Bankless: Menyalakan kembali pasar? Tinjauan peristiwa penting terkini dalam jalur AI+Crypto

Originally Posted by: Arjun Chand

Terjemahan asli: TechFlow

AI tokens have dominated the market over the past year, with many seeing this as a convergence cycle between AI and cryptocurrency . However, in recent months, AI tokens have been trending downward, with many falling 25%-50% from their local highs.

Still, this is not necessarily a cause for concern. Pullbacks are normal in a crypto bull run and contribute to long-term performance. This article explores the future developments of the top AI and crypto projects and the catalysts that could reignite the market.

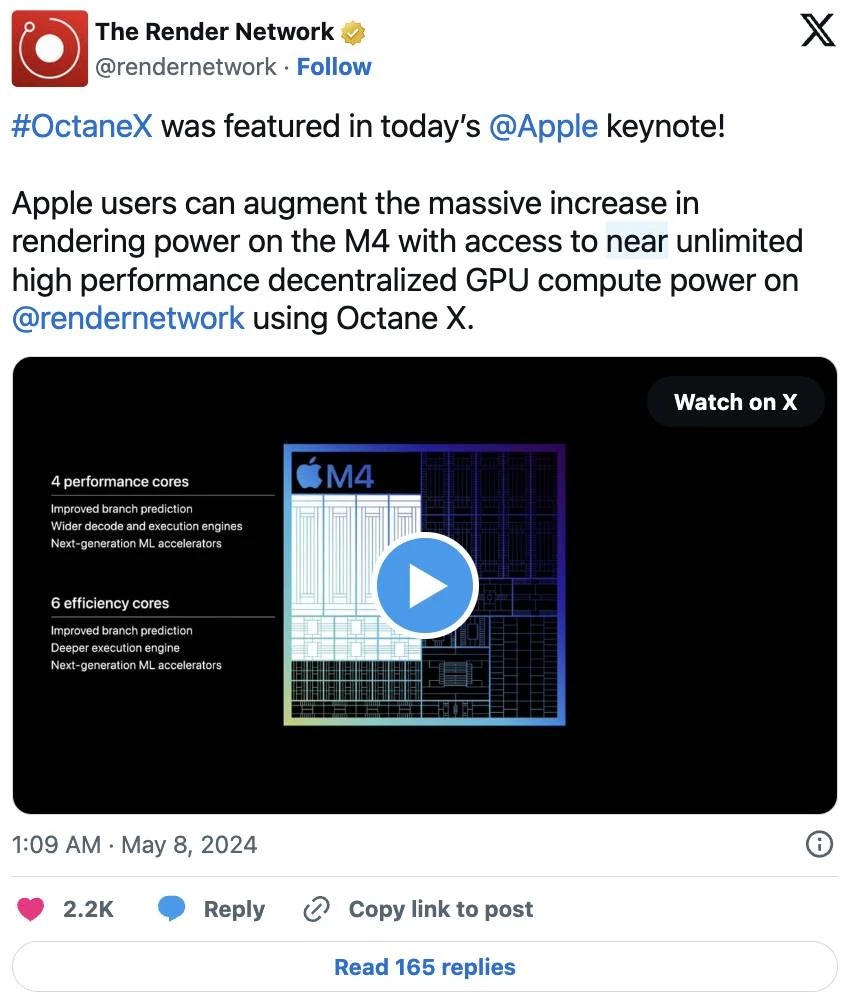

Render x Apple

At this years WWDC, Apple announced Apple Intelligence , its new suite of AI features available across all devices. Its no surprise that every major tech company is jumping on the AI bandwagon. What really stood out was the demonstration of OctaneX, a 3D design software powered by Render Network, on the latest iPad Pro.

( Tweet details )

OctaneX can use the decentralized GPUs of the Render Network. Millions of Apple users can now access unprecedented rendering power. Imagine creating Hollywood-level CGI on an iPad – thats what Render and Apple are making possible.

( Tweet details )

The integration with Apple is a big win for Render. It’s a validation of Render’s technology and vision. Apple is basically saying, “Hey, this Render Network stuff is legit!” This could attract a whole host of developers and creators to the platform, further boosting the network’s growth.

With the new Apple software coming to market later this year, this could be a big catalyst for Render as it will unlock a large new user base for the network. And, more importantly, more users using OctaneX means increased demand for Render services, boosting the value of the RNDR token. We ’ve already seen price increases following news releases , which could be a sign of things to come, so keep an eye on Render.

