Electric Capital report: 39,000 new developers joined, Solana is the ecosystem with the most new developers

Original author: Maria, Electric Capital

मूल अनुवाद: 1912212.eth, फ़ोरसाइट न्यूज़

The sixth annual ElectricCapital Developer Report has been produced by 829 people since its creation, and we analyzed a record 902 million code commits covering 1.7 million code repositories.

How will the क्रिप्टो industry perform in 2024?

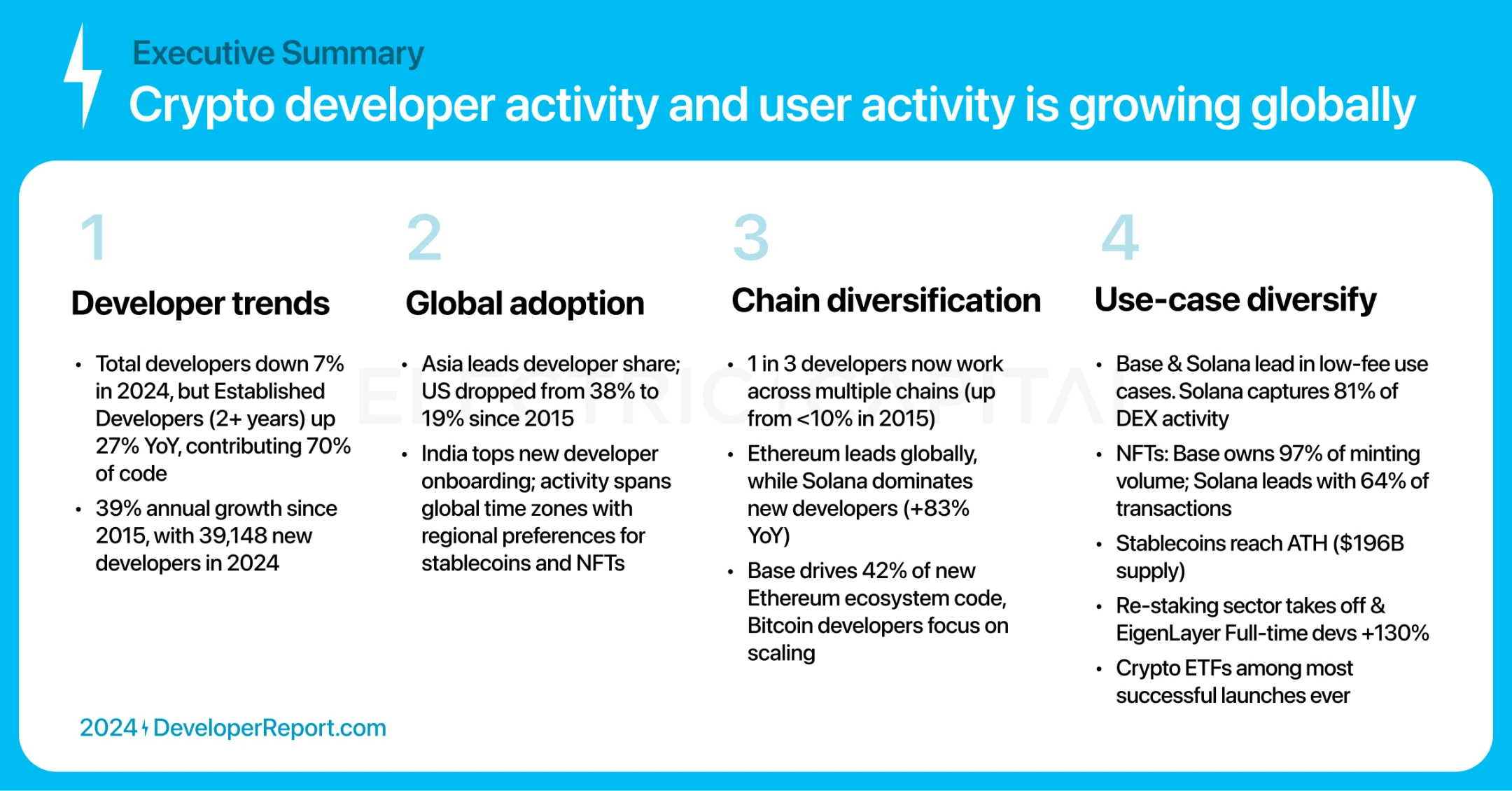

मुख्य बिंदुओं का सारांश:

-

The crypto industry is global in nature, and developer momentum has shifted from North America to other regions.

-

Developers and use cases are diversifying across ecosystems.

-

The applications cover all time zones, indicating widespread adoption around the world.

We underestimate the number of developers in the crypto space because our statistics focus only on open source development activity.

We underestimate the number of developers in the crypto space because our statistics focus only on open source development activity.

Our methodology includes:

-

Combine developer profiles into a single, standard identity.

-

Identify and exclude bot accounts.

-

Remove code bases such as data lists that do not reflect development activity.

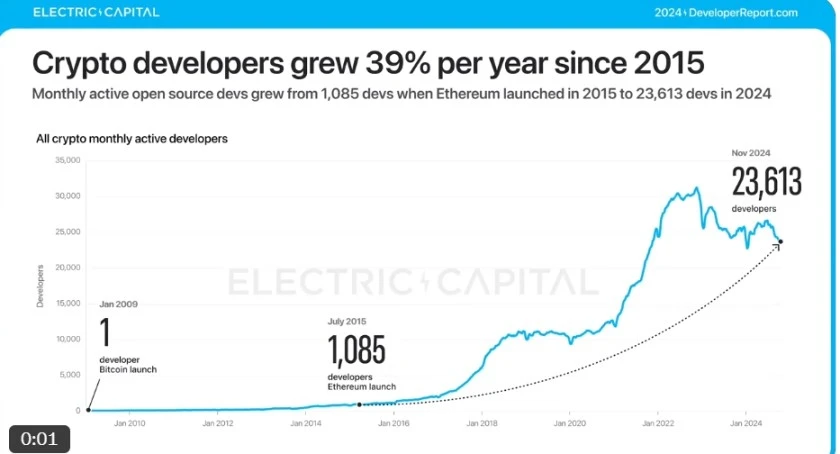

Since Ethereum launched in 2015, the crypto industry has grown at an average annual rate of 39%. In 2015, there were about 1,000 monthly active developers. Today: 23,613 monthly active developers.

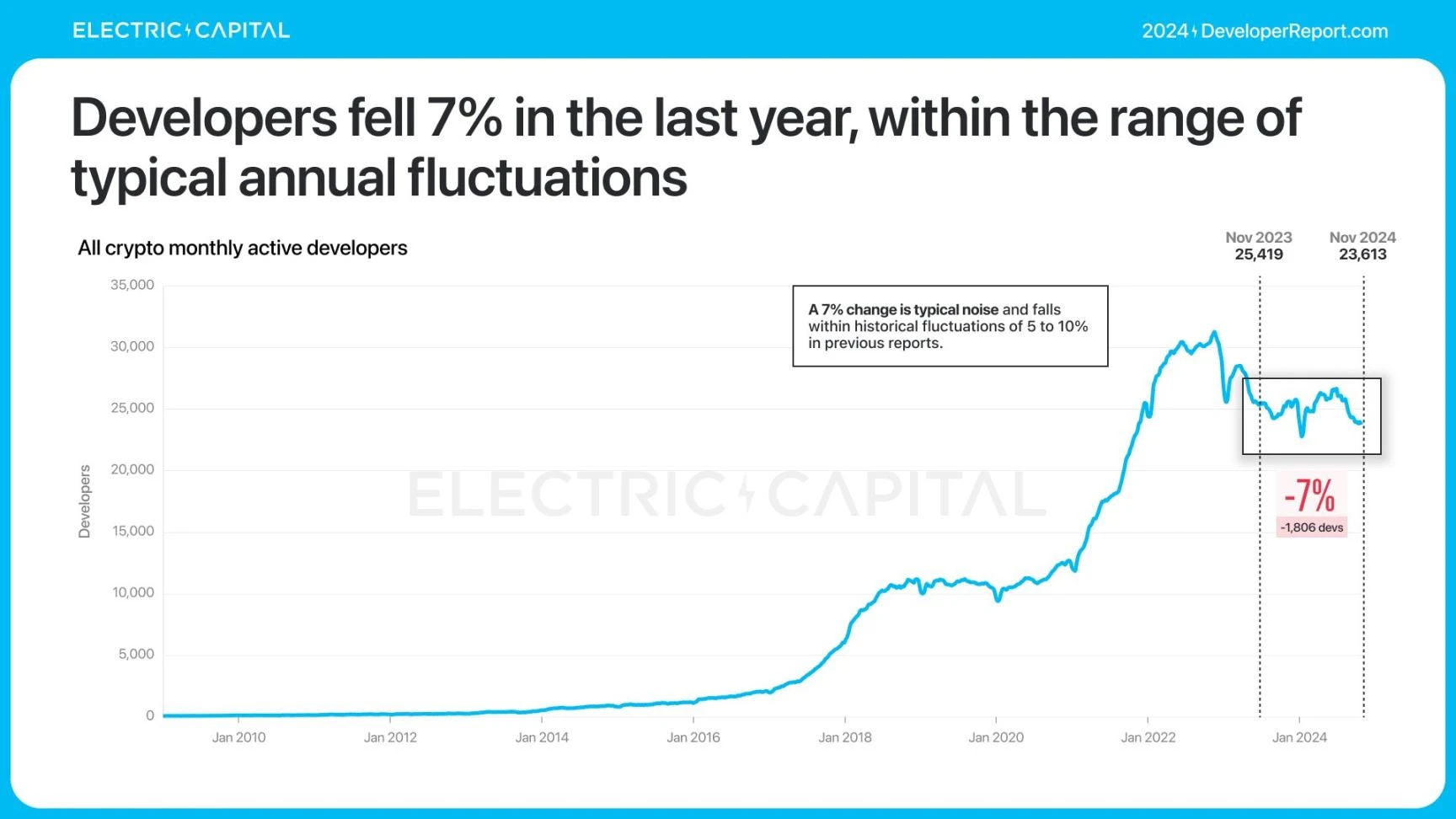

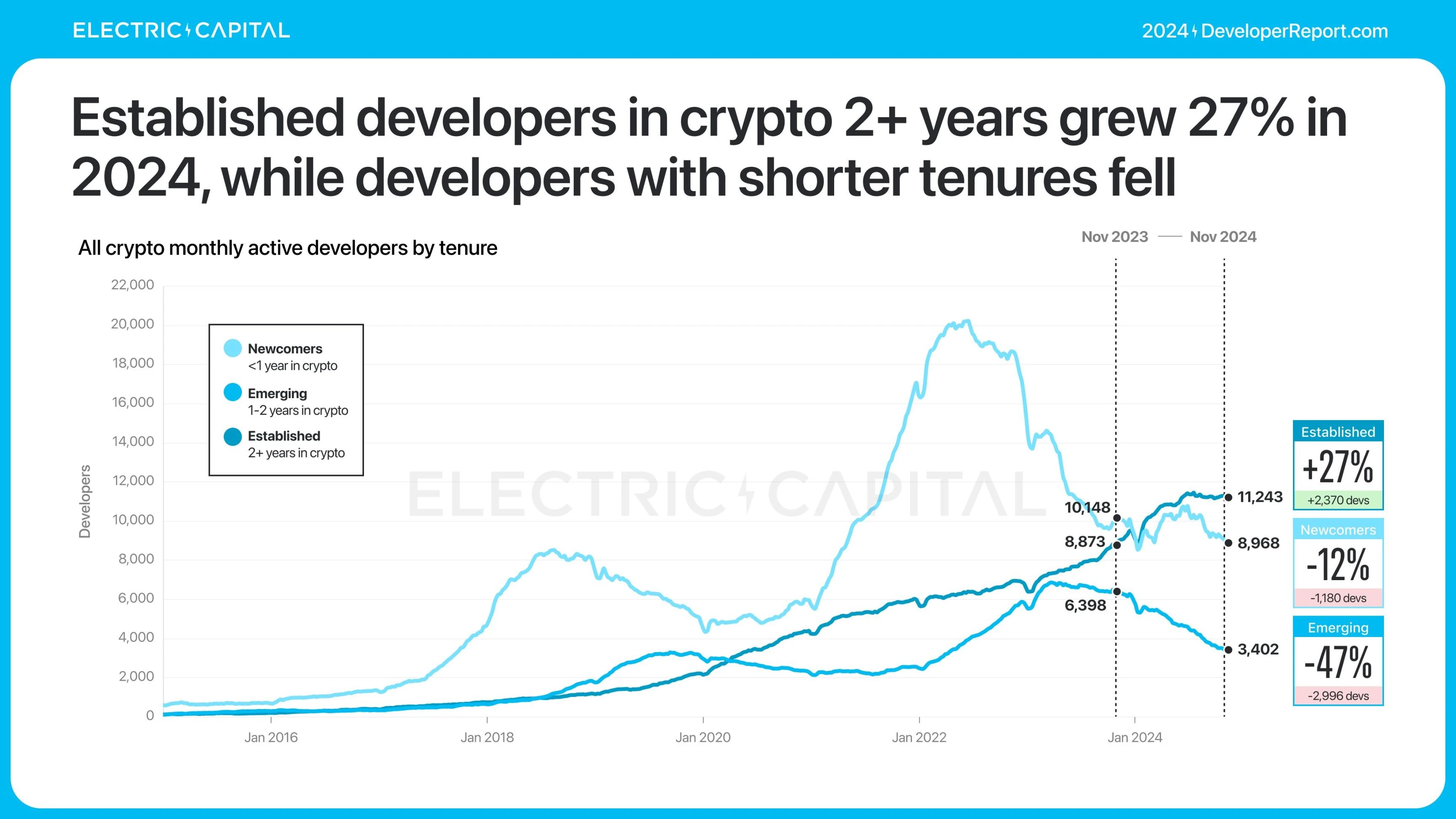

The number of monthly active developers has declined slightly by 7% over the past year.

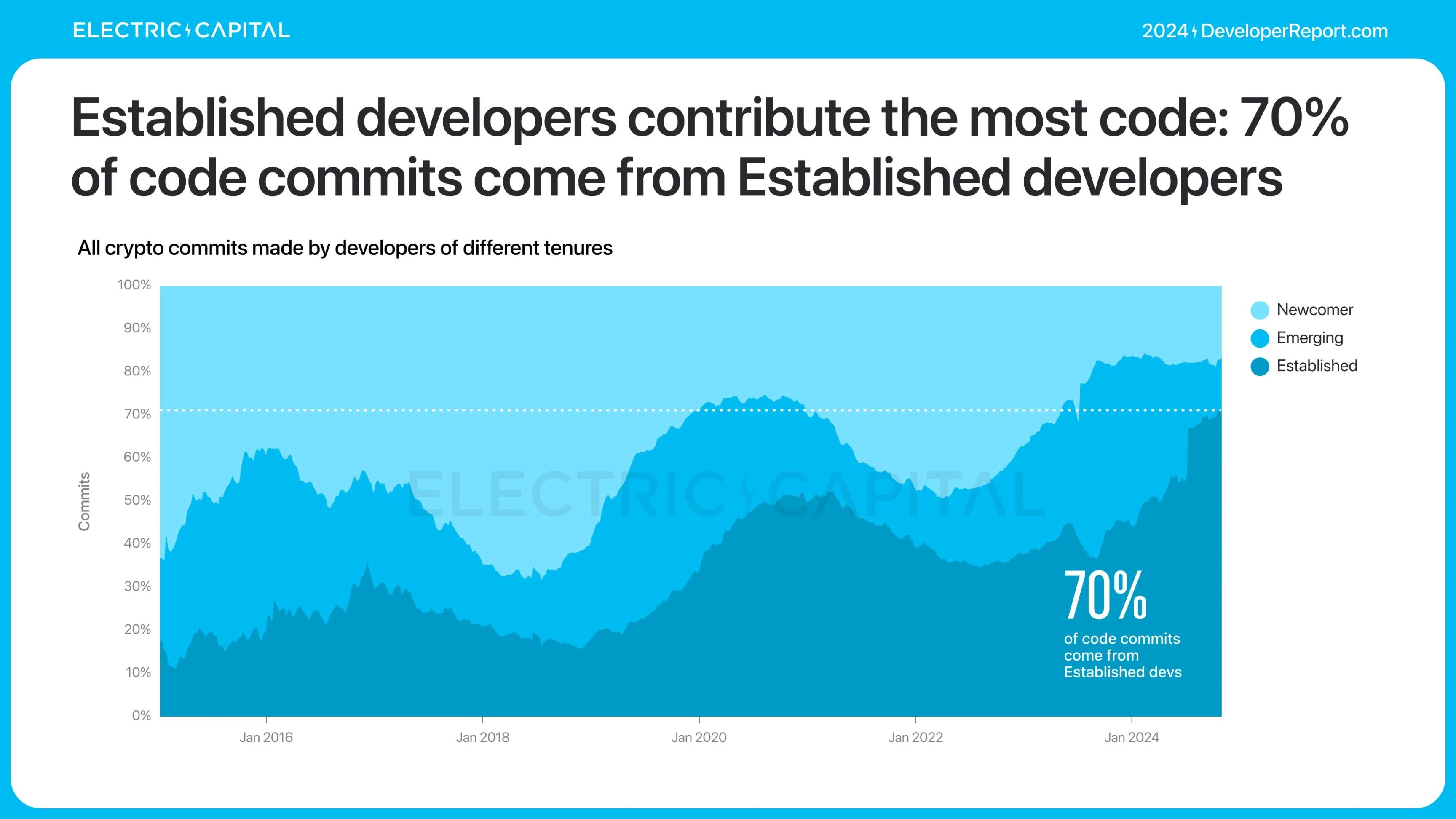

However, the number of developers who have been working in the crypto industry for more than two years grew by 27%.

These experienced developers drive the industry forward as they contribute 70% of code commits.

How has the crypto industry changed since 2015? Let’s take a look at the global diversity of crypto developers.

The center of gravity of developer distribution has shifted from the United States and Europe, which account for 82%, to the rest of the world.

Asia is now the continent with the highest percentage of developers, with one in three crypto developers living in Asia. Europe is second. Since 2015, North America has dropped from first to third place.

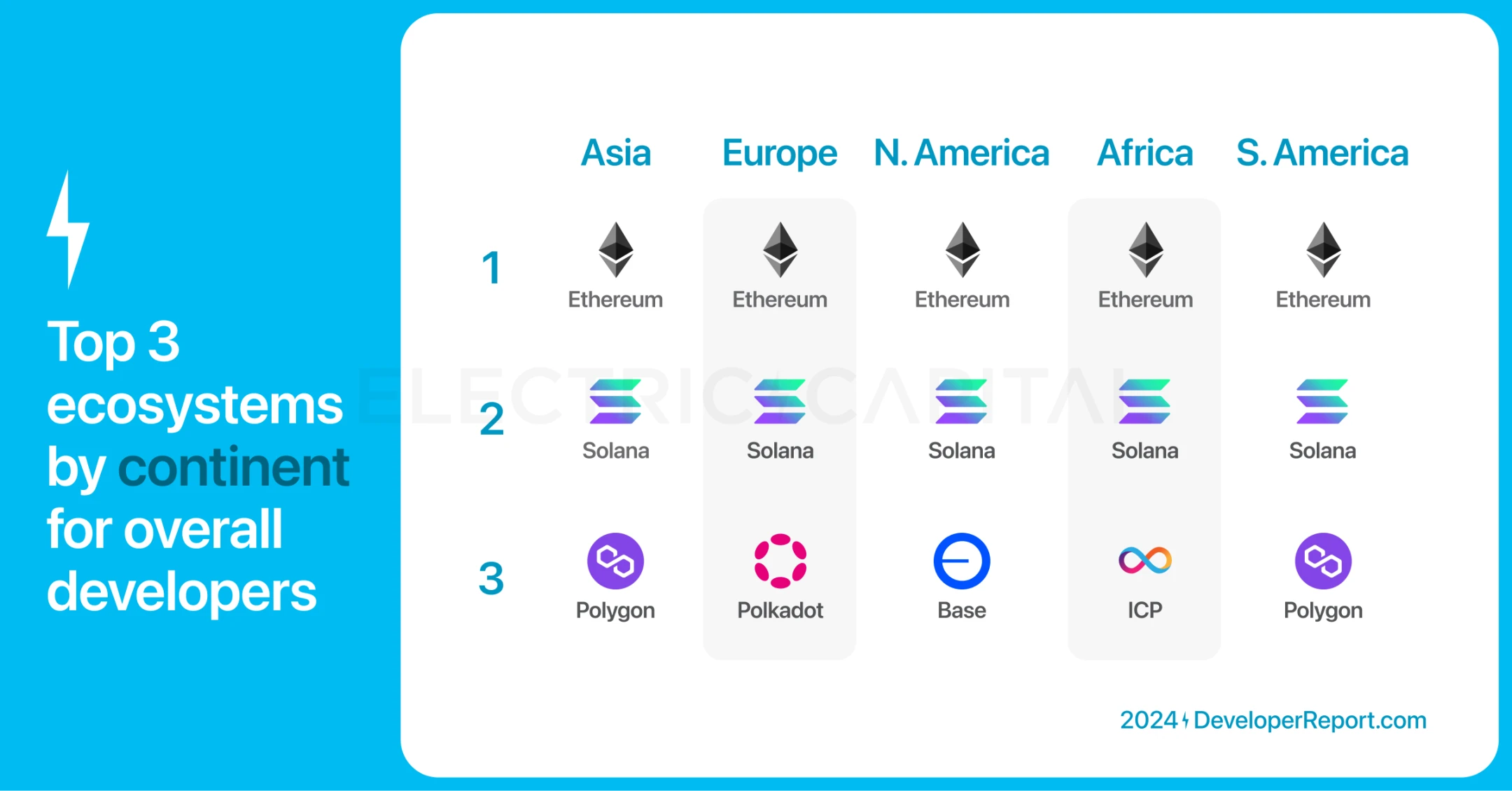

We can identify the top ecosystems on these continents by the percentage of developers.

Ethereum is the number one ecosystem in every major continent by developer share.

-

Solana ranks second.

-

Polygon ranked third in Asia and South America.

-

Polkadot ranks third in Europe.

-

Base ranks third in North America.

-

dfinity ranks third in Africa.

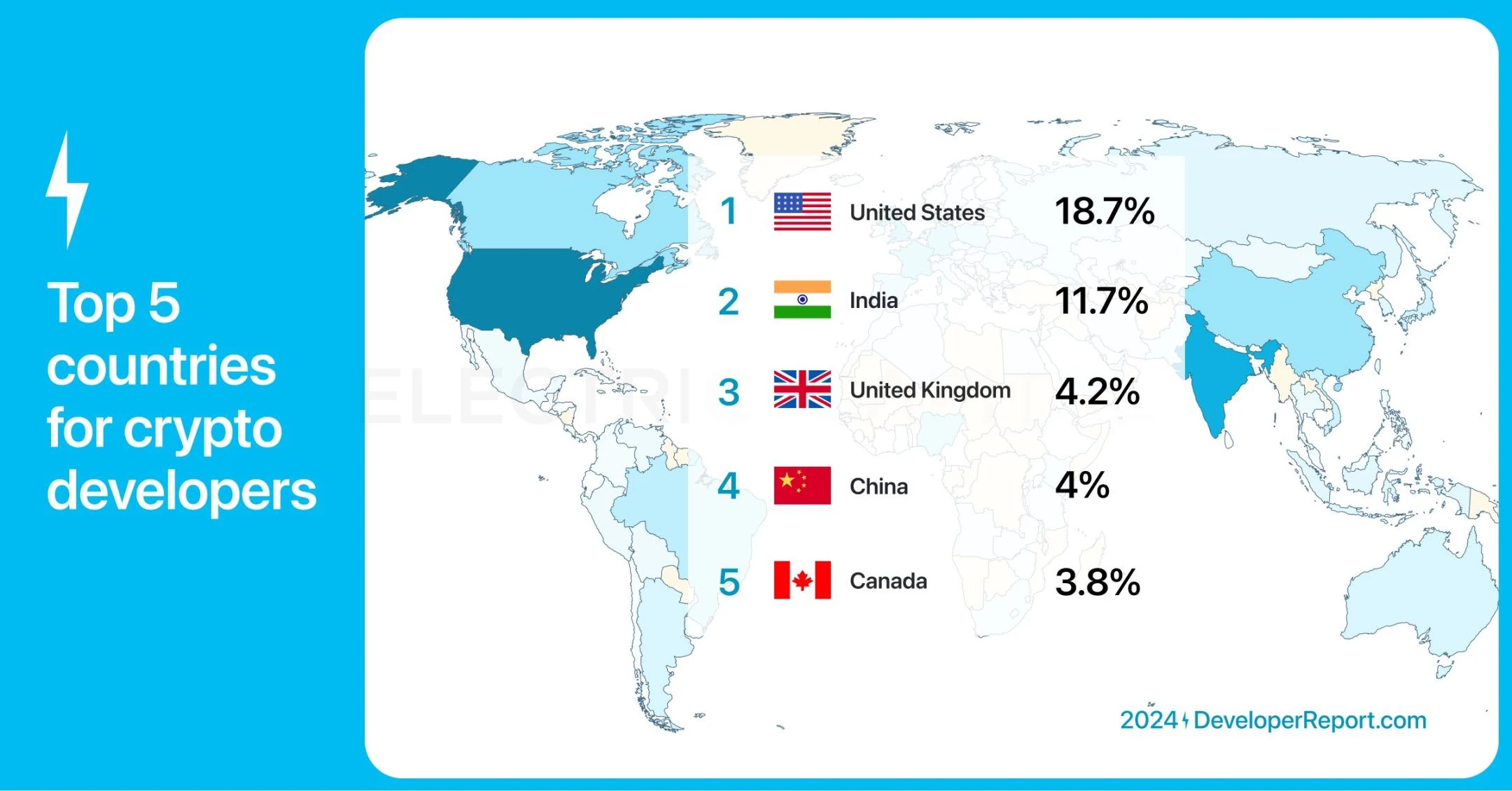

The United States, India, the United Kingdom, China, and Canada account for the largest share of crypto developers worldwide.

The United States, India, the United Kingdom, China, and Canada account for the largest share of crypto developers worldwide.

The United States remains the country with the highest percentage of crypto developers, but has continued to decline since 2015. India rose from 10th to second place.

Share of top three ecosystem developers by country:

-

Ethereum ranks first in the United States, the United Kingdom, China, and Canada, and second in India.

-

Solana ranks first in India and second everywhere else.

-

Base ranks third in the United States and India.

-

Polygon ranked third in the UK.

-

NEAR Protocol ranks third in Canada.

-

Polkadot ranks third in China.

India welcomes the highest number of new crypto developers in 2024. 17% of new crypto developers come from India.

India welcomes the highest number of new crypto developers in 2024. 17% of new crypto developers come from India.

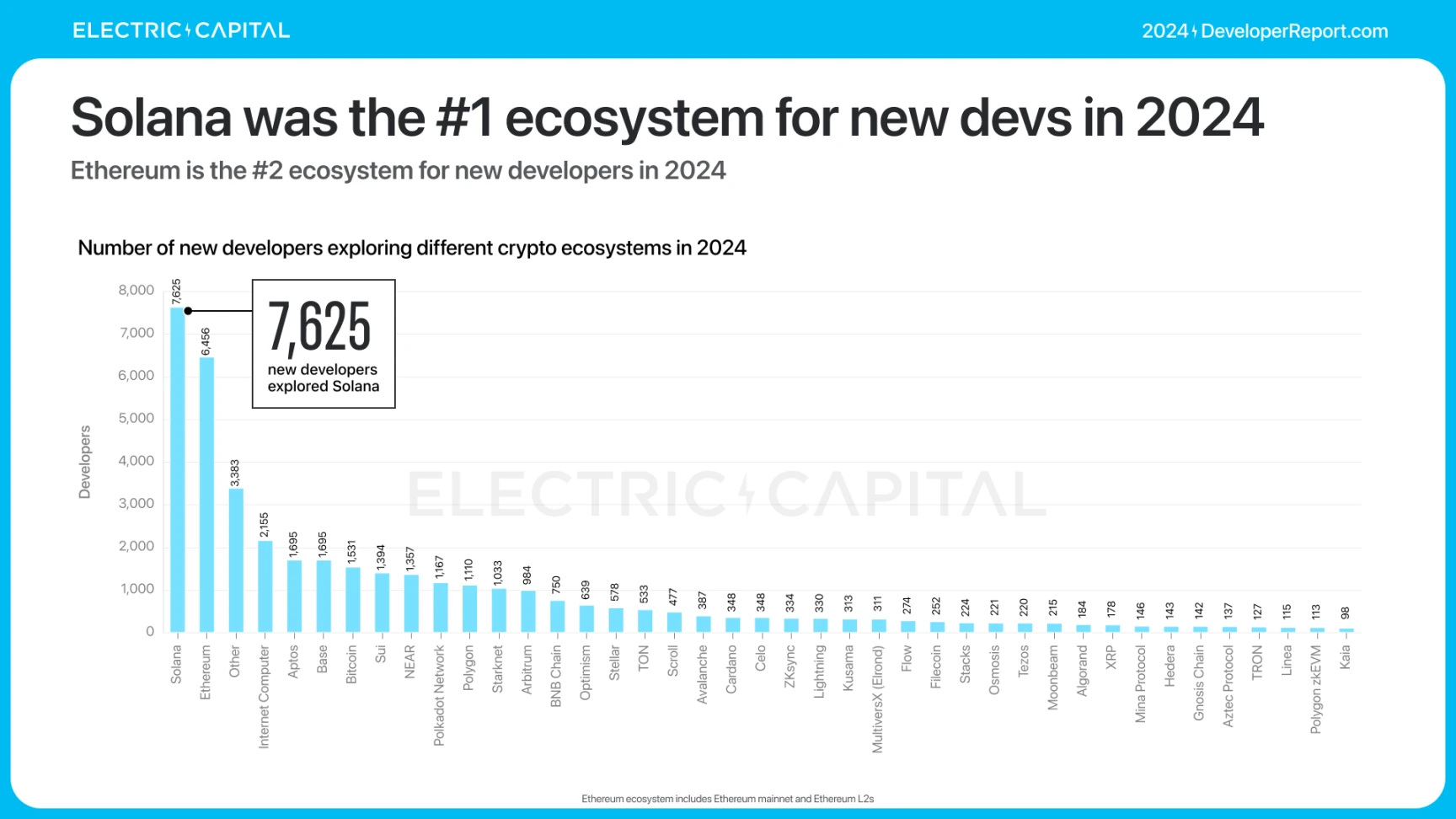

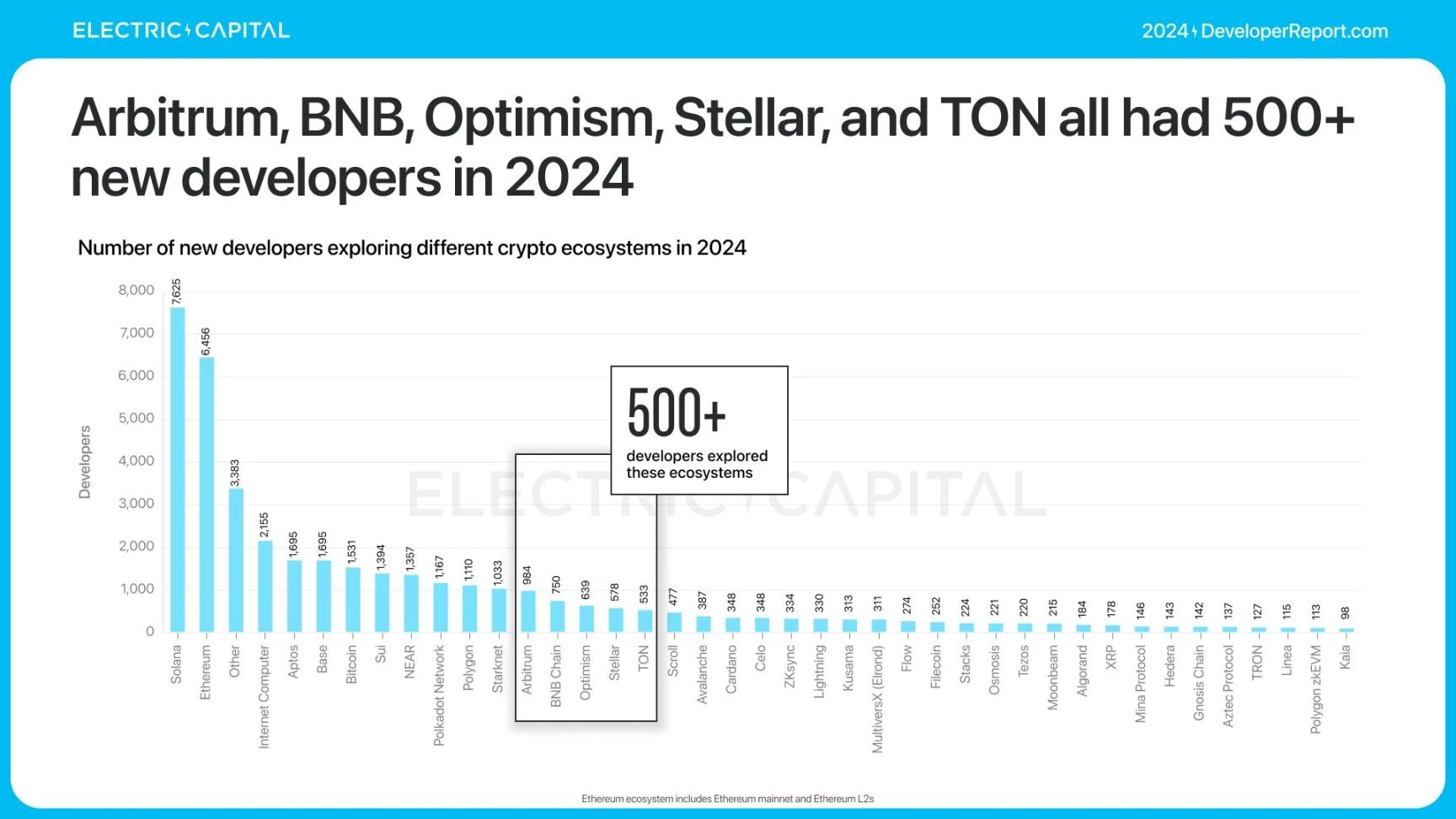

Let’s focus on new developers — a total of 39,148 new developers explored crypto in 2024. We can break these new developers down by ecosystem.

