From the transaction volume, fees and income, I will tell you why I am bullish on HYPE in the long term.

स्रोत: Thor Hartvigsen

ओडेली प्लैनेट डेली द्वारा संकलित ( @ओडेलीचाइना )

अज़ुमा द्वारा अनुवादित ( @अज़ुमा_एथ )

पृष्ठभूमि

Since the launch of HYPE, Hyperliquid has seen significant growth in both trading volume and revenue.

HYPE was officially launched on November 29th, with an opening price of around US$2. It experienced a sharp rise in December until recently when it fell back (down about 34% from its all-time high).

What鈥檚 next for HYPE and Hyperliquid?

This article will analyze the fundamentals of Hyperliquid and HYPE in depth, explore HYPEs upside expectations, and analyze potential valuations based on transaction volume and revenue growth trends in 2025.

Trading volume data

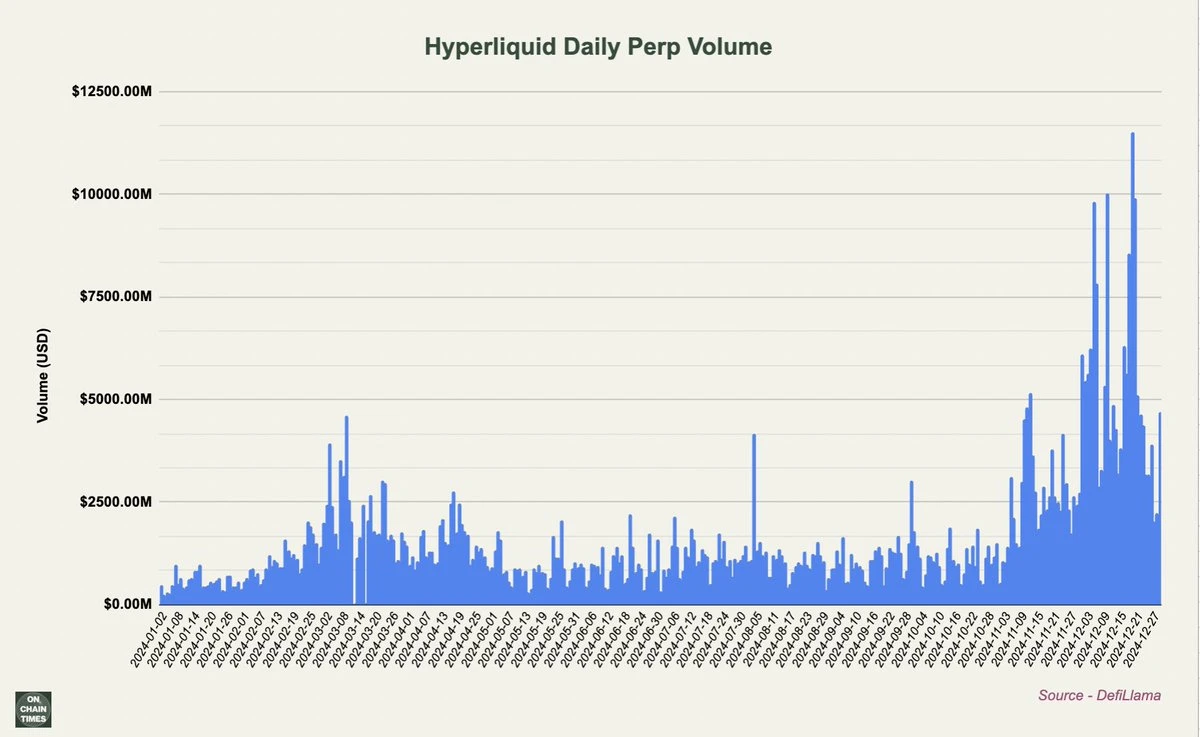

While some expected trading volume on Hyperliquid to drop following the HYPE airdrop (as has historically been the case with other derivative exchanges), the opposite has happened. Since then, trading volume on Hyperliquid has increased significantly, setting new highs of over $10 billion in daily trading volume on multiple occasions.

