अनुप्रयोग स्तर मूल्य को ग्रहण करता है, तथा अंतर्निहित श्रृंखला मूल्य को संग्रहीत करती है?

Original article by Ryan Watkins, Co-founder of Syncracy Capital

मूल अनुवाद: 1912212.eth, फ़ोरसाइट न्यूज़

There is a popular view in the industry that there are no other valuable applications besides Bitcoin and stablecoins. In the last cycle, the industry was completely driven by speculation and has made little progress since the crash in 2022. The industry infrastructure is oversaturated, and the VCs that fund them may pay the price for their lessons due to improper capital allocation.

The second half of the above statement makes sense as markets begin to punish blind infrastructure investment and winners emerge on the basis of the crypto economy. However, when we look at the data, we see that there are few applications relative to infrastructure and similarly little progress has been made since the last cycle. The first half of the statement does not hold water.

Contrary to popular opinion, the age of applications has arrived, and many applications have surpassed infrastructure in revenue. There are a large number of applications on mainstream platforms like Ethereum and Solana, with annual revenues of 8-9 figures and growing at triple-digit percentages each year. However, while these numbers are impressive, applications still trade at a much lower price than infrastructure, which has an average revenue multiple of about 300 times higher. While infrastructure assets like ETH and Solana, which are at the center of the smart contract ecosystem, are likely to maintain a premium for value storage, multiples for non-monetary infrastructure assets (such as second-layer tokens) are likely to compress over time. Syncracy believes that the market has not yet fully recognized this reality, and as capital flows into non-monetary infrastructure, leading applications will be ready to re-price from here, with prices moving higher.

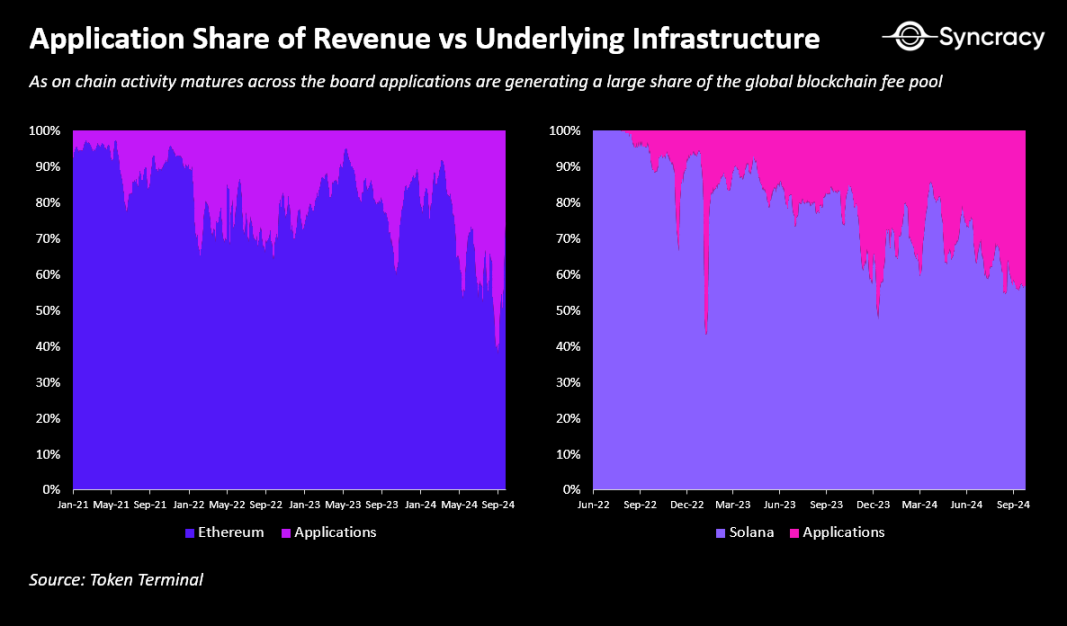

The tipping point in the future trend may be that applications account for a larger share of the blockchain fee pool and revenue exceeds most infrastructure assets. Data from Ethereum and Solana, two major application ecosystems, already show that applications are taking a share of the revenue from the platforms they rely on. This trend may accelerate further as applications are taking a larger share of the economy and achieving vertical integration to better control the user experience. Even Solana applications, which pride themselves on synchronous composability, are keeping some operations off-chain and pushing them to run off-chain, while using L2 and sidechains to achieve expansion.

