Kolom Volatilitas SignalPlus (20240522): ETF Resolusi Masa Depan

Yesterday (21 May), according to Jinshi, Fed Governor Waller said that weak inflation data in the next three to five months will allow the Fed to consider cutting interest rates at the end of the year, and there is no need to raise interest rates at the moment. Fed Vice Chairman Barr also reiterated that high interest rates need to be maintained for a longer period of time. The 10-year US Treasury yield fell for the first time in five days, once dropping to 4.40%, but has recovered most of its losses today, now reporting 4.437%. The three major US stock indexes closed higher, with the SP and Nasdaq rising 0.26%/0.2% respectively, reaching new historical highs again.

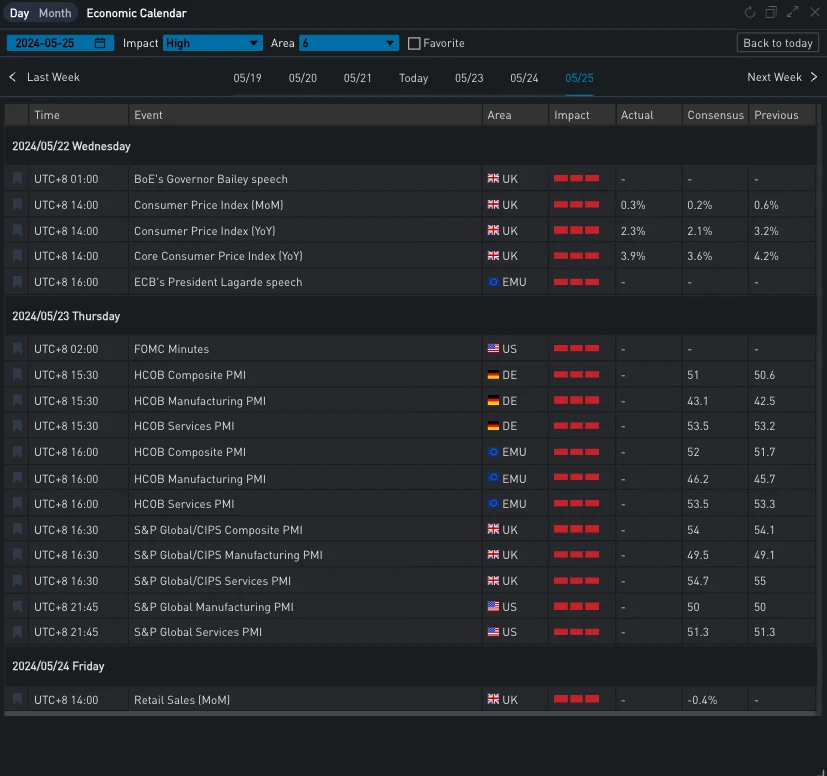

Sumber: SignalPlus, Kalender Ekonomi

Sumber: Investasi

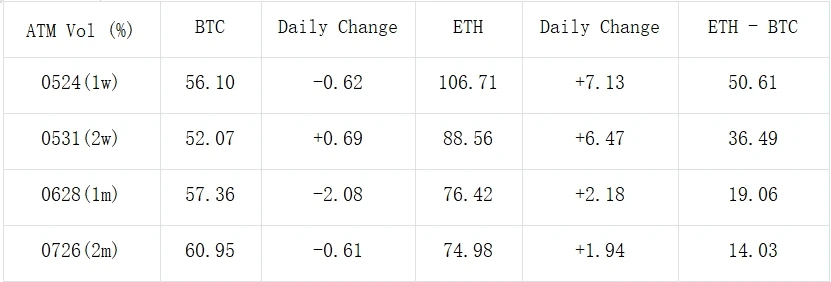

In terms of digital currencies, as the Ethereum spot ETF decision date approaches, ETHs overall IV level has risen again, and the price has successfully broken through the 3,700 mark. Bitcoin prices are slightly weak, and the currency price has adjusted back to around US$70,000.

