Analisis Protokol Pensil: Gulungan peluang paling hemat biaya saat ini

The value flow within the Layer 2 ecosystem often changes with the expected trend of airdrops. With the successive issuance of tokens by Layer 2 projects such as Starknet and Manta, the enthusiasm for interaction within the community has gradually shifted to other Layer 2 networks that have not yet issued tokens.

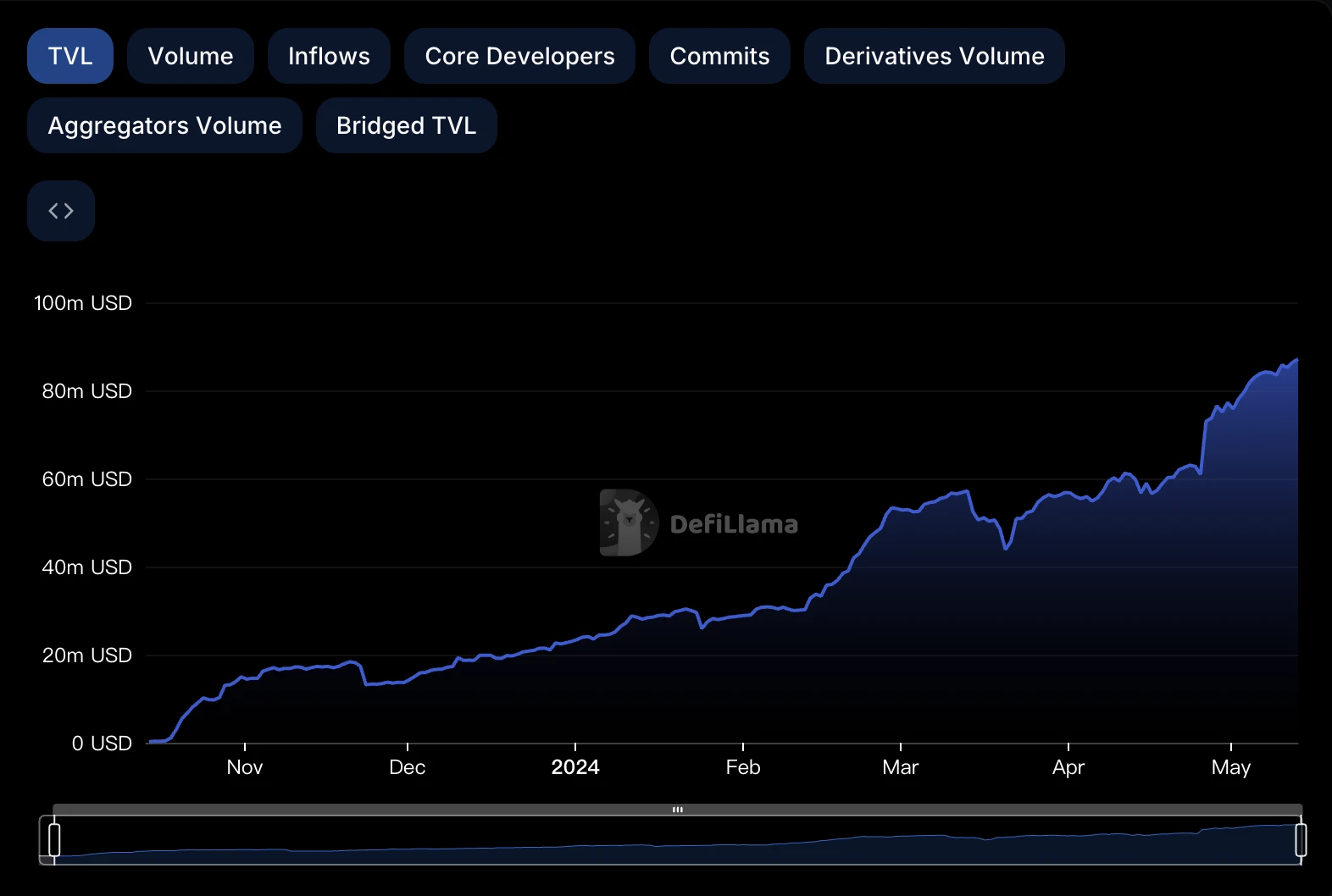

Among many potential options, Scroll has become one of the main Layer 2 platforms for receiving traffic and capital transfers, with tens of millions of dollars of financing endorsement and multiple selections by Ethereum co-founder Vitalik . Defillama data shows that Scrolls total locked value (TVL) has maintained a fairly good net inflow trend in the past few months, and has now grown to about 87 million US dollars.

