वर्ल्ड लिबर्टी फाइनेंशियल के मूल्य का गहन विश्लेषण: ट्रम्प के अभियान के वित्तपोषण संबंधी नुकसान के लिए एक नया विकल्प

मूल लेखक: @वेब3 मारियो (https://x.com/web3_mario)

Abstract: First of all, I wish you all a happy Mid-Autumn Festival. During the holiday, I found an interesting topic and studied World Liberty Financial, which has been very popular in the past two days. This DeFi project, in which members of the Trump family are deeply involved, made more detailed promises in the Twitter space on September 17, including the distribution of WLFI tokens and the vision of the project. Trump spent a long time talking about his optimistic attitude towards the crypto field in the meeting. So for such a project that does not seem to be so Web3-style, how should we grasp its value? I have done some research on this point and have some experience to share with you. In general, I think the core value of World Liberty Financial lies in finding new fundraising channels to alleviate Trumps 2024 campaigns disadvantage in raising funds. Then the essence of investing in WLFI tokens is a bet on Trumps election and a political donation.

The negative image of Lianchuang and the lack of a specific roadmap make World Liberty Financial controversial

Many articles have already introduced the background of this project. Here is a brief review. In fact, the project has been controversial since its announcement. The focus of the controversy is on three aspects:

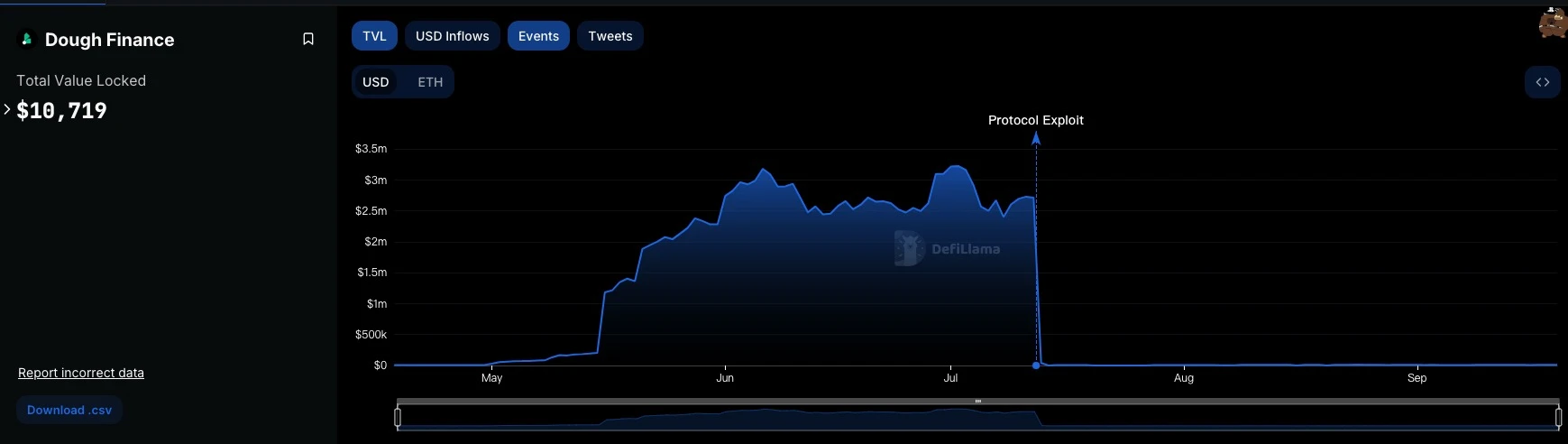

The co-founders have a negative background: considering that the two members of the Trump family who are deeply involved in the project, Eric Trump and Donald Trump Jr., do not have much experience in the crypto industry, the industry background of these two Trump sons is still related to real estate. Therefore, it is generally believed that the actual operators of the project are their two co-founders, Zachary Folkman and Chase Herro. Trump said in the live broadcast that Herro and Folkman were introduced to Trumps son by Steve Witkoff, an investor in the real estate industry. Prior to this, the two had collaborated on a DeFi lending project called Dough Finance, which was established in April 2024 and suffered a flash loan attack on July 12, losing more than 1.8 million US dollars, and then the project entered a state of stagnation. In addition, the resumes of the two are not the elite routes of most entrepreneurs in the technology or financial industries. Folkmans previous influential project was called Data Hotter Girls, a dating teaching seminar, and Herro had a criminal record in the past.

