Behind the surge in RIF and URO, are Molecules three engines rising?

Original author: KarenZ, Foresight News

In mid-November, after RIF and URO experienced an astonishing thousand-fold growth in just a few days, the DeSci market immediately entered a correction phase. It is worth noting that URO rebounded strongly last weekend, with an increase of nearly 200%. We cant help but start to explore who the platform behind it, pump.science, is? At the same time, what role does Molecule, which is from the same team as pump.science and Bio Protocol, play?

What is Molecule?

Molecule aims to advance scientific research through democratized funding and IP tokenization, transforming IP into liquid on-chain assets, and aligning incentives between researchers and funders to foster a more collaborative and efficient scientific research ecosystem.

Molecule is working on three modules: Catalyst, a fair distribution platform for scientific projects, Bio, a bottom-up new financial layer of DeSci, and Pump.science, a barrier-free scientific experiment and fundraising platform, to build bridges between infrastructure, financial layer, and research and experimental projects and users.

In terms of background, in June 2022, Molecule completed a $13 million seed round of financing, led by Northpond Ventures, with participation from Backed VC, Shine Capital, Speedinvest and former Coinbase CTO Balaji Srinivasan. In December 2023, Molecule received $1 million in funding from Sora Ventures. As mentioned in DeSci Gold Rush | Leading VitaDAO: How to Lead Longevity Research? , Paul Kohlhaas, the author of the VitaDAO white paper, is also the founder and CEO of the DeSci projects Molecule and BIO Protocol, and has also worked at Consensys. Tyler Golato is also the co-founder of VitaDAO, Molecule, and BIO Protocol.

Catalyst——Fair distribution platform for scientific projects

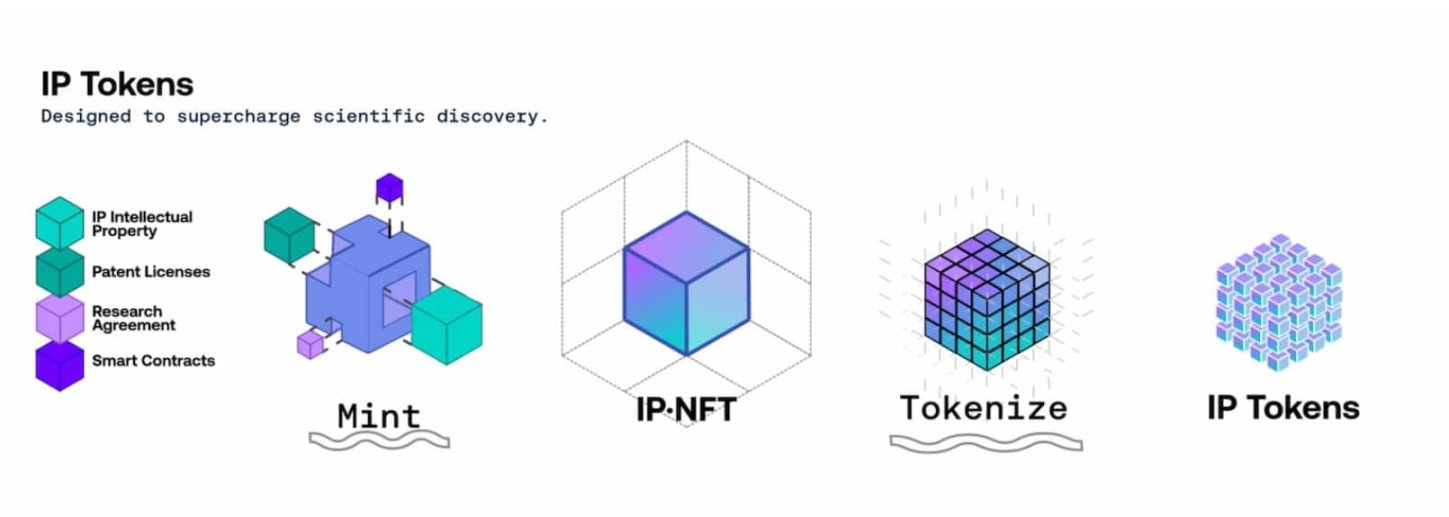

Catalyst is one of Molecules core platforms, which realizes the tokenization and issuance of IP through IP-NFT and IP टोकन (IPT). When talking about Catalyst, we have to talk about Molecules IP-NFT and IP Token (IPT) first. Among them, IP-NFT bundles the potential intellectual property rights of the RD project into an IP-NFT, and then the project can tokenize the IP-NFT into an IP token (IP-NFTs governance token), decentralize the IP directly to individuals (IP token holders) and raise funds, and the holders enjoy partial governance rights of the IP.

