बीटीसी अस्थिरता: सप्ताह की समीक्षा 16 सितंबर, 2024 – 16 सितंबर

Key Metrics: (September 16, 4pm Hong Kong time -> September 23, 4pm Hong Kong time):

-

BTC/USD + 7.8% ($58,900 -> $63,500), ETH/USD + 14.5% ($2,305 -> $2,640)

-

BTC/USD December (end of year) ATM volatility -0.1 v (59.5->59.4), December 25 day risk reversal volatility +0.8 v (2.4->3.2)

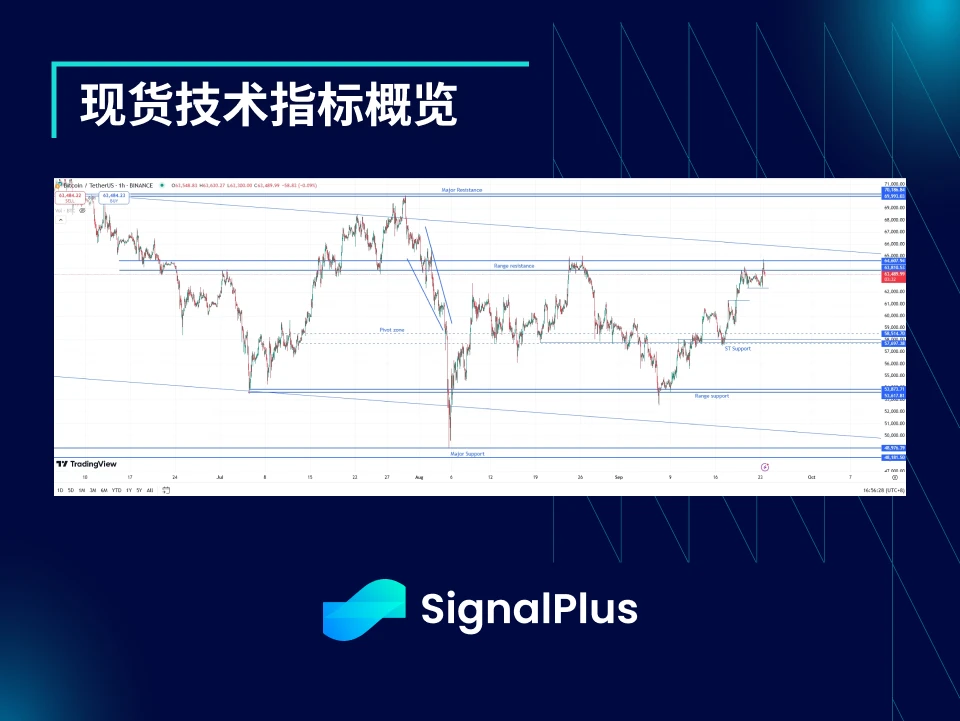

स्पॉट तकनीकी संकेतकों का अवलोकन

-

After the short-term bullish support discussed last week was tested, the spot price gradually recovered and moved significantly higher after the Fed FOMC meeting, rising to the $64-65k range resistance. The market has been hovering in this range for the past few trading days, but the current price performance of BTC above $64k is not satisfactory.

-

From a technical analysis perspective, we expect the price to consolidate and form support in the $61.5k to $64k range. If it breaks out of this range, the spot price may be expected to further challenge the highs close to $70k.

-

It is worth noting that if the price breaks through the upper limit of the range, it will be accompanied by a breakthrough of the long-term flag top (see the figure below), which may trigger greater market fluctuations:

बाज़ार events:

-

The Fed’s FOMC meeting chose to start the rate cut cycle with a 50 basis point rate cut, which greatly boosted the market sentiment of stocks and cryptocurrencies (especially altcoins), while gold and silver prices also rose. Interestingly, the dollar did not weaken further against the G10 currencies, which suggests that the dollar’s position may have been overstretched, limiting the dollar’s downside.

-

U.S. presidential polls continue to slightly favor Harris, but this has not weighed on cryptocurrency prices as the short-term narrative focus shifts to the Federal Open Market Committee’s rate cuts.

