फोरसाइट वेंचर्स: इंटेंट एसेट, वेब3 एसेट के बड़े पैमाने पर अनुप्रयोग के लिए प्रवेश बिंदु

Original author: Mike@Foresight Ventures

The revolution of idle assets

In 2013, Alibabas Yuebao was launched, bringing asset management into a new era. Before that, it was difficult for ordinary users to find a safe and efficient way to manage their idle funds. Banks current deposit interest rates were low, and financial products were complicated and difficult to understand. The birth of Yuebao changed everything.

The birth of Yuebao

It was an era when Internet finance had just emerged. The Alipay team realized that users often had some idle funds in their payment accounts. If these funds could be invested, it would not only bring benefits to users, but also improve user experience. So they jointly launched a product called Yuebao with Tianhong Fund.

Yuebao is easy to use. Users only need to click a few times in the Alipay App to transfer their account balance to Yuebao and start enjoying the benefits of daily settlement. This transparent and convenient way of financial management quickly won the favor of users. Soon, the number of Yuebao users exceeded 10 million, and the scale of funds managed also rose rapidly.

Web3 Opportunities

With the development of blockchain technology and Web3, a new era of asset management is coming. Products similar to Yu’ebao are also emerging in the Web3 field.

The Web3 version of Yuebao has great potential because it can fully utilize the many advantages brought by blockchain technology and the huge market opportunities provided by the large amount of idle assets on the current chain:

1. Hundreds of billions of dollars of idle assets on the chain

There are a large number of underutilized assets in the blockchain ecosystem, with a total value of hundreds of billions of dollars. Many users store their cryptocurrencies in their wallets, waiting for the market price to rise, and these assets do not generate any income during the idle period. The Web3 version of Yuebao can effectively utilize these idle assets by providing functions similar to money market funds in traditional finance, providing users with stable income. This model can not only increase the utilization rate of user assets, but also promote the liquidity and activity of the entire blockchain ecosystem.

2. Decentralization and transparency

The Web3 version of Yuebao is based on blockchain technology and has the advantages of decentralization and transparency. Unlike traditional financial institutions, users can directly make investment operations through smart contracts without relying on intermediaries. This decentralized model reduces intermediaries, reduces operating costs, and improves investment efficiency. In addition, all transactions and capital flows are recorded on the blockchain, which users can view and verify at any time. This transparency enhances user trust.

3. High liquidity and convenience

Compared with traditional financial products, Web3 Yuebao usually has higher liquidity. Users can deposit or withdraw funds at any time without worrying about lock-up periods or penalties for early redemption. This high liquidity makes Web3 Yuebao more flexible and able to meet the diverse needs of users. In addition, with a user-friendly interface and simple operation process, Web3 Yuebao can provide users with a convenient investment experience.

4. Diversified sources of income

The Web3 version of Yuebao can use various decentralized finance (DeFi) protocols on the blockchain to provide users with diversified sources of income. For example, users can earn income by participating in lending agreements, liquidity mining, staking, etc. Unlike traditional money market funds, these sources of income include not only interest, but also platform token rewards and other forms, making users investment returns richer and more diversified.

5. Wider user coverage

Blockchain technology enables the Web3 version of Yuebao to cover users around the world without being restricted by region or country. Any user with Internet access can participate in the investment, which brings it a broad market prospect. Especially in some areas where traditional financial services are underdeveloped, the Web3 version of Yuebao can provide users with a new way to manage their finances and fill the gap in financial services.

In the Web3 field, the emergence and development of LST (liquidity pledge token) and LRT (liquidity re-pledge token) proves the huge potential and opportunities of this market. Although most products can generate stable income, their application scenarios are still relatively limited. Yuebao not only supports friend transfers, but also shopping on Taobao, and the user experience is almost the same as a bank account. However, the Web3 products currently on the market have not yet reached the level of widespread application like USDT or ETH.

