The trust crisis in the prediction market: When the “truth engine” starts to lie, how to build a more reliable predictio

मूल लेखक: michaellwy

मूल अनुवाद: टेकफ्लो

The potential of prediction markets has been widely recognized, but some key issues remain unresolved. This article will reveal the challenges currently facing prediction markets by analyzing recent disputes, especially the difficulties in dispute resolution. For developers, this is a huge opportunity: prediction markets are still in the early stages of development, and whoever can solve these core problems is likely to lead the next wave of innovation.

परिचय

Prediction markets are a tool that uses financial incentives to gather information. By allowing traders to bet their own judgments with funds, prediction markets can drive prices closer to the probability that reflects collective wisdom. When this mechanism works properly, prediction markets often produce more accurate predictions than traditional methods.

The advantages of prediction markets were fully demonstrated in the prediction of the 2024 US presidential election. Among them, the Polymarket platform was more reliable than traditional polls and successfully predicted Trumps victory.

As Polymarket’s credibility continues to grow, mainstream media have begun to accept it as a data source. Media such as Bloomberg, which have long been skeptical of क्रिप्टो projects, not only cited its odds in their reports, but even the search engine Perplexity also displayed its forecast data in the results, and traditional media also increasingly referred to its forecast results.

Ethereum founder Vitalik also expressed support for the prediction market. He का मानना है कि that “prediction markets and community annotations are becoming two important social cognitive technologies in the 2020s.”

However, despite the great potential of prediction markets, their decentralized “truth verification” mechanism still faces many challenges. Recently, the controversial market on Polymarket about “whether the US government will shut down” exposed key flaws in the system design and brought important insights to decentralized dispute resolution.

This article will analyze this dispute in detail, explore the design loopholes in the prediction market’s dispute resolution mechanism, and put forward suggestions for improvement.

How does Polymarket work?

Polymarket operates like a traditional exchange, but users trade probabilities rather than assets. For example, in the market for “Will Bitcoin reach $100,000 in 2024?” traders can use the system to buy or sell positions between 0% and 100%.

Suppose you believe that Bitcoin will reach $100,000 in 2024 and buy $100 worth of YES tokens at 47 cents. If your prediction is correct, you will receive $212 (calculated as 100/0.47), which is the inverse of your purchase price. This dynamic trading mechanism allows market participants to adjust their positions at any time based on the latest information, providing real-time collective forecast insights.

Polymarket’s trading mechanism is based on the Conditional Token Framework . Here is a specific example:

-

Assume the total funds in the Bitcoin prediction market is $1,000:

-

Alice believes Bitcoin will reach $100,000 and buys $200 worth of “Yes” tokens for 20 cents;

-

Bob believes that it will not be reached and buys $800 worth of “No” tokens at 80 cents;

-

The system matches the two orders because they total $1,000 (i.e. 100%);

-

The system receives 1000 USDC and creates 1000 pairs of “yes/no” tokens:

-

Alice gets 1,000 “yes” tokens (20 cents each);

-

Bob gets 1000 No tokens (80 cents each).

-

By the end of 2024, winners will be able to redeem each token for $1:

-

If Bitcoin reaches $100,000, Alice’s $200 will become $1,000 (a 5x gain), while Bob’s tokens will lose value;

-

If it is not reached, the situation is reversed, Bob makes a profit, and Alices tokens go to zero.

