Analisis Makro SignalPlus (06/06/2024): Arus masuk ETF BTC melampaui $1,2 miliar dalam dua hari

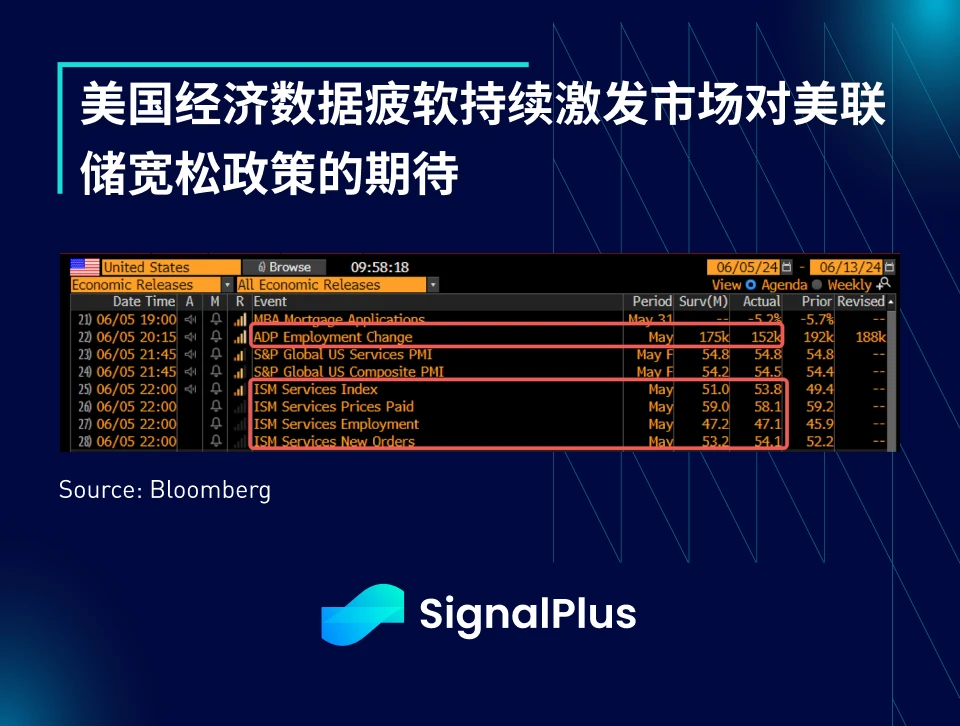

Risk appetite continued on the back of weak ADP employment data (152K vs 175K) and the employment component of the US Services PMI. Survey respondents cited “adjusting our hiring and capital investment strategies and managing borrowing”, “feeling the slowdown”, “hiring is slowing and prices are rising slightly”, and “high interest rates are reducing capital investment and slowing major facility upgrades”, leading the market to ignore the strongest overall performance of the non-manufacturing ISM index in 9 months (53.8 vs 51).

