मूल्य-से-आय अनुपात को देखते हुए, क्या आज का DeFi उद्योग अधिक मूल्यवान है?

Why is value currency no longer working?

Under the impact of the meme craze, 2024 became the first round of disenchantment bull market in the history of cryptocurrency. This year, the industry finally stopped hiding its belief in money and gambler nature. The disenchantment of technological liberalism has caused most people to fall into extreme nihilism. Even the slogan embrace the scam cannot mobilize the emotions of speculators. The simple and crude meme PVP casino has become the last spiritual opium to maintain the industrys activity.

The consensus of criticizing VC coins and value coins is widespread, from retail investors, communities to exchanges, and even VCs themselves. Looking back at the development history of cryptocurrency, despite exciting innovations in application scenarios such as DeFi, the underlying logic of the industry has never changed. When you ask a project owner what his business model is, the final answer must be: Sell coins. This has led to the absurd behavior of talking about business models in the crypto industry, because in essence, an industry based on speculation has no logic.

However, this Ponzi growth has finally peaked. After the collapse of FTX, Three Arrows, Celsius, etc., people discovered that the so-called institutional bull in the previous cycle was actually a leverage bull. From the perspective of total market value, the crypto industry has never returned to its peak in 2021. This seems to indicate something. Perhaps the gambler capital in this world is really limited.

Today, the soul-searching question facing the crypto industry seeking growth is: Can it really accommodate large-scale long-term funds and serious investors? With this question in mind, we start from some simple perspectives of traditional value investing and briefly analyze the revenue capacity of the DeFi field, which has the most clear application scenarios in the industry.

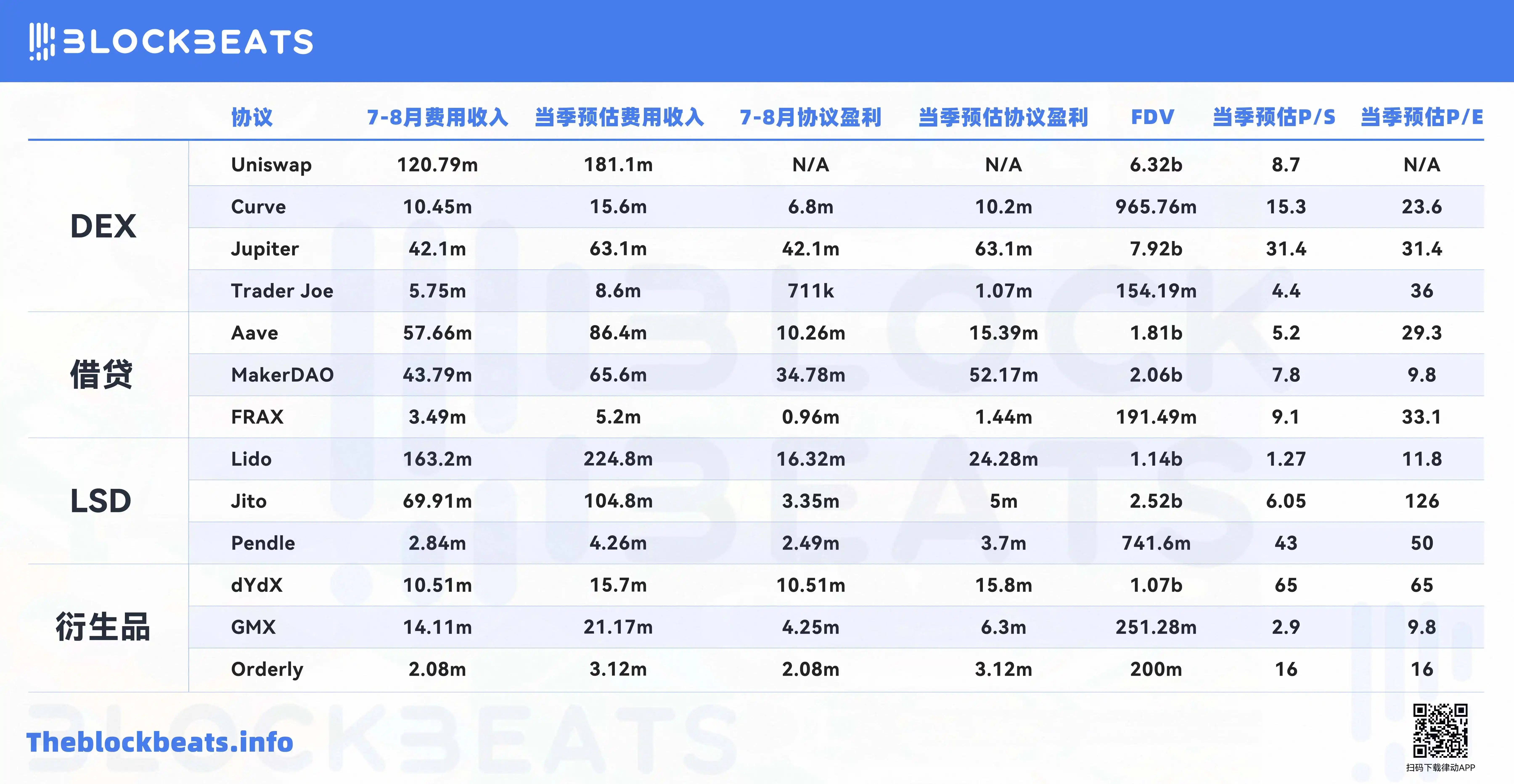

BlockBeats Note: In this article, we use the P/E ratio as the main indicator to judge the valuation level of the protocol. The protocol fee income (Fees) is regarded as revenue, and its P/S ratio is calculated based on this, while the protocol profit (Revenue) is the actual profit obtained by the protocol or DAO after deducting the distribution of interests of all parties, and its P/E ratio is calculated based on this. In addition, since the third quarter has not yet ended, the performance of the quarter will be estimated based on the average of the data in July and August.

डेक्स

The DEX field selects the leading protocols of the mainstream public chain ecosystem to better present the DEX revenue of the entire crypto industry, including: Uniswap and Curve in the Ethereum ecosystem; Jupiter in the Solana ecosystem; Trader Joe in the Avalanche ecosystem. As a reference, in the traditional financial market, Coinbases P/E ratio is currently 38, and Robinhoods P/E ratio is 62.5.

यूनिस्वैप

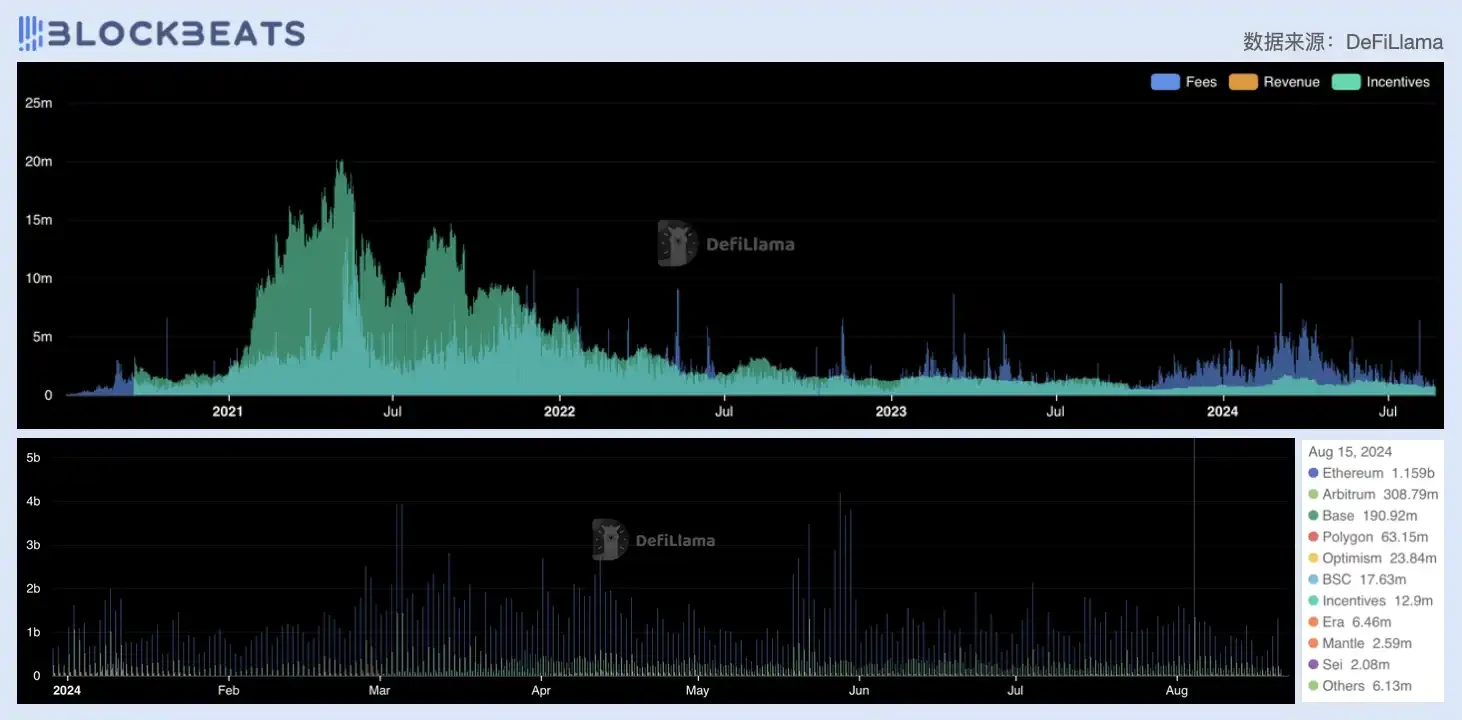

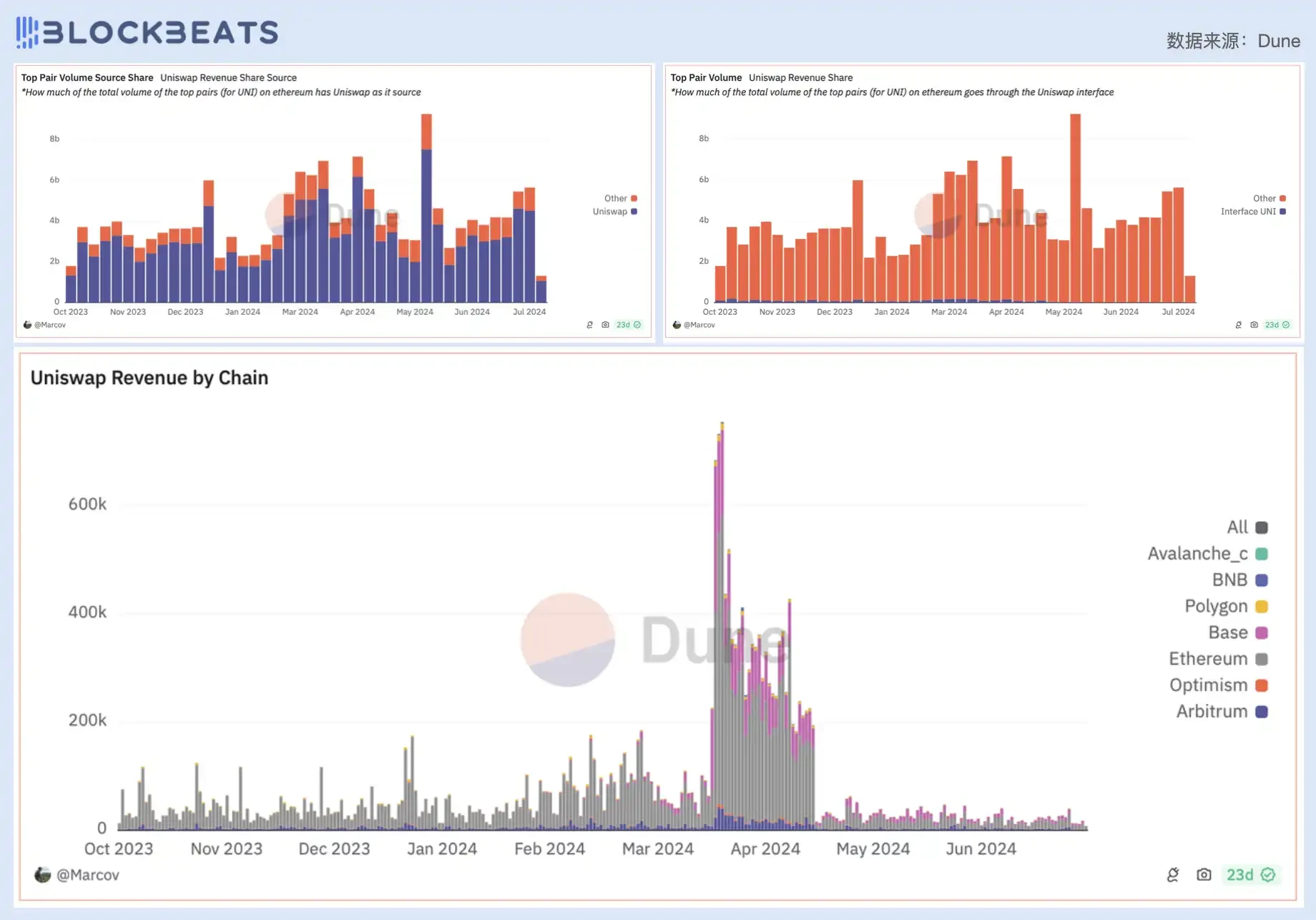

Due to the current fee mechanism of the protocol, the Uniswap protocol itself does not have any profitability. Therefore, when the protocol fees are regarded as protocol revenue, we can only use the price-to-sales ratio (P/S Ratio) to calculate the valuation level of Uniswap. In the past three quarters, Uniswaps P/S valuation multiplier has been relatively stable at around 8. During the sharp rise in UNI prices in April this year, the fee income of the Uniswap protocol also increased accordingly due to changes in trading volume and fee mechanisms, and showed a resonant trend with the UNI coin price in the following months.