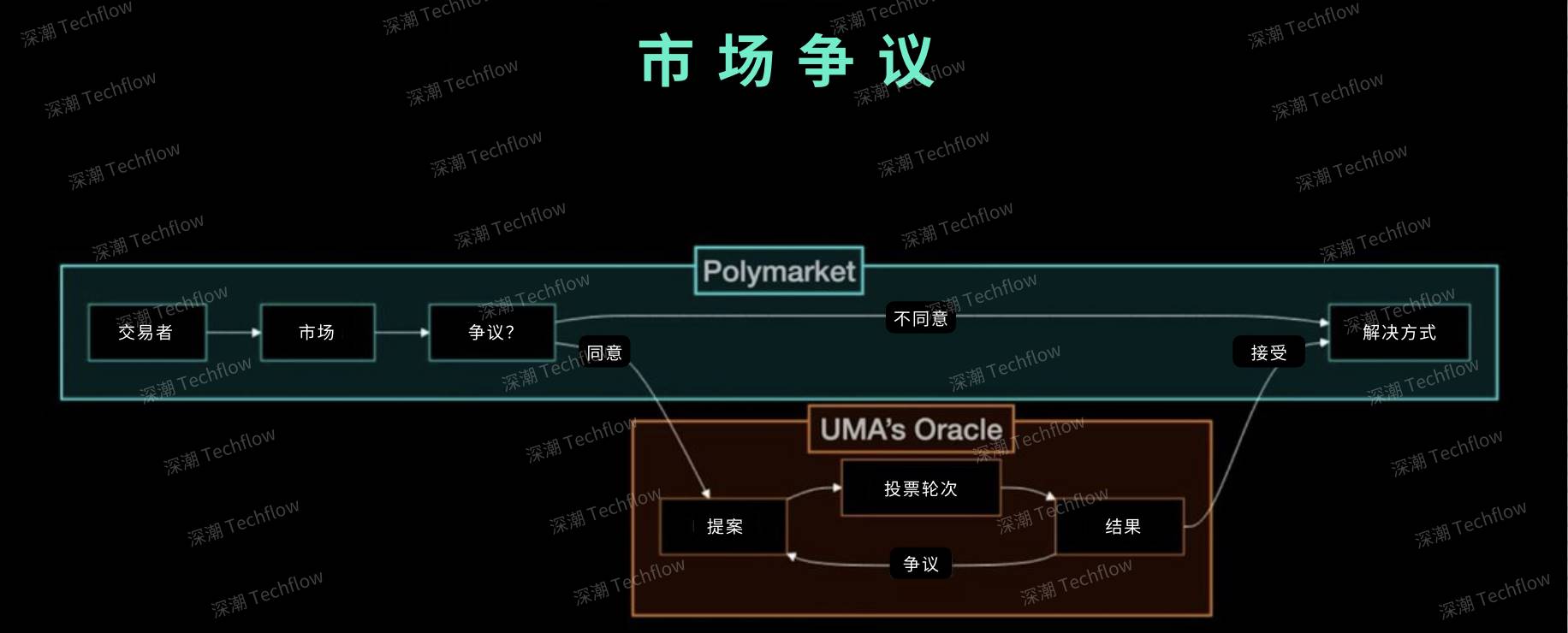

On the Polymarket platform, all transactions are completed automatically through the Polygon network, and the market results are determined by social consensus. If there is a dispute over the market results, the UMA protocol (a system based on optimistic oracles) will intervene to help verify and finally determine the market results.

The operating mechanism of the UMA protocol is as follows:

-

When market results are disputed, any user can trigger a vote;

-

Holders of UMA tokens will vote on the outcome;

-

Voting weight is proportional to the number of UMA tokens held;

-

The winner of the vote will be rewarded, while the loser will be punished.

Original image from michaellwy , compiled by TechFlow

A detailed explanation of this mechanism can be found in UMA’s official video . In addition, reports from ASXN और Shoal Research also provide a more comprehensive analysis of how UMA works.

Controversy surrounding the U.S. government shutdown

Prediction markets have demonstrated a strong ability to predict the outcomes of events, and their success in the 2024 US election has further enhanced their credibility.

However, what happens when the prediction market system goes wrong? The recent market controversy surrounding whether the US government will shut down has revealed some key flaws in the current prediction market design.