Solana became the ecosystem with the largest number of new monthly developers joining in July 2024.

Overall new developers in 2024: Solana is the ecosystem with the most new developers, ranking first.

Ethereum ranked second. Dfinity, Aptos, Base, Bitcoin, SuiNetwork, NEAR Protocol, Polkadot, Polygon, and Starknet all had more than 1,000 new developers joining.

arbitrum, BNBCHAIN, Optimism, StellarOrg, and ton_blockchain all had over 500 new developers join.

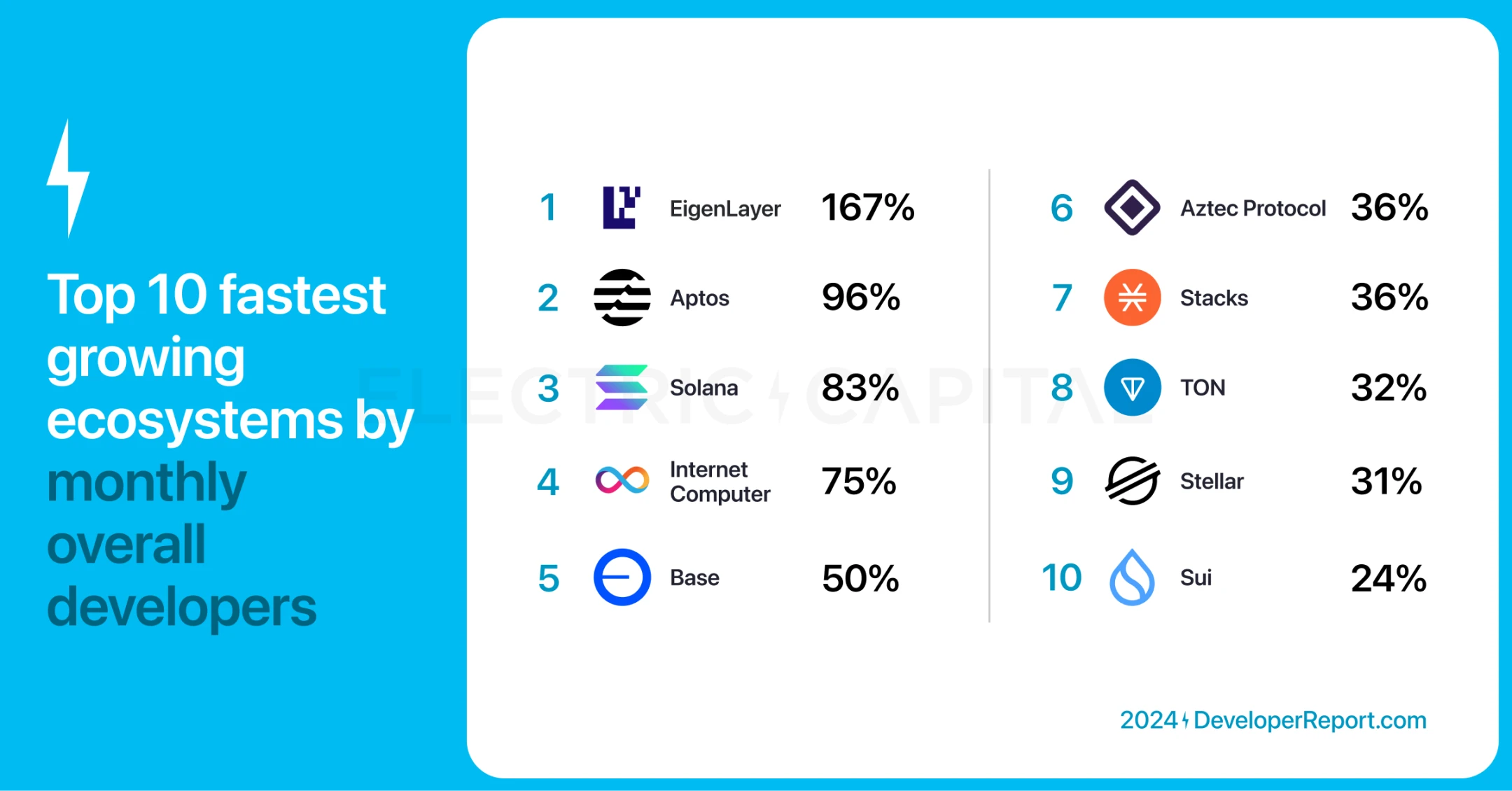

Who is growing the fastest in total developer count? Total developer count reflects interest from new developers and hackathon attendees.

Based on data from Q3 2023 and Q4 2024, the top 10 ecosystems with the fastest growth in total developer base are:

Who is growing the fastest in terms of full-time developers? Full-time developers commit code more than 10 days per month, so they contribute a steady amount of work to the ecosystem.

Based on data from Q3 2023 and Q4 2024, the top 10 fastest growing ecosystems for full-time developers are:

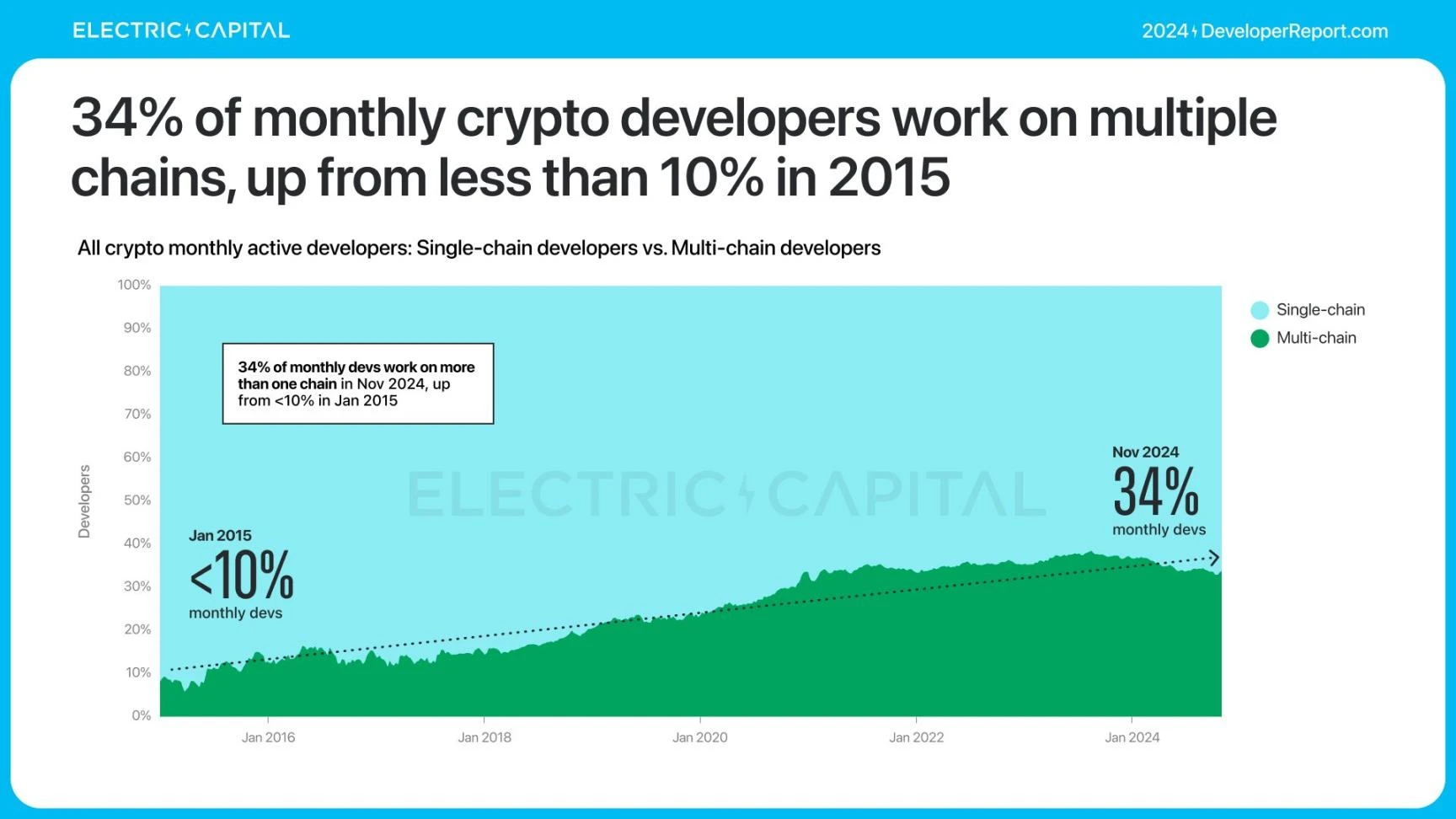

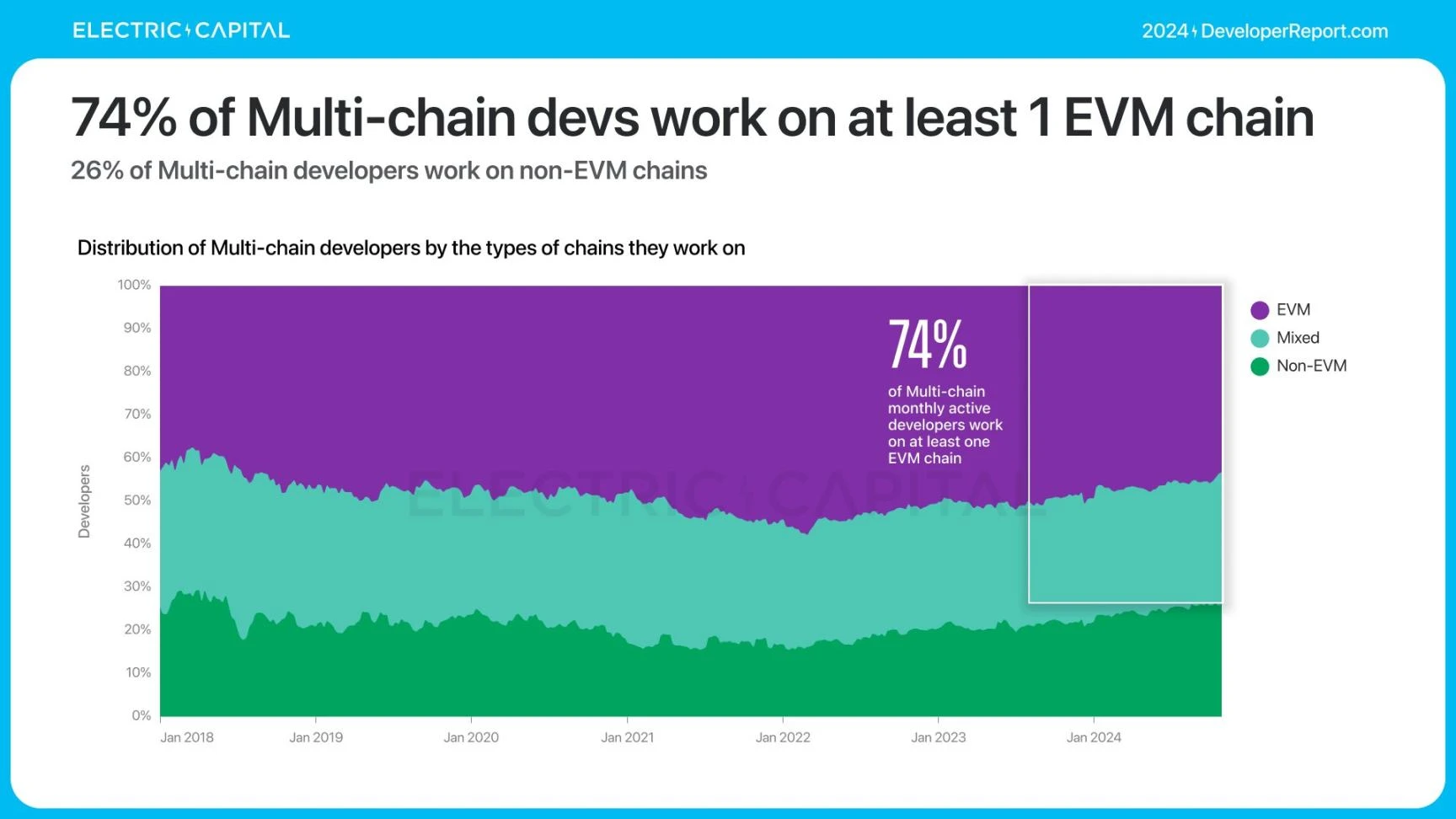

Many developers are active on multiple chains — One in three crypto developers now work on multiple chains, and this trend is growing. Monthly active multichain developers have increased from less than 10% in 2015 to 34% in 2024.

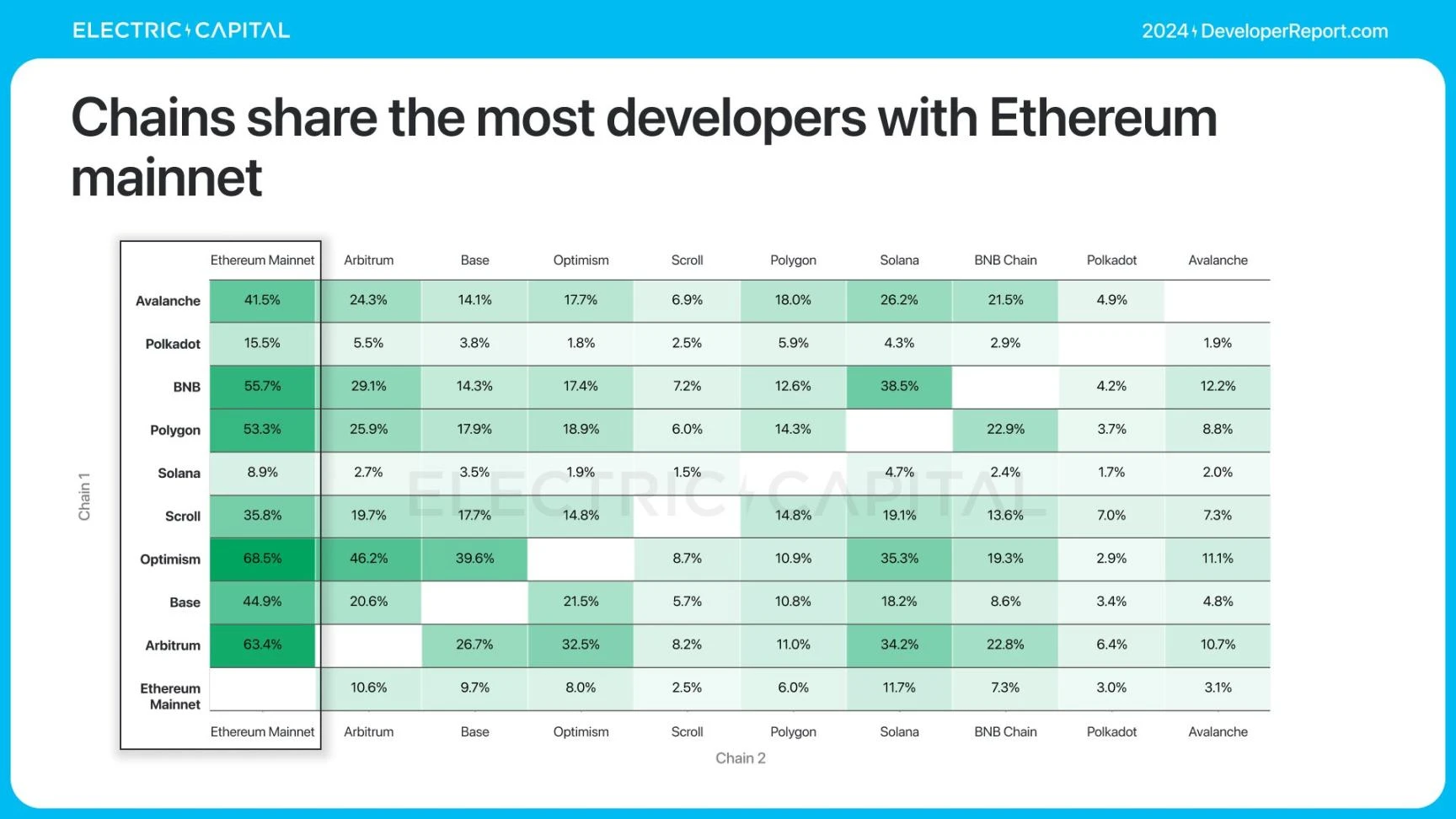

The chain with the most multi-chain developers shares developer resources with Ethereum.

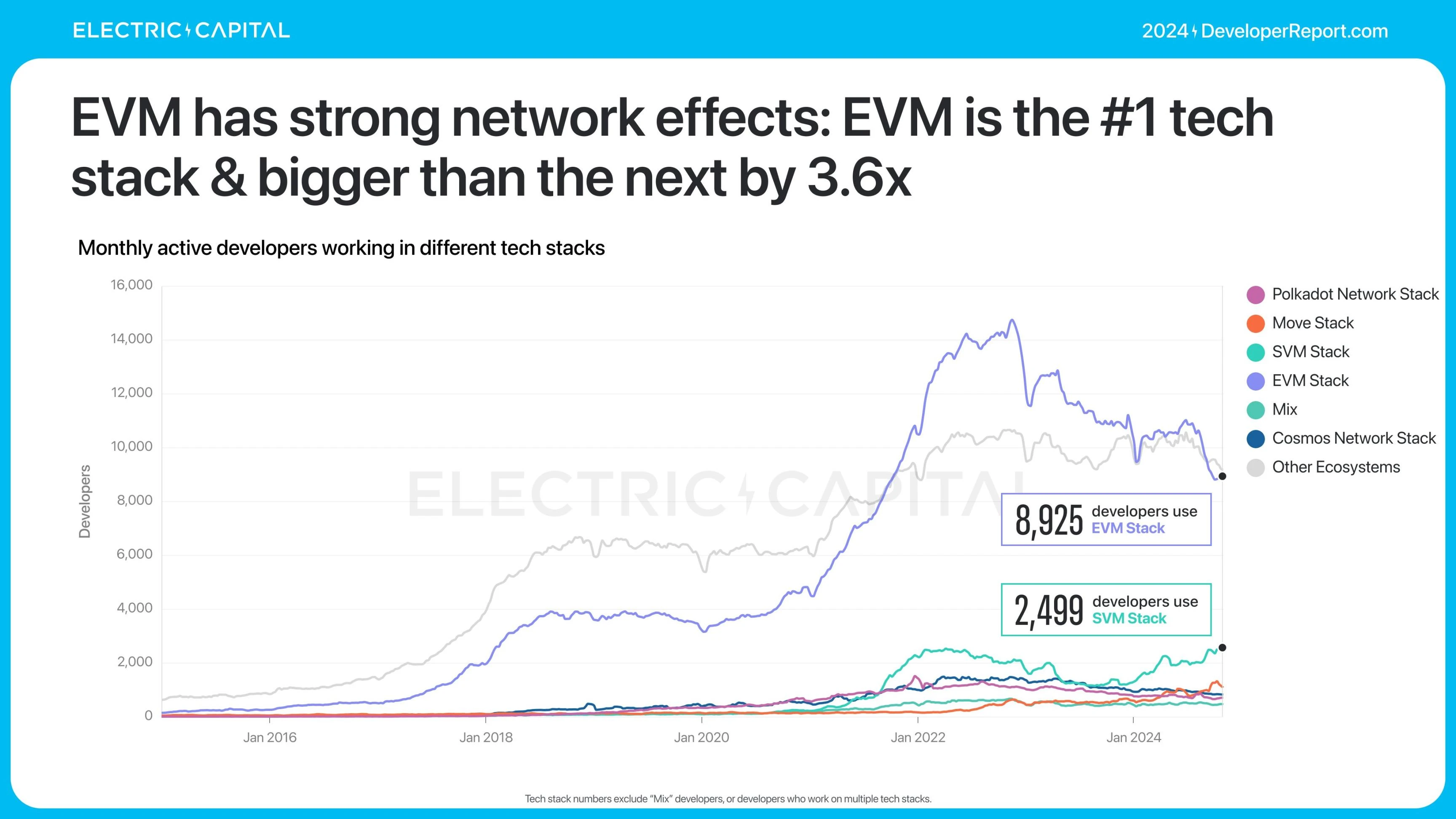

The EVM chain shares the most developers and has a significant network effect: 74% of multi-chain developers work on the EVM chain.

The percentage of EVM cross-chain deployers has grown 4x since 2021.

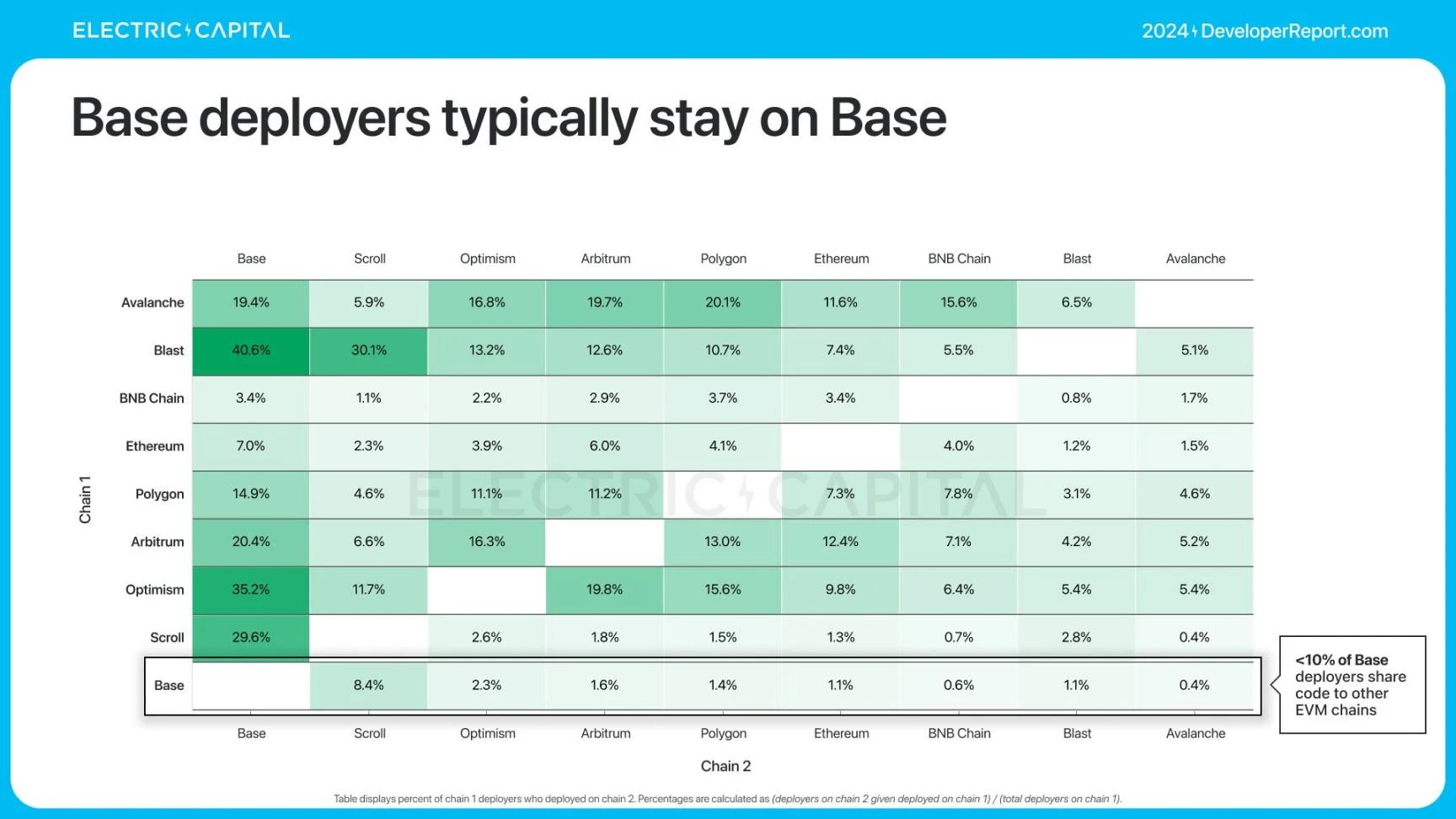

Base is the most popular chain among EVM multi-chain deployers in 2024, but Base deployers tend to stay on the Base chain.

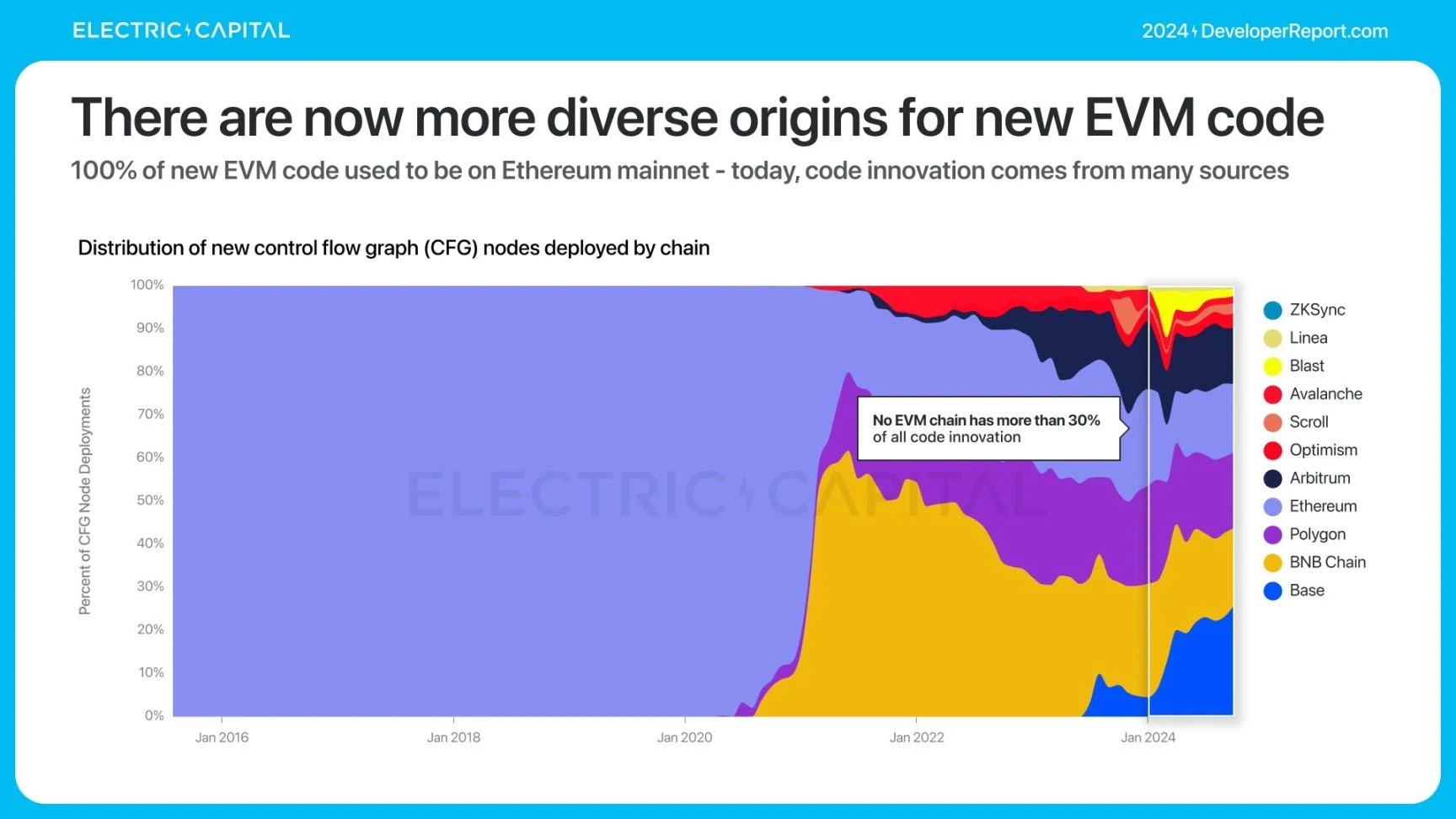

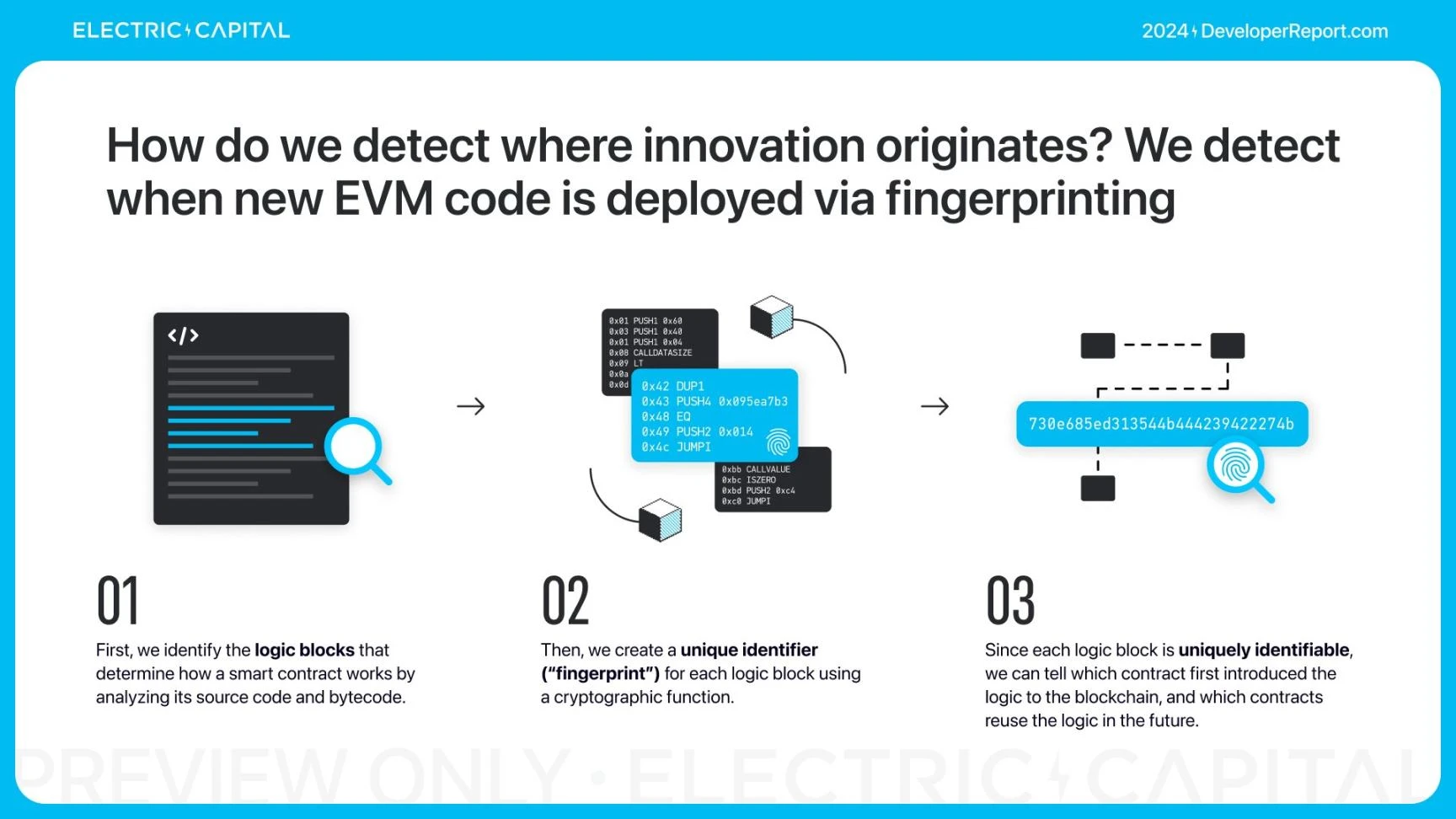

Since deployers publish code to multiple chains, where is most of the original code written?

