"फैट वॉलेट" सिद्धांत: अंतिम उपयोगकर्ता और मुद्रीकरण के अवसर

Original article by Robbie Petersen, Researcher at Delphi Digital

मूल अनुवाद: लफ़ी, फ़ोरसाइट न्यूज़

Throughout the history of क्रिप्टोcurrency, value capture in the blockchain stack has been a hotly debated topic. The core debate has always been between the protocol layer and the application layer, but there is a third layer in the stack that most people overlook: the wallet.

The “fat wallet” theory holds that as protocols and applications “slim down,” whoever owns the two most valuable resources, distribution and order flow, will be able to capture more value. And as the ultimate front end, no one is better able to monetize this value than the wallet.

This article will explore the fat wallet theory in three steps. First, we will outline three structural trends that will continue to drive commoditization at the protocol and application layers. Second, we will explore various ways for wallets to monetize, including pay-for-order (PFOF) and application distribution services (DaaS). Finally, we will explore why Jupiter and Infinex may beat wallets in the competition for users.

Protocol and application thinning

The question of where in the blockchain stack value will ultimately converge can be reduced to a simple framework. For each corresponding layer of the stack, ask yourself the following questions:

If products in this tier increase their fees, will users leave for cheaper alternatives?

Simply put, if Arbitrum raises its fees, will users switch to other protocols (such as Base), and vice versa? Similarly, at the application layer, if dYdX raises its fees, will users switch to other undifferentiated perpetual DEXs?

Following this logic, we can identify where switching costs are highest, and therefore who has strong pricing power. Similarly, we can use this framework to identify where switching costs are lowest, and therefore which layer of the stack will become increasingly commoditized over time.

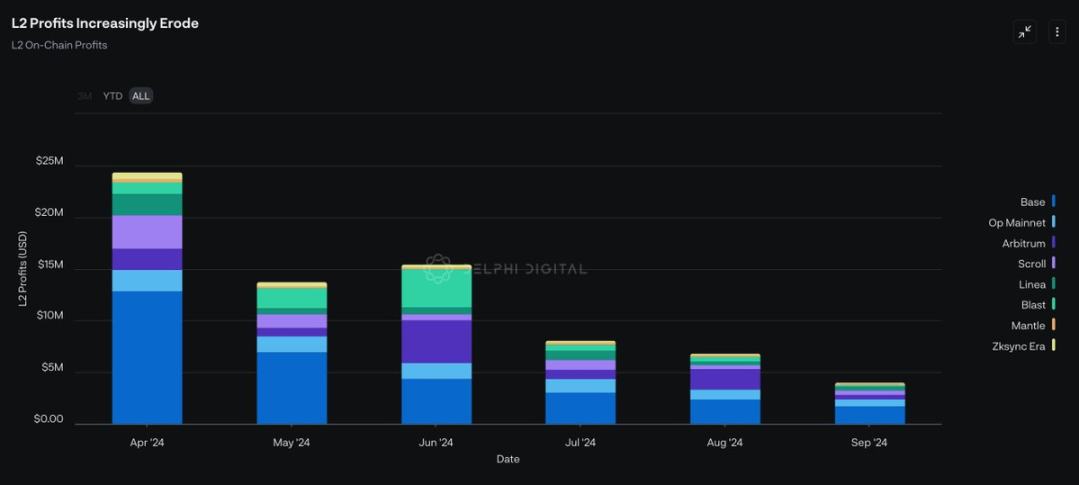

While protocols have historically had strong pricing power, I believe this is changing. Today, there are three structural trends that are increasingly “weakening” the protocol layer:

-

Multi-chain applications and chain abstraction: As applications deploy across multiple chains to remain competitive, the user experience across blockchains will become increasingly indistinguishable, and in turn, the switching costs at the protocol layer will only get lower and lower. In addition, chain abstraction will further reduce switching costs by abstracting cross-chain bridges. As a result, applications will no longer be constrained by the network effects of a single chain, but rather chains will be increasingly constrained by the traffic distribution of applications.

