बिटकॉइन ईटीएफ विकल्प स्वीकृत, क्या बिटकॉइन में विस्फोटक वृद्धि होगी?

मूल लेखक: मेंश, चेनकैचर

मूल संपादक: निआन किंग, चेनकैचर

18 अक्टूबर को, अमेरिकी प्रतिभूति और विनिमय आयोग ने कहा कि अदला-बदली आयोग ने न्यूयॉर्क स्टॉक एक्सचेंज (NYSE) और शिकागो बोर्ड ऑप्शंस एक्सचेंज (CBOE) के आवेदनों को मंजूरी दे दी है, जो 11 स्वीकृत बिटकॉइन ETF प्रदाताओं को ऑप्शन ट्रेडिंग करने की अनुमति देगा। वर्तमान में, बिटकॉइन में वृद्धि जारी है, और उच्चतम बिंदु $69,000 से अधिक हो गया है।

ईटीएफ विश्लेषक सेफर्ट ने परमिशनलेस सम्मेलन में कहा कि बिटकॉइन ईटीएफ विकल्प वर्ष के अंत से पहले लॉन्च किए जा सकते हैं, लेकिन सीएफटीसी और ओसीसी के पास सख्त समय सीमाएं नहीं हैं, इसलिए इसमें और देरी हो सकती है, जिससे इसे 2025 की पहली तिमाही में लॉन्च किए जाने की अधिक संभावना है।