The HYPE airdrop accounts for 31% of the total supply. It is estimated that 42.81% of the supply will be available for future distribution and community rewards. Although it is foreseeable that part of the remaining share will be used for staking incentives and HyperEVM Layer 1 ecosystem incentives, the possibility that traders and HYPE holders will receive some kind of reward again without knowing it in the future is not zero.

At a price of $25, 42.81% of HYPE supply is equivalent to approximately $11 billion.

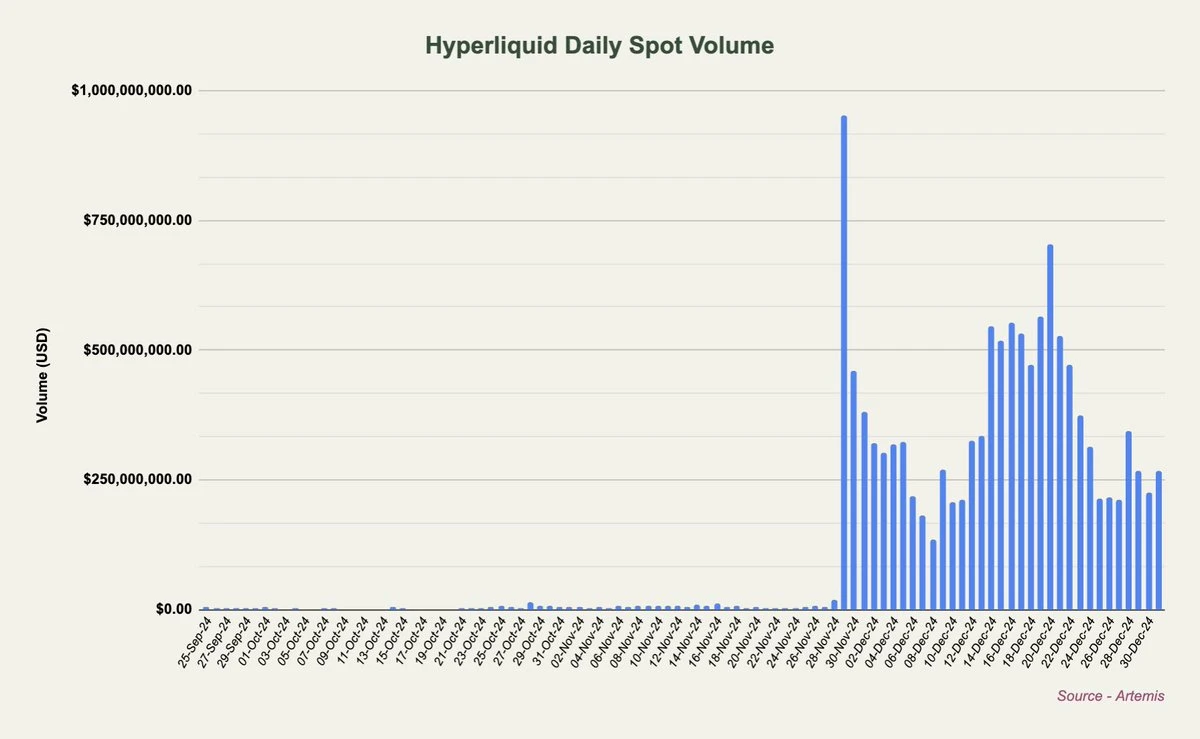

In addition to contract trading volume, Hyperliquid鈥檚 spot trading volume has also increased significantly since HYPE went live, with trading volumes of $250-500 million on most trading days.

