साप्ताहिक संपादकों की पसंद ओडेली प्लैनेट डेली का एक कार्यात्मक स्तंभ है। हर हफ़्ते बड़ी मात्रा में वास्तविक समय की जानकारी को कवर करने के अलावा, प्लैनेट डेली बहुत सारी उच्च-गुणवत्ता वाली गहन विश्लेषण सामग्री भी प्रकाशित करता है, लेकिन वे सूचना प्रवाह और गर्म समाचारों में छिपे हो सकते हैं, और आपके पास से गुज़र सकते हैं।

इसलिए, प्रत्येक शनिवार को, हमारा संपादकीय विभाग कुछ उच्च-गुणवत्ता वाले लेखों का चयन करेगा जो पिछले 7 दिनों में प्रकाशित सामग्री से पढ़ने और एकत्र करने में समय बिताने के लायक हैं, और डेटा विश्लेषण, उद्योग निर्णय और राय आउटपुट के दृष्टिकोण से क्रिप्टो दुनिया में आपके लिए नई प्रेरणा लाएंगे।

अब आइए और हमारे साथ पढ़ें:

निवेश और उद्यमिता

बाजार संरचना में भारी बदलाव के साथ, कौन से ट्रैक विशेष ध्यान देने योग्य हैं?

The current coin price is OK, but the industry is in a deep bear market. The passage of the Bitcoin ETF marks the emergence of a digital currency market with almost completely independent liquidity outside the originally free-flowing crypto market: the U.S. stock market. This is actually a watershed event in the history of crypto development. The current deviation between the coin price and the industry is a new phenomenon that has emerged under this new market structure. The real bull market will only come when liquidity becomes loose.

The four tracks with great opportunities are: BTCFi, Meme, stablecoin payments, and Web3 social.

दिग्गजों के निवेश रुझानों को समझना: ग्रेस्केल किस क्रिप्टो परिसंपत्तियों पर दांव लगा रहा है?

Grayscale’s bullish stance on the crypto market has been evident in its recent product launches.

Grayscale decentralized AI funds include FIL, NEAR, RNDR, LPT, and TAO. Grayscale dynamic income funds include SOL, CBETH, NEAR, etc. Other trust funds include NEAR, STX, MKR, TAO, and SUI.

A look at 15 recent crypto projects that have catalysts driving them

Ignas topics: Monad (expected to launch the mainnet at the end of 2024), MegaETH (expected to launch the mainnet at the end of 2024), Berachain, Eigenlayers second staking event, Symbiotic (expected to launch the mainnet in the third quarter), Ethereum Pectra upgrade (expected in the first quarter of 2025), Fantom (being rebranded as Sonic), Maker (rebranding, transitioning to NewGovटोकन and NewStableToken), Pudgy Penguins L2 solution (Abstract), Story (IP chain) and Sonys Soneium, Fractal Bitcoin (mainnet is about to be launched) and OP_CAT, Stacks Nakamoto upgrade (coming soon), Coinbase cbBTC launch, Uniswap (potential $UNI fee sharing, date to be determined).

क्रिप्टो बाजार में अमीर कैसे बनें: शीर्ष निवेशकों की जोखिम प्रबंधन रणनीतियाँ

Manage risk through your portfolio.

Assume you are wrong and plan for it.

Look for asymmetry and be patient.

Use theory verification and failure.

Employ a multi-factor selling strategy.

Go back to step one and make a plan for when you make a profit.

Stop listening to VCs forcing infrastructure narratives; now is the opportunity for liquidity funds to rise; build products for users, embrace speculation, and pursue income; Solana is the best place to experiment because of its low startup costs.

यह भी अनुशंसित: Dialogue with the Founder of Delphi Digital: The Growth Path of the Crypto Investment Research Giant .

अपनी परिसंपत्तियों से धन अर्जित करना जारी रखें, पांच उच्च-उपज स्थिर मुद्रा रणनीतियों की समीक्षा करें

The article introduces the corresponding strategies for USDe, USD 0 (Usual Money), USDz, Deusd, USDM, and Dyad.

प्रतिमान: समुदाय ही आधार है, एक गर्मजोशी भरा क्रिप्टो समुदाय बनाने के लिए पांच नियम

Community is the core of your ecosystem’s growth flywheel. For early community building, qualitative experience trumps quantitative metrics. Incentives may be why users join, but culture is why they stay. Promote and optimistically delegate trust within the community. People-centered facilitation creates people-centered communities.

