Bitget Research Institute: SEC AS menyetujui ETF spot Ethereum 19b-4, ETHFi dan aset ekologis lainnya diharapkan akan bergabung

Cryptocurrency prices saw significant volatility on Thursday, with liquidations of all leveraged crypto derivatives positions surging to over $360 million that day, the highest level since May 1:

-

The sectors with strong wealth-creating effects are: RWA sector and Ethereum staking sector;

-

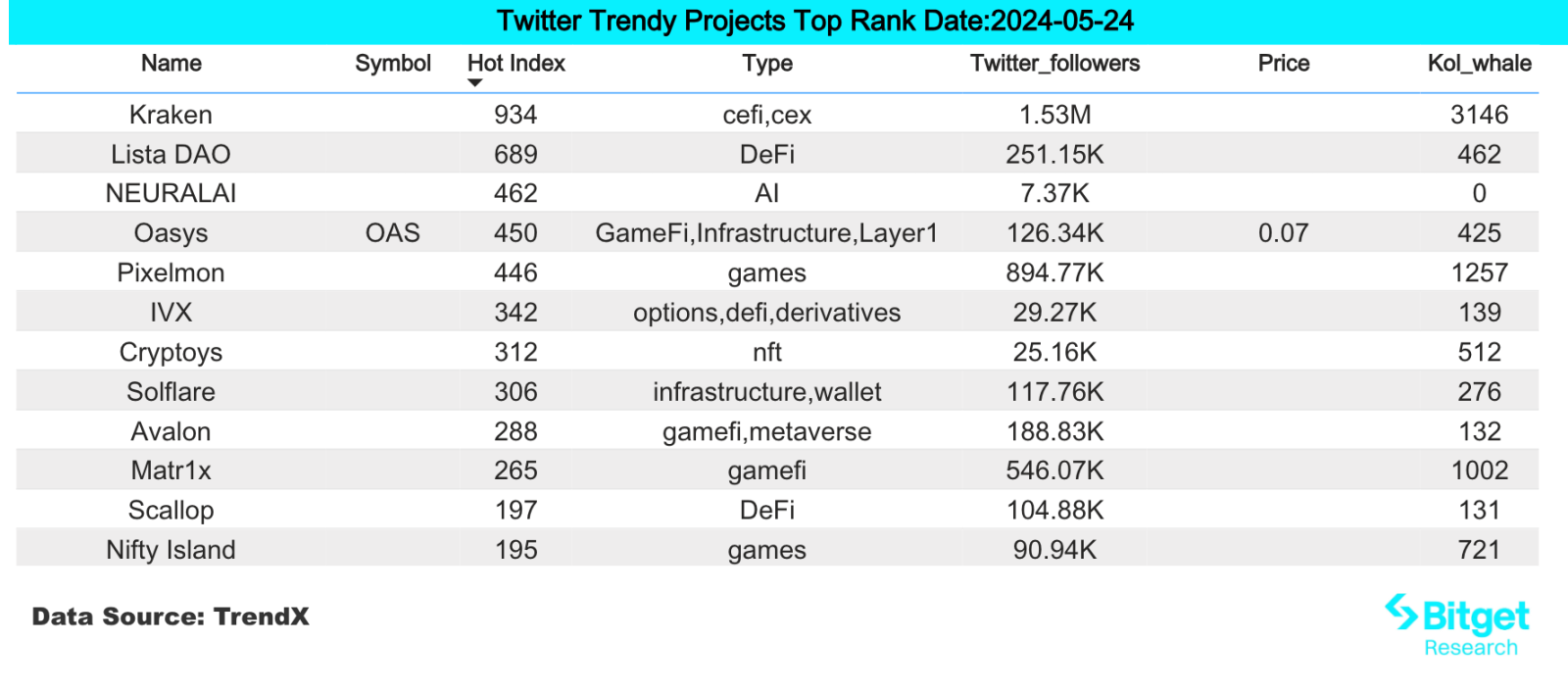

Hot search tokens and topics by users are: Plume Network, Lista (LISTA);

-

Potential airdrop opportunities include: Sanctum, Synthr;

Data statistics time: May 24, 2024 4: 00 (UTC + 0)

1. Lingkungan pasar

Cryptocurrency prices saw significant volatility on Thursday. Before the approval, ETH first fell to $3,500 around the closing time of the traditional U.S. market, then soared to around $3,900, and finally stabilized above $3,800 after confirmation. Bitcoin also fell to a low of $66,000, then soared to $68,300 before falling back below $68,000.

