan token kepada komunitas, dengan sisanya dikunci untuk tim, investor, yayasan, hibah, atau acara pembukaan lainnya. Proyek yang diluncurkan sebelum 2022 cenderung memiliki distribusi yang lebih beragam.

Sumber: Coin Metrics Labs

Token dengan FDV tinggi dan sirkulasi rendah selalu menjadi objek cemoohan dalam komunitas kripto. Contoh historisnya adalah token FTX, FTT, yang menggelembungkan neracanya dengan menghitung sahamnya yang tidak likuid sebagai aset untuk mengimbangi kewajibannya. Proyek token yang diluncurkan dengan FDV tinggi dan sirkulasi rendah telah dikritik sebagai alat untuk memperkaya investor awal dan orang dalam lainnya dengan mengorbankan investor ritel. Hal ini dapat menyebabkan sentimen pasar berubah menjadi nihilistik, yang menyebabkan masuknya likuiditas ritel dalam jumlah besar ke memecoin, yang cenderung menawarkan bagian pasokan yang lebih besar kepada publik pada tahap awal.

Namun apakah rendahnya jumlah saham yang beredar menjadi satu-satunya alasan pergerakan harga yang kurang bergairah?

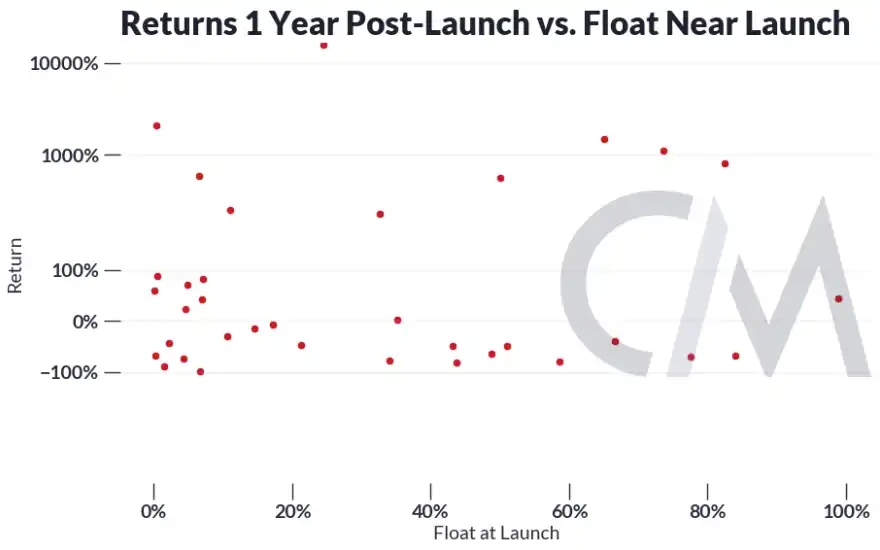

Sumber: Umpan data pasar Coin Metrics, Network Data Pro

Kami menemukan bahwa, secara umum, jumlah sirkulasi pada saat penerbitan tidak memiliki efek signifikan pada apresiasi token 1 tahun setelah penerbitan. Hal ini cukup konsisten dengan temuan kami sebelumnya, yang menunjukkan bahwa guncangan mendadak pada sirkulasi tidak memiliki dampak arah yang konsisten pada harga.

tetesan udaras and Protocol Activities

Beberapa protokol menggunakan airdrop untuk mendistribusikan token ke komunitas dan mengurangi risiko rendahnya sirkulasi. Airdrop memberi penghargaan kepada pengguna awal protokol dengan memberi mereka token berdasarkan perilaku tertentu yang diinginkan yang mendorong pengembangan protokol, mirip dengan cek stimulus kripto untuk pengguna awal. Dalam SOTN sebelumnya, kami menemukan bahwa sebagian besar alamat melikuidasi token yang di-airdrop segera setelah menerimanya.

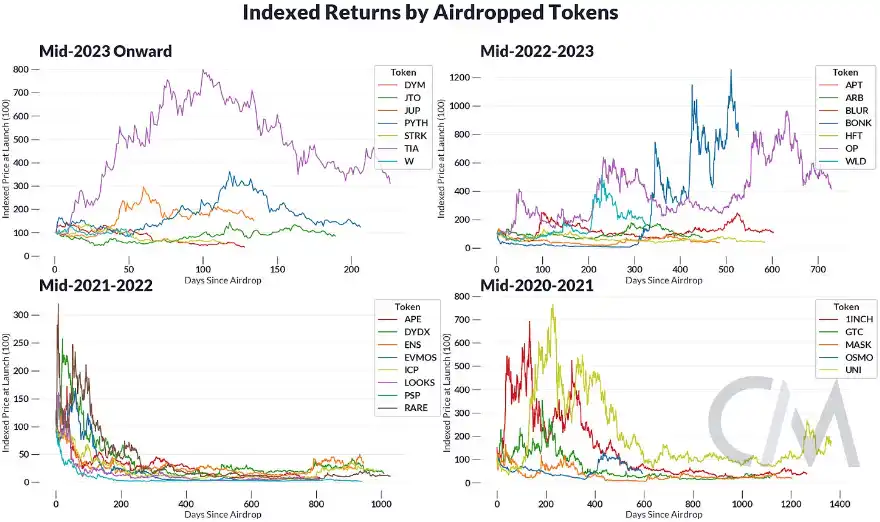

Meskipun airdrop dapat mendatangkan keuntungan besar, sebagian besar token yang di-airdrop kehilangan nilai jangka panjangnya.