The product roadmap is not clear: Although the Trump family has been promoting the project with vague descriptions over the past month and promised that it will do many things at the same time, in fact, the project has not been able to disclose some more detailed and accurate plans or descriptions. In this twitter space, Folkman seems to have given some descriptions that the project does not try to create new financial instruments, but aims to improve the usability of DeFi. During the fireside chat, Donald Trump Jr. talked about his familys experience of being de-banked, which refers to the difficulties that some individuals or companies encounter in obtaining credit lines from established financial institutions. So it is not difficult to see that the focus of the project at the beginning of its launch should still be on the lending scenario, but such information does not seem to be enough to convince most people. And recognize its vision and business logic.

Centralization of WLFI token economics: In this interview, Folkman also gave a detailed distribution plan for WLFI tokens, 20% of the project tokens are allocated to the founding team including the Trump family, 17% of the tokens are used for user rewards, and the remaining 63% of the tokens will be available for public purchase. However, this distribution ratio seems to be very different from traditional Web3 projects. The tokens are basically concentrated in the hands of the team and the whales, and there is not even any allocation for community incentives.

So why did such a seemingly unattractive project receive strong support from the Trump family, especially when it was launched at this sensitive time close to the election? I think the core reason is to find new fundraising channels to alleviate Trumps 2024 campaigns disadvantage in fundraising. So the essence of investing in WLFI tokens is a bet on Trumps election, which is a political donation.

Trumps current campaign funds are at a clear disadvantage, and he hopes to find more flexible fundraising channels

We know that the U.S. federal government consists of three parts: the legislature, the judiciary, and the executive branch. The executive branch obtains positions through appointment, recruitment, or examination. The legislature, specifically Congress, is composed of the Senate and the House of Representatives, and members of both houses are elected. The judiciary is in between the two, and different state laws have different regulations. During his presidency, Trump appointed more than 200 federal judges, which greatly changed the ideological composition of the federal judicial system. This is also the reason why he can maintain countermeasures when facing the legal litigation crisis in the first half of the year.

The essence of an election is a political show, which requires a large amount of money to be spent on publicity in order to gain more voter support. The publicity channels cover all aspects, both online and offline. Moreover, considering that the entire publicity actually started a year before the election, the capital consumed in such a long period is far from the same level as that of events such as the release of a movie or a concert. Although the publicity rhythm is affected by some unexpected events, it is highly likely that the budget will be allocated in an increasing trend. The closer to the election, the faster the funds will be consumed.

Due to the legislative power, some interest groups will be formed between the government and the business community in this process. Some large entrepreneurs will choose to fund some politicians in exchange for the politicians promotion of some bills that are in their own interests after the politician wins the election. And this donation is the so-called political donation. In order to avoid excessive rent-seeking and the worst corruption, the US law has designed some bills to standardize the entire process. Among them, the 527 organization is a tax-free organization designed for candidates to raise funds to support elections. Of course, there are many subdivisions, with different designs for the scale of capital received and the way it is used.

Usually, a politicians performance in some key events or unexpected events will significantly affect the amount of funds raised, because funders funding for politicians is also carried out in stages. For example, a bad debate or a sudden scandal will affect the funders confidence in the entire future election and stop donating. Therefore, the fund-raising situation can more accurately reflect the performance of the candidate.

After introducing this background knowledge, lets take a look at the fundraising gap between the Trump 2024 campaign team and the current Harris 2024 campaign team. This gap is mainly reflected in two aspects: fund size and control efficiency.

