Arthur Hayes: Sekarang adalah waktu terbaik untuk berinvestasi di Bitcoin dan altcoin

Original title: Group of Fools

Penulis asli: Arthur Hayes

Terjemahan asli: Ismay, BlockBeats

Editors note: In this article, Hayes explores cryptocurrency investment strategies under the current macroeconomic situation. With the Bank of Canada and the European Central Bank cutting interest rates, the cryptocurrency market is about to recover from the summer downturn, heralding a new round of bull market. Hayes believes that since 2009, Bitcoin and other cryptocurrencies have been a powerful weapon against the traditional financial system. In the current macro-environment, Hayes recommends actively going long on Bitcoin and altcoins, and supports the issuance of tokens by new projects, as the market will usher in a strong rebound.

The USD-JPY exchange rate is the most important macroeconomic indicator. In my last article, The Easy Button , I wrote that something had to be done to strengthen the yen, and the solution proposed was that the Fed could exchange newly printed dollars for unlimited amounts of yen with the Bank of Japan (BOJ). This would allow the Bank of Japan to provide unlimited dollar firepower to the Ministry of Finance of Japan (MOF) to buy yen in the global foreign exchange market.

While I still believe in the validity of this solution, it seems that the central bank crooks who run the G7 group of idiots have chosen to convince the market that the interest rate differentials between the yen and the dollar, euro, pound and maple (canadian) dollar will narrow over time. If the market believes this future state, it will buy the yen and sell other currencies. Mission accomplished!

In order for this magic to work, the G7 central banks (the Federal Reserve, the European Central Bank “ECB”, the Bank of Canada “BOC” and the Bank of England “BOE”) must lower their “high” policy rates.

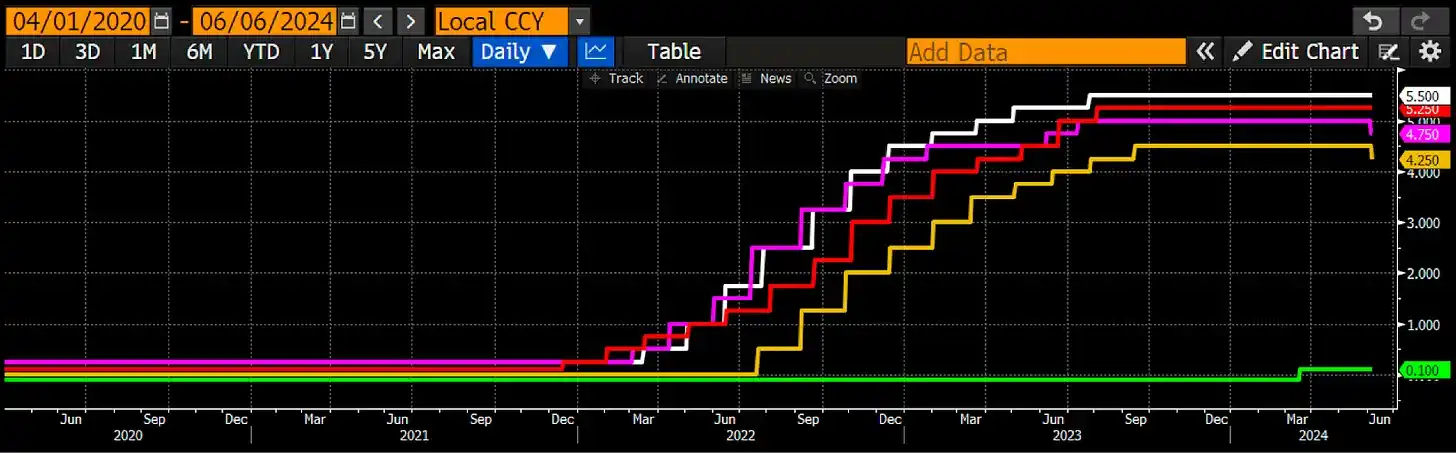

It is critical to note that the Bank of Japan (BOJ) policy rate (green) is 0.1%, while other countries are at 4-5%. The interest rate differential between local and foreign currencies fundamentally drives exchange rates. From March 2020 to early 2022, everyone was playing the same game. There was free money as long as you stayed home, had the flu, and got the mRNA vaccine. When inflation was so severe that the elites could no longer ignore the pain and suffering of their common people, the G7 central banks – except the Bank of Japan – all aggressively raised rates.

The Bank of Japan cannot raise interest rates because it owns over 50% of the Japanese Government Bond (JGB) market. When interest rates fall, JGB prices rise, making the Bank of Japan look solvent. However, if the Bank of Japan allows interest rates to rise and JGB prices to fall, the highly leveraged central bank will suffer catastrophic losses. I do some of the scary math for readers in Easy Button.