According to data from CoinGlass, during this turbulent period, liquidations of all leveraged crypto derivatives positions soared to more than $360 million that day, the highest level since May 1. Most of the liquidated positions were long positions, worth about $250 million, indicating that highly leveraged traders were concentrated on betting on an immediate surge after the ETF was approved. ETH traders were hit the hardest, with liquidations reaching $132 million.

2. Sektor yang menghasilkan kekayaan

1) Sector changes: RWA sector (ONDO)

Main reason: This bull market mainly originated from the traditional market buying brought by ETFs. As a way to introduce traditional financial markets, RWA has been constantly updating its products and raising funds. Recently, RWA layer 2 network Plume Network completed a $10 million seed round of financing.

Rising situation: ONDOs daily increase today is 13.46%;

Faktor-faktor yang mempengaruhi prospek pasar:

-

Perubahan kebijakan moneter makro: Dari segi lingkungan makro, kenaikan imbal hasil obligasi Treasury AS bertenor 10 tahun mendukung fundamental jalur ATMR; kita perlu memperhatikan perubahan selanjutnya pada indeks dolar AS, imbal hasil Treasury AS dan pasar kripto, dan secara dinamis menyesuaikan strategi perdagangan;

-

Perubahan dalam proyek TVL: Proyek jalur ATMR pada dasarnya didukung oleh TVL. Anda dapat memperhatikan perubahan TVL jalur ATMR. Jika TVL suatu proyek terus naik/tiba-tiba naik, biasanya itu merupakan sinyal untuk membeli;

2) Sector changes: Ethereum staking sector (LDO, SSV, ETHFI)

Main reason: The U.S. Securities and Exchange Commission today approved the 19 b-4 forms of multiple Ethereum spot ETFs, including those from BlackRock, Fidelity and Grayscale. Since ETFs only allow Ethereum tokens and do not allow staking, this regulation greatly reduces the attractiveness to ETF investors, so the Ethereum re-staking sector will usher in substantial benefits.

Rising situation: LDO rose 10.8% in the past 4 days, SSV rose 7.97% in the past 7 days, and ETHFI rose 22.85% in the past 4 days;

Faktor-faktor yang mempengaruhi prospek pasar:

-

Fund inflow after ETH ETF is approved: At present, the ETF is in the countdown for listing after approval. If a large amount of funds flow in after approval, it will further push up the ETH price.

-

Protocol trends: The cash flow of staking sector projects is relatively stable and easy to predict. They are a type of project whose token prices can be estimated more accurately. The main influencing factors are the protocol TVL, income distribution method, token destruction, etc.

3) The sector that needs to be focused on in the future: TON ecosystem

alasan utama:

-

Panteras investment in TON may be at least over US$250 million, which is Panteras largest investment in cryptocurrency in history.

-

Notcoin, a high-traffic project in the TON ecosystem, has been listed on Binance, but the TON token itself has not yet been listed on Binance. The market expects that it is only a matter of time before TON is listed on Binance.

-

The infrastructure of the TON ecosystem is in its early stages. Currently, high-traffic projects such as Notcoin and Catizen have emerged, demonstrating a huge user base backed by Telegram.

-

The increase in the issuance of stablecoins in the ecosystem has brought financial vitality. The supply of USDT on the TON chain reached 130 million within two weeks, making it the eighth blockchain in terms of USDT issuance.

Daftar proyek spesifik:

-

TON: The native token of the Ton chain, currently listed on exchanges such as OKX and Bitget.

-

FISH: Ton ecosystem head meme token.

