The next trillion-dollar opportunity: how to seize the transition wave of Crypto+AI?

Originally Posted by Karthik Senthil

मूल अनुवाद: टेकफ्लो

परिचय

When the narrative of smart contracts gradually lost its appeal, the strong entry of AI brought a breakthrough, driving a wave of enthusiasm and innovation beyond expectations. From the consensus layer of Bitcoin to the execution layer of smart contracts, and then to the current AI-driven application layer, has the क्रिप्टो industry ushered in the third technological leap?

KOL @karsenthil published his opinion articles on Crypto X AI at different times, believing that we are on the eve of the next take-off of the encryption industry.

The original text is divided into two parts, with a relatively scattered structure.

में the first article, the author expressed the view that AI will drive blockchain into the next technological leap. In the दूसरा article, he elaborated on the specific implementation path of AI at the application and infrastructure layers, and the potential opportunities for investors and builders.

TechFlow has integrated and compiled it, and the following is the complete content.

Crypto X AI Argument (Part 1) — We are experiencing a “leapfrogging” development

AI is driving blockchain towards its next major leap.

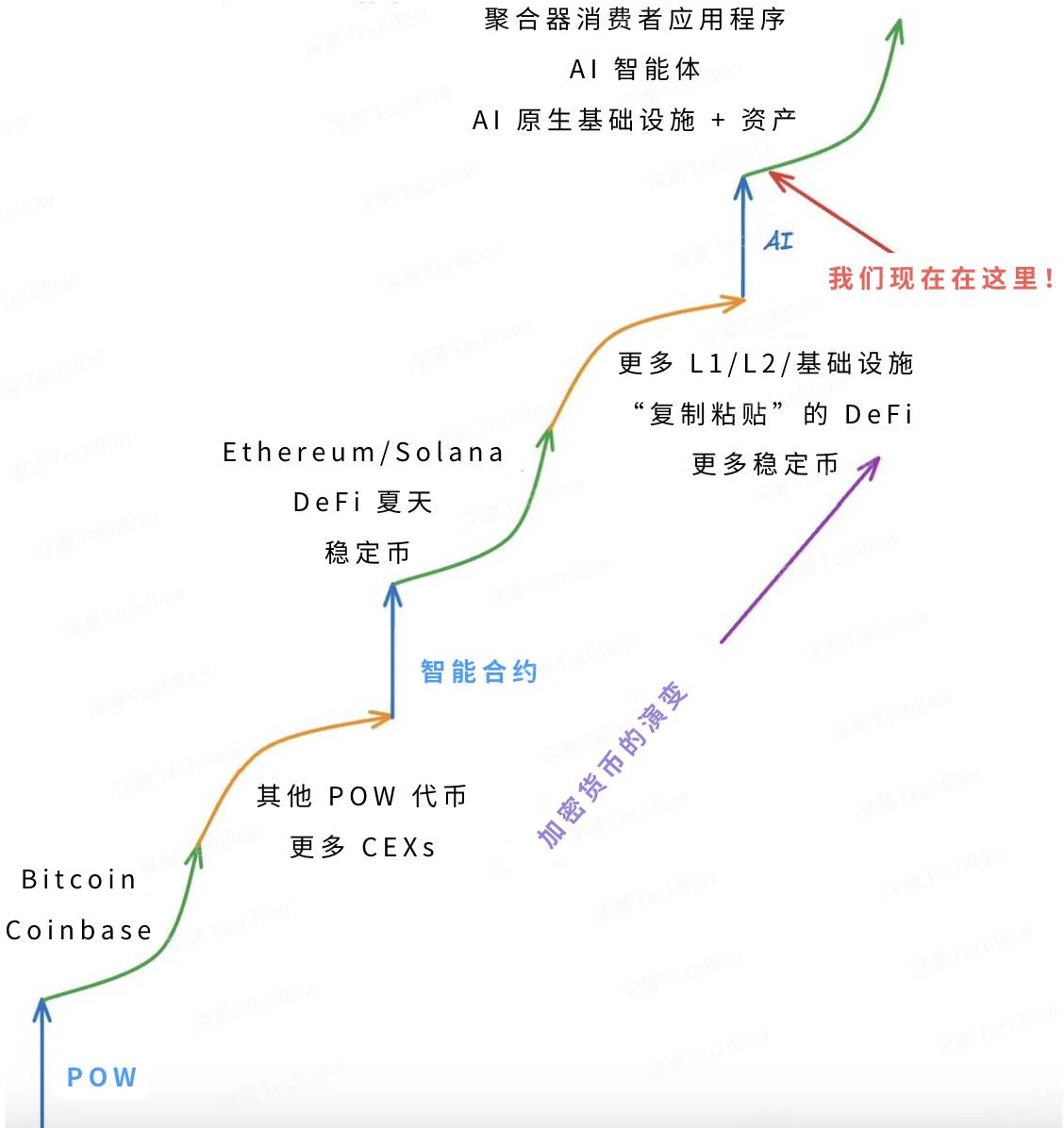

Each stage of blockchain development generally follows a similar trajectory:

-

A “leapfrogging” technological advancement has triggered a new wave of innovation;

-

As a large number of imitators joined in, technological progress gradually stagnated;

-

Then, the next technological leap comes along, pushing the industry forward.