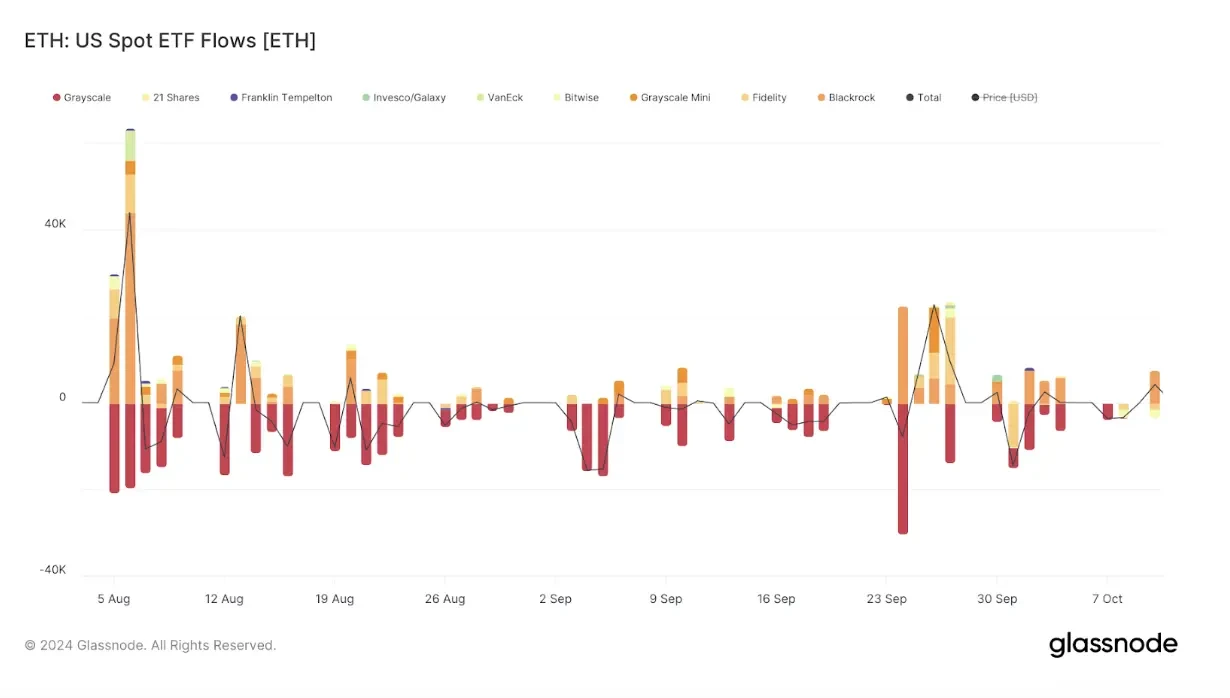

इसी समय, एसईसी ने बिटवाइज़ और ग्रेस्केल एथेरियम ईटीएफ विकल्पों की स्वीकृति को स्थगित कर दिया। बाजार ने अनुमान लगाया कि ऐसा इसलिए हुआ क्योंकि इसकी स्वीकृति के बाद एथेरियम ईटीएफ में प्रवाहित होने वाली धनराशि अपेक्षा से कम थी। एसईसी को उम्मीद है कि इस प्रस्ताव के बाजार स्थिरता पर प्रभाव की आगे जांच की जाएगी और 10 नवंबर को फैसला सुनाया जाएगा।

बिटकॉइन और एथेरियम ईटीएफ अंतर्वाह और बहिर्वाह:

बिटकॉइन ईटीएफ विकल्प क्यों महत्वपूर्ण हैं?

बिटकॉइन विकल्प ऐसे अनुबंध हैं जो धारक को एक निश्चित समय सीमा के भीतर पूर्व निर्धारित मूल्य पर बिटकॉइन खरीदने या बेचने का अधिकार देते हैं, लेकिन दायित्व नहीं। संस्थागत निवेशकों के लिए, ये विकल्प अंतर्निहित परिसंपत्ति के मालिक होने के बिना मूल्य अस्थिरता या बाजार की चाल पर सट्टा लगाने के खिलाफ बचाव का एक साधन प्रदान करते हैं। ये बिटकॉइन इंडेक्स विकल्प संस्थागत निवेशकों और व्यापारियों को बिटकॉइन के लिए अपने जोखिम का विस्तार करने का एक त्वरित और लागत प्रभावी तरीका प्रदान करते हैं, जो दुनिया के सबसे बड़े जोखिम के लिए अपने जोखिम को कम करने का एक वैकल्पिक तरीका प्रदान करते हैं। क्रिप्टोमुद्रा।

बिटकॉइन ईटीएफ विकल्पों का पारित होना इतना महत्वपूर्ण क्यों है? हालाँकि बाजार में कई क्रिप्टो विकल्प उत्पाद हैं, लेकिन उनमें से अधिकांश में पर्यवेक्षण की कमी है, जिससे संस्थागत निवेशक अनुपालन आवश्यकताओं के कारण भाग लेने से हिचकते हैं। इसके अलावा, बाजार में कोई भी विकल्प उत्पाद ऐसा नहीं है जो अनुपालन और तरल दोनों हो।

सबसे ज़्यादा लिक्विड ऑप्शन उत्पाद डेरीबिट द्वारा लॉन्च किया गया है, जो दुनिया का सबसे बड़ा बिटकॉइन ऑप्शन एक्सचेंज है। डेरीबिट बिटकॉइन और एथेरियम ऑप्शन के 24/7/365 ट्रेडिंग का समर्थन करता है। ऑप्शन यूरोपीय शैली के हैं और भौतिक अंतर्निहित क्रिप्टोकरेंसी में सेटल किए जाते हैं। हालाँकि, क्रिप्टोकरेंसी की सीमा के कारण, डेरीबिट उपयोगकर्ता पारंपरिक पोर्टफोलियो जैसे कि ETF और स्टॉक में परिसंपत्तियों के साथ मार्जिन को पार नहीं कर सकते हैं। और यह संयुक्त राज्य अमेरिका सहित कई देशों में कानूनी नहीं है। क्लियरिंग हाउस के अनुमोदन के बिना, काउंटरपार्टी जोखिम को कभी भी ठीक से हल नहीं किया जा सकता है।