That is why if it is up to G7 policymaker Janet Yellen to narrow the spread, the only option is for central banks with “high” policy rates to lower theirs. In traditional central bank theory, if inflation is below target, rate cuts are beneficial. What is the target?

For some reason, I dont know why, every G7 central bank has an inflation target of 2%, regardless of differences in culture, growth, debt, population, etc. Is inflation currently racing through 2%?

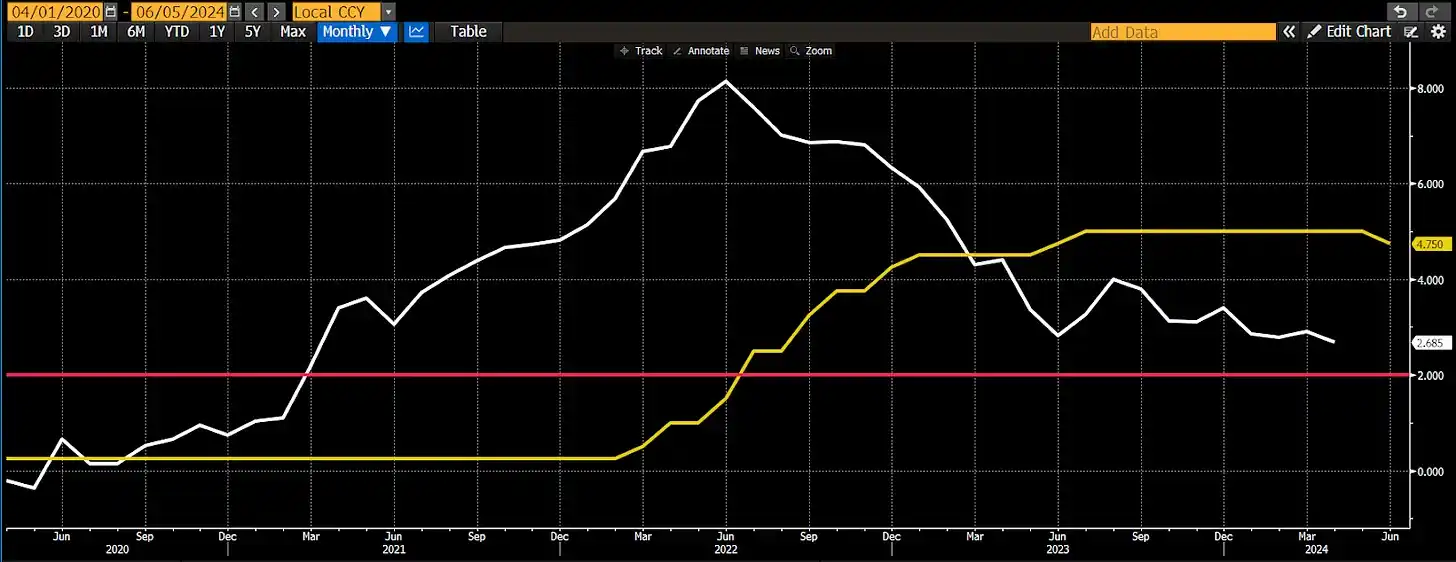

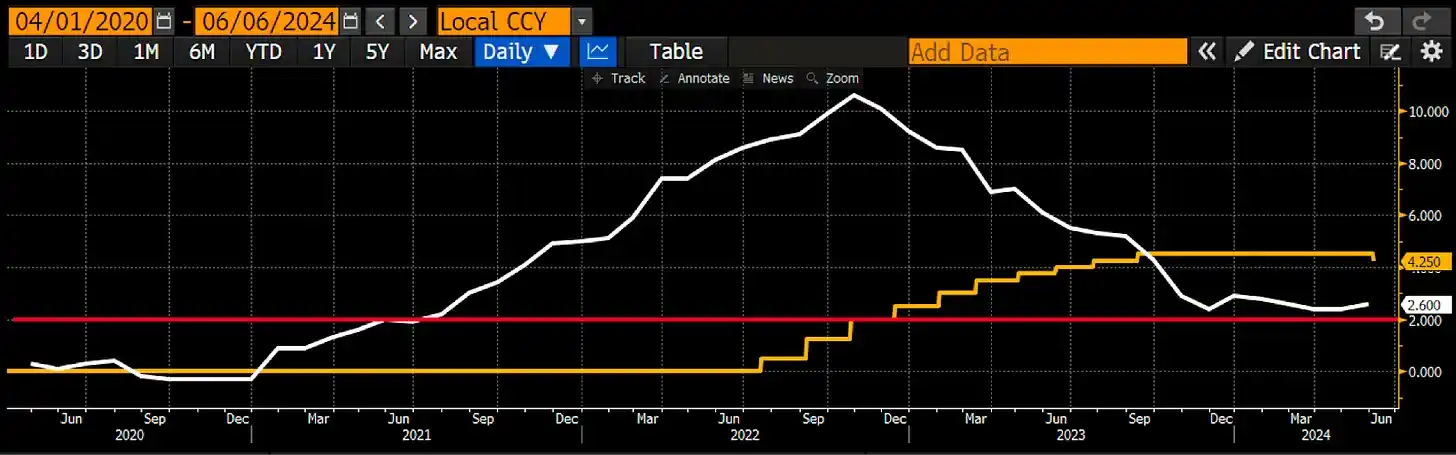

Each colored line represents a different G7 central banks inflation target. The horizontal line is 2%. No G7 countrys inflation statistics – even those released by manipulated and dishonest governments – are below target. Putting on my technical analysis hat, it seems that G7 inflation is forming a local bottom in the 2-3% range before bursting higher.

Given this graph, a traditional central banker would not cut rates at current levels. Yet this week, the Bank of Canada (BOC) and the European Central Bank (ECB) cut rates when inflation was above target. This is odd. Is there some kind of financial turmoil that requires cheaper money? No.

The Bank of Canada (BOC) cuts its policy rate (yellow) when inflation (white) is above target (red).

The European Central Bank (ECB) cuts its policy rate (yellow) when inflation (white) is above its target (red).

The problem is the weak yen. I think Miss Yellen has stopped the kabuki show of rate hikes. Now is the time to get down to business in preserving the US-dominated global financial system. If the yen is not strengthened, the big bad Chinese reds will unleash a devalued yuan to match the ultra-cheap yen of their main export competitor, Japan. In the process, US Treasuries will be sold off, and if that happens, it will mean the end of the American-led world game.

Next Steps

The G7 will meet in a week. The communique following the meeting will be of great interest to the market. Will they announce some kind of coordinated currency or bond market operation to strengthen the yen? Or will they remain silent but agree that all countries except the Bank of Japan (BOJ) should start cutting rates? Stay tuned!