-

REDO: A dog-themed meme coin on the Ton chain.

3. Pencarian Populer Pengguna

1) Dapp Populer

Plume Network:

Modular RWA L2 network Plume Network announced its launch on Arbitrum Orbit. Plume is a modular L2 blockchain dedicated to real-world assets (RWA), integrating asset tokenization and compliance providers directly into the chain. Plume Network team members come from companies and projects such as Coinbase, Robinhood, LayerZero, Binance, Galaxy Digital, JP Morgan, dYdX, etc. Yesterday, it completed a $10 million seed round of financing, led by Haun Ventures, and participated by Galaxy Ventures, Superscrypt, A Capital, SV Angel, Portal Ventures and Reciprocal Ventures. The funds raised will be used to recruit more employees in engineering design, marketing and community functions. The Plume Network open incentive testnet will be launched in the next few weeks, followed by the mainnet later this year.

2) Twitter

Lista (LISTA):

Binance Megadrop will launch Lista (LISTA), a liquidity staking and decentralized stablecoin protocol. The maximum supply of the token is 1 billion, the initial circulation is 230 million (23% of the supply), and the total Megadrop is 100 million (10% of the supply). Binance will list LISTA after the Megadrop is completed, and the specific listing plan will be announced separately. Lista DAO is a liquidity staking and decentralized stablecoin lending protocol. Users can stake and liquidity stake on Lista, as well as borrow lisUSD using a range of decentralized collateral. The report also introduces the LISTA token: LISTA is the governance token of Lista DAO, which is used for the following functions: governance, protocol incentives, voting, and fee sharing. The protocol consists of the following main parts that work together: decentralized stablecoin lisUSD and BNB liquid staking token slisBNB.

3) Wilayah Pencarian Google

Dari perspektif global:

ETH ETF: A new compliance milestone in the crypto world: Ethereum spot ETF finally approved. On May 23rd, local time in the United States, the U.S. Securities and Exchange Commission (SEC) officially approved all Ethereum ETFs, providing investors with a new opportunity to invest in Ethereum through traditional financial channels. This decision is seen as a major endorsement of the cryptocurrency industry, becoming the second cryptocurrency ETF approved by the SEC after the spot Bitcoin ETF. After approval, the price of Ethereum rose slightly and fluctuated around $3,800, reaching a high of $3,856. It is currently reported at $3,807, a 24-hour increase of 1.3%. After the news landed, the fluctuation was not as large as in the previous few days, but it caused a lot of attention on the entire Twitter social media.

Dari penelusuran terpopuler di setiap wilayah:

(1) Europe and CIS regions show a certain degree of interest in MEME:

As the crypto market rebounded significantly, PEPE tokens continued to hit new highs, and users began to buy back their chips into MEME coins to gain higher returns. From the searches of European users, it can be seen that European users generally search for MEME coins more frequently, which also means that users in the European market are more involved in the MEME coin market.

(2) The Asian region has shown a clear increase in attention to BTC, ETH ETFs, etc.:

Influenced by Bloombergs report that Hong Kong may pass BTC and ETH ETFs this week, searches in the Asian region have clearly increased their attention to the event. As the core region of Asian finance, Hong Kong has always been at the forefront of financial innovation. With the passage of ETFs, it has once again become the focus of Asia. Traditional finance and large funds can enter the encryption field through this channel, which has a positive impact on both industry development and retail investment.

Potensi tetesan udara Peluang

Tempat suci

Protokol LST Ekosistem Solana Sanctum secara resmi mengumumkan peluncuran program loyalitas Sanctum Wonderland. Menurut laporan, Sanctum Wonderland bertujuan untuk memanfaatkan SOL sepenuhnya guna memperoleh manfaat melalui pengalaman gamifikasi. Pengguna dapat mengumpulkan hewan peliharaan dan memperoleh poin pengalaman untuk ditingkatkan dengan mempertaruhkan SOL, dan memperoleh EXP melalui hewan peliharaan.