Traditional TVL model is stuck

In the bull market of the crypto market in the first half of this year, Total Value Locked (TVL) has become the core indicator for the publicity and promotion of major projects. TVL is usually used to measure the total amount of assets locked in DeFi projects, reflecting the user participation and market trust of a project. It is a relatively effective indicator in the past crypto market cycles, because TVL represents actual real money, and its counterfeiting cost is much higher than other data indicators such as the number of addresses and social media attention. Therefore, projects with higher TVL have obvious advantages in market promotion and attracting investors.

In this context, many projects attract users by offering high yields and airdrop incentives to store assets on their platforms, thereby quickly increasing their TVL data. This strategy is intended to demonstrate the strength and attractiveness of the project, but this approach has exposed some problems in this cycle.

TVL Rigidity

As the market develops, investors have discovered that there are significant problems with the TVL narrative of this cycle. After many projects issue coins and go public on exchanges, their TVL tends to decline rapidly. These TVLs are not contributed by a wide range of crypto users, but by a small number of large users or pre-negotiated partners who quickly increase TVL in a short period of time through the mining, withdrawal and selling method to realize cashing out. This rigid TVL does not represent the true vitality of the project ecosystem, but a short-term data surge achieved through artificial manipulation.

This phenomenon has triggered broader industry issues, such as some high TVL projects repeatedly delaying the time of airdrop distribution or user asset unlocking due to concerns that once cashed out, these TVLs will be lost quickly. As a result, the credibility and validity of TVL as a measure of the vitality of an on-chain ecosystem has also been questioned.

Why does TVL rigidity occur?

The reason for the rigidity of TVL is that for ordinary crypto users, the absolute benefits of participating in these projects are limited, and once the market fluctuates, the cost of withdrawing assets or converting them is high, or it takes a long time to wait, which may lead to missing market opportunities. In other words, the opportunity cost of participating in these projects is too high for ordinary users, so their willingness to participate is low, resulting in TVL being dominated by large users and becoming a tool for them to cash out.

In-depth discussion: TVL projects are difficult to meet users’ asset usage needs

The project owners are aware of this problem and have tried to optimize it, but these measures are often limited in effect and difficult to truly meet the needs of users. The current TVL project mainly provides two ways to exit assets: one is for users to actively apply to the project owner to redeem assets, and the other is to exchange them in a decentralized exchange (DEX) through derivative assets (such as xxETH).

However, no matter which method is used, if users want to have a good liquidity experience, one party needs to pay high maintenance costs. For example, in the redemption plan, the project party needs to bear the continuous maintenance costs , which usually causes users to wait for a long time to redeem their assets; and in the liquidity pool plan, the LP (liquidity provider) who provides liquidity also needs to bear the costs, which often leads to insufficient pool depth, high slippage, and even a large price difference between derivative assets and native assets when the market fluctuates.

इसलिए, when asset liquidity solutions require specific parties to bear high maintenance costs, these costs will eventually be passed on to users, resulting in a poor user experience. To solve this structural problem, fundamental reforms are needed from the bottom up. After in-depth research, we found that the Intent Assets recently launched by dappOS can effectively meet this challenge.

dappOS Intent Assets: Make revenue assets available on-chain at any time

dappOS is an intention execution network that has received investments from top institutions such as Binance Labs and Polychain. Its latest valuation has reached $300 million, making it a leading project in the intention track. The intention assets launched by dappOS allow users to enjoy higher asset yields while ensuring that their assets are available on the chain at any time. Whether users bring intention assets to exchanges as native assets or purchase new MEME coins on the chain, users can use them directly. Users can directly use intention assets for transactions and transfers without having to wait for a long time or endure high slippage.