However, despite this, the Uniswap protocol itself does not make any profit, which is determined by the current protocol fee mechanism. Currently, when users trade tokens through the Uniswap protocol, they need to pay a 0.3% transaction fee, which will be shared entirely by the liquidity providers (LPs) of the pool and the liquidity reserves of the pool. The Uniswap protocol itself has no economic return. According to official documents, the team may also allow the protocol to charge a fee of 0.05% in the future. This fee switch is therefore regarded as one of the most important factors affecting UNIs fundamentals.

On the other hand, as the leading DEX in Ethereum and even the crypto market, Uniswap remains very strong in terms of business scale and activity. The total transaction value (GMV) of the protocol remained at US$180 billion in the first and second quarters of this year. Although the crypto market cooled down in the third quarter, current data shows that Uniswap has maintained a relatively stable business level.

From the source of fee income, although the Uniswap team and community have worked hard to promote the multi-chain development of the protocol in the past six months, the Ethereum mainnet is still the largest source of fees for the protocol, with a transaction volume of $1.16 billion on August 15 alone, followed by Arbitrum and Base, whose combined transaction volume is roughly the same as the mainnet. According to the latest report from Coingecko, in the first half of this year, Uniswap is still the application protocol with the largest ETH consumption, destroying a total of about 71,915 ETH.

Uniswap Fee Income and Revenue Source Ecosystem

In the past week (August 18-22), Uniswap V3s transaction volume on the Ethereum mainnet reached 3.96 billion US dollars, of which the top 15 trading pairs contributed 3.28 billion US dollars, accounting for 82.8%. Correspondingly, Uniswaps LPs also received a total of 4.36 million US dollars in LP incentives in the past week, of which the LP income of the top 15 trading pairs was 2.34 million US dollars, accounting for 53.6%. This is because in trading pairs with larger trading volumes, LPs are more inclined to choose liquidity pools with lower fees to generate income (Uniswap LP fee tiers are not discussed here).

Uniswap top trading pairs and fee tier ratios

Since the protocol itself is not profitable, Uniswap Labs generates revenue for itself through front-end API charges in order to solve the problem of continuous operation of the team. In October last year, Uniswap Labs began to charge a 0.15% transaction fee for transactions of mainstream tokens including ETH, USDC, WETH, USDT, DAI, etc. in its web applications and wallet products, and raised the fee to 0.25% in April this year, and expanded the scope of levied currencies, and Uniswap Labs revenue surged accordingly.

Although only a small portion of the trading activities on the Uniswap protocol are completed through the official web API, the team can still make a lot of money from it because the protocol GMV is very considerable. As of writing, its total revenue has reached $59.6 million, and is about to break the $60 million mark.

Top left: Liquidity sources of Uniswap’s top trading pairs; Top right: Volume (traffic) sources of Uniswap’s top trading pairs; Bottom: Breakdown of Uniswap Labs’ profit sources

But Labs making money does not mean UNI holders can also make money. Due to the fee mechanism, the value source supporting the token price has always been the biggest pain point of UNI. In extreme theoretical cases, the development of the Uniswap protocol and Uniswap Labs has almost nothing to do with the UNI token. When the two generate income, these values cannot flow to UNI. When the two encounter bottlenecks, panic will be reflected in the price of UNI first.

Therefore, after the community launched a proposal in May this year to turn on the fee switch and incentivize UNI holders, the market reacted so violently to UNI. However, this change that completely affects the fundamentals of Uniswap does not seem easy to achieve, and the proposal has been repeatedly postponed due to obstruction from various interest groups. What is reflected behind this is still the industrys concerns and compromises on the regulatory issues of securities or not.

वक्र

As one of the leading DEXs that once competed head-on with Uniswap, Curves trading volume has now dropped to eighth place, overtaken by Aerodrome of the Base ecosystem. Curves full circulation PE value is far from the current circulation multiplier, and its valuation expectations have fallen rapidly in the past two quarters, from 60 to 25 and then to the current 19. On the one hand, it is limited by market turmoil and large fluctuations in coin prices, and on the other hand, it is also related to the fact that its founder encountered liquidation again in the second quarter of this year, which affected market confidence.

Unlike Uniswap mentioned above, Curve has been actively practicing token value capture since its launch. Curve was originally an AMM focused on stablecoin swaps. With a series of economic model innovations, Curve has expanded the utility of CRV. In addition to distributing fees to LPs, it also distributes CRV to them and returns part of the fees to CRV holders. This structure enables LPs to obtain benefits other than fees, and CRV holders can also obtain part of the benefits from the generated fees.

In June this year, Curve changed its fee allocation incentive mechanism, transitioning from 3 CRV tokens to its native stablecoin crvUSD to improve the practicality of crvUSD and enhance Curves stability and liquidity. The redemption role of crvUSD to Curve was once very obvious. From the perspective of revenue channels, crvUSD has exceeded Pools revenue for a period of time since its launch. However, on August 5, a large-scale on-chain liquidation occurred in the crypto industry, causing Curve to lower the lending rate of crvUSD. The interest rates of pools such as ETH and WBTC were as low as zero tenths, and capital flight was obvious.

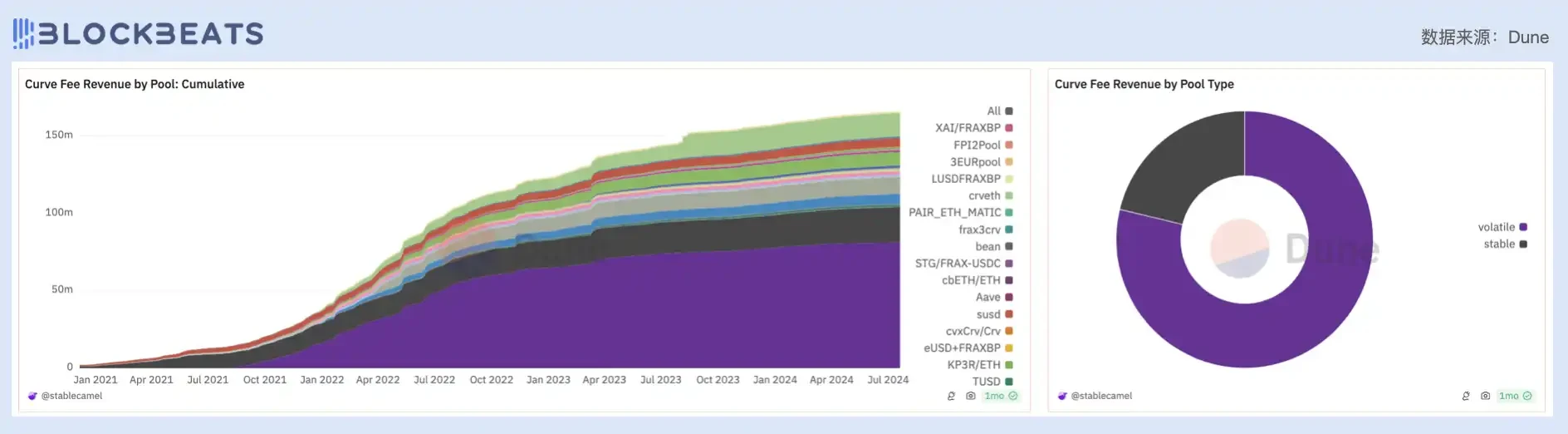

Curve Protocol Profit and Source

A detailed analysis of the breakdown of Curves liquidity pool revenue shows that this DeFi protocols flagship business is losing its main position. At this stage, the main contributor to Curves pool revenue has shifted from the former 3 CRV pools (consisting of DAI/USDC/USDT) to the TriCrypto pool (consisting of USDT/WBTC/WETH), which accounts for more than half. Judging from the revenue contribution ratio of the stablecoin pool and the non-stablecoin pool, Curves main stablecoin transactions in the past are even more bleak, accounting for less than 22%.

Left: Curve Protocol profit sources (by liquidity pool); Right: Curve Protocol profit sources (by liquidity pool attributes)

It can be seen that as the stablecoin market gradually moves towards the winner-takes-all decisive battle stage, the low-slippage stablecoin trading scenario (Stable Swap) that relied on the prosperous stablecoin ecosystem in the past is gradually disappearing, and along with it is Curves soul-searching question about what kind of platform should it be. At present, Curves answer is crvUSD. In the future when its old business is gradually dying out, Curves fate almost entirely depends on its victory or failure in the stablecoin decisive battle.

Jupiter

Jupiter is the leading DEX trading aggregator on Solana. As a trading platform, Jupiter provides spot trading, DCA fixed investment, and limit order trading services. In addition to carrying trading needs, Jupiter also provides Launchpad services. In October 2023, Jupiter launched a perpetual contract trading product and entered the derivatives market. Three months later, $JUP was launched. When JUP was first launched, Jupiters P/E ratio was 48. In the second quarter, affected by the cold market conditions, P/E fell slightly by 16%. As the market warmed up, Jupiters P/E also returned to its original position.

Jupiters profit channels mainly include limit order transactions, DCA order transactions and derivatives transaction income, as well as the part of the tokens allocated to Jupiter by projects incubated or operated by Jupiter Launchpad. Currently, Jupiter charges fees of 0.1%, 0.1% and 0.07% for limit order, DCA and perpetual contract opening transactions respectively. As of August 23, Jupiters revenue this year is calculated to be US$120 million.

Jupiter Protocol Revenue Source Breakdown

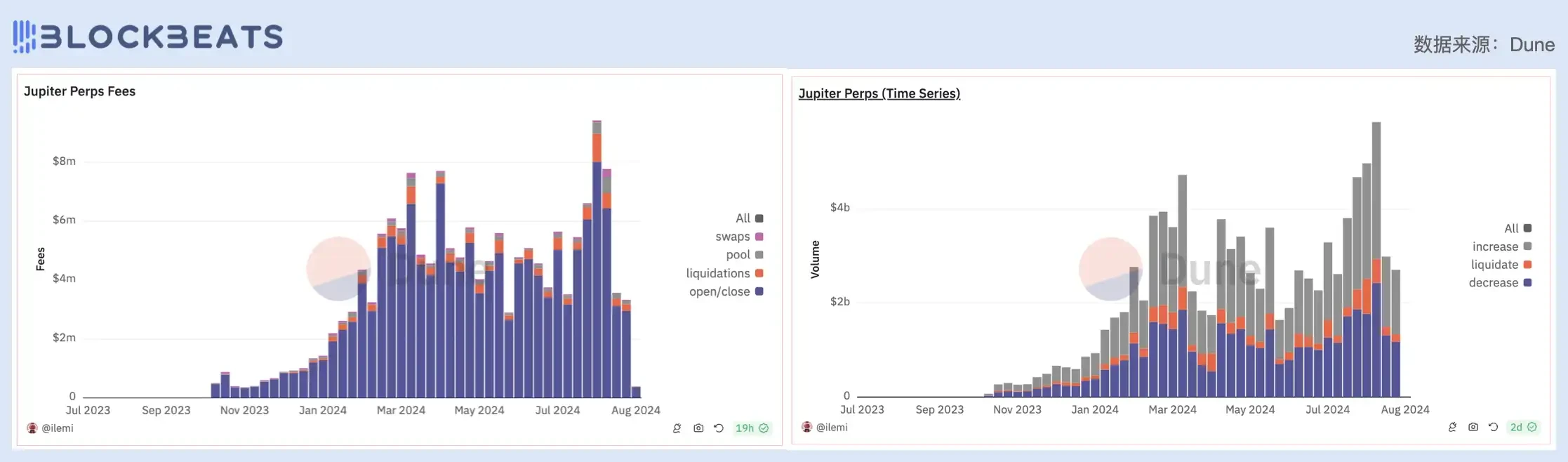

Among Jupiters current revenue, perpetual contract products (Perps) support the overall revenue of the protocol. Since its launch in October last year, Jupiters perpetual contract trading product revenue has steadily increased, with weekly fees increasing from US$500,000 at the end of October to US$2.6 million at the end of January. In mid-March, Jupiters transaction fees exceeded US$7.6 million. Since its launch, Jupiter has relied on perpetual contract products to generate nearly US$150 million in protocol revenue.

Left: Jupiter perpetual contract product fee income source breakdown; Right: Jupiter perpetual contract product user interaction behavior breakdown

For investors, JUPJupiter provides an entry point for users to share protocol income. Investors can capture the growth dividend of Jupiters perpetual contract products through JLP (Jupiter Liquidity Pool). JLP is a basket of currencies, and its assets are composed of SOL, ETH, WBTC, USDC, and USDT. On this basis, the mechanism of JLP is similar to GMXs GLP. On the one hand, it makes profits from the losses of perpetual contract traders, and on the other hand, it obtains 75% of all perpetual transaction fees. These fees will be automatically reinvested in JLP, thereby achieving continuous compound interest.

In the transaction fees of Jupiter perpetual contract products, the daily trading volume is mainly between US$200 million and US$900 million, with a peak of US$1.6 billion on August 5. Corresponding to this is the continuous loss of contract users. According to Chaos Labs data, traders on Jupiter perpetual contract products have been in a loss state for nearly three months. When the market experienced a sharp fluctuation on August 5, traders lost more than US$30 million, and these losses brought liquidation income to Jupiter. It can be said that under ideal circumstances, when the market rises, JLP, as a crypto market blue chip ETF, can rise in sync with the market, and when the market ends the unilateral rise, traders on Jupiter perps will lose more, and JLPs income will also increase, realizing a positive flywheel.

Jupiter perpetual contract users did not realize profits

Since its launch, JLP has maintained a steady upward trend, and there has been no significant decline even when the overall crypto market fell. In March, assets such as SOL and ETH rose to a staged high and began to fluctuate and fall. JLP achieved a slight increase overall, and its annual yield of over 100% impressed the community. After the market fell, JLPs annual yield also decreased. Currently, the TVL of the JLP pool is US$661 million, with an annual yield of 21.9%.