Sebelumnya, protokol layanan staking likuiditas ekosistem Solana, Sanctum, telah menyelesaikan putaran pendanaan lanjutannya, yang dipimpin oleh Dragonfly, dengan partisipasi dari Solana Ventures, CMS Holdings, DeFiance Capital, Genblock Capital, Jump Capital, Marin Digital Ventures, dan lainnya. Total pendanaan kini telah mencapai US$1,1 triliun.

Metode partisipasi khusus: buka tautan, hubungkan dompet, isi kode undangan, ② tukarkan Sol dengan Infinity, setorkan setidaknya 0,122 SOL + 0,05. Dompet setoran perlu menyiapkan setidaknya 0,172 SOL, dan setorkan setidaknya 0,11 SOL. Hewan peliharaan akan otomatis tumbuh dan mendapatkan EXP. Setelah saldo LST lebih rendah dari 0,1 SOL, hewan peliharaan akan memasuki hibernasi dan berhenti mendapatkan EXP. Mereka yang mampu disarankan untuk menyetor lebih dari 1 SOL. 1 SOL akan mendapatkan 10 EXP per menit, yang dapat ditarik kapan saja, dan biaya GAS sangat rendah.

Synthr

Synthr is a full-chain synthetic protocol that allows cross-chain minting and transfer of synthetic assets without the need for cross-chain bridges. The project mints assets on-chain through synthetic assets (Synthetix), which means that its technology can easily bring RWA to the chain, such as real estate, bonds or stocks, for cross-chain transactions and transfers.

The project raised $4.25 million from top funds including MorningStar Ventures, Kronos Research, and Axelar Fdn.

Specific participation method: The project has just been opened for testing. Users can participate in early interactions by entering the test network, registering a wallet, and receiving test coins through the faucet. Continue to pay attention to the subsequent progress of the project and actively participate in various on-chain interactions.

Informasi lebih lanjut tentang Institut Penelitian Bitget: https://www.bitget.fit/zh-CN/research

Bitget Research Institute berfokus pada fokus pada data on-chain dan menambang aset berharga. Ini menambang investasi nilai mutakhir melalui pemantauan real-time atas data on-chain dan pencarian populer regional, dan memberikan wawasan tingkat institusional bagi para penggemar kripto. Sejauh ini, ini telah memberi pengguna global Bitgets aset berharga tahap awal di berbagai sektor populer seperti [Ekosistem Arbitrum], [Ekosistem AI], dan [Ekosistem SHIB]. Melalui penelitian berbasis data yang mendalam, hal ini menciptakan efek kekayaan yang lebih baik bagi pengguna global Bitgets.

【Penafian】Pasar ini berisiko, jadi berhati-hatilah saat berinvestasi. Artikel ini bukan merupakan nasihat investasi, dan pengguna harus mempertimbangkan apakah opini, pandangan, atau kesimpulan dalam artikel ini sesuai dengan keadaan spesifik mereka. Berinvestasi berdasarkan informasi ini adalah risiko Anda sendiri.

This article is sourced from the internet: Bitget Research Institute: US SEC approves Ethereum spot ETF 19b-4, ETHFi and other ecological assets are expected to continue to rise

Asli | Odaily Planet Daily Penulis | Asher Dalam seminggu terakhir, dengan rebound kuat harga Bitcoin, sektor GameFi juga mengalami peningkatan yang baik. Mungkin sekarang adalah waktu yang tepat untuk berinvestasi di sektor GameFi. Oleh karena itu, Odaily Planet Daily telah merangkum dan memilah proyek game blockchain yang baru-baru ini populer atau memiliki aktivitas populer. Kinerja pasar sekunder sektor game blockchain Menurut data Coingecko, sektor Gaming (GameFi) naik 6,9% dalam seminggu terakhir; total nilai pasar saat ini adalah $20.475.708.280, peringkat ke-28 dalam peringkat sektor, turun tiga peringkat dari peringkat sektor nilai pasar total minggu lalu. Dalam seminggu terakhir, jumlah token di sektor GameFi meningkat dari 360 menjadi 365, dengan 5 proyek ditambahkan, peringkat…