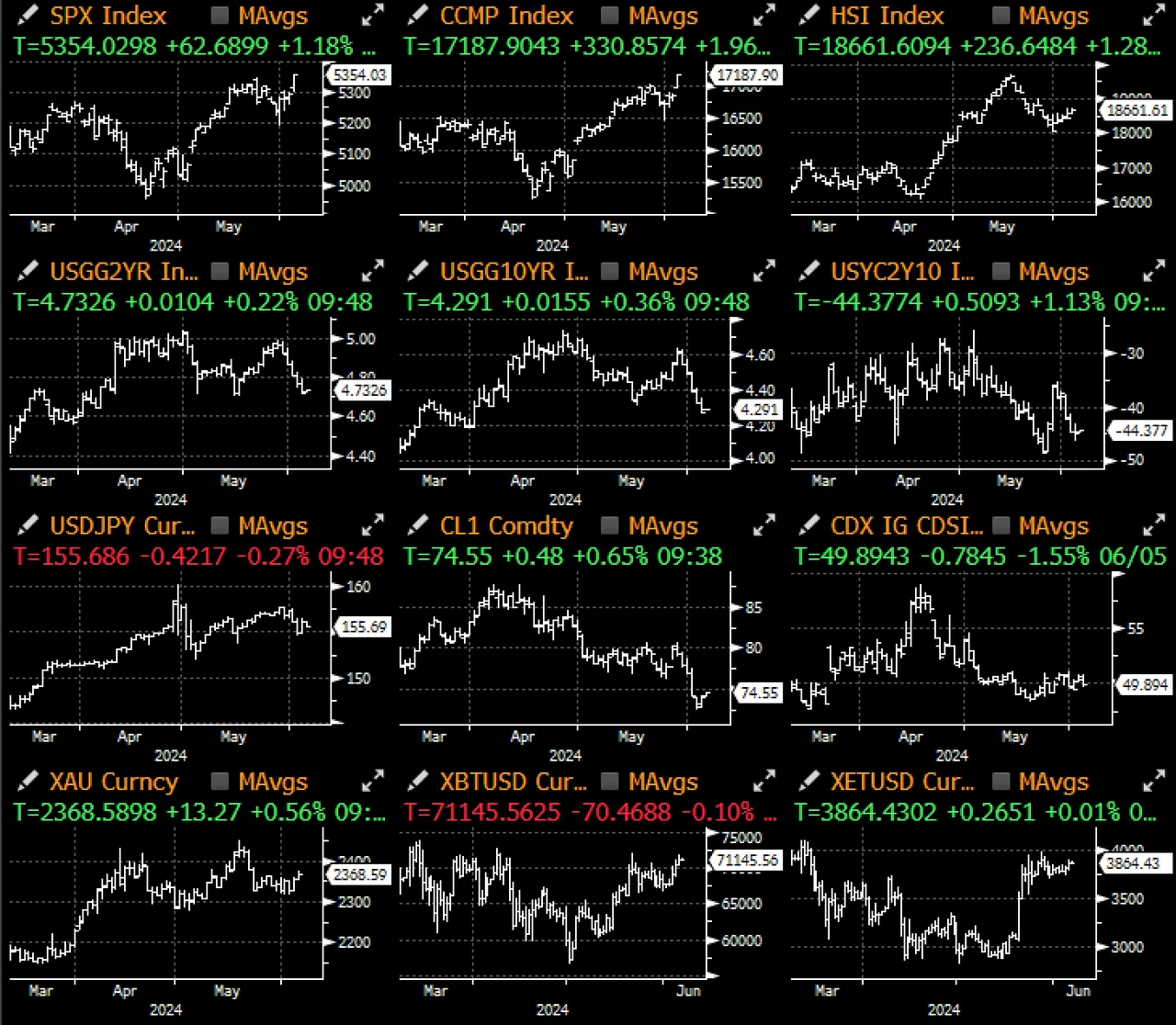

The Bank of Canadas 25 basis point rate cut is seen as the start of the upcoming easing cycle, and federal funds futures pricing shows that there will be two full rate cuts before the end of the year, and the probability of a rate cut in September has also risen to more than 60%. With the full return of the Feds rate cut expectations, the 10-year US Treasury yield is currently below 4.30%, the 2/10 s curve has re-inverted, and the spread has returned to the recent low of -45 basis points.

As yields fell, the Nasdaq rose another 2% yesterday and the SPX rose 1.1%, approaching all-time highs again. With a series of weak employment indicators in the past two weeks, and the market expecting weak non-farm payrolls on Friday, ETF investors have poured $58 billion into the US stock market this month, with inflows up to $315 billion so far this year, the traditional stock market adage Sell in May And Go Away has completely failed to come true.

Incredibly, Nvidias dominance of the market continues to expand, with its daily trading volume almost equal to the next nine stocks combined.

Finally, stocks are also poised to enter a friendly first half of July, the most seasonally positive two-week period for stocks, with data going back to 1928. The crypto space is no slouch either, with ETF inflows continuing to accelerate, with another $333 million yesterday following Tuesdays $886 million inflows. Will prices see more all-time highs? Are there any bears left? Enjoy it while you still can, folks!

Anda dapat mencari SignalPlus di Plugin Store ChatGPT 4.0 untuk mendapatkan informasi enkripsi real-time. Jika Anda ingin segera menerima pembaruan kami, silakan ikuti akun Twitter kami @SignalPlus_Web3, atau bergabunglah dengan grup WeChat kami (tambahkan asisten WeChat: SignalPlus 123), grup Telegram, dan komunitas Discord untuk berkomunikasi dan berinteraksi dengan lebih banyak teman. Situs Resmi SignalPlus: https://www.signalplus.com

This article is sourced from the internet: SignalPlus Macro Analysis (20240606): BTC ETF inflows exceeded $1.2 billion in two days

Terkait: Prediksi Harga Dogwifhat (WIF): Akankah Mencapai $5?

Secara Singkat Harga WIF bergerak dalam segitiga simetris, dan penembusan akan mengirimnya reli sebesar 44%. Chaikin Oscillator berada jauh di atas 0, yang menunjukkan bahwa tekanan beli telah meningkat sejak April dimulai. MACD juga hampir mencatat persilangan bullish, yang akan memperkuat potensi kenaikan. Kegilaan koin meme mendorong harga dogwifhat (WIF) mencapai titik tertinggi baru sepanjang Maret, dan tampaknya ini mungkin terjadi lagi. Saat tekanan beli meningkat, token meme Solana mungkin juga melonjak, asalkan dapat menembus resistensi ini. Mengapa Dogwifhat Mendapatkan Momentum di Kalangan Investor Harga WIF kemungkinan akan mencatat lonjakan dalam beberapa hari mendatang karena peningkatan bullish dari investor. Hal ini terlihat pada indikator Chaikin, yang…