Is short selling profitable forever? CEX has become the exit liquidity

Original author: Shaofaye 123, Foresight News

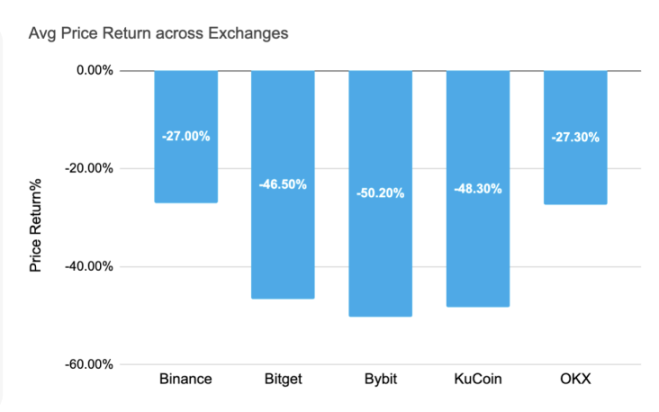

Centralized exchanges performed poorly in 2024 and were mocked as the on-chain exit liquidity. According to a research report released by Animoca Digital Research, the average return rate of major exchanges in the first three quarters was negative.

Entering 2025, the listing of coins on centralized exchanges is still a tombstone for new coins. Can short selling really make money forever? This article takes you through the listing of coins on major exchanges in January.

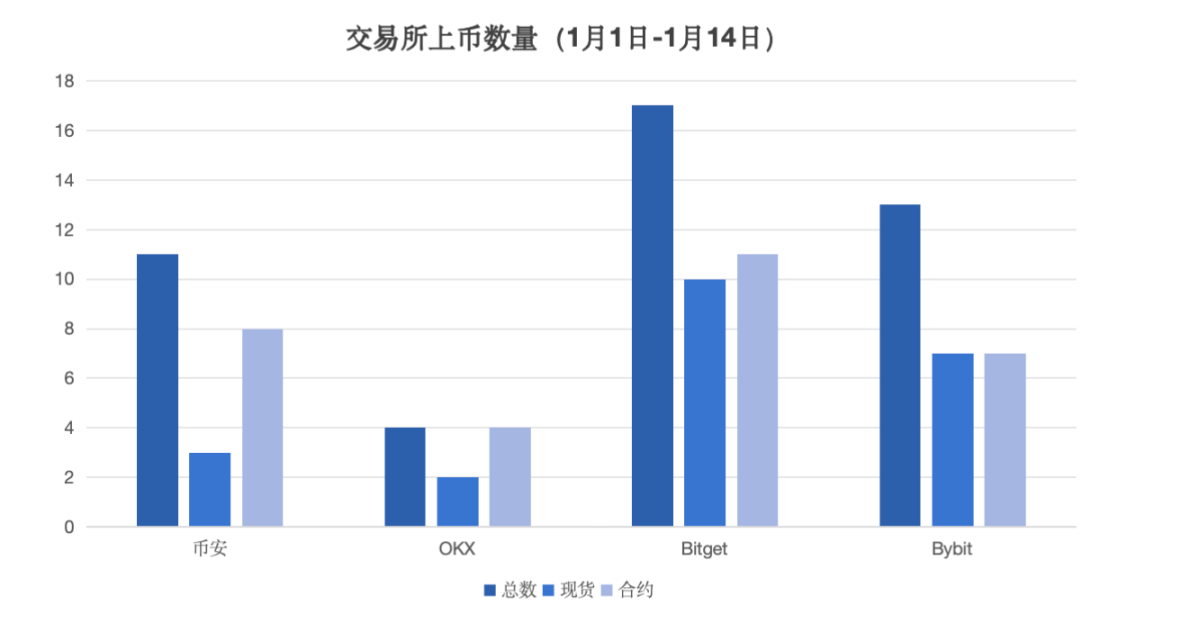

Overview of new listings on various exchanges in January

Major exchanges have started listing coins at the beginning of this year. From the data, OKX has the most conservative coin listing strategy, with only 4 tokens listed. Bitget has adopted a more proactive coin listing strategy, with 17 tokens listed so far this year and the highest proportion of spot tokens listed. Binance and Bybit have listed 11 and 13 tokens respectively, with Binance having the lowest proportion of spot tokens listed.