-

Harris still maintains a slight lead in the polls for the U.S. presidential election, but the impact on cryptocurrency prices is limited as the short-term market focus shifts to the Federal Reserves interest rate cuts.

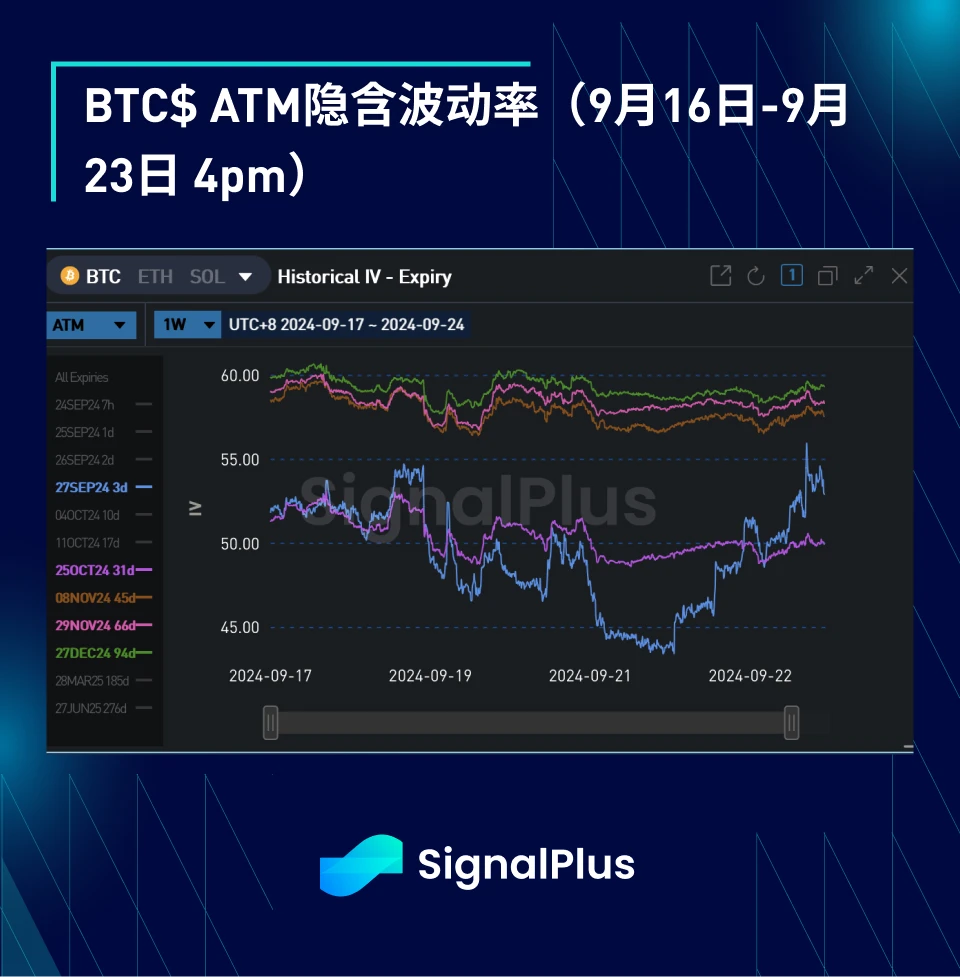

एटीएम निहित अस्थिरता:

-

Except during the FOMC meeting, the markets realized volatility remained subdued, and the market is waiting for new catalysts. High-frequency and fixed-term volatility data show that realized volatility remains around 45, while the 4.5% volatility in the morning after the Fed meeting slightly exceeded the equilibrium point that the market priced for the event (the equilibrium point was raised from 2.5% to 3.6% before the event).

-

The lack of clear direction ahead of the FOMC meeting and further unwinding of bearish hedges weighed on volatility. Nevertheless, with markets trading at range lows and the election approaching, implied volatility remained supported in most cases.

-

At the beginning of the week, the contract was heavily sold off near the expiration date, and then faced pressure before the Fed meeting; then, it was heavily sold off again over the weekend and failed to break through the key resistance level of $64-65k. On September 23, the spot price briefly rose to the upper limit of the range, but it quickly faded, and then the Gamma contract was also heavily sold off.