Specifically, IP-NFT combines two legal contracts with one smart contract to achieve on-chain registration and management of IP and RD data rights. IPT represents partial governance rights over the generated IP, and holders enjoy rights such as governance rights, updates on research and development progress, and detailed reports, but do not give holders the right to obtain guaranteed financial returns or revenue sharing from the commercialization of these assets.

Through Catalyst, funding can be achieved by investing ETH in the project on Base, and the price follows the joint curve. Once the funding target of the selected project is reached, the negotiation phase will begin (this phase can last up to 12 weeks). During the negotiation phase, the funds are locked in the projects wallet. Once completed, the projects IP-NFT will be minted and IP Token will be issued. If the crowdfunding is successful, users will receive a proportional amount of IPT. It is worth mentioning that the purchased IP Tokens and the excess amount of contributed ETH will be locked for a period of time before being released.

Of course, if the project does not reach its funding goal by the deadline or negotiations fail, the party that contributed funds will receive a full refund of the contributed ETH. However, if funds are withdrawn during the fundraising campaign, a 5% fee will be deducted.

Research projects currently in the process of token issuance on the Molecule Catalyst platform are exploring things like studying Alzheimer’s disease antibodies, restoring brain function through transplantable tissues, engineering fibers, tooth enamel erosion, targeting enzymes associated with inflammation and aging, and more.

BIO Protocol – Bottom-up DeSci New Financial Layer

As a management and liquidity protocol in the DeSci field, BIO Protocol is committed to accelerating the development of biotechnology, allowing patients, scientists and biotechnology professionals around the world to jointly fund, build and own tokenized biotechnology projects and IP.

In early November 2024, BIO Protocol received investment from Binance Labs, which was Binance Labs first foray into the DeSci field. In addition, BIO Protocol also completed the community financing of the Genesis stage this month, with a total financing of US$33.06 million. Paul Kohlhaas, founder of BIO Protocol, revealed that BIOs Launchpad and token transfer functions will be launched in the early first quarter of next year.