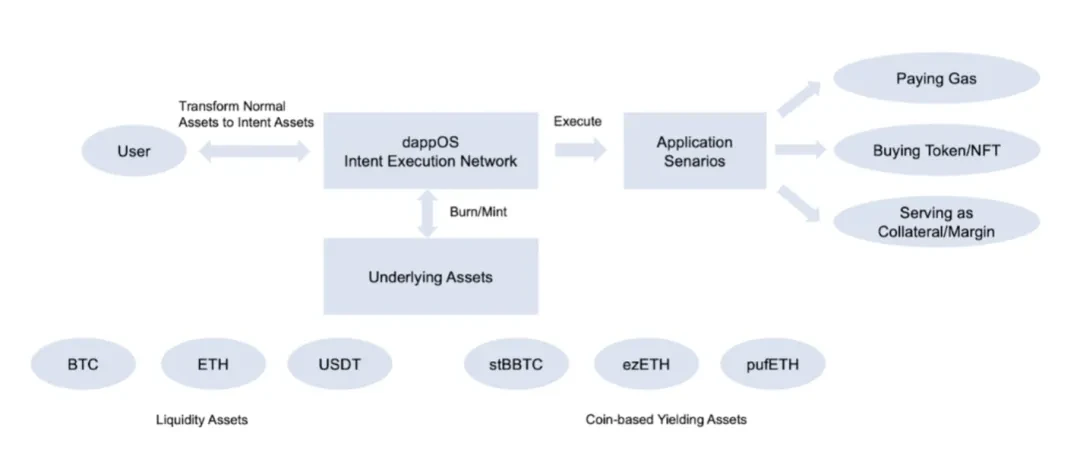

The reason why intent assets can do this is because of the dappOS intent execution network behind it. There are many decentralized service providers in the network. When a user puts forward the demand of converting intent assets, the network will ask these service providers for quotes and find the most suitable service provider to complete the task. Each service provider can make a quote based on its own situation and complete the users needs at the lowest cost. The network does not care about the specific method used by the service provider, but only cares whether the task can be completed within the specified time.

In this way, the dappOS intention execution network eliminates the need for a single service provider to bear high maintenance costs, achieving a dynamic balance between liquidity maintenance costs and actual needs. Since the network allows service providers to adopt on-chain or off-chain solutions, such as leveraging tools from centralized exchanges, this further reduces liquidity maintenance costs and optimizes user experience.

What is an Intent Asset?

Intent Asset is a new type of asset supported by dappOS that can automatically adapt to different scenarios and generate interest when idle. Similar to the principle of Yuebao, by aggregating interest and application scenarios such as Pendle, Babylon, Benqi, Berachain, BounceBit, Ether.Fi, GMX, KiloEx, Manta, Puffer, Pendle, QuickSwap, Taiko, Zircuit, etc., and then executing it on the backend through the nodes of the intent network, intent asset can have a wide range of application scenarios while generating interest.

Taking stablecoins as an example, dappOS provides a flexible asset called intentUSD. This asset can not only be used as currency, but also generate interest when idle. This innovative approach allows stablecoins to automatically convert between different forms based on user needs. For example, when USDT is needed, intentUSD can be used as USDT; and when USDC transactions are made, intentUSD can be converted into USDC.

DappOS helps users handle the staking, unstaking and conversion of yield-generating assets through its intent execution network, ensuring that they are directly usable in different scenarios. In this way, intent assets are basically the same as native assets such as USDT or ETH in terms of usage functions, but they continue to generate income when idle.

Key benefits include:

-

Instant Redemption : No waiting or lock-in period.

-

High yield : For example, the annual yield of USDT/USDC is 12%, and that of ETH is 7%, and the income is distributed in real time without waiting for token issuance.

-

Easy to use : When interacting with dApps or withdrawing to exchanges, the USDT/ETH balance will be loaded directly, and the user experience is no different from native USDT/ETH.

In this way, intent assets are not only functionally equivalent to native assets, but can also continue to generate income when idle, greatly improving the utilization efficiency and income level of users assets.

Interaction example:

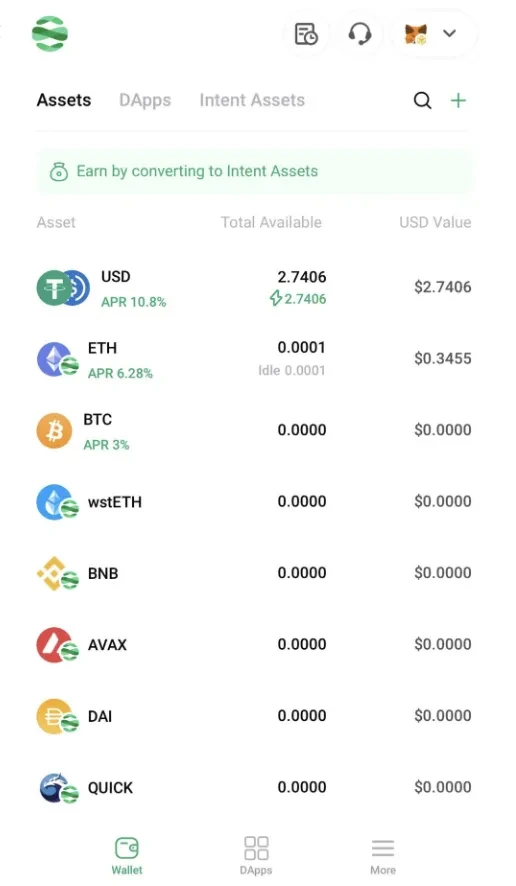

The following figure shows the interface of normal interest generation of intUSD after generating intent assets in DappOS

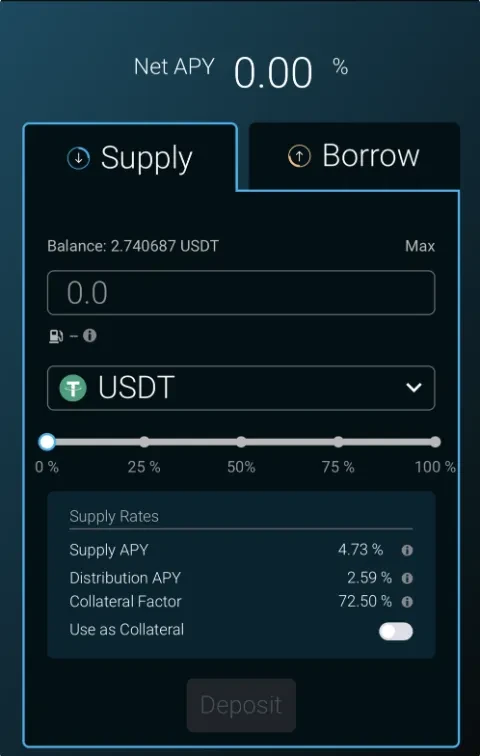

When we switched to Benqi, we found that Benqi automatically recognized intUSD as USDT and could be used normally.

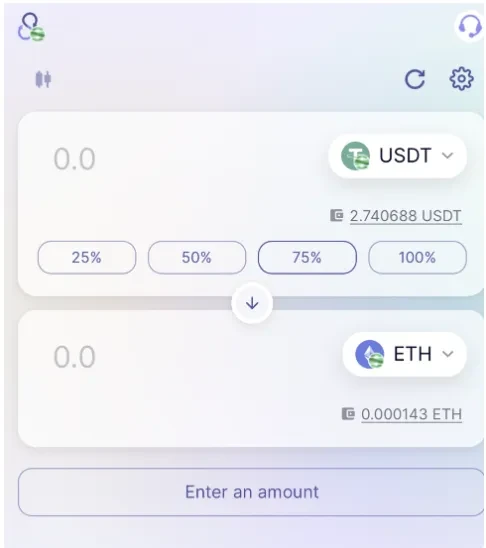

When you go to the syncswap interface, intUSD will also be recognized as USDT/USDC. In different dapps, intUSD can be used as the USD asset supported by this dapp.

Intent asset has a wide range of application scenarios and has unique advantages in different customer groups and scenarios:

DeFi Player: Alex

Alex is an experienced DeFi player who is familiar with various decentralized financial protocols and tools. One day, he discovered the Intent asset of dappOS and felt that this was a great opportunity to utilize his existing assets.

Alex has some idle ETH, and he decided to convert it into intentUSD and use it to generate income. He staked intentUSD in the liquidity pool of dappOS and started to earn staking rewards. Later, he saw a new liquidity mining project that offered high returns, so he transferred part of intentUSD to the liquidity pool of the project to get additional rewards.