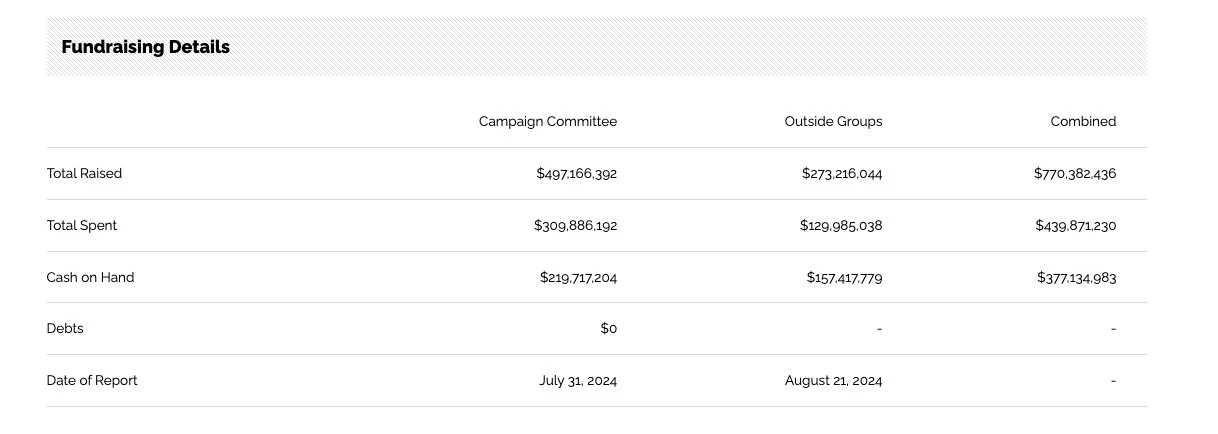

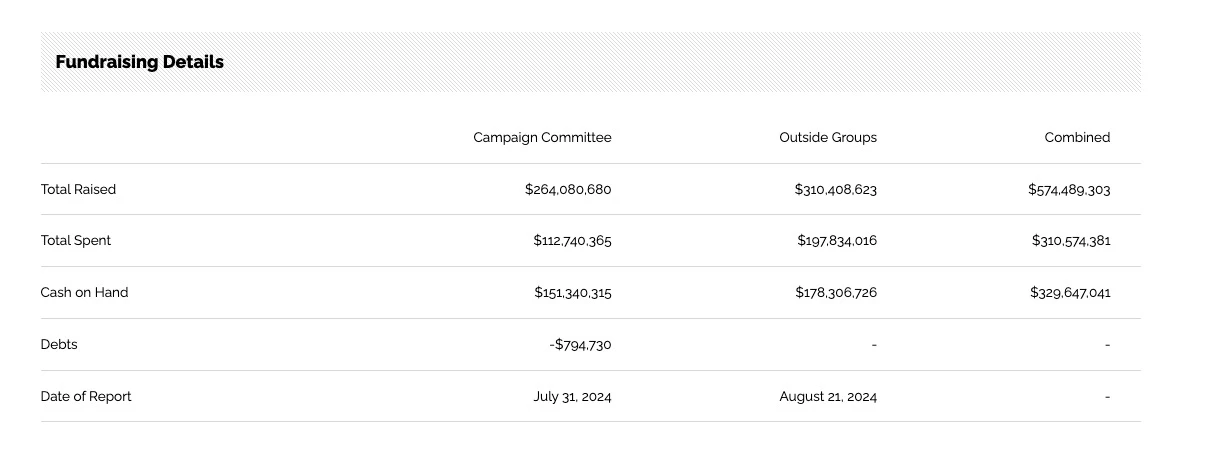

First of all, regarding the scale of funds, in fact, the Democratic Party has always been ahead of the Republican Party in the scale of campaign fund raising. This situation has intensified after Harris was formalized. It seems that the support forces within the Democratic Party have completed the integration and began to support this young candidate. So far, Harriss team has raised a total of 770 million US dollars and has spent 440 million US dollars. The Trump team has raised a total of 570 million US dollars and has spent 310 million US dollars. Whether from the perspective of the remaining funds or the funds invested in the past, the Trump team undoubtedly has a greater disadvantage, which is why after the assassination, in addition to successfully forcing the Democratic Party to replace Biden, Trumps momentum has been fading. And after the first presidential debate last week, Harris undoubtedly performed better in terms of debating skills, which allowed her to quickly raise 50 million US dollars within 24 hours after the debate, which shows her strong ability to attract money.

