लड़ाई बढ़ती जा रही है, जिससे एथेरियम L2 युद्ध की वर्तमान स्थिति का पता चल रहा है

Original author: Ceteris

मूल अनुवाद: लफ़ी, फ़ोरसाइट न्यूज़

Last year in the Infrastructure Year Outlook report, I wrote a special chapter on L2 Wars, in which I elaborated on my views on the Rollup field and the trends in the coming year. The main points are as follows:

-

Blast is a hybrid of the Rollup architecture and will lead to the end of the kumbaya era.

-

The L2 ecosystem will become more fragmented and isolated, and L2 will launch its own cross-chain/interoperability standards and SDKs to launch new chains/L3.

-

Rollups require an alternative data availability layer (DA) to scale.

-

DA will disappear as a source of value accumulation. DA will usher in disruptive innovation, and charging a premium for DA will no longer be feasible.

-

Ethereum’s new bull market theme is “global proof-of-stake validation layer and currency”.

-

The value accumulation of the DA layer will be limited.

-

If all value is aggregated in the sorting layer, then the value accumulation of L2 tokens is theoretically positive.

The views in this article are outdated. Ethereum has experienced many crises, and the above views have been repeatedly mentioned and discussed. In fact, you can see that a large part of the Ethereum community has shifted its attention to how to expand L1 instead of transferring value to Rollup.

https://twitter.com/ChainLinkGod/status/1832198208287863174

However, everyone is watching and discussing this, it’s no longer really an “alpha” or contrarian view. So, what did we see today and what to do next?