Hyperliquid vs CEX

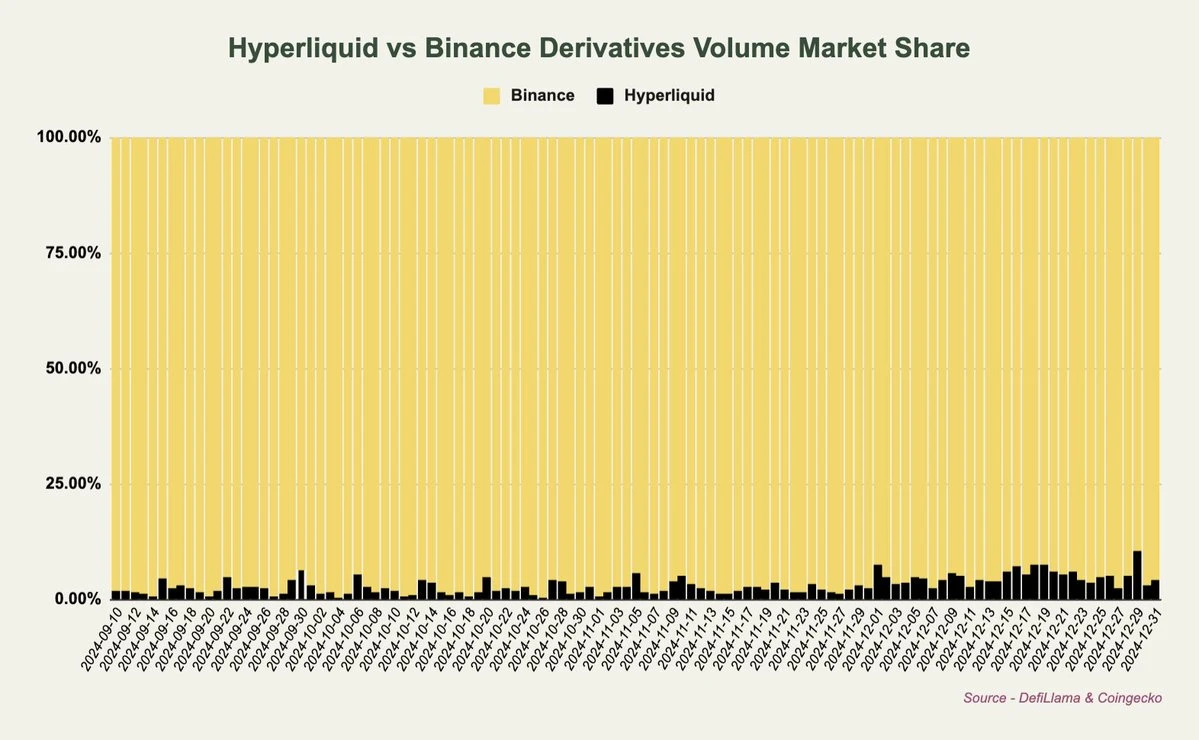

For a long time, I have been tracking the trading volume of Hyperliquid compared to centralized exchanges (CEX) such as Binance.

Hyperliquids bullish outlook involves market share growth as more users and trading volume start to move on-chain over time. Comparing Hyperliquid to Binance, its clear that theres still a long way to go. However, as shown in the chart below, Hyperliquids market share has shown a clear upward trend in December. Over the past two weeks, Hyperliquids relative market share has been around 5-8%.

According to Coingecko, Binance鈥檚 recent daily derivatives trading volume is between $60 billion and $150 billion. However, these volume figures cannot be verified from the CEX end and need to be treated with caution.