-

The market has stripped out the risk premium from the front end of the curve, so election volatility has again fallen slightly. Given that the election odds are still close to 50/50 at the moment, we expect volatility to rise further as we get closer to the election.

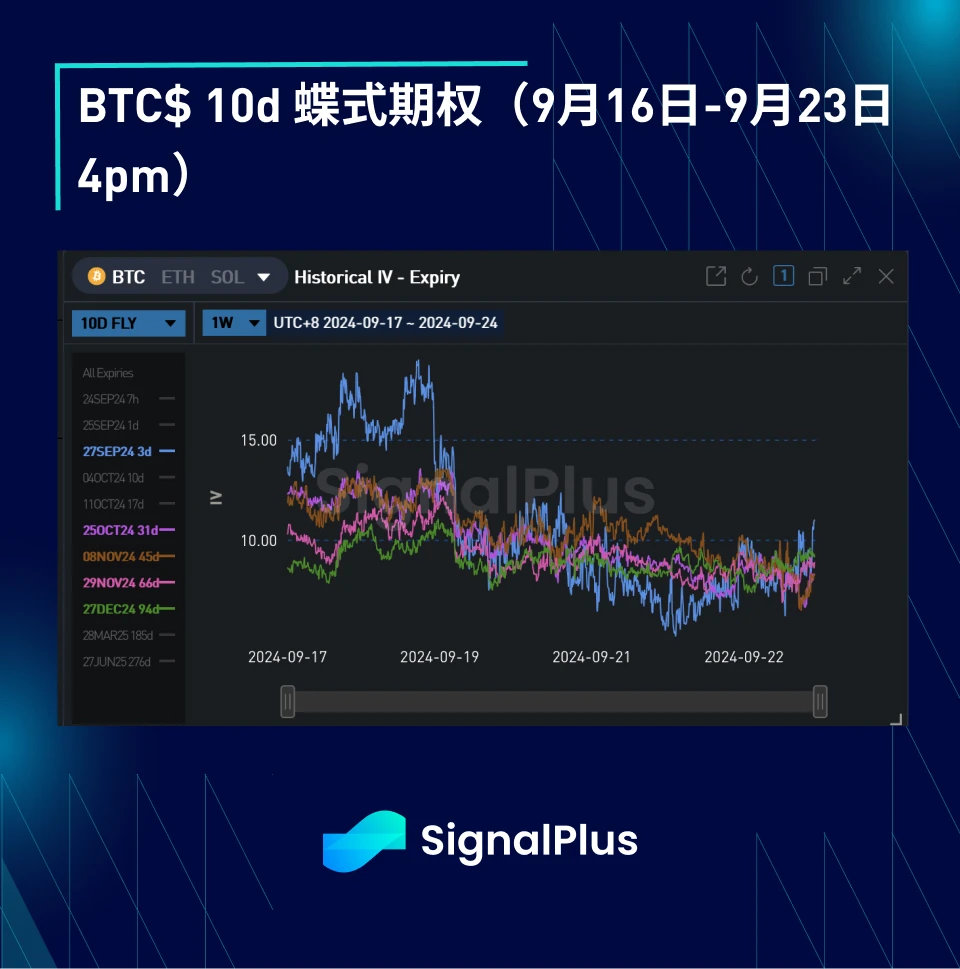

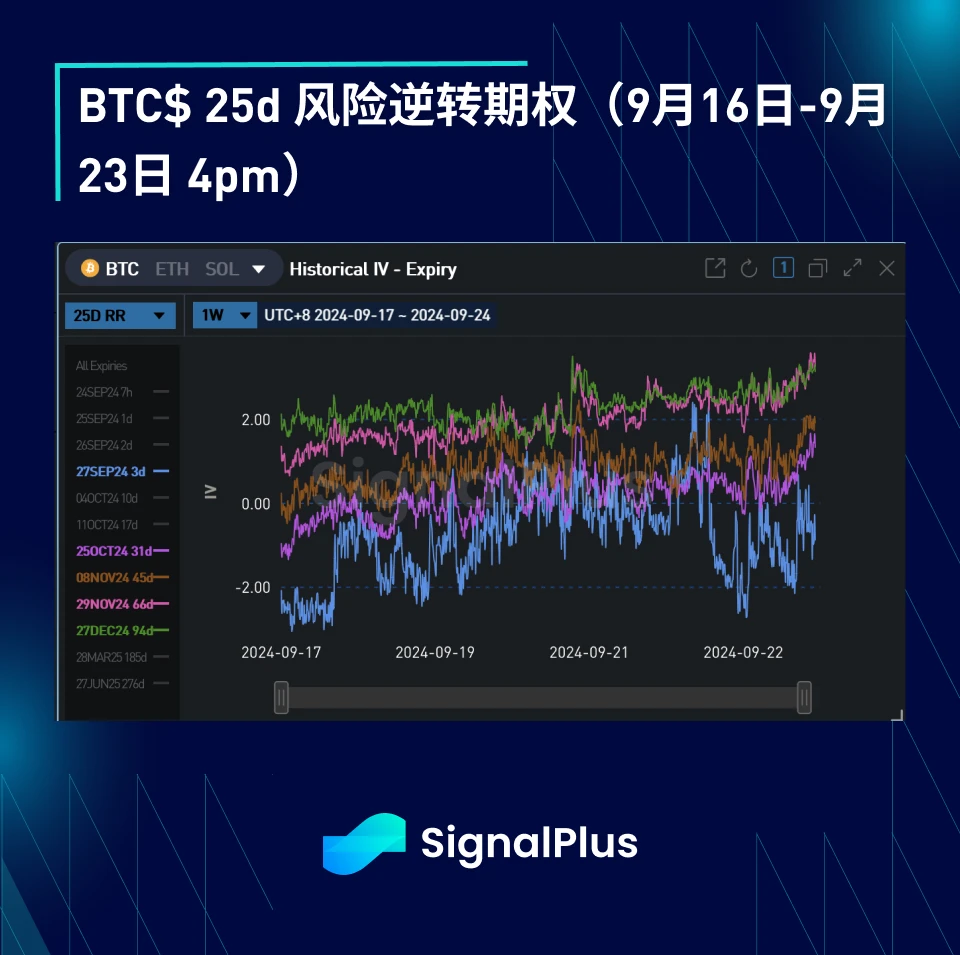

तिरछापन/उत्तलता:

-

The price skew is tilted upwards this week, with the market seeking to break through the $64-65k range resistance to drive a new round of price increases. This is reasonable in the short term, but structurally, Fed policy alone does not seem to be enough to drive spot prices to new all-time highs and form a new volatility regime before the election.

-

The market’s move to liquidate put options this week (selling a butterfly/buying a risk reversal) has reduced the butterfly premium, while on the other hand, since the FOMC, upside demand has mainly come from call spread strategies, further depressing the premium level.

Good luck to everyone this week!

You can use the SignalPlus trading vane function at t.signalplus.com to get more real-time crypto information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlusCN, or join our WeChat group (add assistant WeChat: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends. SignalPlus Official Website: https://www.signalplus.com

This article is sourced from the internet: BTC Volatility: Week in Review September 16, 2024 – September 16

Related: Overview of recent ETH airdrop opportunities and on-chain Alpha

Original author: The DeFi Investor Original translation: TechFlow 3 ETH airdrop strategies If you hold ETH, you might as well leverage it in DeFi. Currently, there are many high-quality ETH airdrop opportunities that may bring considerable returns. Although the days of depositing $100 in a dApp and getting a $1,000 airdrop are over, it is still possible to earn high double-digit annualized returns through ETH. Today, I will share the three ETH airdrop strategies that I think are most worthy of attention. Let’s find out. 1. Mantle + Karak Mantle is the most well-funded project on Ethereum’s second layer network and the developer of the rapidly growing ETH liquid staking protocol mETH Protocol . Confirmed mETH holders will receive airdrop rewards from the mETH protocol. Here is my strategy for…