वर्तमान क्रिप्टो बाजार में खुदरा निवेशक पैसा क्यों नहीं कमा सकते?

मूल लेख Regan Bozman

मूल अनुवाद: टेकफ्लो

Why is there so much talk of the cycle being over? Why is everyone so miserable? We can boil it all down to this: retail investors can no longer make real money in the current market structure.

Some random thoughts on returning to basics and getting out of the current cycle

The answer to why there are no retail investors in this round is actually very simple – its because the traditional cryptocurrency market (such as infra tokens) no longer has a 500x price. Now there is a more interesting casino with a better MEME at their fingertips.

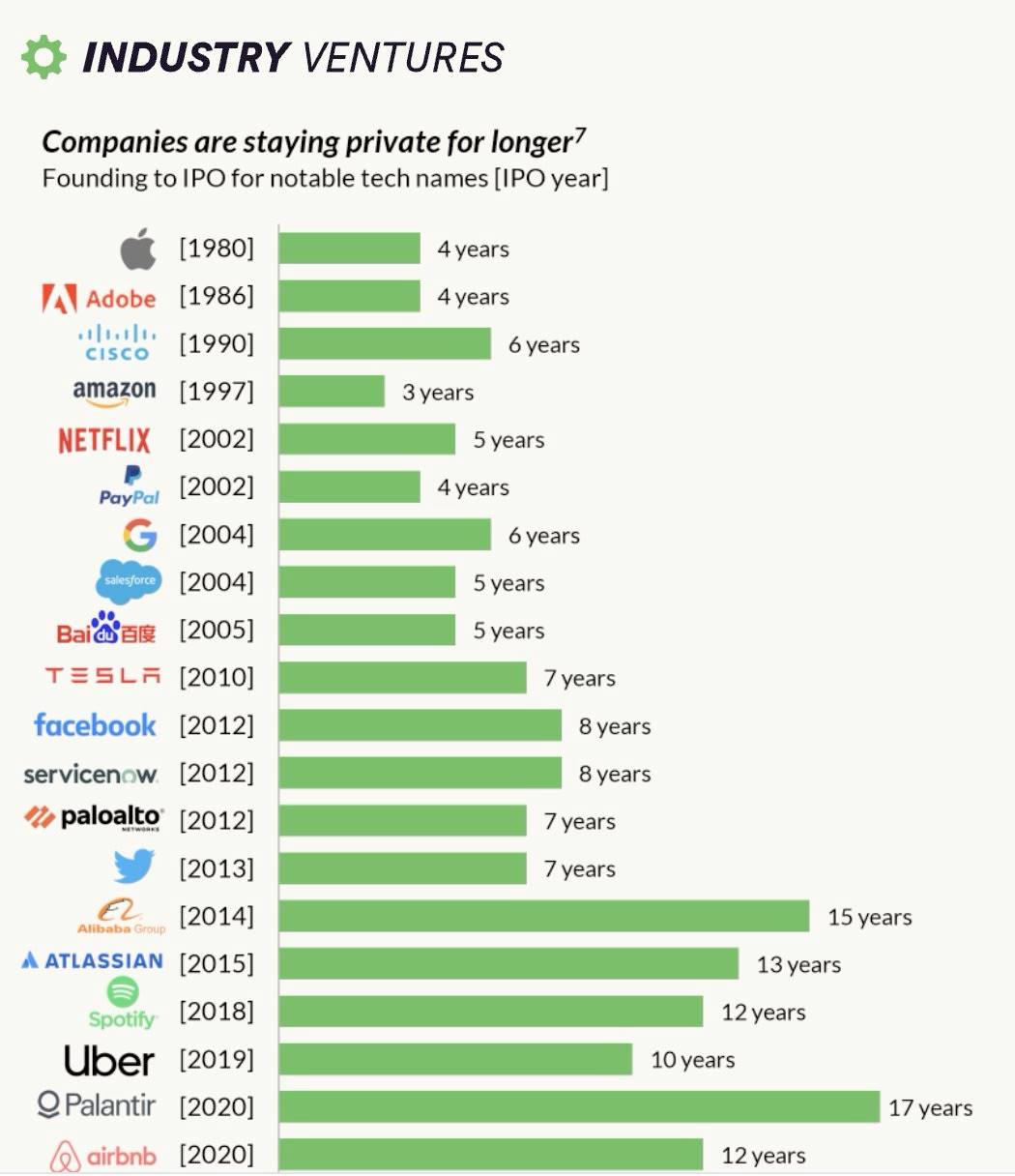

We are essentially reproducing what happens in the VC/IPO markets where companies stay private longer, which means more of the upside stays “private” (e.g. VC funds) and is inaccessible to retail investors.