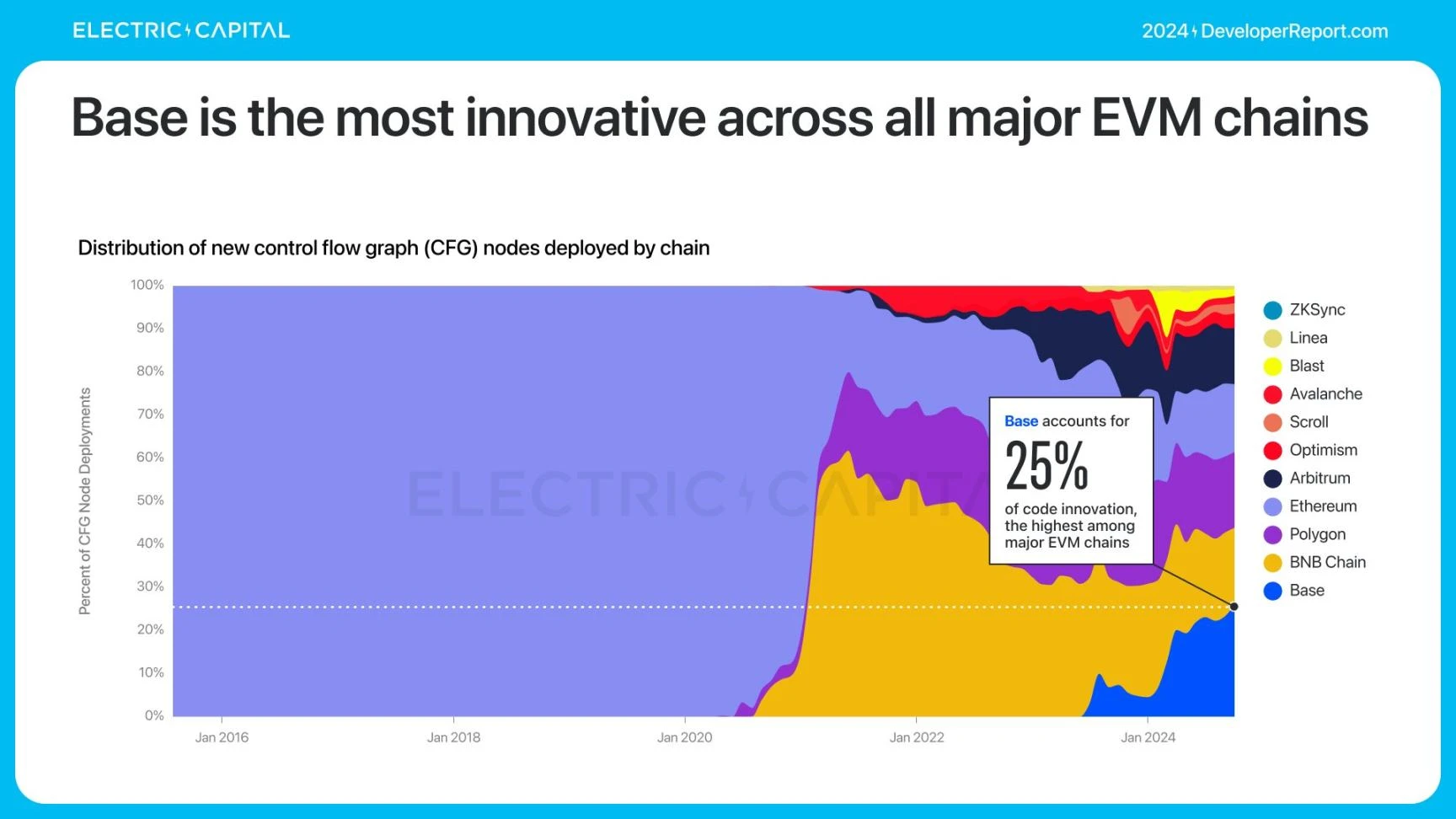

Before 2020, almost all original on-chain code logic on the EVM was on Ethereum.

Currently, no EVM chain has more than 30% code innovation.

Base now accounts for 25% of the original on-chain code logic on all EVM chains, the most of all major EVM chains.

This is how the Ethereum ecosystem stays ahead of code innovation — through L2 chains. 65% of innovation happens on the mainnet and ETH L2 chains.

The Ethereum ecosystem has demonstrated strong network effects through its dominance in the EVM and multi-chain developers. How is this ecosystem performing?

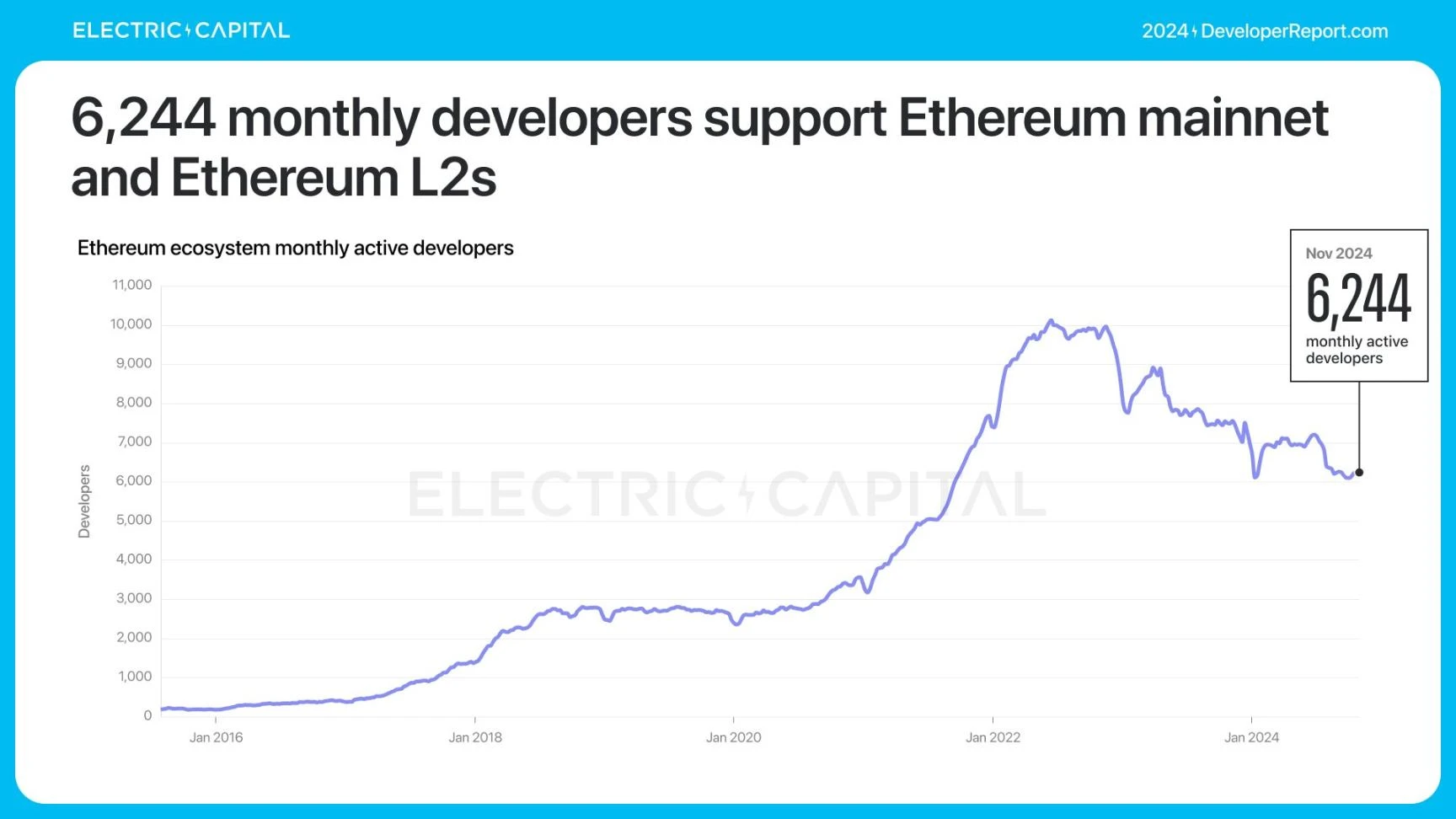

Ethereum’s monthly active developers are 6,244, down 17% year-over-year.

Most of the losses came from developers who joined after 2021. Among developers who have been working on Ethereum for more than 2 years, there has been a 21% increase.

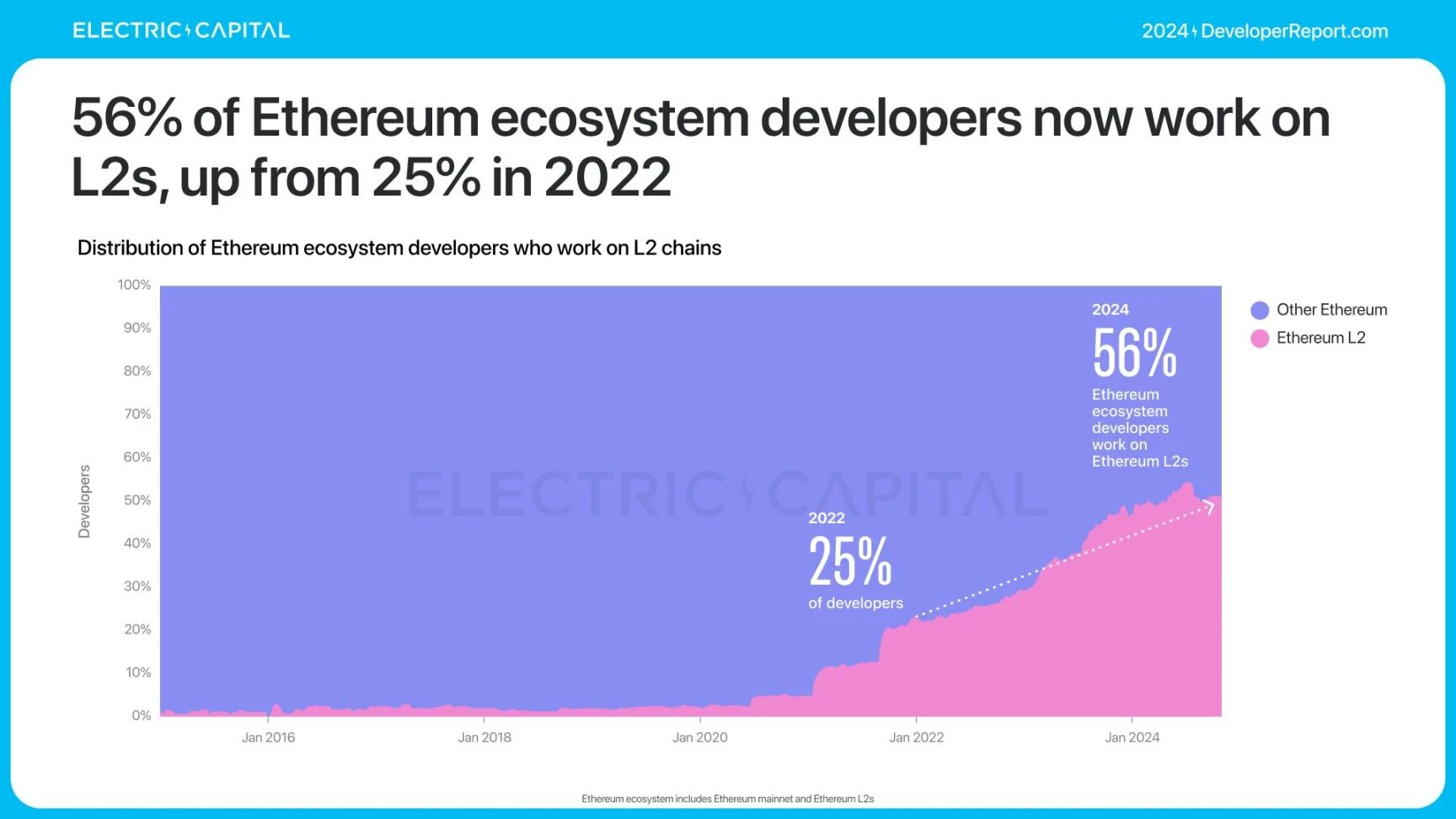

Now more than half of Ethereum developers work on the Ethereum L2 chain, and this proportion will be 25% in 2022.

Ethereum L2 chains have experienced significant growth in developers over the past 4 years. The total number of monthly active developers on Ethereum L2 chains is 3,592, an average annual growth of 67% since Arbitrum launched in 2021.

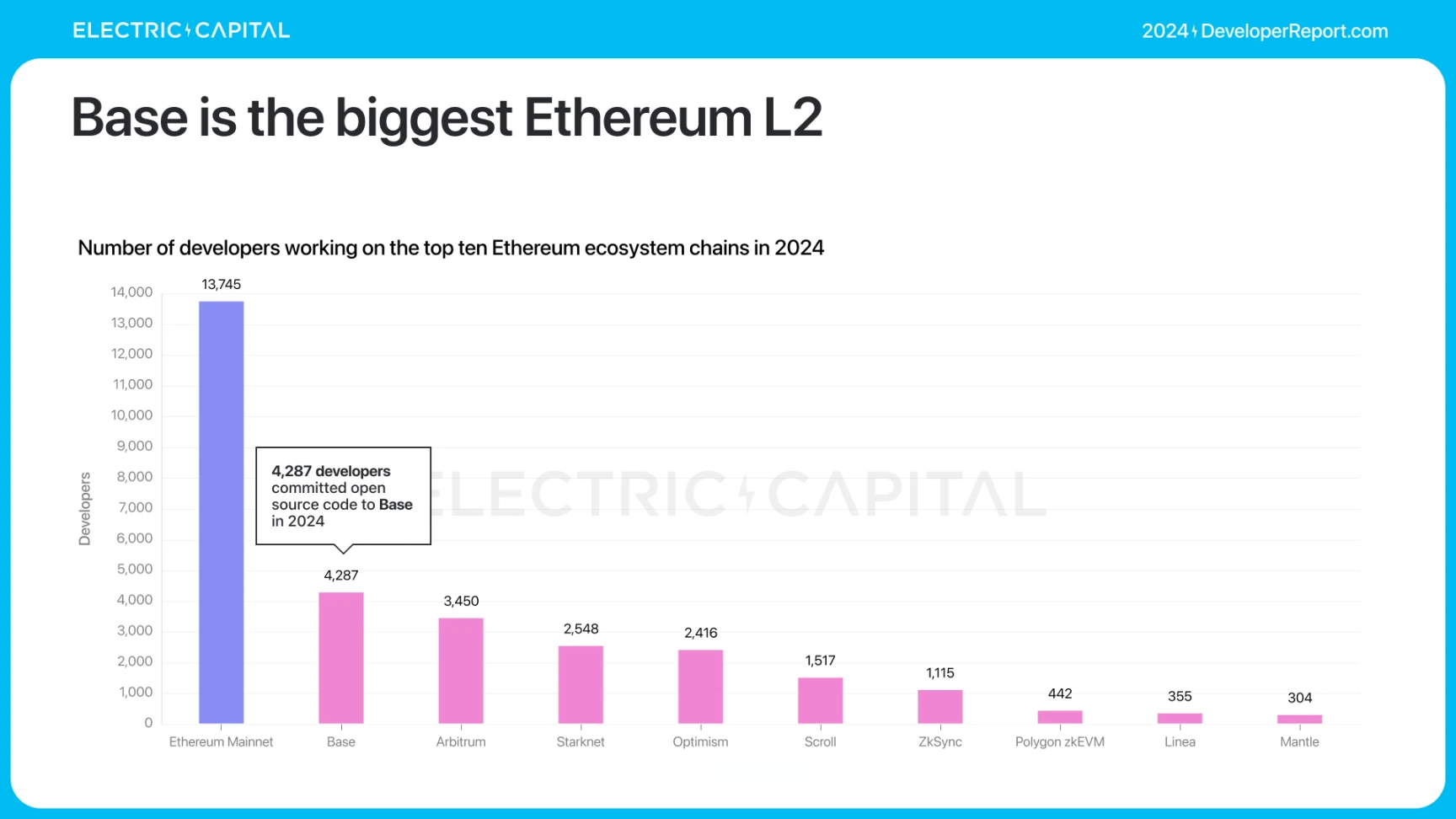

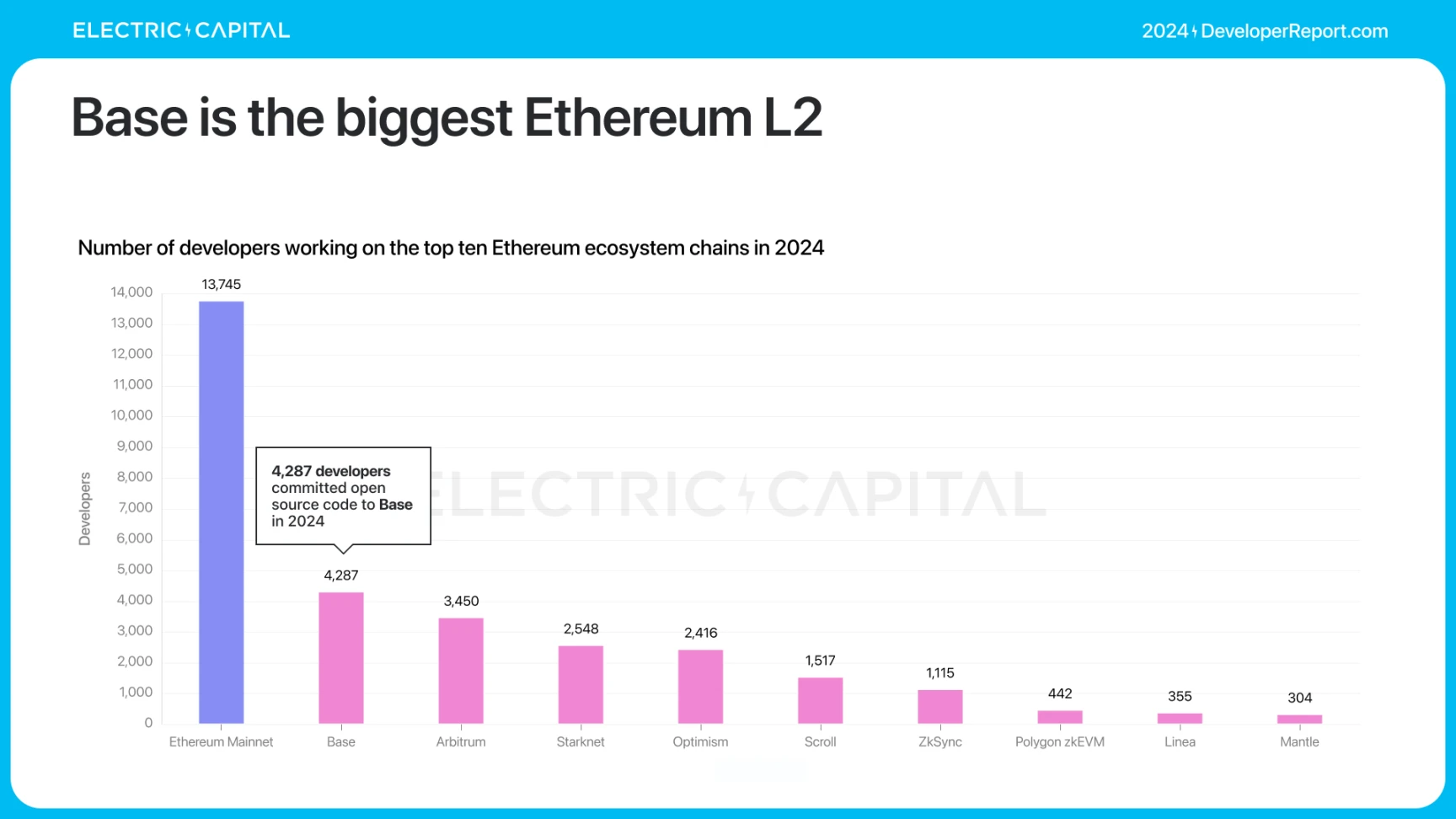

Base is the largest Ethereum L2 chain.

Arbitrum, Starknet, and Optimism all have more than 2,000 developers in 2024.

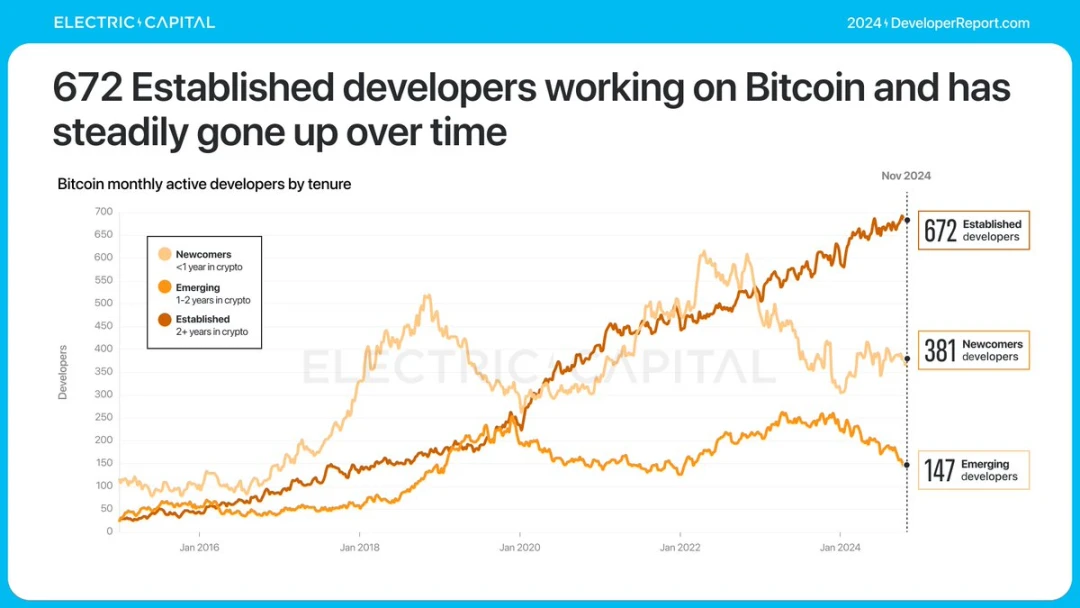

In 2024, the number of Bitcoin monthly active developers is 1,200, which remains stable. The number of experienced Bitcoin developers (those who have been engaged in Bitcoin development for more than 2 years) has steadily increased. Currently, the number of experienced Bitcoin developers active per month has reached 672, a new high.

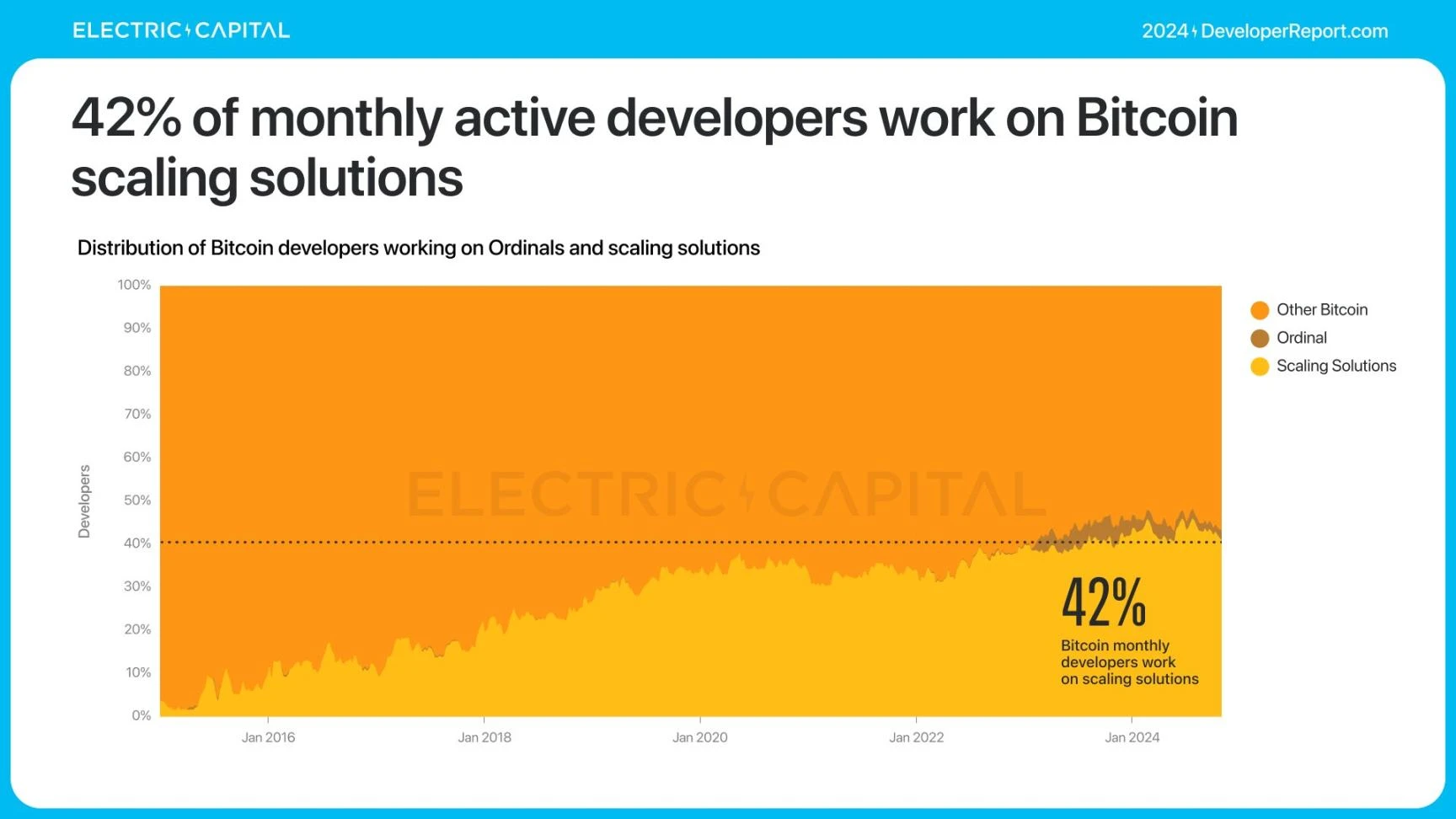

42% of Bitcoin developers — almost half — are working on Bitcoin scaling solutions.

Zero-knowledge proofs (ZK) are a developer-centric, research-driven field. How is it developing?

More than 2,000 monthly active developers work in the ZK ecosystem, of which 823 are full-time developers committing code more than 10 days per month.

