Panduan Perdagangan Naratif ETF ETH: Memanfaatkan Peluang Emas Ekosistem ETH dan Sektor RWA

Penulis asli: 0X KYLE

Terjemahan asli: TechFlow

Perkenalan

In this article, the author analyzes the launch of Ethereum ETF and its potential impact on the market, and proposes a specific trading strategy. Although the market has changed during the writing period, the author believes that there is still room for profit. This article not only explores the performance of Ethereum and its related assets, but also involves the opportunities of the RWA (real world asset) industry under the new regulatory environment.

Konten teks

I started writing this article on May 24, 2024, when ETH was at $3632.22 and ONDO was at $1.08. While the prices of some assets have moved during the writing process, the author believes that the upside potential remains, albeit with a reduced risk/reward ratio on the trade.

Congratulations, dear crypto enthusiasts. In a move that surprised everyone, the U.S. Securities and Exchange Commission (SEC) approved a rule change for an Ethereum ETF , despite Gary Gensler’s public hardline stance against ETH.

I won’t go into the reasons behind this decision — that’s for the political commentators on Twitter. What we care about is that this decision has happened and marks a significant shift in the US government’s attitude towards cryptocurrencies.

This is also thanks to the approval of FIT 21 (“FIT 21 provides the regulatory clarity and strong consumer protections needed for the digital asset ecosystem to thrive in the United States”) – a new era of regulatory compliance for businesses is about to begin.