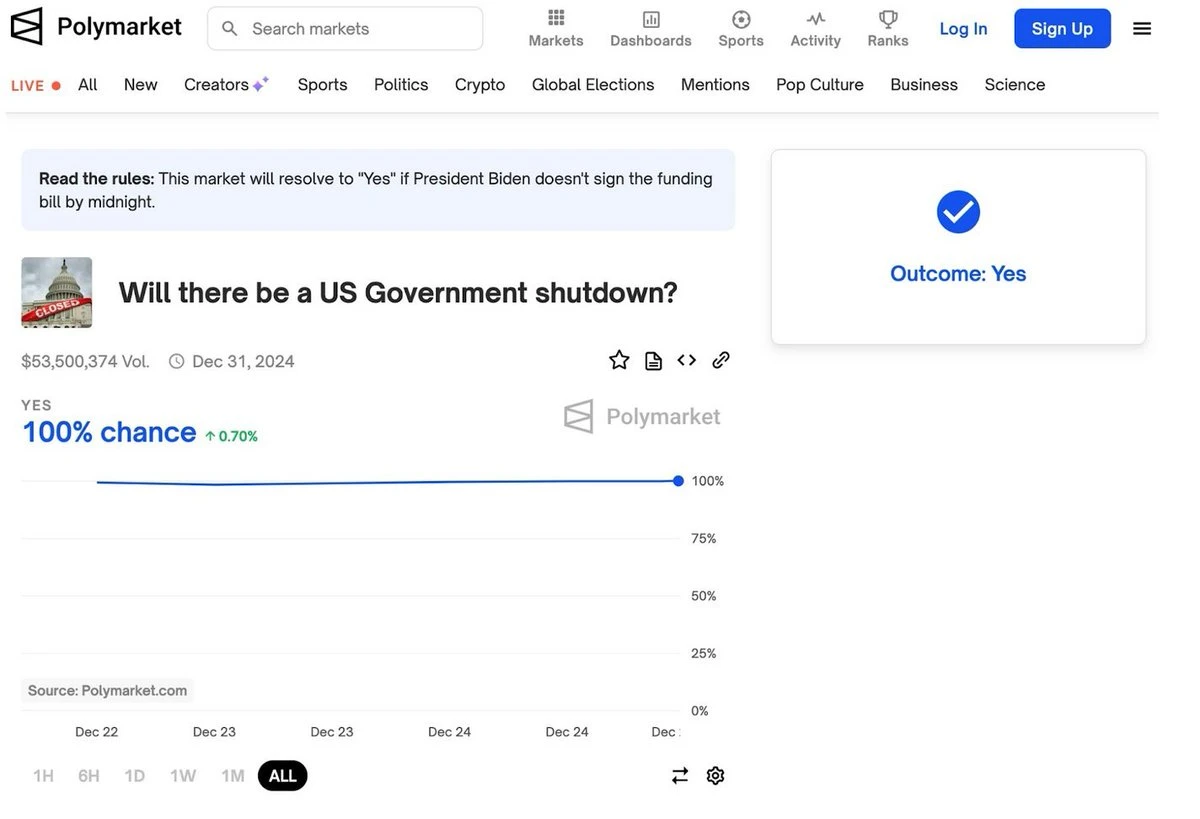

Polymarket created a बाज़ार predicting whether the U.S. government will shut down between August 30 and December 31, 2024. At first, the market design seemed simple enough. However, despite President Biden signing an appropriations bill ( HR 10545 , the American Relief Act) that successfully avoided a shutdown, and despite media outlets across the political spectrum confirming that no federal government disruption had occurred, the market continued to indicate a 99% chance of a shutdown as the trading deadline approached, ultimately ruling the outcome as “yes.”

The controversy over this result mainly stems from the modification of the rules by Polymarket during the operation of the market. Specifically, after a large number of transactions had occurred, the platform added a new rule description and introduced a deadline that did not originally exist – midnight on December 20, 2024. This change directly led to the disconnection between market results and reality.

What should have been a simple binary prediction market turned into a debate about prediction market manipulation and design flaws due to a temporary adjustment of the rules.

Timeline of events

-

December 20 at 6:00 PM (EST): The probability of the “yes” option (predicting a shutdown) is 20%, having dropped from 70%. This change is because traders generally expect the Senate to pass HR10545 to avoid a shutdown.

Polymarket official tweet: The probability of a government shutdown has dropped to just 20%. Funding bill is about to pass.

-

Later in the day: Polymarket added a banner to the market UI stating that if Biden fails to sign the bill by midnight, the market will interpret it as yes. The probability of the yes option then quickly spiked to 98% as traders bet that the Senate would not pass the bill in time for Biden to sign it.

– If President Biden does not sign the funding bill by midnight, the market will interpret this as a yes.

-

बाज़ार comment section reaction: A heated debate broke out in the comment section. Holders of the No option were confused by the sudden surge in probability and pointed out that all news sources reported that the Senate was about to pass a bill to avoid a government shutdown.