सीएमई के बिटकॉइन वायदा विकल्पों और लेजरएक्स के बिटकॉइन विकल्पों, सीएफटीसी द्वारा विनियमित एक क्रिप्टो विकल्प एक्सचेंज, के बोली-पूछ प्रसार बहुत बड़े हैं। कार्य सीमित हैं, उदाहरण के लिए, लेजरएक्स में मार्जिन तंत्र नहीं है। लेजरएक्स पर प्रत्येक कॉल विकल्प को मूल्य रूप में बेचा जाना चाहिए (अंतर्निहित बिटकॉइन का स्वामित्व), और प्रत्येक पुट विकल्प को नकद में बेचा जाना चाहिए (स्ट्राइक मूल्य के नकद मूल्य का स्वामित्व), जिसके परिणामस्वरूप उच्च लेनदेन लागत होती है।

बिटकॉइन से संबंधित परिसंपत्तियों पर विकल्प, जैसे कि माइक्रोस्ट्रेटजी विकल्प या बीआईटीओ विकल्प, में बड़ी ट्रैकिंग त्रुटियां होती हैं।

वर्ष की शुरुआत से ही एमएसटीआर के शेयर मूल्य में तेज वृद्धि भी अप्रत्यक्ष रूप से दर्शाती है कि बिटकॉइन हेजिंग लेनदेन के लिए बाजार में मांग है। बिटकॉइन ईटीएफ विकल्प बाजार को ऐसे विकल्प उत्पाद प्रदान कर सकते हैं जो अनुपालन करने वाले और व्यापार की गहराई वाले दोनों हैं। ब्लूमबर्ग के शोधकर्ता जेफ पार्क ने बताया: बिटकॉइन विकल्पों के साथ, निवेशक अब अवधि के आधार पर पोर्टफोलियो आवंटन कर सकते हैं, खासकर दीर्घकालिक निवेश।

अस्थिरता बढे या घटे?

बिटकॉइन ईटीएफ विकल्पों की लिस्टिंग से बिटकॉइन की अस्थिरता पर क्या प्रभाव पड़ेगा, इस पर बहस के दोनों पक्षों की अलग-अलग राय है।

जो लोग मानते हैं कि अस्थिरता बढ़ सकती है, उनका मानना है कि एक बार विकल्प सूचीबद्ध होने के बाद, बहुत सारे खुदरा निवेशक बहुत ही अल्पकालिक विकल्पों में भाग लेंगे, और GME और AMC जैसे मेम स्टॉक पर जो हुआ, उसके समान गामा निचोड़ होगा। गामा निचोड़ उस प्रवृत्ति को संदर्भित करता है जो त्वरित अस्थिरता होने पर जारी रहेगी क्योंकि निवेशक इन विकल्पों को खरीदते हैं और उनके प्रतिपक्ष, बड़े ट्रेडिंग प्लेटफ़ॉर्म और मार्केट मेकर, को लगातार अपनी स्थिति को हेज करना चाहिए और स्टॉक खरीदना चाहिए, जिससे कीमतें और बढ़ जाती हैं और कॉल विकल्पों की अधिक मांग पैदा होती है।

लेकिन चूंकि केवल 21 मिलियन बिटकॉइन हैं, इसलिए बिटकॉइन बिल्कुल दुर्लभ है। यदि IBIT को गामा निचोड़ का अनुभव होता है, तो केवल वे ही विक्रेता होंगे जो पहले से ही बिटकॉइन के मालिक हैं और उच्च USD मूल्य पर व्यापार करने के लिए तैयार हैं। क्योंकि हर कोई जानता है कि कीमत को कम करने के लिए अधिक बिटकॉइन नहीं होंगे, ये विक्रेता बेचना नहीं चुनेंगे। सूचीबद्ध विकल्प उत्पादों ने गामा निचोड़ का अनुभव नहीं किया है, जो यह संकेत दे सकता है कि यह चिंता निरर्थक है।