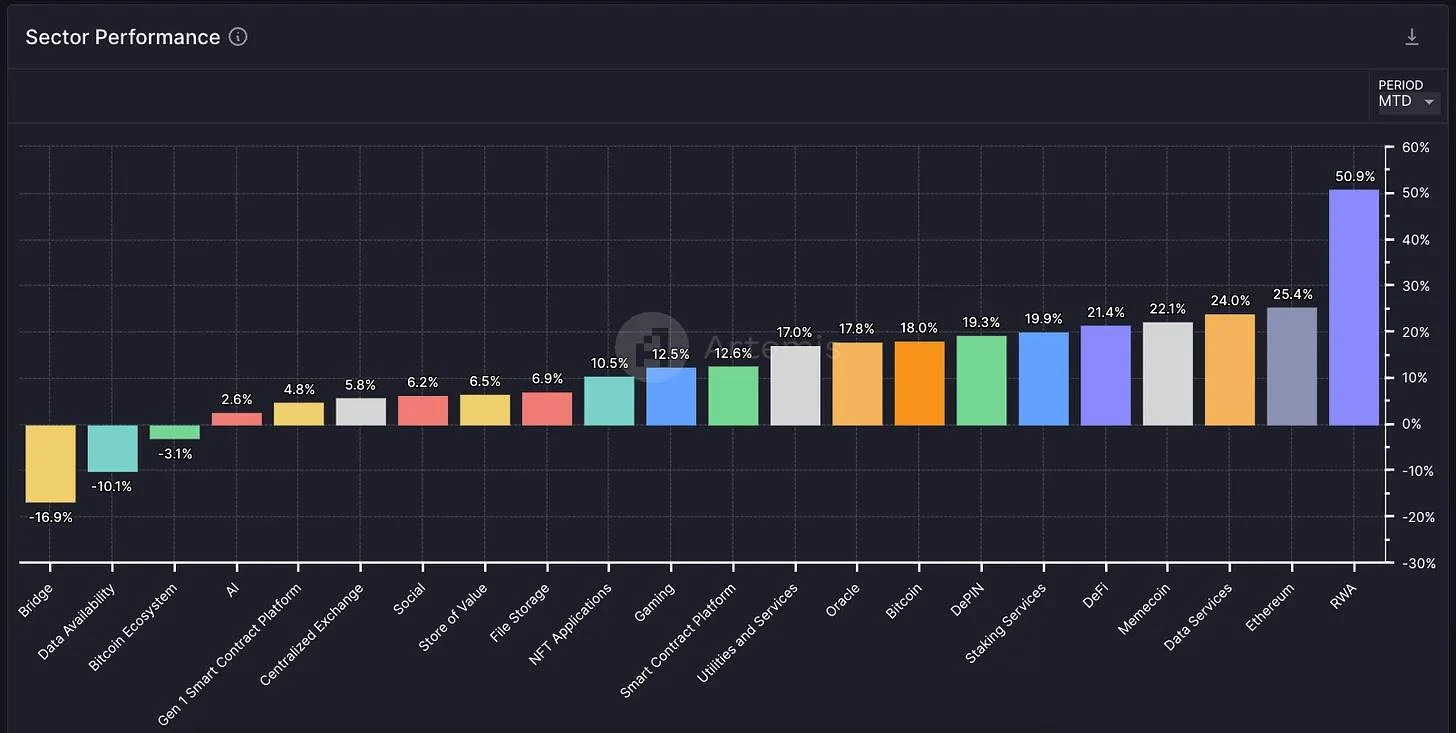

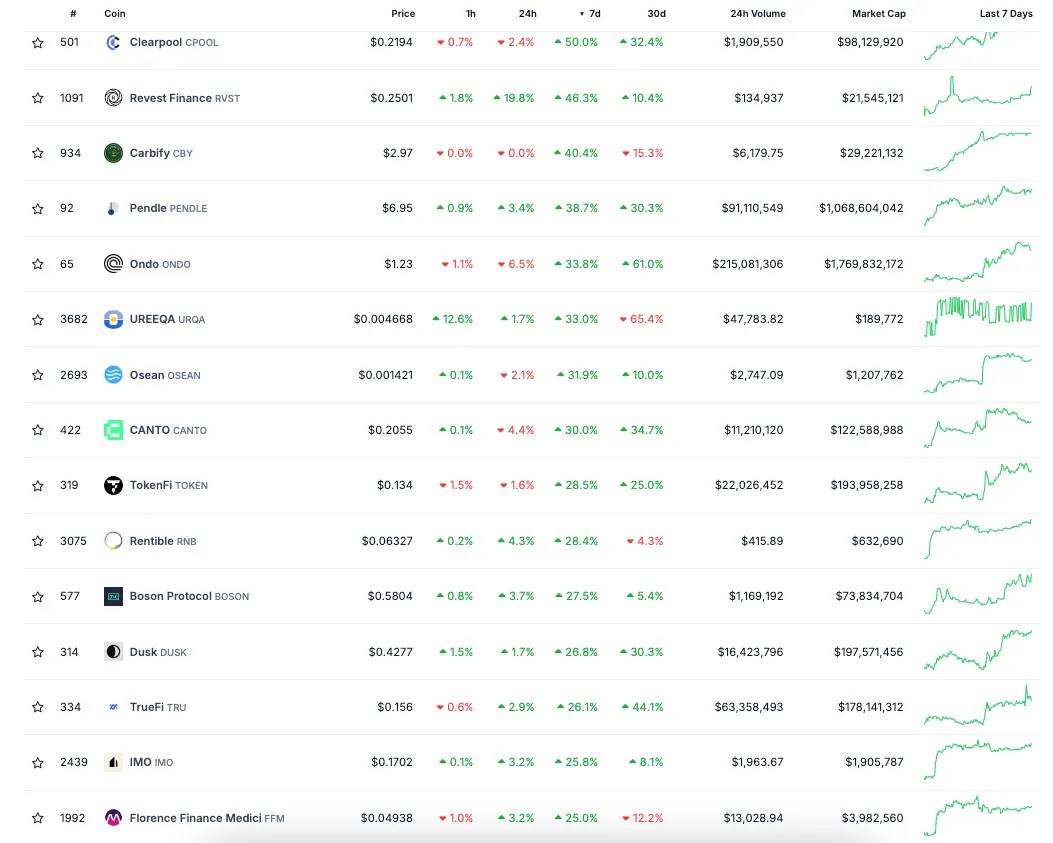

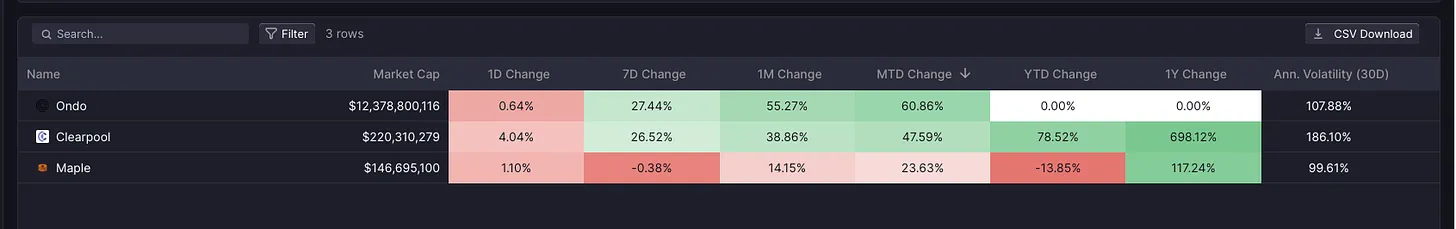

The US government’s new dovish stance on cryptocurrencies is very bullish, and you can see how the market is digesting this information — RWA and Ethereum sectors are the standout month-to-date (MTD) performers.

I believe that with the ETH ETF and the recent dovish stance towards cryptocurrencies, both sectors are poised to continue outperforming in the coming weeks and months.

Sector performance MTD, from Artemis.xyz

memperkenalkan

Overview

This argument can be broken down into two parts. First, the outperformance of Ethereum as an asset class and its associated alternatives, and then the outperformance of the RWA sector as beta to the overall “bullish crypto government stance”.

These two sectors are closely linked because:

-

With the SEC approving an ETH ETF, signaling a more dovish stance towards crypto, this means that institutionally driven RWA assets will also see more flows (as we’ve already seen with ONDO’s relationship with BlackRock).