The big question is whether the Fed will start cutting rates so close to the U.S. presidential election in November. Normally, the Fed doesn’t change policy so close to an election. However, typically, the favored presidential candidate doesn’t face a possible prison sentence, so I’m prepared to be flexible in my thinking.

If the Fed cuts rates at its upcoming June meeting and their preferred adjusted inflation measure remains above target, the USD/JPY exchange rate will fall sharply, which means the yen will strengthen. Given that Slow Joe Biden is losing ground in the polls due to rising prices, I dont think the Fed is ready to cut rates. The average American is obviously more concerned about their vegetables becoming more expensive than the cognitive ability of the old man seeking re-election. To be fair, Trump is also a vegetable because he likes to eat McDonalds fries and watch Shark Week. Despite this, I still think cutting rates is political suicide. My base case is that the Fed will keep current policy unchanged.

By June 13, when these amateurs sit down to their taxpayer-funded feast, the Fed and the Bank of Japan will have held their June policy meetings. As I have said before, I do not expect any changes in monetary policy from the Fed and the Bank of Japan. The Bank of England (BOE) will also meet shortly after the G7 meeting, and although the market generally expects its policy rate to remain unchanged, I think we may have a surprise cut given the rate cuts by the Bank of Canada and the European Central Bank. The Bank of England has nothing to lose. The Conservatives will suffer a heavy defeat at the next election, so there is no reason to disobey the orders of their former colonial masters in order to control inflation.

Leaving the turbulent zone

This week, rate cuts from the Bank of Canada and the European Central Bank kicked off the June central bank policy changes that will lift cryptocurrencies out of the northern hemisphere summer doldrums. This was not the base case I expected. I thought the fireworks would go off in August, right around the time the Fed holds its Jackson Hole symposium. That’s usually the venue for announcements of sudden policy changes in the fall.