-

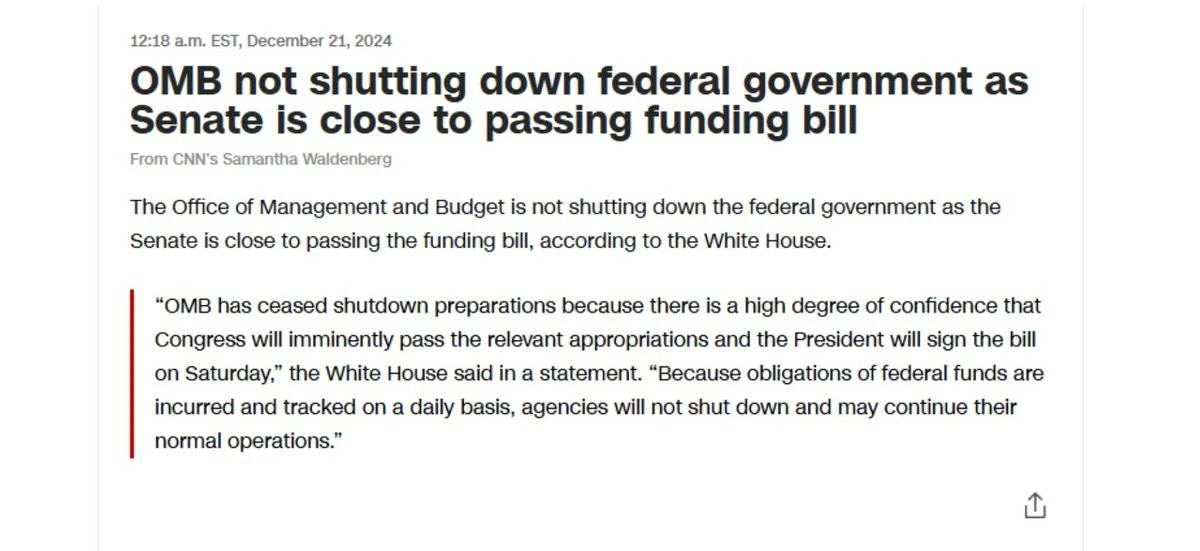

December 21, 00:38: The Senate successfully passed the funding bill.

-

Morning of December 21: Biden officially signed the bill into law, and major media outlets unanimously reported and confirmed that a government shutdown had been successfully avoided.

Senate close to passing funding bill, OMB wont shut down federal government.

The Office of Management and Budget (OMB) will not shut down the federal government as the Senate moves closer to passing a funding bill, according to the White House.

OMB has ceased shutdown preparations as Congress is expected to pass the related appropriations bill and the President will sign it on Saturday, the White House said in a statement.

“Because obligations for federal funds are generated and tracked daily, agencies will not shut down and can continue to operate normally.”

Why did the market interpret this as a “yes” when in fact there was no government shutdown?

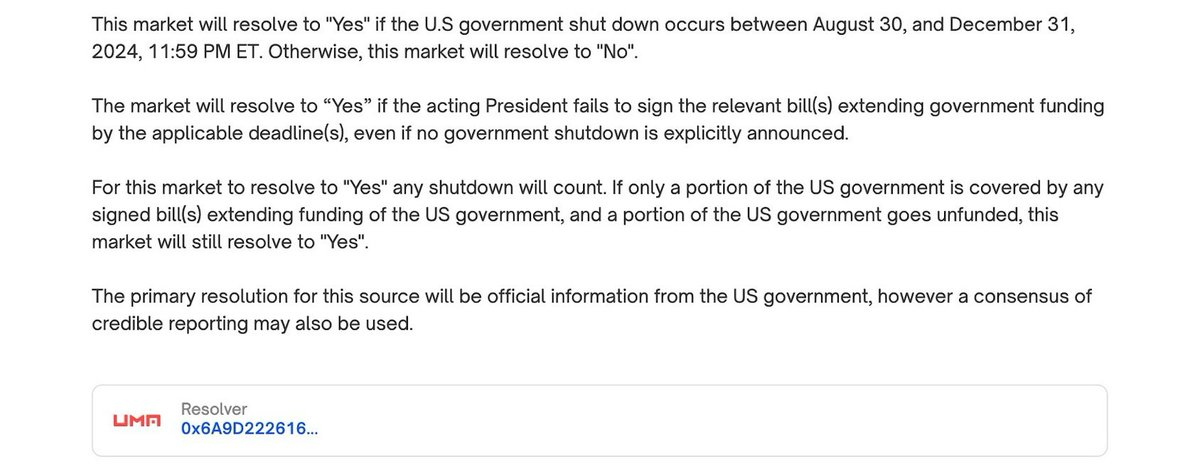

Even though the government did not actually shut down, the market ultimately interpreted it as “yes.” To understand this outcome, we need to analyze the original rules of the market carefully.