At present, most users who have just entered the Scroll ecosystem will face a difficult problem: how to find the most cost-effective interactive targets and use relatively less investment to gain greater potential airdrop returns.

Looking at the current status of the Scroll ecosystem, most of the projects with high TVL rankings have either already issued tokens or have been deployed on multiple chains for a long time (multi-chain deployment often means that the coin issuance cycle is relatively long, and the single-chain interaction weight is relatively low). There are relatively few projects that have not yet issued tokens and are native to Scroll. In this context, Pencils Protocol, which has just completed its brand reshaping, seems to have become the most cost-effective choice for interacting with the Scroll ecosystem.

“Scroll is paper, Pencils is pen”

Pencils Protocol was formerly known as PenPad. Before the project was renamed, it had launched two rounds of early token generation activities on the Scroll network (Season 2 is currently underway) and attracted widespread attention from Scroll users. The reason why Pencils Protocols unique position in the Scroll ecosystem is emphasized is the ambiguous relationship between Pencils Protocol and Scroll.

From an investment perspective, Pencils Protocols latest round of financing has already secured contributions from many well-known investment institutions in the industry, including OKX Ventures, Animoca Brands, Presto Labs, Gate.io, etc. Scroll co-founder Sandy also participated in this round of financing.

As early as in a joint event in March this year, Pencils Protocol mentioned that completing tasks can get double rewards of Scroll points and Pencils Protocol tokens. This was the first time that the term Scroll points was leaked through unofficial channels. Then in April this year, Scroll officially announced the loyalty program Session Zero and confirmed that it would launch a points system.

From the perspective of positioning, Pencils Protocol is a comprehensive DeFi protocol native to Scroll and centered on the community. With the completion of the brand reshaping, the project has now identified three main product lines – Launchpad, Staking, and Vaults Restaking.

Launchpad is an asset issuance service, which was the core product of Pencils Protocol when it was PenPad. Looking forward to the future, Pencils Protocol hopes to provide a fair, open and efficient asset issuance platform for high-quality projects on Scroll. Through a series of innovative subscription and auction product modules, the entire Launchpad subscription process will be more fair, easy to operate, combinable and localized, providing users and project parties with a one-stop, flexible and innovative subscription service. As the primary new product platform in the future of the Scroll ecosystem, it will help high-quality projects in the ecosystem to better complete token distribution.

Staking and Vaults Restaking are both yield optimization services. Different from traditional PoS Staking, Staking in the context of Pencils Protocol actually provides a single-coin yield optimization service. Users can obtain income simply and efficiently by depositing ETH (and its derivatives LST, LRT), stablecoins, WBTC (and other BTC voucher tokens), Scroll ecosystem high-quality tokens, etc. At the same time, they can use the liquidity voucher token pToken issued by Pencils Protocol to release the liquidity of deposited assets and further participate in other DeFi activities.