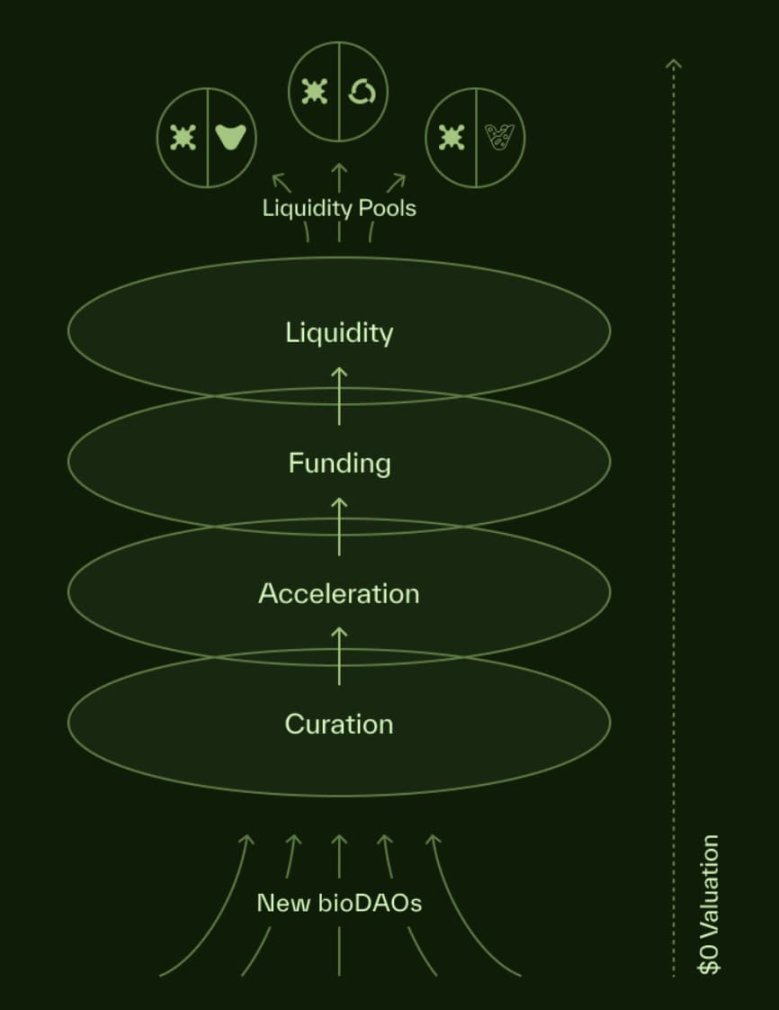

Curation, Funding, Liquidity, Bio/acc Rewards, and Meta-Governance are the five core sections of the BIO Protocol. In the curation section, BIO holders use locked vBIO tokens to stake or vote to select the BioDAO of their choice. The selected BioDAO can obtain funds through the BIO Launchpad, as well as the communitys token liquidity support, incentives, and other acceleration services. The relevant holders of the successful pledged DAO will receive BIO token rewards and have the opportunity to participate in BioDAOs initial token financing round (through BIO Launchpad) and IP asset financing round (through Molecule) in advance. In addition, the proceeds from the sale of IP and products by BioDAO can flow back into the BioDAOs treasury to fund and transform the next generation of research and development.

The Bio/acc Rewards program issues rewards in the form of BIO tokens to incentivize BioDAO to reach key milestones, such as the initial token auction through the BIO Launchpad, the launch of IP-Tokens, the launch of consumer products, and decentralized clinical trials. According to BIOPSY-5, 4% of the BIO token supply (132.8 million tokens) will be allocated to Bio/Acc rewards. VitaDAO received 21 million BIO tokens through Bio Protocols bio/acc rewards program. In terms of meta-governance, the BIO protocol holds various BioDAO tokens in its treasury, which can be regarded as a meta-governance layer, enabling BIO holders to manage a wide range of BioDAO and scientific IP assets.

So how does BIO Protocol empower its token, BIO? First, the BIO network will provide a $100,000 grant to the incubated BioDAO in exchange for 6.9% of the BioDAO token supply, and can also receive allocations of bioDAO scientific IP assets. The BIO Treasury can also earn fees and income from the liquidity it provides. In addition, the BIO token is also used for the above-mentioned planning of BioDAO, priority participation in the BioDAO token sale and IP token sale, discounts on BioDAO health products/services, meta-governance in BioDAO, and governance voting.

