Cryptocurrency Taxation in Asia: Bullish or Bearish?

-

Tax policies take many forms, including tax exemptions, progressive taxes, flat taxes, transitional taxes, and transaction-based taxes, reflecting each countrys economic strategy and policy priorities.

-

There is a major conflict between the governments need for tax revenue and investors concerns about excessive taxation, which has led to capital outflows to overseas exchanges.

-

In order for क्रिप्टोcurrency taxation to make progress, a balanced policy of revenue collection needs to be developed to support the healthy development of the market.

1. Cryptocurrency trading and taxation

Taxation of cryptocurrency transactions has been a hotly debated topic since the cryptocurrency trading market emerged. However, the core conflict has always existed – the needs of the government and investors are different. The government emphasizes the need to ensure taxation, while investors are worried that excessive taxation will lead to reduced profitability.

However, taxation is an inevitable component of the modern capitalist system and a key driver of market development. In particular, cryptocurrency taxation is expected to lay the foundation for market growth through three key effects.

First, it can establish a formal market. The example of stock markets shows that taxes on profits or transactions are often tied to official recognition of assets. This helps to create a stable basis for market activity.

Second, investor protection can be strengthened. The U.S. Consumer Financial Protection Act and the Consumer Financial Protection Bureau (CFPB), established in 2010, are examples of proper regulation to protect investors. In Web3 markets, limiting indiscriminate product releases and misleading advertising can help prevent fraud and protect investor rights.

Finally, taxation can accelerate the integration of cryptocurrencies into the existing financial system by clarifying their legal status. Such integration can increase market stability and trust.

However, given the uniqueness of the cryptocurrency market, it is difficult to expect taxation to have a positive effect based solely on the experience of the stock market. Given the rapid growth of cryptocurrencies, many current tax systems have been criticized as a pure means of extracting value. This has led to increasing conflicts between governments and investors.

Against this backdrop, this report will examine the cryptocurrency taxation regimes of major Asian countries. It will analyze how the three effects mentioned earlier – market establishment, investor protection, and system integration – are implemented. By doing so, it will provide a balanced perspective of both investor and government perspectives.