Soon after, Alex needed some stablecoins to participate in an emerging DeFi project. He converted part of his ETH into intentUSD and used it directly in this DeFi project. In this way, he maintained the flexibility of his assets and maximized his returns in different DeFi platforms. Or Alex wanted to replenish margin on Arbitrums GMX to trade perpetual contracts. He found that he could use intentUSD directly as USDC without the additional conversion step.

New player: Lisa

Lisa didn’t know much about Web3 and cryptocurrency, but she heard a lot about digital assets and DeFi and decided to give it a try. She bought some USDT but didn’t know how to make better use of these assets.

Lisa learned about the Intent asset of dappOS through a friends recommendation. She decided to convert her USDT into intentUSD. At first, she just kept intentUSD in her wallet and checked the interest income it generated every day. She was satisfied with this simple and convenient way of financial management because the income was significantly higher than traditional bank deposits, and there was no need to exchange it into other assets or perform complex operations such as cross-chain and staking.

One day, Lisa wanted to use some of the interest to buy groceries. Unfamiliar with on-chain operations, she tried to withdraw IntentUSD directly to the exchange and then use the exchanges debit card to make purchases. Due to her lack of understanding of on-chain operations, she repeatedly encountered setbacks, but she found that IntentUSD could be smoothly withdrawn to the exchange and magically converted into USDT/USDC, and that gas fees could be settled by IntentUSD.

Institutional Investors

Imagine a traditional large investment institution that manages billions of dollars in assets. They have a strong interest in the blockchain and DeFi fields and are looking for a stable and efficient way to invest.

They noticed the Intent asset of dappOS and thought it was a good opportunity to optimize fund management. The institution decided to allocate part of the funds to intentUSD in order to obtain stable returns without affecting liquidity. They used the Intent execution network of dappOS to convert intentUSD on different chains and diversify investments to reduce risks.

Institutions also use intent assets to participate in various high-yield DeFi projects. For example, they use part of intentUSD for liquidity mining to earn additional rewards. At the same time, in the event of market fluctuations, they can also withdraw intent assets at any time to ensure that they can be quickly converted into fiat currency for emergency processing when needed, ensuring the immediacy and flexibility of entry and exit, and achieving stable income growth. Due to the characteristics of the intent network, security is also guaranteed, and its asset portfolio can be efficiently managed and optimized.

Whether you are an experienced DeFi player, a newcomer to Web3, or a large institutional investor, dappOSs Intent assets provide solutions that adapt to different needs. Through these stories, we can see the wide application and huge potential of Intent assets in various scenarios, helping users to achieve efficient asset management and maximize returns in the blockchain world.

The principle of Intent Asset

Intent assets leverage the unique capabilities of the dappOS execution network, taking the users ordinary or intent assets as input and outsourcing complex settlement tasks to the networks service providers to achieve the users expected results. Users do not need to worry about the underlying operational processes, but only need to focus on the final results of the transaction, such as earning revenue, completing interactions with dApps, and withdrawing to centralized exchanges.

The OMS (Intent Management System) mechanism of dappOS gives nodes a high degree of freedom to optimize costs and efficiency without compromising user security. The OMS mechanism allows nodes to flexibly adjust resources according to actual conditions to achieve optimal performance and cost-effectiveness by assigning a predetermined value to each intent task. In this way, the users intent tasks can be executed at the fastest speed and lowest cost, ensuring a smooth and efficient user experience while maintaining a high level of security for user assets.

dappOSs Intent Execution Network not only handles different types of intent tasks, but also ensures that these tasks are seamlessly compatible across different blockchains and decentralized applications. Users can freely use Intent assets in a multi-chain environment without worrying about compatibility issues between different assets. For example, users can withdraw intentUSD as USDT on an exchange when needed, or use it as USDC on Arbitrums GMX. This flexibility and compatibility enables Intent assets to be flexibly used in a wide range of application scenarios, providing unparalleled convenience.

Users earn income based on USDT, ETH, and BTC by holding intent assets (such as intentUSD, intentETH, and intentBTC). These income mainly comes from the stable appreciation of underlying assets (such as wstETH, sUSDe, sDAI, and stBBTC) and participation in income-generating activities in decentralized finance (DeFi) protocols. The underlying assets are designed to appreciate steadily, ensuring the stability and growth of income, allowing users to maximize their income while maintaining asset liquidity.