-

The institutional “ETH thesis” has been tokenization, stablecoins, real-world settlement — major institutions will go around talking about RWA assets on Ethereum; after all, this has always been the main narrative for ETH.

therefore:

-

Long ETH and its best beta

-

Long RWA – ONDO is my favorite

You could also consider going long on other RWAs, but the reason I don’t do that is because ONDO itself is an altcoin to ETH, and going down the risk curve just means that you are more vulnerable to the market in a downside scenario.

A comprehensive analysis of the ETH ETF

Now to break down the ETH ETF trade. I think this is very interesting because unlike the BTC ETF, which we had plenty of time to “prepare” for, the ETH ETF caught many market participants off guard. That’s why we saw a 25% rally in ETH on a day when the odds of an ETH ETF getting approved changed dramatically overnight.

The problem is that the market rarely allows you to make the same trade twice – and the argument for this trade relies on the idea that an “ETH ETF is not priced in yet.” To gauge this, we first have to look at the performance of the BTC ETF:

Key Dates for BTC ETFs

-

June 15, 2023: A critical week for BTC, BlackRock shows their hand and files for a spot Bitcoin ETF

-

October 23, 2023: Perhaps what really solidifies the possibility of a BTC ETF is that the SEC did not appeal Grayscale’s court ruling, which means they are seriously considering it → Markets are therefore confirmed

-

January 10, 2023: Bitcoin ETF officially launched

Some things to note

-

BlackRock ETF announcement essentially kicks off the end of discount trading

-

The discount will only fully end when the ETF is launched (this statement may seem obvious, but if you think about it, its like free money now that weve proven that an ETF can/will be launched, so the discount may even end before the ETF is launched)