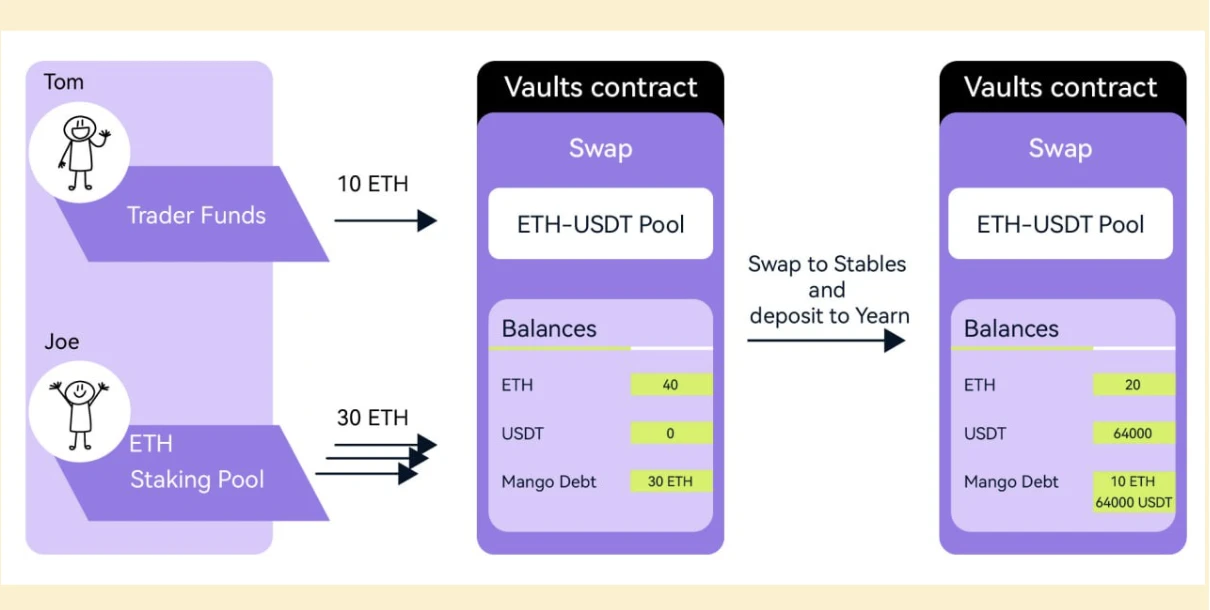

Vaults Restaking focuses on the area of leveraged income, providing users with advanced functions to increase the leverage of their positions by borrowing funds, thereby achieving multiple returns . In addition, the Vaults section of Pencils Protocol will also cooperate with multiple Liquid Restaking protocols to provide users participating in Vaults with more income opportunities, such as ETHs native staking income, LRT protocol point income, EigenLayer point income, etc.

In addition to the three core products mentioned above, the operation of Pencils Protocol will also be highly dependent on its loyalty points system Pencil Points. After the Pencils Protocol officially launches the main functions of the protocol in the future, users can accumulate Pencil Points by depositing in the Staking product. Pencil Points not only have the opportunity to bring users continuous future airdrop income (including but not limited to Pencils Protocol protocol tokens), but can also be consumed in Launchpad products to obtain more quotas and lower prices, or consumed in Vaults products to increase leverage and earn income at a faster rate.

In short, the vision of Pencils Protocol is to serve as the cornerstone of DeFi on Scroll, helping early projects in the ecosystem to complete the token distribution process on the one hand, and helping users of the ecosystem to capture ecological value on the other. As the saying often mentioned in the community says, Scroll is paper, Pencils is a pen. If the underlying network Scroll, which can be directly translated as scroll, is regarded as a blank sheet of paper, Pencils Protocol will be the pen that draws various maps on this sheet of paper.

How to kill two birds with one stone?

For ordinary people, compared to understanding the business logic of Pencils Protocol frame by frame, how to interact effectively and gain potential benefits may be a more important issue.

In February this year, Pencils Protocol (then called PenPad) announced that it would jointly launch a three-season token generation event with Scroll, and distribute token rewards accounting for 18% of the total supply to early supporters . Previously, Season 1 started on February 27 and ended on March 22, and Season 2 started on March 25 and is still ongoing.