Contents of the picture:

The outcome for this market will be Yes if a U.S. government shutdown occurs between August 30 and December 31, 2024 at 11:59 PM (ET). Otherwise, the outcome will be No.

If the Acting President fails to sign a bill extending government funding by the relevant deadline, the result of this market will still be judged as yes even if a government shutdown is not explicitly declared.

Regardless of the type of shutdown that occurs, this market will call it a yes. For example, if only some U.S. government departments receive funding extension bills, while other departments do not receive funding, this market will still call it a yes.

The main basis for judgment of this market will be official information from the US government, but when necessary, it may also refer to the consensus of reports from credible media.

Analysis of market rules:

-

Point 1 – This is relatively simple and looks at whether a government shutdown occurs within a specified time period (note that the end date of the time period is December 31, 2024).

-

Point 2 – This is the core of the dispute. The “yes” holders believe that according to market rules, the President must sign the bill before the applicable deadline. They believe that midnight on December 20th is the applicable deadline, and since the signing was not completed before then, the market result should be “yes” (we will discuss this more later).

-

Point 3 – This concerns the shutdown of some government departments, but is not relevant to the current issue, so I will not discuss it in depth here.

-

Point 4 – The primary basis for explaining market outcomes will be official information released by the US government, with possible reference to consensus reports from credible media outlets.

The “yes” camp’s view:

-

Polymarket added a banner clearly stating that midnight on December 20 was the deadline.

-

The platform released “additional background information” on December 21 that further supports this rule.

Additional Background

According to the rules, if the Acting President fails to sign legislation extending government funding by the applicable deadline (12:00 midnight ET on December 20), the market will interpret this as a yes even if a shutdown has not been explicitly declared.

President Biden failed to sign the bill extending funding by midnight on December 20, so the market should interpret this as a yes.

-

Since Biden failed to sign the bill before midnight, the rules should have automatically interpreted that as a yes.

-

They argue that the rules are binding even if there is no actual government shutdown.

The “No” camp’s view:

-

Time issue:

-

The original market rules covered the period from August to December 31, 2024. The midnight deadline of December 20, which the “yes” camp stressed, was not explicitly written into the rules, but only mentioned the “applicable deadline”.

-

Federal funding operates on a daily basis, so the actual deadline is December 21 at 11:59 p.m.

-

The fact that the banner stating the “midnight deadline” was still visible on December 21st defies logic because the criteria for interpretation had expired.

-

Actual situation:

-

The White House senior deputy press secretary once confirmed : OMB (Office of Management and Budget) is ready to work because it is confident that the bill will pass.

-

Conventional logic would suggest that a missed deadline should result in a shutdown, but since no shutdown occurred, no critical deadline was missed.

Finally, a separate Polymarket question on “Will the House and Senate pass the appropriations bill by midnight?” correctly ruled “No.” The key point here is that missing a procedural deadline is not the same as a government shutdown, which confuses process with outcome. This is also why there are two separate pages, because the spirit of the market is different.

The core tension here is not just about interpretation, but about whether prediction markets should prioritize interpretations of technical rules over the real-world outcomes they are supposed to predict. When the market rules “yes” to a government shutdown that objectively never happened, the truth-seeking mechanism is broken.