JLP Price Chart

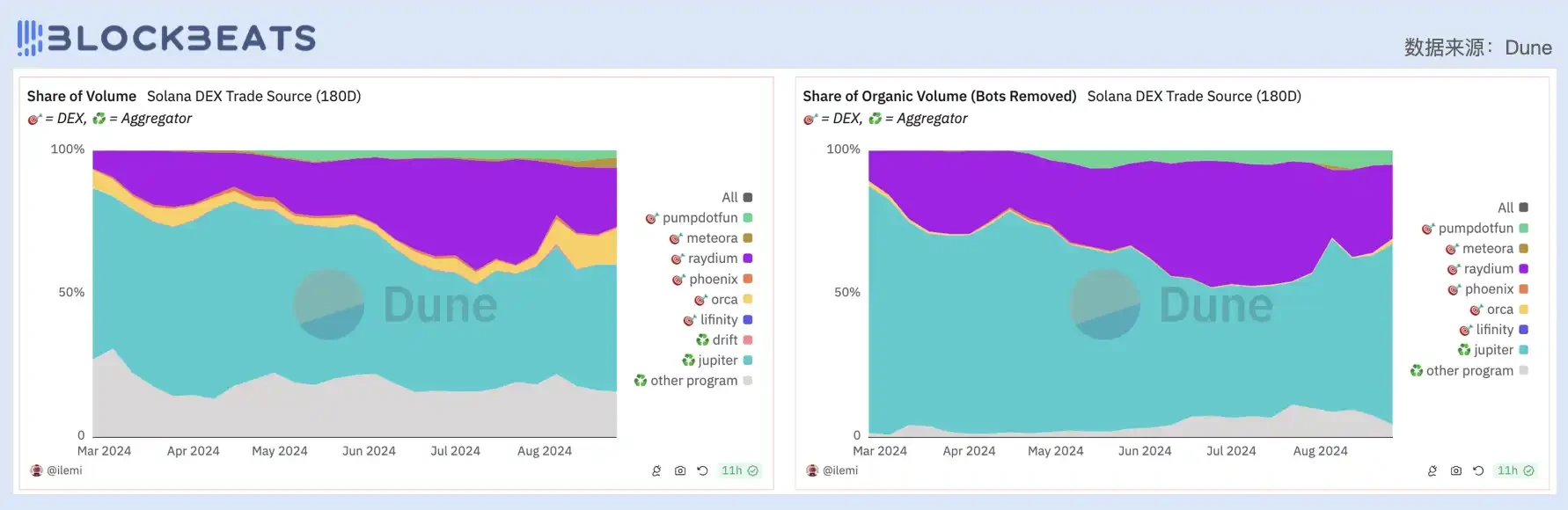

JLPs achievements are the accumulation of Jupiets development in the DeFi field in recent years. Looking back on its history, the market for its main trading aggregation business has reached its ceiling and the growth space is saturated. At the beginning of this year, Jupiters DEX trading volume surpassed Uniswap V3 many times, becoming the DEX aggregator with the largest trading volume. In addition, 44.3% of Solana DEXs trading volume is conducted through Jupiter; if robot trading behaviors such as MEV and brushing are excluded, the trading volume through Jupiter accounts for 63% of Solana DEXs total trading volume.

Left: Breakdown of Solana DEX trading volume sources; Right: Breakdown of Solana DEX trading volume sources (excluding robot trading)

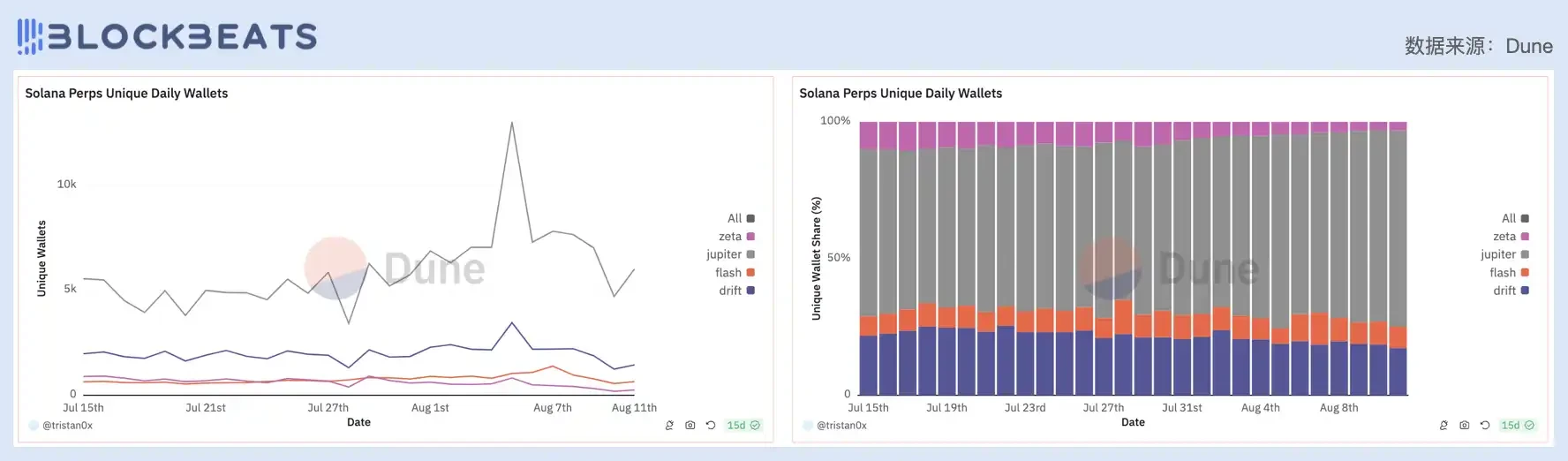

Although Jupiters DEX aggregation business does not appear to generate direct profits, its market share advantage makes Jupiter the preferred entry point for Solana ecosystem users to trade. This traffic advantage brings a lot of traffic support to its Perps products. Among the perpetual contract products in the Solana ecosystem, Jupiters daily independent wallet count accounts for more than 70%, far exceeding other products such as Drift, Zeta and Flash.

Left: Sources of Solana’s daily user growth; Right: Sources of Solana’s perpetual contract products’ daily user growth

Looking ahead to JUPs future growth, the determining factor is whether JUP can share Jupiters revenue dividend. Currently, JUP is positioned as a governance token, and the founder of Jupiter has repeatedly emphasized the importance of JUP to community development, intending to separate JUP from protocol revenue. Therefore, Jupiters performance in the perpetual contract market has overestimated JUPs growth expectations, and JUP is facing a similar growth dilemma as UNI.

Trader Joe

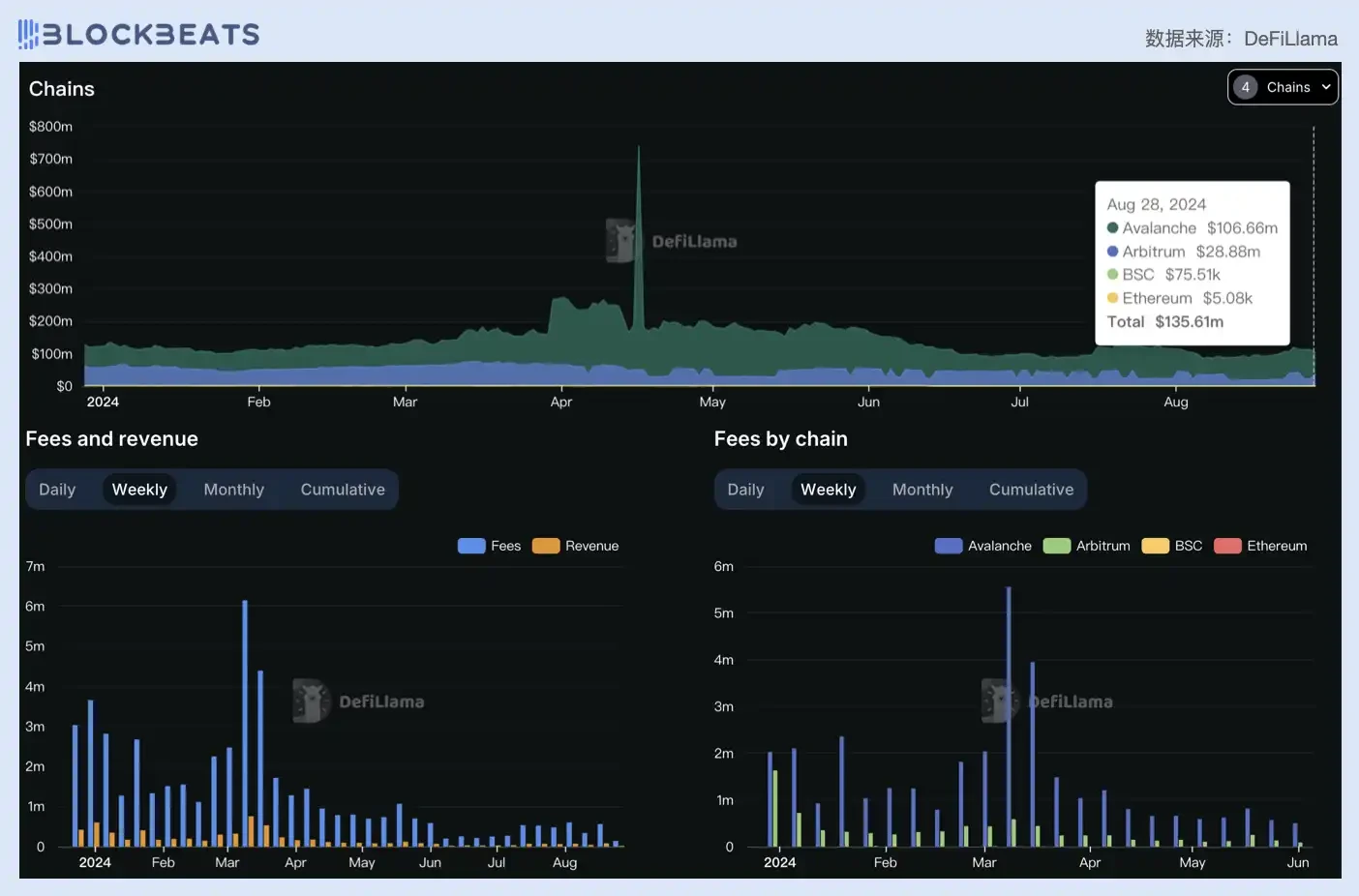

Trader Joes valuation multiples and GMV indicators have fluctuated significantly in the first three quarters of 2024. In the second quarter, P/E valuation multiples rose across the board, increasing by 76%. After that, Trader Joes revenue and transaction volume remained at a relatively stable level, and the markets expectations for Trader Joes growth were stable.

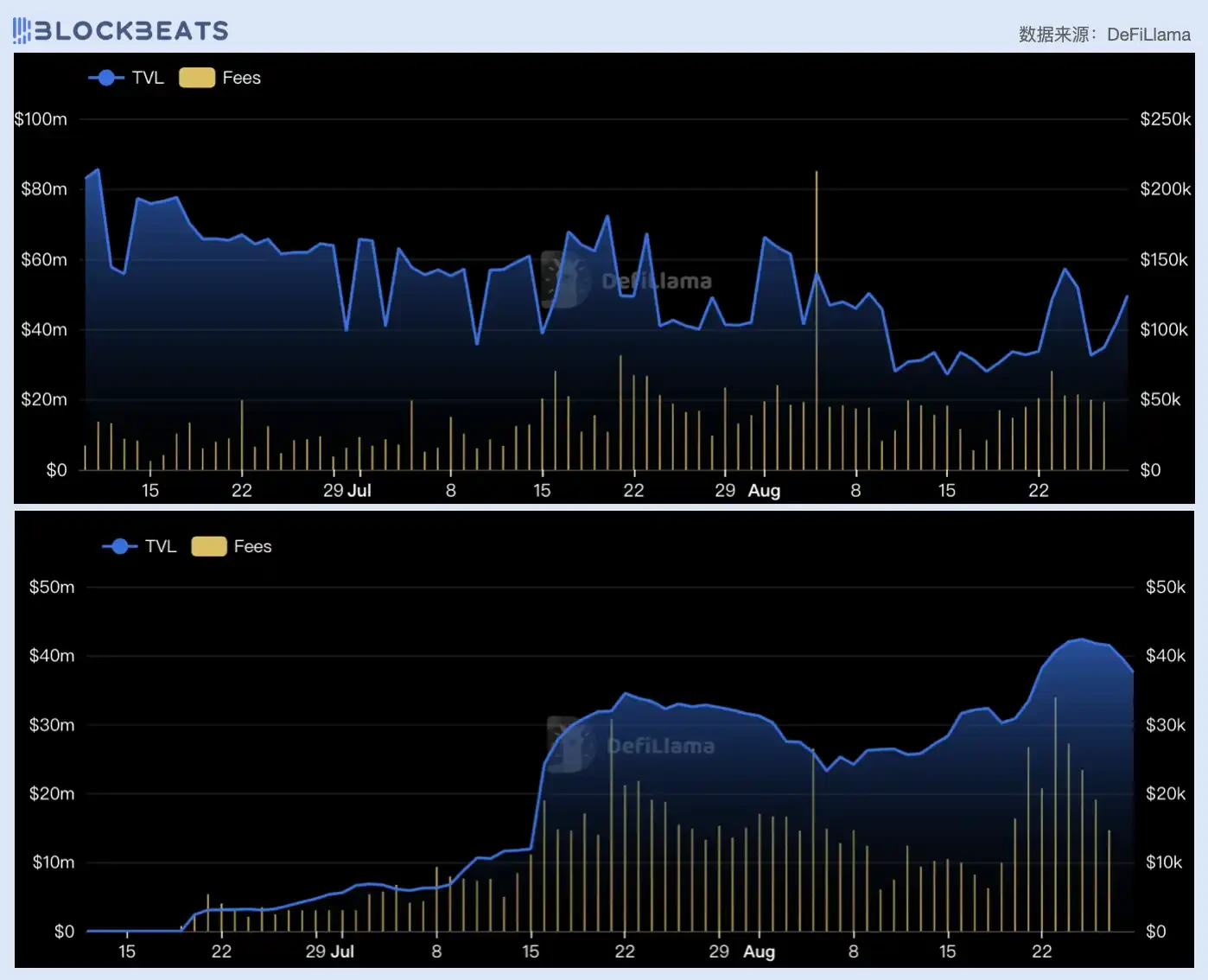

Since the beginning of 2024, Trader Joes TVL has remained between $150 million and $200 million. It was more prosperous from April to June, and the TVL has dropped below $100 million in the past month. Trader Joes TVL is mainly distributed in Avalanche ($114.26 M) and Arbitrum ($45.38 M), accounting for a large proportion of the total TVL. Correspondingly, Avalanche is also the main source of fee contribution for Trader Joe, accounting for about 60% – 70%, followed by Arbitrum, accounting for 21%.