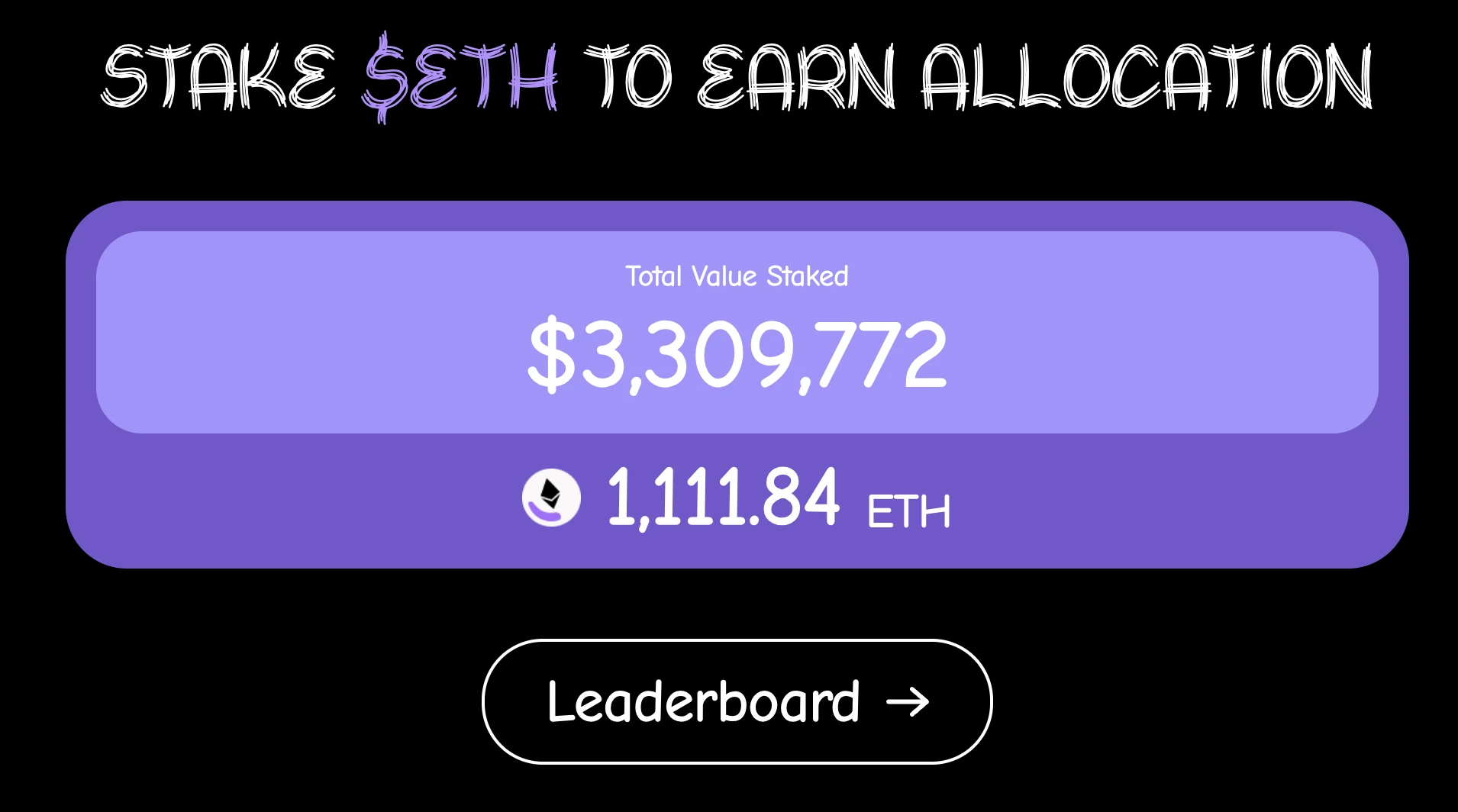

In the Season 2 event, users can deposit ETH on situs web resmi as individuals or in teams, and accumulate corresponding points rewards. The deposit will be limited to a minimum of 0.05 ETH. When a user deposits 0.05 ETH for the first time, he will immediately receive 100 points, and 20 points will be received for each 0.05 ETH deposited thereafter. Users with deposits greater than 0.5 ETH can start their own team and receive 10% of the invitation points from the players they invite. With each 1 ETH increase in the total deposit amount of the team, all team members will have a chance to draw points, thereby accelerating their own points accumulation progress.

It is worth mentioning that the points here are not the same as the Pencil Points mentioned in the previous article. The points will currently be mainly used for the generation and distribution of the Pencils Protocol protocol token PDD – Pencils Protocol has clearly mentioned that it will distribute 6% of the tokens to the community in the Season 2 event. The more points users accumulate, the more tokens they can get, and the lower the subscription price. However, Pencils Protocol has mentioned in the latest announcement that it will convert the deposit contract into part of the Staking and Vaults services when Season 3 is launched. This will also allow users to convert their points in Season 1 and Season 2 into Pencil Points, thereby continuing to participate deeply in the Pencils Protocol.

As of the time of writing, Pencils Protocols Season 2 token generation event has attracted a total of approximately 1,111 ETH deposits, worth approximately $3.3 million, making it the largest native protocol in the Scroll ecosystem in terms of lock-up size. However, overall, the competitive pressure of Pencils Protocols token generation event is still relatively small, and new users still have a greater chance to catch up with the pioneers.