-

Maturation of the MEV supply chain: While MEV will never be completely eliminated, there are many initiatives both at the application layer and closer to the bottom layer to redistribute MEV extracted from users. Importantly, as the MEV supply chain continues to mature, value will accumulate more and more onto the MEV supply chain and then be captured by the applications with the most exclusive user order flow. This means that protocols will lose bargaining power, while the status of front-ends and wallets will rise.

-

The rise of the proxy paradigm: In a world where transactions are primarily executed by agents and “solvers” rather than humans, attracting this proxy flow will become a necessity for blockchain survival. Importantly, given that agents and “solvers” are programmed to focus on optimizing for best execution, protocols will no longer compete around intangibles such as “consistency”. Instead, transaction fees and liquidity are what matter, which will only further “weaken” the protocol layer as protocols are forced to compress fees and incentivize liquidity to remain competitive.

So, revisiting our original question: if a protocol raises its fees, will users leave it in search of cheaper alternatives? While it may not be obvious today, I believe that as switching costs continue to compress, the answer for more and more protocols will be: YES.

Data source: Dune Analytics @0x Kofi

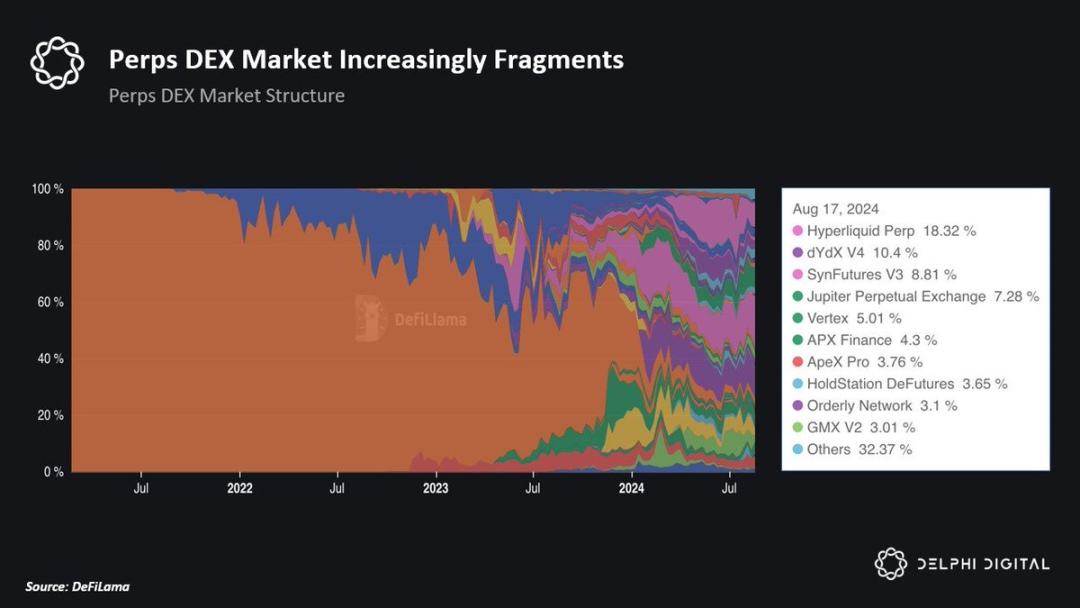

Intuitively, one would think that if the protocol is weakened, applications must also become more powerful. While applications will certainly regain some value, the theory of fat applications is itself simplistic. Different vertical applications accrue value in different ways, and the question should not be will applications become fatter?, but which specific applications?

As I mentioned in A New Framework for Crypto बाज़ार Moats, the unique structural differences of crypto applications (forkability, composability, and token-based value capture) can reduce the entry barriers and costs for emerging competitors. Therefore, although a few applications have some properties that cannot be easily copied, it is extremely difficult for crypto applications to cultivate moats and maintain market share.

Again, back to our original framework: if an app raises its fees, will users switch to cheaper alternatives? I think 99% of apps will have this problem. Therefore, I expect most apps will have difficulty capturing value because turning on the fee switch will inevitably cause users to switch to the next undifferentiated app that offers a more generous incentive.