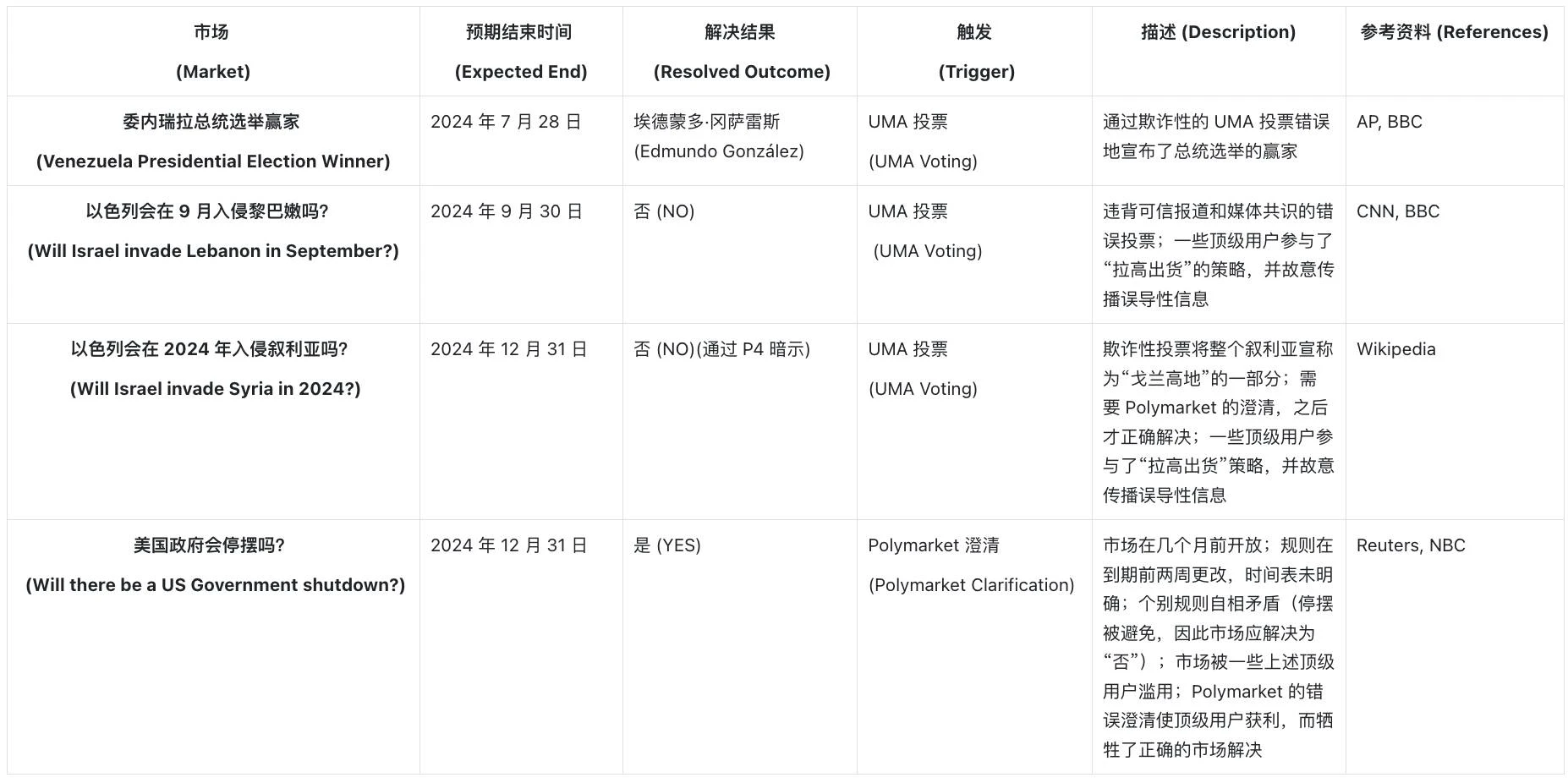

Similar disputes are not uncommon

One might think this is just an isolated incident caused by poorly written rules. But in fact, similar disputes are not uncommon. A watchdog website called Polymarketfraud (please forgive the provocative name) has documented many cases where market rulings contradict reality.

The Venezuelan presidential election winner market is particularly interesting. The current president of Venezuela is Nicolas Maduro, but the market has ruled that opposition candidate Edmundo Gonzalez has won the recent election.

Frank Muci explores this in more depth in this लेख . Here is a quick summary.

-

The market rules clearly state: The primary basis for resolving disputes is Venezuelas official information, but if there is a consensus on credible media reports, it can also be used as a reference.

-

Official election results show Maduro wins:

-

First announcement: 51.20000% vs. 42.20000%

-

Second announcement: 51.9500% versus 43.1800% (this result, which is accurate to multiple decimal places, especially with multiple zeros, makes people doubt its authenticity and may involve data falsification).

-

However, according to polling station data, the oppositions vote share showed they were ahead by more than 20%.

-

UMA token holders (who have the final say in resolving disputes) were heavily lobbied to ignore official sources of information from Venezuela and instead rely on the consensus reports of electoral fraud from credible media.

-

Ultimately, UMA holders voted to overturn the primary basis for resolution stated in the Polymarket rules, ruling that González won — though Maduro remains in power.

The inconsistency of this decision-making approach is revealing. In the case of the US government shutdown, UMA voters strictly followed a technical rule (a late-added clause regarding the midnight deadline) and ignored the medias consistent report that there was no government shutdown. However, in the case of the Venezuelan election, they did the exact opposite, overturning the main source of information and supporting the medias consensus report of election fraud.