Top: Trader Joe’s total TVL change; Bottom left: Trader Joe’s fee income and contract profit; Bottom right: Trader Joe’s fee income sources

From the perspective of JOE empowerment, JOE holders can obtain protocol dividends. TraderJoes protocol income ratio has multiple modes, among which V1 charges 0.05% of all transactions as protocol income, V2 does not charge protocol fees, and all protocol fees are allocated to LP. V2.1 charges different protocol fees according to different LB pools, ranging from 0-25%. As can be seen in the figure below, JOEs market value fluctuates synchronously with protocol fees.

Trader Joe’s Protocol Revenue and TVL Correlation with Market Cap

In mid-June, Trader Joe launched V2.2, introduced the Liquidity Book hook function, and implemented centralized incentives. The daily output fee of Trader Joe V2.2 has a good growth momentum, and the daily output fee has exceeded $20,000 in the past week, while the daily output fee of Trader Joe V2.1 in the same period was between $20,000 and $50,000. In the two months since its launch, Trader Joe V2.2 has accumulated $5.66 million in agreement fees, and after deducting LP incentives, there are still $1.2 million in agreement income.

Top: Trader Joe V2.2 TVL and fee data changes; Bottom: Trader Joe V2.1 TVL and fee data changes

Looking ahead to the development space of Trader Joe, the first thing to consider is that its trading activities mainly take place on Avalanche. Since March, Avalanches trading volume has dropped significantly, reflecting that Avalanches appeal is not as good as before. However, Grayscale launched the AVAX Trust Fund last week, which may boost the price of AVAX to a certain extent, thereby bringing liquidity to Trader Joe.

But the most important thing is Trader Joes polishing of its own business. Last week, Trader Joes official Twitter released the latest roadmap, announcing that the existing DEX will be expanded to form the Joe Stack, and stated that the core competition of decentralized exchanges in the future will focus on CLOB (central limit order book) in order to provide higher capital efficiency. Trader Joe V2.2, as part of the Joe Stack layout, started relatively smoothly. The V3 design proposed by Trader Joe in the roadmap is related to the memecoin issuance service. Through the advancement of these businesses, Trader Joes development space will have more driving force.

उधार

Due to the overall monopoly of the head protocols in the crypto industry, the lending protocols selected in this article are all from the Ethereum ecosystem, including: Aave, MakerDAO, FRAX. At present, these protocols have basically entered the stage of multi-chain development, so the source of income is not limited to the Ethereum mainnet itself. As a reference, in the traditional financial market, Lending Clubs current price-to-earnings ratio is 29.7, and SoFis price-to-earnings ratio is -16.2.

आवे

After hitting a high in the first quarter of this year, Aaves P/E ratio began to cut in half in the second quarter and stabilized at around 22 in the following months. This is partly due to the price drop of the AAVE token in early April, and partly due to the continuous strengthening of the fundamental data of the Aave protocol itself. The protocol GMV has maintained steady growth in the past two and a half quarters, and in the third quarter, which has just passed the halfway point, this figure has exceeded the performance of the entire second quarter.

In terms of protocol fee income, Aave has repeatedly hit new highs this year, and its overall performance is close to the level of the previous bull market, which is relatively rare in current DeFi projects. From the source of fee income, Aave, like Uniswap, mainly relies on the on-chain activities of the Ethereum mainnet. In Aaves overall market, Ethereum V3 accounts for more than 13.9 billion, accounting for 72% of GMV.

Since the end of last year, Aaves user activity has been growing steadily, and even the cooling of the market has not stopped this trend. From the perspective of user behavior, user deposits account for the absolute majority, because many people regard Aave as a relatively safe on-chain interest-earning channel.

Aave protocol fee income and protocol profit

However, it is worth noting that compared with Uniswap, Aaves growth in the Base ecosystem is more significant. In the past period of time, Aave has been creating a new high in daily new users in the past two years, and a large part of the rapid growth comes from the Base ecosystem. From May to July, when the market was relatively cold, the growth rate of new users of Aave in the Base ecosystem significantly exceeded that of other ecosystems, and in terms of the number of unique wallet addresses of the V3 version, Base also became the ecosystem with the largest number of Aave users, accounting for 29.8%.

Top: Aave protocol daily new users; Bottom left: Aave user activity and interaction behavior breakdown; Bottom right: Aave user ecosystem source

On the other hand, the Aave communitys proposal to activate fee conversion at the end of July is also an important reason for the recent strong performance of AAVE tokens. The proposal hopes that the protocol will start a fee conversion mechanism to repurchase AAVE tokens from the open market, thereby returning the value of the protocol to the tokens. At the same time, the news that Aave made a huge profit of $6 million during the on-chain liquidation in August further increased the expectations of this proposal.

The smart money in the market is obviously more sensitive to these signals. Many addresses have bought AAVE in large amounts since the beginning of the month, making the token enter the Smart Money Inflow List many times. Recently, a whale spent 4,000 stETH (about 10.4 million US dollars) in one day and bought nearly 80,000 AAVE at an average price of 135 US dollars. This optimistic sentiment is also reflected on social media, with more and more tweets calling AAVE. However, in terms of PE, the current price of AAVE tokens has achieved a reasonable market valuation of Aave as a leading lending protocol, and there is only room for expectation and speculation.

MakerDAO (now Sky Protocol)

MakerDAOs PE value has been relatively stable this year, remaining around 8 for the three quarters. This is a relatively low level in the history of project development, second only to the fourth quarter of 2023, when MakerDAOs price-to-sales ratio was only 6.3. At the same time, MakerDAO GMV has also remained at a stable level, which is almost the same as the four quarters of last year.

According to data from makerburn.com, the PE value officially given by MakerDAO is 31, which is at a high level in the past year. However, from the perspective of protocol revenue, Makers revenue has quickly returned to the original downward channel after a surge at the beginning of the year. This means that from the perspective of MKR token prices, the market has not lowered its valuation expectations due to the decline in Maker protocol revenue.

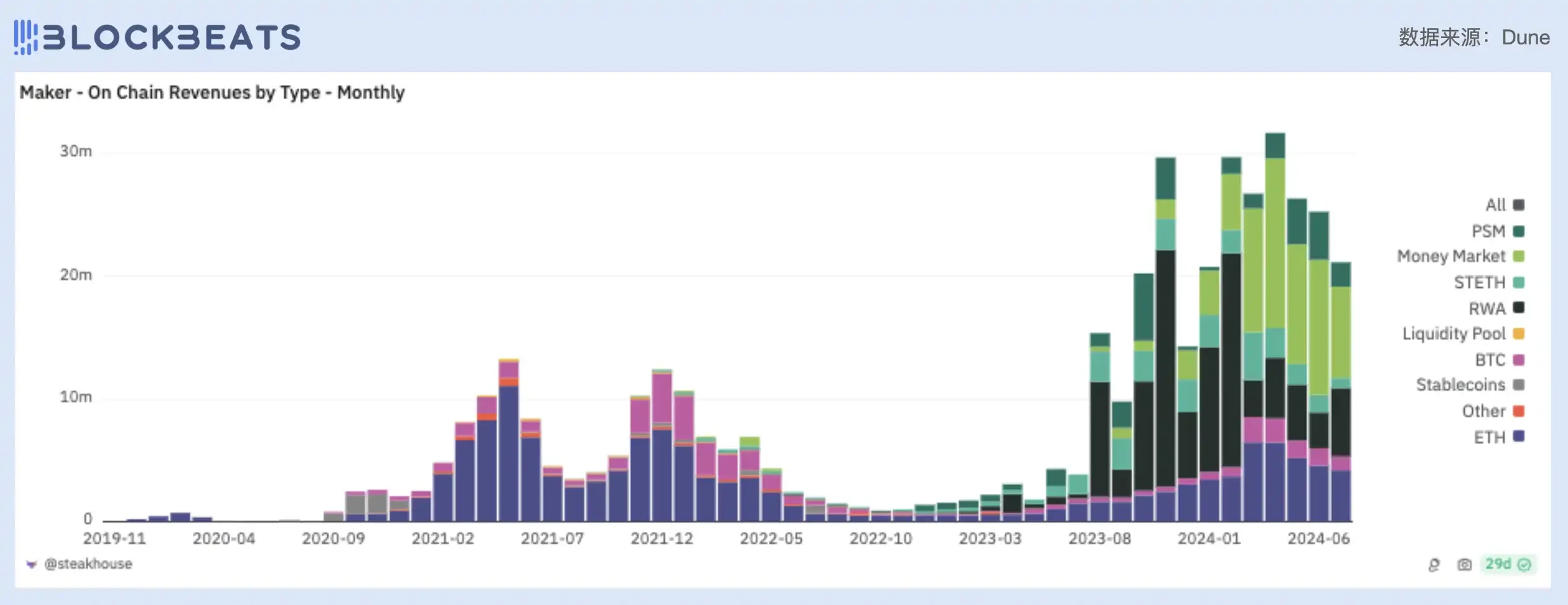

MakerDAO officially announces the correlation between P/E and annualized profit of the protocol

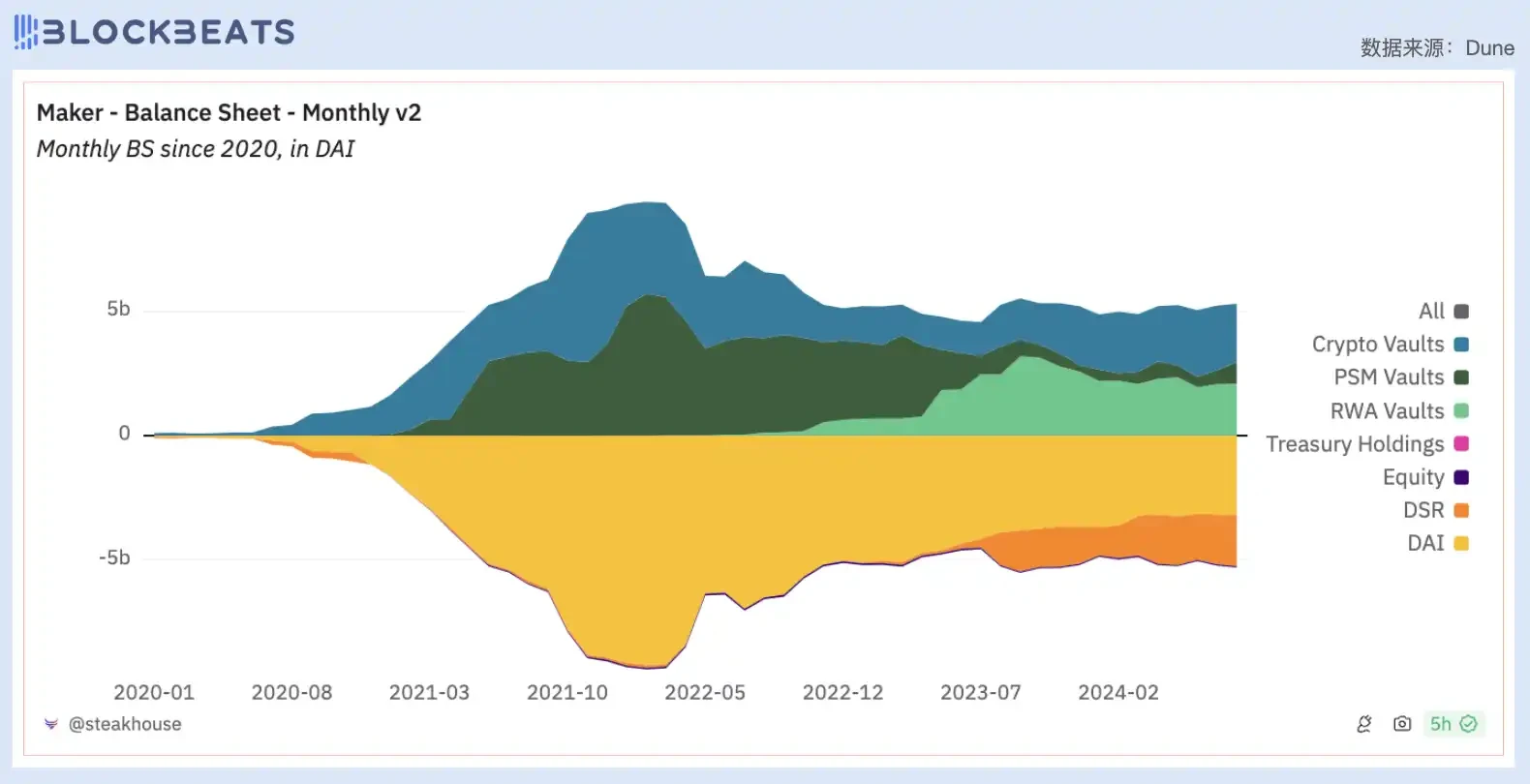

MakerDAO can be said to be the most profitable DeFi protocol besides Uniswap. Its main sources of income include RWA income, stability fees paid by users, and liquidation penalties. Thanks to the RWA shift in 2022, MakerDAO allocated 80% of its funds to short-term US Treasury bonds and 20% to investment-grade corporate bonds to obtain interest income. This not only drives an increase in overall fees, but also gives MakerDAO a more stable and diversified source of income. Judging from MakerDAOs current income types, RWA accounts for the vast majority of its income.

MakerDAO Protocol Revenue Source Breakdown

In the second quarter of this year, MakerDAOs revenue reached $85 million, a record high, but the current MakerDAO fee income has fallen compared to the better market conditions in March. So far, MakerDAO has generated profits of approximately $61.875 million in the third quarter of this year. Stability fee income was $227 million, liquidation income was approximately $3.73 million, Uniswap transaction fee income was approximately $1.65 million, DAI expenditure was $40.71 million, MKR expenditure was $8.586 million, and DSR expenditure was $120 million.

MakerDAO Protocol Balance Sheet

In addition to RWA, the hype about the Maker split also fueled the markets expectations for the MakerDAO protocol itself. Last year, MakerDAO launched its Endgame plan to reduce costs and increase efficiency, launching upgraded versions of DAI and MKR, NewStable (NST) and NewGovToken (NGT), and also launched the first SubDAO SparkDAO to expand the ecosystem.