Finally, I believe the rise of AI brokers and solvers will have a similar impact on applications as it did on protocols. Given that brokers and “solvers” are primarily optimized for execution quality, I expect applications will also be forced to compete aggressively to attract broker flow. While liquidity network effects should create a winner-take-all situation in the long run, in the short and medium term, I expect applications to experience a race to the bottom.

This begs the question, if both protocols and applications continue to weaken, where will value re-aggregate?

The “Fat Wallet” Theory

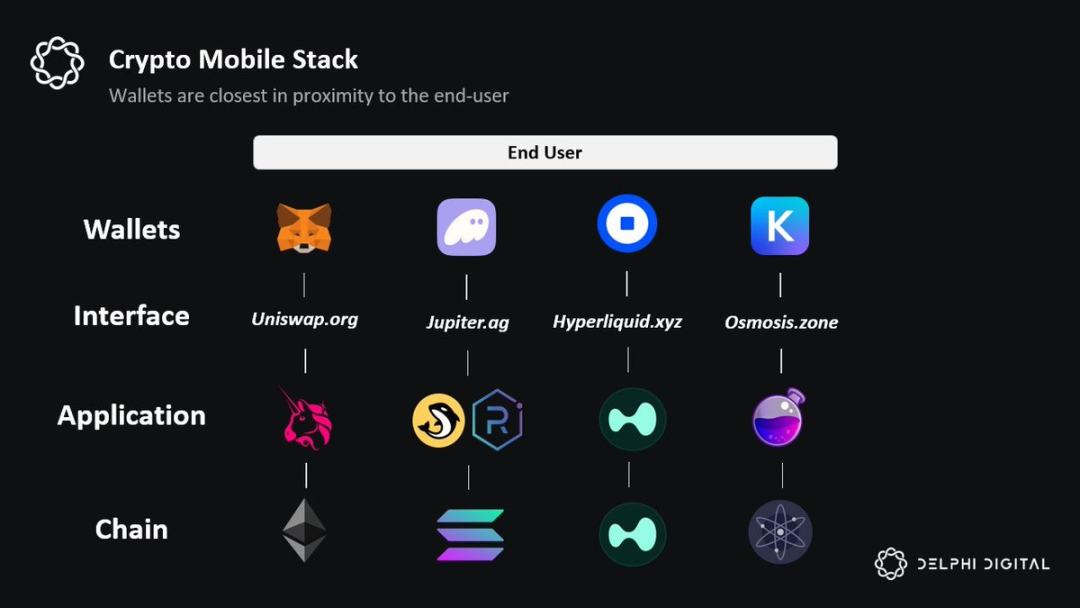

The simplest answer is: whoever owns the end user wins. While in theory this can be any front end including an application, the “fat wallet” theory states that no one is closer to the user than the wallet.

Wallets dominate the mobile UX for crypto: The best litmus test to understand who owns the end user in the mobile web is to ask the following question: Which Web2 application do users ultimately interact with? While most users “interact” with Uniswap’s frontend to transact, they still access this frontend through a wallet app. This means that if mobile devices dominate the cryptocurrency UX, wallets will only continue to strengthen their connection to the end user.

Wallets are where users are: Crypto applications are inherently financial. Unlike Web2, almost every on-chain transaction is some form of financial transaction. Therefore, the account layer is critical to crypto users. In addition, there are some unique features of the wallet layer: payments, native yields on idle user deposits, automated portfolio management, and other consumer use cases such as crypto debit cards.