Original image from @karsenthil , compiled by TechFlow

The first major leap in cryptocurrency occurred at the consensus layer, marked by the invention of Bitcoin and Proof of Work (PoW). From 2009 to 2014, this wave increased the market value of cryptocurrency by more than 10,000 times (from about $750,000 to about $7.5 billion).

The second leap occurred at the execution layer, with the emergence of smart contracts, which made blockchain programmable. Today, most blockchain infrastructure (such as L1, L2) and applications (such as tokens, stablecoins, DeFi) rely on this core innovation. From 2014 to the present, this wave has driven the market value of cryptocurrencies to grow by about 500 times to about $3.5 trillion, of which projects born in this stage account for about 43% (about $1.5 trillion) of the total market value.

However, the current technological progress has once again stagnated. Why is this happening? Here is my (possibly controversial) opinion:

-

The potential of smart contracts has been largely exhausted. Even the recently popular memecoins are just a re-combination of existing technologies (such as tokens, bonding curves, and the NFT community craze), rather than a completely new invention.

-

Smart contracts have become a major bottleneck for user experience (UX). Current crypto applications need to interact directly with smart contracts, which means that users must understand where the contract runs, what its functions mean, and how to interact with it, as well as sign transactions and pay gas fees.

Fortunately, the next technological leap is here—one that is enabling new innovations at the application layer by improving usability.