On August 27, the Maker Protocol was officially renamed Sky, launching SKY as the new native governance token, and DAI was also renamed USDS; each MKR token can be upgraded to 24,000 SKY tokens, and DAI will be converted to USDS at a 1:1 ratio.

After the expected split is realized, MakerDAOs valuation may have lost an important expected push, and the market has also had centralization concerns about Maker. Maker co-founder Rune Christensen clarified that only USDS has the freezing function, but this also further confirmed Makers subsequent RWA shift, because if Maker wants treasury bond returns as support, even through secondary treasury bond transactions, it must have a freezing function and VPN region blocking function.

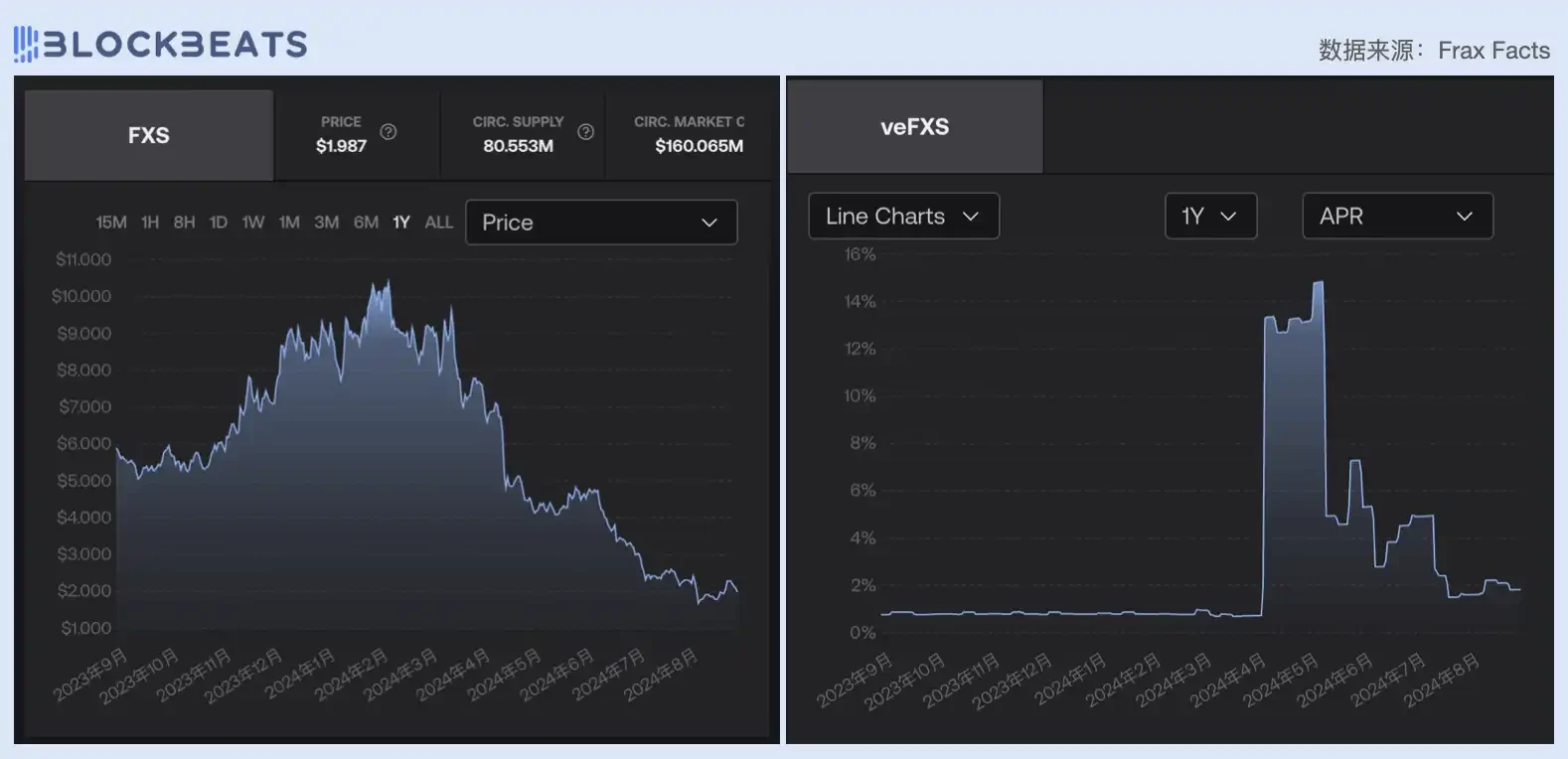

फ़्रैक्स

Frax Finance is a DeFi application that integrates multiple product lines such as stablecoins, trading loans, LSD, RWA, L2, etc. It has issued assets such as FRAX, FPI, frxETH, sFRAX, FXB, and built application scenarios from lending to chains around these assets. At the beginning of its launch, Frax Finance had gained an absolute advantage in Curve War with frxETH and was considered one of the most innovative DeFi products. Frax Finance also continued to innovate in this cycle and bet on Fraxtal, but the results were not satisfactory.

The market value of Frax Finance has been falling since the second quarter, and the FRAX token has fallen by more than 70% in half a year, while the protocol revenue has experienced a period of growth, causing Frax Finances PE to fall by 83% in the second quarter. In the past two months, FRAXs decline has slowed down, protocol revenue has also grown slowly, and the PE ratio has rebounded.

In addition to the gas fees charged by Fraxtal, Frax Finances revenue channels include treasury bond income, AMO and ETH LSD. FRAX and FPI are two stablecoins in the Frax Finance ecosystem. FRAX is pegged to the US dollar at a 1:1 ratio. Its current market value is $640 million, ranking eighth in the stablecoin market, which is about one-eighth of the market value of DAI. FPI is a stablecoin pegged to the average of the US CPI-U. Its current TVL is $97 million. The two together only account for 0.4% of the stablecoin market.

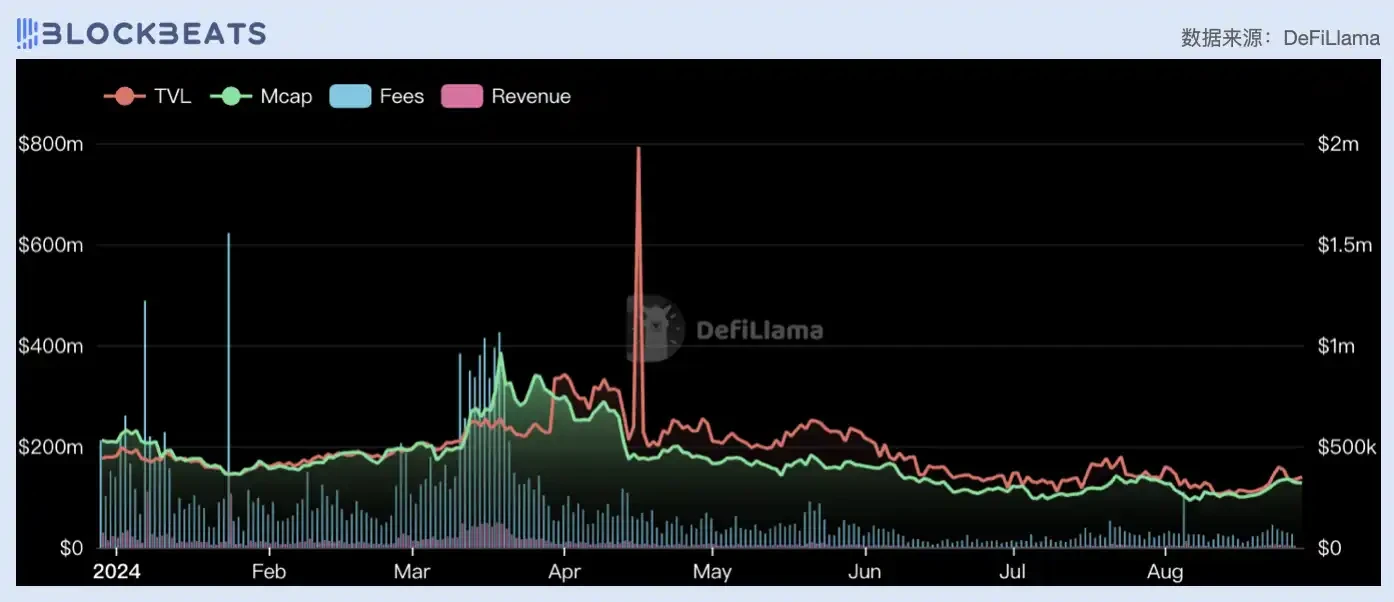

Frax protocol revenue and TVL correlation with market capitalization

In addition to stablecoins, Frax Finaces performance in spot trading and liquidity staking markets is also not as good as before. Fraxswap charges a 0.3% handling fee for each transaction. Since the TVL fell below $60 million, this fee has remained between $1,000 and $5,000. DefiLlama data shows that the estimated annualized fee is $1.8 million. Frax Ethers daily revenue has also been on a downward trend this year, with an annualized revenue of $1.43 million.

Top: Fraxswap TVL and revenue changes; Bottom: Frax Ether TVL and revenue changes

As the existing business failed to make breakthrough progress, Frax Finance turned its attention to chain development. In February this year, Frax Finance launched the modular blockchain Fraxtal, hoping to capture block fees and open up new sources of income. Frax Finance also integrated all tokens in the ecosystem into the Fraxtal application in order to achieve a positive cycle. frxETH is used as a gas payment token, and FXS is the Fraxchain sequencer staking token. Users can also stake veFXS on Fraxtal, while veFXS could only be staked on the Ethereum mainnet before.

However, after the launch of Fraxtal, it only accounted for $13 million of daily trading volume in Fraxswaps chain trading volume, which is comparable to the trading volume data of Fantom, Avalanche and other chains, and did not reflect the liquidity advantage of own chain. Fraxtals activation effect on frxETH and veFXS is not obvious. The supply of frxETH has shown a downward trend since the beginning of the year, and the price of FXS has also fallen rapidly since February, with a drop of nearly 50% in two months.

Left: Changes in the proportion of Fraxswaps transaction volume on each chain; Right: Changes in frxETH supply

In addition to Fraxtals efforts, Frax Finance also resumed its proposal to distribute protocol fees to veFXS holders in April. After the fee switch was turned on, Frax Finance claimed that the income of veFXS stakers increased by 15 times. From the data, veFXSs APR did surge significantly between April and May, reaching a high of nearly 16%. But it soon fell sharply and is currently less than 2%.

Left: FXS price trend; Right: veFXS APR change

In general, a P/E of 50 indicates that the market still has high expectations for Frax Finances future growth and is optimistic about its relatively comprehensive product layout in the DeFi field, but Frax Finances current business performance and revenue decline trend do not support this high valuation. Fraxs profitability is under pressure. In the fiercely competitive DeFi market, building an L2 can only consume Frax Finances energy and market attention.

Liquidity Staking

In the field of liquidity pledge, leading protocols including LSD and LRT have been selected, including: Ethereum ecosystem liquidity pledge protocol Lido, interest rate derivatives protocol Pendle; Solana ecosystem liquidity pledge protocol Jito.

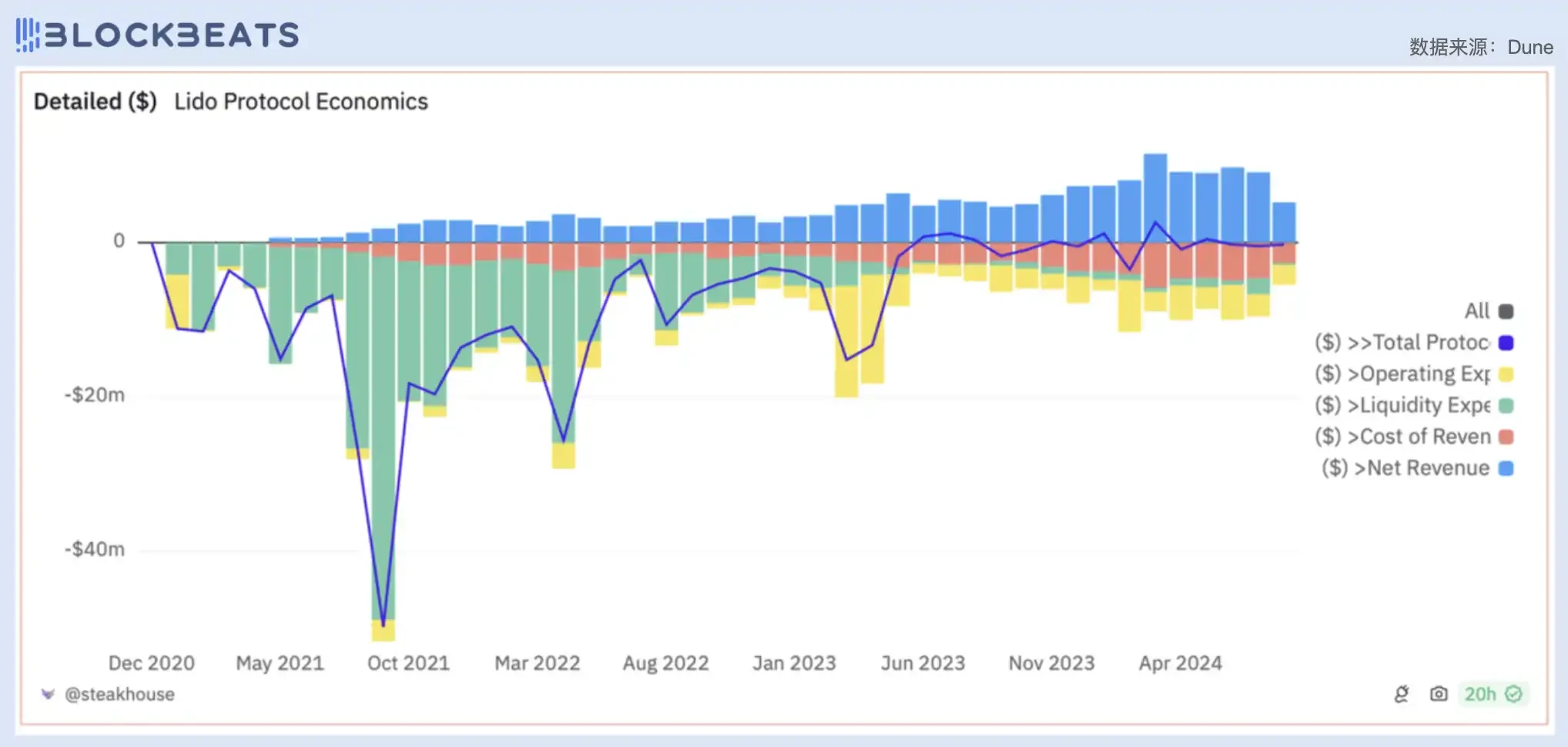

लीडो

In terms of financial reports, Lido may be the best looking in the DeFi field. Since its revenue comes directly from PoS release, Lido continues to create considerable profit returns by relying on scale effects. Currently, Lido occupies 28.5% of the entire ETH staking market, and the protocol charges 10% of ETH staking income, totaling $175 million as of writing.

