बीटीसी अस्थिरता: 28 अक्टूबर – 4 नवंबर, 2024 तक सप्ताह की समीक्षा

Key indicators: (October 28, 4pm -> November 4, 4pm Hong Kong time)

-

BTC/USD price increased by +0.15% ($68,500->$68,600), ETH/USD price decreased by -2.4% ($2,520->$2,460)

-

BTC/USD ATM volatility increased by +3.7 points at the end of the year (December) (54.3->58.0), and 25 delta skewness decreased by -0.6 points at the end of the year (3.7->3.1)

Spot technical indicators at a glance:

-

On Wednesday, the price of the coin hit a record high, which initially made us feel that we underestimated the potential of the spot market to explode before the election. However, the price of the coin failed to sustain the high point and quickly fell back, and the price of 70k US dollars has become the main resistance level again. At the same time, the highest price set will become the target of the next round of competition in the market, provided that Trump wins the election.

-

We currently believe that the price of the currency may fluctuate between $66k and $70k in the next few days until the election situation मार्गदर्शकs the next major move.

-

If Harris wins, the price of the coin may break the flag support of $63.5k to $64k and move down to $60k. It is even possible to slide down to the lower support range around $54k in the next few days. On the other hand, if Trump wins, the price of the coin will break through $74k and even have the potential to move up to $77k to $78k.

बाज़ार Theme:

-

Trading activity in the क्रिप्टो space has increased as the US election odds on Polymarket fluctuate. When Trumps odds of winning rose to 67%, the BTCUSD spot price briefly broke through 73.6k USD to hit a new all-time high. Then when the weekend polls pushed the odds back to 55%, the coin fell back and tested 67.5k USD. The odds of the Republicans taking the seat also fell from 48% to 37%. Despite the narrowing odds gap, price movements across markets reflect that market sentiment remains bullish and preparing for Trumps victory.

-

The US Non-Farm Payrolls (NFP) data came in at 12k, well below the expected 100k. But the market generally shrugged it off, attributing it to recent hurricanes and labor strikes. The BTCUSD spot market saw some fresh inflows after the data was released and briefly pushed the price up to $71.5k before spitting out the entire gain. The market is cautious about chasing gains during the election.

-

Microstrategy announced a three-year, $42 billion Bitcoin investment plan in its earnings report last week, raising funds primarily through the issuance of shares and convertible bonds to increase its Bitcoin holdings. While this should be a boost to prices in the medium term, short-term price action is primarily affected by the election.

BTC Implied Volatility:

-

Realized volatility increased this week, mainly due to changes in Polymarket election odds. The odds went from 58% to 67% to 54% (Trump is ahead). High-frequency realized volatility increased to a mid-40s level, which must be admitted is not a particularly high number in Bitcoin history but is significantly higher than in previous weeks. In addition, the change in the price of the currency after the settlement of the expiration date on November 1 shows that the market is holding more short Gamma before the election.

-

Implied volatility levels were well supported this week as the market saw a wave of demand for November options, mainly for expiration dates after the US election. Demand was concentrated in the upper strike price range of $75k to $80k, but we also saw some straddles/wide straddles for pure trading volatility. Volatility rebounded from recent lows due to the large demand.

-

The market priced in the event volatility of election day to a recent low over the weekend, as the high volatility roll data and theta data encouraged retail investors to hold short positions over the weekend. With only a 7% premium to the volatility of the straddle combination expiring on the Friday after the election and FOMC, we believe that holding long Gamma should have enough profit space in the event volatility. Just a 67% to 54% change in odds drove the price down from a high of $73.5k to a low of $67.5k last week, suggesting that it should not be difficult to rise to $75k after Trumps victory or fall to $60k after Harriss victory.