From the perspective of potential benefits, in addition to being able to use points to directly obtain Pencils Protocol tokens, depositing through the Pencils Protocols Season 2 token generation event can also unlock multiple additional benefits.

-

The first potential benefit is the equity-based NFT badge rewards that Pencils Protocol provides to all users. Pencils Protocol has announced earlier that it will provide S badges representing Scroll and P badges representing Pencils Protocol based on user points at the end of Season 2. Badge holders will have priority in the whitelist of new projects on Pencils Protocol, receive specific fee discounts in other projects in the Scroll ecosystem, and be included in the first batch of Scroll Canvas badge recipients (there is no official description for this yet, so it is worth imagining)…

-

The second benefit is that PDD, as the most effective medium for accumulating Pencil Points in the future, has the golden shovel attribute to leverage the subsequent profit opportunities of the Scroll ecosystem. This also means that participating in the deposit of Season 2 in advance can help users take a step ahead in the subsequent gold rush of the Scroll ecosystem.

-

The third benefit is also the point that many users are most concerned about – the interaction weight with Scroll. The competition for Layer 2 airdrops has become increasingly fierce. High-quality participation around ecological head projects is often more valuable than slightly blind and indiscriminate interactions. As the native leader that is most tightly bound to the underlying mother body in the Scroll ecosystem, the interactive behavior on the Pencils Protocol is likely to be particularly valued by Scroll, which may bring unexpected surprises to users.

According to the latest disclosure of Pencils Protocol, the Season 2 event is expected to officially end on May 20, when Pencils Protocol will officially activate the withdrawal function of previous deposits and confirm the PDD reward share that users can obtain through final calculations – users can freely choose to use the deposited ETH for discounted subscription, or give up the subscription opportunity and retain ETH.

Afterwards, users can choose to migrate their ETH deposits directly to the new contract, continue to participate in Pencil Protocols Staking and Vaults and earn Pencil Points rewards; they can also choose to withdraw ETH directly. Although this will not affect the PDD share, it means that the user will give up all previous points.

Ultimate cost performance

Over the past year, Points-Fi gameplay built around a points system has gradually become a new trend.

Restaking, Layer 2, DePIN, DeFi… New projects in various fields have all chosen to use the points system to accumulate liquidity before TGE, and the ETH, stablecoins and other assets in the hands of users have also become the bargaining chips that various project parties are striving for. For ordinary users, it is inevitable to fall into a selective barrier when faced with the emerging temptations of deposits or staking.

Compared with some other points-based projects on the market with extremely fierce competition or unclear profit redemption dates, the advantages of Pencils Protocol are: first, the time cost is relatively short and the profit redemption is relatively fast; second, the competition pressure of Pencils Protocols Season 2 deposit activity is relatively small; third, by participating in Season 2, you can not only obtain PDD, but also leverage multiple future benefits of the Scroll ecosystem in various forms.

This is why we boldly judge that the current Pencils Protocol may be the most cost-effective interactive option for the Scroll ecosystem.

This article is sourced from the internet: Analysis of Pencils Protocol: Scrolls most cost-effective opportunity at the moment

Terkait: Harga Protokol NEAR Bersiap untuk Konsolidasi Besar

Singkatnya, RSI NEAR turun di bawah 70, menunjukkan minat pembeli bisa mereda. Di sisi lain, jumlah transaksi di NEAR tumbuh 191.29% dalam 13 hari terakhir. EMA menunjukkan kemungkinan fase konsolidasi, ditopang oleh support dan resistance yang kuat. Analisis harga Near Protocol (NEAR) menyajikan gambaran yang kompleks, menunjukkan sentimen pasar yang bervariasi. Campuran indikator memberikan gambaran berbeda tentang lintasan jangka pendek NEAR. Pergeseran Momentum On-Chain Dinamika pasar NEAR Protocol telah mengalami perubahan, sebagaimana dibuktikan dengan RSI yang turun ke 66 dari sebelumnya 76 pada tanggal 27 Maret, menandai penurunan pertama di bawah 70 sejak 23 November. RSI, yang membantu mengidentifikasi kondisi jenuh beli atau jenuh jual , menunjukkan melemahnya tekanan beli karena turun dari level tinggi yang dipertahankan sebelumnya. Meskipun…