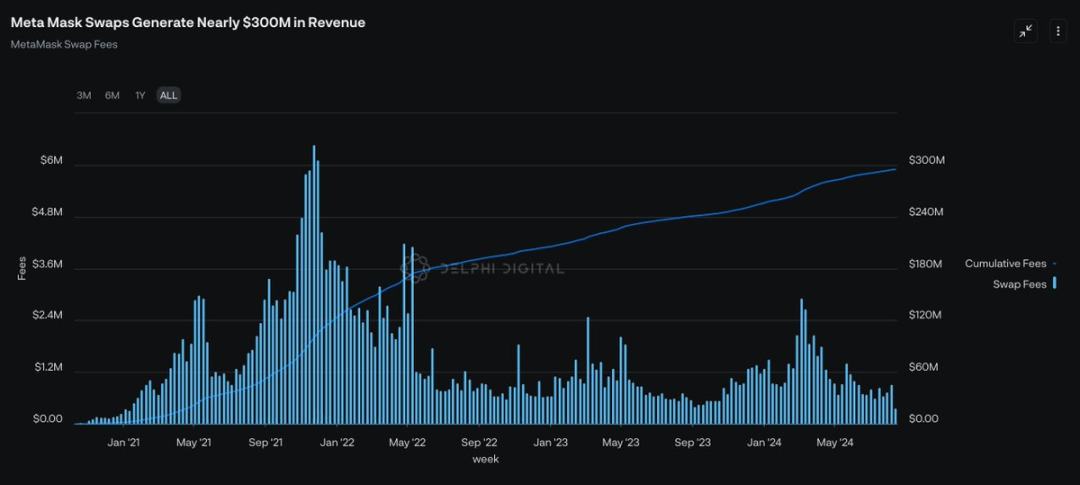

Wallet switching costs are surprisingly high: While in theory switching wallets is as easy as copying and pasting a seed phrase, it remains a psychological sticking point for most average people. Given the high level of trust users have in wallet providers, I believe brand and “affinity” are strong sources of moats at the wallet level. Revisiting our original question again: If a wallet raises its fees, will users switch to cheaper alternatives? The answer seems to be: “NO”. The swap feature within the MetaMask wallet charges a fee of 0.875%, but is still used by a large number of users.

Chain abstraction: While chain abstraction is a technically thorny problem, one of the more compelling solutions is to solve the chain abstraction problem at the wallet layer. The idea that I can easily access any application on any chain through a single account balance seems particularly intuitive. oneBalance, Brahma, Polaris, Particle Network, Ctrl Wallet, and Coinbases Smart Wallet are all moving toward this vision. In the future, I expect more teams to meet user needs through chain abstraction at the wallet layer.

Unique synergy with AI: While I expect AI agents to increasingly commoditize the rest of the blockchain stack, users will still need to authorize agents to ultimately execute transactions on their behalf. This means the wallet layer is best suited to be the canonical front end for AI agents. Other benefits of integrating AI at the account layer include automated staking, yield farming strategies, etc.

Now that we’ve covered “why” wallets will have an end-user relationship, let’s think about “how” they will monetize that relationship.

Monetization Opportunities

The first opportunity for wallets to become profitable is to own user order flow. As I mentioned before, while the MEV supply chain will continue to develop, one thing will inevitably become true: value will disproportionately belong to those who have the most exclusive access to order flow.