Judging from the PE value, the markets valuation expectations for Lido are still shrinking, falling from 31.6 in the first quarter to 18.7 in the second quarter. The main reason is of course the overall decline in the crypto market, but in the current third quarter, the PE indicator has further fallen to 13.7, which to a certain extent reflects the markets reassessment of the development pattern of the pledge and re-pledge track.

Building a monopolistic business model in a decentralized world has always been an important reason for Lido to be criticized. Many competitors have also used this to play their own marketing cards and continue to snatch users from Lido. It must be admitted that this track is far from entering the final stage. New LSD and LRT protocols are still emerging, and Lido seems to be unable to keep up with the pace in the rapidly changing market trends. This can also be seen from Lidos customer acquisition costs. Although the revenue of the protocol continues to grow, its customer acquisition costs (also known as customer acquisition difficulty, the red part in the figure below) are also continuing to increase.

Lido Agreement Expenses and Net Profits

In the past, the market positioned Lido as the absolute leader in the liquidity staking track, but with the emergence and development of the narrative of reducing centralization and the re-staking track, Lidos position has been shaken. In addition, the markets emphasis on protocol revenue generation and token value feedback has become increasingly strengthened. As another mainstream governance token without value capture, LDO has also been questioned by investors.

जीतो

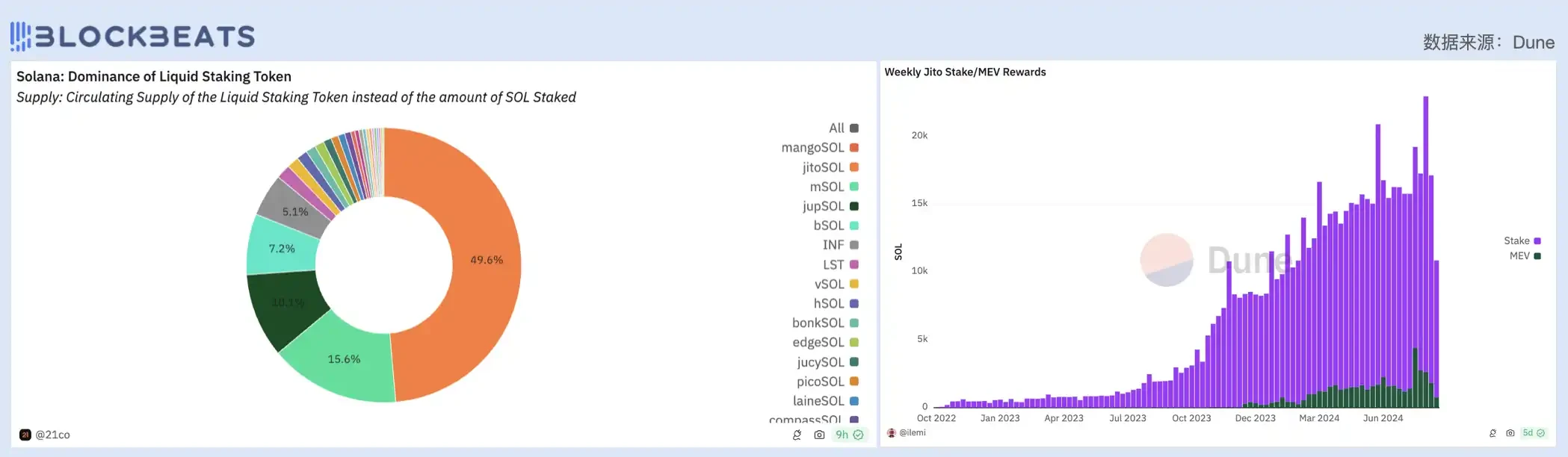

Jito is the first protocol in the Solana ecosystem that combines MEV solutions and liquidity staking business. It also uses MEV income as a staking reward, increasing the protocol staking income. With the substantial growth of the Solana ecosystem in this round of the market, Jitos MEV and liquidity staking businesses have both achieved rapid growth. Compared with Ethereum, Solanas liquidity staking development started late. As a new force after the recovery and rise of the Solana ecosystem, Jito was officially launched in December last year. With the airdrop incentive, Jito quickly became the top DeFi protocol in the Solana ecosystem.

However, with the end of the bonus period at the beginning of the project and the increase in competitors, the markets valuation expectations for Jito are gradually returning to normal levels. Since the first quarter, when the Solana ecosystem was hot, Jito had just completed its airdrop and was listed on major trading platforms, with a PE value of 534. However, after the market sentiment calmed down in the second quarter, Jitos PE value fell back to 153, and is currently stable at around 120. However, Jitos GMV is also increasing steadily, and it has exceeded the total amount of the second quarter before the end of the third quarter.

At present, the liquidity pledge ratio on Solana has increased from about 2% in the first half of 2023 to around 6% at present. In terms of the market share of LST assets, stSOL and mSOL used to share the market, but with Lidos withdrawal from the Solana ecosystem, Jito has become a latecomer. At present, JitoSOLs share is close to 50%.

However, the current farming channels for LST assets on Solana are not abundant, and without the temptation of sufficient yield, users do not have a strong demand for holding LST assets. However, in July this year, Jito announced the launch of the pledge infrastructure platform Jito Restaking, which supports mixed pledge, re-pledge and LRT modules, as well as the AVS section, which is equivalent to becoming the EigenLayer of the Solana ecosystem, which means that JitoSOL still has a lot of room for development in the future.

In addition, the MEV memory pool income has also been the moat supporting Jitos ecological niche. It extracts 5% of the MEV tips paid to Solana validators, and part of the fees will also be allocated to JitoSOL. Pledgers can not only obtain SOL staking rewards, but also additional MEV rewards. However, data shows that from the current number of SOL staked in Jito, the MEV rewards obtained are relatively small.

Left: Solana liquidity staking market share breakdown; Right: Jito liquidity staking fund size and MEV fee income

Jitos pseudo memory pool setting once made it a unicorn project in the Solana ecosystem, but in March this year, Jito suspended the pseudo memory pool function provided by the Jito block engine. However, Jito searchers can still submit other types of MEV transaction bundles that do not rely on the memory pool Stream, such as arbitrage and liquidation transactions.

At the end of April, Jupiter launched Jito Bundles Tipping to combat MEV attacks. Since May, the proportion of Jito Tips in the Solana network has gradually increased, and users are increasingly choosing to pay tips to get a better trading experience, but Jito Labs share of value distribution has remained at around 2%.

Left: Sources of Solana on-chain transaction volume (traffic); Right: Distribution of Solana on-chain value (revenue)

On July 28, Jitos fee income reached $3.27 million, surpassing Lidos $2.94 million, becoming the protocol with the highest fee income among all blockchains on that day. It can be foreseen that as one of the infrastructures of the Solana ecosystem, Jitos future development prospects are still relatively optimistic. However, its governance token JTO currently has limited value capture capabilities except for its governance function. From a PE perspective, what we need to consider is whether the $3 million in revenue and the so-called leading position can justify its PE valuation of over 100?

पेंडल

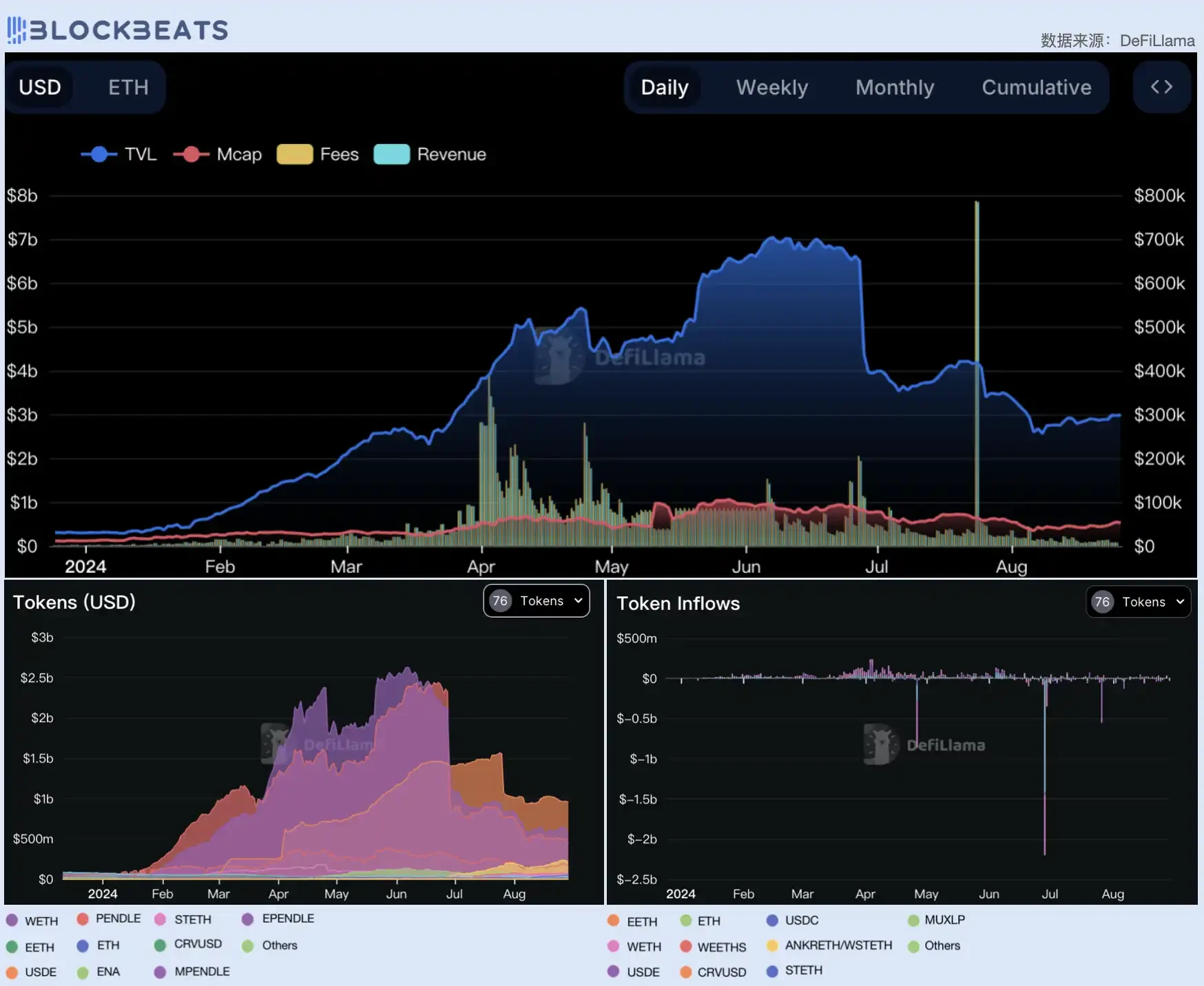

Pendle Finance is a pioneer in the on-chain interest rate derivatives market. In 2023, this market experienced significant growth. Pendles circulating PE index reached 555 in Q4 2023, and fell sharply to 77.9 in the first half of 2024, and recently rebounded to around 180.

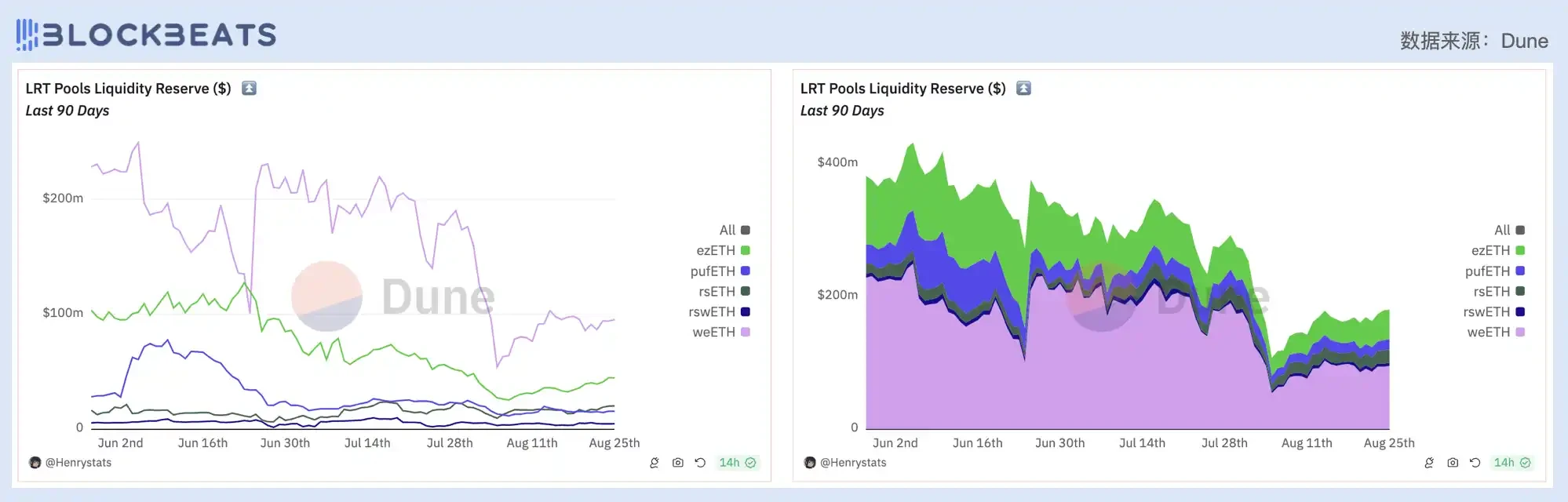

The Ethereum staking boom in April brought a huge amount of liquidity to Pendle, and this prosperity lasted until early June. Most transactions on Pendle are concentrated on Ethereum and its related re-staking tokens. The prosperity during this period relied heavily on the airdrop incentives of LRT protocols such as Etherfi, Ethena and Renzo. These protocols have given 2-4.5 times the airdrop points multiplier to the liquidity providers on Pendle, and also buried risks for Pendles subsequent business development.