-

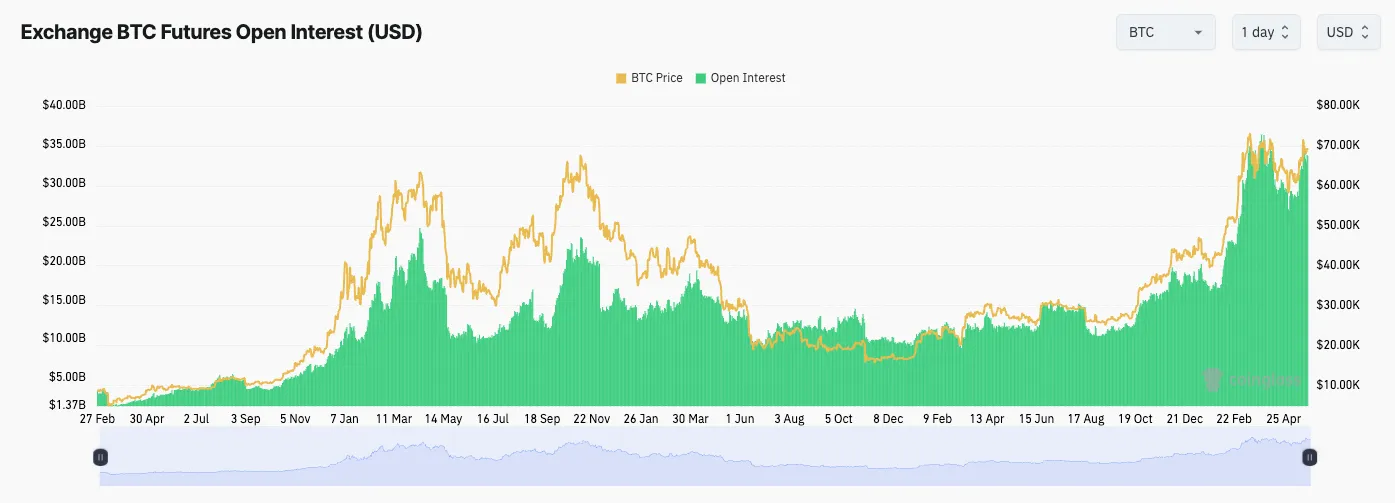

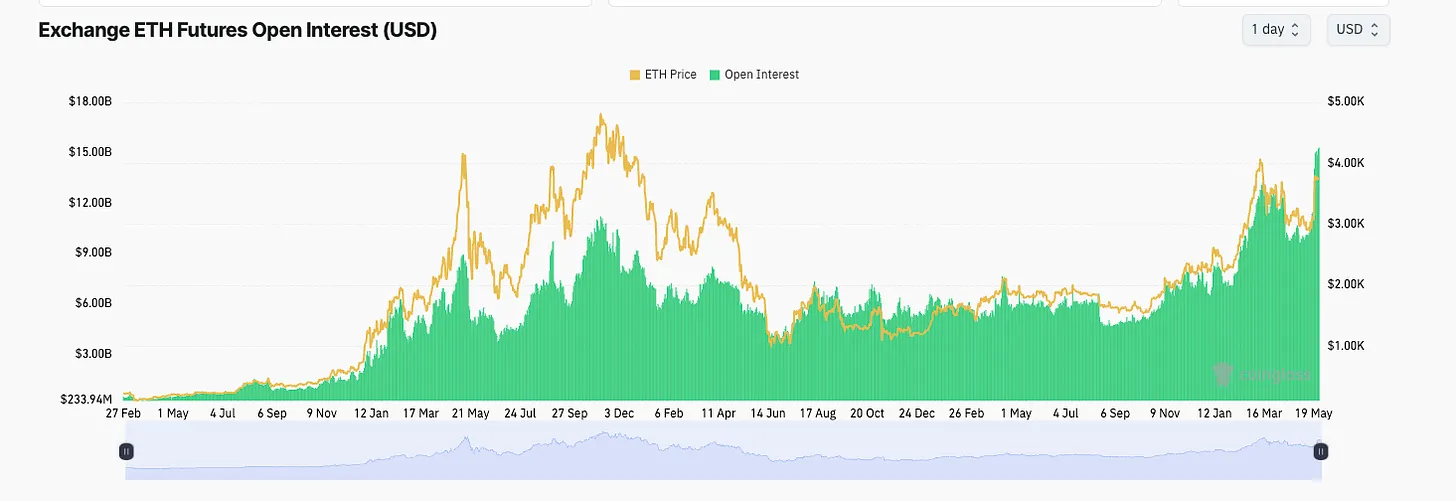

After June 15, open interest (OI) surged, fell back in August, but started to rise in October, peaking in February.

-

I follow the CME OI because it is the best tool to understand institutional positioning

Key Dates for the ETH ETF

-

May 20, 2024: Bloomberg analyst raises odds of ETH ETF approval from 25% → 75%

-

May 23, 2024: SEC approves exchange-traded spot Ethereum ETF application

There are some interesting things to note here:

-

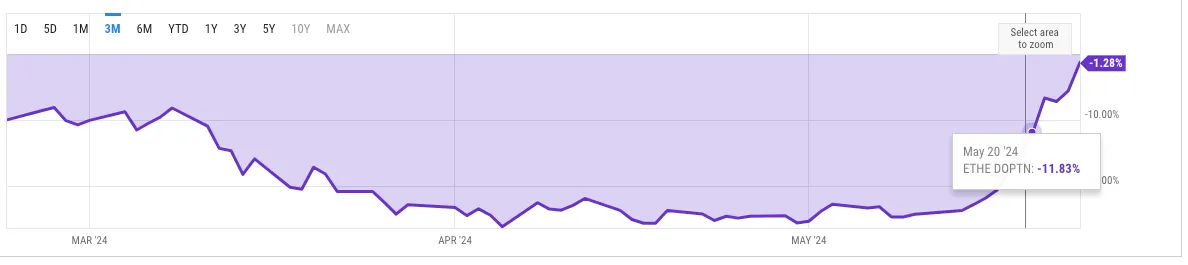

Grayscale Ethereum Trust (ETHE) closed at a discount of -24% to -1.28% in 2 days, while GBTC took months to close