एयरड्रॉप अवसर और सहभागिता मार्गदर्शिका

Fours airdrop points are divided into four parts: pre-airdrop, daily check-in, platform usage and social media tasks.

The top addresses on Four.meme have obtained a large number of points through unknown means. According to the current transaction volume of the platform, the subsequent growth and proportion of points will not be too large. Therefore, only when the expected value of the airdrop exceeds 10 million US dollars or the transaction activity of the platform increases significantly, there will be a certain interactive airdrop value.

However, judging from the performance of the leading token binancedog and other tokens listed on Pancake, the Four ecosystem’s wealth creation and Fomo’s rhythm control are average. Apart from the advantage of official support, there is no sign of community and sentiment gaining momentum. The win rate and profit-loss ratio are insufficient for the sole purpose of airdrops. Currently, it is only recommended to use it for trading purposes.

बिटकॉइन पारिस्थितिकी तंत्र

बेबीलोन मेननेट के लॉन्च के बाद आप बाजार पर पड़ने वाले प्रभाव को किस प्रकार देखते हैं?

Babylon has implemented a secure, cross-chain-free, and custody-free Native Staking solution for POS chains such as BTC layer 2 by building a complex UTXO script contract on the Bitcoin mainnet. In theory, the greater the demand for such security services on the POS chain, the greater the potential for Babylon’s staking and interest-earning.

The launch of Babylon will definitely stimulate and catalyze the BTC layer 2 market, which has been sluggish for a long time. It has two main impacts:

-

It will allow many projects that originally combined CeFi to upgrade their technology, eliminate the criticized centralization problem, and make the slogan of asset interest generation easier to gain market trust.

-

It can bring direct commercial vitality to many BTC second-layer POS chains. On the one hand, BTC interest will accelerate the TVL accumulation speed of some POS chains, allowing the TVL points war to continue. On the other hand, in addition to BTC interest, there will also be various gameplays such as LSD, LRT platform + DeFI combination interest.

But objectively speaking, the security consensus provided by Babylon relies on its Cosmos SDK chain, rather than being directly controlled and scheduled by the script program on the BTC main chain. The subsequent series of complex derivative gameplays are naturally limited to the scope of asset management.

एथेरियम और स्केलिंग

Spending transparency is questioned. How does the Ethereum Foundation use its ETH?

The Ethereum Foundation holds $845 million worth of ETH, which is 0.25% of the total supply of ETH. According to the latest report from the Ethereum Foundation, in the fourth quarter of 2023, the Ethereum Foundation allocated $30 million. In the third quarter of 2023, the Ethereum Foundation allocated $8.9 million.

In general, the Ethereum Foundation’s financial disclosures are delayed and not transparent enough.

The story behind the Ethereum Foundations massive sale of ETH

Judging from the transfer records of the Ethereum Foundation in the past year, it is not difficult to find that its operations are basically regular sales. It is not accurate to call it a top escape master just by selling at high prices a few times.

The Ethereum Foundations selling of ETH is understandable, after all, the teams development and operation requires financial support. Moreover, the 273,000 ETH held by the Foundation only accounts for 0.25% of the total supply. From the perspective of market capitalization, the Foundations selling behavior has little direct impact on market liquidity, and the negative effects are more reflected in market sentiment, such as causing ETH holders to lose confidence and follow suit.

डेटा समीक्षा: कैनकन अपग्रेड के बाद एथेरियम में क्या परिवर्तन हुए हैं?

Liquidity fragmentation due to the continuous development of the Rollup network. Despite the great success of these L2s, they cost relatively little to publish data on Ethereum due to the EIP-4844 upgrade. With the reduction in costs, L2 now contributes less to the destruction of ETH and also reduces the gas fee on the mainnet. Since the implementation of EIP-4844, the operating profit margin of L2 has increased significantly.

Despite the surge in L2 usage, the direct benefit to ETH as an asset is unclear. Over the past few months, while L2 profits have risen sharply, the ETH burn rate has declined, resulting in less value flowing into ETH.

