एक के बाद एक अच्छी खबरें आने के साथ, क्या ZKsync पुनर्जागरण का सूत्रपात करेगा?

मूल लेखक: फ्रैंक, PANews

Since the airdrop, ZKsync has been plagued by bad news. Ecological data has declined rapidly, and the token price has also fallen all the way, from $0.29 after the launch to $0.08, a drop of 72.8%. Not only that, it was also reported that 16% of the employees were laid off.

However, since September, new developments of ZKsync have been reported frequently, such as hiring a chief marketing officer from Solana, launching an on-chain governance system, and welcoming the migration of Treasure DAO. ZKsync seems to be experiencing a revival. PANews makes a comprehensive analysis of the recent development status of ZKsync to see whether this once-popular star L2 is about to experience a revival?

Start by expanding your circle of friends

The changes in ZKsync seem to have started with layoffs. On September 3, it was reported that Matter Labs, the developer of ZKsync, announced a layoff of 16% of its employees, a total of 24 people. This is the first layoff in the companys six years of existence, and Matter Labs CEO Alex Gluchowski clarified that the decision to layoffs was not due to the companys financial situation, and that the next step would be to plan strategic recruitment.

In fact, ZKsync did have a blood transfusion after the layoffs. On September 11, Matter Labs announced that it had hired Meghan Hughes, former vice president of marketing at the Solana Foundation, as chief marketing officer. Previously, Meghan Hughes had worked at Google, Facebook, Niantic, and Stripe. Matter Labs revealed to the media that Hughes was hired to help Matter Labs share its story and improve its narrative.

Two days later, ZKsync announced the launch of an on-chain governance system. This is a governance system built around the principles of separation of powers and checks and balances. By design, no person or entity can change the ZKsync protocol. After Matter Labs CEO Alex Gluchowski announced the news on Twitter, it also triggered a lot of discussion in the community. Among them, Solana co-founder Toly questioned the statement that the new ZKsync protocol is not a multi-signature under Alex Gluchowskis tweet. The discussion between the two remained at the theoretical level and did not extend to other levels. However, such a long-distance conversation still brought a certain degree of topicality to ZKsync.

On September 14, Treasure co-founder Karel Vuong published a long article on social media to explain why Treasure DAO intends to migrate from Arbitrum to ZKsync. Karel Vuong said that ZKsync is more conducive to the projects vision of large-scale adoption in terms of scalability, throughput, cost, game possibilities, onboarding, and interoperability. This is the main reason why the team chose ZKsync.

On September 23, after repeated testing for a month, Aave V3 was finally deployed on the ZKsync Era mainnet.

On September 25, Coinbase announced that it would launch the ZKsync (ZK) token. Subsequently, the ZK token rose in response, with the highest increase reaching 7.59% within 15 minutes. On the 25th, the highest increase reached 14.5%, and the price reached 0.14, setting a record high in nearly two months.

In addition, projects such as Chainlink CCIP and Stratis have also announced their deployment on ZKsync.

On-chain data shows slight improvement

In addition to expanding its influence in the ecosystem, ZKsyncs on-chain data has also improved recently. Looking back at the data after the airdrop, we can see that TVL, the number of on-chain transactions, and the number of active addresses on the chain have been declining since March. After entering September, ZKsync has seen a significant rebound in these data.

On March 9 this year, the TVL of ZKsync Era reached a peak of $188 million. By August 5, this figure had dropped to $72 million, a drop of more than 60%. As of September 29, the TVL of ZKsync Era had rebounded to $140 million, ushering in a leap-forward recovery.