-

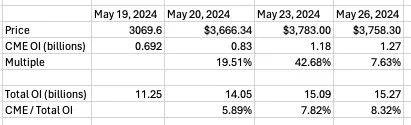

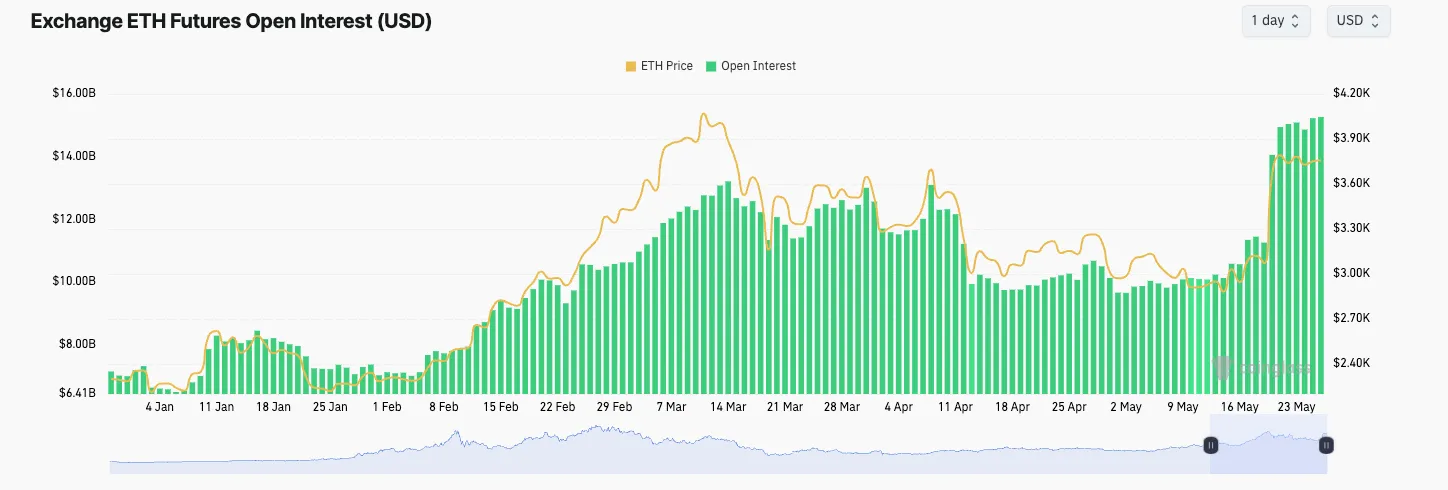

CME OI growth is not as strong as BTC ETF growth

-

Most of ETHs price action was reflected when the market adjusted the probability of ETF approval upward, rather than when the actual event of ETF approval occurred. This means that the market has already acted in advance of the actual announcement, reflecting the change in expectations for the ETF. In contrast, each Bitcoin ETF announcement has led to a significant increase in price, which shows that the market will not react the same way to the same trading opportunity twice.

Arguments and risks

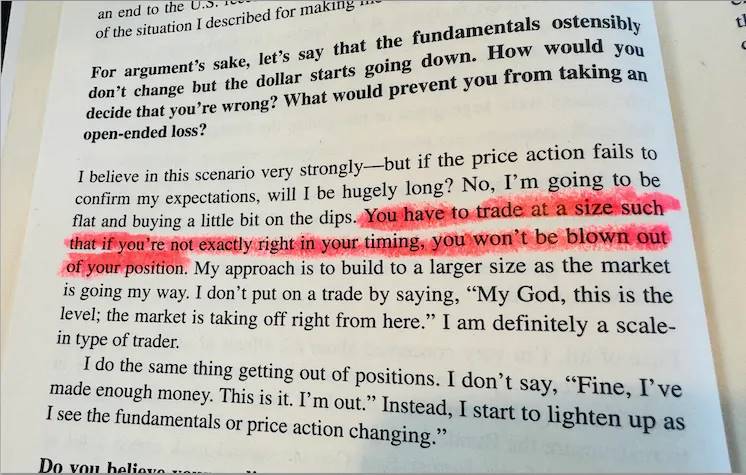

I’m going to start with the risk of a trade because I believe it’s more important to measure the downside risk of a trade than the upside risk – manage your downside risk and let the upside risk be managed naturally.

mempertaruhkan:

Key Risks: Market Top/Close to ETH Top/Time-Based Capitulation

The argument for this is how quickly the discount closed and how ETH’s price performed around the announcement. You could argue these guys knew how the trade worked — it was basically an up-and-down trade, but the CME OI and total OI were basically stagnant.

If ETH OI was only 4 billion less than BTC OI on January 10, this could be a sign of all longs are long, whos going to buy?

Honestly, I find this argument pretty strong. I believe the market is front-running this trade – even though the ETF has just launched, the OI has already expanded past all-time highs, unlike BTC trading where the market only saw such high OI when the ETF launched.

The market equates “ETF approval” with “ETH ETF launch,” which are two completely different things. This view is reasonable when you look at how the price reacted upon the approval announcement and how quickly the discount closed.

ETH OI surges

BTC OI surges

I actually agree with this sentiment, which is why I said at the beginning of the article that “both sectors are poised to continue to outperform in the weeks and months ahead.”

I believe that when market participants realize that the impact of the Ethereum ETF will not be immediate, there may be a price decline (i.e. time-based capitulation). This is a suitable time to buy. I have set up buy orders at different price levels and plan to complete them gradually and steadily. Here is a paragraph to illustrate how I trade:

Special regulatory risks

I dont know how registration risk works so I cant really comment on that, but from what Ive seen on Twitter (DOT) COM, people are saying why only 19 b-4s are getting approved and not S-1s.