Pendle re-staking related liquidity pool fund reserve breakdown

Since the third quarter, the end of the LST protocol airdrops and the expiration of multiple financial products on Pendle have brought liquidity challenges to Pendle. At the end of June, Pendles TVL experienced a sharp drop from $6.6 billion on June 27 to $3.9 billion on July 1, and the protocol revenue was also cut in half. Specifically, $1.3 billion of eETH (Ether.fis LST token) and $700 million of WETH flowed out of Pendle on June 28. Currently, there are only $445 million of eETH on Pendle.

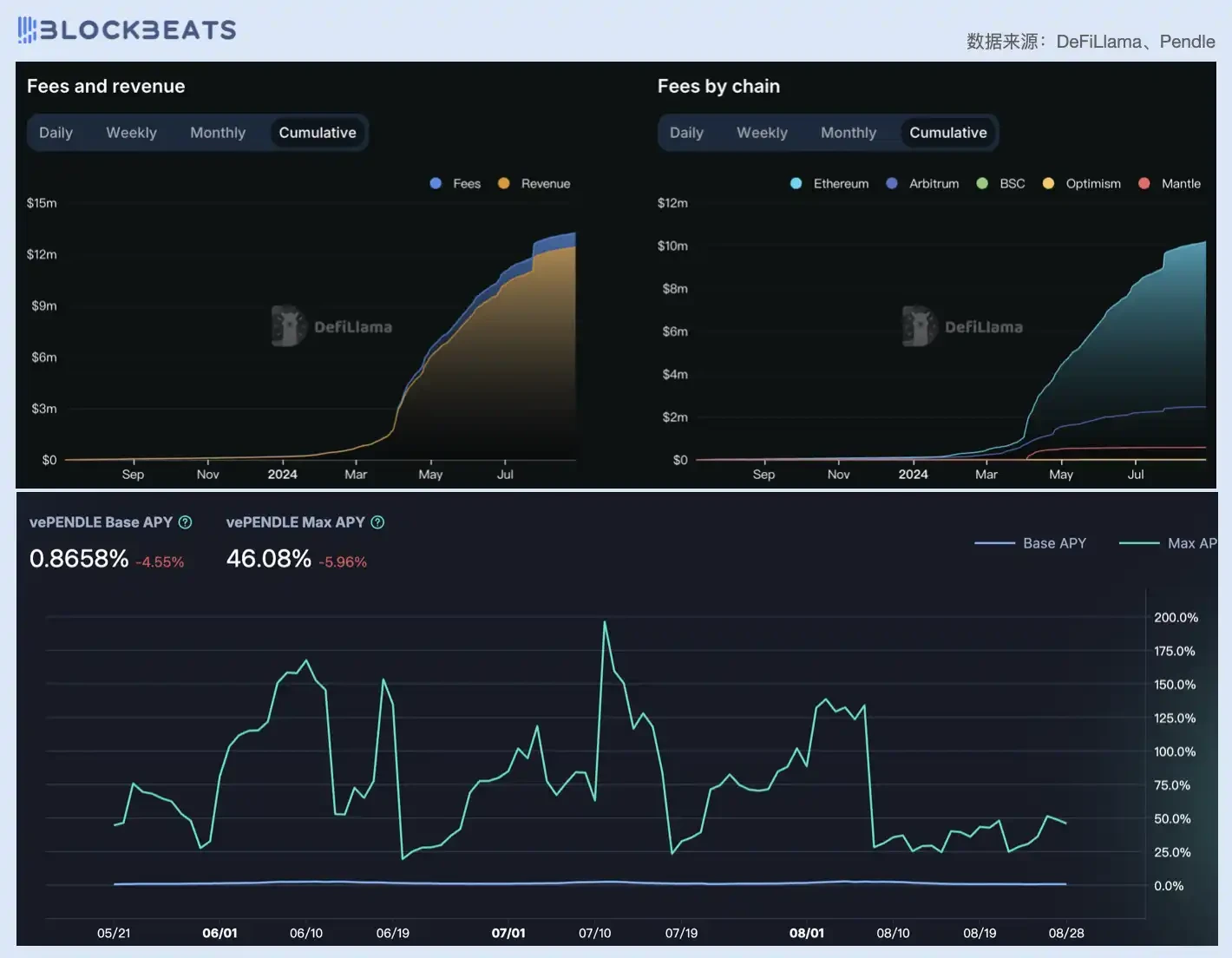

Top: Pendle protocol revenue and TVL and market value correlation; Bottom left: Pendles TVL changes in each liquidity pool; Bottom right: Pendles capital inflow and outflow breakdown

In terms of protocol revenue, Pendle has accumulated revenue of about $12 million, and the revenue growth rate has slowed down significantly since July. 20% of Pendles revenue belongs to liquidity providers, and the rest is distributed to $vePendle holders. In the past three months, vePENDLEs base APY has been between 0.8% and 2.5%, and the maximum APY has fluctuated between 25% and 150%, reflecting that ve PENDLEs income is very unstable.

Top left: Pendle protocol cumulative fee income and profit; Top right: Pendle chain cumulative fee income source breakdown; Bottom: vePendle basic APY and maximum APY changes in the past 90 days

From Pendles rise to its failure, it can be seen that Pendle is currently very dependent on the development of the LRT track. Although in the long run, the LRT track still has a lot of room for growth, but in the context of insufficient new liquidity, the prosperity of the LRT protocol in the first quarter is more like a flash in the pan. Pendle needs to choose new growth channels and make good use of its leading advantage in the interest rate derivatives track.

Derivatives Market

In the derivatives market, we selected the top protocols with the highest transaction volume and the emerging protocols that have been launched recently as a reference for the development and changes of valuation in this field under the concept of CLOB (central order book), including: dYdX, GMX, Orderly Network. Because some top protocols have not yet issued tokens, such as Hyperliquid, they are not included.

डीएक्स

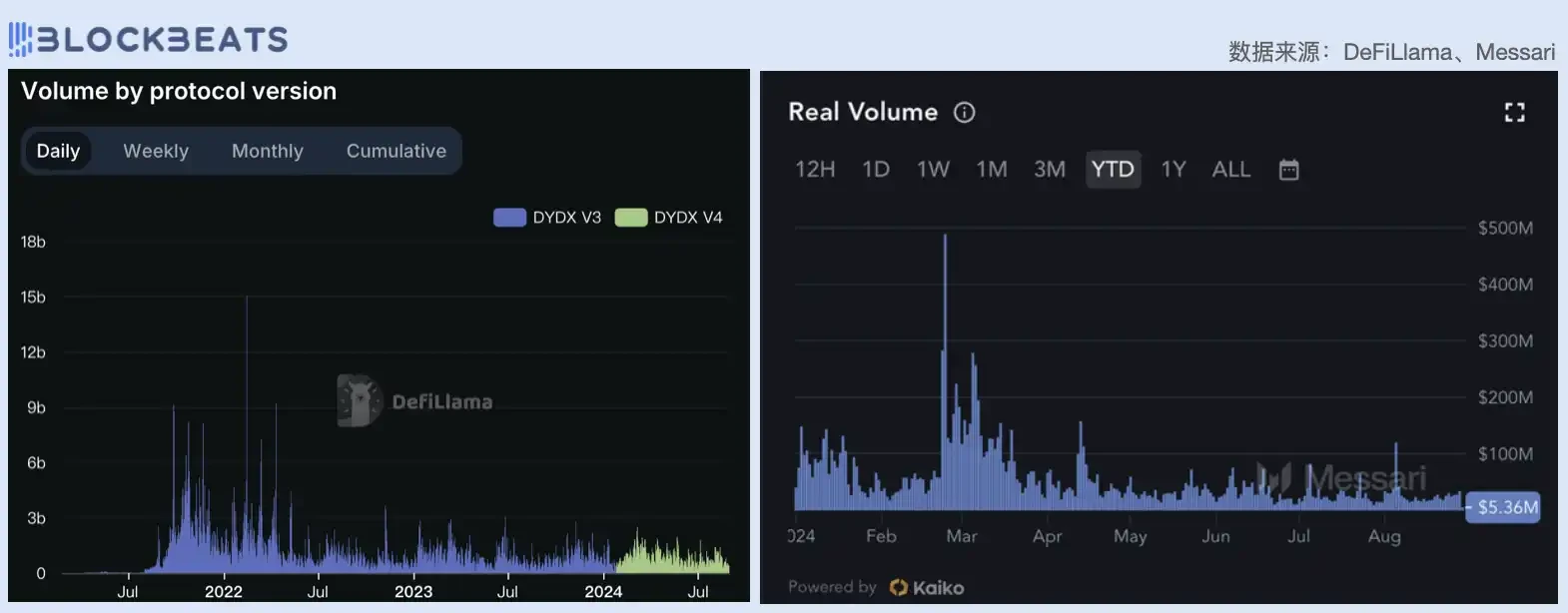

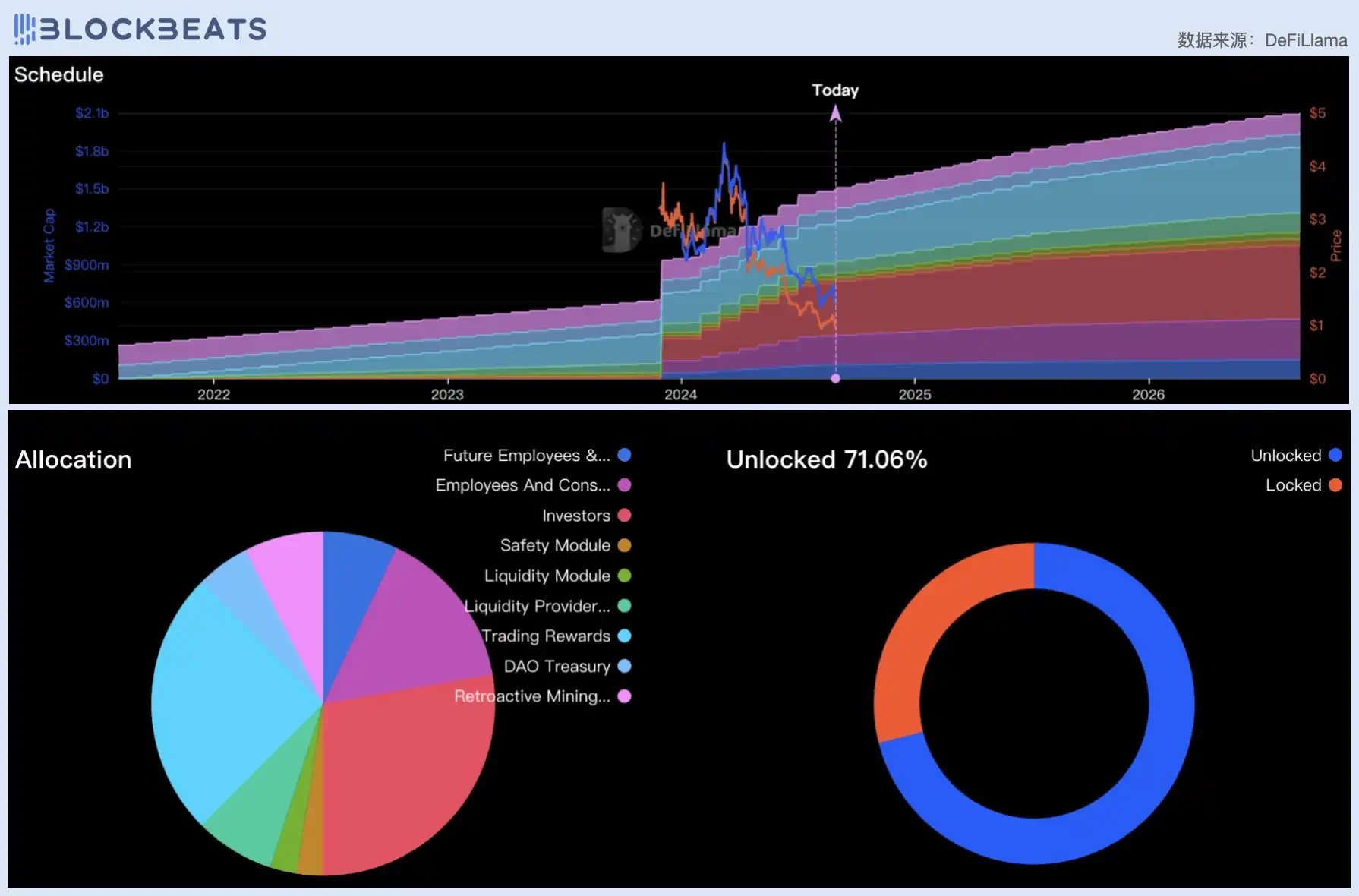

Among decentralized perpetual trading protocols, dYdXs trading volume ranks at the top all year round, making it a well-deserved top protocol. However, after several years of launch, dYdX has also faced severe transformation challenges. Since the beginning of this year, dYdXs protocol revenue and token market value have continued to decline, with protocol revenue falling from $139 million in the first quarter to $75 million in the second quarter. So far, the third quarter revenue has just exceeded $25 million, and there is no sign of stopping the downward trend. The current P/E ratio is 39.5.

In October 2023, dYdX started the v4 upgrade, realizing the transition from the Ethereum Layer 2 network to an independent blockchain in the Cosmos ecosystem. The v4 upgrade will make dYdX completely decentralized and community-operated, and DYDX will become a real yield token. However, in terms of token prices, DYDX only rose at the beginning of this year, and has continued to fall since March, and has now fallen 77% from its high point.