Source: Deribit (as of 22 MAY 16: 00 UTC+ 8)

Sumber: SignalPlus

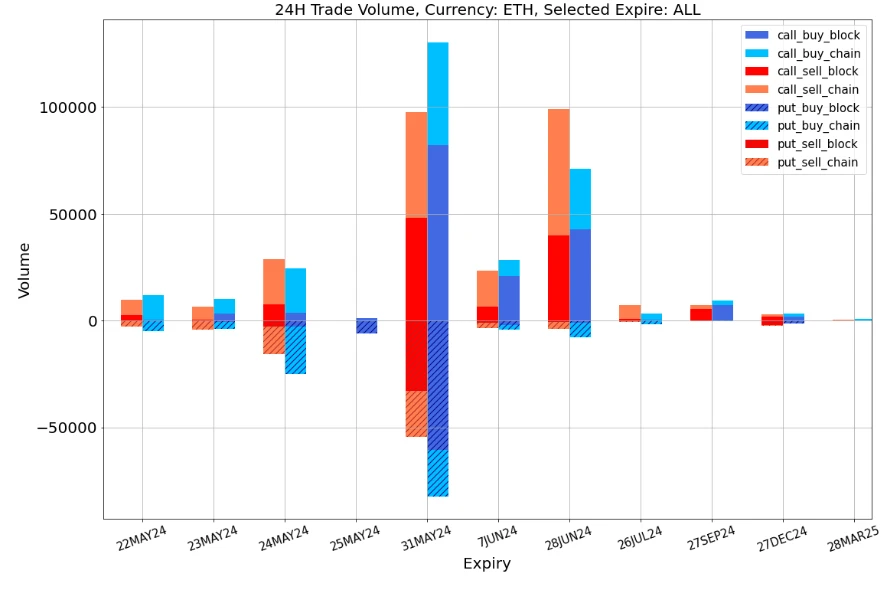

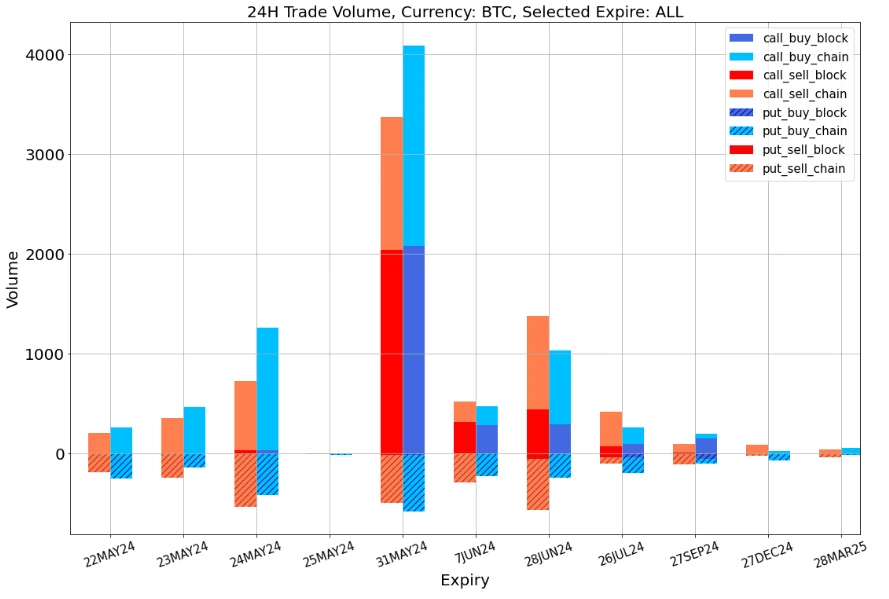

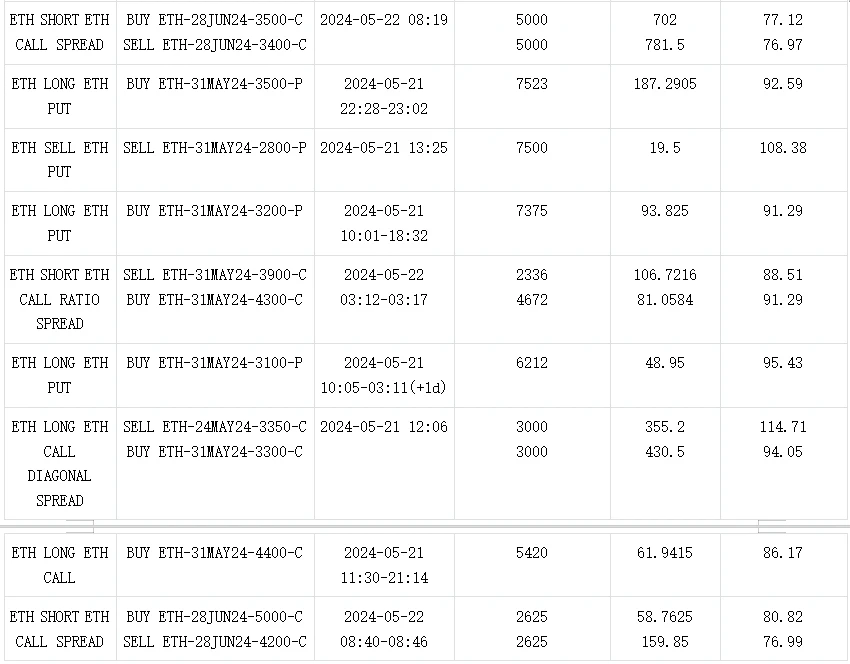

In terms of trading, BTC mainly adopts bullish strategies, among which the single-leg transaction volume of 31 MAY 77000 vs 81000 Call Spread is close to 1400 BTC, becoming the focus yesterday. In terms of ETH, the sharp rise in the price of the currency has caused a large number of stop-loss and take-profit orders, among which the 31 MAY 3000-C buy-back stop-loss is about 19500 ETH, and the 28 JUN 24 3600-C sell-profit is about 18000 ETH, which is the most significant position reduction point yesterday; the bulk platform has hot transactions, mainly including the June bullish Call Spread, the end of May Long 3400 Put, the selling of call options and the buying of put options on Wing explain the overall significant decline of ETHs Vol Skew in the upward market yesterday.

Sumber: SignalPlus

Sumber Data: Deribit, distribusi keseluruhan transaksi ETH

Sumber Data: Deribit, distribusi transaksi BTC secara keseluruhan

Sumber: Perdagangan Blok Deribit

Sumber: Perdagangan Blok Deribit

Anda dapat mencari SignalPlus di Plugin Store ChatGPT 4.0 untuk mendapatkan informasi enkripsi real-time. Jika Anda ingin segera menerima pembaruan kami, silakan ikuti akun Twitter kami @SignalPlus_Web3, atau