Rollup Status

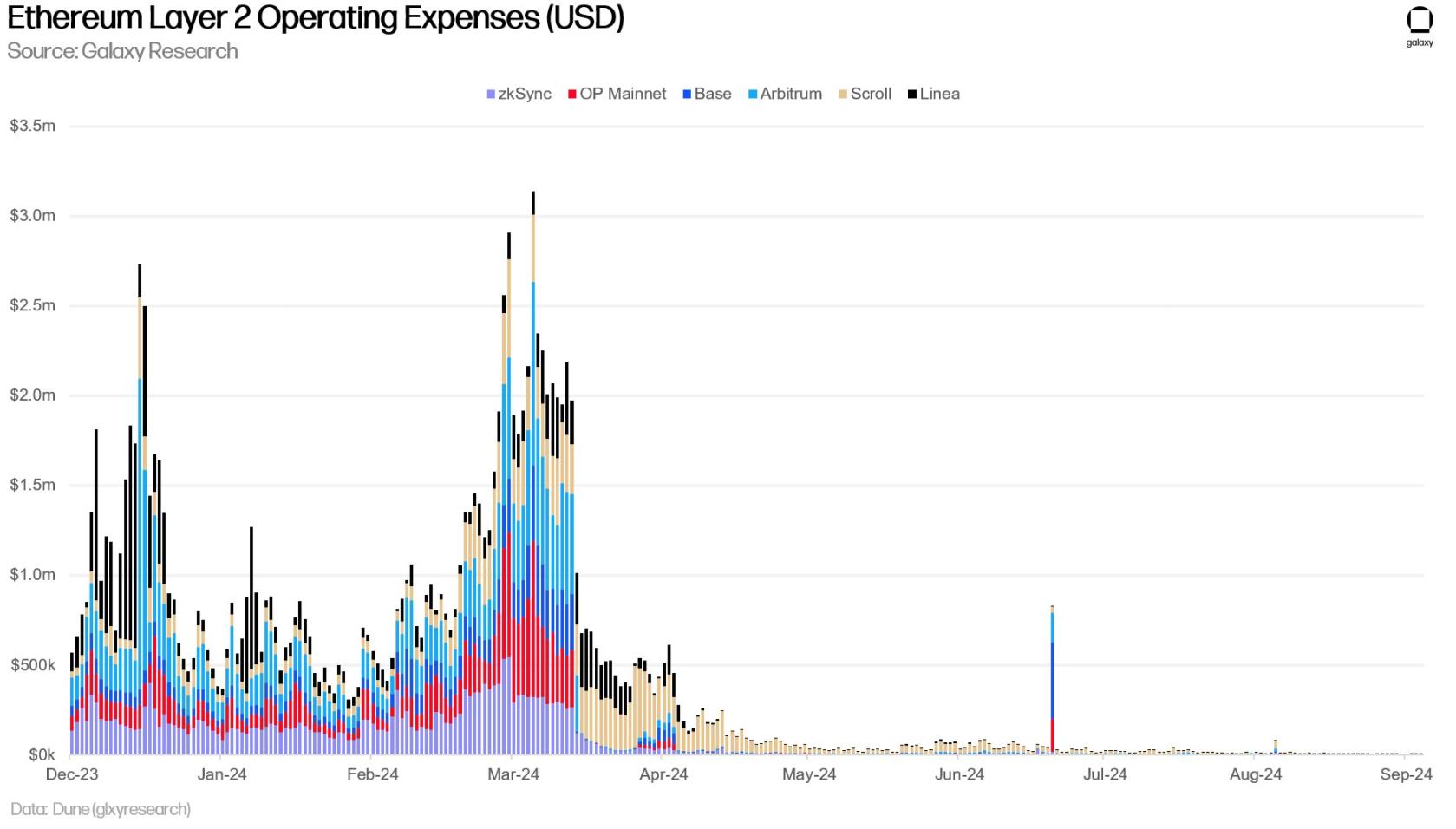

First, revenue. What happened to Ethereum’s revenue after EIP-4844? The following chart from Galaxy gives an intuitive answer, DA is no longer an important value driver for the Ethereum economy.

Is this an entirely bad thing? No! Ethereum has no choice. As we’ve highlighted, DAs have undergone “disruptive innovation,” which means that charging a premium has become more challenging. While we’re sure Ethereum will still be able to charge higher fees than other DA layers so that Rollups can inherit the full security of Ethereum, it’s not clear to what extent Rollups will be able to do this. The main benefit of a shared DA layer is interoperability. By sharing a DA layer, cross-chain becomes more secure, and economies of scale can be achieved this way. Again, while this is a key benefit, no one really knows how much this benefit is worth. Will Rollups pay 10 times the fees of other DA layers? Or 100 times? There is a definite answer to this question, we just don’t know how much it is.