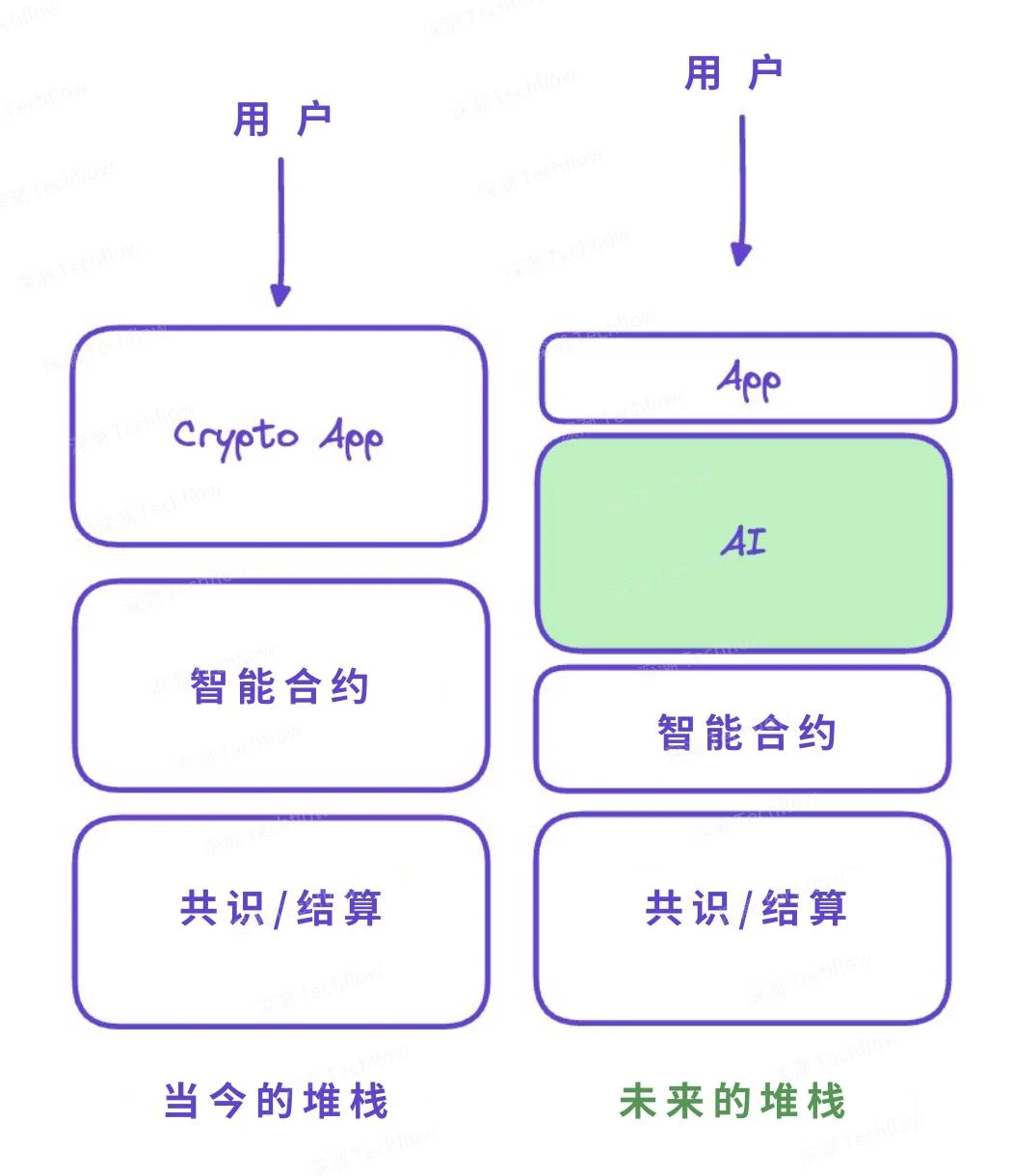

AI will become the user experience layer of crypto

Every new technology that becomes popular requires a powerful “front end” to simplify complexity and integrate functionality. PCs have graphical user interfaces (GUIs) and operating systems, the Internet has web browsers and FAANG, and mobile devices have native apps and app stores.

AI will become the user experience layer of blockchain technology, providing users with an order of magnitude better experience, thereby driving wider adoption. AI can solve the three major UX problems in crypto technology: user onboarding, execution of complex operations (usually requiring multiple steps, which large language models (LLMs) are very good at handling), and feature discovery. I predict that by 2030, 40% of the worlds population will have experienced on-chain transactions, and more than 95% of on-chain transactions will be completed through AI. By then, people will unconsciously use applications powered by blockchain technology.

Original image from @karsenthil , compiled by TechFlow

To achieve this goal, AI will work both up and down the technology stack as a link between the application layer and the blockchain infrastructure. In the future, applications will interact directly with AI agents, which will aggregate and perform on-chain operations on behalf of users. In addition, smart contracts will evolve into intelligent tokens that are deeply integrated with AI, providing users with a generative and customized experience instead of the current one-size-fits-all model.