Crypto once reversed this and democratized access to asymmetric upside. But not anymore! L1 and L2 raised more money from VCs. There were no public token sales. VCs made money. Retail investors were marginalized. Perhaps retail investors’ disillusionment with this cycle isn’t that surprising.

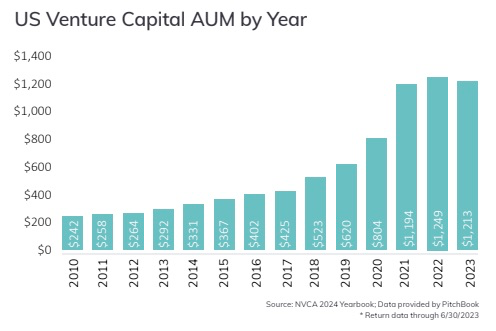

A big reason companies are willing to stay private longer is that venture investors now have five times more money than they did a decade ago. Companies can now raise more than $1 billion in private markets without having to deal with the additional overhead of the public markets.

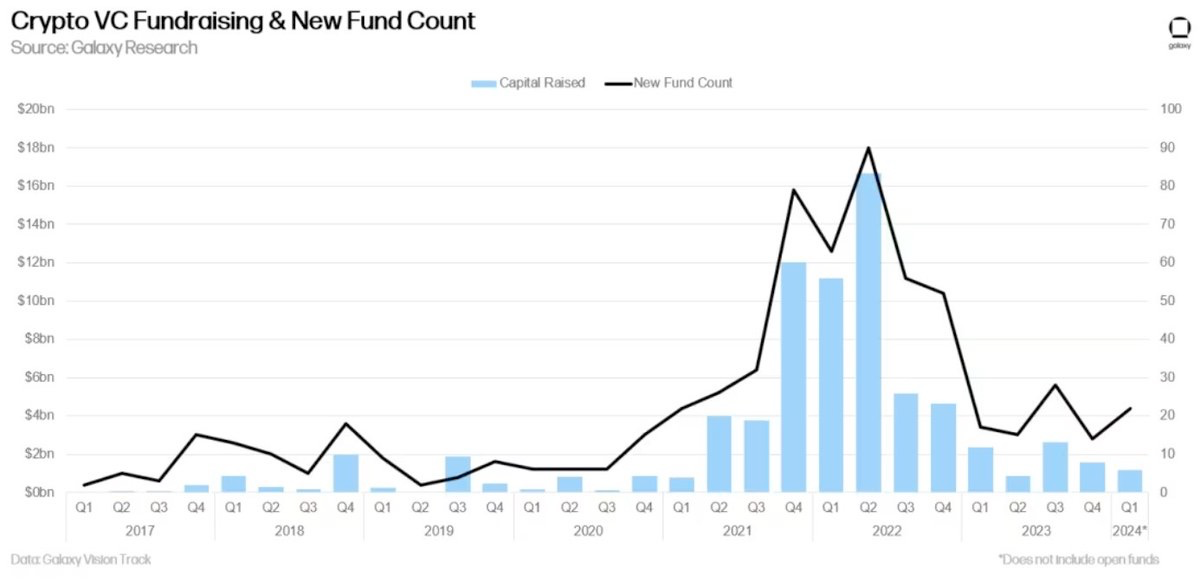

Not surprisingly, the same trend is occurring in crypto VC investing — more money is flowing into crypto VC funds now than five years ago.

Cryptocurrency should solve this problem!

ICOs were designed to democratize capital formation and further the reward for risk. They have absolutely succeeded in doing just that.

Buying Ethereum at 30 cents during the ICO in 2014 and seeing it go to $3,000 today would be a 10,000x return in 10 years, absolutely beating any venture capital investment in the same period. Anyone on Earth can participate, which is awesome.

Now that the industry has clearly grown, the entry price has naturally climbed, but these opportunities have not disappeared. $SOL launched at $0.22 in 2020, and is now at $140, which would represent a 636x return in 4 years, which would also likely beat almost all venture capital returns over the past five years.

We have moved away from this market structure this cycle . There are now few opportunities for retail investors to buy tokens before they are issued, or to buy tokens at low prices on the open market.

