Babylon: Bagaimana cara membuka nilai keamanan Bitcoin?

Penulis asli: Peneliti YBB Capital Zeke

Kata pengantar

Di era modular yang dipimpin oleh Ethereum, menyediakan layanan keamanan dengan menghubungkan lapisan DA (ketersediaan data) bukanlah hal baru. Konsep keamanan bersama yang dibawa oleh Staking memberikan dimensi baru untuk jalur modular, yaitu, menggunakan potensi emas dan perak digital untuk menyediakan keamanan dari Bitcoin atau Ethereum untuk banyak protokol blockchain dan rantai publik. Dari sudut pandang naratif, ini cukup hebat. Ini tidak hanya melepaskan likuiditas triliunan nilai pasar, tetapi juga merupakan inti utama dari jalur ekspansi masa depan. Ambil contoh protokol staking Bitcoin Babylon dan protokol re-staking (ReStaking) Ethereum EigenLayer, yang telah memenangkan pendanaan besar masing-masing sebesar US$$70 juta dan US$$100 juta. Tidak sulit untuk melihat bahwa VC teratas sangat dikenal untuk jalur ini.

Namun, ada juga banyak keraguan. Jika modularisasi adalah hasil akhir dari ekspansi, dan keduanya sebagai pemain kunci pasti akan mengunci sejumlah besar BTC dan ETH, maka apakah keamanan protokol itu sendiri layak dipertimbangkan? Akankah boneka bersarang gila yang terbentuk dengan banyak protokol LSD dan LRT menjadi angsa hitam terbesar di blockchain masa depan? Apakah logika bisnisnya masuk akal? Karena kami telah menganalisis EigenLayer dalam artikel sebelumnya, berikut ini terutama akan membahas masalah di atas melalui Babylon.

Memperluas konsensus keamanan

Rantai publik yang paling berharga di dunia blockchain adalah Bitcoin dan Ethereum. Keamanan, desentralisasi, dan konsensus nilai yang terkumpul selama bertahun-tahun adalah inti utama yang memastikan bahwa keduanya dapat berdiri di puncak rantai publik selama bertahun-tahun. Keduanya juga merupakan karakteristik langka yang paling sulit ditiru untuk rantai heterogen lainnya, dan inti dari pemikiran modular adalah menyewakan karakteristik ini kepada mereka yang membutuhkan. Pada tahap ini, ada dua golongan utama dalam pemikiran modular:

-

Yang pertama adalah menggunakan Layer 1 (biasanya Ethereum) dengan keamanan yang memadai sebagai tiga layer terbawah atau bagian dari layer fungsional Rollup. Solusi ini memiliki keamanan dan legitimasi tertinggi, dan juga dapat menyerap sumber daya dari ekosistem rantai utama. Namun, untuk Rollup tertentu (rantai aplikasi, rantai ekor panjang, dll.), throughput dan biayanya tidak terlalu bersahabat;

-

Yang kedua adalah membuat lapisan DA dengan keamanan yang mendekati Bitcoin dan Ethereum dan kinerja biaya yang lebih baik. Misalnya, Celestia, yang sudah kita kenal, menggunakan arsitektur fungsional DA murni, meminimalkan persyaratan perangkat keras node, dan memiliki biaya gas yang rendah, untuk membuat lapisan DA dengan kinerja dan keamanan yang kuat serta desentralisasi yang sebanding dengan Ethereum dalam waktu sesingkat mungkin. Kerugian dari solusi ini adalah akan memakan waktu untuk menyelesaikan keamanan dan desentralisasi, dan tidak ortodoksi serta bersaing secara terbuka dengan Ethereum, sehingga ditolak oleh komunitas Ethereum.

Fraksi lainnya adalah Babylon dan Eigenlayer, yang menggunakan ide inti POS (Proof-of-Stake) untuk menciptakan layanan keamanan bersama dengan meminjam nilai aset Bitcoin atau Ethereum. Dibandingkan dengan dua yang pertama, keberadaannya netral. Keunggulannya adalah meskipun mewarisi ortodoksi dan keamanan, ia juga memberi aset rantai utama nilai pemanfaatan yang lebih besar dan lebih fleksibel.

Potensi emas digital

Terlepas dari logika dasar mekanisme konsensus, keamanan blockchain sangat bergantung pada berapa banyak sumber daya yang dimilikinya untuk mendukungnya. Rantai PoW membutuhkan banyak perangkat keras dan listrik, sementara PoS bergantung pada nilai aset yang dijaminkan. Bitcoin sendiri didukung oleh jaringan komputasi PoW yang sangat besar, yang dapat dikatakan sebagai yang paling aman di seluruh blockchain. Namun, sebagai rantai publik dengan nilai pasar yang beredar sebesar 1,39 triliun dolar AS dan menempati setengah dari blockchain, asetnya hanya digunakan dalam dua skenario utama: transfer dan pembayaran Gas.

Adapun separuh blockchain lainnya, terutama sejak Ethereum Shanghai ditingkatkan ke PoS, dapat dikatakan bahwa sebagian besar rantai publik menggunakan PoS dengan arsitektur yang berbeda untuk menyelesaikan konsensus secara default. Namun, karena rantai heterogen baru itu sendiri tidak dapat menarik terlalu banyak jaminan modal, keamanannya sangat dipertanyakan. Di era modular saat ini, meskipun zona Cosmos dan berbagai Layer 2 juga dapat menggunakan berbagai lapisan DA untuk menebusnya, ia juga kehilangan otonomi. Untuk sebagian besar rantai publik lama atau rantai aliansi dengan mekanisme POS, pada dasarnya tidak mungkin untuk menggunakan Ethereum atau Celestia sebagai DA, dan nilai Babylon adalah untuk mengisi celah ini dan menjaminkan BTC untuk memberikan perlindungan bagi rantai PoS. Sama seperti manusia yang menggunakan emas untuk mendukung nilai uang kertas di masa lalu, BTC memang sangat cocok untuk memainkan peran ini di dunia blockchain.

