Kolom Volatilitas SignalPlus (16/05/2024): Makroekonomi positif, BTC kembali ke 66.000

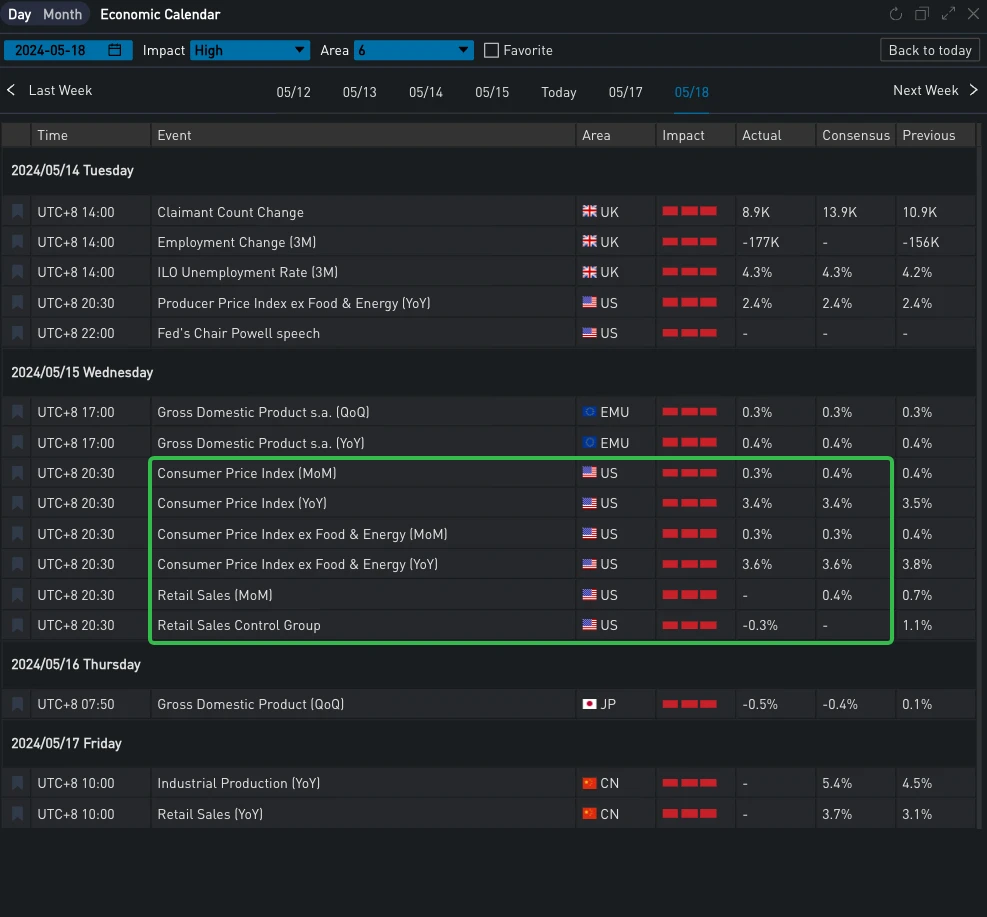

Kemarin (15 Mei 24), data ekonomi penting dirilis. Dalam beberapa hari terakhir, tiga data inflasi berturut-turut melampaui ekspektasi, sementara indeks CPI AS secara kasar sesuai dengan ekspektasi; data ritel secara tak terduga datar, melanjutkan pelemahan data konsumen baru-baru ini. Meskipun tingkat inflasi dan momentum saat ini masih jauh lebih tinggi dari target Fed, kedua data ini telah meredakan kekhawatiran pasar tentang percepatan kembali harga sampai batas tertentu, memulihkan kepercayaan pasar terhadap pemangkasan suku bunga Fed pada bulan September, dan imbal hasil Treasury AS turun dalam jangka pendek. Tiga indeks saham utama AS juga ditutup naik sekitar 1%, mencetak rekor tertinggi.