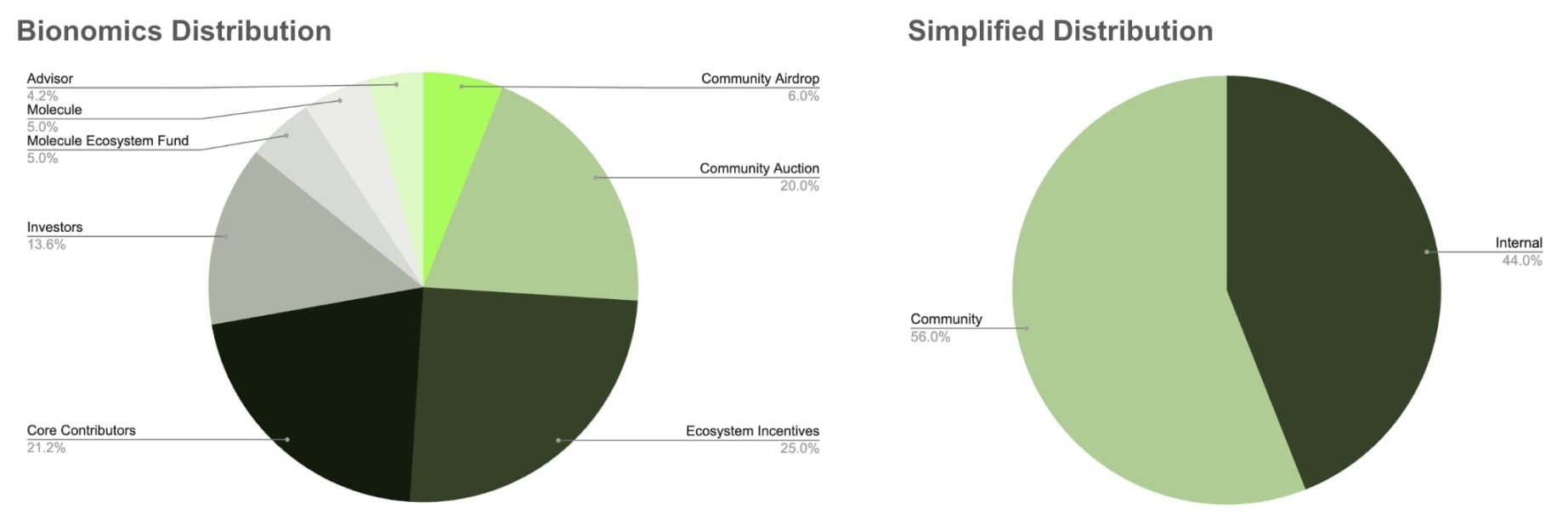

The total supply of BIO is 3.32 billion, with an unlimited supply (determined by BIO governance voting), and it is currently in a non-transferable state on Ethereum. In terms of token distribution, ecological incentives account for 25%, community auctions account for 20%, Molecule Ecological Fund accounts for 5%, community airdrops account for 6%, investors account for 13.6%, core contributors account for 21.2%, and Molecul accounts for 5%. Among them, the airdrop targets include BioDAO token holders, early supporters of BIO from concept to release, including core contributors of Cohort 1 BioDAO from Molecules bio.xyz, etc.

The BIO ecosystem is a network of multiple BioDAOs, each of which specializes in developing research and products in a specific scientific field.

-

VitaDAO (token VITA, market value of US$130 million): For details, see DeSci Gold Rush | Leading VitaDAO: How to Lead Longevity Research?

-

AthenaDAO (ATH, $9.7 million market cap): dedicated to advancing women’s health research, education, and funding, starting with women’s reproductive health.

-

PsyDAO (PSY, $4.7 million market cap): Focused on psychedelic science research, it completed the first PSY token sale in mid-November 2024 and raised $2 million.

-

ValleyDAO (GROW, $9M market cap): Focused on synthetic biology, it has raised over $2M and is working with Imperial College London.

-

HairDAO (HAIR, $70 million token market cap): Designed to solve the problem of hair loss, it has launched Follicool shampoo products (including SHAMPOO membership) that do not contain harmful parabens or sulfates. Officials say that this shampoo is designed for all hair and skin types to clean and nourish hair follicles. Consumers will receive 1 million POO tokens for each bottle of FolliCool ($49.95) purchased. POO manages the future development of the HairDAO shampoo product catalogue, including all sales revenue. HairDAO also advocates that human biologists make greater use of the human hair follicle organ culture (HFOC) model for preclinical research, but the cost of HFOC research is too high for mainstream adoption. Therefore, HairDAO plans to expand HFOC in the next year to reduce the cost of each study by 60 times.

-

CryoDAO (CRYO, $16M market cap): dedicated to advancing cryopreservation research.

-

CerebrumDAO (NEURON, $11M market cap): Advancing brain health, raised over $1.5M. CerebrumDAO entered into a deal with Fission Pharma to address mitochondrial dysfunction in neurodegenerative diseases.

-

The above 7 BioDAOs are the first batch of BioDAOs in the BIO incubator, and the following three BioDAOs are the second batch of BIO advance projects:

-

Long COVID Labs: Founded by serial healthcare entrepreneur Rohan Dixit, by incentivizing scientists, patients, and advocates to collaborate and share data, the first therapeutic candidate is a combination of a long-acting monoclonal antibody and a viral replication inhibitor.

-

Curetopia: Focus on long-tail rare diseases.

-

Quantum Biology DAO: A quantum microscope is being built to observe quantum phenomena in real time, and will support research in the field of quantum biology (the project has launched a token auction on Bio). The founder and chief scientist of Quantum Biology DAO is quantum engineer Clarice D. Aiello.

pump.science——A platform for scientific experiments and funding without barriers

In September of this year, the Solana Foundation provided a grant to Molecule to build the Solana-native DeSci funding platform pump.science.

pump.science is built on Pump.fun. Compared to Catalyst, pump.science is a research trial and fundraising platform with almost no threshold. On pump.science, anyone, including drug developers, scientists, etc., can submit longevity health ideas and drug strategies to raise funds for their experiments, and others can bet on which intervention measures will extend the lifespan of different model organisms tested to support promising ideas.