Dari 0 sampai 1

Merilis emas digital selalu menjadi narasi yang paling ambisius dan sulit dalam blockchain. Dari sidechain awal, jaringan lightning, bridged wrapped tokens hingga rune dan BTC Layer 2 saat ini, dapat dikatakan bahwa apa pun solusinya, ada beberapa kekurangan yang melekat. Jika Babylon ingin menerapkan keamanan Bitcoin, solusi terpusat yang memperkenalkan asumsi kepercayaan pihak ketiga harus dikecualikan terlebih dahulu. Di antara solusi yang tersisa, rune dan jaringan lightning (dibatasi oleh kemajuan pengembangan yang sangat lambat) saat ini hanya memiliki kemampuan untuk menerbitkan aset, yang berarti bahwa Babylon perlu merancang rencana perluasan kapasitas untuk meningkatkan staking asli Bitcoin dari 0 menjadi 1.

Elemen dasar yang tersedia saat ini di Bitcoin adalah sebagai berikut: 1. Model UTXO, 2. Timestamp, 3. Metode tanda tangan jamak, 4. Kode operasi dasar. Solusi Babylon didasarkan pada kemampuan pemrograman dan kapasitas penyimpanan data Bitcoin yang lemah. Dengan berpegang pada prinsip minimisasi, hanya fungsi yang diperlukan dari kontrak gadai yang perlu diselesaikan di Bitcoin, yaitu, gadai BTC, penyitaan, pemberian hadiah, pengambilan, dll. semuanya diselesaikan di rantai utama. Setelah mencapai 0 hingga 1 ini, persyaratan yang rumit diserahkan ke zona Cosmos untuk diproses. Namun masih ada masalah utama di sini, bagaimana cara merekam data rantai PoS ke rantai utama?

Pengintaian Jarak Jauh

UTXO (Unspent Transaction Outputs) adalah model transaksi yang dirancang oleh Satoshi Nakamoto untuk Bitcoin. Ide intinya sangat sederhana. Transaksi tidak lebih dari arus masuk dan arus keluar dana, sehingga seluruh sistem transaksi hanya perlu dinyatakan dalam bentuk input dan output. Yang disebut UTXO adalah ketika dana masuk tetapi tidak banyak yang dibelanjakan, dan bagian yang tersisa adalah output transaksi yang tidak dibelanjakan (yaitu, bitcoin yang belum dibayarkan). Seluruh buku besar Bitcoin sebenarnya adalah kumpulan UTXO. Dengan mencatat status setiap UTXO, kepemilikan dan sirkulasi Bitcoin dikelola. Setiap transaksi akan menghabiskan UTXO lama dan menghasilkan UTXO baru. Karena propertinya memiliki potensi tertentu untuk skalabilitas, secara alami menjadi titik awal bagi banyak solusi ekspansi asli. Misalnya, jaringan lightning yang menggunakan UTXO dan multi-signature untuk membuat mekanisme penalti dan saluran status, atau prasasti dan rune yang mengikat UTXO untuk mewujudkan SFT (token semi-fungible). Semuanya didasarkan pada titik awal utama ini untuk menjadi kenyataan.

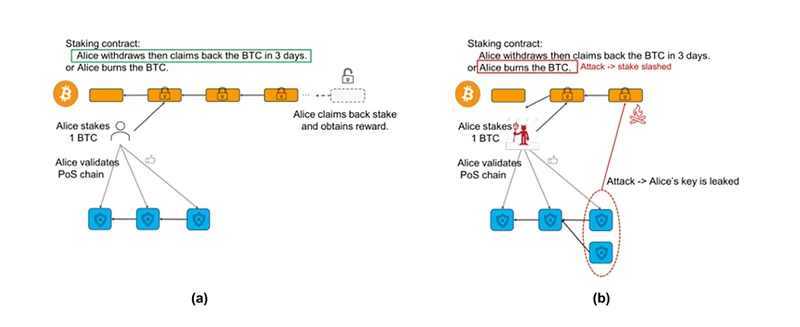

Tentu saja, Babylon juga perlu menggunakan UTXO untuk mengimplementasikan kontrak gadai (Babylon menyebutnya gadai jarak jauh, yaitu, keamanan BTC ditransmisikan dari jarak jauh ke rantai PoS melalui lapisan tengah). Pada saat yang sama, ia dengan cerdik menggabungkan kode operasi yang ada dalam hal pemikiran. Langkah-langkah khusus untuk mengimplementasikan kontrak dapat dipecah menjadi empat langkah berikut:

-

Penguncian dana Pengguna mengirim dana ke alamat yang dikontrol oleh multi-signature. Melalui OP_CTV (OP_CHECKTEMPLATEVERIFY, yang memungkinkan pembuatan templat transaksi yang telah ditetapkan sebelumnya untuk memastikan bahwa transaksi hanya dapat dieksekusi sesuai dengan struktur dan kondisi tertentu), kontrak dapat menentukan bahwa dana ini hanya dapat dibelanjakan jika kondisi tertentu terpenuhi. Setelah dana dikunci, UTXO baru dibuat untuk menunjukkan bahwa dana ini telah dijaminkan;

-

Verifikasi bersyarat memanggil OP_CSV (OP_CHECKSEQUENCEVERIFY, yang memungkinkan kunci waktu relatif untuk ditetapkan, berdasarkan nomor urutan transaksi, yang menunjukkan bahwa UTXO hanya dapat digunakan setelah waktu relatif atau jumlah blok tertentu) untuk mencapai kunci waktu, yang dapat memastikan bahwa dana tidak dapat ditarik dalam jangka waktu tertentu. Dikombinasikan dengan OP_CTV yang disebutkan di atas, staking, unstaking (jika waktu staking terpenuhi, pemberi jaminan dapat menggunakan UTXO yang terkunci), dan slashing (jika pemberi jaminan berperilaku jahat, UTXO akan dipaksa untuk digunakan ke alamat terkunci dan dibatasi ke status yang tidak dapat digunakan, mirip dengan alamat lubang hitam) dapat dicapai;

