सिग्नलप्लस वोलैटिलिटी कॉलम (20240909): एक और मैक्रो सप्ताह

Last Fridays lower-than-expected non-farm payrolls and downward revisions to previous figures have once again raised concerns about a recession, causing the U.S. stock market to post its worst weekly performance since March 2023. Negative risk sentiment has also dragged down the performance of digital currencies, once again confirming the curse from seasonal statistics. At the same time, U.S. bonds have seen a steep bull trend, and the 2/10s yield has finally ended its inverted pattern.

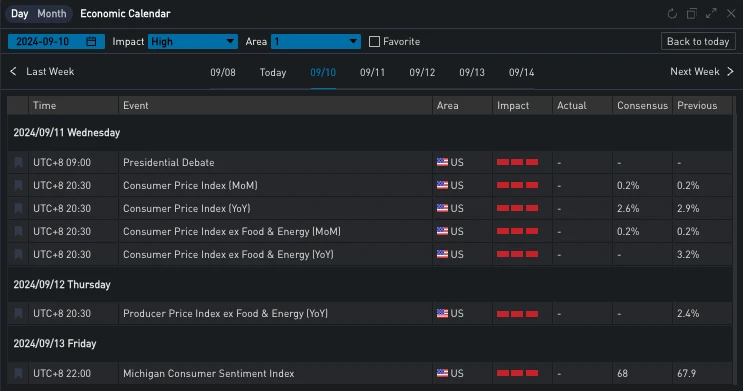

स्रोत: सिग्नलप्लस, आर्थिक कैलेंडर

This week, the crypto community is still focusing on macro events. After a quiet weekend, option market makers have quietly raised the front-end IV. Although BTC and ETH are very similar in Term Structure, the details are slightly different. First, notice that the peak of BTCs front end is at 11 SEP and ETHs is at 12 SEP. The two expiration dates are priced-in with very high Vol Premium.

The uncertainty of the 12 SEP mainly comes from the CPI data. Although the influence of inflation data has retreated to that of employment data, it has once again become the top priority in the minds of financial traders this week and may become a decisive factor in determining whether the Federal Reserve will cut interest rates by 50 basis points at the FOMC meeting in late September.

For traders who bought 11 SEP, the main focus was on the presidential campaign speech at 9 a.m. Beijing time. This confrontation was the first and perhaps only opportunity for Trump and Harris to face off head-on, with less than two months until the official election day, forcing them to seize every opportunity to convince voters. Topics about digital currencies were bound to appear in the conversation between the two sides, and the market gave BTC a higher correlation, which was also reflected in the term structure.

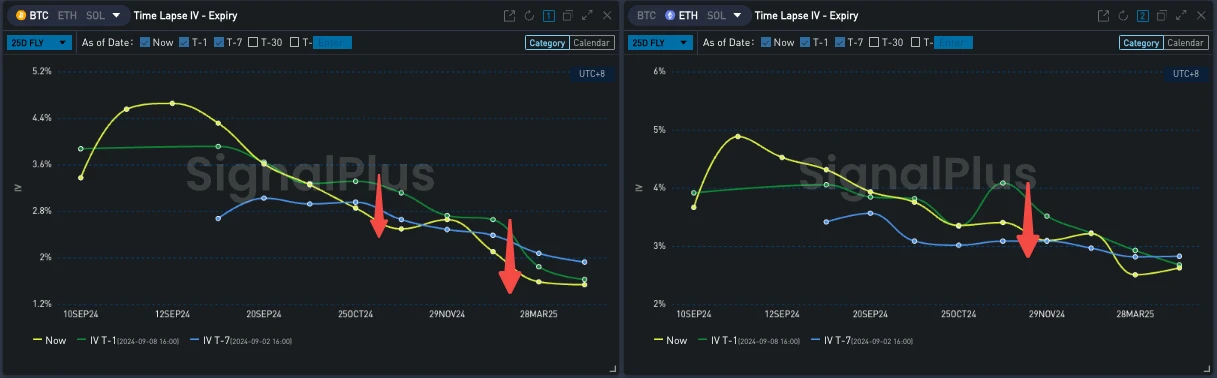

स्रोत: सिग्नलप्लस

The middle of the term structure forms a trough with 25 OCT as the lowest point, and uncertainty is allocated to the days before the FOMC meeting and the presidential election. The two currencies have slightly different structures in Forward IV. The low point of ETH 12 SEP-13 SEP has the opportunity to be leveled and corrected. The flat slope of ETH at the end of the month and the Vol Premium that is 10% higher than BTC may also attract cross-currency volatility trading.

Judging from the curvature of the volatility smile, the far end of Fly has retraced after a brief rise, approaching the level of a week ago.

Source: Deribit (as of 9 SEP 16: 00 UTC+ 8)

स्रोत: सिग्नलप्लस

आप t.signalplus.com पर सिग्नलप्लस ट्रेडिंग वेन फ़ंक्शन का उपयोग करके अधिक वास्तविक समय की क्रिप्टो जानकारी प्राप्त कर सकते हैं। यदि आप हमारे अपडेट तुरंत प्राप्त करना चाहते हैं, तो कृपया हमारे ट्विटर अकाउंट @SignalPlusCN को फ़ॉलो करें, या हमारे WeChat समूह (सहायक WeChat जोड़ें: SignalPlus 123), टेलीग्राम समूह और डिस्कॉर्ड समुदाय में शामिल हों ताकि अधिक मित्रों के साथ संवाद और बातचीत कर सकें।

सिग्नलप्लस आधिकारिक वेबसाइट: https://www.signalplus.com

This article is sourced from the internet: SignalPlus Volatility Column (20240909): Another Macro Week

Original author: Bird Brother DappOS is not unfamiliar to Web3 users. In the last round of AARK airdrop, many users received thousands of ARBs. It is difficult to get back from reliable projects. The key is that DappOS is a top-level project led by Binance and Ploychain, and participated by many institutions such as IDG, Sequoia, OKX, and HashKey. It just completed a $15.3 million Series A financing in March this year, with a valuation of $300 million. Today, I will share a three-way idea of using SOFA to interact with DappOS. You can deposit idle funds into SOFA to get high returns and share 33% of the $RCH airdrop of the SOFA project. You can also get activity incentives up to 70,000 U. It can be said that you…