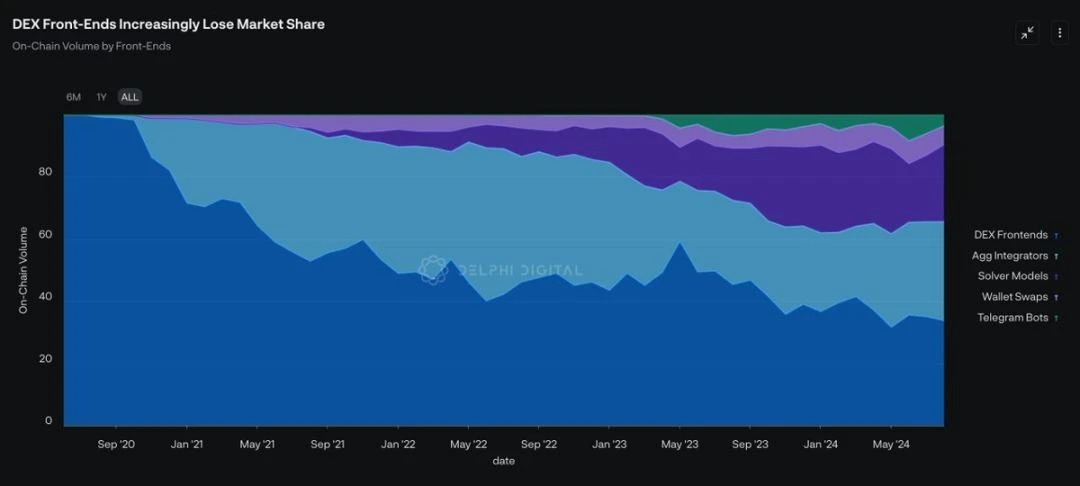

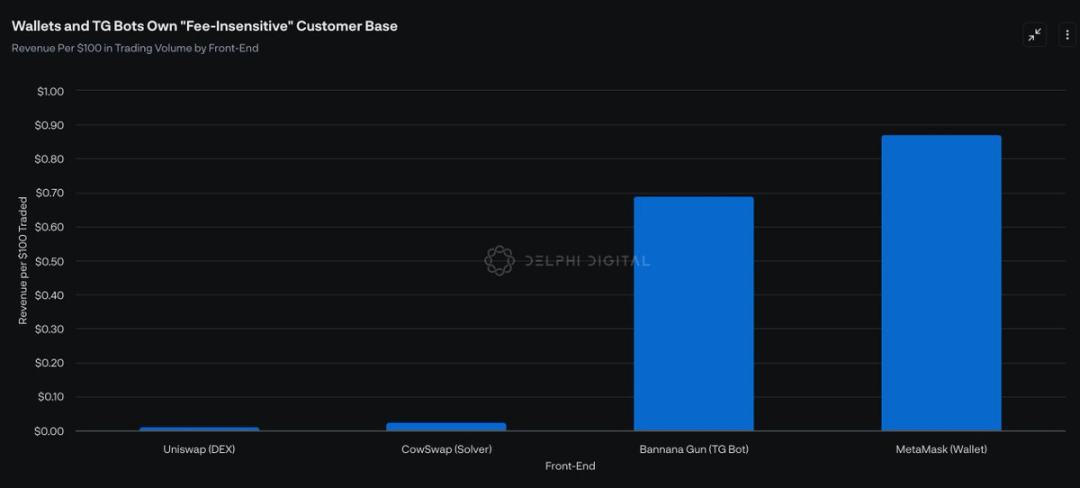

Today, the frontends that own the majority of order flow by volume are solvers and DEXs. However, there are few nuances that can be discerned from this chart alone. It is important to understand that not all order flow is created equal. There are two types of order flow: (1) fee-sensitive order flow and (2) fee-insensitive order flow.

Generally speaking, solvers and aggregators dominate the “fee sensitive” order flow. Given that these users typically trade over $100K in size, execution is important to them. These traders will not accept even 10bps of excess fees. Therefore, “fee sensitive” traders are a lower value customer segment. Despite accounting for the majority of the front-end market by volume, they generate much less value per $1 traded.

In contrast, Wallet अदला-बदली and TG Robot have a more valuable user base: “fee-insensitive” traders. These traders do not pay for execution, but for convenience. Therefore, paying 50 basis points for a trade is insignificant to these users. As a result, TG Robot and Wallet Exchange generate much higher revenue per $1 of trading volume.

Looking ahead, if wallets are able to capitalize on the trends above and continue to own end-user relationships, I expect in-wallet exchange features to continue to cannibalize market share from other frontends. More importantly, even if they can only increase market share by 5%, it will have a huge impact as wallet exchanges generate nearly 100x more revenue per $100 traded than DEX frontends.

The second opportunity for wallets to profit from being close to the end user is Distribution as a Service (DaaS).