-

Pembaruan Status Setiap kali pengguna mempertaruhkan atau menarik dana yang dipertaruhkan, hal itu melibatkan pembuatan dan pengeluaran UTXO. Keluaran transaksi baru akan menghasilkan UTXO baru, dan UTXO lama akan ditandai sebagai telah digunakan. Dengan cara ini, setiap transaksi dan aliran dana dicatat secara akurat di blockchain untuk memastikan transparansi dan keamanan;

-

Berdasarkan jumlah yang dipertaruhkan dan waktu yang dipertaruhkan, kontrak akan menghitung hadiah dan mendistribusikannya dengan menghasilkan UTXO baru. Hadiah ini dapat dibuka dan digunakan setelah memenuhi persyaratan tertentu melalui ketentuan skrip.

Stempel waktu

Dengan kontrak staking asli, wajar untuk memikirkan masalah pencatatan peristiwa historis pada rantai eksternal. Dalam white paper Satoshi Nakamoto, blockchain Bitcoin memperkenalkan konsep penandaan waktu yang didukung oleh PoW, mekanisme yang menyediakan urutan kronologis yang tidak dapat diubah untuk berbagai peristiwa. Dalam kasus penggunaan asli Bitcoin, peristiwa ini merujuk pada berbagai transaksi yang dilakukan pada buku besar. Saat ini, untuk meningkatkan keamanan rantai PoS lainnya, Bitcoin juga dapat digunakan untuk memberi cap waktu pada peristiwa pada blockchain eksternal. Setiap kali peristiwa tersebut terjadi, ia memicu transaksi yang dikirim ke penambang, yang kemudian memasukkannya ke dalam buku besar Bitcoin untuk memberi cap waktu pada peristiwa tersebut. Cap waktu ini dapat digunakan untuk memecahkan berbagai masalah keamanan blockchain. Konsep umum penandaan waktu peristiwa dalam rantai anak pada rantai induk disebut checkpointing, dan transaksi yang digunakan untuk menambahkan cap waktu disebut transaksi checkpoint. Secara khusus, cap waktu dalam blockchain Bitcoin memiliki karakteristik penting berikut:

-

Format waktu: Stempel waktu mencatat jumlah detik sejak 1 Januari 1970 00:00:00 UTC. Format ini disebut stempel waktu Unix atau waktu POSIX;

-

Fungsi: Fungsi utama stempel waktu adalah untuk mengidentifikasi waktu pembuatan blok, membantu node menentukan urutan blok, dan membantu mekanisme penyesuaian kesulitan jaringan;

-

Stempel waktu dan penyesuaian tingkat kesulitan: Jaringan Bitcoin menyesuaikan tingkat kesulitan setiap 2016 blok (kira-kira setiap dua minggu). Stempel waktu memainkan peran penting dalam proses ini, karena jaringan menyesuaikan tingkat kesulitan penambangan berdasarkan total waktu pembuatan 2016 blok terakhir, sehingga kecepatan pembuatan blok baru mendekati 10 menit;

-

Pemeriksaan validitas: Saat sebuah node menerima blok baru, node tersebut akan memverifikasi stempel waktunya. Stempel waktu blok baru harus lebih besar dari waktu rata-rata beberapa blok sebelumnya dan tidak boleh melebihi 120 menit waktu jaringan (yaitu 2 jam ke depan).

Server stempel waktu adalah primitif baru yang ditetapkan oleh Babylon yang dapat mendistribusikan stempel waktu Bitcoin melalui blok PoS melalui pos pemeriksaan Babylon untuk memastikan keakuratan rangkaian waktu dan mencegah manipulasi. Server adalah lapisan teratas dari seluruh arsitektur Babylon dan merupakan sumber inti persyaratan kepercayaan.

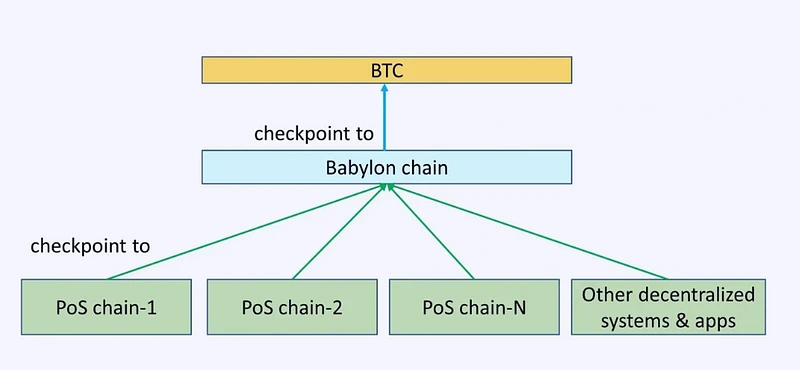

Arsitektur tiga tingkat Babylon

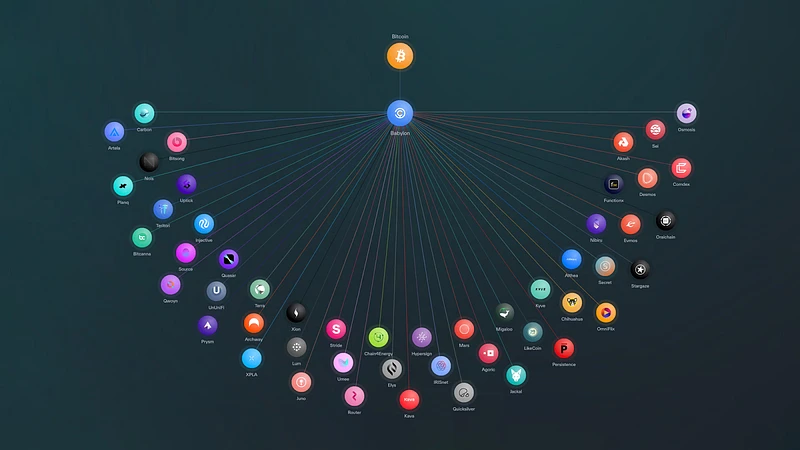

Seperti yang ditunjukkan pada gambar di atas, keseluruhan arsitektur Babylon dapat dibagi menjadi tiga lapisan: Bitcoin (sebagai server stempel waktu), Babylon (Zona Cosmos) sebagai lapisan tengah, dan lapisan permintaan rantai PoS. Babylon menyebut dua lapisan terakhir sebagai Bidang Kontrol (Babylon sendiri) dan Bidang Data (bidang permintaan data, yaitu berbagai rantai konsumen PoS).