Performance of new coins on various exchanges

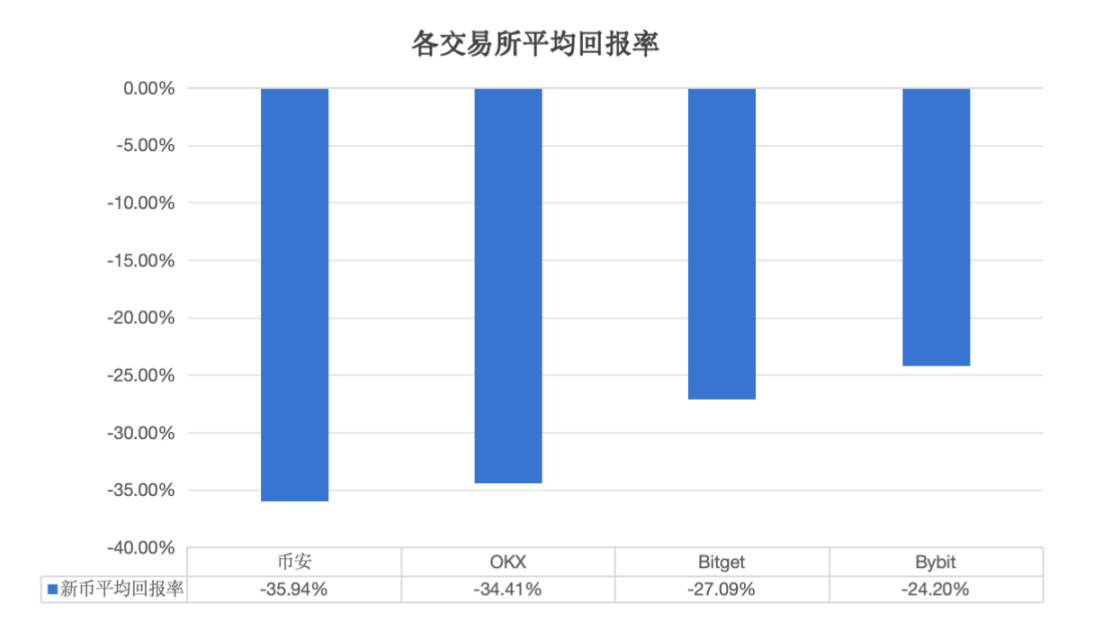

Since the beginning of the year, the average return rate of exchanges is still negative, among which Binances average return rate has dropped the most, down about 10%, and the average return rate is -36%. The data of other exchanges are not much different, among which Bitget, with the largest number of listed coins, has a decline of about -27%.

The above table counts all the tokens (spot and contract) newly launched on the four major exchanges since January. To avoid the phenomenon of plug-in, the statistical price is the higher of the opening and closing prices of the day. From the above data, all new tokens on Binance have negative returns, without exception. Bitget has 2 projects that rose against the trend in a falling market, Bybit has 1 token that achieved positive returns, and the rest were wiped out. OKXs only 4 projects also fell.

In addition, most of the tokens launched in January are still concentrated in AI agent projects. After being criticized by the community for only launching VC coins, the number of VC coins launched by Binance in January dropped sharply. Among the 11 tokens launched, 9 are related to AI agents, accounting for as high as 81%. However, since Binance was launched one month later than other exchanges on average, and the fermentation speed on the chain was far behind, the market value had already surged when it was launched, but it still ended dismally in the end. AI16Z fell after the announcement of its launch on Binance, with a drop of more than 10% in 5 minutes. In addition, the market value of the projects launched on Binance is relatively high, and it is almost never less than 100 million US dollars, which leads to subsequent price weakness and lack of growth. In contrast, the market value of the few rising tokens in Bitget, SWARMS and AVAAI, was less than 100 million US dollars when they were launched, and the odds of small-cap tokens are gradually increasing.

He Yi once said in the community, If you dont like it, you can short it. Now it seems that shorting Binances new tokens is a 100% profitable business. Not only that, other exchanges are also very average. If you short a new coin on the day it goes online, there is rarely even a retracement phenomenon. More tokens fall again and again, starting with a halving. It is a thing of the past to be listed on Binance and you can rise. Soul pouring has become the communitys impression of the continuous decline of Binances new tokens.