Sumber: SignalPlus, Kalender Ekonomi

Sumber: Investasi

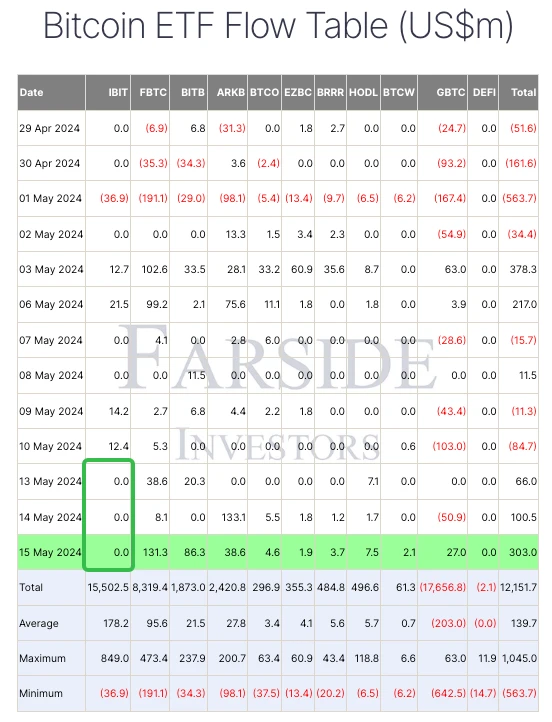

Dalam hal mata uang digital, didorong oleh melemahnya data ekonomi AS, harga BTC telah meningkat hingga menembus angka 66.000, menarik perhatian masyarakat. Arus masuk BTC Spot ETF baru-baru ini juga relatif sehat. Meskipun IBIT tidak lagi mengalami pertumbuhan, total arus masuk per hari kemarin mencapai 303 $m, yang sebagian besar disumbangkan oleh FBTC dan BITB. Di sisi lain, dari bagan perbandingan di bawah ini, kita dapat melihat bahwa kinerja ETH di putaran pasar ini relatif buruk. Dalam 24 jam terakhir, ia hanya memperoleh setengah dari peningkatan BTC dan kembali ke sekitar 3.000 dolar AS.