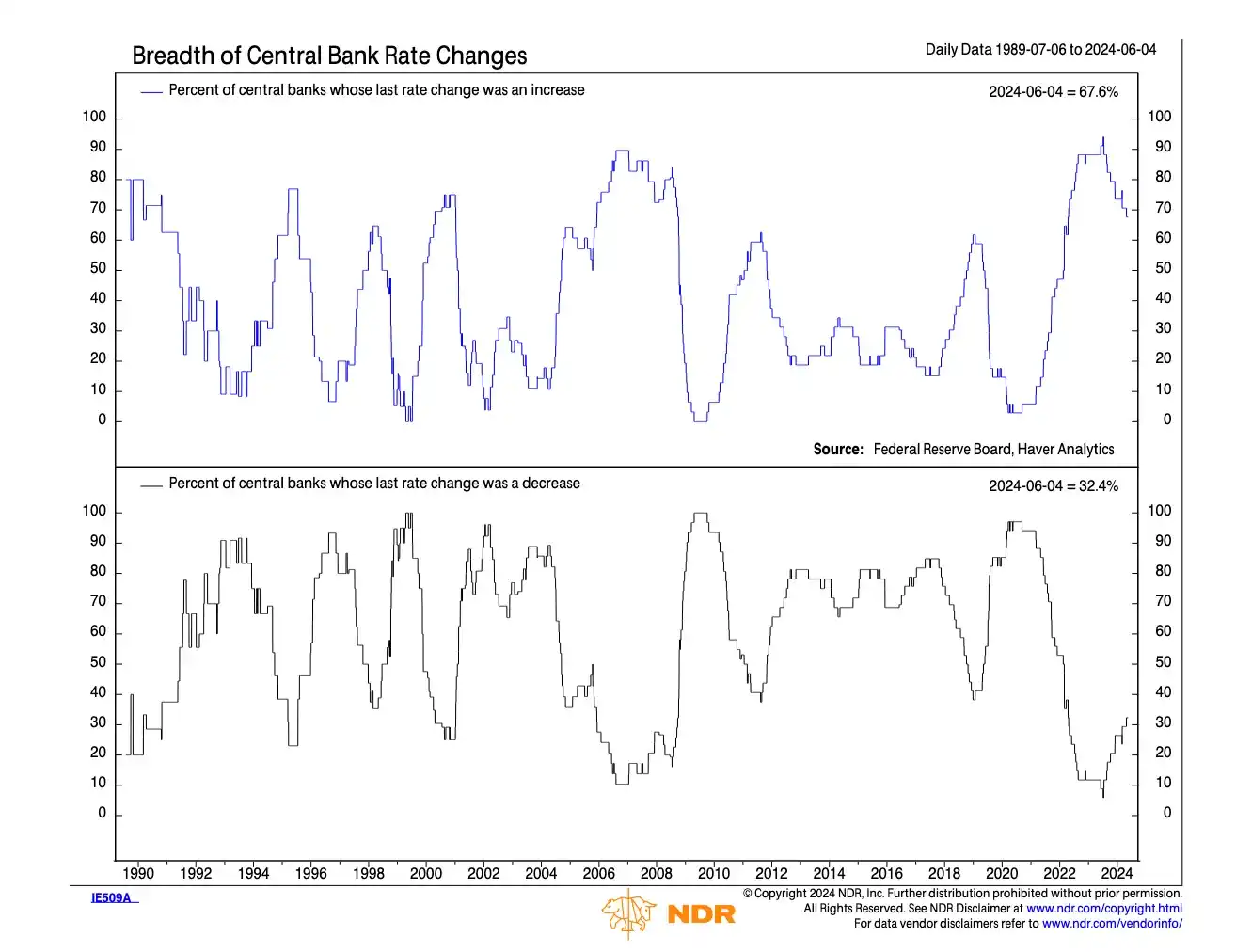

The trend is clear. The fringe central banks are beginning an easing cycle.

We know how to play this game. It’s the game we’ve been playing since 2009, when our savior Satoshi Nakamoto gave us the weapons to defeat the demons of legacy finance.

Go long Bitcoin, then other altcoins.

The macro environment has changed relative to my benchmark, so my strategy will change with it. For those Maelstrom portfolio projects that ask me whether to launch their token now or later, my answer is, start now!

With my excess synthetic USD cash (e.g. Ethena’s USD, USDe) holdings and earning a nice annual yield, now is the time to deploy it again in altcoins I believe in. Of course, I’ll tell readers what these are after I buy them. But one thing is for sure, the crypto bull market is waking up and about to pierce the veneer of profligate central bankers.

This article is sourced from the internet: Arthur Hayes: Now is the best time to invest in Bitcoin and altcoins

Related: Over 82 Million Shiba Inu (SHIB) Tokens Burned in Past 24 Hours: Price Impact

In Brief 82 million Shiba Inu tokens burned, increasing burn rate by 4,111.57%. Shiba Inu community hopeful despite minor price impact on SHIB. Recent bullish development includes Shibarium hardf fork. Over 82.14 million Shiba Inu (SHIB) tokens have been burned, resulting in an extraordinary 4,111.57% increase in the burn rate over the past 24 hours. Shibburn, the dedicated Shiba Inu burn tracker, monitored the development. Can Shiba Inu Price Surge 24%? The process of burning these tokens involves permanently removing them from circulation by transferring them to a dead wallet. This method is strategically designed to decrease the overall supply of SHIB, thereby increasing its scarcity and potential market value. Following this recent burn, the total number of SHIB tokens destroyed has climbed to over 410 trillion, with roughly 589…