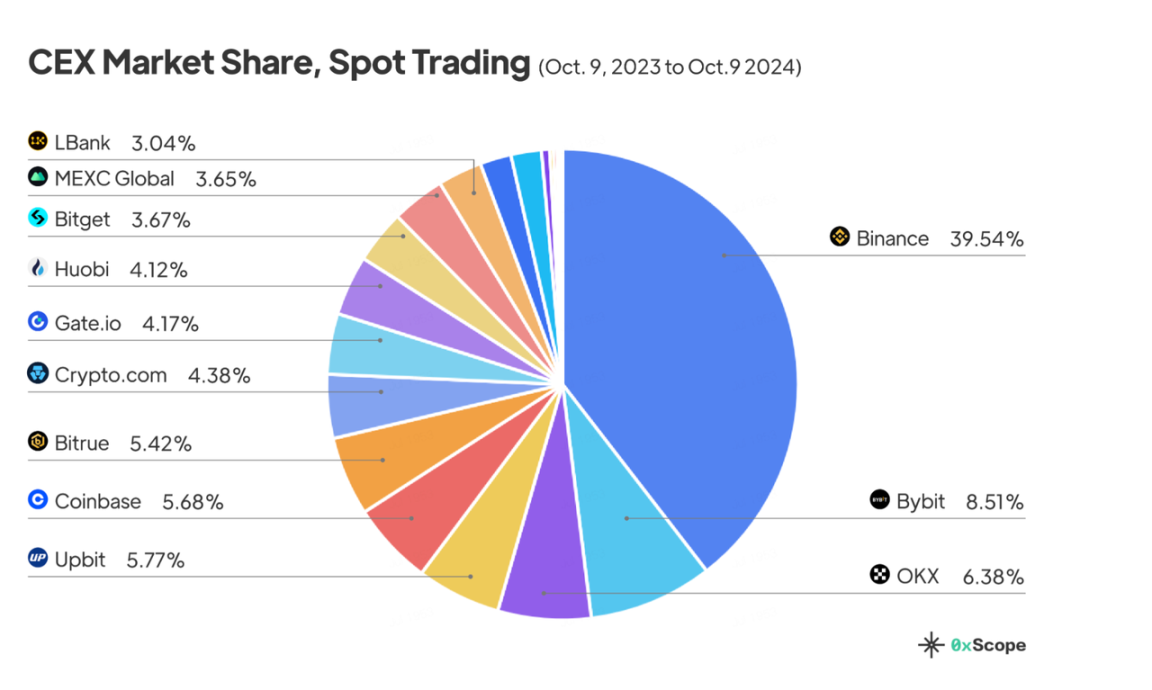

According to the 2024 CEX बाज़ार Report recently released by 0x Scope, in the spot market trend, Binances market share has shrunk from 50.9% to 42.5% year-on-year.

Liquidity battle

Centralized exchanges have long dominated liquidity with mature infrastructure, strong market depth, and efficient matching mechanisms. However, as on-chain infrastructure continues to improve, centralized exchanges have gradually become exit liquidity, and their listing effect is constantly weakening. Pump.fun completed the rapid issuance of Memecoin with its unique pricing curve, and then on-chain DEXs such as Hyperliquid attracted a lot of attention with large airdrops, and the overall market share of centralized exchanges has been declining. On-chain DEXs are eroding the traditional advantages of centralized exchanges at a faster rate.

With the gradual optimization of on-chain user experience and many DeFi innovations, more and more users and funds will migrate to the chain. The high transparency, decentralization and user ownership of funds in the on-chain ecosystem will further accelerate this transformation. However, this does not mean that centralized exchanges will withdraw from the stage. With their advantages such as compliant operations and convenient transactions, centralized exchanges will still play an important role in user education, the introduction of new assets, and the entry of institutional funds.

In the future, the boundary between CEX and DEX may gradually blur. This liquidity competition will eventually shift from a competition for users and funds to a competition to improve user experience and promote industry development.

The battle for liquidity will bring more innovation and progress, and the क्रिप्टो industry will ultimately win.

This article is sourced from the internet: Is short selling profitable forever? CEX has become the exit liquidity

24 H popular currencies 1. Popular currencies on CEX CEX top 10 trading volume and 24-hour rise and fall: BTC: +0.36% ETH: -1.8% XRP: +4.89% SOL: +5.51% DOGE: -0.1% BNB: +0.75% PEPE: -3.75% PENGU: +720.92% TRX: -4.18% LTC: +7.43% 24-hour price increase list (data source: OKX): PENGU: +448.96% PRQ:+ 34.2% VELO: +14.15% FORTH:+ 11.23% LTC: +7.36% RON:+ 6.75% XLM: +6.11% SD: +5.58% ZENT: +5.14% ARG: +4.73% 2. Top 5 popular memes on the chain (data source: GMGN): STD UFD VIOLET Adillo BRODIE 3. Todays most searched currencies PENGU: PENGU is the official token of the Pudgy Penguins project. The token was open for airdrops and listed on Binance at 22:00 yesterday. The highest price reached 0.07 USDT. The current price is 0.027 USDT, with a market value of 1.705 billion…