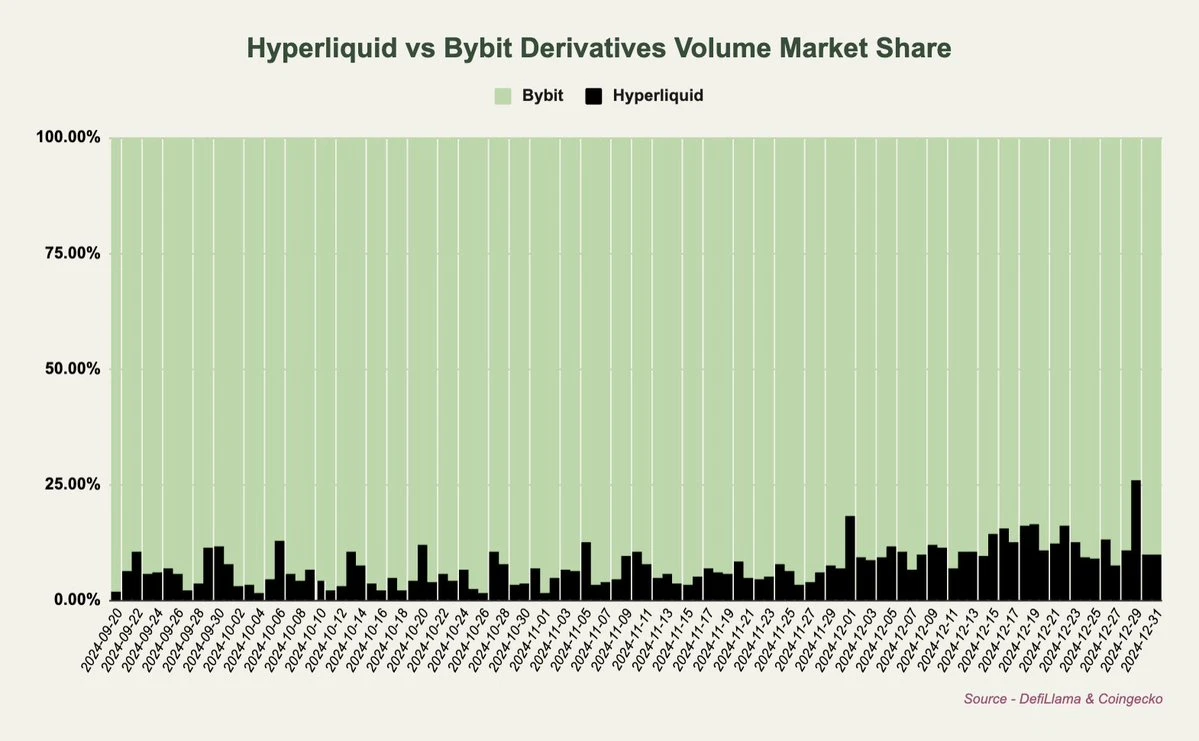

Compared to Bybit, Hyperliquid鈥檚 market share recently reached 25% (peak data).

Fees and income

Contract Trading

The fees on Hyperliquid are paid by users trading on the platform. Compared to other exchanges such as Binance, Hyperliquid has lower fees, a move designed to incentivize more trading activity. For perpetual contract trading, for most users, the fee for market orders is 0.035% and the fee for limit orders is 0.01%. The higher the trading volume, the lower the fee.

These fees are collected by the HLP market making vault, insurance fund, assistance fund (mainly responsible for repurchase), and some other miscellaneous addresses on Hyperliquid. The Hyperliquid team has not disclosed the specific distribution of platform transaction fees, so it is difficult to accurately estimate HYPEs repurchase data.

Spot Trading

The fees users pay on the spot market are used to buy and burn the specific tokens being traded. Not surprisingly, HYPE currently accounts for the majority of Hyperliquid鈥檚 spot trading volume. So far, HYPE鈥檚 spot trading fees have exceeded 100,000 HYPE (over $2 million at current prices).

Overall, this has no material impact on the supply of HYPE (at least not yet) compared to the buybacks by the rescue fund.

Spot Auction

Hyperliquid also generates significant revenue from spot auctions. At $500,000 per auction, Hyperliquid can earn an additional $141.29 million per year.