Sumber: TradingView

Sumber: Investor Farside

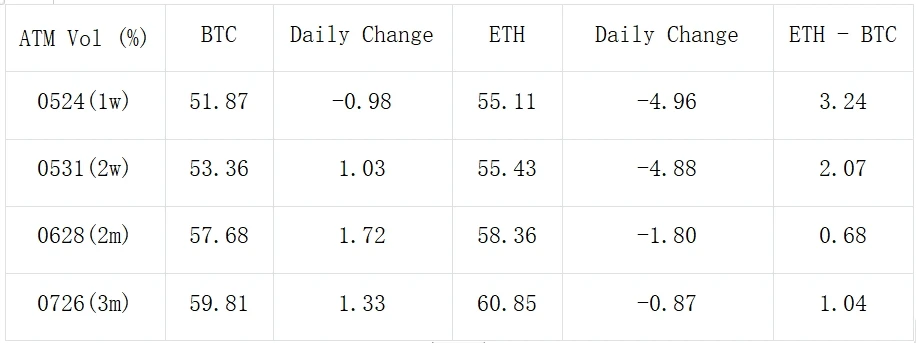

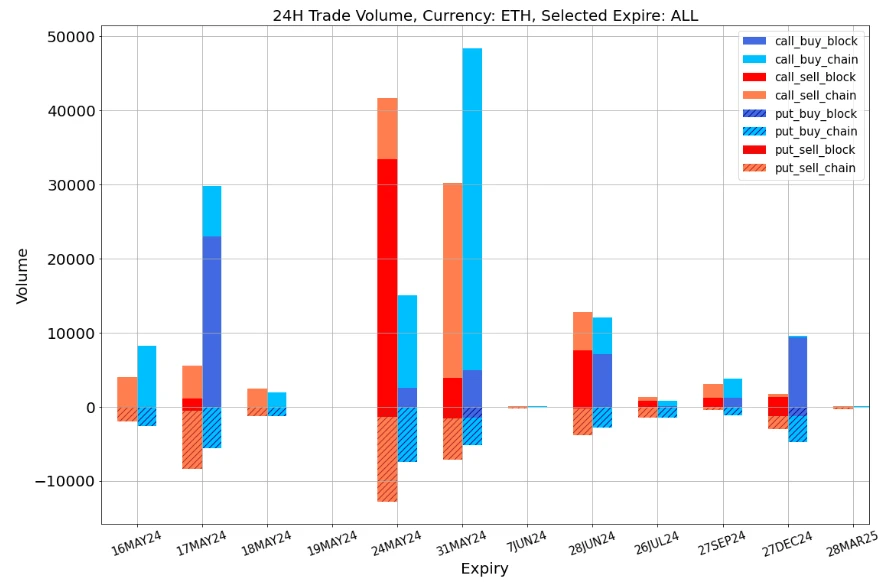

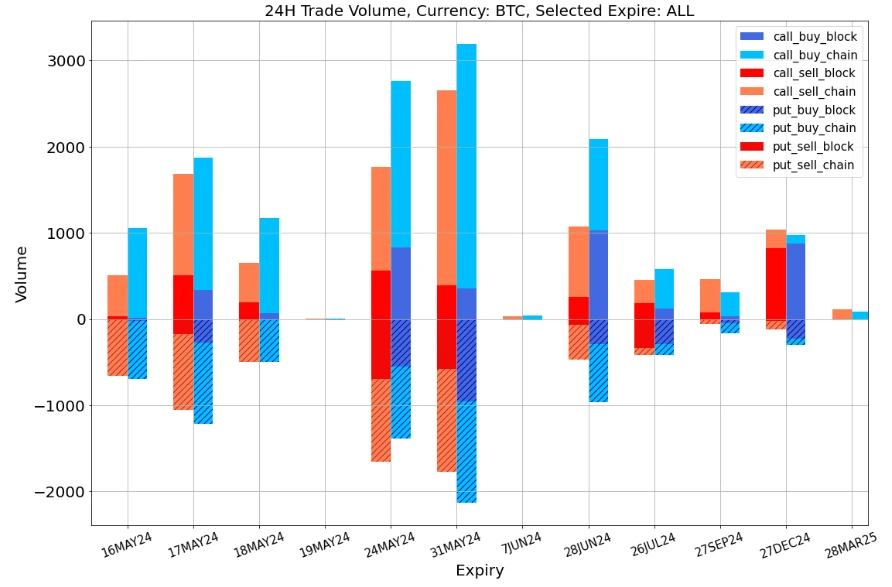

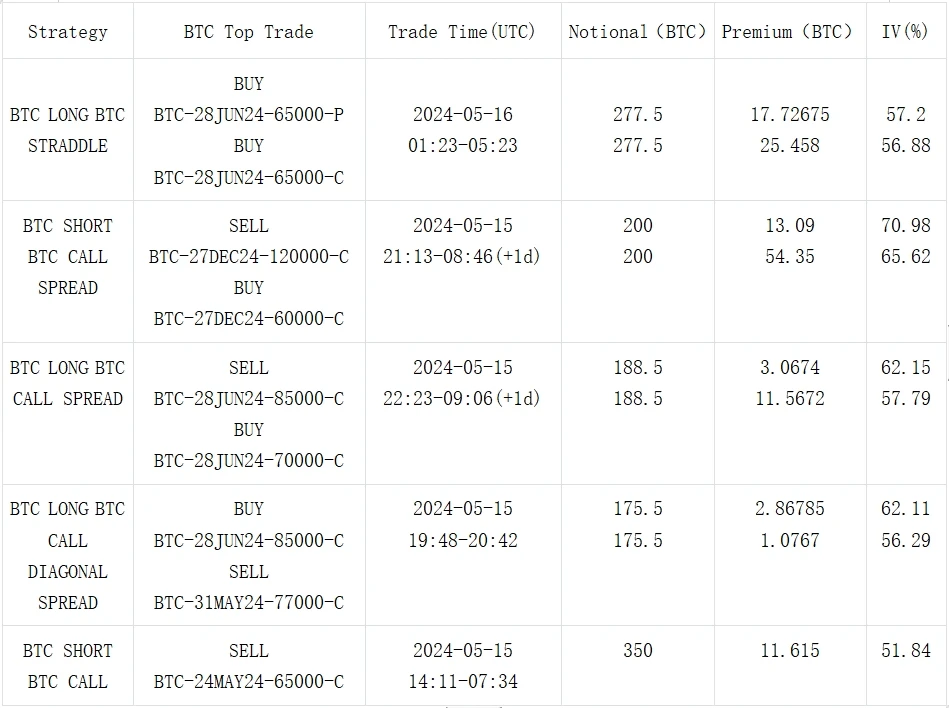

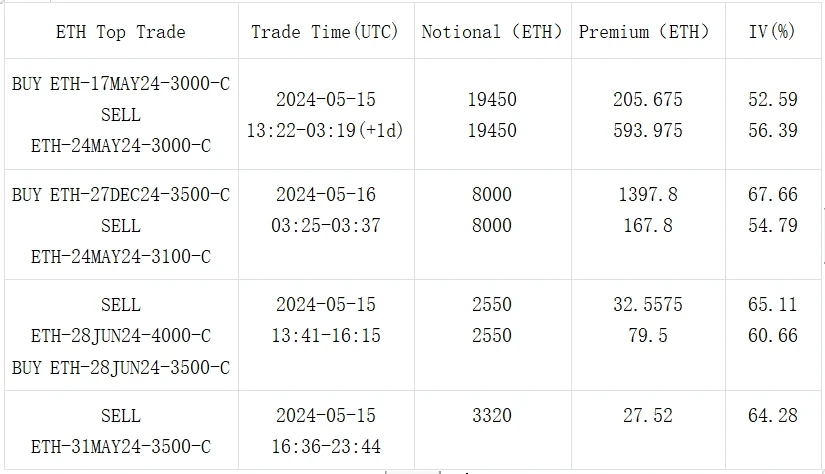

Dalam hal opsi, level volatilitas tersirat dari BTC dan ETH juga menunjukkan perubahan yang sangat berbeda. Perubahan utama BTC tercermin dalam pergerakan naik dari IV jangka menengah dan panjang. Perdagangan blok pada hari terakhir juga sebagian besar didistribusikan dalam jangka menengah dan panjang. Yang terbesar adalah Long Straddle sebesar 277,5 BTC per leg, yang bullish pada volatilitas pada akhir Juni, dan sebaran diagonal dari penjualan Mei dan pembelian Call Juni. IV front-end ETH turun tajam, menarik sekelompok transaksi Beli 17 MEI vs Jual 24 MEI dengan volume hingga 19.450 ETH per leg di blok. Pada saat yang sama, ada juga banyak posisi opsi panggilan pada rantai opsi pada akhir Mei. Meskipun ETH telah berkinerja relatif buruk baru-baru ini, masih ada pedagang yang membayar untuk ruang kenaikan berikutnya.

Sumber: Deribit (per 16 MEI 16: 00 UTC+ 8)

Sumber: SignalPlus

Sumber Data: Deribit, distribusi keseluruhan transaksi ETH

Sumber Data: Deribit, distribusi transaksi BTC secara keseluruhan

Sumber: Perdagangan Blok Deribit

Sumber: Perdagangan Blok Deribit