bergabunglah dengan grup WeChat kami (tambahkan asisten WeChat: SignalPlus 123), grup Telegram, dan komunitas Discord untuk berkomunikasi dan berinteraksi dengan lebih banyak teman. Situs Resmi SignalPlus: https://www.signalplus.com

This article is sourced from the internet: SignalPlus Volatility Column (20240522): Tomorrows Resolution ETF

Terkait: Harga Polygon (MATIC) Terjebak dalam Konsolidasi, Tapi Bull Rally Mungkin Sudah Dekat

Sekilas harga Polygon saat ini tertahan dalam konsolidasi menuju level resistance di $0.746. Pemegang MATIC menunjukkan tanda-tanda potensi akumulasi, yang secara historis menghasilkan aksi unjuk rasa. Hanya 33% dari pasokan token asli Polygon yang menghasilkan keuntungan, sehingga memenuhi syarat untuk mendapatkan keuntungan yang besar. Harga Polygon (MATIC) menunggu isyarat bullish yang kuat yang dapat mendorong altcoin keluar dari konsolidasi yang saat ini dialaminya. Mengingat bahwa altcoin adalah salah satu aset yang menghasilkan keuntungan terendah, kemungkinan besar investor akan mendorong kenaikan harga ke tingkat buku. keuntungan. Petunjuk Investor Polygon tentang Akumulasi Harga MATIC dapat mengalami penembusan di atas penghalang $0.74 jika hanya investor yang bertindak sesuai. Selama pemegang MATIC menahan diri untuk tidak menjual, konsolidasi dapat berlanjut dan akumulasi dapat memungkinkan terjadinya kenaikan. Ini kemungkinan hasil untuk MATIC…