The rise of fat apps

Is the Rollapp Theory inevitable? As applications struggle to overcome the limitations of a single global state machine that cannot efficiently handle all on-chain transactions, modularity between blockchains seems imperative. For example, while Solana’s performance has been impressive, in April it began to have problems simply due to millions of users trading MEME every day. While Firedancer will help, it is unclear whether it can provide the order-of-magnitude performance improvement required for billions of daily active users (and even more, including AI agents and enterprises). As mentioned above, Solana’s modularity has already begun.

The real question is how far this shift will evolve and how many applications will ultimately move operations off-chain. Running the entire global financial system on a single server, the fundamental argument for any integrated blockchain, would require full nodes to be run in hyperscale data centers, which would make it nearly impossible for end users to independently verify the integrity of the chain. This would undermine the fundamental properties of a globally scalable blockchain, which is to ensure solid property rights and resist manipulation and attack. In contrast, Rollups enable applications to spread these bandwidth requirements across a collection of independent sorters that can simultaneously achieve hyperscale performance while ensuring end-user verification through DA sampling of the underlying base layer. Furthermore, as applications scale and begin to build close relationships with users, they may require maximum flexibility from the underlying infrastructure to best meet user needs.

This is already happening in Ethereum, the most mature on-chain economy, where leading applications such as Uniswap, Aave, and Maker are actively developing their own Rollups. These applications are pursuing more than just scalability – they are also demanding features such as custom execution environments, alternative economic models (such as native yield), enhanced access controls (such as permission deployment), and customized transaction ordering mechanisms. In this way, applications can not only increase user value and reduce operating costs, but also gain greater economic control relative to their base layer infrastructure. Chain abstraction and smart wallets will only make this application-centric world more seamless and reduce the friction between the current different block spaces over time.

In the short term, next-generation DA providers like Celestia and EigenLayer will be key enablers of this trend, providing greater scale, interoperability, and flexibility for applications while ensuring cheap verifiability. However, in the long term, it is clear that every blockchain that aims to become the foundation of the global financial system needs to ensure cheap verification for end users while expanding bandwidth and DA. For example, while Solana is integrated in concept, it already has teams working on light client verification, zero-knowledge compression, and DA sampling to achieve this ultimate goal.

Once again, the point here is not a specific scaling technology or blockchain architecture. It may well be that for integrated blockchains, token extensions, coprocessors, and Rollups are sufficient to achieve scaling and provide the necessary customizability for applications without destroying their composability. Regardless, the trend is towards applications continuing to move towards greater economic control and technical flexibility. It seems inevitable that application revenue will exceed its underlying infrastructure.

On-chain value capture

The more important question now is how value will be distributed between applications and infrastructure as applications gain more economic control in the coming years. Will this shift be an inflection point that prompts applications to produce infrastructure-like results in the coming years? Syncracy believes that while applications will continue to capture a larger share of the global blockchain fee pool over time, the underlying infrastructure (L1) may still produce greater results, albeit with fewer players involved.