Anda dapat mencari SignalPlus di Plugin Store ChatGPT 4.0 untuk mendapatkan informasi enkripsi real-time. Jika Anda ingin segera menerima pembaruan kami, silakan ikuti akun Twitter kami @SignalPlus_Web3, atau bergabunglah dengan grup WeChat kami (tambahkan asisten WeChat: SignalPlus 123), grup Telegram, dan komunitas Discord untuk berkomunikasi dan berinteraksi dengan lebih banyak teman. Situs Resmi SignalPlus: https://www.signalplus.com

Artikel ini bersumber dari internet: Kolom Volatilitas SignalPlus (16/05/2024): Makroekonomi positif, BTC kembali ke 66.000

Terkait: Prediksi Harga Fantom (FTM): Bisakah Mencapai Tertinggi Baru dalam 2 Tahun?

Singkatnya Pasokan FTM di tangan para pedagang telah menurun secara signifikan dalam beberapa hari terakhir, menunjukkan peningkatan pada pemegang jangka menengah dan panjang. RSI 7 hari FTM saat ini berada di 77, turun dari 81 minggu lalu, masih menunjukkan status overbought. Garis EMA menggambarkan skenario bullish, dan kita bisa segera melihat harga tertinggi dalam 2 tahun untuk harga FTM. Berkurangnya pasokan FTM di kalangan pedagang selama beberapa hari terakhir menandakan pergeseran nyata ke arah akumulasi oleh pemegang saham jangka menengah dan jangka panjang, menunjukkan semakin kuatnya keyakinan terhadap prospek masa depan FTM. Harga FTM didukung oleh sentimen pasar yang positif, dengan RSI 7 hari yang menunjukkan minat investor yang tinggi meskipun berada di zona overbought. Tren bullish yang ditunjukkan oleh garis Exponential Moving Average (EMA) mengisyaratkan…