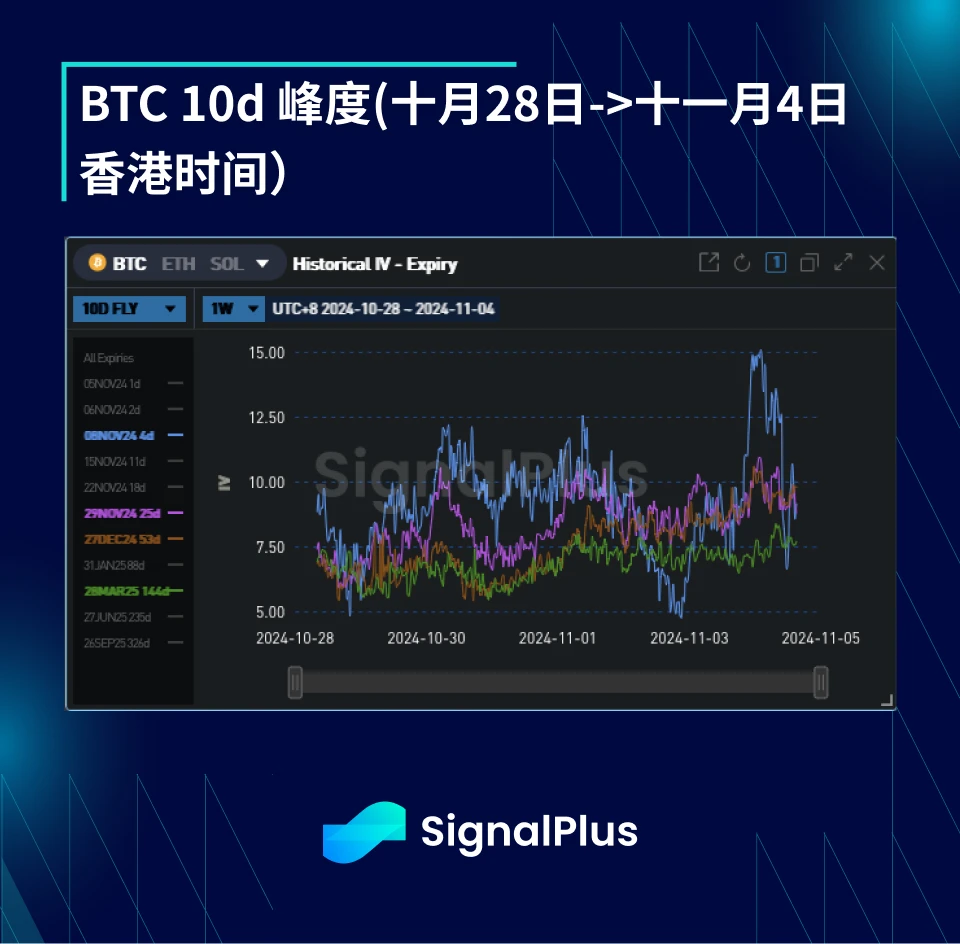

Skewness/Kurtosis:

-

Skewness continued to move downwards this week, seemingly tracking the movement of spot prices and changes in the election odds. The skewness for the November 8 expiry actually reversed downwards quite dramatically, reflecting higher slippage as the market prepared for a Trump win and believed that a “surprise” Harris win would lead to a drop in the coin’s price.

-

Kurtosis has gradually increased from its lows this week as buyers emerged on both sides of the real-time price, especially for the November expiration date.

आने वाले सप्ताह में सभी को शुभकामनाएँ!

आप सिग्नलप्लस ट्रेडिंग वेन फ़ंक्शन का उपयोग यहां कर सकते हैं t.signalplus.com अधिक वास्तविक समय क्रिप्टो जानकारी प्राप्त करने के लिए। यदि आप हमारे अपडेट तुरंत प्राप्त करना चाहते हैं, तो कृपया हमारे ट्विटर अकाउंट @SignalPlusCN को फॉलो करें, या अधिक दोस्तों के साथ संवाद और बातचीत करने के लिए हमारे WeChat समूह (सहायक WeChat जोड़ें: SignalPlus 123), टेलीग्राम समूह और डिस्कॉर्ड समुदाय में शामिल हों।

सिग्नलप्लस आधिकारिक वेबसाइट: https://www.signalplus.com

This article is sourced from the internet: BTC Volatility: Week in Review October 28 – November 4, 2024

संबंधित: सुई इकोलॉजिकल मीम सीज़न आ रहा है, यहां 12 लोकप्रिय मीम्स हैं

मूल लेखक: करेन, फ़ोरसाइट न्यूज़ सोलाना से कार्यभार संभालने के बाद, सुई पिछले दो महीनों में 3 गुना से अधिक बढ़ गई है, जो रिकॉर्ड ऊंचाई पर पहुंच गई है। इसी समय, सुई पारिस्थितिकी तंत्र और मेम पारिस्थितिकी तंत्र भी फलने-फूलने के संकेत दे रहे हैं। यह लेख सुई पारिस्थितिकी तंत्र में 12 मेम परियोजनाओं को छांटता है, जिनमें से कुछ को मिस्टेन लैब्स के सह-संस्थापक एडेनियी अबियोडुन द्वारा ट्विटर पर फ़ॉलो और उल्लेख किया जाता है। प्रवेश करने से पहले कृपया अपना शोध करें, DYOR। FUD FUD सुई पर एक पग OG मेम प्रोजेक्ट है, जिसे दिसंबर 2023 में सुई समुदाय में मुफ़्त में एयरड्रॉप किया गया है। FUD की कुल आपूर्ति 100 ट्रिलियन है, जिसमें से 50% समुदाय को आवंटित किया जाता है, 20% का उपयोग तरलता के रूप में किया जाता है, 5% योगदानकर्ताओं को आवंटित किया जाता है, और 5% रणनीतिक भंडार को आवंटित किया जाता है। FUD ने…