Fraudulent Markets

( स्रोत )

This list is still being expanded and work is ongoing to research other markets. It is reasonable to assume that in all of the above markets, numerous (new) users have lost significant funds, while some of the top users mentioned above have made a significant profit on their costs. While there is no hard evidence at this time, it is reasonable to suspect that these accounts may have coordinated behavior and/or had inside information in the UMA voting process and/or Polymarket clarifications.

Furthermore, it can be further argued that the rule regarding “Will there be a US Government shutdown?” is intentionally misleading and does not clearly state which deadlines are valid for the market resolution. However, all indications are that the market should resolve to “YES” if, for example, a government shutdown does occur before 2025.

Polymarket should consider refunding users affected by these fraudulent markets and/or adopting a 50/50 solution where applicable. If no action is taken, this controversial market trend will continue, resulting in a small number of large users making profits while a large number of new users losing money. This may be a matter for the CFTC and/or FBI to look into as soon as possible.

Another example involved the Israel-Hezbollah ceasefire market. Despite credible reports that military action was continuing, the market still priced in a “yes” outcome. A YouTube video titled “ Game Prediction Markets: $40 Million Lessons ” explains the event in detail.

Additionally, Lou Kerner presents an interesting theory in his article about potential issues with the US election market. Although he calls it a “conspiracy theory,” his analysis suggests that Polymarket’s presidential election market may be structurally biased in favor of Trump.

The scenario he envisions is this: If Trump loses, he may refuse to concede defeat, claiming voter fraud and contesting the results, as he did in 2020. So even if Kamala Harris actually wins the election, the market may not rank the result in her favor.

This situation creates a “heads I win, tails I don’t lose” situation for Trump supporters. If Trump wins, bettors will directly profit; if he loses but disputes the result, the market resolution may be delayed or changed by the vote of UMA token holders.

Problems

The first is the issue of rule manipulation. When platforms can add instructions at will, the role of oracles becomes meaningless. In the case of the government shutdown, the posting of the new banner caused the market odds to quickly surge to yes and changed the original effective deadline from December 31 to December 20, 2024.

This also raises other questions about the resolution criteria. When the rules conflict, which one should prevail? Although the main resolution criteria clearly stipulate news sources and credible reports, and set a deadline of December 31, the market ultimately made a resolution based on the clarification added later, that is, midnight on December 20. This inconsistency in the priority of rules has seriously damaged the markets credibility.

Another structural challenge lies in the relationship between UMA holders and the Polymarket resolution system. Since UMA token holders can participate in both trading and voting, this creates a strong interest binding relationship between large traders and oracle voters.

Although Polymarket and UMA are supposed to be independent systems that check and balance each other, in reality UMA is the only oracle provider for Polymarket. This reminds me of a scene in the movie The Big Short where the ratings agency employees admit that they must give AAA ratings or the bank will switch to a competitor. When the success of a system depends on pleasing those powerful participants, independence is out of the question.

Dispute Resolution: The Achilles’ Heel of Prediction Markets

The core value of prediction markets lies in their ability to accurately determine facts. Even with the most sophisticated user interface (UI), the most complex trading system, and the most ample liquidity, it all means nothing if you can’t reliably determine who has won the bet. Polymarket currently relies on UMA’s oracle system to resolve disputes, but the system’s operating mechanism may have potential vulnerabilities.

Overview of the basic mechanism of UMA:

-

When market outcomes are disputed, any user can trigger a voting process.

-

UMA token holders vote on the outcome according to the rules.

-

The size of the voting power depends on the number of UMA tokens held by the user.

-

The winners of the votes will be rewarded, while the losers will be punished.

में गंदगी भरी सड़कें blog, Luca Prosperi proposed a concept called Corruption Value Multiple (CVM) to measure the potential risk of the market in response to the oracle problem of Polymarket. Here is his analysis:

-

Currently, the total value of open bets on Polymarket is around $300 million, while the total market cap of UMA is only $220 million.

-

Controlling half of UMA’s tokens would require approximately $110 million.

-

This means that for every $1 spent controlling UMA, $1.36 worth of stakes could be influenced.

However, the actual risk may be higher for a number of reasons, including:

-

The actual voting rate of UMA tokens is usually only 20%, far below 100%.

-

Market rules are often vague, leaving a grey area for dispute adjudication.

-

Voters may be influenced by public opinion or interested parties.