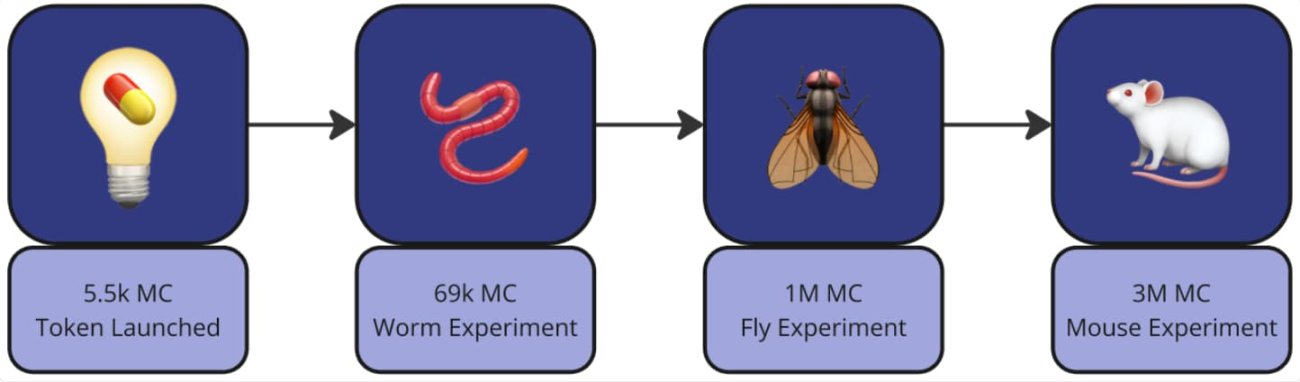

On Pump.science, drug developers and scientists who submit test interventions need to pay a certain amount of SOL as experimental fees. These SOLs will be used to purchase the first batch of tokens, and once the scheme reaches a certain market value threshold, the experiment will be conducted on the Wormbot platform. Here we first mention Wormbot, which is a low-cost, fast experimental platform for testing a large number of potential longevity therapies at low cost.

When the solution is tested on real nematodes, you can watch the experimental data stream. The data is transmitted to users regularly for users to evaluate the value of the intervention. Of course, going a step further, it will be tested on fruit flies and mice to collect more expensive, time-consuming but more relevant data for humans. The relevant interventions can be sold as supplements or research chemicals after obtaining permission. Of course, as the token market value grows, tokens will be sold at key milestones (at a market value of $70,000, a market value of $1 million, and a market value of $3 million) to pay for progressively more advanced testing.