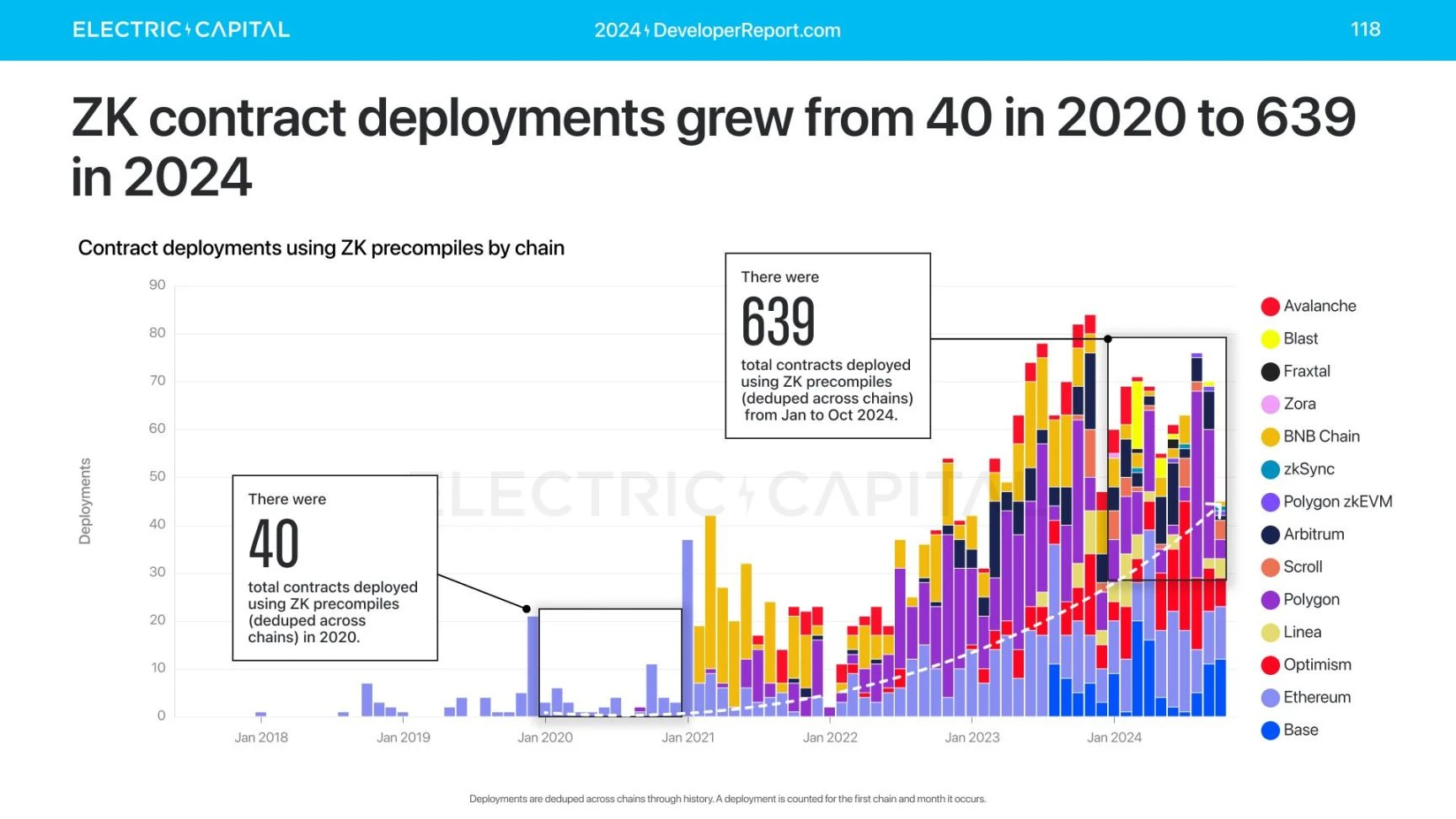

On-chain deployments of zero-knowledge proofs (ZK) also grew from 40 in 2020 to 639 in 2024.

While the numbers are still relatively flat, they show clear growth. The number of deployers has also increased.

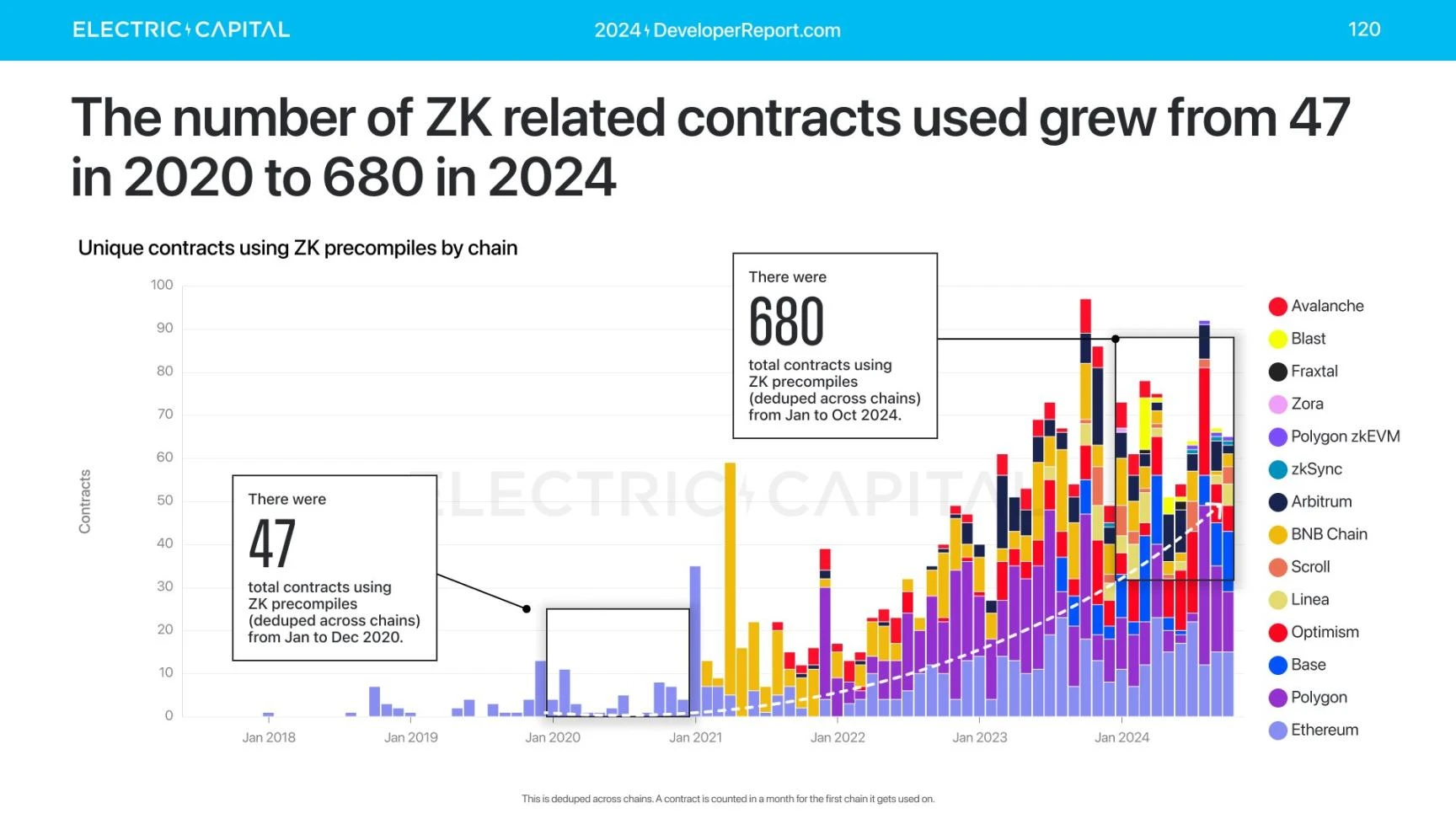

ZK is also gaining usage—the number of contracts precompiled using ZK has grown from 47 in 2020 to 680 this year.

When are Zero-Knowledge Proof (ZK) developers and users active?

Deployers of ZK Rollup contracts are active during Eastern Hemisphere business hours, as are ZK users.

ZK users and deployers appear to be concentrated in the Eastern Hemisphere, particularly in Eastern Europe, Africa, and Asia.

NFT and DeFi are established use cases in the crypto space – most of the top smart contracts are related to NFT or DeFi. How are these use cases developing? Lets start with NFT.

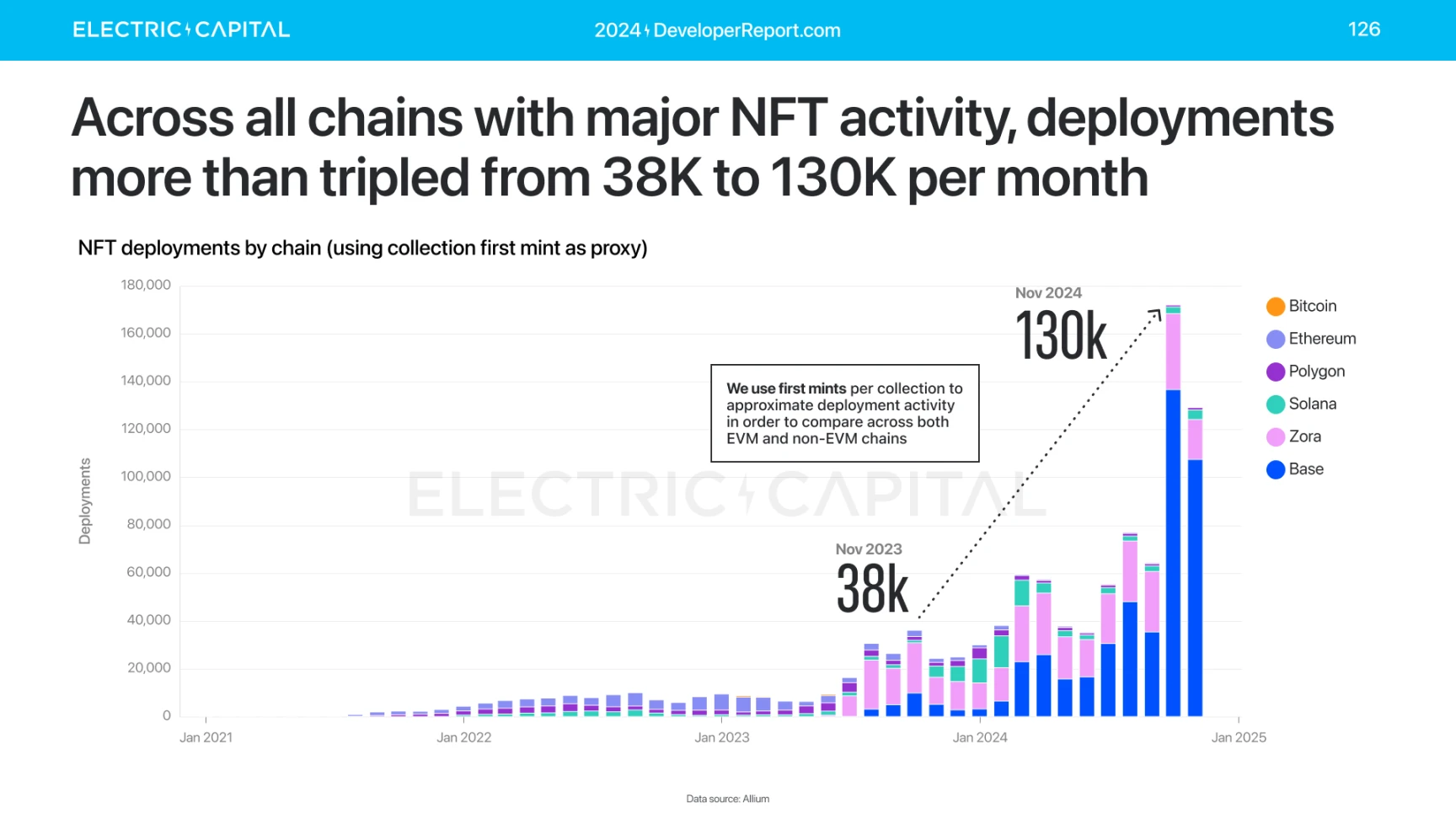

Across all major NFT active chains (Bitcoin, Ethereum, Polygon, Solana, Zora, Base), NFT deployment has grown more than 3x year-over-year.

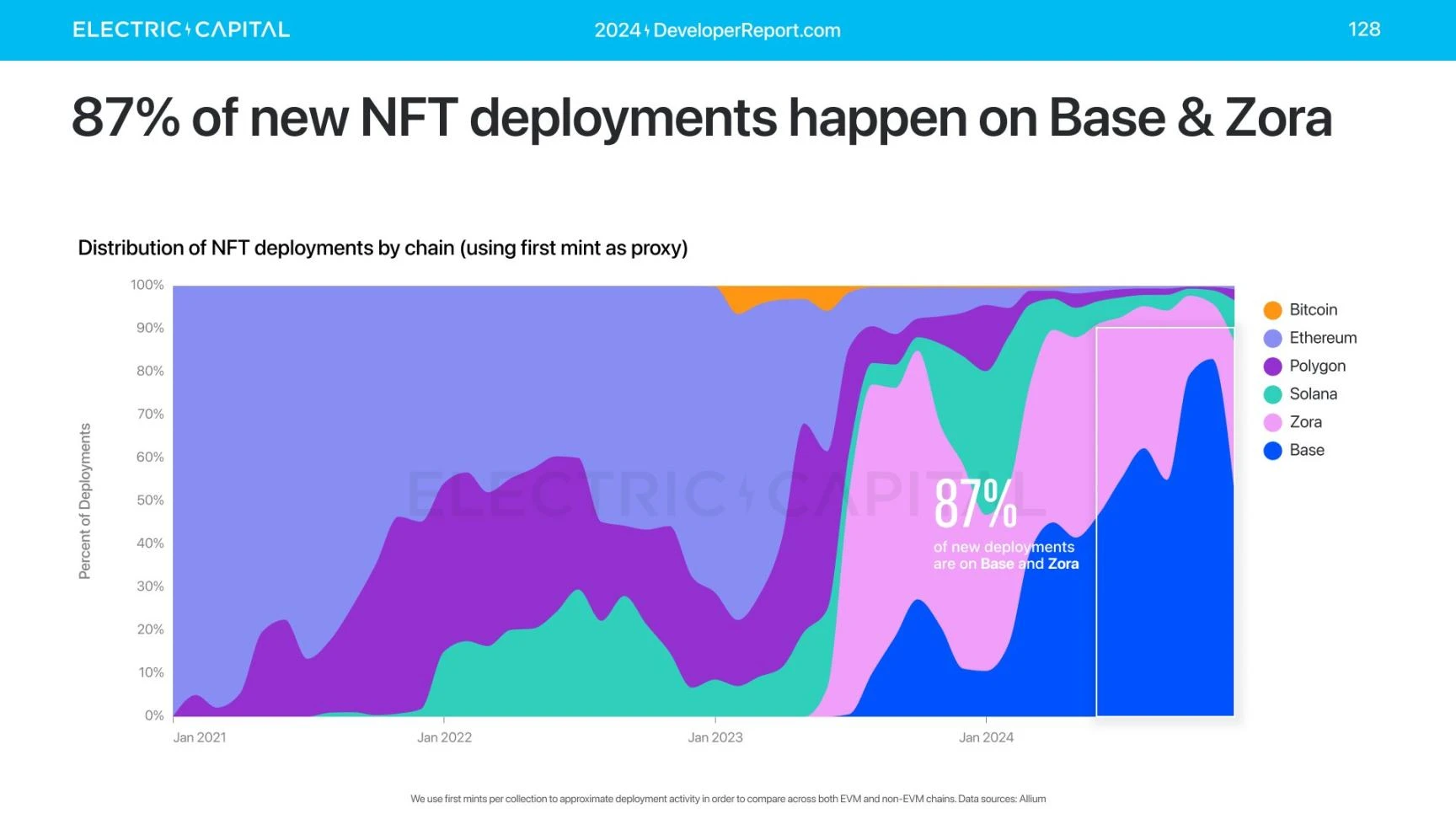

NFT deployments reached an all-time high. 87% of new deployments occurred on Base and Zora.

NFT activity has shifted significantly towards minting.

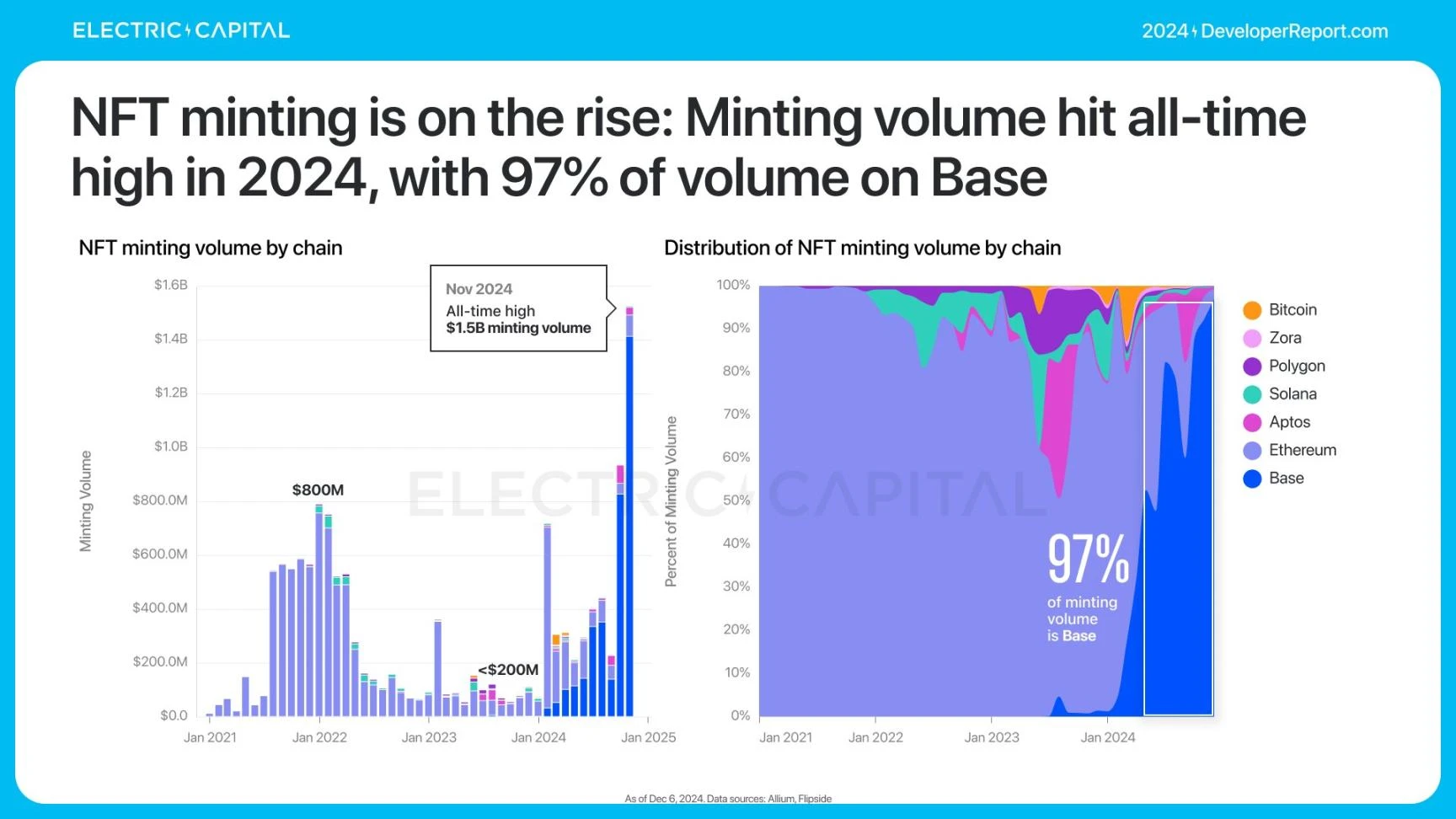

In 2024, NFT minting reached an all-time high, with 97% of minting occurring on Base.

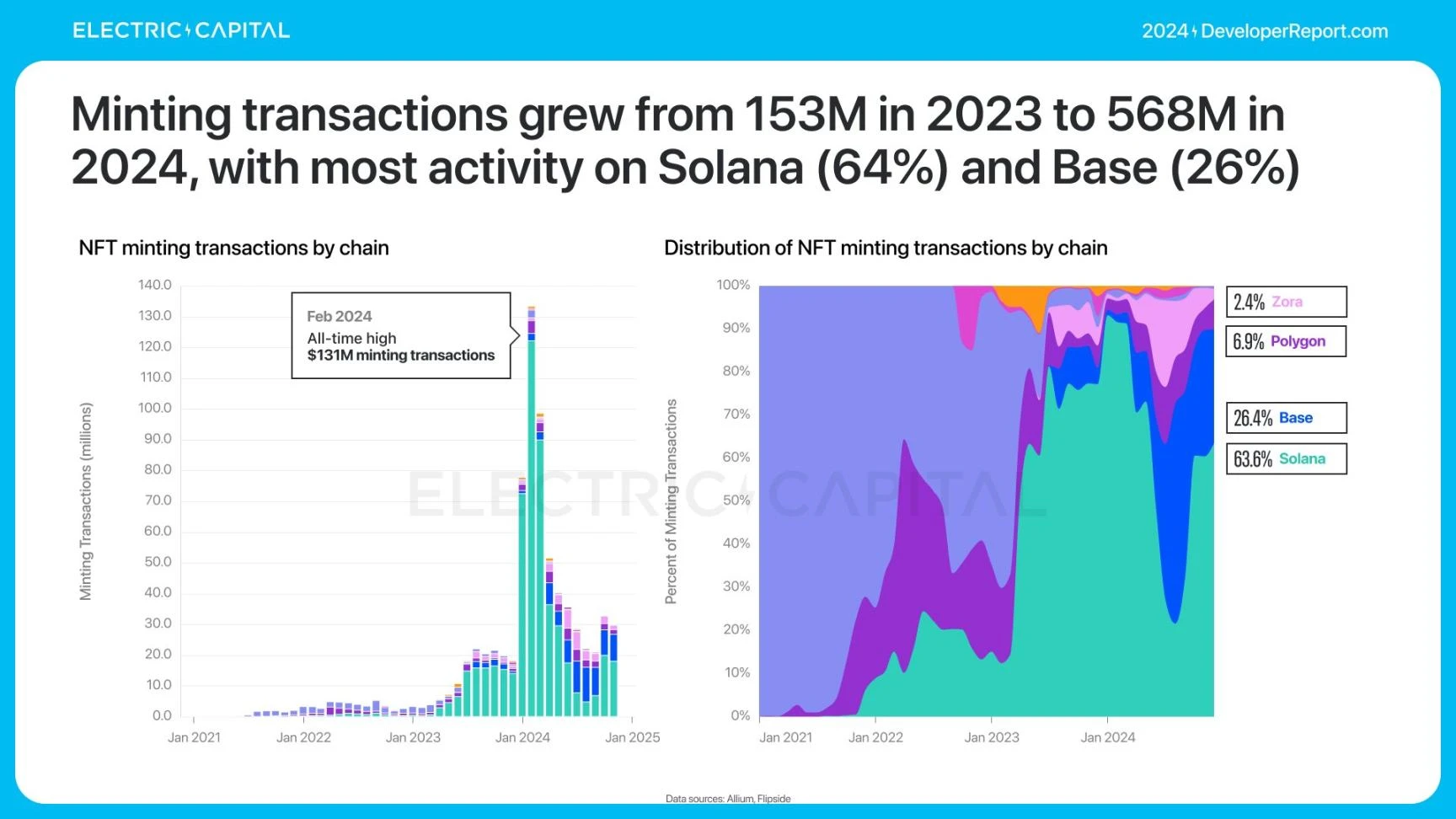

Solana has 57% of minting wallets and captures 64% of minting transactions.

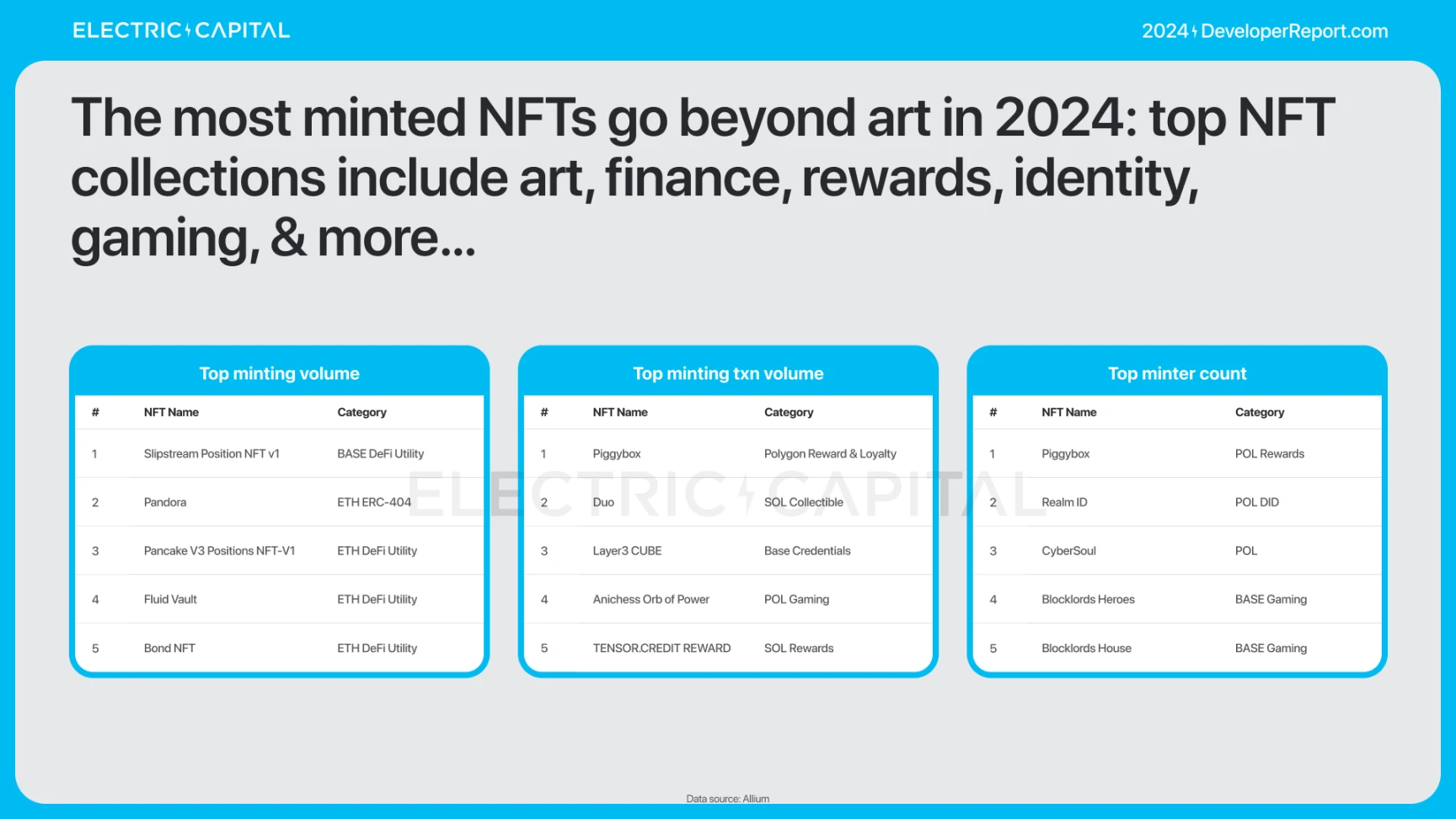

The increase in minting activities is because NFT has gone beyond the art field in 2024 and covers more application scenarios.

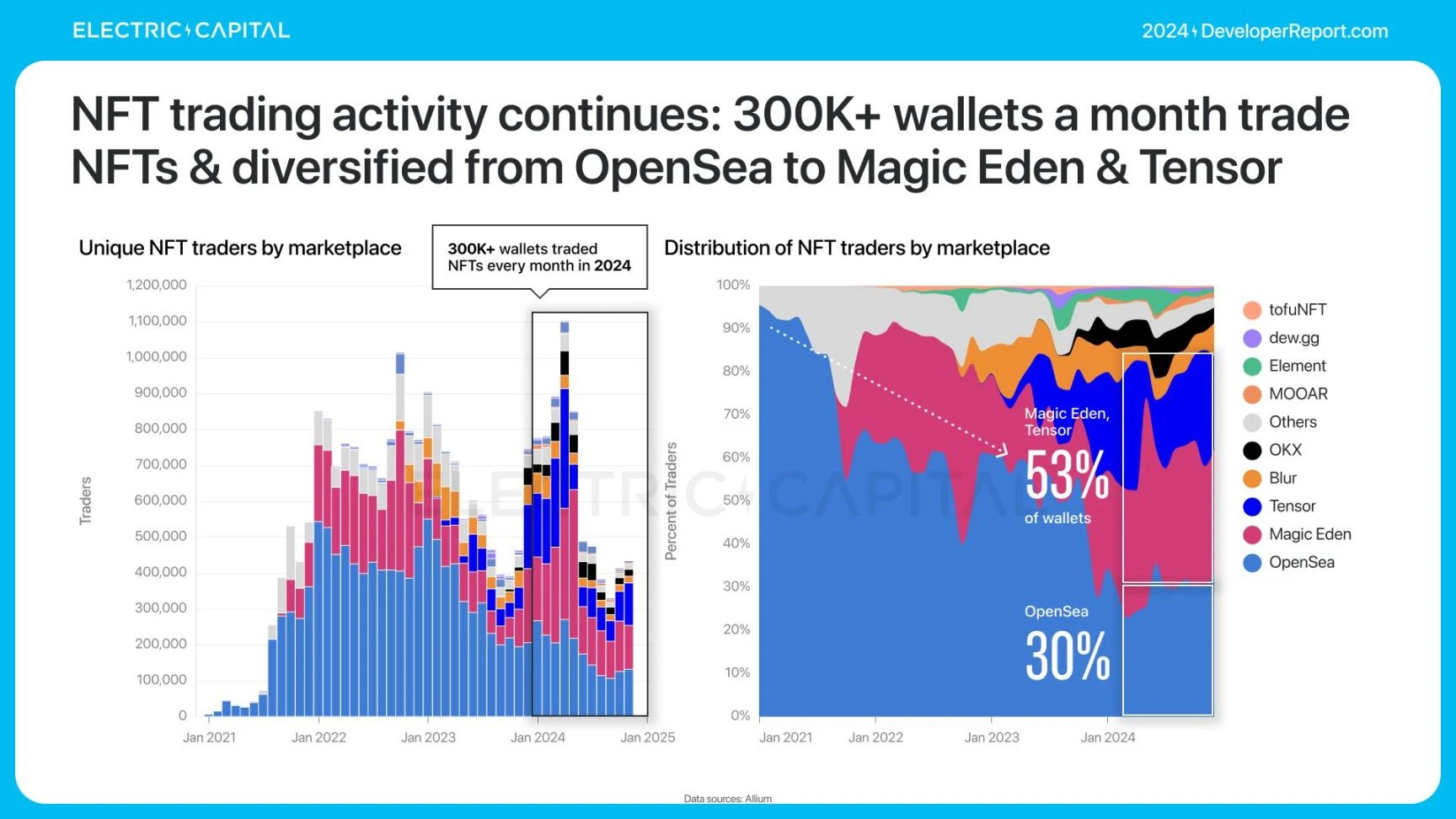

NFT trading remains an important basic application and has expanded from OpenSea to platforms such as Magic Eden and Tensor.