2. Comparative analysis of cryptocurrency taxation in major Asian markets

Source: X

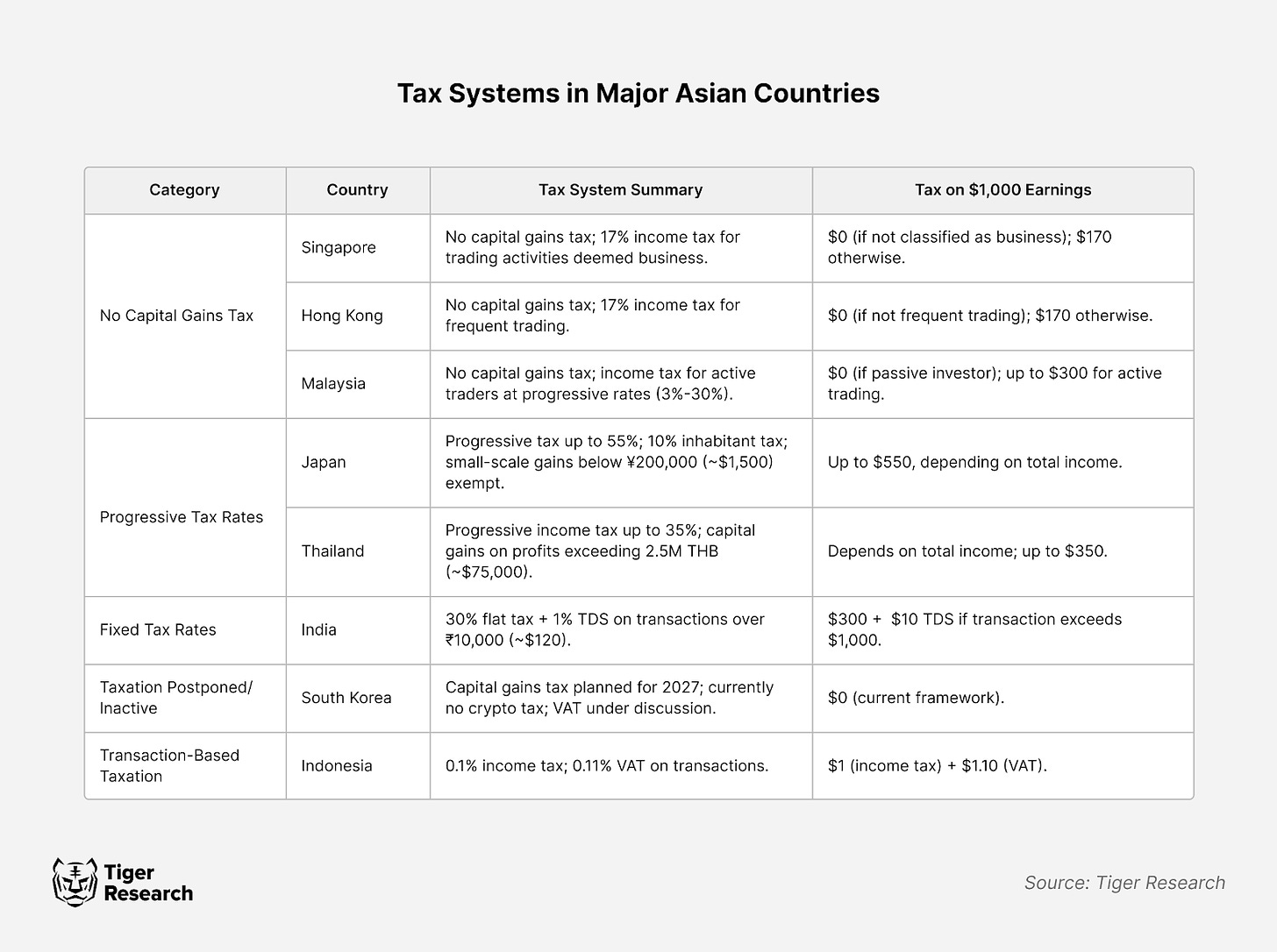

Our analysis of cryptocurrency tax systems in major Asian countries reveals five different policy types. These differences reflect each country’s economic structure and policy priorities.

For example, Singapore is exempt from capital gains tax and only imposes a 17% income tax when cryptocurrencies are deemed as business income. This flexible approach has solidified Singapores position as a global cryptocurrency hub. Similarly, Hong Kong is considering tax exemptions for investment income of hedge funds and family offices, further enhancing its appeal to institutional investors.

In contrast, Japan imposes a high tax rate of up to 55%, with a focus on curbing speculative activities. However, Japan is also considering a proposal to reduce the tax rate to 20%, which could indicate a possible change in its current approach to crypto taxation.

2.1. Key duty-free countries: Singapore, Hong Kong, Malaysia

Major Asian financial centers such as Singapore, Hong Kong and Malaysia have all adopted a capital gains tax exemption policy for cryptocurrencies, which is in line with the long-standing economic strategies of various countries.

These countries’ tax-free policies are consistent with their traditional financial frameworks. Historically, they have attracted global capital through low tax rates, including no capital gains tax on stock investments. Maintaining this stance on cryptocurrencies demonstrates policy consistency and a clear commitment to their economic principles.

This strategy has yielded significant results. For example, Singapore became Asia’s largest cryptocurrency trading center in 2021. As there is no tax burden on investment profits, investors are actively participating in the market, accelerating its growth.

However, tax exemptions are not without their limitations. The main challenges include the risk of overheated speculation and reduced direct tax revenues for governments. These countries are taking alternative measures to address these issues. They are securing indirect tax revenues through the development of the financial services industry and maintaining market stability through strict regulation of exchanges and financial institutions.