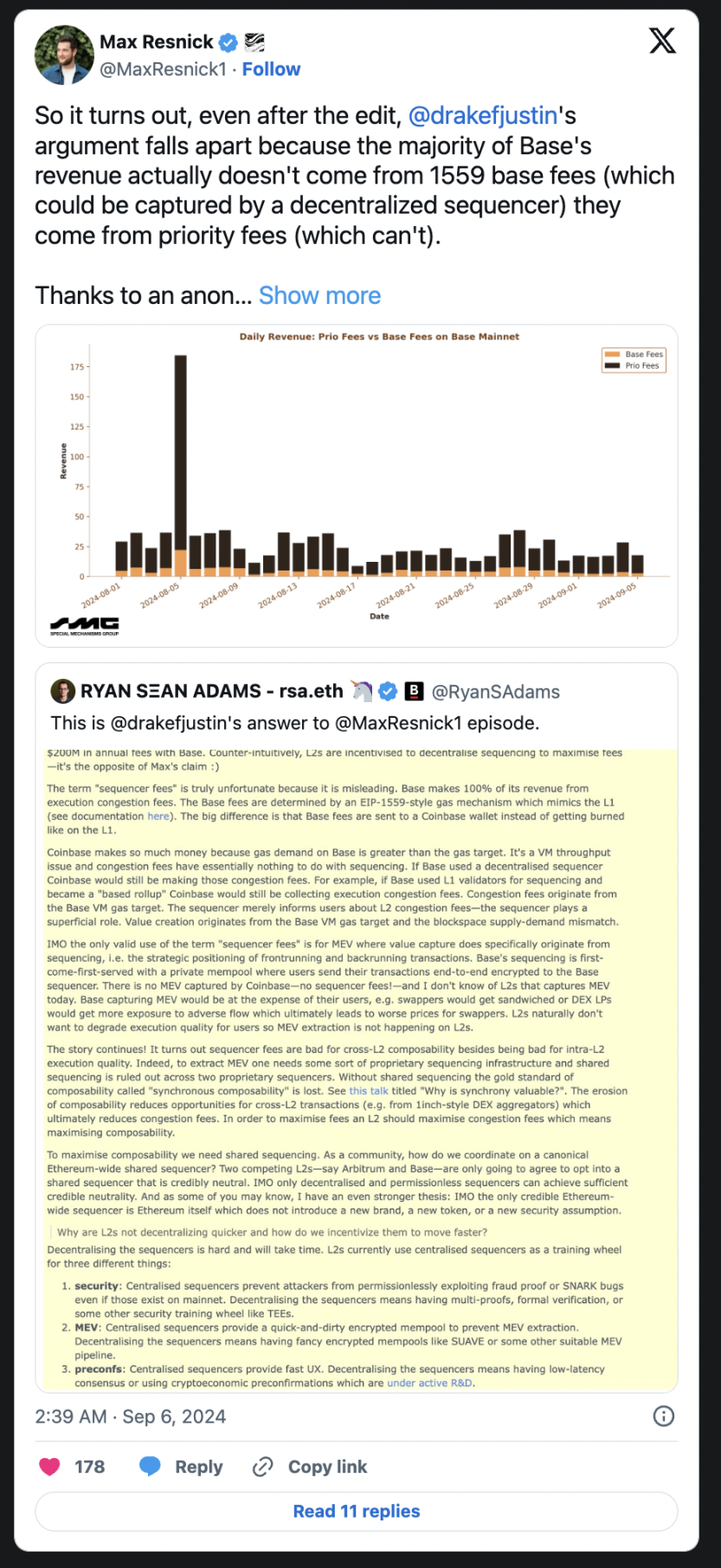

Therefore, the reduction of Ethereum DA fee income is natural, and it has no choice. Now, some people have begun to question the Ethereum Rollup roadmap, represented by Max Resnick and Doug Colkitt.

https://twitter.com/0x doug/status/1831898285130330367

https://twitter.com/MaxResnick1/status/1831764059664085461

Now that everyone agrees on the impact of DA’s disruptive innovation on the Ethereum economy, is it doomed to fail?

The Path Forward for Ethereum

As we said in our annual outlook report, the theme of Ethereum now boils down to Global Proof-of-Stake Validation Layer and Currency. What does this mean exactly?

OK, that’s not entirely true, but we do know what it means. Ethereum is the most decentralized and oldest base layer, which gives it a competitive advantage over all other blockchains for asset issuance and proof of proof. Even if the economics aren’t as strong, Ethereum is still a premium asset. However, removing all the execution work would return Ethereum to its pre-EIP-1559 economic model, where ETH is mostly recycled.

https://twitter.com/ceterispar1bus/status/1815855290577031247

That’s why we’re starting to see a lot of renewed focus on L1 scaling and moving applications back to Ethereum L1. We know that execution on L1 incurs fees. What we don’t know is whether the world will adopt ETH as money. If every Rollup used ETH as money, it would become a non-state-backed currency used around the world like BTC. To me, this is an optimistic and possible outcome, the challenge is that whether Vitalik, Justin Drake, you, or I think ETH is money is largely irrelevant.

Will ETH become the world currency?

We return to the previous question: Why are people trying to scale L1 again and increase L1 fees? Is this correct? Felipe from Theia argues that if we value L1 tokens based solely on MEV and fees, they will go to zero anyway, so the only thing that can justify their valuation is to become an emerging market reserve asset, i.e. currency. I support this view.

https://twitter.com/TheiaResearch/status/1829508309696786700

Finally, Wei Dai believes that for a Rollup-centric roadmap to be economically viable, Ethereum needs to provide network effects for L2 in two ways:

-

Providing composability and censorship resistance based on ordering.

-

More robust shared settlement, where assets issued on one L2 can also be used on other L2s to eliminate fragmentation.

This is the only way for Ethereum to work in the long term.

https://twitter.com/_weidai/status/1830488020556083533

I think all of the above are valid points, but I don’t know what the real answer is. There is a view that if Ethereum focuses on scaling L1 again, it will just become a “worse Solana” because Ethereum will never be able to compete with Solana in terms of L1 execution. I don’t think anyone really knows the outcome, people just believe in different things. Ultimately, the market will decide what is valuable.

This article is sourced from the internet: The battle is escalating, revealing the current status of the Ethereum L2 war

Original author: 0x Facai On August 20, 2024, the Chinese 3A masterpiece Black Myth: Wukong that millions of players have been looking forward to was finally officially launched. The number of online players of the game once exceeded 1.4 million, ranking fourth in the history of Steams highest number of online players. Not only in China, Black Myth: Wukong also continues to dominate the list of Steams global best-selling products. In addition, on the homepage of todays Youtube live broadcast, almost all of them are Black Myth game live broadcasts. As the first truly 3A masterpiece, Black Myth received relatively high scores from foreign media such as IGN in its first battle, and countless Chinese players sighed: When playing games, I finally dont have to go online to search for…