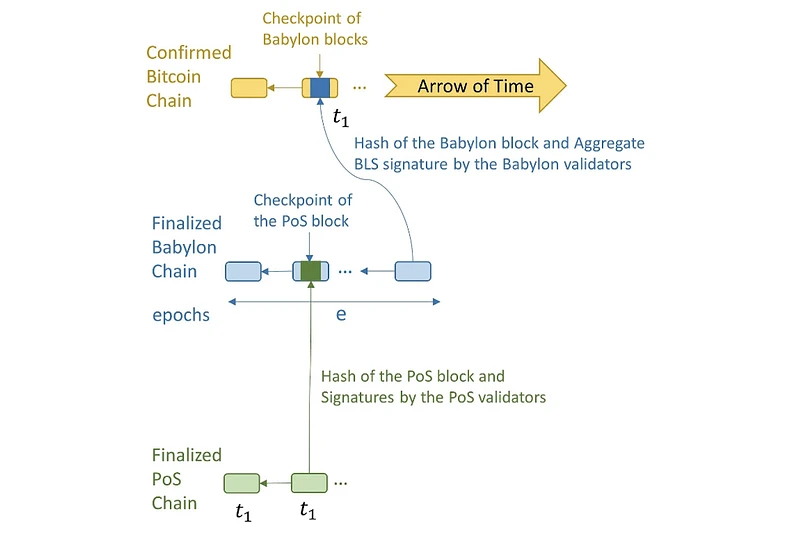

Setelah memahami implementasi dasar dari protokol tanpa kepercayaan, mari kita lihat bagaimana Babylon sendiri menggunakan zona Cosmos untuk menghubungkan kedua ujungnya. Menurut penjelasan terperinci Stanford Tse Labs tentang Babylon [1], Babylon dapat menerima aliran titik pemeriksaan dari beberapa rantai PoS dan menggabungkan titik pemeriksaan ini dan menerbitkannya ke Bitcoin. Dengan menggunakan tanda tangan agregat validator Babylon, ukuran titik pemeriksaan dapat diminimalkan, dan frekuensi titik pemeriksaan ini dikontrol dengan mengizinkan validator Babylon untuk berubah hanya sekali per Epoch.

Validator dari setiap rantai PoS mengunduh blok Babylon dan mengamati apakah titik pemeriksaan PoS mereka disertakan dalam blok Babylon yang diperiksa oleh Bitcoin. Hal ini memungkinkan rantai PoS untuk mendeteksi ketidaksesuaian, misalnya, jika validator Babylon membuat blok yang tidak tersedia yang diperiksa oleh Bitcoin dan berbohong tentang titik pemeriksaan PoS yang disertakan dalam blok yang tidak tersedia tersebut. Komponen utama yang menyusun protokol adalah sebagai berikut:

-

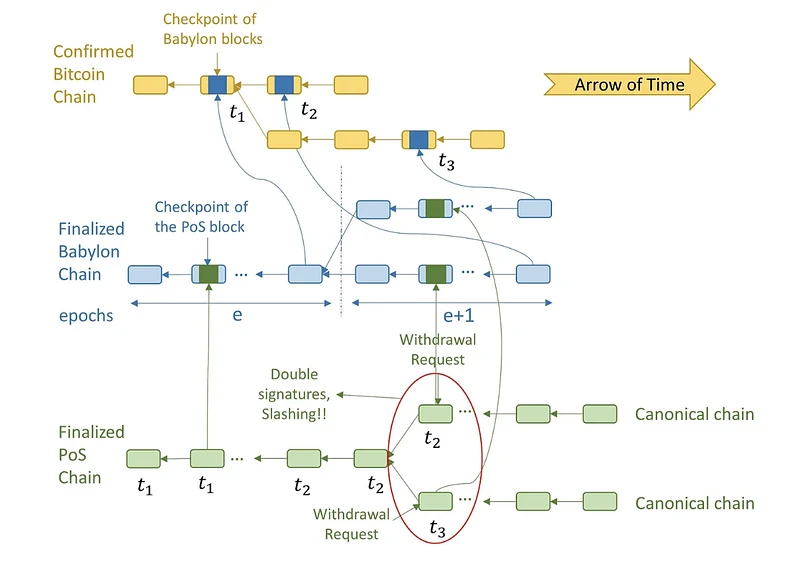

Titik pemeriksaan: Hanya blok terakhir dari Babylon Epoch yang diberi titik pemeriksaan oleh Bitcoin. Titik pemeriksaan terdiri dari hash blok beserta satu tanda tangan BLS agregat yang sesuai dengan tanda tangan dari set validator 2/3 yang menandatangani blok untuk finalisasi. Titik pemeriksaan Babylon juga berisi nomor Epoch. Blok PoS dapat diberi stempel waktu blok Bitcoin melalui titik pemeriksaan Babylon. Misalnya, dua blok PoS pertama diberi titik pemeriksaan oleh blok Babylon, yang selanjutnya diberi titik pemeriksaan oleh blok Bitcoin dengan stempel waktu t_ 3. Oleh karena itu, blok PoS ini diberi stempel waktu Bitcoin t_ 3.