From the perspective of AI, the future of blockchain applications becomes clearer. For example, the next generation of financial super applications may use AI to proactively recommend and execute on-chain DeFi operations based on user intentions and preferences (such as security, yield, etc.), combined with real-time information from the prediction market. Users do not need to understand the difference between L1 and L2, or the names of protocols and assets, or even how cross-chain bridges work. The prototype of this trend has begun to emerge.

Crypto X AI Thesis (Part 2) — Opportunities for Builders and Investors

So, who will be the biggest winner?

As AI innovation at the application level continues to accelerate, the answer is obvious: applications are still the focus (of course, infrastructure support is also indispensable, after all, this is still the crypto field). As David mentioned below, we have begun to see the shift from the infrastructure cycle to the application cycle , and the addition of AI will further promote this trend.

@divine_economu: “In 2024, the cryptocurrency space has reached two important milestones:

-

For the first time, the top projects are dominated by apps

-

Hot protocols are those that support the development of applications in innovative ways

This is the first time in crypto history that we are moving from an infrastructure-led cycle to an application-centric cycle.”

( ट्वीट विवरण )

I am particularly bullish on the following four categories of crypto products, all of which are in the early stages of development and therefore have great growth potential:

Aggregators, also known as SuperApps

I predict that in the future, the “FAANG of crypto” will emerge: these super applications will integrate functionality from agents that simplify the on-chain user experience (UX) and connect directly with users. At the same time, these applications will vertically integrate the technology stack, not only improving their own application capabilities, but also attracting the attention of developers by providing infrastructure (similar to Amazon or Google). In their respective fields (such as search and advertising, finance, business, social, etc.), such applications will exhibit monopolistic characteristics. Just as FAANG companies contribute about 20% of the SP index today, I expect this category of applications to account for a similar proportion of the crypto market share by 2030. Conservative estimates put the size of this market opportunity at hundreds of billions of dollars, while optimistic estimates could reach trillions of dollars.

Especially in the field of DeFi (or DeFAI ), I think this is a killer application scenario: imagine a next-generation one-stop financial super application where users can seamlessly access all financial assets on the chain, get investment advice or ideas, analyze market sentiment in real time, and quickly execute investment decisions. Another exciting direction is the crypto version of Google, which solves the discovery problem of crypto applications and assets by designing algorithms similar to PageRank, while achieving profitability through advertising or innovative value streams.

The winners in this category will create unimaginable results because they will have a key advantage that Web2 super applications do not have: tokens. टोकनs are the only tool in the crypto space that has been proven to have strong product-market fit (PMF), which can attract users, gather believers and investors, and occupy the market mind.

Agents as SaaS

I am excited about AI agents that can perform extremely well in a certain area. These agents can be used in combination through aggregators or other agents, just like todays SaaS products or financial products. For example, imagine a fully autonomous agent that accepts funds from liquidity providers (LPs) and makes top investments in the crypto market (both being the top 1% of high-liquidity traders and participating in the best performing investment opportunities) while charging lower management fees than ETFs or funds. Or, an agent that can achieve high returns in prediction markets or sports betting. Another example is a tool like @aix_bt that provides high-quality market and investment research data. These agents will enable users to access previously inaccessible markets (such as the US dollar or real-world assets RWAs that are now on the chain) and provide advanced investment strategies (such as quantitative trading or venture capital).

@Loopifyyy: “The first AI agent that can actually do on-chain transactions for me, I would invest my entire net worth in a heartbeat. It solves the UX problem, now I can use blockchain with a simple prompt, cross-chain or not.”

This isn’t limited to finance. I can imagine a future where you have an AI doctor that is specifically trained on a specific patient’s profile, able to bill insurance companies over crypto payment channels, and prescribe low-risk medications. Or an AI insurance agent that is able to find the cheapest home insurance for your house. Of course, frankly, we’re still a ways off from realizing these scenarios (most agents today can’t even complete basic on-chain interactions).