2.2. Countries with progressive tax systems: Japan and Thailand

Japan and Thailand have high progressive tax rates on cryptocurrency trading profits. The policy reflects the broader social goal of wealth redistribution by taxing high-income groups. In Japan, the top tax rate is 55%, which is consistent with the policy for traditional financial assets.

However, such a high tax rate also has considerable drawbacks. The most notable problem is capital flight, where investors transfer assets to tax-free areas such as Singapore, Hong Kong or Dubai. There are also concerns that the heavy tax burden may inhibit market growth. Regulators are also closely monitoring market feedback.

2.3. Uniform tax rate country: India

Source: ISH News Youtube

India imposes a flat tax rate of 30% on profits from cryptocurrency trading. This approach differs from the progressive taxation system used in traditional financial markets and reflects India’s strategic choice to achieve two key goals: administrative efficiency and market transparency.

Indias flat tax policy has produced several significant results. First, the tax system is simple and clear, reducing the administrative burden on taxpayers and tax authorities. In addition, applying the same tax rate to all transactions minimizes tax avoidance strategies such as splitting or circumventing transactions.

However, the uniform tax system also has obvious limitations. The biggest concern is that it may discourage small investors from entering the market. Even small profits are subject to a high tax rate of 30%, which puts a heavy burden on small-scale investors. In addition, imposing the same tax rate on high-income groups and low-income groups also raises questions about tax fairness.

The Indian government is aware of these issues and is currently exploring solutions. Proposed measures include reducing tax rates for small transactions or providing incentives for long-term holders. These efforts aim to retain the benefits of a unified tax system while promoting balanced growth in the market.

2.4. Transition method: South Korea

Source: Kyunghyang News

South Korea has adopted a cautious approach to cryptocurrency taxation, reflecting the high uncertainty of the cryptocurrency market. A notable example is that the financial investment income tax, which was originally scheduled to be implemented in 2021, was postponed to 2025. The implementation of cryptocurrency taxation has also been further postponed to 2027 along the same lines.

This transitional approach has clear advantages. It allows the market to grow organically while providing time to observe policy outcomes in other countries and global regulatory trends. By studying the cases of Japan and Singapore, South Korea aims to establish an optimized tax framework ex post facto.

But this approach also has challenges. At the same time, the lack of a clear tax system may cause market confusion and increase the risk of speculative overheating. In addition, due to the lack of regulatory infrastructure, investor protection may be affected, which may hinder long-term market development.

2.5. Transaction-based taxation: Indonesia

Indonesia has implemented a unique transaction-based taxation system, which is different from other Asian countries. The system imposes 0.1% income tax and 0.11% value-added tax (VAT) on transactions. The policy was introduced in May 2022 as part of Indonesias broader financial market modernization reforms.

The transaction tax increases market transparency by applying a low, uniform rate to all transactions, streamlining procedures, and encouraging the use of licensed exchanges. Since its implementation, trading volumes on these exchanges have increased.

But the policy has its limits. Similar to India, the flat tax rate places an undue burden on small-scale traders. For frequent traders, the cumulative tax costs could be very high, raising concerns about reduced market liquidity.

The Indonesian government is aware of these challenges and plans to refine its policies based on market feedback. Measures under consideration include tax cuts for small transactions and incentives for long-term investment. These adjustments are intended to preserve the advantages of transaction-based taxation while addressing its shortcomings.

3. Conflict between investors and governments

Although tax systems vary from country to country, conflicts between governments and investors over cryptocurrency taxation remain a common problem. These conflicts arise not only from taxation practices, but also from fundamental differences in the perception of digital assets. The nature of this conflict varies depending on the tax policy of each country.

Governments around the world see profits from cryptocurrency trading as a new source of tax revenue. In particular, as the COVID-19 pandemic has exacerbated fiscal deficits, the rapid growth of the cryptocurrency market has become an attractive means of earning stable income. For example, Japans progressive tax system imposes a tax rate of up to 55%, and Indias flat tax rate of 30%, both highlighting the governments strong push for taxation.