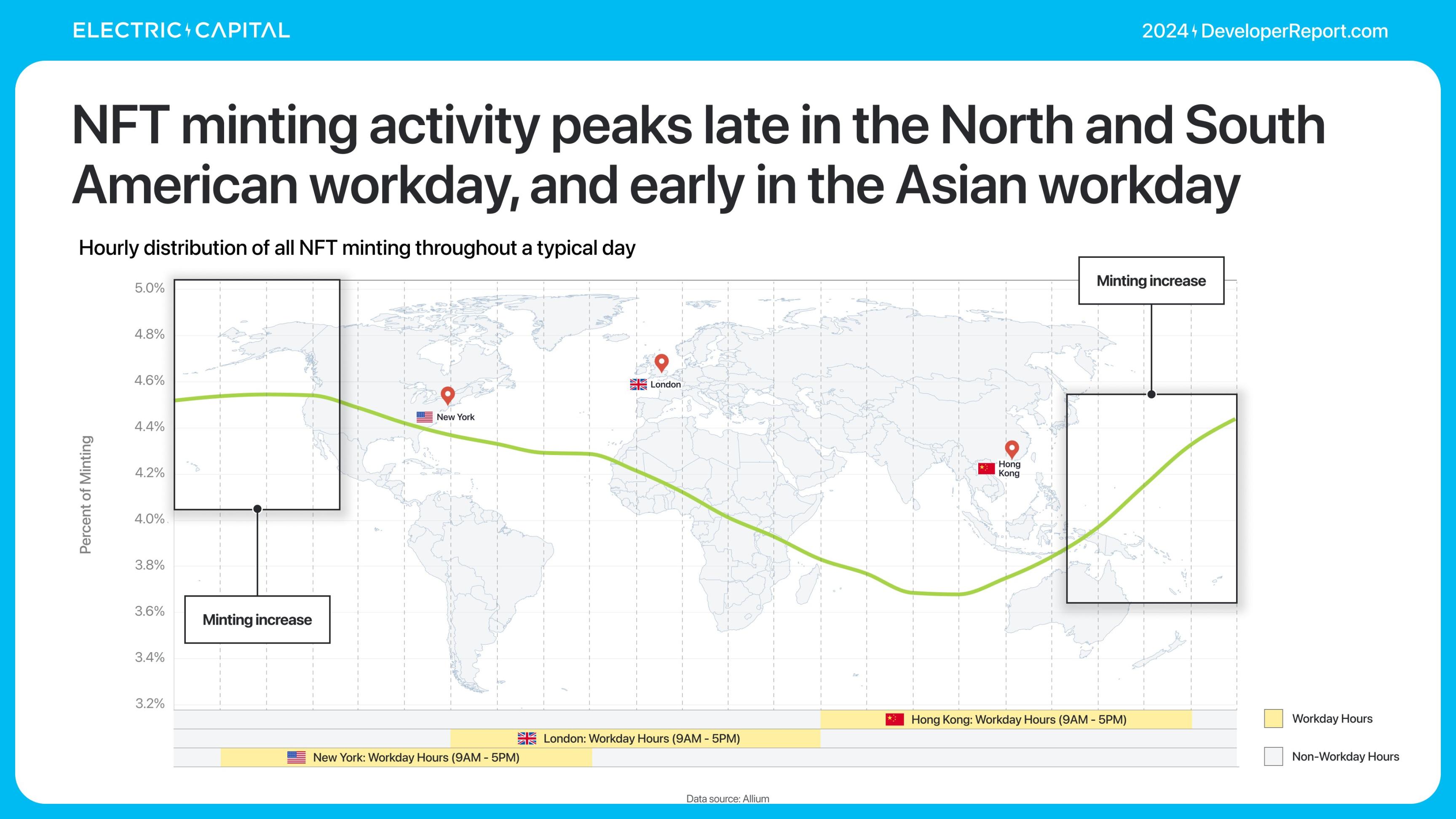

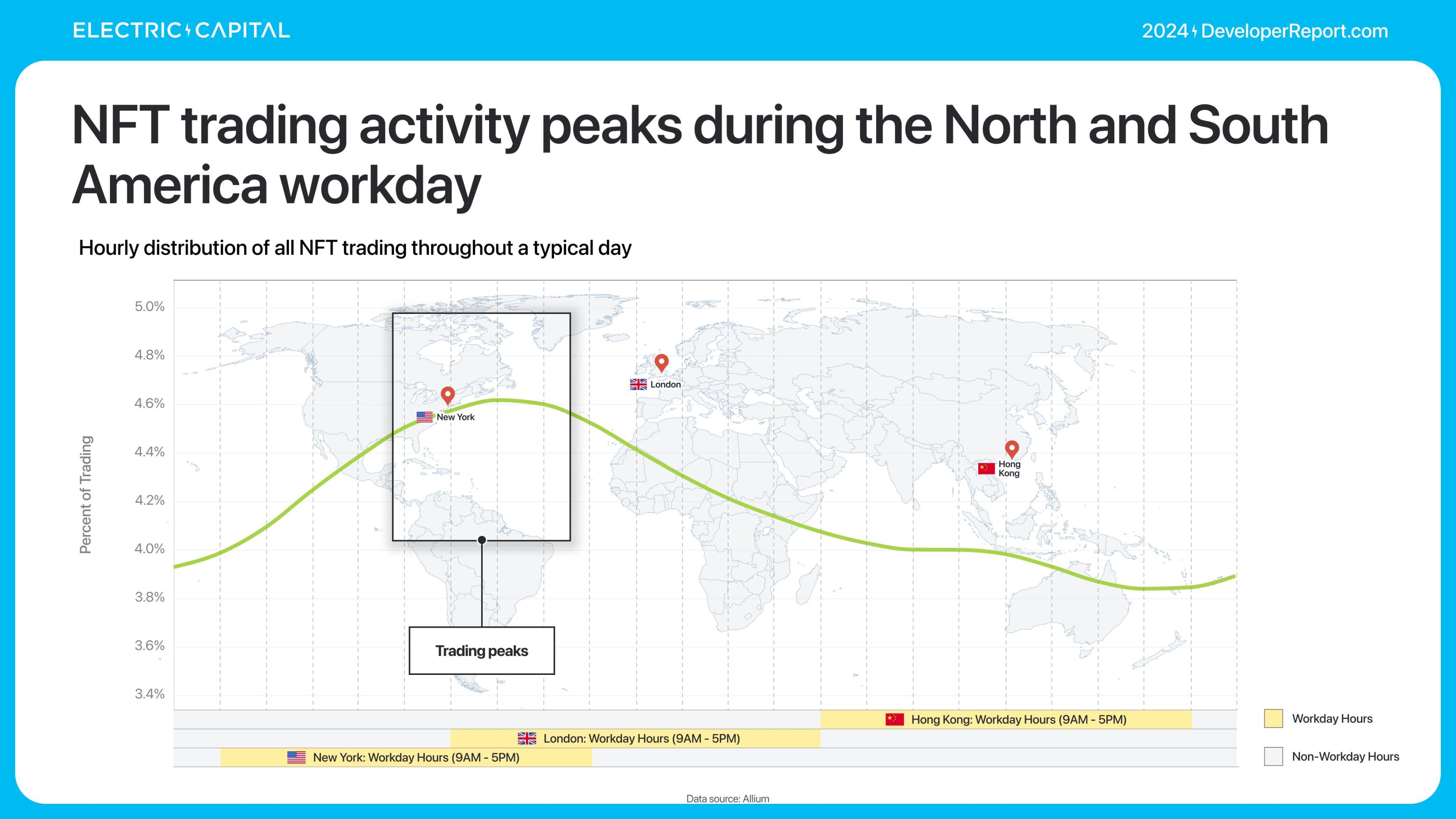

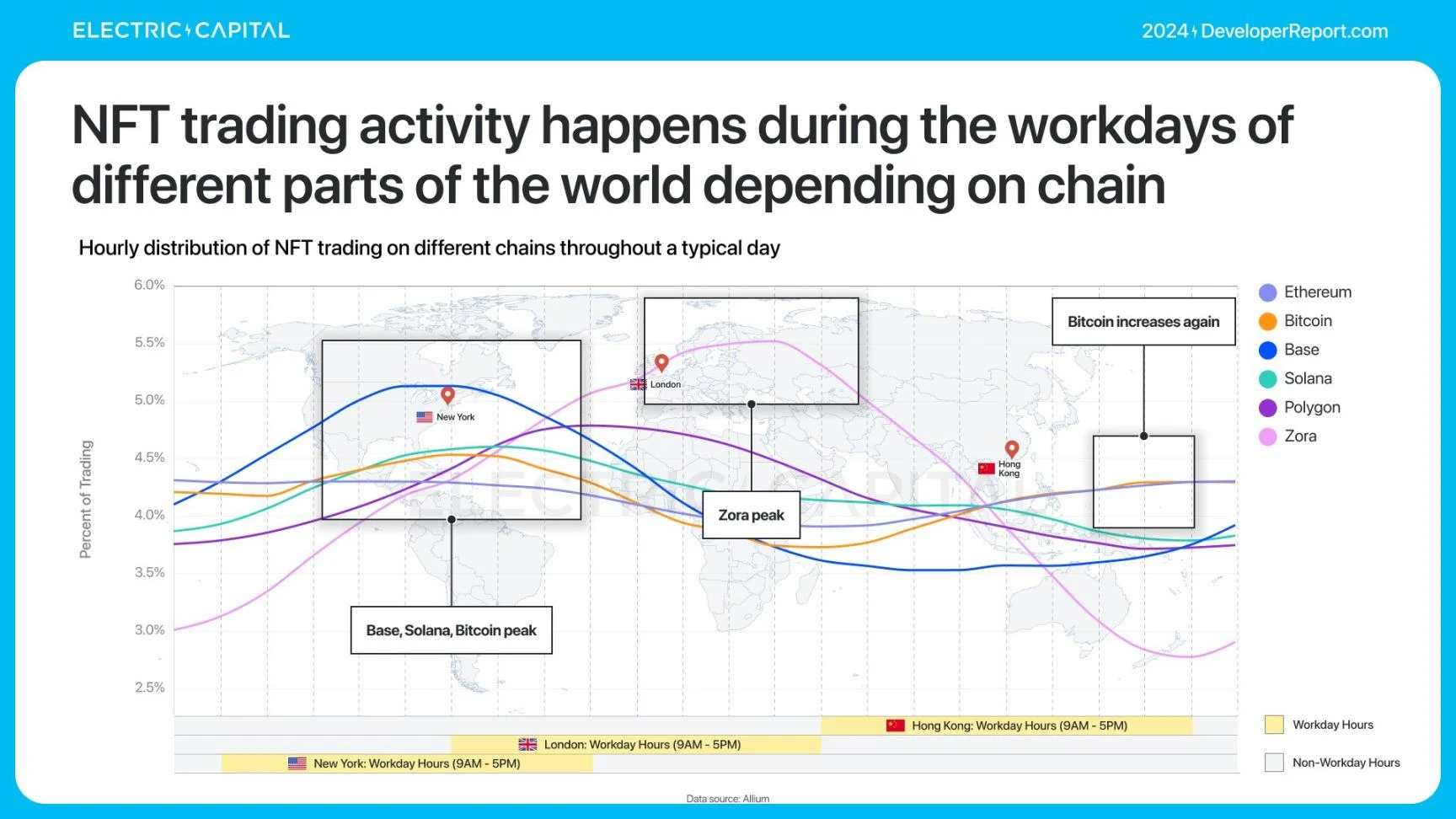

Volume for NFT minting and trading peaks in different regions — suggesting there are different user groups.

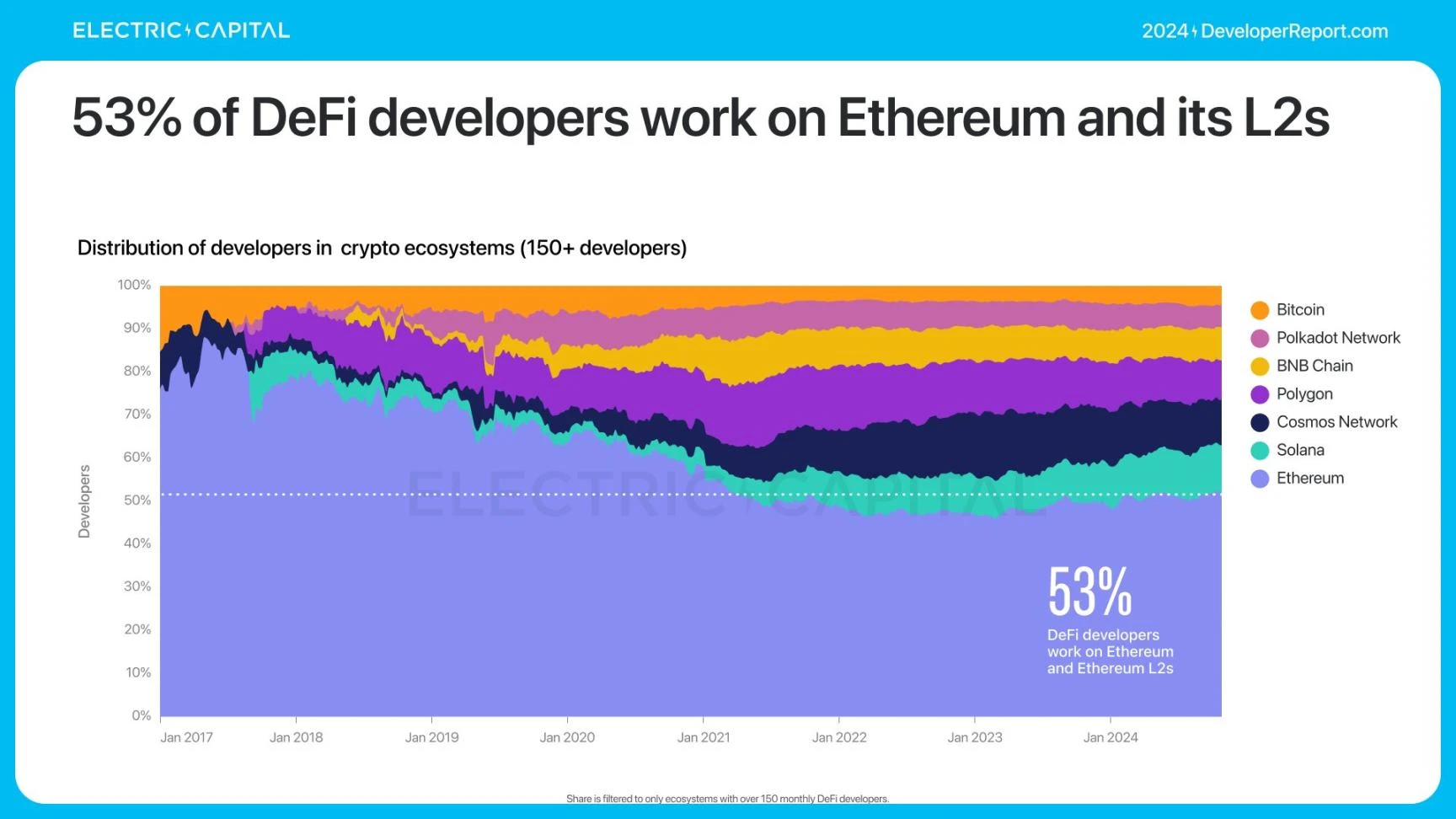

3,532 monthly active developers are engaged in DeFi development. DeFi developers are experienced – 2,097 (59%) have been working in DeFi for more than 2 years.

53% of DeFi developers work on Ethereum and its L2 chains.

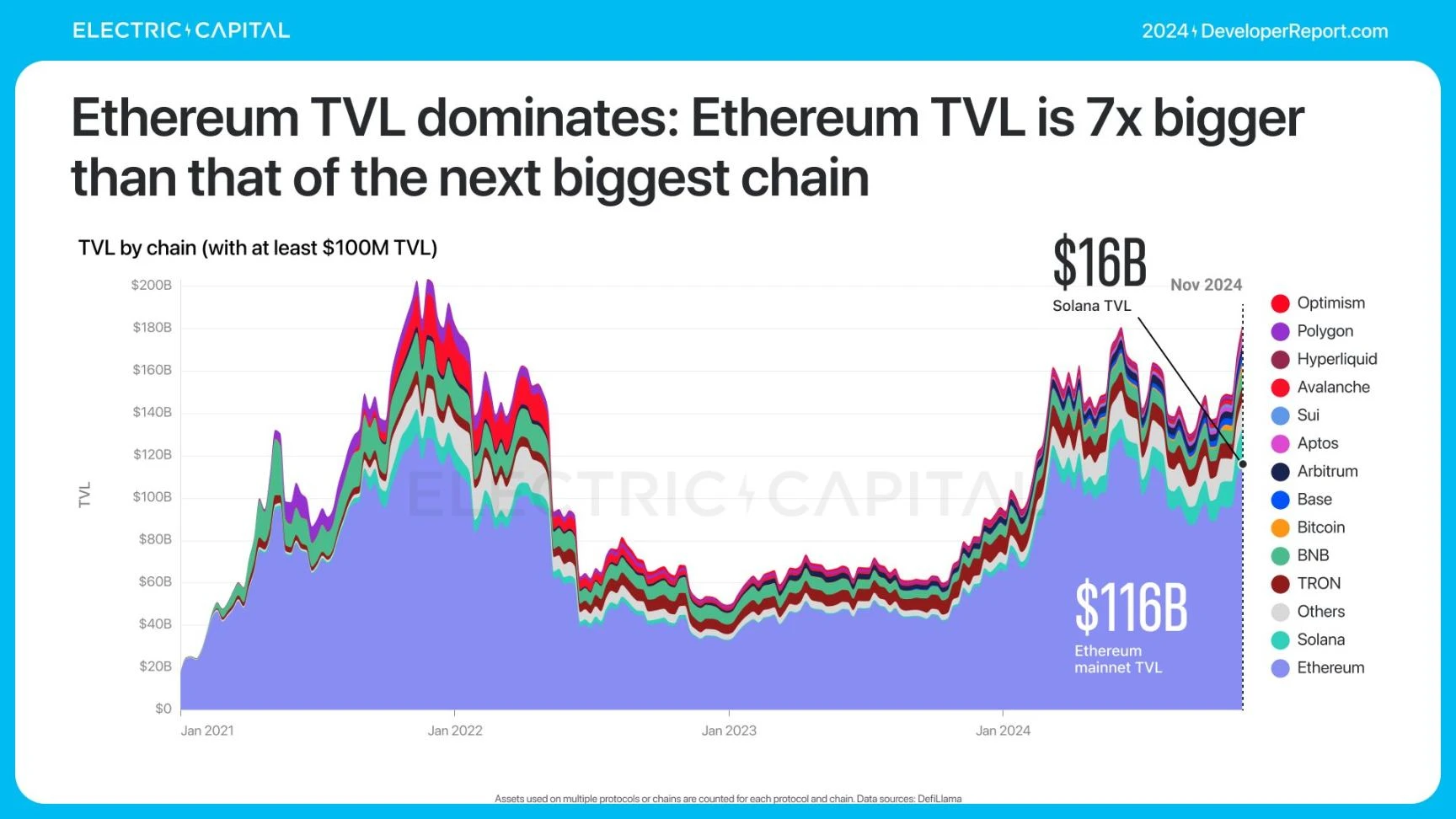

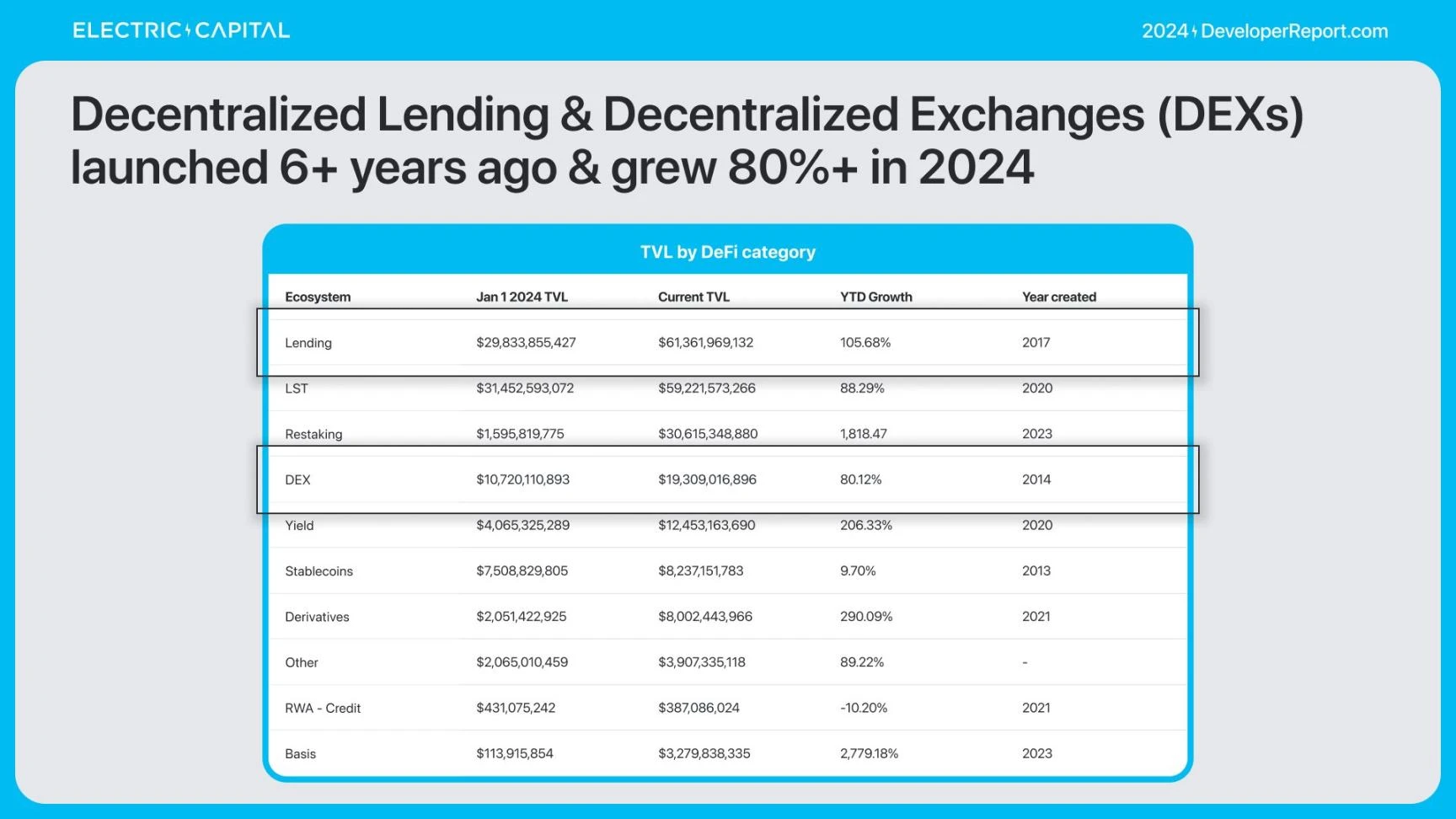

In 2024, DeFi’s total value locked (TVL) grew by 89%.

Ethereum’s TVL dominates, being 7 times that of the next largest chain.

Most TVL has been concentrated in Ethereum.

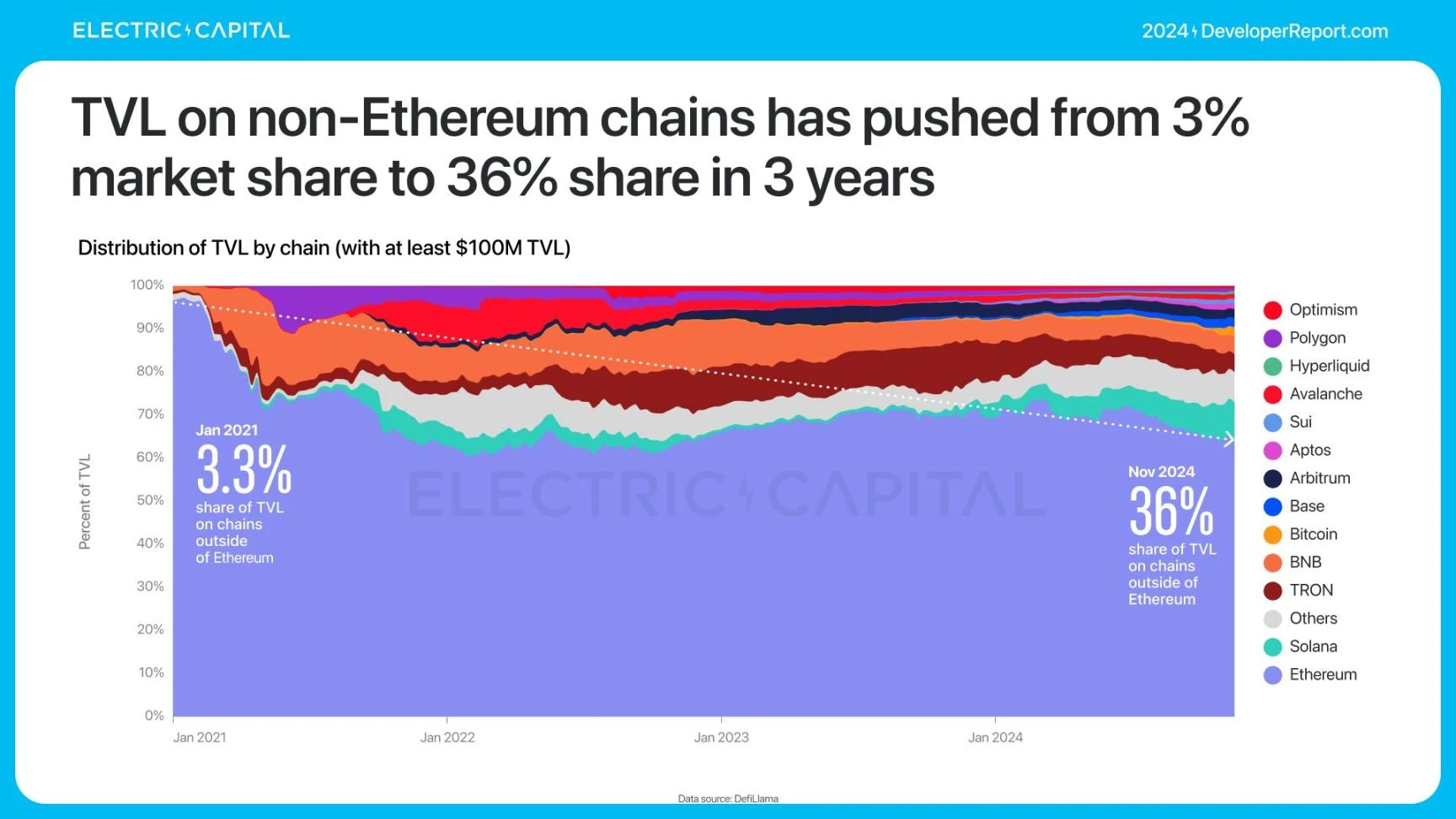

Non-Ethereum TVL grew from 3% to 36% in 3 years.

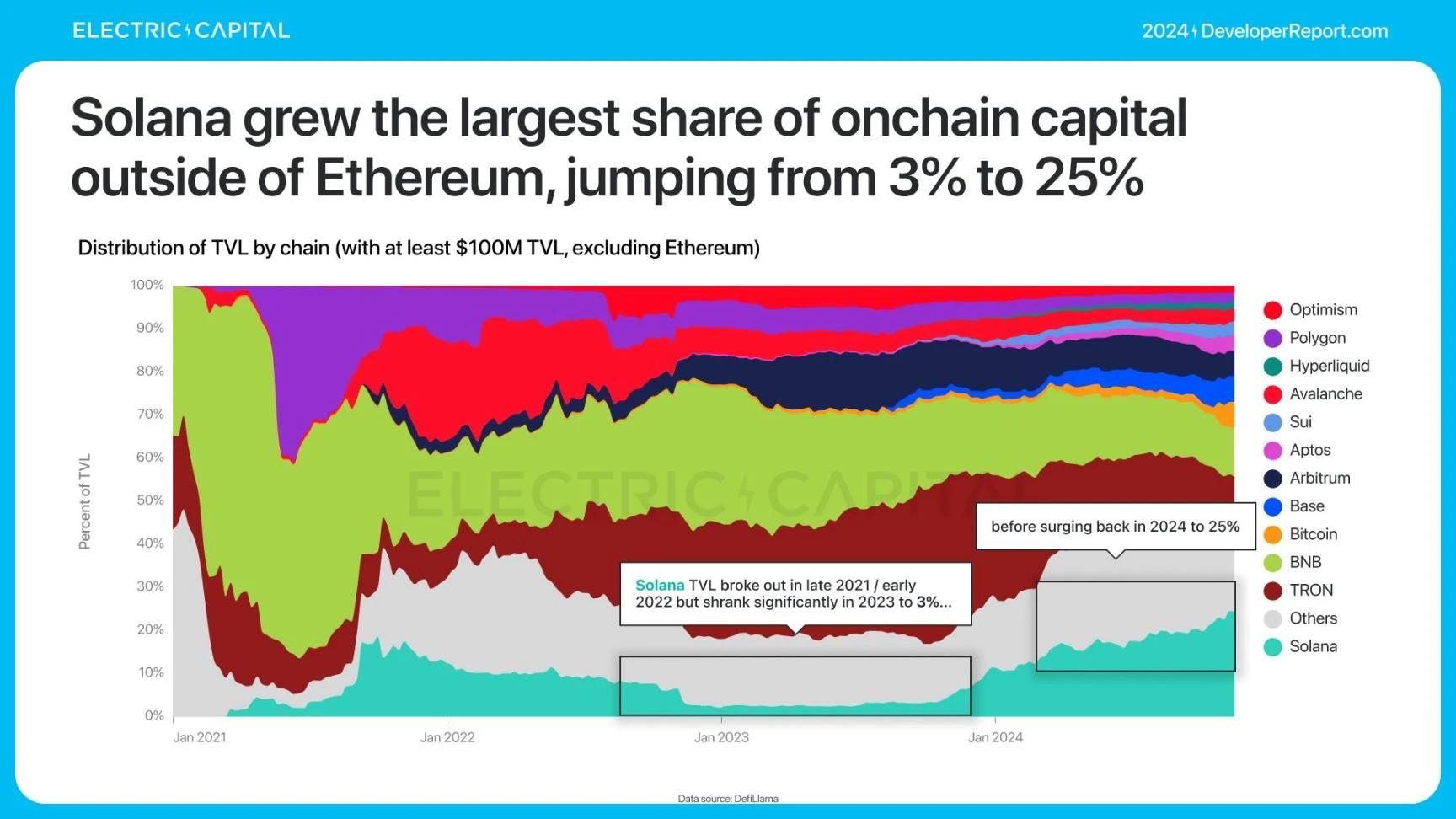

The biggest jump in TVL share happened on Solana

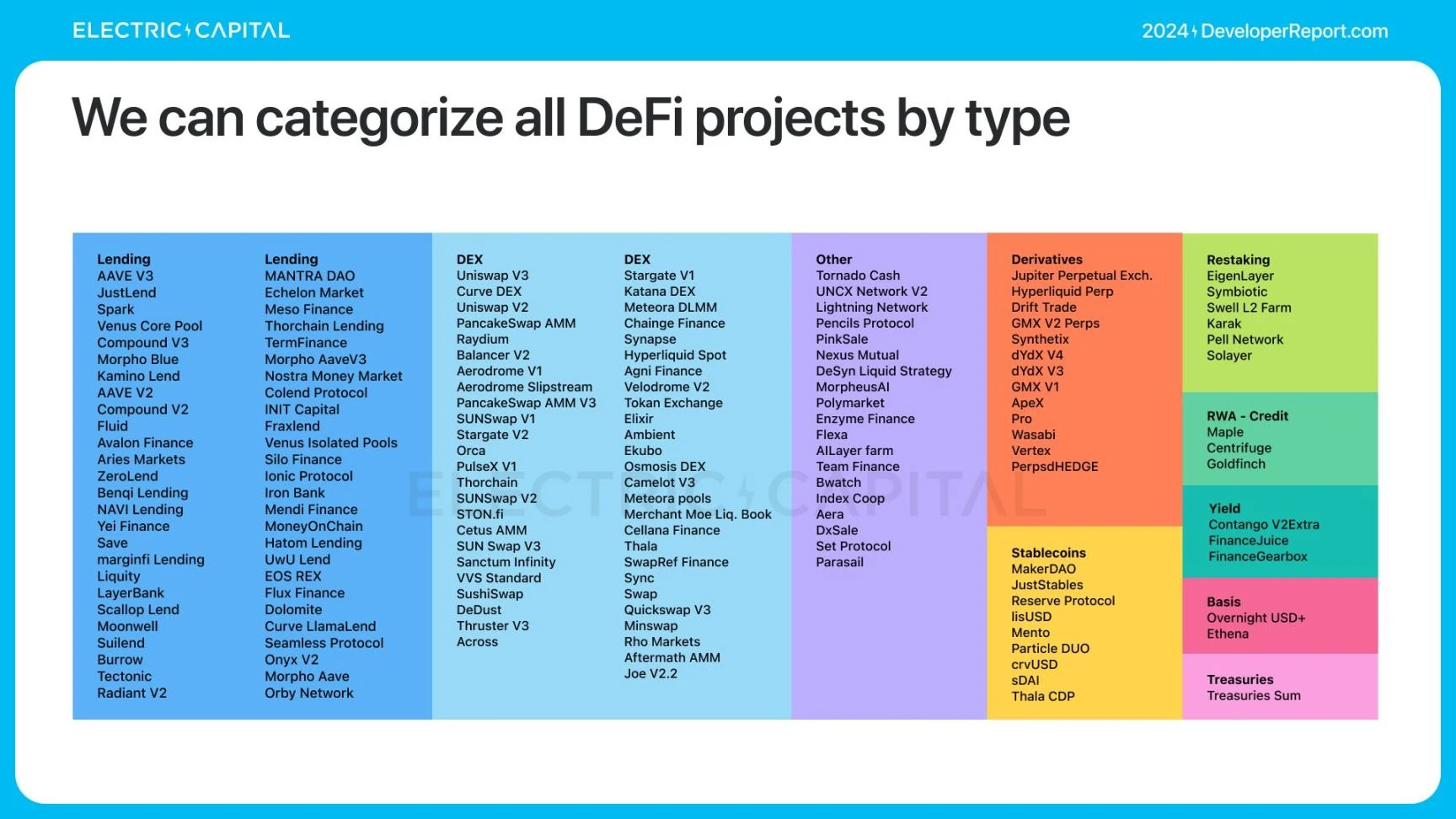

What’s driving all this TVL growth? We can categorize DeFi developers by developer type.