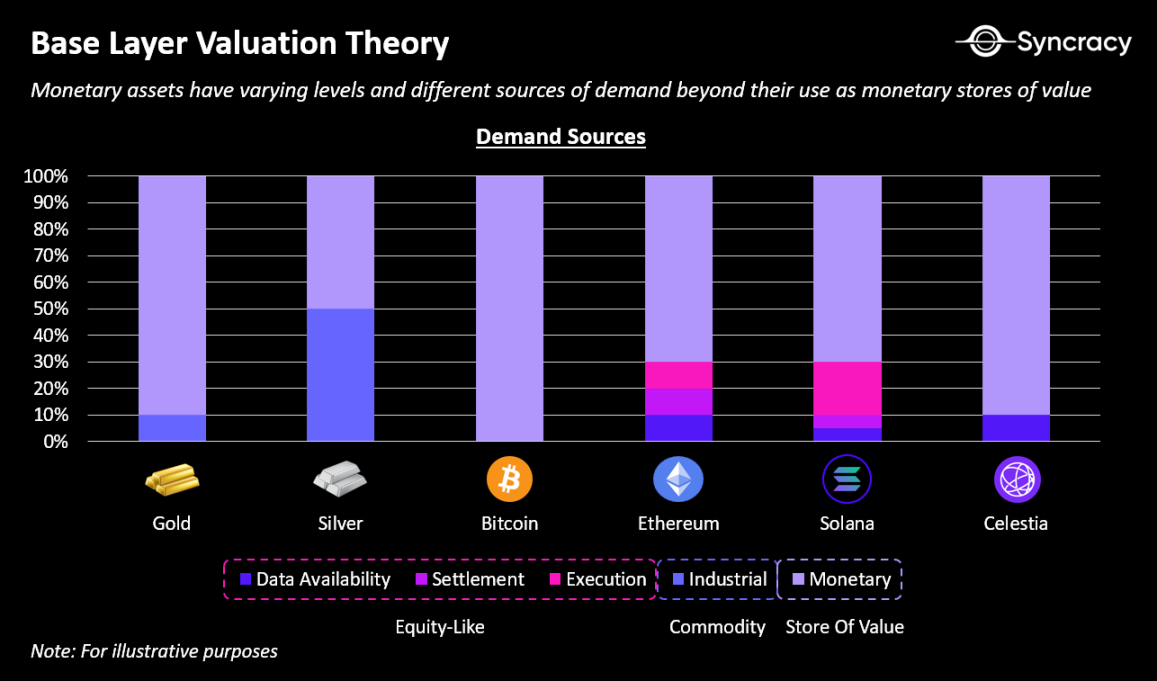

The core argument underpinning this view is that in the long run, all base layer assets, such as BTC, ETH, and SOL, will compete as non-sovereign digital stores of value – the largest TAM in the cryptoeconomy. While it is commonly believed that Bitcoin is similar to gold and other L1 assets are similar to stocks, this distinction is largely narrative driven. Fundamentally, all native blockchain assets share common characteristics: they are non-sovereign, not easily confiscated, and can be transferred in a cross-border digital environment. In fact, these attributes are essential for any blockchain that aims to build an independent digital economy that is not controlled by the state.

The key difference between them lies in their strategies to achieve global adoption. Bitcoin directly challenges central banks by attempting to replace fiat currencies as the dominant global store of value. In contrast, L1s such as Ethereum and Solana aim to build parallel economies in cyberspace, creating organic demand for ETH and SOL as they grow. In fact, this is already happening. In addition to being a medium of exchange (fee payments) and a unit of account (NFT pricing), ETH and SOL are also the most dominant stores of value in their respective economies. As proof-of-stake assets, they directly capture fees and maximum extracted value (MEV) generated by on-chain activities, and both assets offer the lowest counterparty risk in their respective ecosystems, making them collateral on the chain. At the same time, as a proof-of-work asset, Bitcoin does not provide holders with collateral or fees, but operates purely as a commodity currency.

While the strategy of building a parallel economy seems ambitious and almost impossible to successfully achieve, it may ultimately prove easier to compete with national economies rather than directly confront them as Bitcoin does. In fact, Ethereum and Solana’s approach reflects how countries have historically competed for reserve currency status: first establish economic influence, then encourage other countries to adopt your currency for trade and investment.