Interpreting the Decentralized Path of Rollup: The Dilemma of Shared Sorting and Ethereum-Based

The Rollup-centric roadmap has resulted in a fragmented and isolated blockchain. This fragmentation has resulted in a lack of value transfer between Rollups. To address this issue, shared ordering mechanisms have emerged, such as Espresso, Astria, and Radius. But this solution inherently requires new trust assumptions, as such a layer must have its own security set.

If we want to build a shared ordering layer for Rollup, Ethereum is the most trusted neutral layer we can build or use. Ethereum-based Rollup (i.e. Based Rollup) is inherently fully composable with Ethereum and other Based Rollups.

However, the Based Rollup solution also faces some challenges. The most important challenge is that the block time is the same as Ethereum, limited to 12 seconds. The solution is to provide a fast confirmation mechanism, such as a centralized sorter, or to speed up Ethereums block time. In the testnet, the speed based on pre-confirmation is faster than the current centralized sorter.

बहु-पारिस्थितिकी

क्या सभी एप्लीकेशन ऐपचैन की ओर विकसित होंगे?

The main reason dApps turn to building their own sovereign chains is that they think they are being exploited, and most dApps do not make money (part of the value created is taken away):

The main (and often only) source of revenue for a dApp is fees. Users pay fees because they directly benefit from them. Additionally, there are several roles in the transaction supply chain that can profit from it, the main one being the block proposer, even though they are the last to see the transaction. In the case of L2, it is the sequencer. MEV (maximum extractable value) is extracted in large amounts.

There are currently three ways to solve this problem: become an Appchain (high cost + high value); choose an L1/L2 that can return value (low cost + medium value); implement application-specific sorting (medium cost + uncertain value).

Galaxy: Telegram founder arrested, how is TON’s ability to resist risks?

It is unclear to what extent the charges against Pavel involve TON or Telegram’s integration with TON. While TON appears to have over 350 validators worldwide, it is unclear how many, if any, are operated by Telegram or its affiliates. Therefore, if France or any other major government sought to attack or shut down TON as part of Durov’s arrest, or for any other reason, it is unclear how resilient TON would be.

TON’s value relies heavily on its continued integration with Telegram.

CeFi DeFi

The secondary OTC market is a place where people can buy and sell various assets, including locked tokens, equity or SAFTs (Simple Agreement for Future Tokens), which are difficult to trade on public exchanges. Today, the term secondary OTC market mainly refers to the buying and selling of locked tokens.

The main sellers in the secondary OTC market include VCs, project teams, and foundations, who are often motivated by early profits or managing selling pressure. Buyers are generally divided into two categories: hodlers who believe in the long-term potential of tokens and are attracted by token discounts, and hedgers who profit from price differences through financial means.

The secondary OTC market is gaining increasing attention as it reflects the pessimism of the market, with tokens often being sold at a significant discount due to limited buyer willingness. Nevertheless, the secondary OTC market still plays a key role in managing liquidity and reducing direct selling pressure on public exchanges, helping to build a more stable and resilient crypto ecosystem.

एसी नया लेख: DeFi भविष्य की कुंजी क्यों है?

At its core, finance has always been about empowerment and putting idle assets to work. In today’s near-dystopian world, we are all reduced to a credit score.

DeFi doesnt care, and DeFi doesnt judge. Everyone is treated equally according to the rules of the system, and these rules are open and transparent for everyone to see. In DeFi, you dont need to be a qualified investor to participate in this market.