-

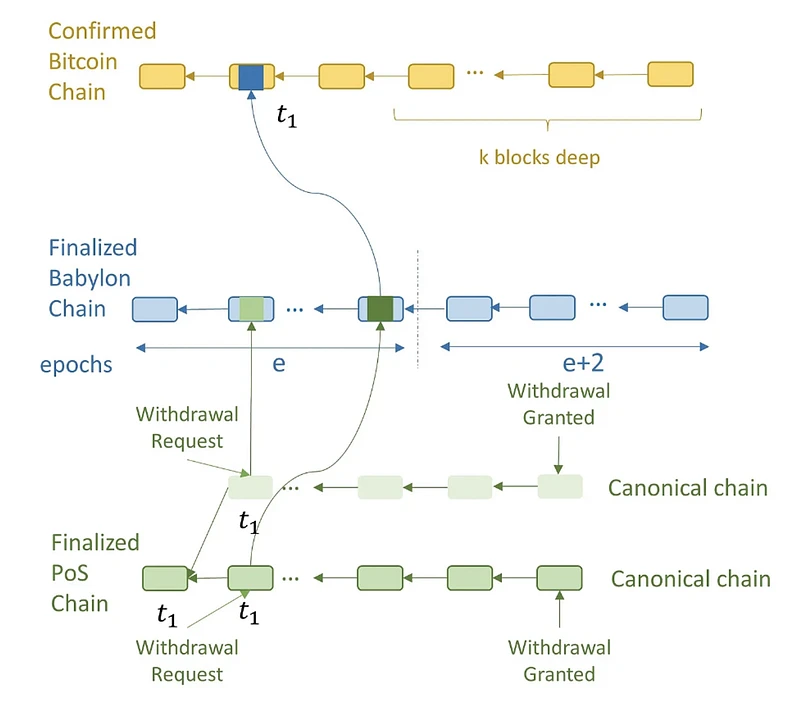

Rantai PoS kanonik: Ketika percabangan terjadi pada rantai PoS, rantai dengan stempel waktu sebelumnya dianggap sebagai rantai PoS kanonik. Jika dua percabangan memiliki stempel waktu yang sama, ikatan tersebut diputus demi blok PoS dengan titik pemeriksaan sebelumnya di Babylon.

-

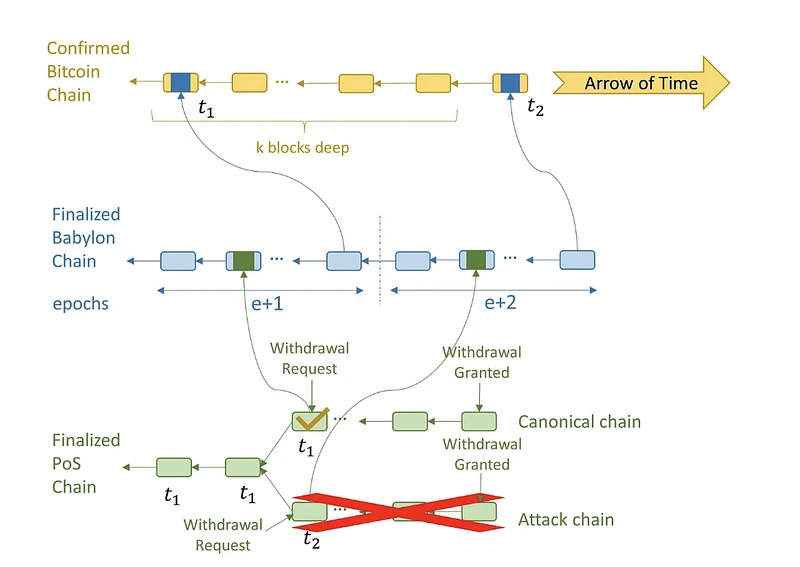

Aturan penarikan: Untuk menarik, validator mengirimkan permintaan penarikan ke rantai PoS. Blok PoS yang berisi permintaan penarikan diperiksa oleh Babylon dan kemudian oleh Bitcoin, dan diberi cap waktu t_ 1 . Setelah blok Bitcoin dengan cap waktu t_ 1 mencapai kedalaman k, penarikan diberikan pada rantai PoS. Pada titik ini, jika validator yang telah menarik saham melakukan serangan jarak jauh, blok pada rantai serangan hanya dapat diberi cap waktu Bitcoin lebih lambat dari t_ 1 . Ini karena setelah blok Bitcoin dengan cap waktu t_ 1 mencapai kedalaman k, blok tersebut tidak dapat dibatalkan. Kemudian, dengan mengamati urutan titik pemeriksaan ini pada Bitcoin, klien PoS dapat membedakan antara rantai kanonik dan rantai serangan, lalu mengabaikan rantai serangan.

-

Aturan pemotongan: Validator dengan blok PoS yang berkonflik dengan tanda tangan ganda dapat dipotong jika mereka tidak menarik saham mereka saat serangan terdeteksi. Validator PoS yang jahat tahu bahwa jika mereka menunggu hingga permintaan penarikan disetujui sebelum melakukan serangan keamanan jarak jauh, mereka tidak akan dapat membingungkan klien, yang dapat melihat Bitcoin untuk mengidentifikasi rantai kanonik. Oleh karena itu, mereka dapat membagi rantai PoS saat menetapkan stempel waktu Bitcoin ke blok pada rantai PoS kanonik. Validator PoS ini bekerja dengan validator Babylon yang jahat dan penambang Bitcoin untuk membagi Babylon dan Bitcoin dan mengganti blok Bitcoin dengan stempel waktu t_2 dengan blok lain dengan stempel waktu t_3. Ini mengubah rantai PoS kanonik dari rantai atas ke rantai bawah di mata klien PoS selanjutnya. Meskipun ini adalah serangan keamanan yang berhasil, hal itu mengakibatkan saham validator PoS yang jahat dipotong karena mereka memiliki blok yang berkonflik dengan tanda tangan ganda tetapi belum menarik saham yang dipertaruhkan.