Rescue Fund and HYPE Buyback

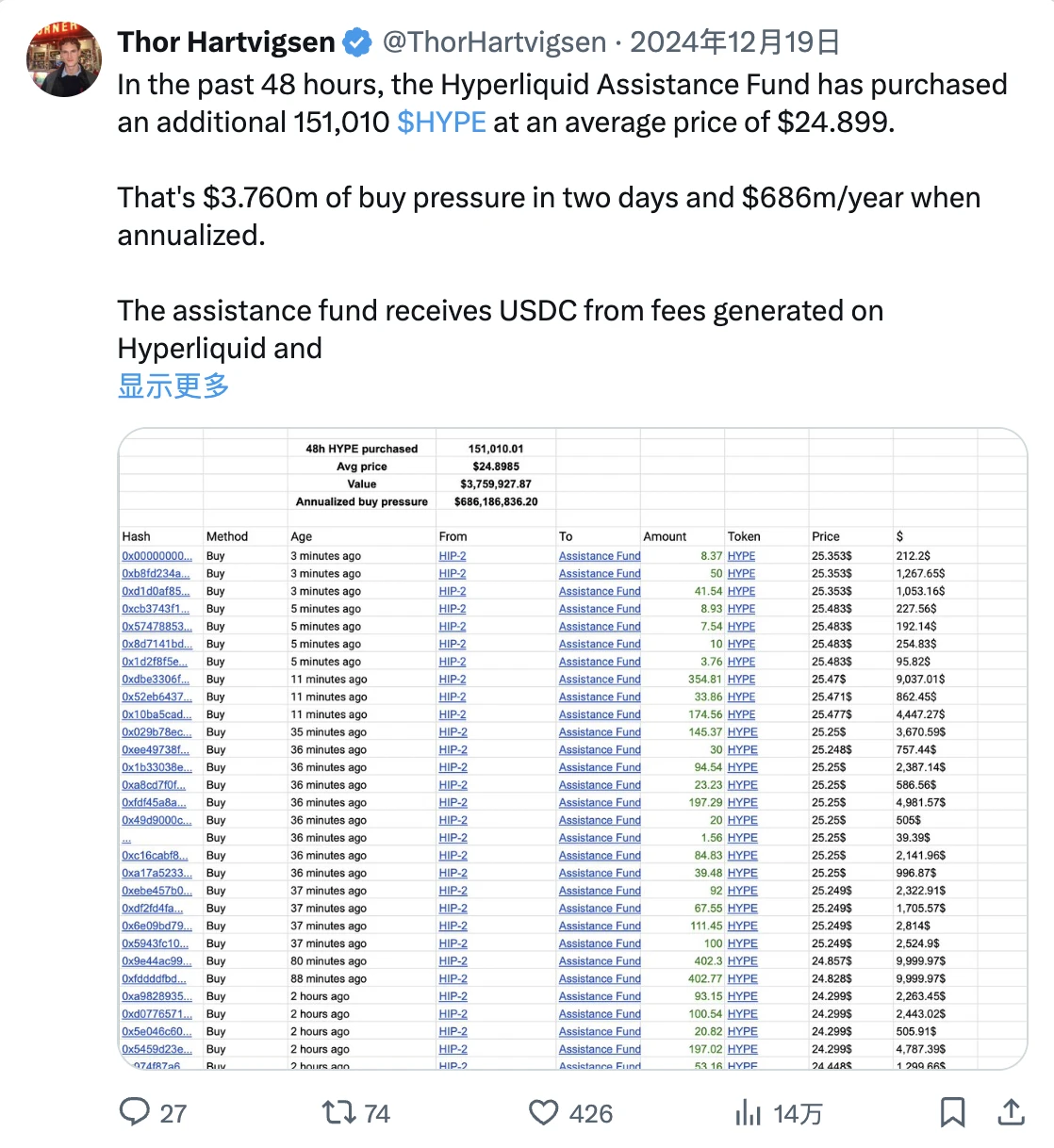

While the details of the revenue distribution from spot auctions and contract trading are still unclear, we can measure the daily HYPE repurchase data through the assistance fund.

Two weeks ago, I published an analysis on X that analyzed the HYPE repurchases of the assistance fund within 48 hours. At that time, a total of about 151,000 HYPE were repurchased within 48 hours, which is equivalent to an annual repurchase of about US$686 million.

During those two days, Hyperliquids average daily volume reached $8 billion.

Valuation Framework

Heading into 2025, HYPEs upside expectations are a bet that Hyperliquids trading volumes continue to grow and that spot auction demand continues to grow, as this will lead to increased revenue for Hyperliquid, which in turn will amplify HYPEs buyback efforts.

A key reason for the growing volume on Hyperliquid is that Hyperliquid still has billions of dollars left for future rewards, which will make Hyperliquid a very profitable trading venue. Other potential catalysts include the spot listing of CEX and the launch of HyperEVM.