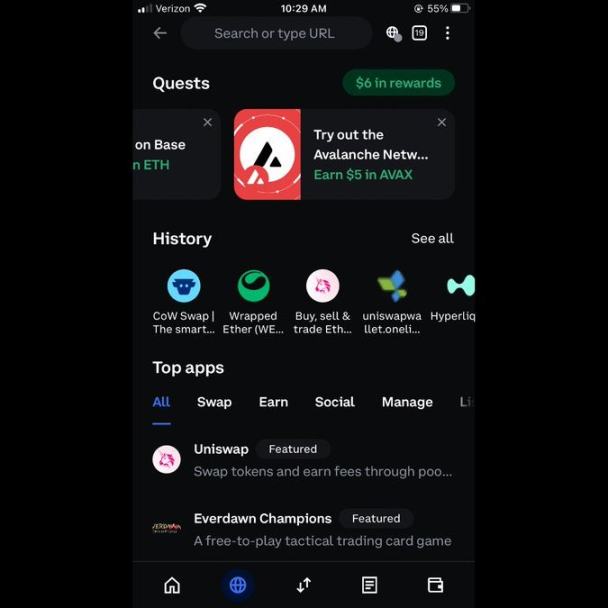

In addition to acting as the canonical front end for users to interact on-chain, applications ultimately rely on wallets as a distribution channel, especially in the mobile web. Therefore, similar to how Apple makes money through iOS, wallets can strike exclusive deals with applications in exchange for distribution services. For example, a wallet provider could set up its own app store and charge applications through some kind of revenue sharing agreement.

Similarly, wallet providers can direct users to specific apps in exchange for some economic sharing. The advantage of this approach over traditional advertising is that users can seamlessly make purchases and interact with apps from their wallets. Coinbase appears to have been exploring a similar path with the launch of “featured” apps and in-wallet “tasks.”

Wallets can also earn some financial rewards for promoting emerging blockchains by sponsoring user transactions. For example, maybe Bearachain just wants to get users on board their blockchain. They could pay Metamask to sponsor cross-chain fees and gas fees on Bearachain. Given that the wallet ultimately owns the end user, they can negotiate some favorable terms.

As more and more users use wallets as their primary on-chain gateway, we can see a shift in demand from “block space” to “wallet space” as attention becomes the most valuable resource in the crypto economy.

Challenges of Fat Wallets

Finally, while wallets have a clear lead in the race for end users, I am still excited about the prospects of two alternative front ends:

-

Jupiter: Through their DEX aggregator, Jupiter has been able to cultivate strong relationships with end users. This is arguably the best starting point for them to build other related products in the crypto space, including their perps DEX, Launchpad, native LST, and most recently, the RFQ/Solver product. I am particularly excited about the release of the Jupiter mobile app as it allows them to acquire end users in a mobile environment before the wallets do.

-

Infinex: By acting as a front-end aggregator for applications on the EVM chain and Solana, Infinex aims to provide a CEX-like experience while retaining principles such as non-custodial and permissionless. Infinex will initially provide spot trading and staking services, and plans to integrate perpetual contracts, options, lending, margin trading, yield mining, and fiat currency entry functions. By abstracting the account layer and using familiar features of Web2 (such as keys), I believe Infinex has the potential to replace wallets as the standard crypto front-end.

While it is unclear to me today who will ultimately win the war for end users, it is becoming increasingly clear that (1) user attention and (2) exclusive order flow will continue to be the scarcest and therefore most monetizable resources in the crypto economy. Whether it is a wallet or some alternative front end like Infinex or Jupiter, I expect the kings of value capture in crypto will be the projects that own both resources.

This article is sourced from the internet: The “Fat Wallet” Theory: End Users and Monetization Opportunities

As of October 27, the statistics of BTC, ETH, and TON on the TrendX platform are as follows: The number of BTC discussions last week was 12.74K, down 12.59% from the previous week; the price last Sunday was $68,532, up 2.13% from the previous Sunday. ETH had 3.96K discussions last week, up 9.21% from the previous week; the price last Sunday was $2,520, up 1.69% from the previous Sunday. TON had 906 discussions last week, down 15.43% from the previous week; the price last Sunday was $4.99, up 0.83% from the previous Sunday. As the 2024 US election approaches, investors are paying more and more attention to market dynamics, especially the prospects of crypto assets such as Bitcoin. The price of Bitcoin has exceeded $69,000, and the markets expectations for…