-

Aturan penghentian untuk titik pemeriksaan PoS yang tidak tersedia: Validator PoS harus menjeda rantai PoS mereka saat mereka mengamati titik pemeriksaan PoS yang tidak tersedia di Babylon. Di sini, titik pemeriksaan PoS yang tidak tersedia adalah hash yang ditandatangani oleh 2/3 validator PoS yang diasumsikan sesuai dengan blok PoS yang tidak dapat diamati. Jika validator PoS tidak menghentikan rantai PoS saat mereka mengamati titik pemeriksaan yang tidak tersedia, maka penyerang dapat mengungkapkan rantai serangan yang sebelumnya tidak tersedia dan mengubah rantai kanonik dalam pandangan klien berikutnya. Ini karena titik pemeriksaan rantai bayangan yang diungkapkan kemudian muncul lebih awal di Babylon. Aturan penghentian di atas mengungkapkan mengapa kami mengharuskan hash blok PoS yang dikirim sebagai titik pemeriksaan ditandatangani oleh set validator PoS. Jika titik pemeriksaan ini tidak ditandatangani, maka penyerang mana pun dapat mengirim hash acak dan mengklaim bahwa itu adalah hash dari titik pemeriksaan blok PoS yang tidak tersedia di Babylon. Validator PoS kemudian harus menjeda titik pemeriksaan. Perhatikan bahwa membuat rantai PoS yang tidak tersedia itu sulit: diperlukan pengrusakan setidaknya 2/3 validator PoS sehingga mereka melengkapi blok PoS dengan tanda tangan tetapi tidak memberikan data kepada validator yang jujur. Namun, dalam serangan yang dihipotesiskan di atas, penyerang jahat menghentikan rantai PoS tanpa menyerang validator mana pun. Untuk mencegah serangan semacam itu, kami mengharuskan titik pemeriksaan PoS diverifikasi oleh 2/3 validator PoS. Oleh karena itu, Babylon hanya akan memiliki titik pemeriksaan PoS yang tidak tersedia jika 2/3 validator PoS memang dikendalikan oleh penyerang. Karena biaya pengrusakan validator PoS, serangan ini sangat tidak mungkin terjadi dan tidak akan memengaruhi rantai PoS lain atau Babylon itu sendiri.

-

Aturan penghentian untuk titik pemeriksaan Babylon yang tidak tersedia: PoS dan validator Babylon harus menghentikan blockchain setelah mengamati titik pemeriksaan Babylon yang tidak tersedia di Bitcoin. Di sini, titik pemeriksaan Babylon yang tidak tersedia adalah hash dengan tanda tangan BLS agregat dari 2/3 validator Babylon, yang seharusnya sesuai dengan blok Babylon yang tidak dapat diamati. Jika validator Babylon tidak menghentikan blockchain Babylon, maka penyerang dapat mengungkap rantai Babylon yang sebelumnya tidak tersedia, sehingga mengubah rantai Babylon kanonik dalam pandangan klien yang terlambat. Demikian pula, jika validator PoS tidak menghentikan rantai PoS, maka penyerang dapat mengungkap rantai serangan PoS yang sebelumnya tidak tersedia serta rantai Babylon yang sebelumnya tidak tersedia, sehingga mengubah rantai PoS kanonik dalam pandangan klien yang terlambat. Ini karena rantai Babylon gelap yang terungkap kemudian memiliki stempel waktu sebelumnya pada Bitcoin dan berisi titik pemeriksaan rantai serangan PoS yang terungkap kemudian. Sama seperti aturan penghentian untuk titik pemeriksaan PoS yang tidak tersedia, aturan di atas menyingkapkan mengapa kami mengharuskan hash blok Babylon yang dikirim sebagai titik pemeriksaan harus disertai dengan tanda tangan BLS agregat yang membuktikan tanda tangan dari 2/3 validator Babylon. Jika titik pemeriksaan Babylon tidak ditandatangani, maka penyerang yang sewenang-wenang dapat mengirim hash yang sewenang-wenang dan mengklaimnya sebagai hash dari titik pemeriksaan blok Babylon yang tidak tersedia di Bitcoin. Validator PoS dan validator Babylon kemudian harus menunggu titik pemeriksaan yang tidak memiliki rantai Babylon atau PoS yang tidak tersedia dalam pracitranya! Membuat rantai Babylon yang tidak tersedia memerlukan kompromi setidaknya 2/3 validator Babylon. Namun, dalam serangan hipotetis di atas, penyerang menghentikan semua rantai dalam sistem tanpa kompromi bahkan satu pun validator Babylon atau PoS. Untuk mencegah serangan tersebut, kami mengharuskan titik pemeriksaan Babylon dibuktikan dengan tanda tangan agregat; jadi hanya akan ada titik pemeriksaan Babylon yang tidak tersedia jika 2/3 validator benar-benar dikompromikan. Serangan ketersediaan data ini sangat tidak mungkin terjadi karena biaya yang dikeluarkan untuk membahayakan validator Babylon. Namun dalam kasus ekstrem, hal ini akan memengaruhi semua rantai PoS dengan memaksanya untuk berhenti.

Lapisan sendiri di BTC

Meskipun Babylon sama dengan Eigenlayer dalam hal tujuan, Babylon sama sekali bukan sekadar cabang Eigenlayer. Dalam situasi saat ini di mana DA rantai utama BTC tidak dapat digunakan secara asli, keberadaan Babylon sangat berarti. Selain menghadirkan keamanan pada rantai PoS eksternal, protokol ini juga sangat penting untuk aktivasi ekosistem BTC.