Source: GMB Labs

From an investors perspective, excessive taxation is seen as an obstacle to market growth. Higher tax rates compared to traditional financial products, coupled with the cumulative tax burden from frequent transactions, discourage investment activities. As a result, capital flight has become a major problem. Many investors are transferring assets to overseas platforms such as Binance, or relocating to tax-free jurisdictions such as Singapore and Hong Kong. This suggests that the governments efforts to ensure tax collection may be counterproductive.

In some cases, governments have focused solely on taxation without introducing policies to support market development, further exacerbating the problem as investors view this approach as overly restrictive and short-sighted.

Finding a new balance between governments and investors is becoming increasingly important. The solution requires more than simple tax adjustments. It requires innovative policies that support healthy market growth while ensuring appropriate tax revenues. Achieving this balance will be a key policy challenge for governments in the coming years.

4. बाज़ार revitalization policies and activation strategies at the national level

Cryptocurrency taxation has a dual impact on market development. While some countries use it as an opportunity for institutionalization and market growth, others face market stagnation and brain drain due to strict tax policies.

Singapore is a great example of a successful market activation. Singapore encourages innovation by exempting capital gains tax, through systematic support for blockchain companies and the operation of a regulatory sandbox. This comprehensive approach has solidified its position as Asia’s leading cryptocurrency hub.

Hong Kong is also implementing an active market development strategy. While maintaining its tax exemption policy for individual investors, Hong Kong is expanding the licensing framework for digital asset management companies. Notably, from 2024, Hong Kong will allow qualified institutional investors to trade in cryptocurrency ETFs, further expanding market participation.

On the other hand, strict tax policies in some countries have also become an obstacle to market growth. High tax rates and complex regulations have prompted investors to transfer assets overseas, leading to the outflow of innovative companies and professional talents. This has raised concerns about the long-term weakening of these countries competitiveness in the field of digital finance.

Ultimately, the success of cryptocurrency tax policy depends on a balance with market development. In addition to simply securing short-term tax revenue, governments must also consider how to foster a healthy and sustainable market ecosystem. Looking ahead, countries will need to continually adjust policies to achieve this critical balance.

5। उपसंहार

Taxing cryptocurrencies is an inevitable step in developing the digital asset market. However, the stabilizing effect of taxation needs to be carefully reconsidered. Some believe that transaction taxes can curb speculative trading and reduce market volatility, but historical cases show that these effects are often not achieved.

A striking example is Sweden in 1986. When the financial transaction tax was increased significantly from 50 basis points to 100 basis points, a large portion of stock trading shifted to the UK market. Specifically, 60% of the trading volume of 11 major Swedish stocks shifted to the London market, highlighting the unintended consequences of poor tax policy.

Both governments and investors must carefully assess the actual impact of taxation. Governments should not only focus on simple tax revenue, but should also focus on fostering a sustainable and healthy market environment. Investors should view taxation as an opportunity to institutionalize the market to promote a more stable and mature investment environment.

Ultimately, the success of cryptocurrency taxation depends on whether governments and market participants can find a balanced approach. This is not just a matter of adjusting tax rates, but a key challenge that will determine the long-term direction and development of the digital asset market.

मूल लिंक : https://reports.tiger-research.com/p/cryptocurrency-taxation-in-asia-bullish-eng

This article is sourced from the internet: Cryptocurrency Taxation in Asia: Bullish or Bearish?

Original author: Dan Morehead, founder of Pantera Capital Compiled by: Odaily Planet Daily Azuma Thousand times profit Pantera’s Bitcoin Fund recently reached a crazy milestone — a thousand-fold profit. With BTC surging nearly 30% following Trump’s victory, the fund’s total return since inception is 131,165% after fees and expenses. I want to share with you our original logic because it seems to me just as convincing today. Odaily Note: In an email on July 5, 2013, Dan, as CEO, called on Pantera to buy BTC at the market price of $65, and said that he had decided to buy 30,000 coins first, and others could decide whether the fund itself would buy. Two days later, on July 7, the Pantera Bitcoin Fund was officially established. The day we chose to…