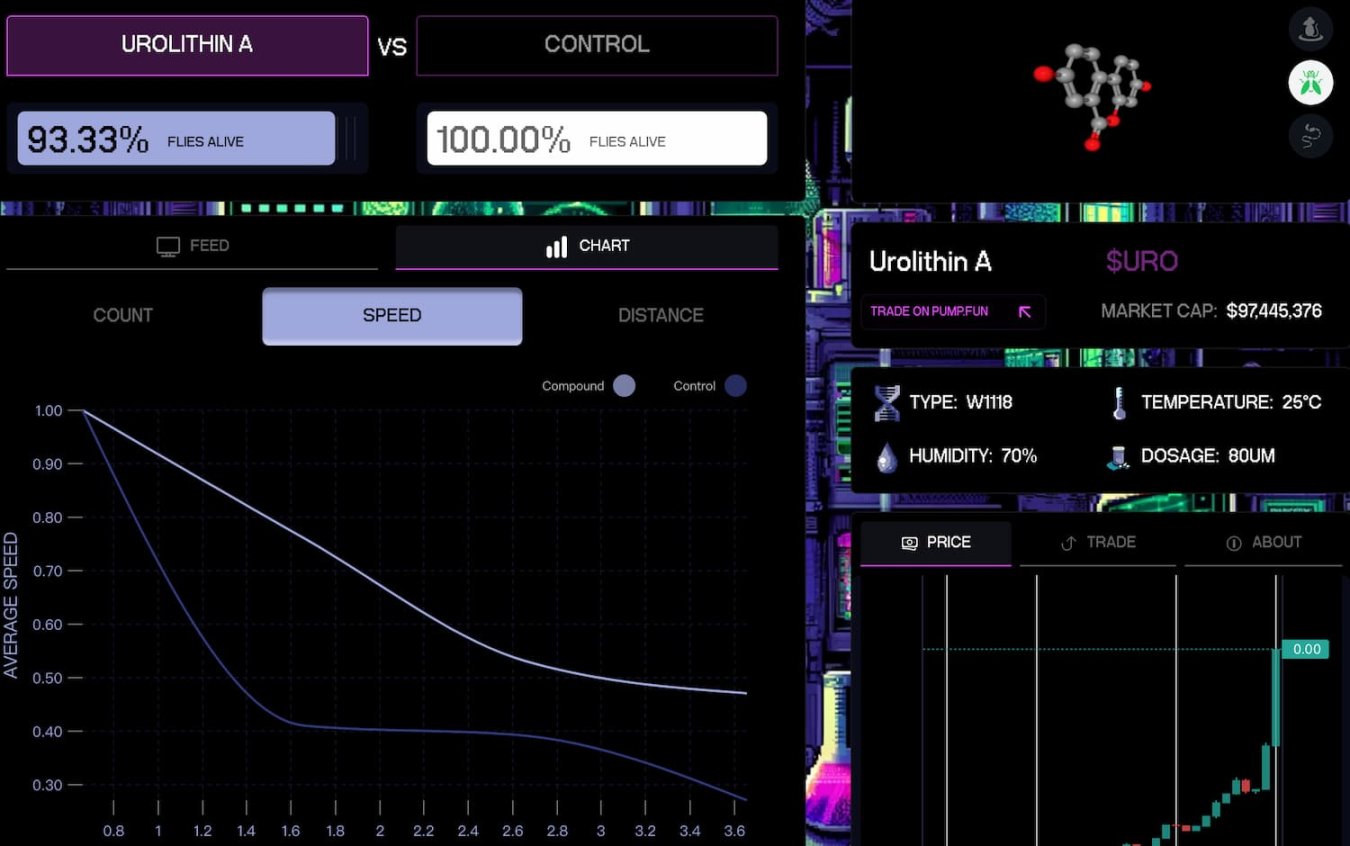

Currently, there are only two experiments on pump.science, Rifampicin (RIF) and Urolithin A (URO), both of which are in the fruit fly testing stage, with market capitalizations of $190 million and $97 million, respectively. The completion rate of both experiments is 2.74%.

Among them, rifampicin is an antibiotic used to treat several types of bacterial infections, including tuberculosis, Mycobacterium avium complex, leprosy, and Legionnaires disease (according to Wikipedia), and has been shown to activate cells natural defense mechanisms against stress and damage in tiny organisms such as Caenorhabditis elegans.

Urolithin A, a compound produced by the body when you eat foods rich in ellagitannins, such as pomegranates, helps drive the process of mitophagy, which clears out old, dysfunctional mitochondria so that new, healthy ones can thrive. In human studies, Urolithin A has shown promise in promoting muscle health and energy.

Both experiments on pump.science tested the longevity of fruit flies by comparing relevant compounds with placebos that do not contain active drug treatment. There were 15 fruit flies in each test tube taking the compounds and placebos. The fruit fly monitoring data were regularly uploaded to the platform for evaluation.

It is worth noting that the lifespan of nematodes in an experimental environment is limited to 20 to 30 days, and the cost of conducting such an experiment is about $300 to $500. In contrast, the lifespan of fruit flies is slightly longer, about 3 months, but the corresponding experimental cost is about two to three thousand dollars. Each mouse experiment costs between $30,000 and $60,000, and the lifespan can be up to 2 to 3 years. Therefore, when it comes to subsequent stage testing, the uncertainty caused by the accumulated time cost is very high.