Contoh

Ada banyak kemungkinan penggunaan Babylon. Berikut ini beberapa yang telah diterapkan atau berpotensi diterapkan di masa mendatang:

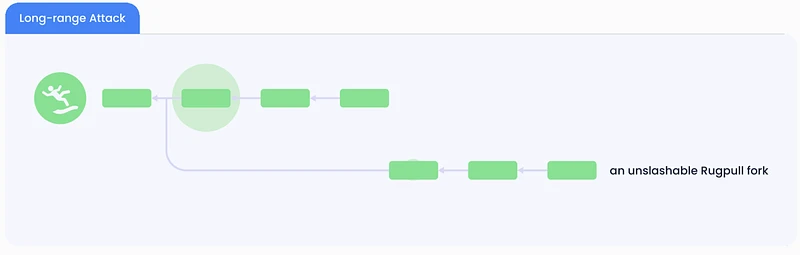

1. Memperpendek siklus staking dan meningkatkan keamanan: Rantai PoS biasanya memerlukan konsensus sosial (konsensus di antara komunitas, operator node, dan validator) untuk mencegah serangan jarak jauh, yaitu serangan yang merusak catatan transaksi atau mengendalikan rantai dengan menulis ulang riwayat blockchain. Serangan ini sangat serius dalam sistem PoS karena, tidak seperti PoW, validator yang berpartisipasi dalam konsensus dalam sistem PoS tidak perlu menghabiskan banyak sumber daya komputasi, dan penyerang dapat menulis ulang riwayat dengan mengendalikan kunci staker awal. Oleh karena itu, untuk memastikan stabilitas dan keamanan konsensus jaringan blockchain, siklus staking yang panjang pada dasarnya diperlukan. Misalnya, siklus unstaking Cosmos membutuhkan waktu 21 hari. Namun, melalui Babylon, peristiwa historis rantai PoS dapat ditambahkan ke server stempel waktu BTC, dengan demikian menggunakan BTC sebagai sumber kepercayaan untuk menggantikan konsensus sosial, sehingga waktu unstaking dapat dipersingkat menjadi hanya 1 hari (yaitu, setelah BTC berjalan sekitar 100 blok). Dan rantai PoS dapat memiliki perlindungan ganda dari staking Token asli dan staking BTC saat ini;

2. Interoperabilitas lintas rantai: Melalui protokol IBC, Babylon dapat menerima data titik pemeriksaan dari beberapa rantai PoS dan mencapai interoperabilitas lintas rantai. Interoperabilitas ini memungkinkan komunikasi dan berbagi data yang lancar antara berbagai blockchain, sehingga meningkatkan efisiensi dan fungsionalitas ekosistem blockchain secara keseluruhan;

3. Integrasikan ekosistem BTC: Sebagian besar proyek dalam ekosistem BTC saat ini tidak memiliki keamanan yang cukup kuat. Baik itu Layer 2, LRT atau DeFi, sebagian besar masih bergantung pada asumsi kepercayaan pihak ketiga. Dan ada banyak BTC yang disimpan dalam alamat protokol ini. Di masa mendatang, mereka mungkin bertabrakan dengan Babylon untuk menghasilkan beberapa solusi pencocokan yang baik, saling memberi umpan balik, dan akhirnya membentuk ekosistem yang kuat seperti Eigenlayer di Ethereum;

4. Manajemen aset lintas rantai: Protokol Babylon dapat digunakan untuk mengelola aset lintas rantai dengan aman. Dengan menambahkan stempel waktu ke transaksi lintas rantai, protokol ini memastikan keamanan dan transparansi aset saat ditransfer antar blockchain yang berbeda. Mekanisme semacam itu membantu mencegah pengeluaran ganda dan serangan lintas rantai lainnya.

Menara Babel

Kisah Menara Babel berasal dari Kitab Kejadian 11:1-9 dalam Alkitab. Ini adalah kisah klasik tentang manusia yang mencoba membangun menara setinggi langit, tetapi dihentikan oleh Tuhan. Maknanya melambangkan persatuan umat manusia dan tujuan bersama. Ini juga merupakan makna yang mendasari protokol Babel, yang bertujuan untuk membangun Menara Babel bagi banyak rantai PoS dan menyatukannya. Dari sudut pandang naratif, tampaknya tidak kalah mengesankan daripada Eigenlayer, pembela Ethereum, tetapi bagaimana situasi sebenarnya?

Hingga saat ini, jaringan uji Babylon telah menyediakan keamanan untuk 50 zona Cosmos melalui protokol IBC. Selain Cosmos, Babylon juga telah mencapai kerja sama dengan beberapa protokol LSD (liquidity promise), protokol interoperabilitas rantai penuh, dan protokol ekologi Bitcoin untuk integrasi. Di sisi lain, dalam hal promise, dibandingkan dengan kemampuan Eigenlayers untuk menggunakan kembali promise dan LSD dalam ekosistem Ethereum, Babylon saat ini masih sedikit lebih rendah. Namun dalam jangka panjang, BTC yang tertidur di banyak dompet dan protokol belum sepenuhnya terbangun, jadi ini hanyalah puncak dari gunung es senilai $1,3 triliun. Babylon saat ini masih perlu membentuk pelengkap positif bagi seluruh ekosistem BTC.

Hingga saat ini, jaringan uji Babylon telah menyediakan keamanan untuk 50 zona Cosmos melalui protokol IBC. Selain Cosmos, Babylon juga telah mencapai kerja sama dengan beberapa protokol LSD (liquidity promise), protokol interoperabilitas rantai penuh, dan protokol ekologi Bitcoin untuk integrasi. Di sisi lain, dalam hal promise, dibandingkan dengan kemampuan Eigenlayers untuk menggunakan kembali promise dan LSD dalam ekosistem Ethereum, Babylon saat ini masih sedikit lebih rendah. Namun dalam jangka panjang, BTC yang tertidur di banyak dompet dan protokol belum sepenuhnya terbangun, jadi ini hanyalah puncak dari gunung es senilai $1,3 triliun. Babylon saat ini masih perlu membentuk pelengkap positif bagi seluruh ekosistem BTC.