Sumber: Data Pasar Coin Metrics

Mengambil hari pertama perdagangan setelah airdrop sebagai titik acuan, hanya sekitar 1/3 token yang mempertahankan nilainya sejak airdrop pertama. Pengembalian rata-rata dari memegang token yang di-airdrop hingga saat ini adalah -61%. Namun, beberapa token yang di-airdrop mengalami apresiasi, seperti BONK (sekitar 8 kali).

Hadiah token pada dasarnya hanyalah cara untuk meningkatkan aktivitas jaringan, tetapi apakah hadiah tersebut benar-benar mengarah pada penggunaan aktual? Mengukur aktivitas ekonomi aktual bisa jadi sulit, karena setiap protokol memiliki kegunaan dan metrik yang berbeda untuk mengukur kegunaan tersebut. Sebagai contoh ilustrasi, kita dapat mengambil Optimism (proyek lapisan 2) dan menggunakan jumlah uang yang disimpan ke dalam jaringan sebagai proksi kasar untuk aktivitas pengguna.

Sumber: Data Jaringan Pro Coin Metrics, Lab Coin Metrics

Setelah airdrop, kami melihat lonjakan permintaan deposit Gateway Bridge Optimism. Tahun berikutnya, aktivitas menurun, bertepatan dengan penurunan umum dalam aktivitas kripto. Singkatnya, airdrop dapat meningkatkan penggunaan protokol dalam jangka pendek, tetapi apakah itu dapat menciptakan pertumbuhan jangka panjang yang nyata dan berkelanjutan masih harus dilihat.

Meskipun petunjuk tentang airdrop dapat mendorong adopsi awal protokol, hal itu tidak selalu mengarah pada aktivitas pengguna yang berkelanjutan. Hal ini semakin rumit dengan munculnya pertanian airdrop, sebuah cara bagi pengguna untuk menggamifikasi aturan protokol dengan menghasilkan aktivitas berlebih di rantai dengan harapan mendapatkan token. Baru-baru ini, pertanian airdrop telah semakin terindustrialisasi dengan pertanian penyihir, di mana sejumlah kecil pelaku memalsukan beberapa identitas di rantai untuk menghasilkan aktivitas dalam skala besar. Hal ini telah menyebabkan tim proyek membagikan hadiah kepada tentara bayaran yang tidak memiliki kepentingan jangka panjang dalam jaringan.

Tim protokol telah mulai melawan sybil dengan mengembangkan metode untuk mengidentifikasi dan memblokir hadiah sybil. Khususnya, LayerZero menawarkan sybil untuk mengidentifikasi diri sendiri dengan imbalan sebagian kecil dari alokasi mereka, tetapi dengan kemungkinan tidak menerima token apa pun. Dengan adanya airdrop skala besar untuk EigenLayer dan LayerZero, masih harus dilihat apakah airdrop akan mencapai hasil yang diinginkan, atau apakah proyek akan membatalkannya sepenuhnya.

Kesimpulannya

Dalam banyak hal, mata uang kripto mengungkap motivasi setiap pelaku pasar. Ekonomi token dapat dilihat sebagai seni memanfaatkan motivasi ini untuk mendorong keberhasilan dan keberlanjutan protokol. Mengalokasikan pasokan token, memberi insentif pada perilaku, dan memastikan nilai jangka panjang adalah keseimbangan rumit yang didekati secara berbeda oleh setiap proyek. Akan menarik untuk melihat bagaimana pengguna dan tim terus beradaptasi seiring dengan berkembangnya kekuatan pasar dan munculnya koin baru.

Artikel ini bersumber dari internet: Decrypting Airdrops: Bagaimana FDV dan Ekonomi Token Mempengaruhi Harga Token?

Sumber asli: DLNews Disusun oleh: Odaily Planet Daily Wenser Catatan redaksi: Baru-baru ini, tren Ethereum spot ETF telah berbalik, yang telah menarik perhatian besar dari pasar dan regulator. Berdasarkan optimisme persetujuan AS terhadap Ethereum spot ETF, harga Ethereum telah meningkat tajam minggu ini, dan harga saat ini adalah $3.807. Meskipun alasan di balik perubahan arah yang tajam masih kontroversial, pengamat pasar dan praktisi mata uang kripto senior umumnya percaya bahwa persetujuan regulator akan memiliki tingkat dampak yang berbeda pada Ethereum dan mata uang kripto lainnya. Dilaporkan bahwa perusahaan manajemen aset VanEck adalah perusahaan pialang pertama yang mengajukan aplikasi untuk Ethereum spot ETF ke Komisi Sekuritas dan Bursa AS (SEC). Hasil aplikasi dokumen 19b-4…