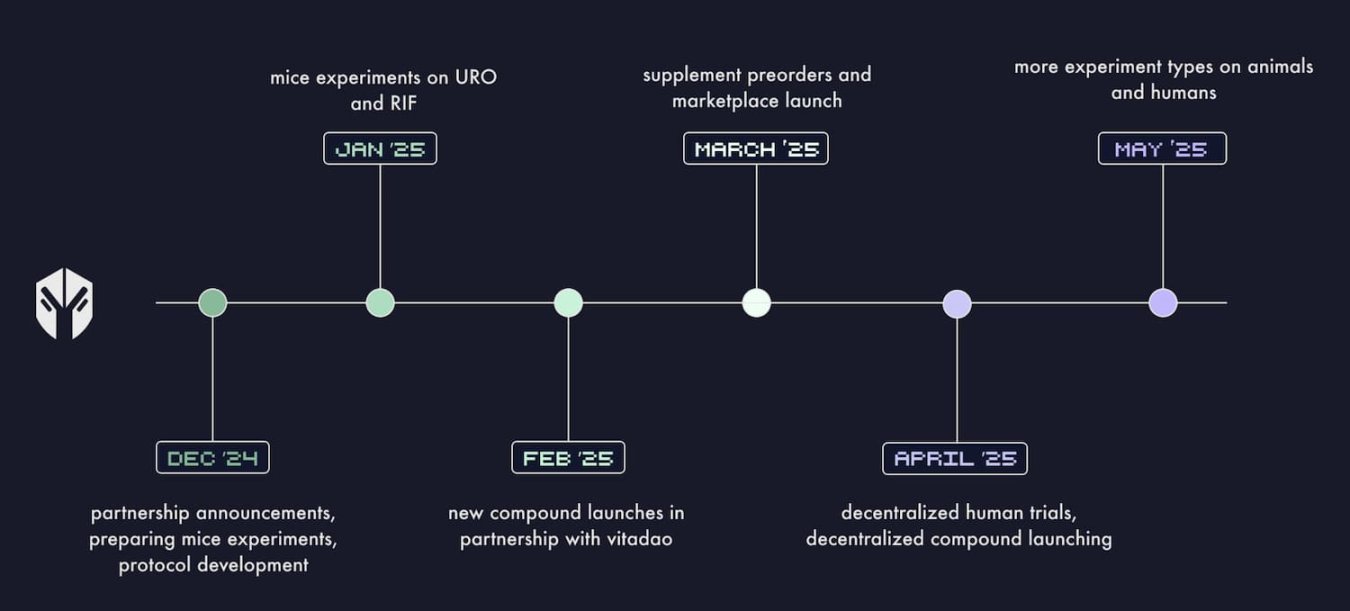

According to the pump.science roadmap, mouse trials will be conducted using rifampicin (RIF) and urolithin A (URO) on January 25, 2025, new compounds will be launched in cooperation with VitaDAO on February 25, 2025, supplement pre-orders will be opened and the market will be launched on March 25, and human trials will be conducted in April.

In early December, Molecule also announced several recent plans, including pump.sciences collaboration with Bio Protocol to promote BioDAOs research; in early 2025, VitaDAO will obtain longevity compounds from Pump Sciences The Longevity Prize and develop them into supplements; launch the DeSci Ecosystem Fund to provide half of Molecules BIO allocation (166 million BIO) to promote breakthrough science; and repurchase $100,000 worth of RIF and URO tokens respectively to reaffirm its commitment to support pump.science and PhDegen.

Currently, the DeSci track is still in a very early stage and has shown great potential for development. This potential is expected to stem from its potential to solve the transparency, funding and collaboration problems in traditional scientific research. However, DeSci still faces challenges, including but not limited to technology adoption, regulatory issues, and how to maintain a balance between the rigor and transparency of scientific research.

This article is sourced from the internet: Behind the surge in RIF and URO, are Molecules three engines rising?

Related: BitMEX Alpha: Exploiting Implied Volatility Skew

Original author: BitMEX Welcome back to our weekly options strategy series. Today we will share a unique trading opportunity presented by significant differences in the Bitcoin options market. The implied volatility (IV) of Bitcoin call options is currently surging, while put options appear to be undervalued. In this article, we will analyze this IV skew phenomenon and propose a strategy that could potentially profit from rising put option IV. With the current market heavily skewed toward calls, we think this contrarian strategy could be particularly rewarding! Let鈥檚 start the analysis. Bitcoin Implied Volatility (IV) Skew Analysis As shown in the above BitMEX options table for BTC options expiring on January 31, 2025, the IV skew between call and put options is about 25%, with the IV of call options being…