However, as these agents continue to innovate in terms of customer acquisition, value realization, and pricing mechanisms through their native tokens (e.g. users need to hold 100 AIXBT to access premium services), the opportunities in this space are almost limitless. As this trend continues to develop, I believe that platforms dedicated to trading and managing AI agents (similar to Ebay or OpenSeas agent बाज़ार) will also usher in huge development opportunities.

AI-Native Infrastructure

The most important infrastructure opportunities in the future (such as the next generation of L1) will no longer focus solely on optimizing speed or cost, but will attract users by significantly improving the user experience (UX). This improvement will be achieved by building a core architecture around AI agents and AI-driven smart contracts, and natively supporting the following functions: efficient on-chain reasoning capabilities (see Section 4 for details), verifiable off-chain reasoning capabilities through trusted execution environments (TEEs), smart accounts that support semi-autonomous AI agent operations (with built-in protection mechanisms that can perform tasks on behalf of users), access to computing resources and model training capabilities, and support for two-way value flow between agents, thereby promoting innovation in agent collaboration and economic models.

Similar to the current era of decentralized applications (dApps), many of the aforementioned agents in category 2 (especially the long tail) will choose to deploy on these new L1s instead of managing infrastructure themselves, while enjoying the network effects of proximity and composability. I am also excited about the potential of these new generation L1s, which may redefine value capture mechanisms, maximum extractable value (MEV), and consensus mechanisms (e.g., can agents become validators?).

This doesn’t mean that I’m pessimistic about Ethereum, Solana, or other mainstream L1/L2 ecosystems. In fact, these ecosystems will gradually introduce similar features in the next few years. But I believe that the new L1s born in this era will be more in line with the needs of contemporary developers and therefore have great development potential. Projects like ai16z and Virtuals have already demonstrated the prototype of this trend, and also show the huge opportunity to become a winner in this field.

Innovation at L1 continues and remains strong.

Intelligent Assets

Currently, some of the hottest applications in the crypto space (such as stablecoins, NFTs, ERC-20/SPL governance tokens) are deterministic and static assets. They perform well in accomplishing their stated goals, but what if users could have smart assets that operate dynamically and automatically optimize to achieve specific goals (such as increasing holders or increasing value)?

Imagine that smart contracts can dynamically call models during on-chain execution, enabling assets to do the following: adjust token supply, release schedules, destruction or staking mechanisms, and even modify other parameters that currently need to be hard-coded or rely on social consensus to change. Each token can even be personalized based on the holders preferences, providing users with a new level of personalized experience.

I expect that early exploration of this type of smart asset will focus on the NFT and DAO space. For example, an NFT could be fully generative in all aspects, not just limited to generating media content. Or, a governance token could automatically write proposals or vote on behalf of users based on protocol history and user preferences.

As the technology continues to mature, the main application scenarios of this category may shift to the financial field. For example, imagine that Ethenas USDE stablecoin can dynamically adjust its synthetic dollar strategy based on macroeconomic conditions. This will be an exciting future!

This article is sourced from the internet: The next trillion-dollar opportunity: how to seize the transition wave of Crypto+AI?

Related: Breakthrough and Reconstruction: Panoramic Outlook of the Crypto World in 2025

Original author: YBB Capital Researcher Zeke Preface Starting with the inscription craze and ending with the first crypto president’s victory, 2024 is coming to an end. This year, Crypto has experienced an extremely unusual “bull market”, with weak performance of copycats, and the meme volume being supreme. In the end, all rivers and streams finally return to BTC. In general, although there are some lows and reluctance, Crypto is indeed moving in a more positive direction. In the coming 2025, we also have many directions worth paying attention to. In this article, we will combine recent views to make a brief outlook for next year. 1. About AI At the current stage, chain abstraction projects often pursue conceptual perfection too much, resulting in the technical implementation process becoming extremely complicated,…