Daily trading volume rises

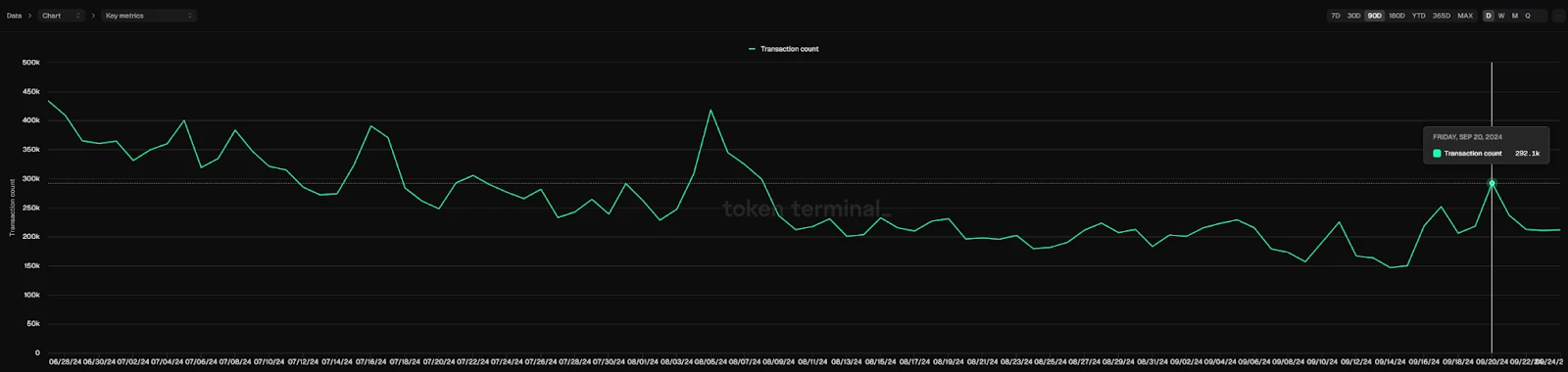

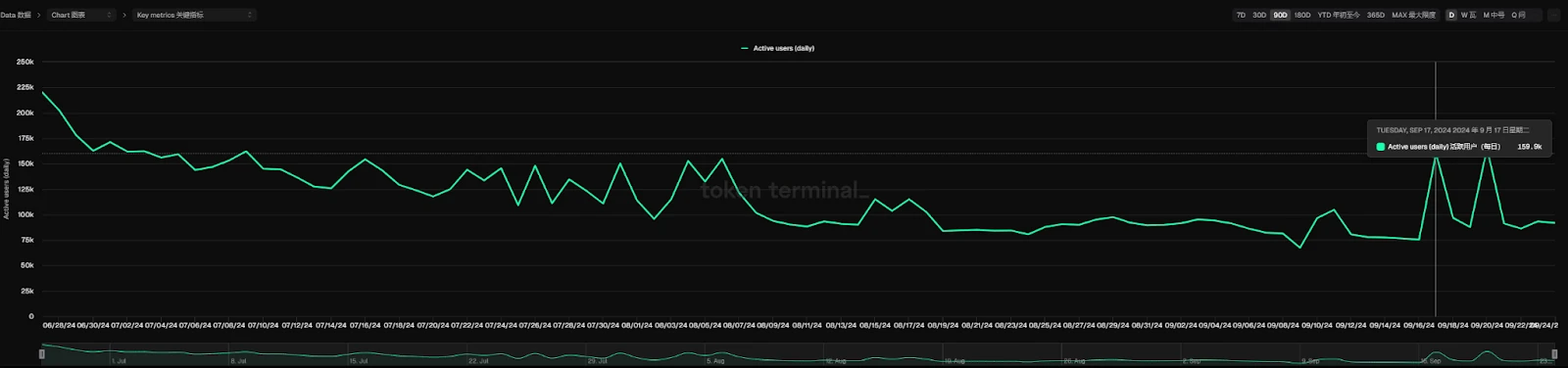

The more obvious change occurred in the number of daily active users. On September 9, the number of daily active addresses of ZKsync Era fell to the bottom, only 67,000. On September 17 and September 20, the number of daily active addresses saw a significant increase, rising to 159,000 and 164,000 respectively. At the same time, the number of on-chain transactions also saw a sudden increase on these two days. From September 15 to September 20, the number of on-chain transactions increased by more than 1 times.

Active users show signs of recovery

The growth of these data may come from Tevaera, a gaming platform within the ecosystem. According to DappRadar data, the number of user addresses of Tevaera in the past 30 days has reached about 150,000, an increase of 160%. The contract creation data of another ZKsync Era has remained at a low level recently without much change, which also indirectly confirms that these data growth may come from a certain application rather than a large number of new tokens.

There is still a big gap with other L2s, and the airdrop phased sell-off has ended

In comparison with other Ethereum L2s, we can see that the TVL of Arbitrum and Base are both over $2 billion, and Optimism is also $680 million. Although the project has recently frequently introduced cooperative project migrations to increase the activity of the ecosystem,

In comparison, ZKsync seems to have a long way to go.

As of September 26, the total number of tokens created in the ZKsync mainnet DEX was 507, and the 24-hour trading volume did not exceed $10 million. The number of people trading the most on-chain tokens was only 333 in 24 hours. Judging from these data, the activity of the ZKsync on-chain ecosystem has not really started to flourish.

Judging from the market performance of the token, the ZK token has rebounded slightly recently. In the past 4 days, the price of ZK has risen by 66%. The current circulating tokens account for 17.5% of the total. Before June 2025, there will be no new unlocking of tokens. Combined with the token airdrop collection in the first three months, the rebound in ZK prices may be related to the basic end of the airdrop selling, coupled with the recent cooperation news within the ecosystem, the listing on Coinbase and other favorable promotions, and the overall rebound of the market.

Overall, it seems that there is still some time before ZKsync recovers. However, the development path of ZKsync is different from that of the recently popular Sui. ZKsync has not launched a one-click coin issuance platform for MEME coins, but temporarily relies on Tevaera and other blockchain games to activate more users. If the blockchain games in the crypto industry recover and replace MEME coins as the growth engine of the next stage, ZKsync may be a good choice to break through in L2 by relying on blockchain games.

This article is sourced from the internet: With good news coming one after another, will ZKsync usher in a renaissance?

Related: A brief introduction to the highly anticipated Firedancer on Breakpoint

Original author: Karen, Foresight News At last week’s Solana Breakpoint conference, the atmosphere was lively, ecosystem product releases followed one after another, and various colorful peripheral activities were the icing on the cake. In this feast, the highlight was the official launch of an early version of the Solana validator client Firedancer on the mainnet. This milestone achievement was given special attention, marking that the Solana network will achieve a qualitative leap in performance, while avoiding the risk of network downtime caused by a single client crash on Solana. The development of Firedancer dates back to 2021 and 2022. As the second Solana validator client developed by Jump Trading Group (the original client Agave was developed by Anza), its original design was to eliminate single point failure risks and enhance…