Satu-satunya solusi untuk boneka Ponzi

Seperti yang disebutkan dalam kata pengantar, Eigenlayer dan Babylon secara bertahap mendapatkan momentum. Dilihat dari tren saat ini, keduanya akan mengunci sejumlah besar aset inti blockchain di masa mendatang. Bahkan jika keamanan kedua protokol itu sendiri tidak menjadi masalah, apakah beberapa nesting doll akan menyebabkan seluruh ekosistem staking memasuki spiral kematian dan menyebabkan penurunan yang tidak kurang dari tingkat kenaikan suku bunga Amerika Serikat? Jalur staking saat ini memang telah mengalami periode panjang kemakmuran yang tidak rasional setelah Ethereum beralih ke PoS dan Eigenlayer keluar. Untuk mendapatkan TVL yang lebih tinggi, pihak proyek sering kali mengeluarkan sejumlah besar harapan airdrop dan manfaat nesting doll yang ditumpangkan untuk memikat pengguna. Satu ETH bahkan dapat menumpuk boneka 5 atau 6 kali dari staking asli ke LSD dan kemudian ke LRT. Ini secara alami akan menyebabkan banyak masalah risiko dengan penumpukan nesting doll. Selama salah satu protokol bermasalah, hal itu akan langsung memengaruhi semua protokol yang berpartisipasi dalam nesting doll (terutama protokol staking di akhir struktur nesting doll). Ada sejumlah besar solusi terpusat dalam ekosistem BTC. Jika Anda menyalin labu dan menyalin set, risikonya hanya akan lebih besar. Namun, satu hal yang perlu diperjelas adalah bahwa Eigenlayer dan Babylon sedang memandu roda gila gadai menuju nilai praktis yang nyata. Intinya, mereka menciptakan penawaran dan permintaan nyata untuk mengimbangi risiko ini. Oleh karena itu, meskipun keberadaan protokol keamanan bersama secara tidak langsung atau langsung berkontribusi pada memburuknya praktik buruk, itu adalah satu-satunya solusi bagi boneka gadai untuk lolos dari keuntungan Ponzi. Pertanyaan yang lebih penting sekarang adalah apakah logika bisnis dari protokol keamanan bersama itu benar?

Penawaran dan permintaan riil adalah kuncinya

Di Web3, baik itu rantai publik atau protokol, logika yang mendasarinya sering kali didasarkan pada pencocokan pembeli dan penjual dengan kebutuhan tertentu. Mereka yang cocok dengan benar dapat memenangkan dunia, dan blockchain itu sendiri hanya membuat pencocokan ini adil, nyata, dan kredibel. Secara teori, protokol keamanan bersama dapat membentuk pelengkap yang baik untuk janji makmur dan ekologi modular saat ini. Namun pikirkan baik-baik, apakah pasokan ini akan jauh melebihi permintaan? Pertama-tama, ada cukup banyak proyek dan rantai utama yang dapat menyediakan keamanan modular di sisi pasokan. Di sisi lain, rantai PoS lama mungkin tidak memerlukan atau tidak akan menyewa keamanan tersebut untuk muka. Dan apakah rantai PoS baru dapat membayar bunga yang dihasilkan oleh sejumlah besar BTC dan ETH, logika bisnis Eigenlayer dan Babylon harus membentuk lingkaran tertutup, setidaknya pendapatan harus diimbangi dengan bunga yang dihasilkan oleh token yang dijaminkan dalam protokol. Bahkan jika keseimbangan ini dapat dicapai, bahkan jika pendapatan jauh melebihi pengeluaran bunga, dalam hal ini akan ada penghisapan darah dari PoS dan protokol baru. Oleh karena itu, bagaimana menyeimbangkan model ekonomi, tidak jatuh ke dalam gelembung ekspektasi airdrop, dan mendorong penawaran dan permintaan dengan cara yang lebih sehat akan menjadi prioritas utama.

referensi

1. 10.000 kata yang menjelaskan bagaimana Babylon memungkinkan ekosistem Cosmos mendapatkan manfaat dari keamanan Bitcoin: https://www.chaincatcher.com/article/2079486

2. Pemahaman mendalam tentang Eigenlayer: Biarkan Ethereum memecahkan situasi Matryoshka? https://haotiancryptoinsight.substack.com/p/eigenlayer?utm_source=publication-search

3. Dialog dengan Fisher Yu, salah satu pendiri Babylon: Bagaimana cara membuka likuiditas 21 juta BTC melalui staking? https://www.chaincatcher.com/article/2120653

4. Utang segitiga atau inflasi ringan: perspektif alternatif terhadap penjaminan kembali: https://mp.weixin.qq.com/s/dMc_WzndAZXRjnEgD2hcew

5. Inilah yang saya lihat di dunia kripto akhir-akhir ini: https://theknower.substack.com/p/a-look-at-what-ive-been-seeing-in

Artikel ini bersumber dari internet: Babylon: Bagaimana cara membuka nilai keamanan Bitcoin?

Judul berita Caixin: Investor daratan saat ini tidak diizinkan untuk berpartisipasi dalam perdagangan ETF spot aset virtual Hong Kong Enam ETF spot aset virtual pertama yang diterbitkan oleh Bosera International, China Asset Management (Hong Kong), dan Harvest Global telah resmi disetujui oleh Komisi Pengawas Sekuritas Hong Kong, dengan tujuan pencatatan pada tanggal 30 April 2024. Meskipun ETF yang relevan pertama kali diterbitkan oleh perusahaan-perusahaan Hong Kong di bawah dana publik Tiongkok, perlu dicatat bahwa investor Tiongkok daratan saat ini tidak diizinkan untuk berpartisipasi dalam pembelian dan penjualan. Menurut daftar produk di situs web Komisi Sekuritas dan Berjangka Hong Kong, keenam ETF spot aset virtual ini secara resmi disetujui pada tanggal 23 April 2024. Produk-produk yang relevan adalah: Harvest Bitcoin Spot ETF…