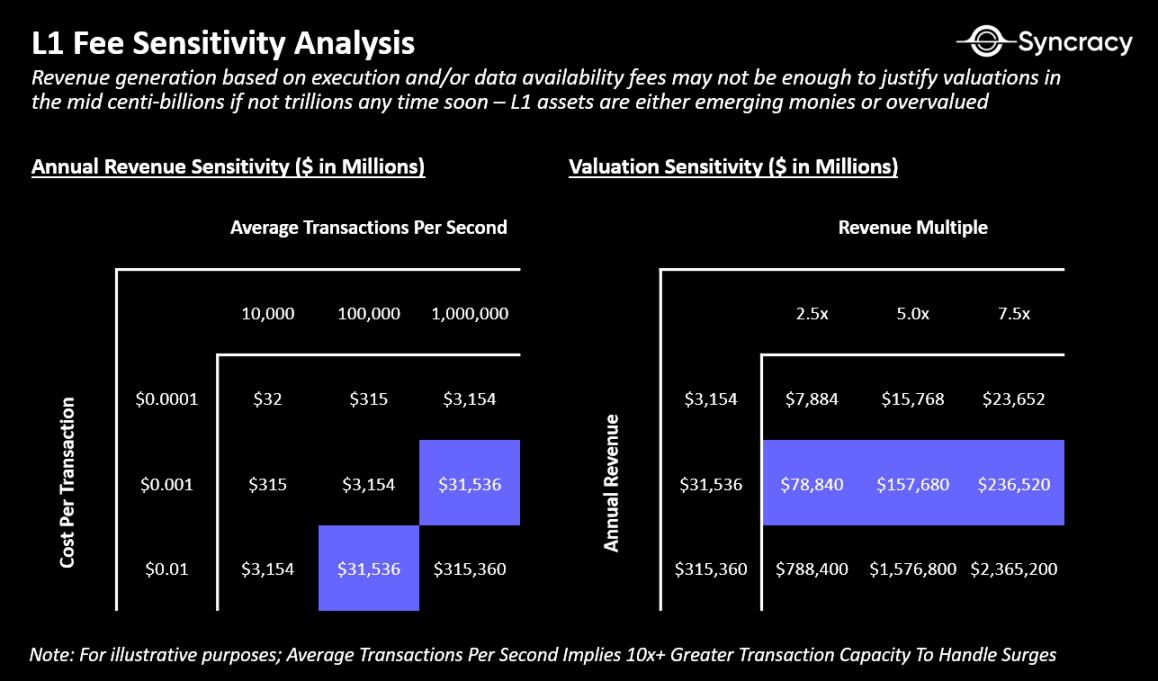

While it is tempting to overlook the incalculable process of monetization in favor of the quantifiable process of value accumulation through fee generation, the latter may lead to disappointing results. Beyond the obvious circular complexity of blockchains generating fees in unbacked, self-issued currencies, the potential for fee capture may not be as large as one might think for the foreseeable future.

Take MEV, for example. MEV is unlikely to become a large enough industry to support current valuations, and it is likely to decrease over time as a share of on-chain activity, accruing increasingly to applications. The closest equivalent to MEV in traditional finance is high-frequency trading (HFT), which has global revenue estimates of between $10 billion and $20 billion. Furthermore, blockchains are likely currently making too much money on MEV, which is likely to decline over time as wallet infrastructure and order routing improve, and applications work to internalize and minimize MEV. Do we really expect MEV revenue on a chain to exceed the entire global HFT industry, 100% of which is owned by validators?

It’s also worth noting that while execution and DA fees may be attractive revenue streams, they may still not be enough to justify valuations that reach hundreds of billions or even trillions of dollars in the near future (there are only so many organizations on the planet that are worth that much). Transaction volumes will need to grow exponentially while fees remain low enough to foster mainstream adoption before they reach acceptable levels — a process that could take a full decade.

So what would provide enough value to validators to continue their vital service? As they have done throughout history, blockchains could use monetary inflation as a permanent subsidy similar to taxes to sustain themselves. Essentially, asset holders would lose a small portion of their wealth over time to subsidize validators who provide sufficient block space for applications, thereby bringing monetary value to the blockchains underlying assets.

All that said, it’s worth considering a more pessimistic view here, which is that blockchains should be valued based on fees, and that over time, as applications gain greater economic control, those fees may not justify lofty valuations. This isn’t an unprecedented situation — during the dot-com boom of the 1990s, telecom companies attracted much of the overinvestment in infrastructure, but many of those companies ultimately became commoditized. While telecom companies like ATT and Verizon adapted and survived, much of the value shifted to applications built on top of that infrastructure, like Google, Amazon, and Facebook. There’s a non-zero chance that this pattern will repeat itself in the cryptoeconomy, with chains providing infrastructure but value being captured and surpassed at the application layer. However, for now, in the speculative early days of the cryptoeconomy, it’s all a big relative value trade — Bitcoin chasing gold, Ethereum chasing Bitcoin, and Solana chasing Ethereum.

The age of apps, the age of cryptocurrency

From a macro perspective, the crypto economy is undergoing a huge transformation from speculative experiments to revenue-generating businesses and active on-chain economies that bring real monetary value to blockchain-native assets. While current activities may seem small, they are growing exponentially as these systems scale and provide more engaging user experiences. Syncracy believes that in a few years, we will look back on this era with humor and wonder why anyone doubted the value of this field when so many obvious big trends emerged at the time.

The age of applications has arrived, and with it, blockchain will create a more powerful non-sovereign digital store of value than ever before.

Special thanks to Chris Burniske, Logan Jastremski, Mason Nystrom, Jonathan Moore, Rui Shang, and Kel Eleje for feedback and discussions

This article is sourced from the internet: The application layer captures value, and the underlying chain stores value?

Related: Uncovering Satoshi Nakamoto: HBO Played a $68 Billion Joke

One hour ago, the top American streaming media HBO finally released a documentary about the founder of Bitcoin. In the trailer that whetted the appetite of all cryptocurrency traders, HBO claimed that this film will reveal who Satoshi Nakamoto is. In the past, people just talked about Satoshi Nakamoto online, but this time it was different. People started to bet money. As the director of the documentary, Hoback, said, the bets on Who is Satoshi Nakamoto have made the topic even hotter, and the betting pool on Polymarket has accumulated to 20 million US dollars. Hoback sits in front of the computer, constantly refreshing the betting pool manually, watching the bets in the pool increase. Although he promises that he will not participate in the betting to earn money, this…