Subnet Tokens on Bittensor

One of the main criticisms of Bittensor is that currently only a small group of validators decide how TAO rewards are distributed between subnets. The BIT 1 proposal, also known as the Dynamic TAO , addresses this issue.

( Tweet details )

Dynamic TAO is one of the most anticipated proposals in Bittensor’s history, second only to the launch of subnets last year. It brings fundamental changes to the network:

-

Empowering TAO Holders : Currently, only a small number of validators decide how TAO rewards are allocated to subnets. This is not fair or efficient as it can be influenced by the bias of a small number of entities. Dynamic TAO changes this by enabling all TAO holders to participate in reward distribution. Imagine a network where everyone can influence the allocation of AI resources – this is the future Bittensor is committed to building.

-

Dynamic Market for Subnets : With a dynamic TAO, each subnet will have its own token, the value of which will be determined in the open market. This incentivizes subnets to perform well and provide valuable AI services. There are no more useless subnets – only the most efficient ones will grow. This also adds a speculative element to the Bittensor ecosystem, gamifying network participation for TAO holders and injecting market forces into the growth of each subnet.

Dynamic TAO is currently in pengujian and is expected to be fully launched soon. The introduction of crypto incentives at the subnet level could be a significant catalyst for Bittensor. This is a major step forward for Bittensor, giving token holders and subnets a real say in shaping the future of decentralized AI.

User-Autonomous AI on NEAR

Forget the meme of the NVIDIA founder touching the arm of the NEAR founder, NEAR recently announced the next phase of its roadmap : making NEAR the home for user-autonomous AI.

( Tweet details )

This is not just hype. The NEAR Foundation is taking real action. They are setting up a dedicated research lab ( NEAR.AI ), attracting top AI talent to develop AI and crypto applications, and setting up an incubator and investment arm focused on AI projects.

They are also building the infrastructure that developers use to build user-driven AI applications, such as data collection tools, reward creators, and monetization tools, while bringing crypto values to AI .

( Tweet details )

NEAR’s focus on “user-owned AI” could be a significant catalyst for the project’s future growth. The team believes their existing user base, developer ecosystem, and funding can position them to become a leader in user-owned AI.

Kesimpulan

While the recent market correction may be frustrating for some, the AI and crypto space remains vibrant. Take a look at these three projects: Render, Bittensor, and NEAR . Each project is solving its own unique problem, and as they gradually implement their respective roadmaps, the future will become more exciting.

And these are just a few examples. There is an interesting ecosystem of projects emerging at this intersection that are developing valuable products.

Plus, there are external factors to consider: OpenAI could have a breakthrough at any moment; Nvidia’s revenue is soaring. Whenever a major player makes a move in AI, it sets off a chain reaction throughout the field.

The question isn’t whether AI and encryption will become important, but how big they will be. While no one can predict the future with certainty, one thing is certain: it’s going to be very interesting.

This article is sourced from the internet: Bankless: Reigniting the market? Review of recent key events in the AI+Crypto track

Terkait: Kontroversi pendiri Shima Capital: dugaan transfer aset rahasia memicu krisis kepercayaan

Artikel asli oleh Leo Schwartz, Majalah Fortune Terjemahan asli: Luffy, Foresight News Ketika Yida Gao kembali ke MIT pada tahun 2022, mantan pelompat galah perguruan tinggi dan penerima penghargaan Phi Beta Kappa itu menghadapi tantangan besar. Universitas bergengsi itu telah mengundangnya untuk mengajar mata kuliah pascasarjana sekolah bisnis tentang mata uang kripto dan keuangan, sebuah posisi yang sebelumnya dipegang oleh Ketua Komisi Sekuritas dan Bursa Gary Gensler. Sepuluh tahun setelah menyelesaikan studi sarjananya di MIT, imigran Tiongkok itu masuk dalam daftar 30 Under 30 versi Forbes dan sejak itu melejit ke dunia mata uang kripto. Yida Gao memiliki perusahaan modal ventura miliknya sendiri yang berfokus pada blockchain, Shima Capital. Gao telah mengumpulkan $200 juta dari raksasa keuangan seperti Bill Ackman dan perusahaan mata uang kripto terkenal seperti Dragonfly dan Galaxy, dan telah menjadi salah satu investor paling aktif di…