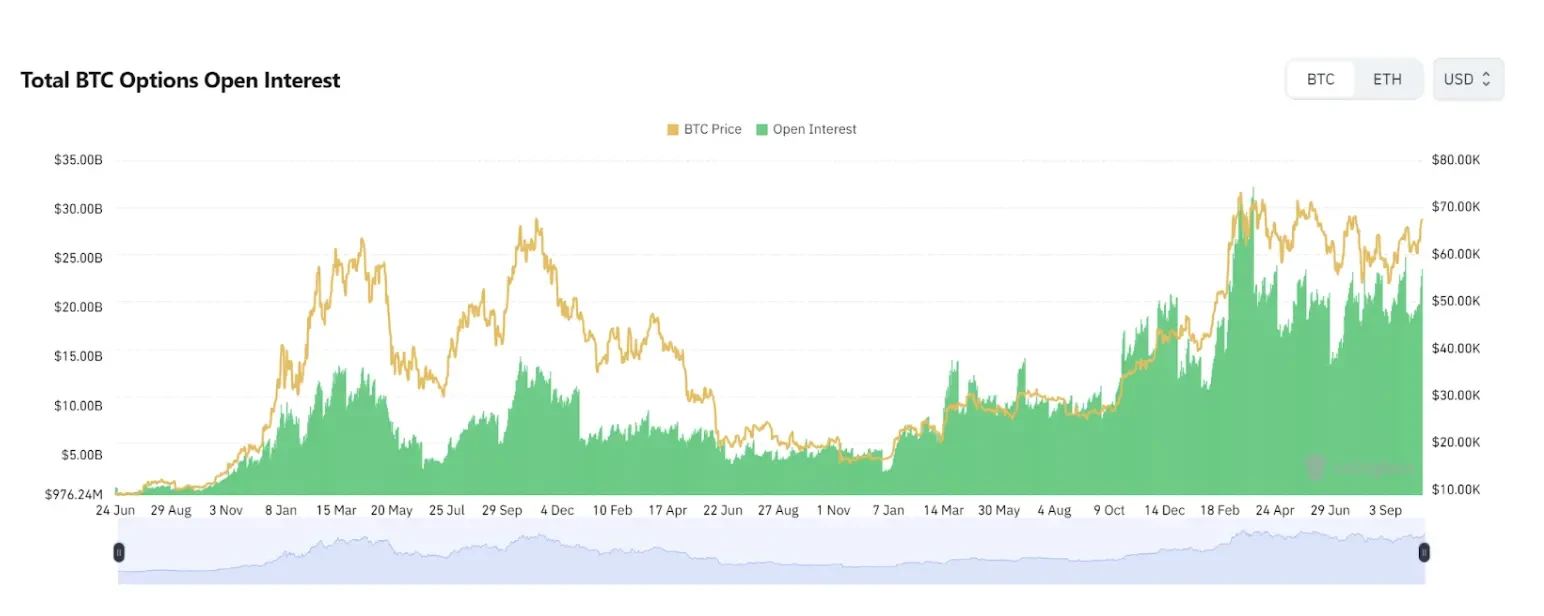

विकल्पों की केंद्रित समाप्ति भी अल्पावधि में बाजार में अस्थिरता का कारण बनेगी। डेरीबिट के सीईओ लुउक स्ट्रिजर्स ने कहा कि सितंबर के अंत में समाप्त होने वाले बिटकॉइन विकल्पों का ओपन इंटरेस्ट इतिहास में दूसरा सबसे बड़ा है, और वर्तमान में डेरीबिट पर लगभग $58 बिलियन ओपन इंटरेस्ट हैं। उनका मानना है कि इस बार $5.8 बिलियन से अधिक विकल्प समाप्त हो सकते हैं, जो समाप्ति के बाद बाजार में महत्वपूर्ण अस्थिरता पैदा कर सकते हैं।

https://www.coinglass.com/options

ऐतिहासिक रूप से, विकल्प समाप्ति बाजार की अस्थिरता को प्रभावित करती है। जैसे-जैसे विकल्प समाप्ति के करीब आती है, व्यापारियों को यह तय करने की आवश्यकता होती है कि उन्हें अपने विकल्पों का प्रयोग करना है, उन्हें समाप्त होने देना है या अपनी स्थिति को समायोजित करना है, जो अक्सर व्यापारिक गतिविधि को बढ़ाता है क्योंकि व्यापारी अपने दांव को हेज करने या संभावित मूल्य आंदोलनों का लाभ उठाने का प्रयास करते हैं। विशेष रूप से, यदि बिटकॉइन की कीमत विकल्प समाप्ति पर स्ट्राइक मूल्य के करीब है, तो विकल्प धारक अपने विकल्पों का प्रयोग कर सकते हैं, जिससे बाजार में अधिक खरीद और बिक्री का दबाव हो सकता है। यह दबाव विकल्प की समाप्ति के बाद मूल्य अस्थिरता को ट्रिगर कर सकता है।