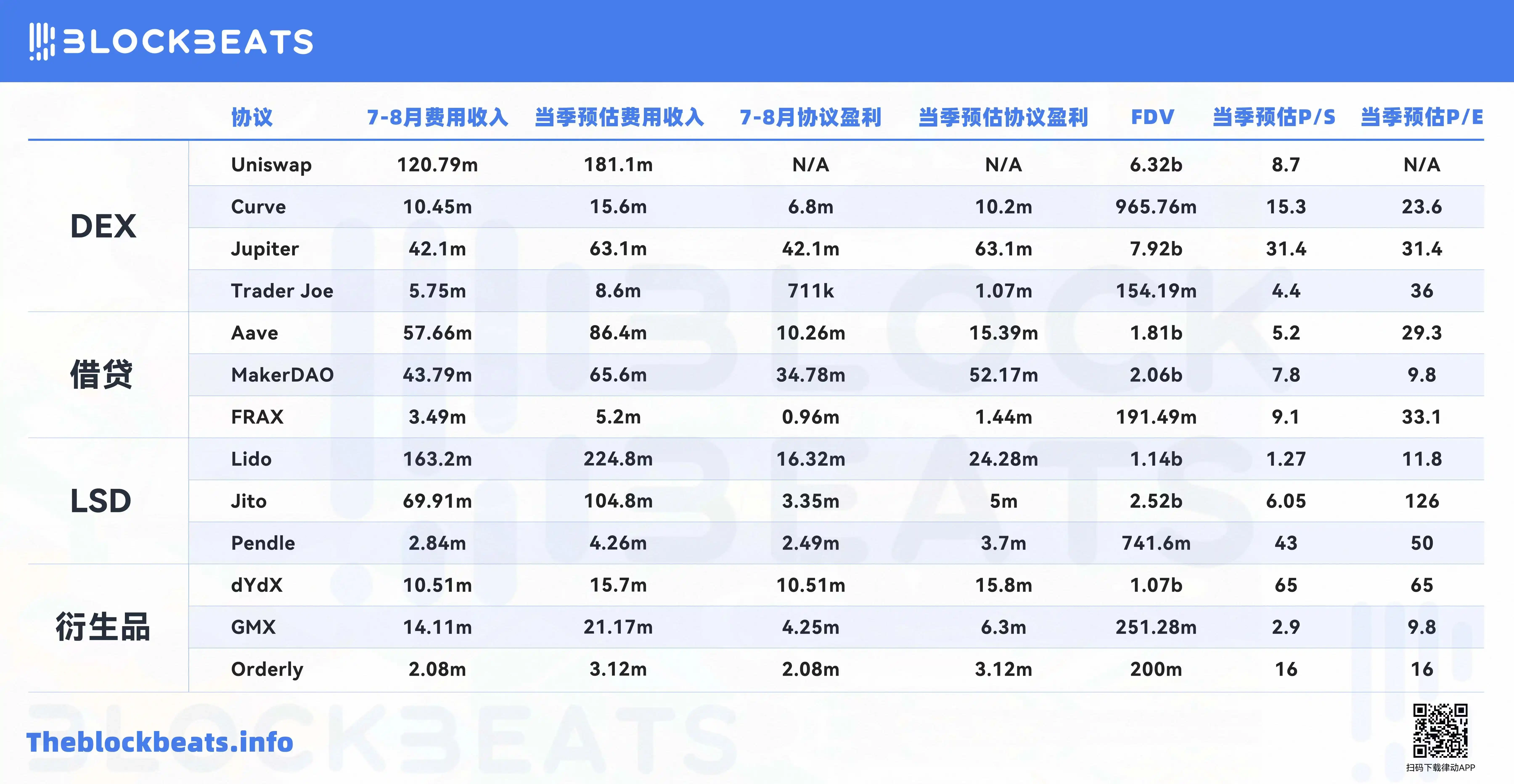

मूल्य-से-आय अनुपात को देखते हुए, क्या आज का DeFi उद्योग अधिक मूल्यवान है?

Starting from some simple perspectives of traditional value investing, the article briefly analyzes the revenue capacity of the DeFi field, which has the most clear application scenarios in the industry.

Investors also need to answer another ultimate question: Are these businesses really related to the tokens I hold?

The success of Pump Fun can be attributed to: for developers or project parties, low threshold participation, liquidity source, and quick listing; for retail investors, Meme cultural recognition and benefit myth.

Future prediction markets: challenges and innovations

The prediction market faces the following challenges: the dilemma of long-tail events, impermanent loss of liquidity providers, insufficient upper limits, market diversity and long-term nature, and regulation.

The innovative breakthroughs of the new wave of products include: specialized liquidity solutions, leverage and combination betting, permissionless market creation, mobile first and real-time prediction, integrated social networks, gamification and social dynamics, content creation and event selection, market making and liquidity, information aggregation and analysis, AI as a market participant, and the introduction of ZK technology to ensure privacy.

4 Alpha Research: Grasp Solanas next new narrative and understand PayFi in one article

The article cites three examples of PayFi: Buy Now Pay Never, Creator Monetization, and Account Receivable. In essence, they all represent a “mismatch” between payment and the time value of funds, and still require an “ideal” reality-based constraint.