Of course, it is also interesting to look at the difference in funders between the two. After Biden attracted the support of billionaires such as Michael Bloomberg and LinkedIn founder Reid Hoffman, Harris herself has also won the support of many wealthy people, including Hoffman, Netflix co-founder Reed Hastings, former Meta COO Sheryl Sandberg and philanthropist Melinda French Gates (wife of Bill Gates). On July 31, more than 100 venture capitalists signed a letter supporting Harriss candidacy and promised to vote for her, including entrepreneur Mark Cuban, investor Vinod Khosla and Lowercase Capital founder Chris Sacca. Trumps core supporters include banker Timothy Mellon, wrestling tycoon Vince McMahons wife Linda McMahon, energy industry executive Kelcy Warren, ABC Supply founder Diane Hendricks, oil tycoon Timothy Dunn, and well-known conservative donors Richard and Elizabeth Uihlein, and of course Tesla founder Elon Musk. However, from this list, we can see that Harris supporters are more from the emerging technology industry, while Trumps supporters focus on traditional industries. In terms of online promotion, Harris undoubtedly has a stronger advantage, but fortunately Musk acquired Twitter. This helped Trump alleviate this disadvantage, so you will find that after Trump returns to Twitter, his online marketing position will undoubtedly revolve around the platform.

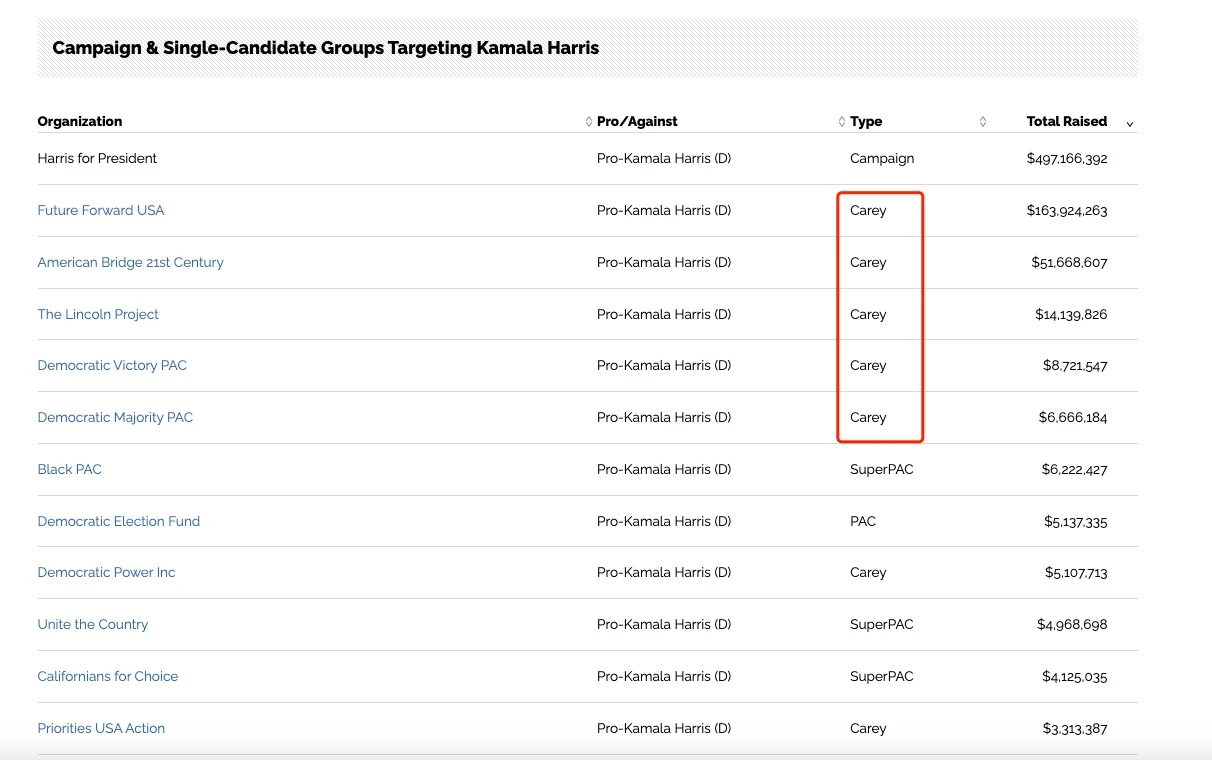

From the perspective of specific funding channels, Harriss external funding channels are mainly through Carey Committee, while Trumps are mainly through SuperPAC. Both organizations belong to the 527 organization just introduced, which has the advantage of unlimited funding donations. However, in terms of funding expenditures, the former has greater flexibility. Carey Committee has two independent funding accounts: one account is used for traditional restricted donations (which can be donated directly to candidates and political parties), and the other account is used for unlimited independent expenditures (for advertising, publicity, etc.). However, Super PAC cannot directly coordinate with the candidates campaign team or political party, nor can it directly donate to the candidate. This makes the Trump team far less efficient in the use of funds than the Harris team.

This will break everyones traditional impression that Trump is a wealthy businessman and should have more advantages in terms of funds. However, the situation is just the opposite. Harris team currently has a clear financial advantage, and this advantage has a tendency to expand further. So at this time, it is easy to understand that taking the risk to launch such an immature crypto project, which also shows that it is hoped that more and more flexible fundraising channels can be found through the crypto field. This can also be a practical expression of currying favor with previous crypto enthusiast voters to a certain extent. So it is worth taking some risks for this. Of course, this also explains why the project is based on the explanation that WLFI will follow the terms of Regulation D to raise funds without a detailed roadmap, which is also a guarantee to control risks within an acceptable range. This is the crux of the problem.