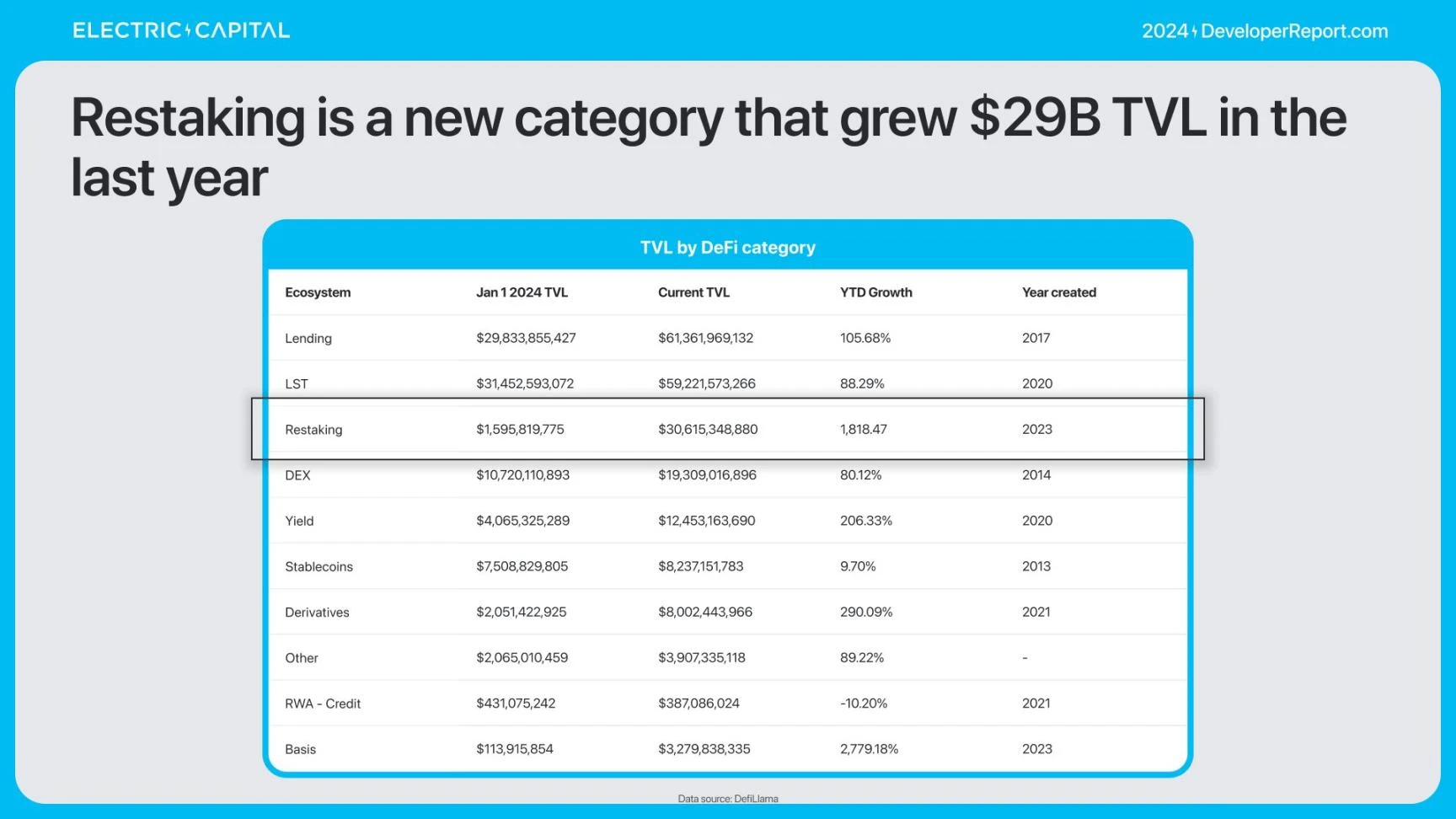

Restaking has grown by $29 billion in TVL over the past year.

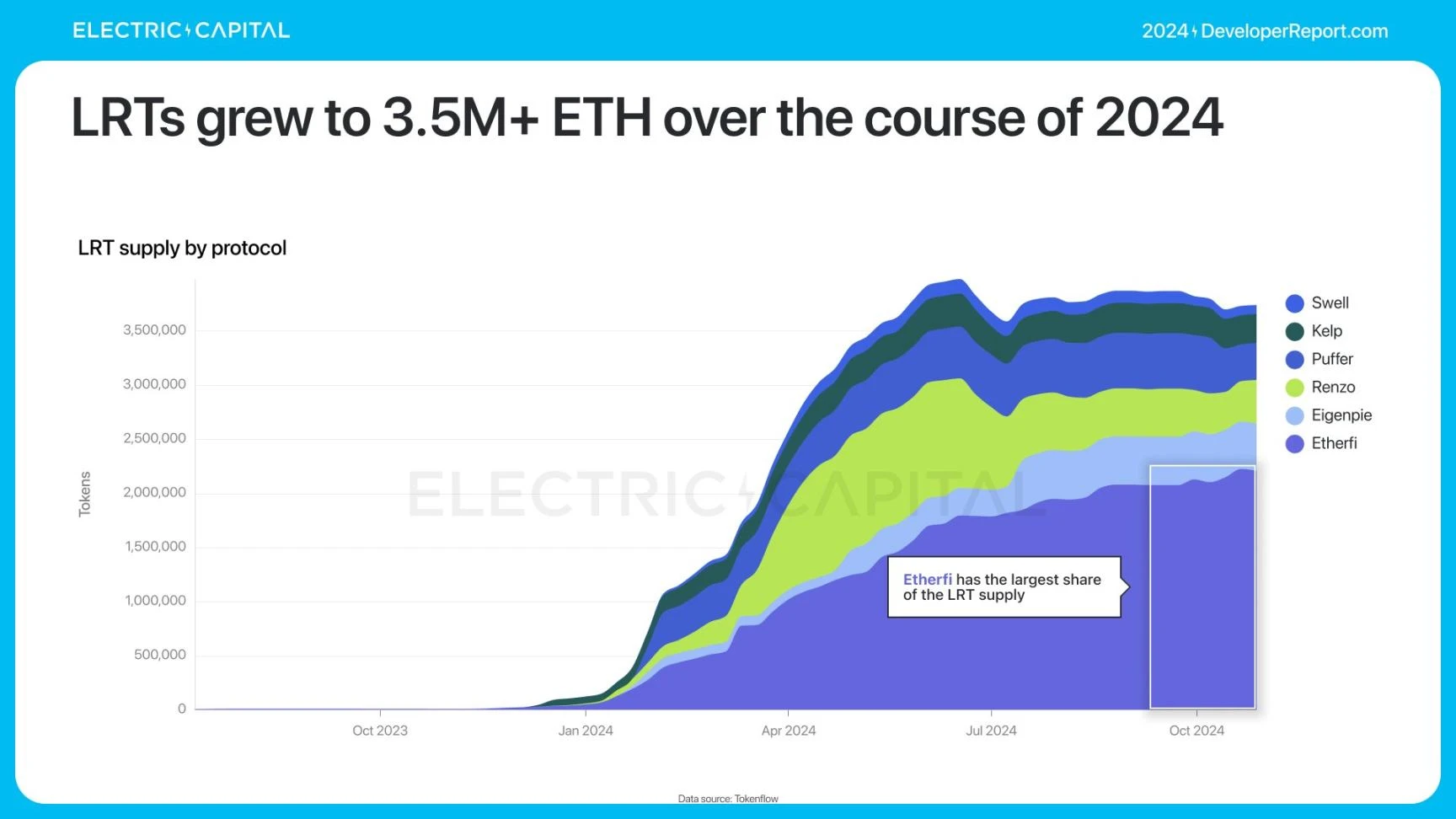

LRTs grew to over 3.5 million ETH.

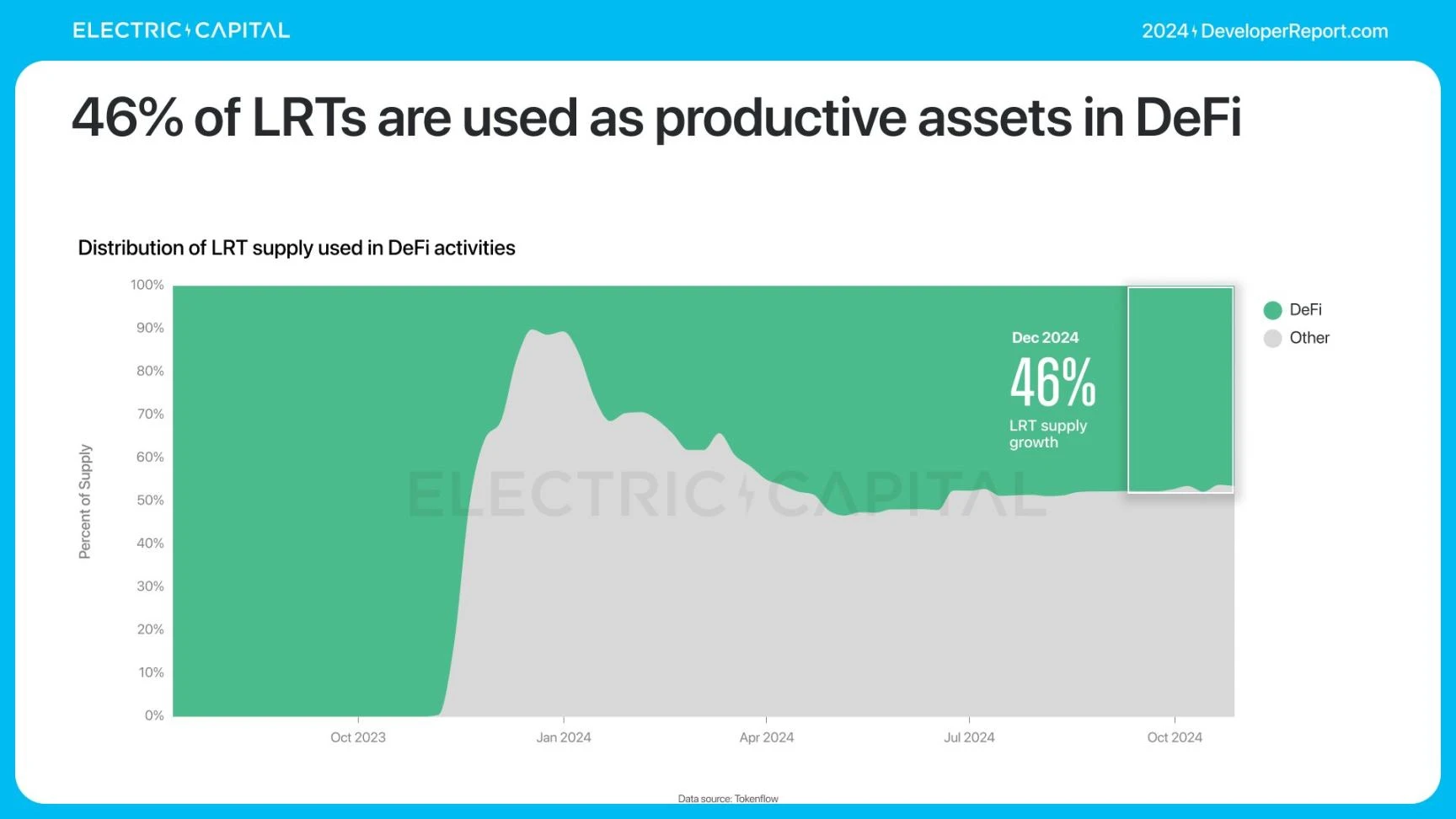

46% of LRTs are used in DeFi.

Most LRTs are deposited in money market, yield, interest rate derivatives and bridging platforms.

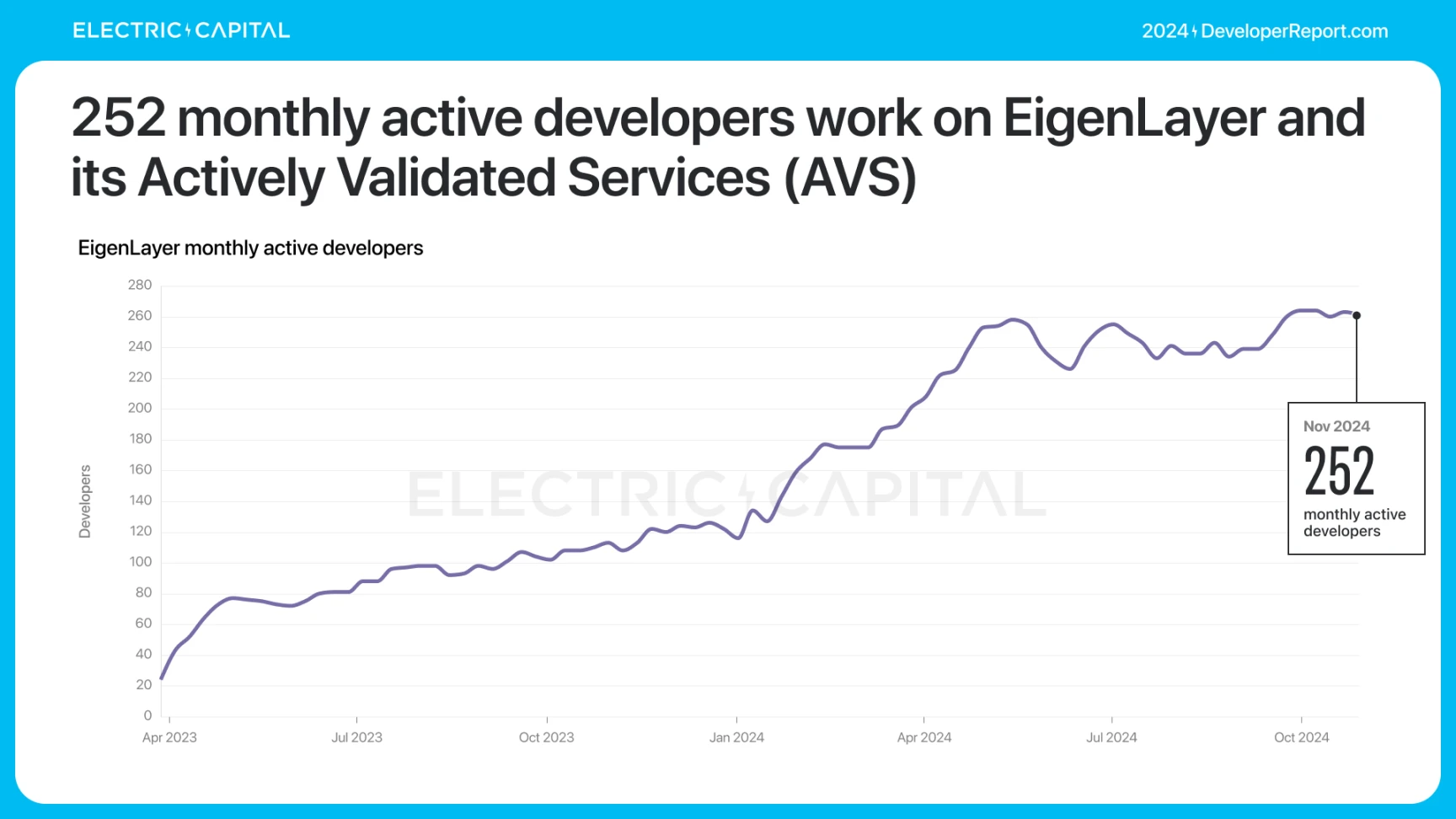

Eigenlayer has enabled the creation of LRTs as a field. So, how is the developer ecosystem of Eigenlayer developing?

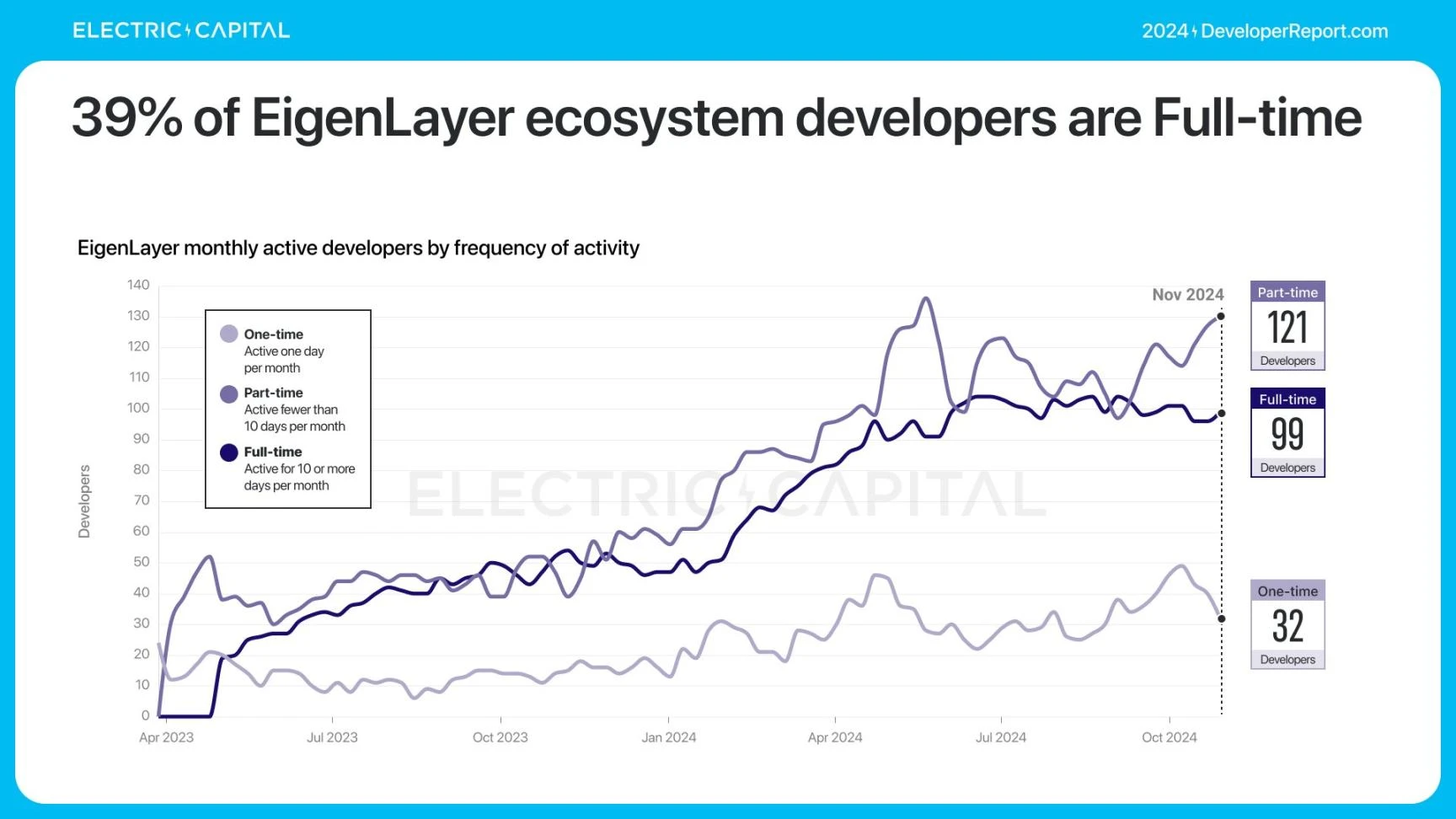

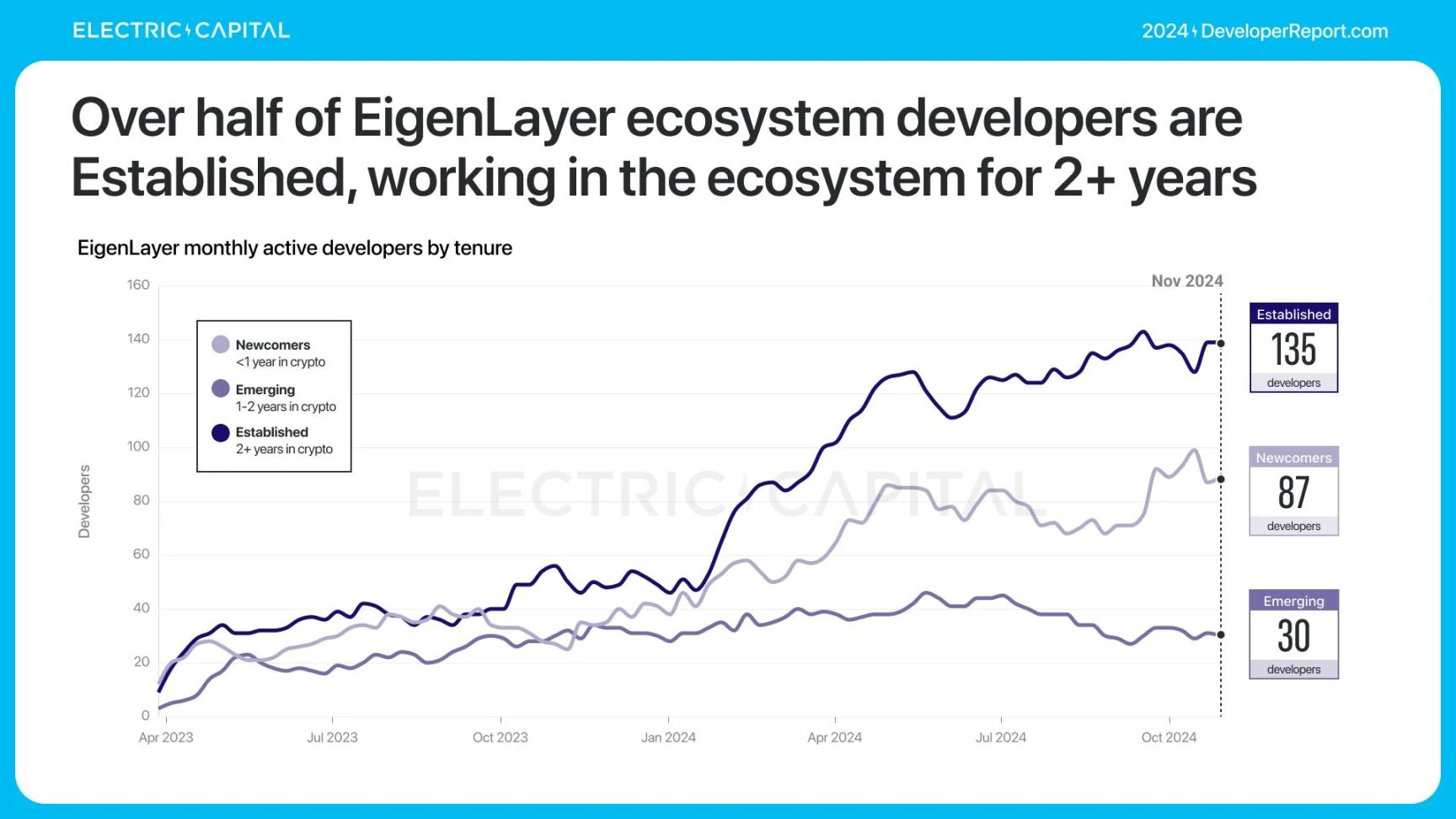

There are 252 monthly active developers working in the Eigenlayer ecosystem. Eigenlayer developers are very engaged: 39% are full-time developers and more than half of the developers have been working in the ecosystem for more than 2 years.

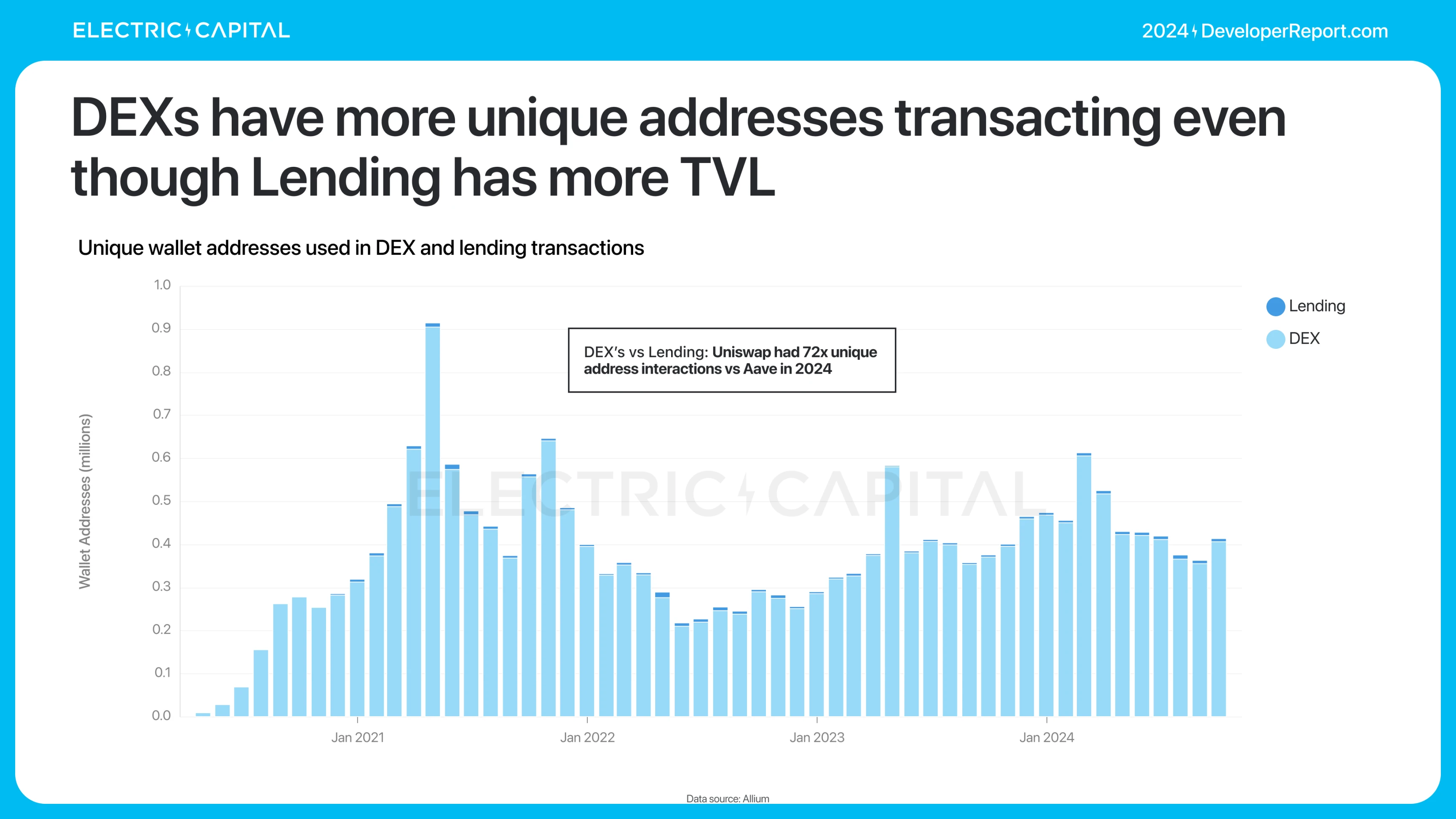

TVL is not the only metric we need to understand DeFi usage. Although lending platforms have 3x the TVL of DEX, DEXs have more unique address transactions. For example – DEX vs. lending platforms: In 2024, Uniswap had 72x more unique address interactions than AAVE.

TVL is not the only metric we need to understand DeFi usage. Although lending platforms have 3x the TVL of DEX, DEXs have more unique address transactions. For example – DEX vs. lending platforms: In 2024, Uniswap had 72x more unique address interactions than AAVE.

In 2024, DEX trading volume almost doubled to $209 billion per month.