Related projects include Huma, Arf, Credix Finance, and NX Finance.

वेब3

मल्टीकॉइन: ब्लॉकचेन संग्रहणीय बाजार का मूल्यांकन करते समय विचार करने योग्य 7 कारक (BECM)

Blockchain-enabled collectibles बाज़ारs (BECMs) are built specifically for collectibles traders, providing instant transactions through cash settlement, reducing settlement times from weeks to seconds, using stablecoins, and leveraging NFTs as digital representations of physical assets held by trusted custodians or authenticators.

BECM has the potential to reshape the multi-billion dollar collectibles market by (1) unifying the market and increasing liquidity, (2) eliminating the need for personal physical storage, thereby encouraging more transactions, (3) increasing trust by providing authentication, and (4) financializing the collectibles industry by facilitating lending.

Its three design axes contain seven key characteristics: the financial axis (lack of vertical trading venues, suitable price points, and being seen as a store of value), the real world axis (difficulty in storage, trust issues), and the emotional axis (the source of time and brand, and the existence of a passionate collector base).

सप्ताह के चर्चित विषय

पिछले सप्ताह, Telegram founder Pavel Durov was arrested in France , facing multiple charges, and was later released ; Telegram issued a statement : the platform complies with EU law and the team is waiting for the matter to be resolved quickly; multiple French government websites were paralyzed by DDoS attacks; TON network was restored after being down ;

In addition, in terms of policies and macro markets, OpenSea: has received a notice from the U.S. SEC Wells that it intends to provide $5 million to support the legal fees of NFT artists and developers; Apple is negotiating to join OpenAIs new round of financing;

In terms of opinions and voices, the Wall Street Journal: Federal Reserve Chairman Powell has sent the strongest signal of interest rate cuts so far; Japanese Prime Minister Fumio Kishida : Web3 and blockchain technology are the basis for solving social problems; Vitalik: I hope to see sustainable applications that do not sacrifice principles such as decentralization. Although USDC is not as good as RAI, it is indeed convenient ; Farcaster’s integration of Telegram groups is not yet mature, and an end-to-end encrypted communication system must be established first; airdrops are an excellent use case for verifying ZK, blockchain identity, credentials and proof frameworks; his DeFi-related remarks have caused controversy; DeFiance Capital founder: Vitalik’s views on DeFi and liquidity mining represent that ETH prices and market value will continue to fall; Bloomberg: Pantera invested in TON tokens at 60% off the market price in May , with a 1-year lock-up period;

संस्थाओं, बड़ी कंपनियों और अग्रणी परियोजनाओं के संदर्भ में, the US trustee opposed the FTX restructuring plan , saying that creditors should not bear the cost of the data breach; मेकरडीएओ rebranded and changed its name to Sky, DAI changed its name to USDS, and MKR will be upgraded and split into SKY; फ्रैक्टल बिटकॉइन mainnet is scheduled to go online on September 9, with 80% of tokens allocated to the community; Terra : Proposal 4818 will be the last chain upgrade to be implemented, and will be led by the community in the future; Trumps second son announced the official launch of the encryption project WLFI;

In the meme field, TON ecosystem meme coin DOGS was launched … Well, it was another week of ups and downs.

जुड़ा हुआ एक पोर्टल है "साप्ताहिक संपादक की पसंद" श्रृंखला।

अगली बार मिलेंगे~

This article is sourced from the internet: Weekly Editors Picks (0824-0830)

Related: Cryptocurrency also has its own world, taking stock of the Coinbase Mafias territory

Original author: Yueqi Yang Original translation: TechFlow After years of dominating bitcoin trading in the U.S. as the go-to exchange for buying and selling bitcoin, Coinbase is now trying to reposition itself as a pillar of the entire financial system, leveraging its Base blockchain, which launched last year. To attract users and turn a profit, Coinbase needs to attract outside applications that offer lending, international payments and other financial services on its blockchain. The crypto giant has a key advantage: a large network of former employees who have founded their own crypto startups, including about 40 in which Coinbase has invested. One example is Moonwell, a decentralized finance application that allows users to borrow and lend cryptocurrencies using blockchains including Coinbase’s Base. Moonwell was launched on Base in August 2023,…