जो लोग मानते हैं कि अस्थिरता कम हो जाएगी, वे दीर्घ अवधि के परिप्रेक्ष्य पर अधिक ध्यान केंद्रित करते हैं। ऐसा इसलिए है क्योंकि विकल्प की कीमतें निहित अस्थिरता को दर्शाती हैं, जो कि भविष्य की अस्थिरता के बारे में निवेशकों की अपेक्षाएँ हैं। IBIT नई तरलता लाता है और संरचित नोटों के अधिक जारी होने को आकर्षित करता है, जिससे संभावित अस्थिरता में कमी आ सकती है, क्योंकि यदि निहित अस्थिरता बहुत अधिक है, तो इसे समतल करने के लिए अधिक विकल्प उत्पाद बाजार में प्रवेश करेंगे।

बड़े तालाब बड़ी मछलियों को आकर्षित करते हैं

विकल्पों के लॉन्च से तरलता और भी अधिक आकर्षित होगी, और तरलता द्वारा लाई गई ट्रेडिंग सुविधा आगे भी तरलता को आकर्षित करेगी, इस प्रकार तरलता का एक सकारात्मक चक्र बनेगा। वर्तमान में, बाजार लगभग इस आम सहमति पर पहुंच गया है कि विकल्पों के लॉन्च से तरलता पर अपने आप में और इसके द्वारा लाए जाने वाले अतिरिक्त परिणामों के संदर्भ में एक आकर्षक प्रभाव पड़ता है।

चूंकि ऑप्शन मार्केट मेकर गतिशील हेजिंग रणनीतियों में संलग्न हैं, इसलिए ऑप्शन अंतर्निहित परिसंपत्ति के लिए अधिक तरलता बनाते हैं। ऑप्शन ट्रेडर्स द्वारा यह निरंतर खरीद और बिक्री ट्रेडों का एक स्थिर प्रवाह प्रदान करती है, मूल्य में उतार-चढ़ाव को सुचारू करती है और बाजार की समग्र तरलता को बढ़ाती है, जिससे स्लिपेज को कम करते हुए पूंजी के एक बड़े पूल को बाजार में प्रवेश करने की अनुमति मिलती है।

आईबीआईटी विकल्पों की शुरुआत से संस्थागत निवेशकों को भी आकर्षित किया जा सकता है, खासकर बड़े पोर्टफोलियो का प्रबंधन करने वाले निवेशकों को, क्योंकि उन्हें अक्सर अपनी स्थिति को सुरक्षित रखने के लिए जटिल उपकरणों की आवश्यकता होती है। यह क्षमता कथित जोखिम अवरोध को कम करती है और बाजार में अधिक पूंजी प्रवाह की अनुमति देती है।

कई संस्थागत निवेशक बड़े पोर्टफोलियो का प्रबंधन करते हैं और जोखिम प्रबंधन, क्रय शक्ति और उत्तोलन के लिए बहुत विशिष्ट आवश्यकताएं रखते हैं। स्पॉट ईटीएफ अकेले समस्या का समाधान नहीं कर सकते। विकल्प बहुत जटिल संरचित उत्पाद बना सकते हैं, जिससे बिटकॉइन में अधिक संस्थागत पूंजी भाग ले सकती है।

आईबीआईटी विकल्पों की स्वीकृति के साथ, निवेशक बिटकॉइन की अस्थिरता में निवेश करने में सक्षम हैं, जिसके परिणामस्वरूप महत्वपूर्ण रिटर्न मिल सकता है, क्योंकि बिटकॉइन की अंतर्निहित अस्थिरता अन्य परिसंपत्तियों की तुलना में अधिक है।