A major driver of the tokens decline is the sharp drop in dYdXs trading volume. Although V4 has improved performance, overall, dYdXs current daily trading volume is far from the protocols peak of $6 billion. It currently only maintains a level of $400 million. After removing wash trading, this figure has fallen to less than $30 million.

Left: dYdX V3 and V4 trading volume; Right: dYdX protocol real trading volume

From the perspective of the source of fees, the fees of dYdX Chain have gradually become the main source of income for the protocol. The fees generated by the two in August were US$3.89 million and US$1.19 million respectively, which shows that dYdXs migration plan is successful. However, in the current stock market competition of derivatives protocols, dYdX has begun to decline. From the perspective of market share, dYdX has been continuously degenerating from its absolute monopoly position in the past, and has been seized by emerging products such as Hyperliquid, Jupiter, and GMX. The current trading volume accounts for less than 20% of the total volume of Perp DEX.

Top left: dYdX protocol TVL breakdown; Top right: dYdX protocol fee income source breakdown; Bottom: Changes in perpetual contract market share

In addition to the hampered market growth, the DYDX token is also facing selling pressure from large unlocking. DYDX has started large-scale chip unlocking since December 1, 2023, with a one-time unlocking of 15% of the total supply, and the remaining 35% unlocked in batches every month, which will be released within 6 years. These token shares mainly come from investors, founders, consultants and employees, accounting for up to 84.41% of the circulating supply. At present, dYdX still has 71.06% of the tokens that have not been unlocked.

Top: DYDX token unlocking schedule; Bottom: DYDX unlocked token ratio and share ownership breakdown

In this cycle, dYdXs performance can be regarded as stable, and it has always maintained a leading position in the perpetual contract track, but the large-scale unlocking of such old debts limits the development space of DYDX. The dYdX official also gave corresponding restrictions. Starting from July 1, the monthly unlocking volume of DYDX has been reduced from 33 million to 8.3 million, a decrease of 75%. However, under the fierce competition, in addition to eliminating the hidden dangers of selling pressure, dYdX needs to find its own incremental market besides building a chain.

जीएमएक्स

As one of the most outstanding protocols in the bear market, GMX adopts a unique mechanism to allow users to trade with a basket of funds pools GLP (GMX Liquidity Pool). The perpetual product JLP of Jupiter, the aforementioned Solana ecosystem DEX platform, draws on this mechanism of GMX.

The PE value of GMX has been declining slightly in the past three quarters, maintaining at around 10. GMV performed poorly due to the poor market conditions in the second quarter. As of now, the total GMV in the third quarter has exceeded the total amount in the second quarter.

Last August, GMX launched V2, which maintained a balance between long and short positions by modifying the fee mechanism, so as to reduce the probability of systemic risk in the face of drastic market fluctuations. Currently, the trading volume is mainly concentrated in V2, but from the perspective of 7-day trading volume, GMX has ranked tenth in the derivatives market.

Perp DEX trading volume ranking in the past 7 days

All fees generated by GMXs Swap and leveraged transactions are distributed to GMX stakers and GLP liquidity providers. The income distribution model is 27% to GMX stakers, 63% to GLP providers, 8.2% to the protocol treasury, and 1.2% to Chainlink.

In July, the GMX community passed a proposal to change the income distribution model to repurchase and distribute GMX, suggesting that the current income distribution model of GMX be changed from repurchase ETH and distribute ETH to repurchase GMX and distribute GMX.

The proposer said that this was done to increase the markets confidence in GMX through continuous buying, and because there are some zombie staking accounts in GMX, distributing rewards as GMX will help reduce the amount of GMX in circulation and put more GMX into a dormant state, thereby stabilizing prices and supporting the market. Although the proposal also stated that users will be provided with the option to convert GMX rewards to other tokens such as ETH, in a sense it can be said that GMX currently only has repurchases but no dividends.

व्यवस्थित नेटवर्क

Orderly Network is a full-chain perpetual contract trading platform established in April 2022. It is jointly incubated by NEAR and WOO Network. It combines the liquidity and transaction speed advantages of CEXs while retaining the transparency, sovereignty and on-chain settlement characteristics of DeFi. It aims to build an efficient trading ecosystem that can meet users needs for liquidity and speed while maintaining decentralization and transparency.

On August 26, Orderly Network completed TGE and started staking its native governance token ORDER. The estimated PE value was 16 based on the opening FDV and the current quarters profit. As a project that has been in operation for a long time but has just started token issuance, this value reflects the markets robust expectations for Orderly.

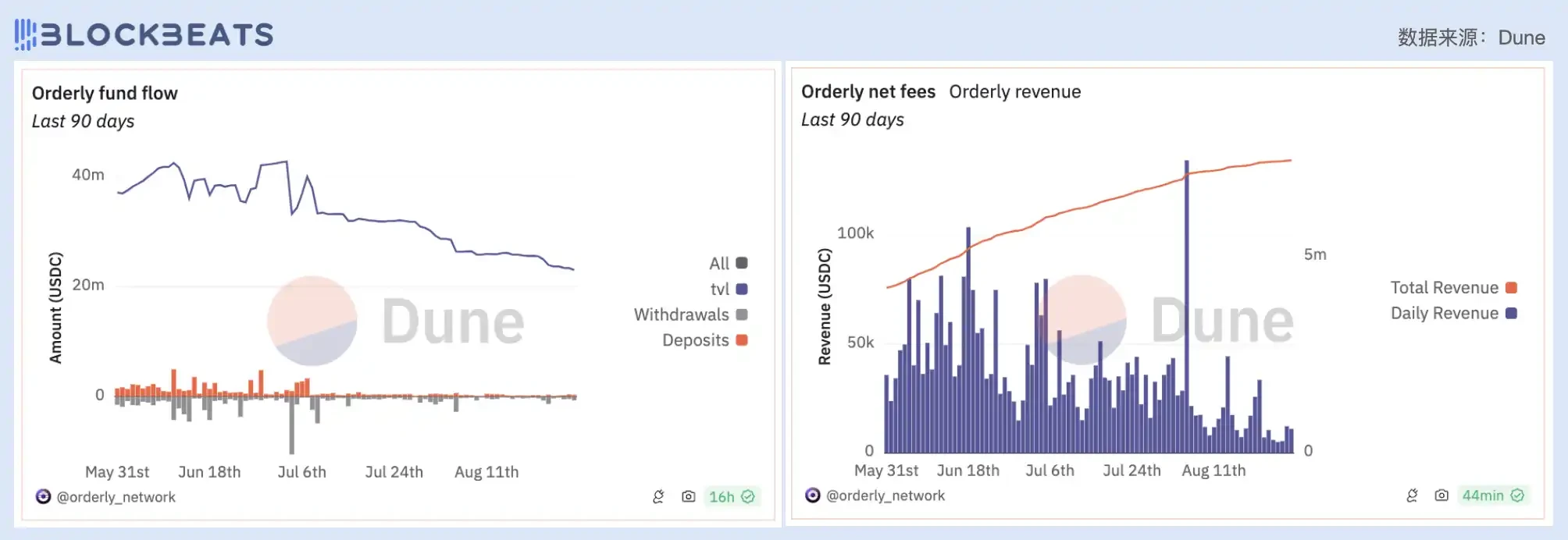

However, since the last quarter, although Orderlys total revenue has been growing, Orderlys TVL and revenue growth rate have been on a downward trend, and the corresponding amount of deposit funds has also been decreasing. On the one hand, this is affected by the overall market conditions, and on the other hand, it is also related to the expected implementation of Orderlys coin airdrop.

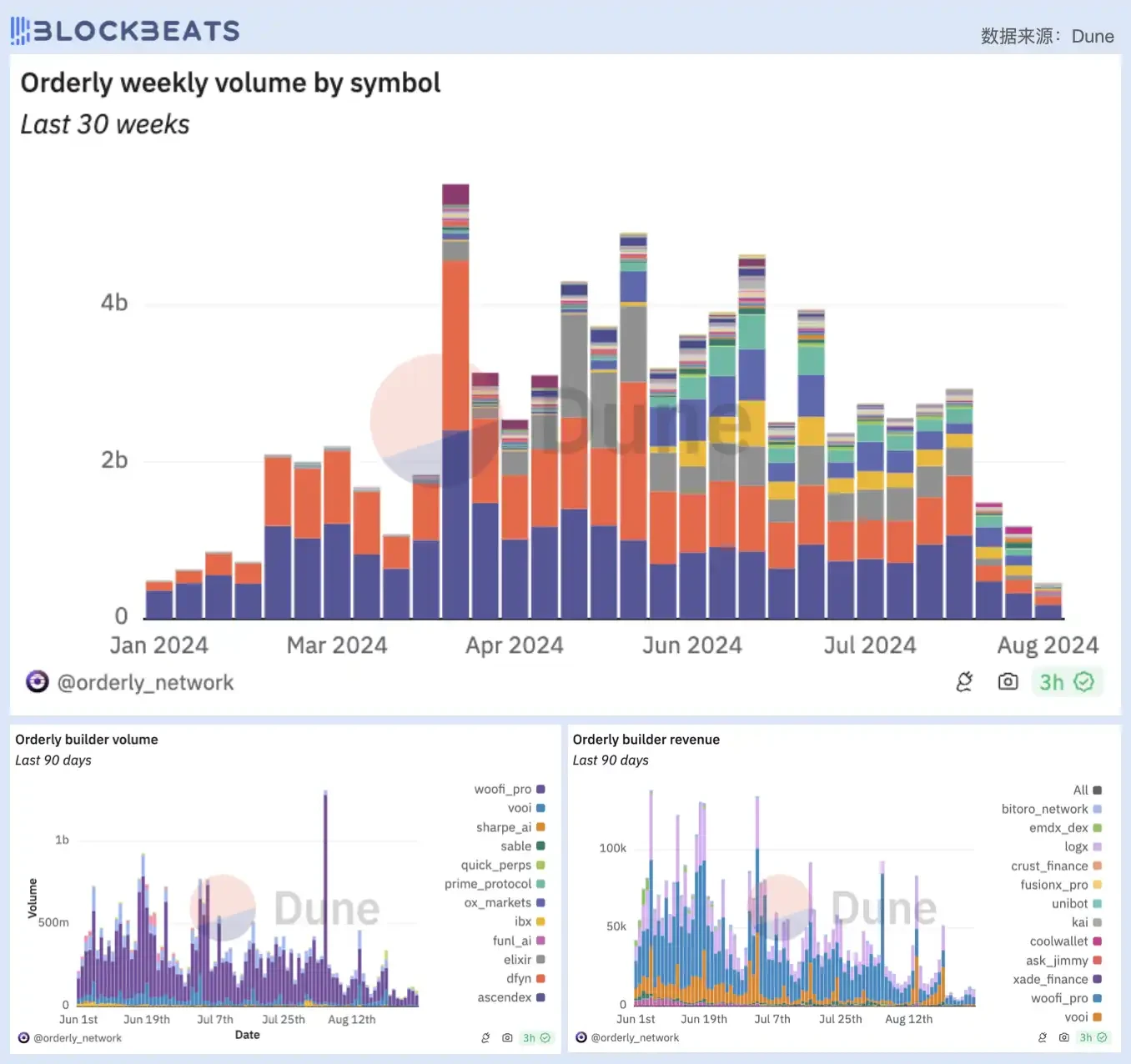

Left: Orderly protocol capital flow and TVL changes; Right: Orderly protocol profit

The current total number of Orderly Network user accounts exceeds 420,000, and the transaction volume in the past 24 hours has reached 100 million US dollars. BTC and ETH are the assets with the largest transaction volume on Orderly. Liquidity fragmentation and inefficient utilization have always been the drawbacks of the DeFi field. Different block networks are independent of each other, and funds are locked in a single network and cannot be shared. Orderly Network uses the cloud liquidity mechanism to uniformly manage and allocate liquidity resources to solve this problem. Currently, WOO, which uses Orderly for transactions, has become the DeFi front-end that contributes the most to Orderly Network transaction liquidity.

Top: Orderly perpetual contract trading pair breakdown; bottom left: Orderly trading volume (traffic) source breakdown; bottom right: Orderly value distribution (profit) flow

At present, Orderly has integrated with 41 crypto projects, which is consistent with its main DEX backend service concept. Its intention to usher in an era of on-chain transaction rebates and customized services for large customers may also bring certain added value to its project expectations. From a PE perspective, Orderly has a certain cost-effectiveness compared to other competitors in the same track, and it is expected to be listed on a first-tier trading platform after the announcement of the completion of financing.

Are DeFi coins overvalued?

When analyzing tokens and project fundamentals, we often use the logic and indicators of traditional financial markets to make analogies and predictions about price fluctuations, but at the same time we deny the possibility of the development of tokens as a new type of stock that is more innovative and composable in terms of underlying technology and application scenarios. This denial comes from a lack of confidence in the application potential of the protocol itself on the one hand, and a great fear and compromise with regulation on the other.

In the current crypto world where narratives are constantly emerging and tokens are changing with each passing day, finding the next narrative can no longer serve as the underlying logic to support the industrys progress. Against the macro backdrop of the end of the whaling era, the crypto industry is also returning to the value thinking of intensive cultivation. Perhaps, finding a good business in a market full of extravagance is the sustainable long-term solution. But even so, investors still need to solve another ultimate question: Do these businesses really have anything to do with the tokens I hold?

This article is sourced from the internet: Judging from the price-to-earnings ratio, is todays DeFi industry overvalued?

Related: Early-stage potential projects that must be participated in this week: Movement, WORLD3

Original | Odaily Planet Daily ( @OdailyChina ) Author | Asher ( @Asher_0210 ) Since the ZKsync and LayerZero airdrops, many people have said that the era of scalping is over. Coupled with the sluggish market in the past two weeks, the communitys enthusiasm for scalping has dropped to a low point. It is true that the era of achieving financial freedom by mindlessly signing up for airdrops is gone forever, but as the definition of high-quality accounts becomes more and more stringent, retail investors have become an entry point to understand high-finance or popular projects by scaling in a short period of time. Odaily Planet Daily has compiled two projects worth participating in this week based on financing status, project popularity and other aspects. Movement: Building the first L2…