So for the Trump team, there are actually many ways to benefit from this project, in addition to the direct ICO sales. There is also an interesting project, which is to cash out using the lending platform. Remember Donald Trump Jr.s problem of his family suffering from debanking? Assuming that World Liberty Financial is successfully launched as a lending agreement and attracts a certain amount of funds, the team will be able to use the large amount of WLFI tokens they control as collateral to lend real money from the platform without having a significant impact on the secondary market price, just like the founder of Curve. This can indeed alleviate the problems they encounter.

So after considering these, I have no doubts about the launch of this project, because the essence of investing in WLFI tokens is a bet on Trumps election, which is a political donation. This plan will be favored by many wealthy people in the crypto field. The future growth depends on the result of this game. If Trump is successfully elected, such a resource-driven project will easily find the direction of specific business. If it fails, there is no doubt that the Trump family should have no time to care about this in an environment where they are busy dealing with various lawsuits. As small investors, we still need to be cautious about the relationship between China and the United States and participate in it with caution.

This article is sourced from the internet: In-depth analysis of the value of World Liberty Financial: a new option for Trumps campaign funding disadvantage

Related: Lianyuan Technology: In-depth exploration of the secondary OTC market for cryptocurrencies

This article Hash (SHA 1): 86af56a1582eed3f40b84c9c5136cd8f48c94ed9 No.: PandaLY Security Knowledge No.030 As the cryptocurrency market matures, the secondary over-the-counter (OTC) market, as an important trading channel, has gradually attracted widespread attention from investors, project owners, and foundations. This market not only provides liquidity for assets that cannot be traded smoothly on public exchanges, but also facilitates the buying and selling of locked tokens in the cryptocurrency field. However, due to its privacy and customized trading characteristics, the secondary OTC market also hides a lot of risks and compliance issues. What is the OTC market? The OTC market, or Over-the-Counter बाज़ार, is a market where buyers and sellers of assets trade through direct negotiation rather than on a public exchange. This type of trading method is usually used to deal with…