-

The money needed to influence market outcomes may be far less than the theoretical $110 million.

This means that if traders believe they can influence outcomes by manipulating the oracle’s rulings, they could artificially drive market prices far beyond their true probability.

These issues reflect the complexity of the prediction market design. Although there is no one-size-fits-all solution at present, the improvement of dispute resolution mechanisms is undoubtedly one of the most important challenges facing the prediction market. If the market ruling results are inconsistent, users trust in the system will gradually erode, and eventually the market will deviate from its original goal.

Improvement direction: How to optimize the dispute resolution mechanism?

Fixed market rules, no post-modification. Once a market is live, its rules should be locked and not changeable. Market terms should not allow any form of supplemental explanation or after-the-fact clarification after creation. The original rules should be used as the only reference. When disputes arise, the oracle should adjudicate strictly according to these basic rules without interference from platform additions.

Establish rule priorities and on-chain records. Market rules need a clear order of priority. For example, when there is a conflict between rules, which rules have higher authority? Primary interpretation criteria (such as credible media reports) should clearly take precedence over secondary mechanisms. This rule hierarchy should be recorded on the blockchain when the market is created, forming an unalterable chain of evidence to ensure the transparency and authority of the rules.

Reputation-based verification mechanism. In addition to the existing token voting, the market can also introduce a reputation-based council system. This system is composed of respected industry experts who participate in the adjudication of market results with their professional reputation as collateral. This mechanism not only introduces higher professionalism, but also increases social responsibility in the verification process.

Inter-subject fork mechanism. Inter-subject fork is a mechanism that draws on Eigenlayer innovations and is specifically designed to handle obvious errors that human consensus can identify. When a major dispute arises in the market, the community can split the token used for arbitration (whether it is an oracle token or a protocol token) into two versions, each supporting a different interpretation of the result. Afterwards, the markets selection mechanism will determine which version of the token retains value. The party supporting the wrong interpretation will be naturally punished economically by the decline in the value of its token, effectively curbing manipulation.

AI Agent as an Independent Arbitrator. To avoid manipulation by token holders due to financial motivations, we can develop a dedicated AI Agent whose sole purpose is to adjudicate market outcomes. Unlike humans who may vote based on their own positions, AI agents can be designed to be completely neutral and focus on analyzing evidence impartially, thereby providing more accurate market decisions. This approach can significantly improve the credibility of the market and the efficiency of decision-making, while reducing the possibility of human interference.

निष्कर्ष के तौर पर

First of all, it should be noted that this article is not specifically intended to criticize Polymarket. However, as the largest (and frankly, the only) player with real influence in the current cryptocurrency prediction market, it is the best case study to understand the challenges facing the entire industry.

Why are these questions so important? If we view prediction markets as simply a speculative platform where traders bet on outcomes, then the impact of its flaws is relatively limited. Sure, some people may lose money on it, but at the end of the day, it’s just another place for speculation.

However, prediction markets are being given a higher status and are seen as “truth engines” – objective tools that can remove noise and bias and reveal the true probability of future events.

This is why the government shutdown case is so interesting. When the market confidently predicted and verified a government shutdown that never actually happened, it revealed how these so-called truth engines can create a false reality that is inconsistent with the facts. The problem is not just the financial losses of some traders, but the greater danger is that these objective verification systems we are building can be used by those with the capital and motivation to manipulate public perception.

As prediction markets grow in influence, their structural weaknesses become a problem that everyone needs to face. If we fail to address these fundamental flaws, we risk turning prediction markets into a powerful tool to distort the truth rather than discover it.

This article is sourced from the internet: The trust crisis in the prediction market: When the “truth engine” starts to lie, how to build a more reliable prediction system?

Related: BTC Volatility Weekly Review (December 23-30)

Key indicators: (December 23, 4pm -> December 30, 4pm Hong Kong time) BTC/USD fell 1.9% ($95,300 -> $93,500), ETH/USD rose 3.0% ($3,300 -> $3,400) The price action over the past week was quite volatile, but it ultimately held between $92,500 and $99,000, resulting in a reduction in realized volatility (at least the volatility between settlement points). We speculate that this trend will continue in the next few trading days, but there is a possibility of volatility at the end of the year settlement. At the same time, this long round of price adjustment may end before the end of the year and prepare for the next round of increases. The current support level is as low as $92,000, and we expect to find good support at the $90,000 level, with…