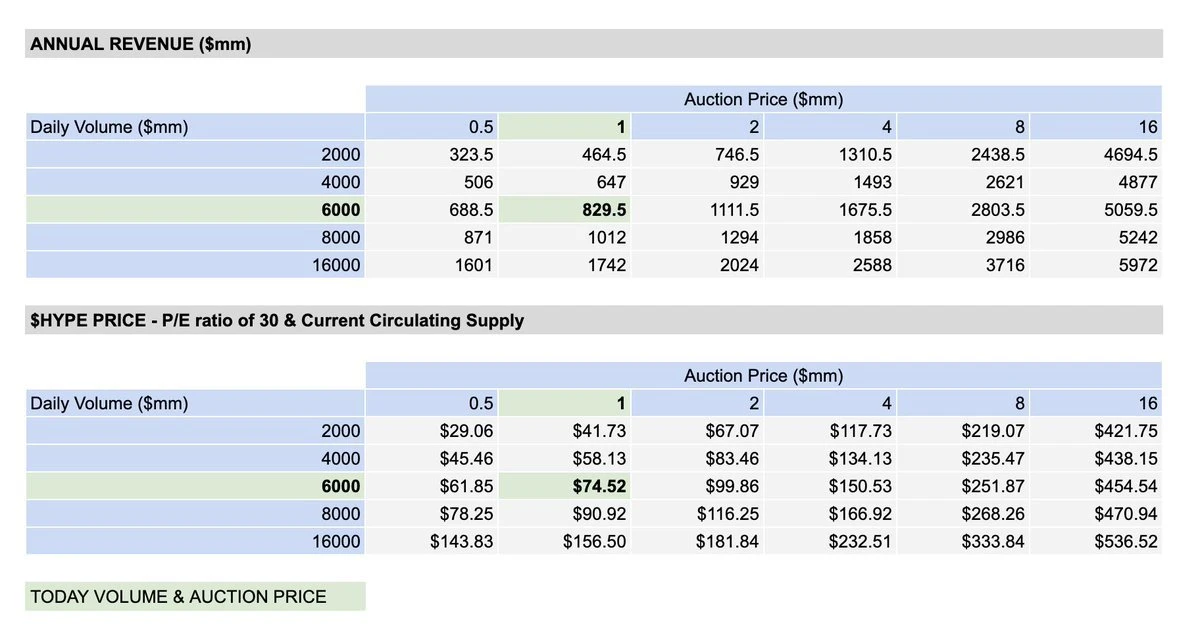

@fmoulin 7 once made a good analysis of HYPEs potential valuation. Assuming a price-to-earnings ratio (P/E) of 30, the corresponding HYPE price expectations under different levels of contract transaction fee income and auction income are as follows.

Odaily Note: For additional reading, please see In-depth Analysis of Hyperliquid: Potential Market Opportunities and HYPEs Bullish Logic .

Hyperliquids average daily volume over the past 14 days was approximately $4.89 billion, with auction prices of approximately $500,000.

Given this, we arrive at an annual revenue estimate of $587.5 million for Hyperliquid, which, assuming a PE ratio of 30, implies a potential HYPE of $52.78. Note that this is calculated on a circulating market cap basis rather than a FDV basis, as future unlocks are mostly related to community incentives rather than internal group unlocks.

There are also two points worth noting: as of now, almost all of these revenues will be used to repurchase HYPE; more and more HYPE has been pledged (currently about 25%), which effectively reduces the liquidity supply.

All in all, if you believe that Hyperliquid trading volume and adoption will continue to grow, there are many reasons to be bullish on HYPE over the longer timeframe.

This article is sourced from the internet: From the transaction volume, fees and income, I will tell you why I am bullish on HYPE in the long term.

According to incomplete statistics from Odaily Planet Daily, there were 21 blockchain financing events announced at home and abroad from November 25 to December 1, an increase from last weeks data (14). The total amount of financing disclosed was approximately US$173 million, an increase from last weeks data (US$118 million). Last week, the project that received the most investment was blockchain payment company Partior ($80 million); synthetic stablecoin issuance protocol usdx.money followed closely behind ($45 million). The following are specific financing events (Note: 1. Sort by the amount of money announced; 2. Excludes fund raising and MA events; 3. * indicates a traditional company whose business involves blockchain): Blockchain payment company Partior completes $80 million Series B financing, with Deutsche Bank participating On November 27, blockchain payment company Partior completed…