Possible future challenges

Although dappOS Intent assets have shown great potential in terms of on-chain liquidity and global access, their success faces challenges in terms of user acceptance, technical complexity, market competition, regulatory compliance, liquidity management, and user experience. Only by continuously optimizing and improving these aspects can we truly achieve its widespread application and long-term development in the blockchain financial ecosystem.

1. Regulatory pressure

As the scale of funds increases, regulators will place higher requirements on Intent Asset risk management. As a new type of on-chain fund, Intent Assets has attracted a large number of individual investors, which means that its fund liquidity and risk management need to be more stringent. In order to prevent systemic risks, regulators may introduce more restrictive measures, such as limiting the investment amount of a single user, raising liquidity requirements, etc. These measures may affect the yield and user experience of Intent Asset.

2. Intensified market competition

When Intent Asset gradually gains attention, it will attract a large number of competitors. Various ecosystems may launch their own Intent Asset to enter this field in order to seize the market, attracting users by offering higher APY and strategies, or even airdrop expectations. However, DappOSs first-mover advantage in the intent network and the teams foresight will raise this barrier.

3. Declining yields

As the market changes and the scale of funds expands, the yield of Intent Asset may experience some fluctuations. Although the yield of Intent Asset is still competitive, the downward trend compared to the high yield in the early days may affect users investment enthusiasm and lead to capital outflow. DappOS can maintain its leading position in yield by aggregating more protocols or seeking new revenue opportunities off-chain. The advantage of DappOS is that every time a new opportunity arises, hungry MEV searchers will take the initiative to fill the gap in the market, absorb new revenue, and feed it back to the users wallet.

4. Liquidity Management

As a highly liquid fund asset, Intent Asset needs to respond to users withdrawal needs at any time. This requires it to ensure sufficient highly liquid assets while maintaining a certain rate of return. This balance is a complex challenge, especially when the market is volatile. How to ensure sufficient liquidity is an issue that Intent Asset needs to focus on.

5. Diversified user needs

As the number of users increases, their financial management needs become more diverse. Different users have different preferences for risk, return, liquidity, etc., which requires Intent Asset to provide more diversified financial products and services. However, too many product choices may increase the complexity and risk of operations. How to find a balance between meeting user needs and controlling risks is a difficult problem that Intent Asset needs to solve.

6. Technical and security risks

As a financial product that relies on the Solver network, Intent Asset faces technical and security risks. With the endless hacker attacks on the chain, the Rug pull of the Defi protocol and the MEV generated, how to ensure the security of users funds has become an important challenge that Intent Asset must deal with. In addition, the rapid development of technology also requires DappOS to continuously upgrade its Solver system to maintain its competitiveness.

7. User Acceptance and Education

Although Intent Asset provides a flexible way to generate income, it takes time for users to understand and accept this new type of asset, especially those who are not familiar with crypto assets and blockchain technology. In the long-term development of Web3, DappOS still needs to carry out extensive user education and promotion activities to help users understand how to use Intent Asset and its advantages.

This article is sourced from the internet: Foresight Ventures: Intent Asset, the entry point for large-scale application of Web3 assets

Related: In-depth analysis: Bitcoin Staking and Restaking project overview and future trends

Original author: CryptoMemento Original translation: Vernacular Blockchain The crypto bear market is taking another turn. It’s a perfect time to write about Bitcoin. With news coming out about many restaking protocols, there’s a lot to discuss. In today’s article, we will walk you through the shift in Bitcoin’s positioning in the Bitcoin Staking/Restaking track, the uses of Bitcoin Liquid Staking, active participants, and future trend forecasts. Abstract: Bitcoin is about stability and security at its core, but with hot topics like Ordinals, Bitcoin NFTs, and Inscriptions, the Bitcoin community is experiencing a Bitcoin Renaissance, with entrepreneurs trying to build Bitcoin layers and ecosystems. Bitcoin is a permissionless protocol that anyone can build on, including those who want to build a Bitcoin-driven financial system and credit system. Bitcoin staking and restaking…