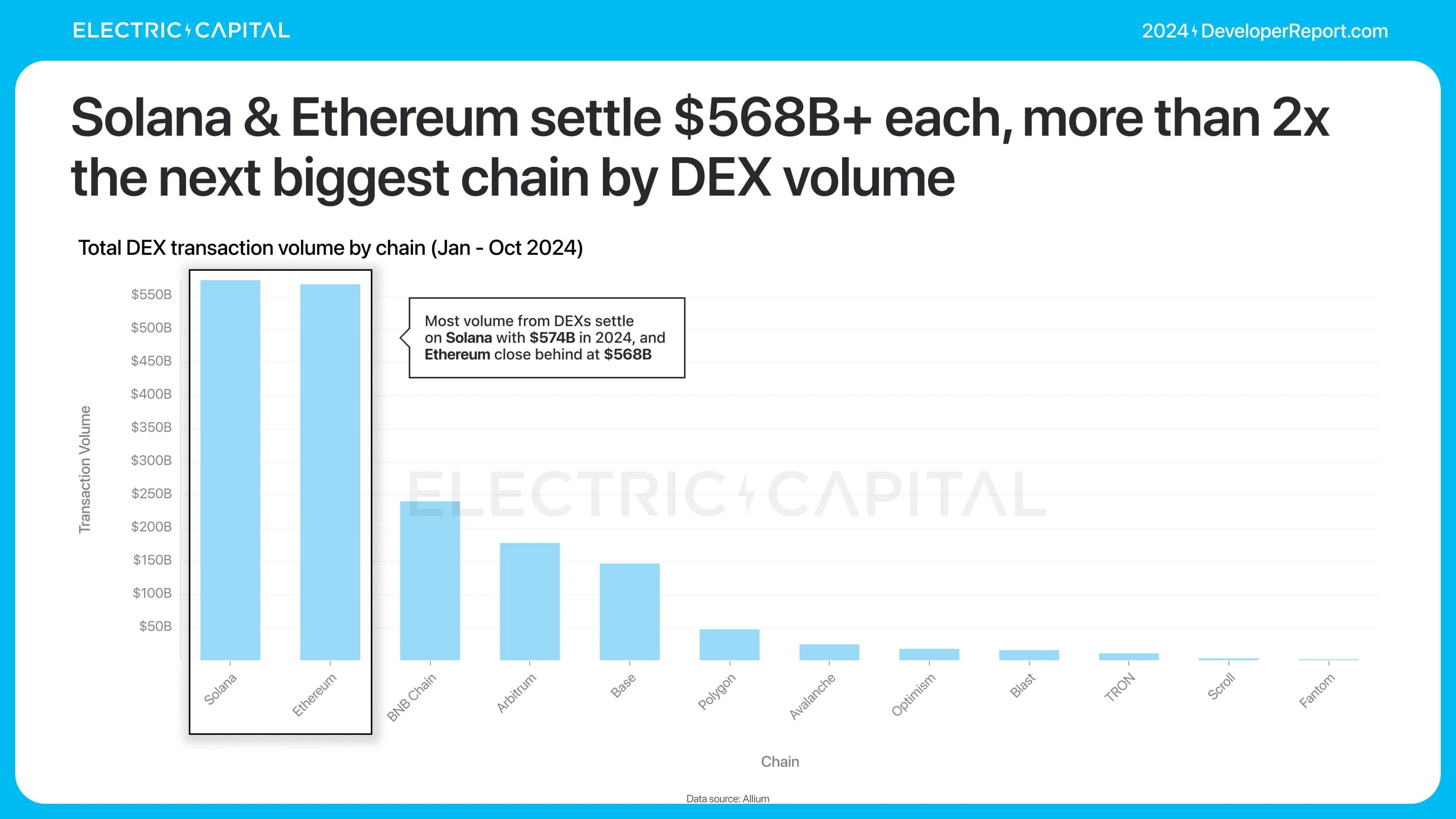

Solana and Ethereum settled the most transactions — more than 2x the next largest chain.

Solana settled the most volume at $574 billion in 2024. The total DEX volume for the Ethereum mainnet and its L2 chains was $931 billion.

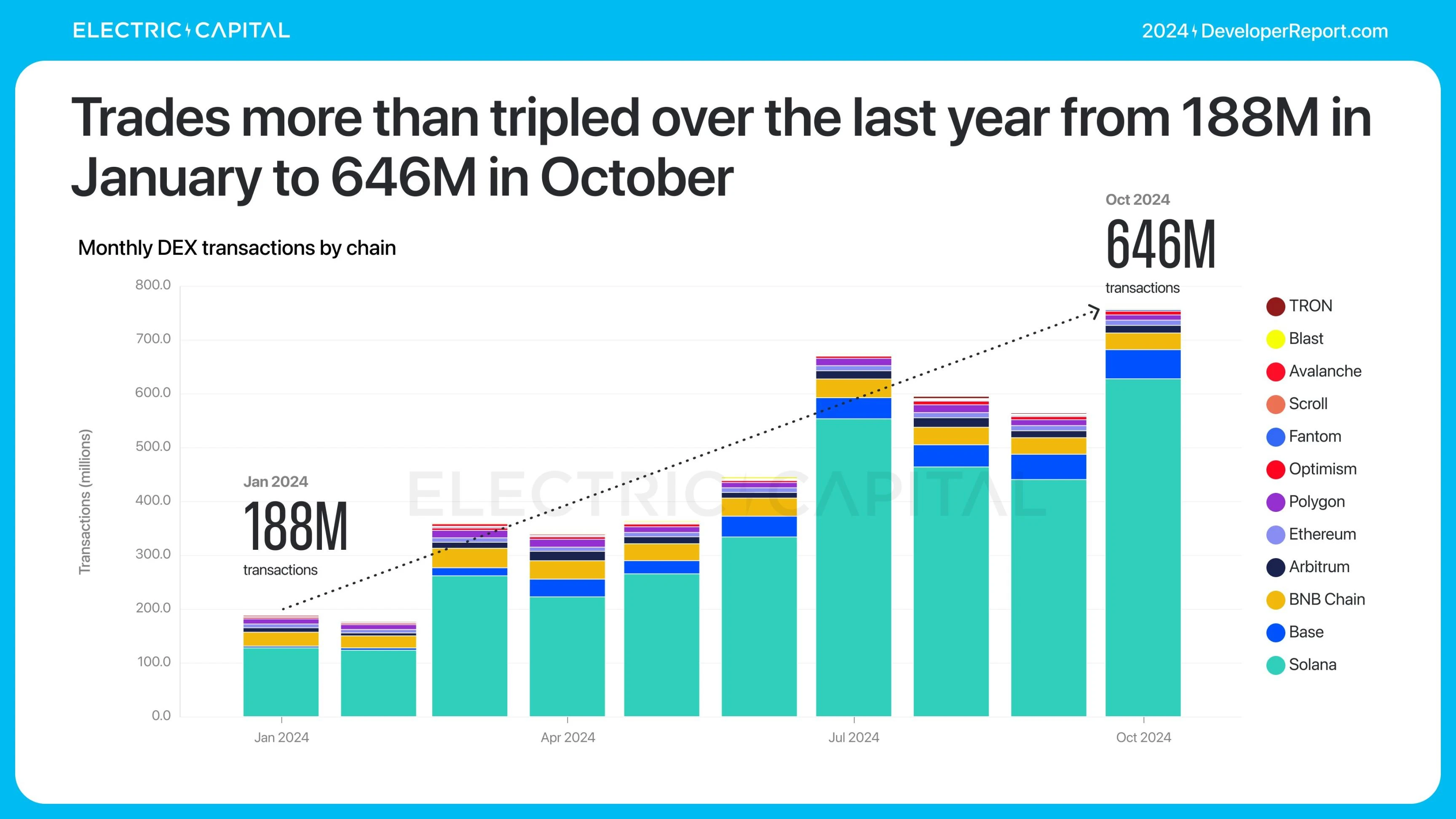

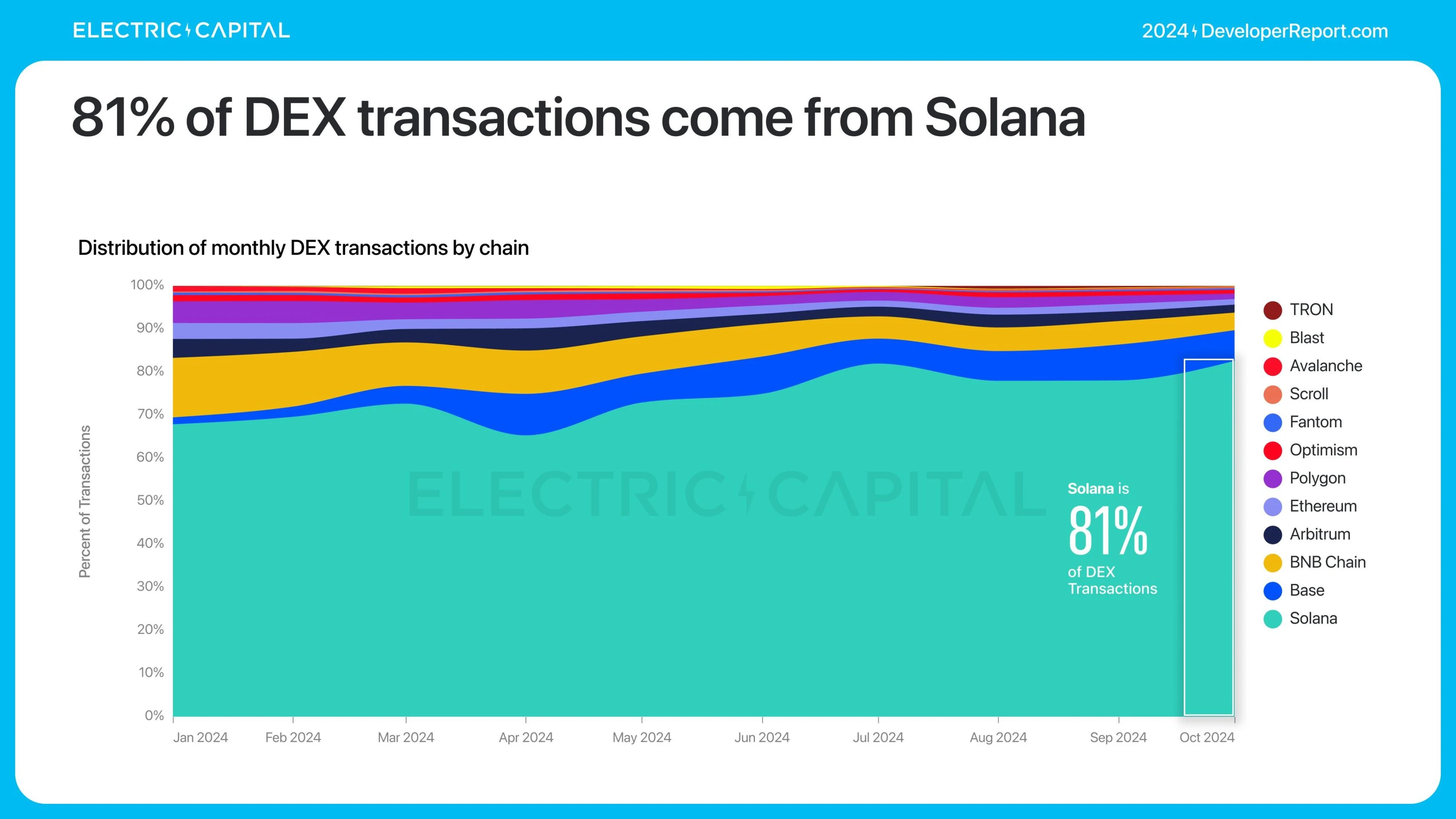

Solana dominates the use case for low-fee DEXs. In 2024, its transaction volume more than tripled, reaching 646 million transactions per month.

81% of DEX transactions come from Solana.

By number of transaction wallets, excluding wallets with only 1 transaction and less than $1, Solana has the most unique transaction wallets, 7 times more than the next largest chain.

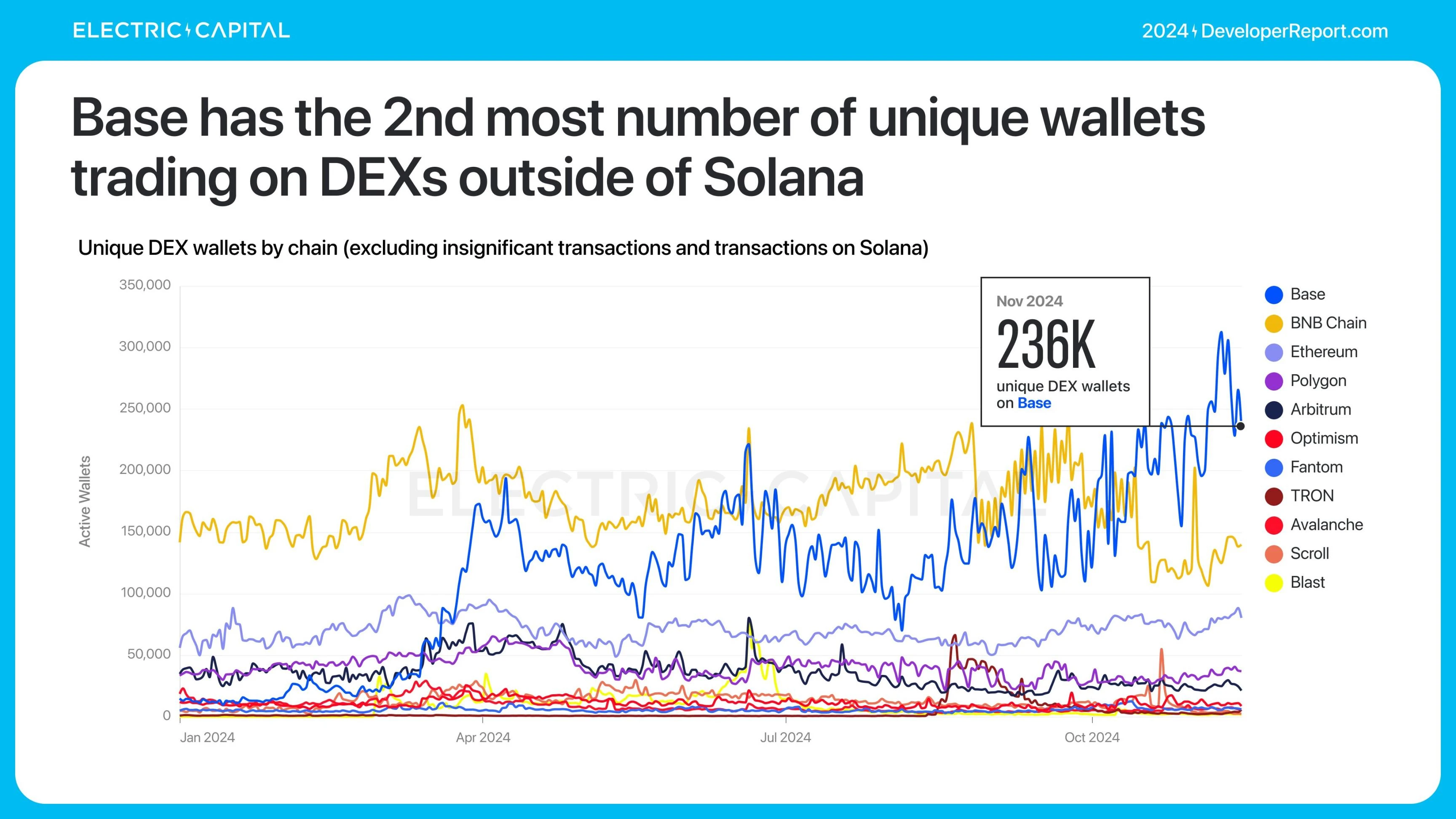

Base has the second most independent trading wallets after Solana.

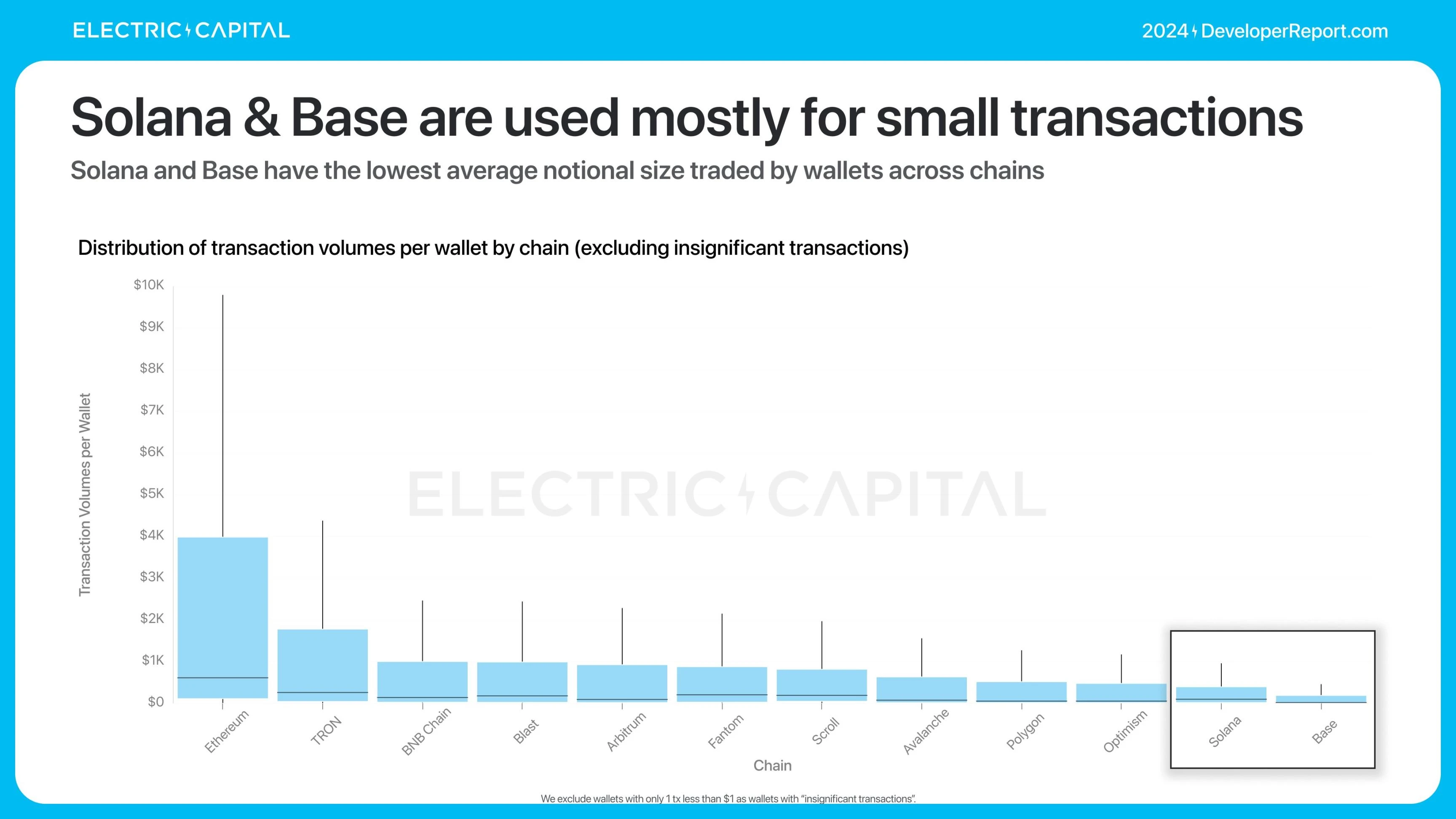

Base and Solana are very popular for small transfers. Wallets on these chains have the smallest average transaction amounts.

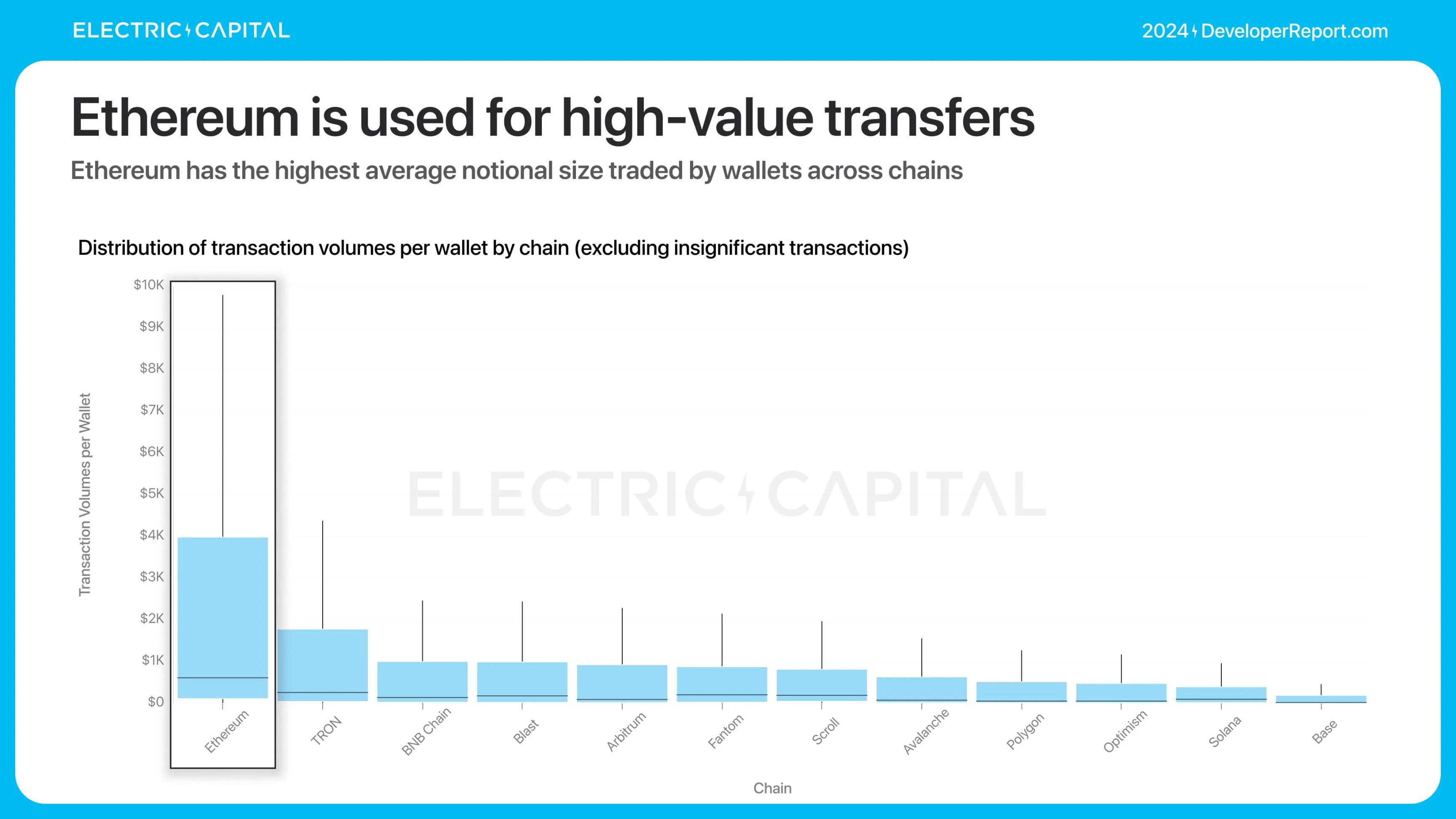

Ethereum is the most popular for high-value transfers. Wallets on Ethereum have the largest average transaction amount.

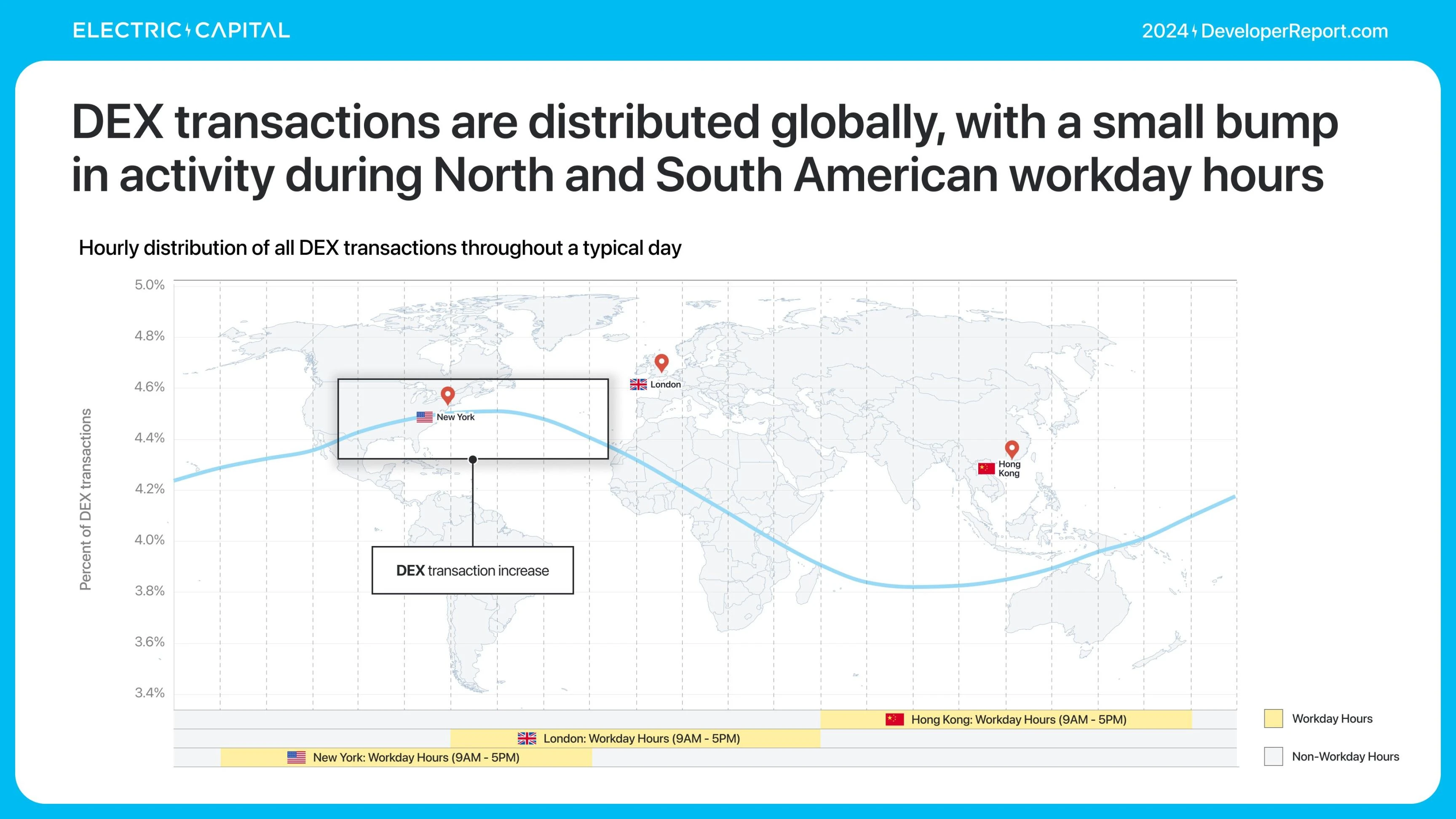

Where are these DEX users? We can understand the usage of DeFi through DEX because financial activities often start or end from DEX.

Global activity is distributed differently across chains — the more evenly activity is distributed, the more global usage is. Ethereum and Solana have the most evenly distributed usage.

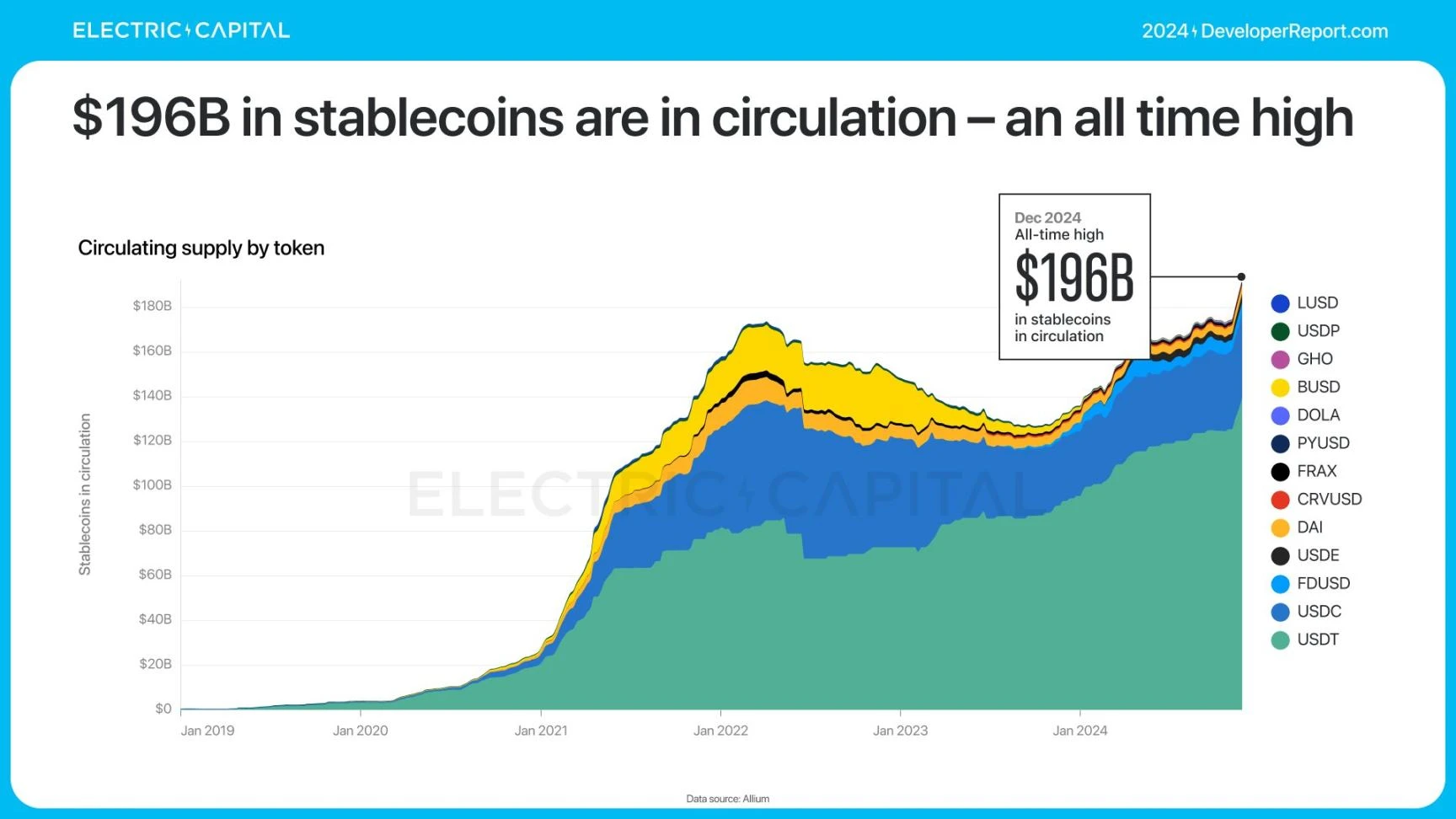

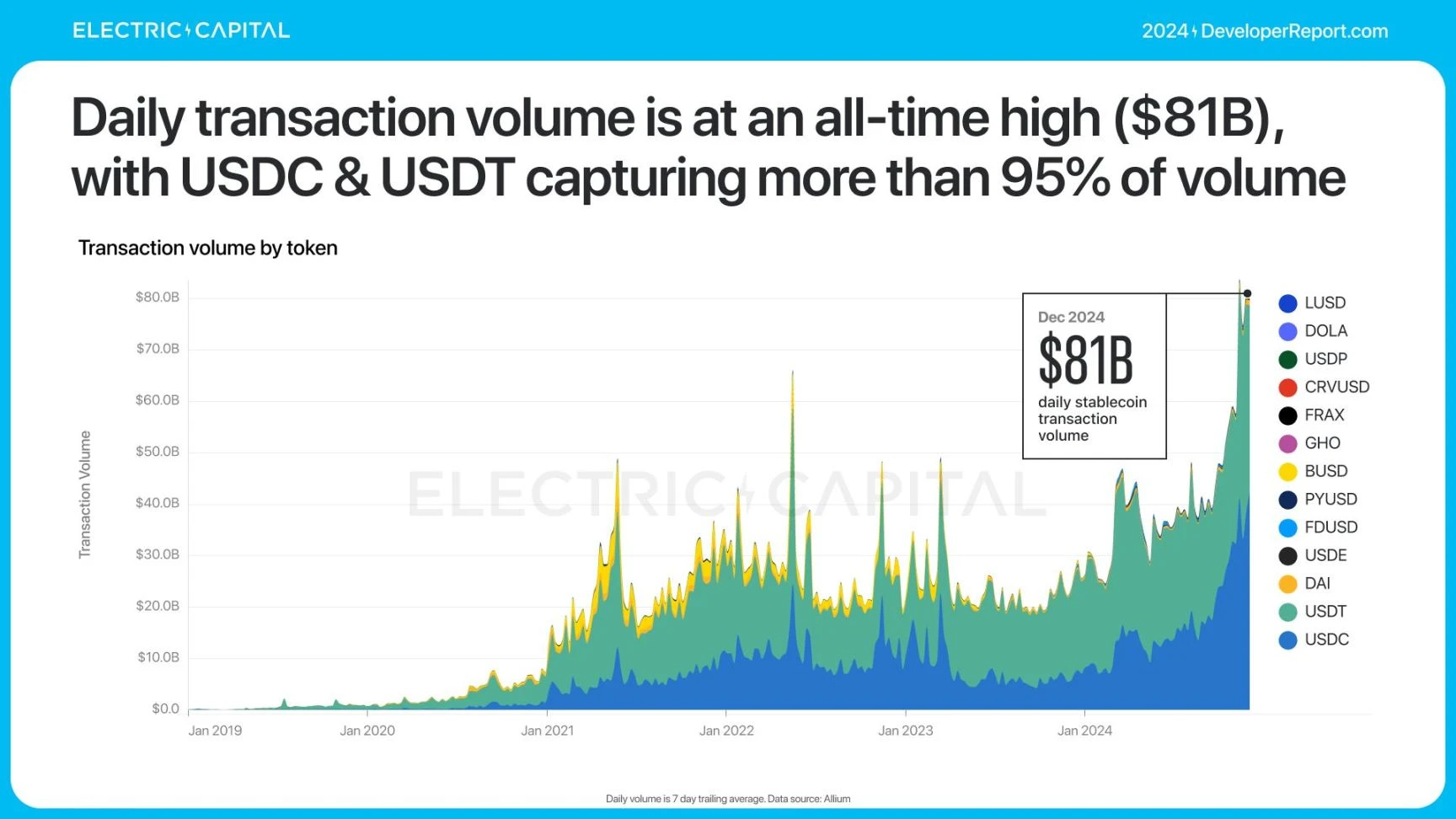

Stablecoins are one of the largest crypto use cases in the world. How are stablecoins performing? Stablecoin usage is at an all-time high: $196 billion in total stablecoins in circulation, with daily trading volume at $81 billion — both records for stablecoins.