Essentially, this means that it can be challenged within the next 10 days I dont know if this is true. But if it is true, if the whole thing is a scam, it will undoubtedly bring huge risks to trading.

Perhaps there are other risks hiding between the lines of this approval, which is definitely something to bear in mind.

I like this trade. What should I do next?

I know this post is already long, but we are getting into the fun stuff. The story so far is: ETH is good, but the market may have front-run too much. But in the long run, there are still bullish catalysts. So, what should you buy?

When choosing a beta for ETH, many participants will be caught in a dilemma – after all, you have Liquid Staking Derivatives (LSDs), L2s, ZK-Rollups and De-Fi protocols, Memes, and more to choose from.

So when plotting the performance of all of these coins, we can see that the top performing coins (sorted by performance from highest to lowest) are:

PEPE, LDO, UNI, PENDLE, METIS, AAVE

This is over a 1 week lookback period (i.e. May 18th – May 26th). This is a crude way to measure performance – a more scientific approach would be to actually calculate the beta of these coins over a more “proper” lookback period, but for me this method works.

I personally chose to go long PEPE and PENDLE among all the coins because they have been the darlings of the market all year. Not only have these coins performed well in specific situations – they are among the best performing coins so far this year.

Best performing coins among the top 100, YTD

Therefore, I think PEPE + PENDLE offer the most upside. They also have the added effect of being high-profile coins, and the market loves them; I would not discount the power of the PEPENDLE combination.

Time of RWA transaction

I spent too long discussing the ETH ETF deal, and now I don’t have the energy to write about the RWA deal. The argument is simple: RWA has been the content driven by institutions entering crypto, and ETH has been the main chain – ONDO has a partnership with BlackRock on ETH.

So this is a beta play to the overall ETH narrative. For asset selection, my main choice is ONDO, and some people I know are also promoting CANTO/DUSK. Personally, I keep it simple on this one – 1 ONDO = 1 CONDO.

lainnya

As a side note, I think a good hedge trade would be the ETH/SOL pair. Overall, I feel like SOL has peaked during this time and a long ETH/short SOL beta would be very attractive.

Kesimpulannya

Whew! If you made it this far, you deserve a cookie! Hope you enjoyed this trade idea. Im getting back into form, so I hope to continue to come up with new trade ideas! Other than that, for you Americans out there, have a very happy Memorial Day. Im in NYC, so feel free to reach out if you want to grab a coffee.

Also, here’s a screenshot I wanted to include just to show how people may be overestimating this whole “spot ETF approval” thing and positioning themselves too early.

This article is sourced from the internet: ETH ETF Narrative Trading Guide: Seizing the Golden Opportunity of ETH Ecosystem and RWA Sector

Terkait: Bitcoin (BTC) Incar Reli Besar: Meningkatnya Permintaan Akan Mendorong Pemulihan

Secara Singkat Harga Bitcoin masih bergerak dalam pola bendera, bersiap untuk potensi penembusan dengan mengamankan $65.000 sebagai support. NUPL menunjukkan bahwa permintaan telah mengalami peningkatan yang cukup besar dalam siklus ini, didukung oleh minat institusional. Permintaan ini kemungkinan akan meningkat ke depannya, mengingat BTC menghadirkan rasio risiko/imbalan yang menarik bagi investor. Harga Bitcoin (BTC) mengantisipasi reli, yang akan membantu mata uang kripto memulihkan kerugiannya baru-baru ini. Institusi adalah kunci untuk ini, tetapi investor ritel juga mendapatkan keunggulan di pasar. Ini akan memberi BTC dorongan yang diperlukan untuk keluar dari tren turun saat ini. Permintaan Bitcoin Melihat Lonjakan Harga Bitcoin sangat bergantung pada institusi untuk kenaikan saat ini, dan pasar melihat efeknya. Jumat lalu menandai yang pertama…