BTC Volatility Weekly Review (December 2 – December 9)

Key indicators: (December 2, 4pm -> December 9, 4pm Hong Kong time)

-

BTC/USD rose 3.9% (95,900->99,600 USD), ETH/USD rose 7.4% (3,640->3,910 USD)

-

BTC/USD ATM volatility in December (end of the year) fell by 0.6 points (55.8->55.2), and 25-day skewness fell by 0.7 points (4.9->4.2)

-

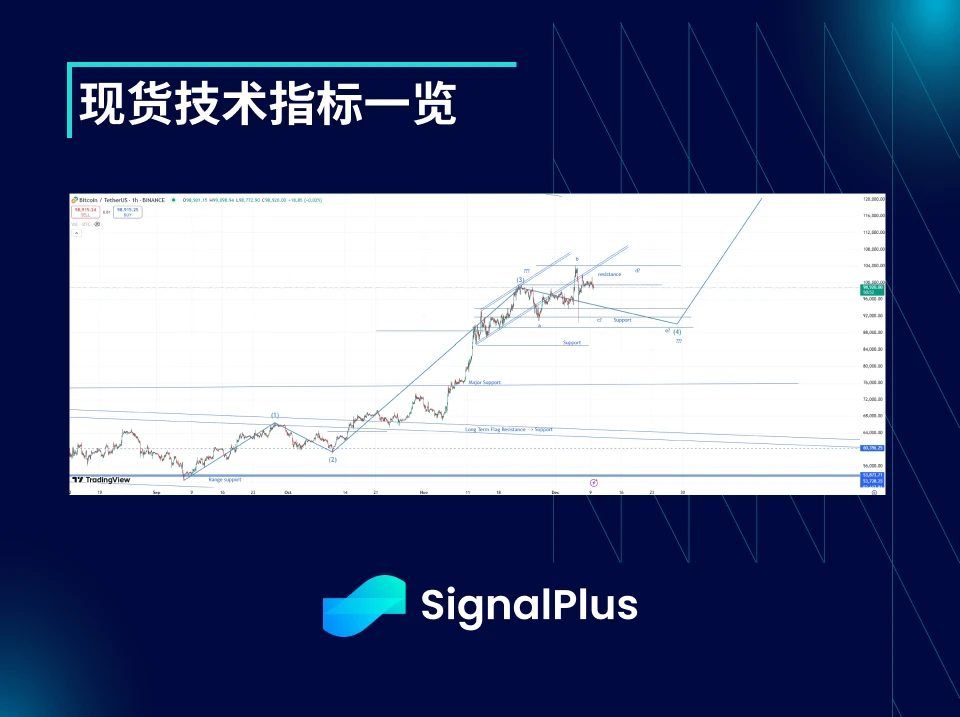

Looking at the trend, the spot market is still correcting the price. Although the price of the coin hit a new high above $100k, it fell back quickly and heavily afterwards. We believe that any rise will be sold off, but there will be a lot of market demand when it falls, so we expect a unilateral correction trend (the price change gradually flattens out). The current resistance level is mainly between $99k and $104k, and the support level starts from $94k until it falls to $85k.

-

Although prices will initially oscillate within this range, we expect realized volatility to eventually subside (assuming prices do not break out). A breakout would take us back to $76k. Any substantial upside breakout would lead to an earlier arrival of the ultimate $115k-$120k range (which we had expected in January-February of next year).

बाज़ार Theme:

-

Bitcoin finally broke through the psychological $100k mark last Thursday, triggering two attempts to $104k, both times with good support. At first it felt like the answer to the recent bull trend was desperate, but momentum quickly faded over the next 24 hours and we retreated back below $100k. This triggered the liquidation of fresh long positions above $100k, causing the price to fall as deep as $90k. But it didn鈥檛 last long, as the market recaptured $100k and was relatively stable in the $96-100k range during the New York trading session.

-

As the overall market sentiment remains bullish, other currencies continue to rise. ETH also pushed higher against USD, surpassing the psychological mark of $4,000, but still 20% away from its all-time high.

-

Price action in traditional financial markets was a bit calmer. The imposition of martial law in South Korea sparked brief concerns (and caused Bitcoin to briefly drop to $93k), but turned out to be just a local political unrest that quickly subsided. China re-promised stimulus next year in response to the general weakness in markets since Trump was elected and promised a new round of tariffs. Finally, US labor data continued to show signs of tapering. Last weeks non-farm payrolls report had no impact on the Feds gradual rate cuts. Overall, therefore, we continue to see the macro backdrop as supportive of risk assets.

BTC ATM Implied Volatility:

-

In general, the market fluctuated greatly last week. First, it dropped to 93k USD due to the martial law in South Korea, then it broke through 100k USD and approached 104k USD, and then it fell back to 90k USD due to liquidation. Despite such large fluctuations, the high-frequency actual volatility is about 60 points, which is only the markets pricing of the average weekly implied volatility in the first quarter of next year!

-

As a result, most of the surge in implied volatility has faded, especially for expiration dates before the end of the year. Unless the $90-104k price range is fully breached, realized volatility will have a hard time sustaining this level. However, at the far end of the term structure, the market has seen significant buy flow, especially above the March-June expiration ($150-200k strikes), leading to higher premiums beyond the January expiration date. Again, considering that it took such high realized volatility last week to maintain a 60 pip weekly implied volatility, the market will have a hard time sustaining such high implied volatility until spot prices break out significantly.

BTC Skewness/Kurtosis

-

Despite some pretty intense pullbacks in the spot market, skewness prices have been largely stable this week. Ultimately, demand in the market is still mainly concentrated above the price, and hedging in the short term is the only demand below the price.

-

Kurtosis has generally increased this week, as realized volatility has increased, but also because of buying demand on individual wings (particularly the upper wing).

आने वाले सप्ताह में सभी को शुभकामनाएँ!

आप सिग्नलप्लस ट्रेडिंग वेन फ़ंक्शन का उपयोग यहां कर सकते हैं t.signalplus.com to get more real-time क्रिप्टो information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlusCN, or join our WeChat group (add assistant WeChat: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends.

सिग्नलप्लस आधिकारिक वेबसाइट: https://www.signalplus.com

This article is sourced from the internet: BTC Volatility Weekly Review (December 2 – December 9)

Related: Trump expands crypto business territory and plans to acquire crypto exchange Bakkt

Original author: BitpushNews As he prepares to take office in the White House around January 20, 2025, Trump continues to expand into new areas of encryption. According to the Financial Times, Donald Trumps social media company Trump Media Technology Group is in advanced negotiations to acquire cryptocurrency trading platform Bakkt. Trump Media will acquire Bakkt in full, with Trump pledging to retain a 53% stake, according to two people familiar with the negotiations. The valuation and financial terms have not been disclosed. The news sent shares of both companies soaring. Trump Media (NASDAQ DJT), which is majority owned by Trump, surged double digits minutes after the report was published. The company, which operates the Truth Social app, closed up more than 16%. Bakkt, which experienced several circuit breakers due to…