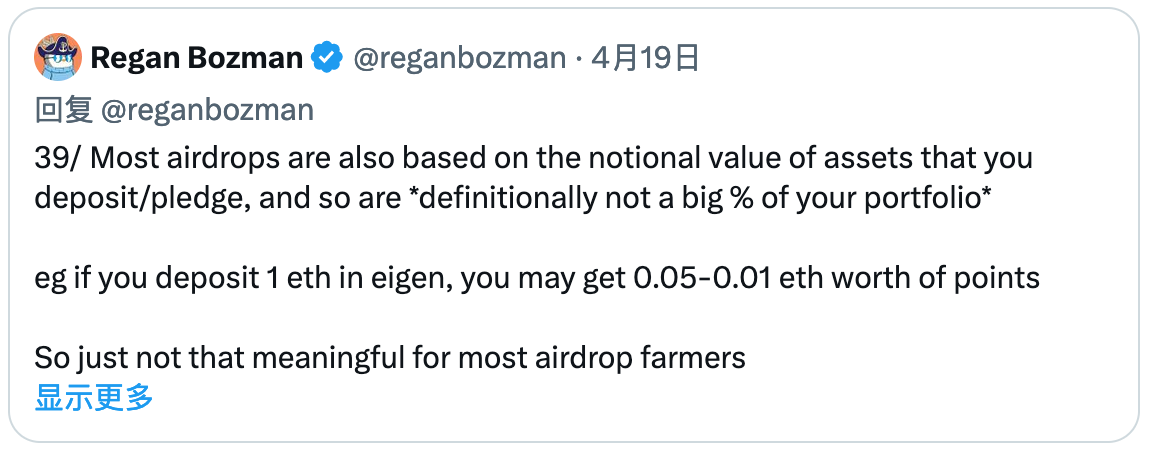

Airdrops are indeed an improvement over the existing venture capital paradigm, where early adopters can receive some financial upside. But they are not as financially sound as token sales, and by definition you can only make so much money from an airdrop.

We’ve gone from a market with uncapped upside to a market with caps — that’s a huge change. $1,000 invested in SOL’s ICO is now $636,000;

$1,000 invested in Eigen will only turn into about $1,030…even if it goes up 10 times, it’s only $1,300. In the last cycle, you controlled your own destiny; in this cycle, you’re waiting for Eigen daddy’s charity.

Financial nihilism means recognizing that these markets have always been about money. Yes, that money funds the technology, but it is that money that drives the entire industry. If you weaken the money part, the entire industry will collapse.

There are several things we can do to improve the current issuance structure. The key is to create uncapped upside for early adopters and the community.

That said, there are larger structural issues in the market, with massive fundraising for L1 and L2 resulting in multi-billion dollar valuations before launch. This creates two problems: (A) a lot of seller pressure; and (B) a floor on the offering price at launch.

I think one of the structural issues facing most altcoins in this cycle is that VC selling pressure is not offset by retail inflows. If $500M is raised pre-launch, then there is $500M of selling pressure (potentially even more if the token price rises).

Raising money privately at a high valuation means you will be trying to sell at an even higher valuation, which can lead to a situation where the market can only go down .

The relationship between venture capitalists and retail investors does not need to be adversarial. Everyone on $SOL made money.

But it becomes much more difficult if you try to cram too much VC money into illiquid markets, and nearly impossible if you deprive the most important market participants of their uncapped upside.

We can point fingers and argue about meme coins, but that completely misses the point of the problem. Meme coins are not the problem — our current market structure is the problem. Let’s get back to our democratic roots and fix what’s wrong with our current market.

This article is sourced from the internet: Why can’t retail investors make money in the current crypto market?

संबंधित: लाइटकॉइन (LTC) की कीमत में सुधार $100 मील के पत्थर की ओर: जानिए कैसे

In Brief Litecoin price fell by 25% in the past two weeks but is still holding above crucial support levels. The total supply in profit is still at 58%, indicating that a market top is far from taking place. Reserve Risk is below the green zone, suggesting confidence is high, and LTC is an attractive asset in terms of risk/reward. The Litecoin price (LTC) hit a multi-month high in March after breaking through the $100 barrier. The altcoin, however, could not sustain this rise and ended up correcting 25%. At the moment, investors are hopeful for a recovery from these losses, and by the looks of it, LTC might make it back to $100. Litecoin Is in a Good Spot Generally, following a correction, assets are considered to be bearish,…

Super drop