बिटकॉइन की वार्षिक वास्तविक अस्थिरता:

ब्लूमबर्ग के विश्लेषक एरिक बालचुनस ने कहा कि विकल्पों का पारित होना बिटकॉइन ईटीएफ के लिए एक बड़ी जीत है, क्योंकि इससे अधिक तरलता आएगी और बड़ी मछलियाँ आकर्षित होंगी।

इसी समय, IBIT विकल्पों की स्वीकृति विनियामक पक्ष पर एक और स्पष्ट बयान है। गैलेक्सी डिजिटल के सीईओ माइक नोवोग्राट्ज़ ने सीएनबीसी के साथ एक साक्षात्कार में कहा कि पारंपरिक बिटकॉइन फ्यूचर्स ईटीएफ के विपरीत, ये विकल्प विशिष्ट समय अंतराल पर व्यापार की अनुमति देते हैं, जो बिटकॉइन की अंतर्निहित अस्थिरता के कारण फंडों से अधिक रुचि को ट्रिगर कर सकते हैं। ईटीएफ विकल्पों की स्वीकृति अधिक निवेशकों को आकर्षित कर सकती है। माइक्रोस्ट्रेटेजी का ट्रेडिंग वॉल्यूम बिटकॉइन की मजबूत मांग को दर्शाता है। विनियामक स्पष्टता डिजिटल परिसंपत्तियों के भविष्य के विकास का मार्ग प्रशस्त कर सकती है।

मौजूदा विकल्प बाज़ारों के लिए, ETF विकल्पों की मंज़ूरी से भी ज़्यादा फ़ायदा होगा। अनचेन्ड पॉडकास्ट में, अर्बेलोस के सह-संस्थापक जोशुआ लिम बाज़ारउन्होंने अनुमान लगाया कि सीएमई विकल्पों की तरलता वृद्धि सबसे अधिक स्पष्ट होगी, क्योंकि दोनों पारंपरिक निवेशकों का सामना करते हैं, और गठित मध्यस्थता के अवसर एक ही समय में दोनों बाजारों की तरलता में वृद्धि करेंगे।

परिवर्तनीय मूल्य प्रदर्शन

विकल्पों की शुरूआत से न केवल निवेशकों को अधिक विविध परिचालन स्थान मिलता है, बल्कि इससे पहले से अप्रत्याशित मूल्य प्रदर्शन भी प्राप्त होता है।

उदाहरण के लिए, जोशुआ लिम ने अपने व्यापार में पाया कि बहुत से लोग चुनाव के बाद कॉल विकल्प खरीद रहे थे, जिसका अर्थ है कि लोग किसी तरह का हेज दांव लगाने को तैयार हैं कि 5 नवंबर के चुनाव के बाद क्रिप्टोकरेंसी के लिए विनियामक वातावरण में ढील दी जाएगी। इन विकल्पों की समाप्ति तिथि के आसपास आमतौर पर कुछ मूल्य उतार-चढ़ाव होते हैं, और ऐसे उतार-चढ़ाव आमतौर पर अत्यधिक केंद्रित होते हैं। यदि बहुत से लोग $65,000 के स्ट्राइक मूल्य के साथ बिटकॉइन विकल्प खरीदते हैं, क्योंकि व्यापारी इस स्थिति में अपने जोखिमों को कम करते हैं, आमतौर पर व्यापारी तब खरीदेंगे जब कीमत $65,000 से कम होगी और फिर जब कीमत इस कीमत से ऊपर होगी तो बेच देंगे, और बिटकॉइन की कीमत स्ट्राइक मूल्य पर टिकी रहेगी।