USDC and USDT account for 95% of trading volume.

Ethereum is the first stablecoin ecosystem – 59% of stablecoins are issued on Ethereum

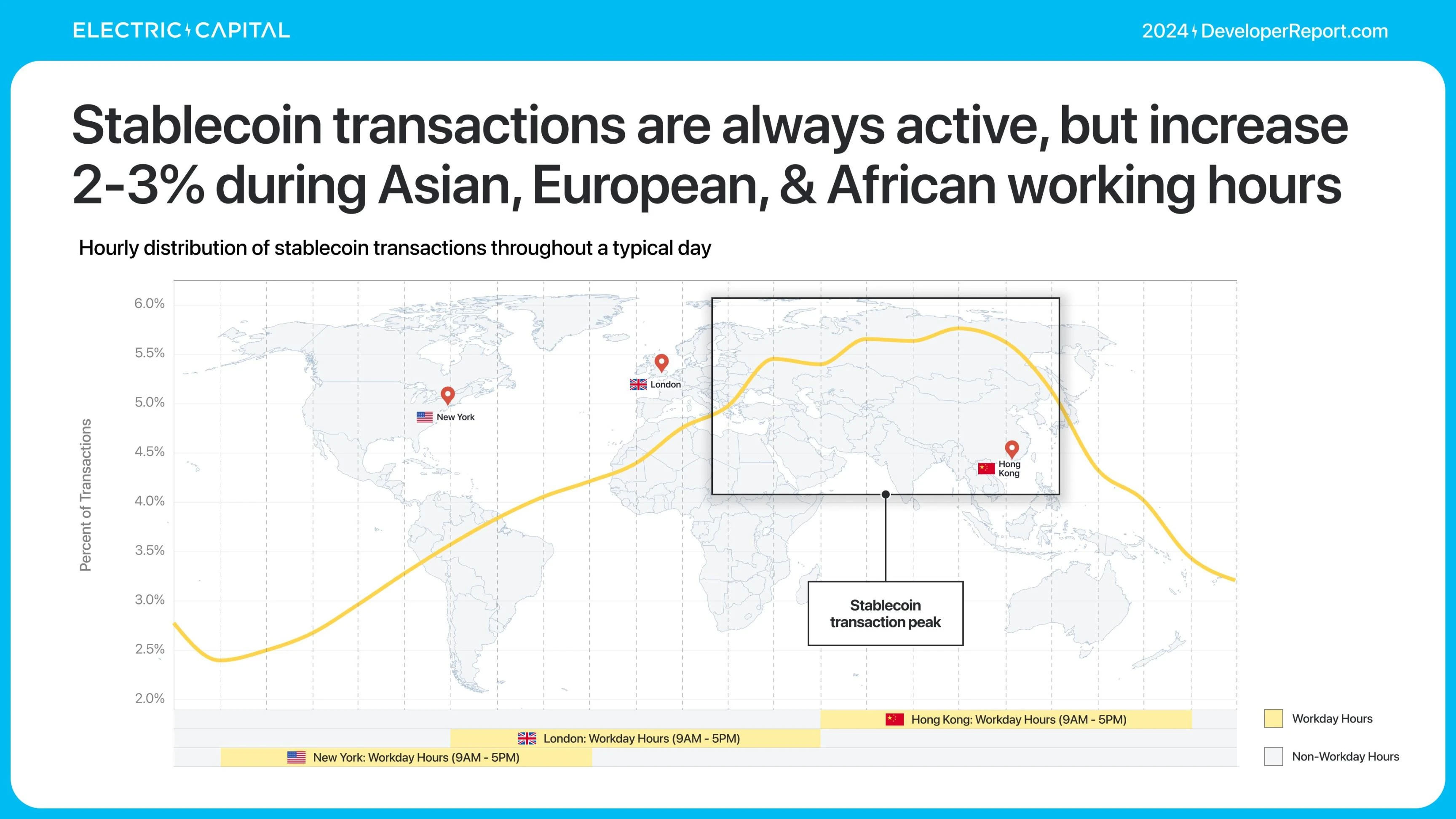

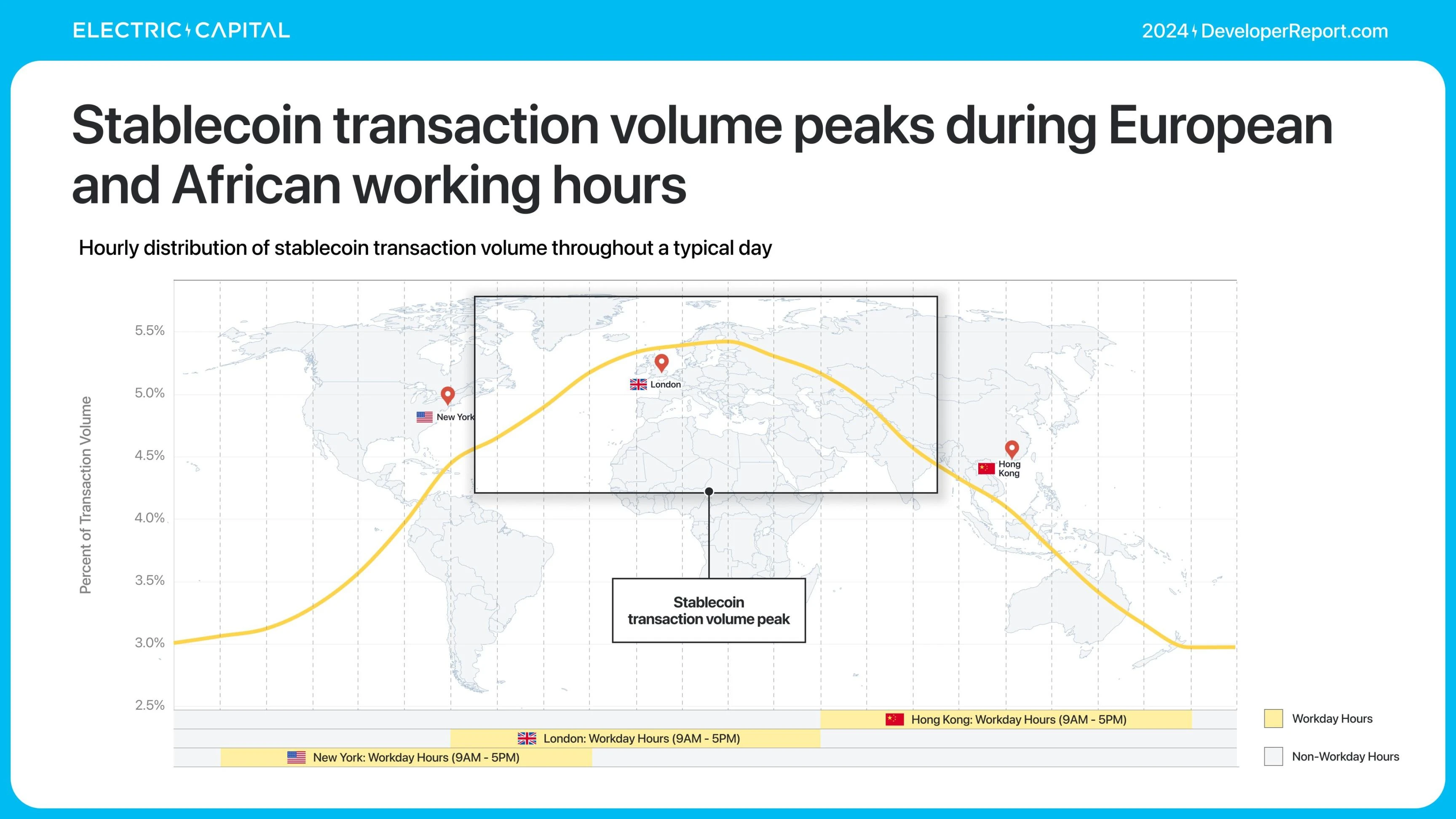

What is the global activity of stablecoins?

Stablecoins were active throughout, but volumes increased by 2-3% during business hours in Asia, Europe, and Africa.

Although stablecoin trading peaks during Eastern Hemisphere business hours, trading volume is more skewed toward the Western Hemisphere.

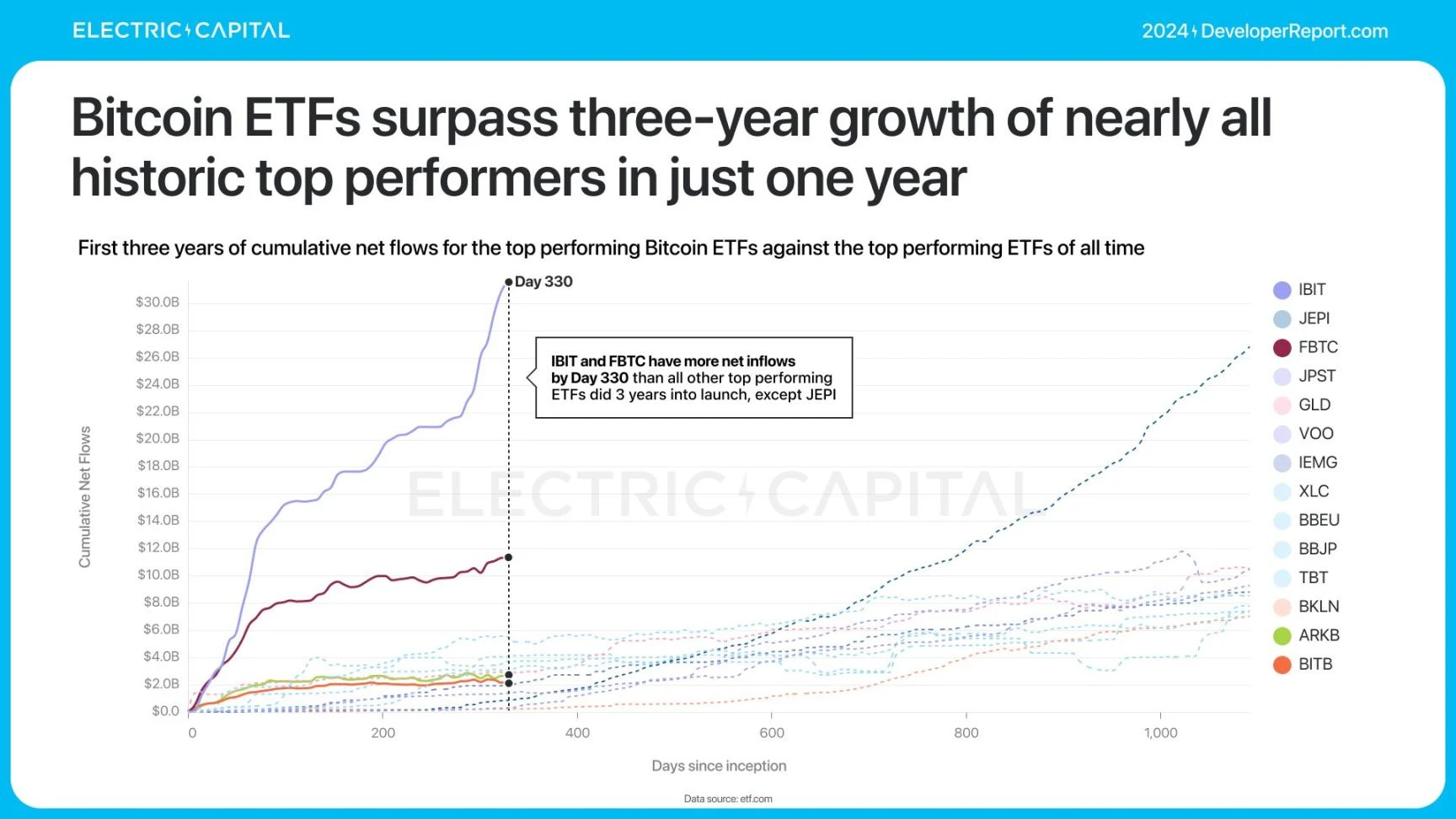

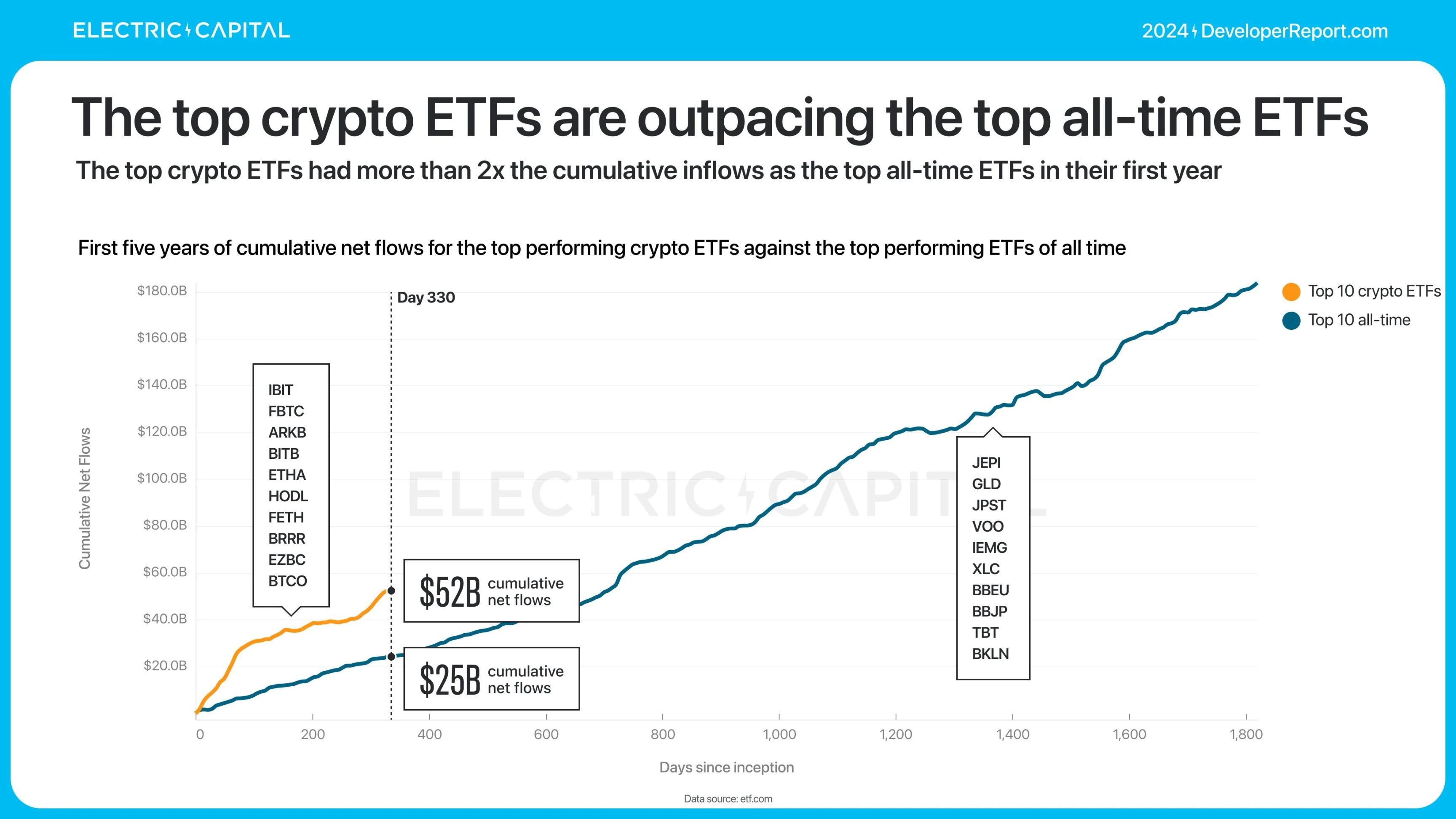

Bitcoin and Ethereum ETFs were launched this year, providing a convenient way for OTC capital to enter on-chain assets. Bitcoin ETF attracted more than $50 billion in net inflows, making it one of the most successful ETFs in history.

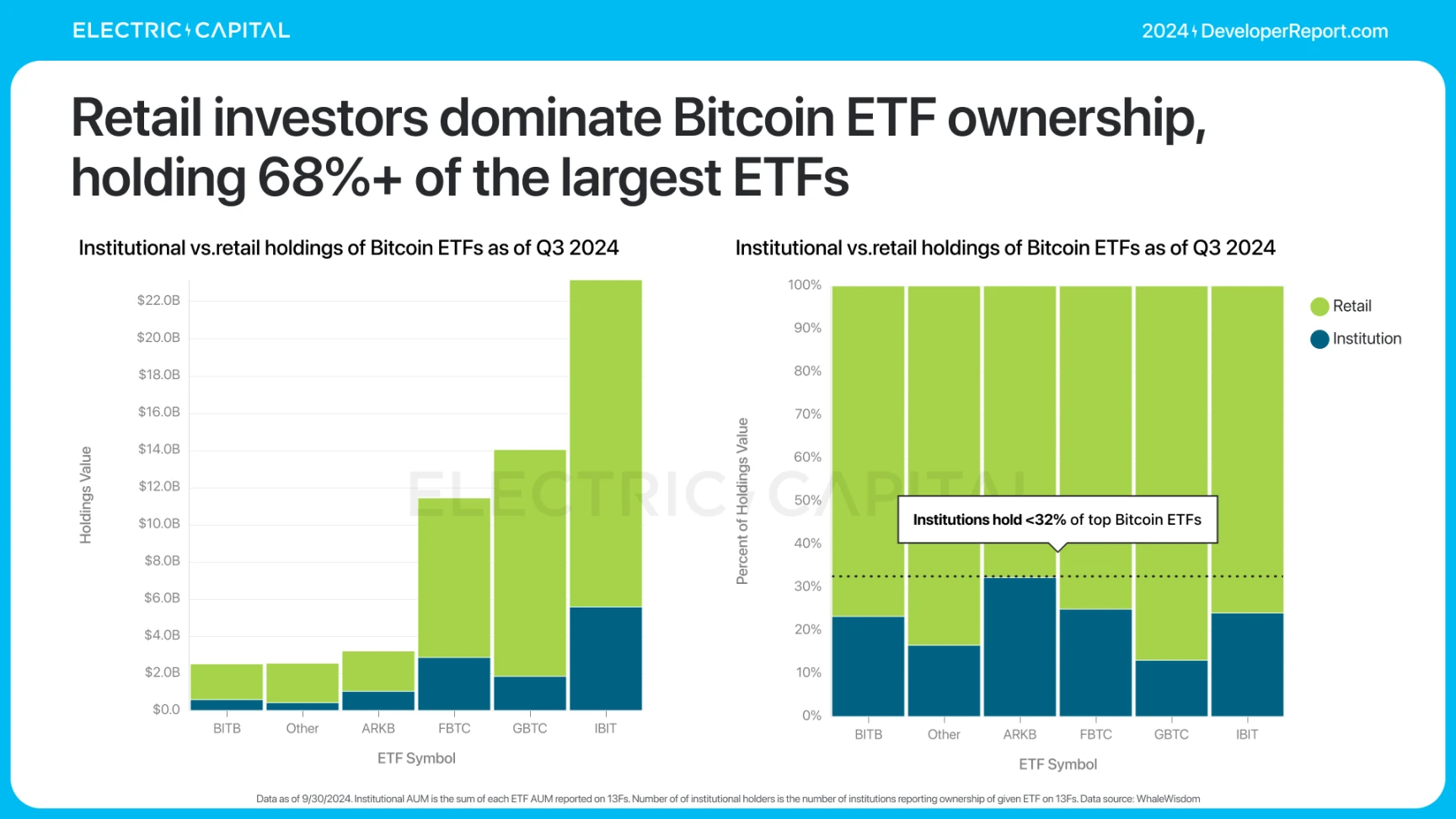

Most of the volume in Bitcoin ETFs comes from retail investors.

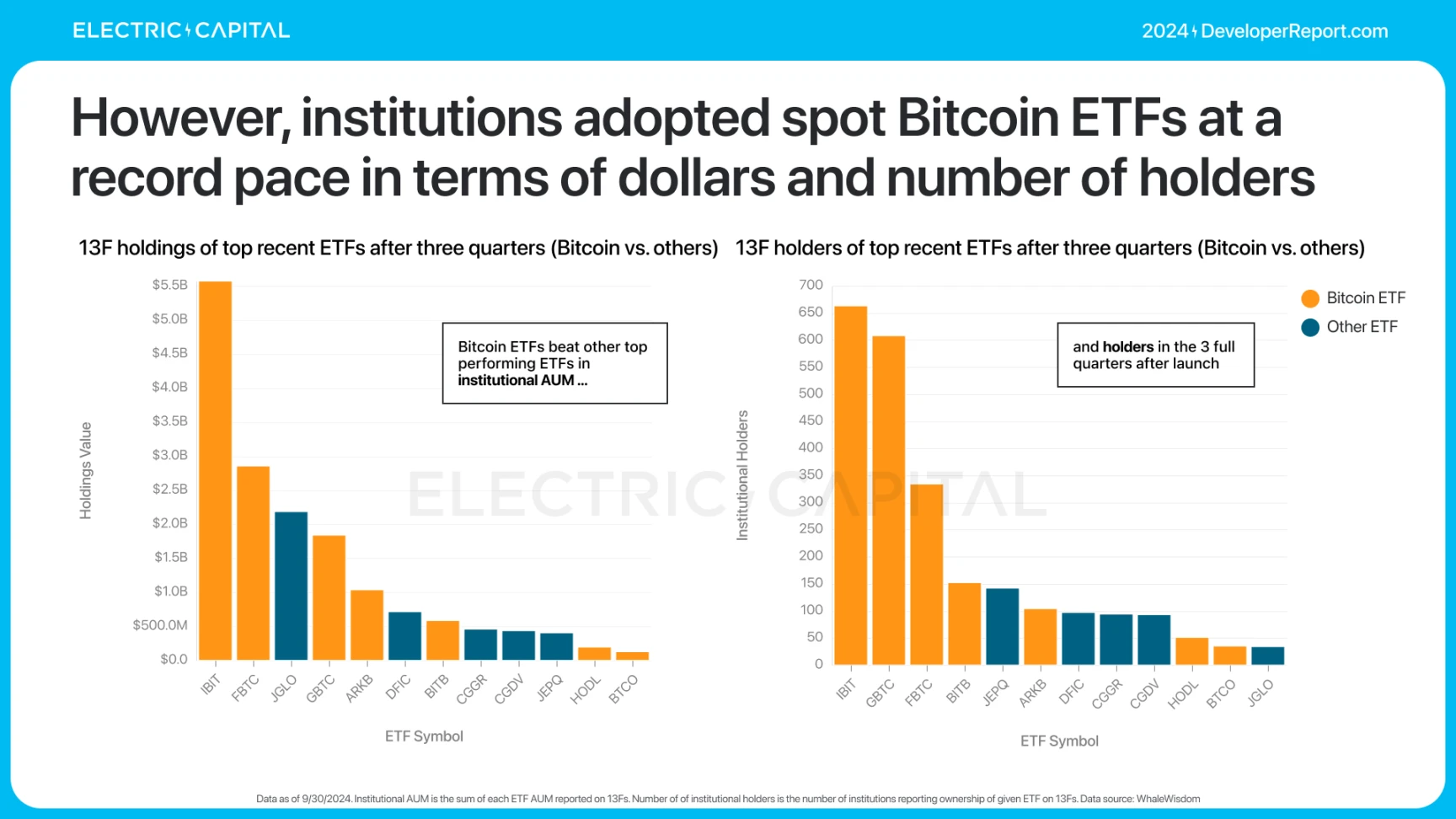

Although Bitcoin ETFs are still in their early stages, institutional investors are buying spot Bitcoin ETFs at a record pace.

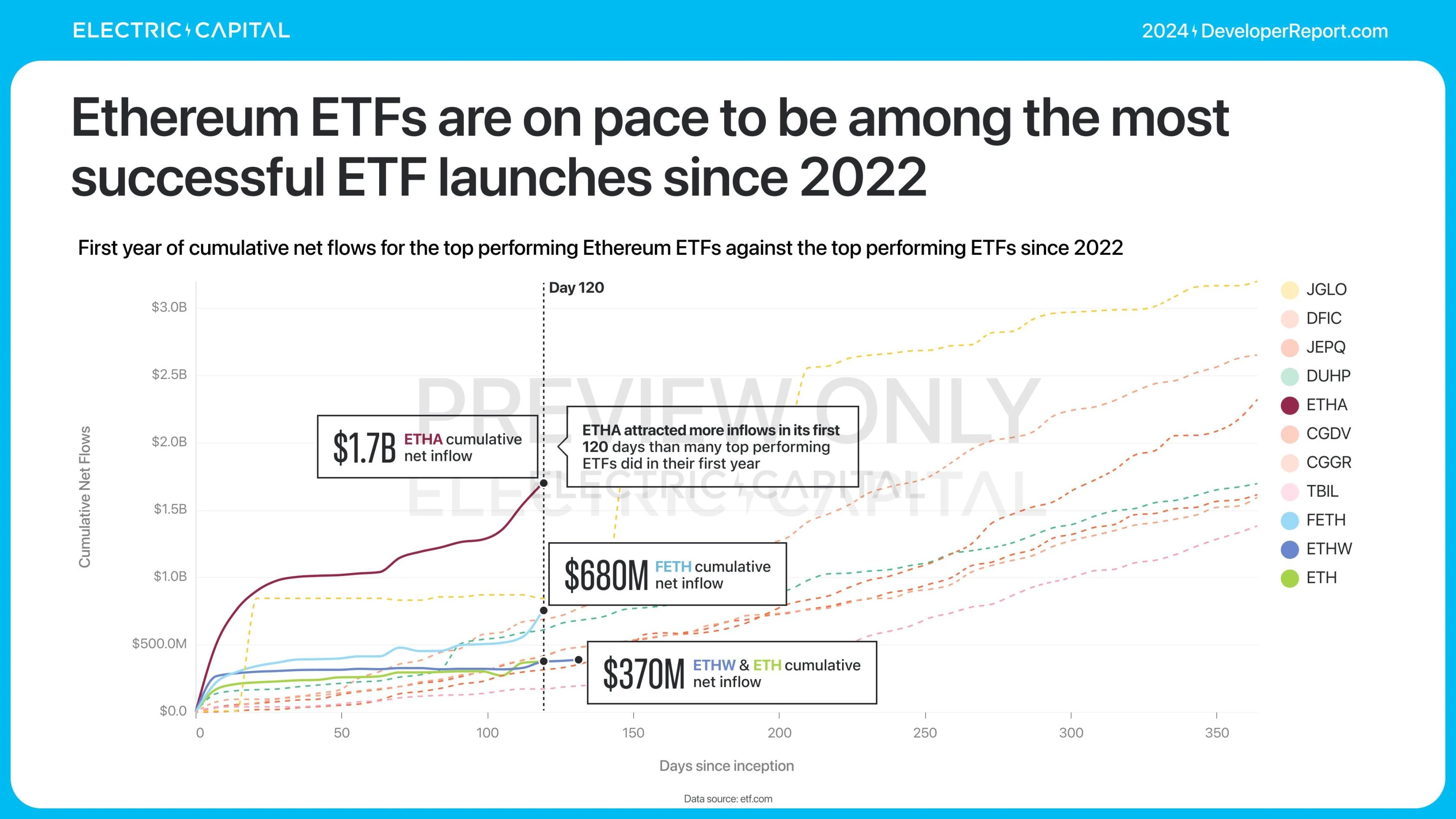

The Ethereum ETF was launched in July this year. Currently, the Ethereum ETF has an asset management scale (AUM) of US$13 billion and has attracted US$3.5 billion in net inflows. This performance is comparable to the most successful ETF launch since 2022 (excluding Bitcoin ETF). This is also mainly driven by retail investors.

The Bitcoin and Ethereum ETFs set a new record. In their first year, they have already received more than twice the inflows of the most successful ETFs in history.

This article is sourced from the internet: Electric Capital report: 39,000 new developers joined, Solana is the ecosystem with the most new developers

Related: AI Meme: The biggest trend in 2024, a repeat of history from DeFi Summer to AI Winter

Original author: Taiki Maeda , Founder of HFAresearch Original translation: TechFlow At the market high in Q1 2024, the top 10 “AI Tech Coins” had a combined market capitalization of $30.9 billion. On the other hand, despite attracting more attention, the top 10 AI Meme Coins had a combined market capitalization of just $2.54 billion. I think the emergence of $GOAT and @truth_terminal has opened up a whole new field of AI that could grow 100x in the future. This is a great opportunity to get ahead in PvE (Player vs. Environment) mode, just like the early days of DeFi summer in 2020. Market Opportunities Meme Coin Super Cycle + AI Super Cycle = AI Meme Coin Ultimate Cycle In Q1 2024, as NVIDIA (NVDA) stock price surged wildly, many…