यदि कोई प्रवृत्ति है, तो यह आमतौर पर कई कारणों से विकल्पों की समाप्ति के बाद तक विलंबित होती है। उदाहरण के लिए, विकल्प आमतौर पर महीने के आखिरी शुक्रवार को समाप्त होते हैं, लेकिन यह जरूरी नहीं है कि यह कैलेंडर महीने के अंत के साथ मेल खाता हो, जो विशेष रूप से महत्वपूर्ण है क्योंकि यह हेज फंड के प्रदर्शन मूल्यांकन और शेयरों की खरीद और बिक्री को चिह्नित करता है, जो परिसंपत्ति वर्ग में प्रवाह और खरीद दबाव पैदा करेगा। इन सभी गतिशीलता के कारण, स्पॉट मार्केट में विकल्प समाप्ति के बाद अस्थिरता होती है, क्योंकि शायद समाप्ति से पहले डीलर हेजिंग गतिविधि समाप्ति के बाद कमजोर हो गई है।

सप्ताहांत पर ऑप्शन का कारोबार नहीं किया जाता है, और शुक्रवार को बाजार बंद होने पर बहुत अधिक IBIT गामा व्यापारियों को अपने डेल्टा को हेज करने के लिए सप्ताहांत पर स्पॉट बिटकॉइन खरीदने के लिए मजबूर कर सकता है। चूंकि IBIT एक नकद मोचन है, इसलिए बिटकॉइन को IBIT में स्थानांतरित करने में कुछ जोखिम हो सकता है। ये सभी जोखिम अंततः बिटकॉइन बाजार में फैल सकते हैं। आप बोली-मांग प्रसार में वृद्धि देख सकते हैं।

निष्कर्ष के तौर पर

संस्थानों के लिए, बिटकॉइन ईटीएफ विकल्प हेजिंग साधनों का बहुत विस्तार कर सकते हैं, जोखिमों और रिटर्न को अधिक सटीक रूप से नियंत्रित कर सकते हैं, और अधिक विविध निवेश पोर्टफोलियो को संभव बना सकते हैं। खुदरा निवेशकों के लिए, बिटकॉइन ईटीएफ विकल्प बिटकॉइन की अस्थिरता में भाग लेने का एक तरीका है। विकल्पों की बहुमुखी प्रतिभा बाजार की क्लासिक रिफ्लेक्सिविटी में तेजी की भावना को भी ट्रिगर कर सकती है, और तरलता अधिक तरलता लाती है। हालाँकि, क्या विकल्प प्रभावी रूप से फंड को आकर्षित कर सकते हैं, पर्याप्त तरलता रख सकते हैं, और फंड को आकर्षित करने का एक सकारात्मक चक्र बना सकते हैं, इसे अभी भी बाजार द्वारा सत्यापित करने की आवश्यकता है।

यह लेख इंटरनेट से लिया गया है: बिटकॉइन ईटीएफ विकल्प स्वीकृत, क्या बिटकॉइन में विस्फोटक वृद्धि होगी?

पिछले 24 घंटों में, बाजार में कई नई लोकप्रिय मुद्राएँ और विषय सामने आए हैं, जो पैसा बनाने का अगला अवसर हो सकते हैं, जिनमें शामिल हैं: मजबूत धन सृजन प्रभाव वाले क्षेत्र हैं: वास्तविक आय क्षेत्र (BANANA, AAVE, APT, SUI) और अन्य टोकन जो बड़ी मात्रा में अनलॉक होने वाले हैं; सबसे ज़्यादा खोजे जाने वाले टोकन और विषय: Catizen, Ether.fi संभावित एयरड्रॉप अवसरों में शामिल हैं: Plume Network, Movement Data सांख्यिकी समय: 11 सितंबर, 2024 4: 00 (UTC + 0) 1. बाजार का माहौल पिछले 24 घंटों में, BTC की कीमत $56,000 के आसपास रही, और 11 US स्पॉट बिटकॉइन ETF की कुल लेनदेन मात्रा $711 मिलियन तक पहुँच गई, जो इसके लॉन्च के बाद से तीसरा सबसे निचला स्तर है। कल US बिटकॉइन स्पॉट ETF में $116.97 मिलियन का शुद्ध प्रवाह था। US Ethereum स्पॉट ETF में कल $116.97 मिलियन का शुद्ध प्रवाह था।